The Cement Packaging Market is witnessing steady growth driven by the rising construction activities across residential, commercial, and infrastructure sectors. Increasing demand for sustainable and cost-effective packaging solutions has encouraged the shift toward durable and lightweight materials. Advancements in packaging technology have led to improved product protection, extended shelf life, and better handling efficiency during transportation and storage.

The market is also benefitting from growing investments in infrastructure modernization and smart city projects across emerging economies. Manufacturers are focusing on enhancing packaging strength and moisture resistance to maintain cement quality and prevent spoilage during long-distance shipments. The adoption of recyclable and eco-friendly materials is further reshaping the market dynamics as sustainability becomes a key priority in the construction supply chain.

Moreover, the integration of automation in packaging lines and demand for customized branding are fueling innovation and competition in the market As construction demand continues to surge globally, the Cement Packaging Market is expected to experience consistent expansion in the coming years.

| Metric | Value |

|---|---|

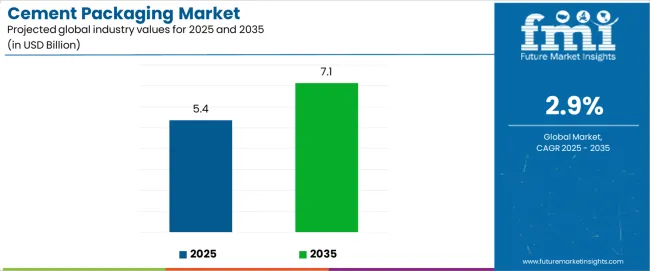

| Cement Packaging Market Estimated Value in (2025 E) | USD 5.4 billion |

| Cement Packaging Market Forecast Value in (2035 F) | USD 7.1 billion |

| Forecast CAGR (2025 to 2035) | 2.9% |

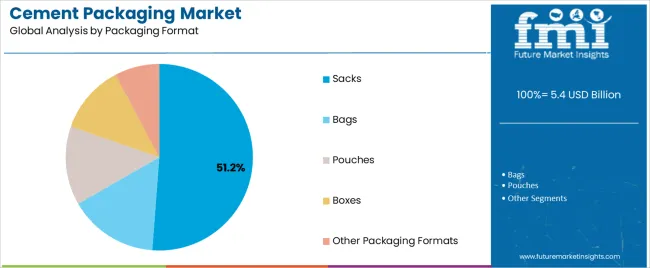

The market is segmented by Material, Capacity, and Packaging Format and region. By Material, the market is divided into Plastic, Paper, and Jute. In terms of Capacity, the market is classified into 5 kg - 20 kg, Less Than 5 kg, 21 kg - 50 kg, and Above 50 kg. Based on Packaging Format, the market is segmented into Sacks, Bags, Pouches, Boxes, and Other Packaging Formats. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

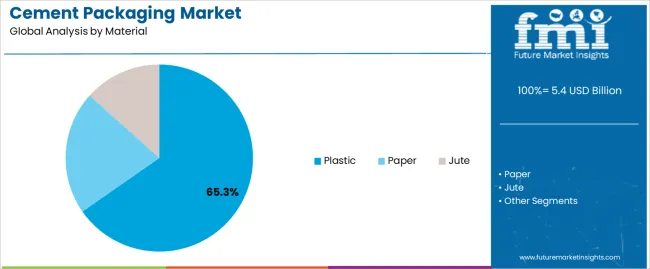

The plastic material segment is projected to hold 65.30% of the Cement Packaging Market revenue share in 2025, establishing it as the dominant material type. The growth of this segment has been influenced by the superior durability, water resistance, and cost-effectiveness of plastic compared to traditional materials. The ability of plastic to withstand harsh handling conditions and environmental exposure without compromising the integrity of the packaged cement has contributed to its wide acceptance.

The lightweight nature of plastic packaging also reduces transportation costs and enhances operational efficiency. Furthermore, the growing use of high-density polyethylene and polypropylene has improved packaging flexibility, making it suitable for both small and bulk cement applications.

The recyclability of modern plastic formulations and their compatibility with automated filling systems are further enhancing demand With ongoing innovations aimed at reducing environmental impact, plastic continues to be the preferred choice for cement packaging across multiple end-use sectors.

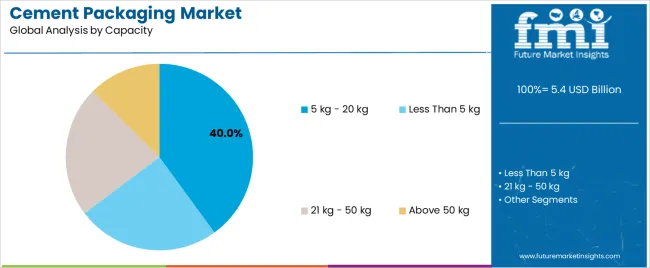

The 5 kg to 20 kg capacity segment is expected to account for 40.00% of the Cement Packaging Market revenue in 2025, making it one of the key contributing segments. The dominance of this capacity range is attributed to the increasing demand from small-scale construction, repair, and retail sectors where portability and convenience are essential. This segment caters to individual consumers and small contractors who prefer manageable quantities for short-term projects.

The ease of transportation, reduced material wastage, and suitability for retail distribution channels have reinforced the adoption of mid-sized packaging. Additionally, packaging within this capacity range supports brand differentiation through printed graphics and improved design features.

Rising urbanization and home renovation trends, particularly in emerging economies, have further boosted the demand for smaller packaging units As consumer preferences shift toward convenience and cost-efficiency, the 5 kg to 20 kg capacity segment continues to play a vital role in driving the overall market growth.

The sacks packaging format segment is anticipated to capture 51.20% of the Cement Packaging Market revenue share in 2025, positioning it as the leading format. This dominance is driven by the widespread use of sacks in bulk cement handling and distribution. Sacks offer superior protection against moisture and dust, ensuring the cement retains its quality during storage and transportation.

The segment benefits from continuous advancements in woven polypropylene and laminated sack technology, which enhance durability and reusability. Sacks are also favored due to their ease of stacking, handling, and compatibility with automated filling systems. The packaging format supports high-volume operations, making it suitable for both industrial and commercial applications.

Furthermore, the cost-effectiveness and availability of sacks across diverse regions have solidified their role as a preferred packaging format in the cement industry As demand for efficient and sustainable packaging continues to rise, the sacks segment is expected to maintain its leadership in the market.

The below table represents the expected CAGR for the global cement packaging market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the year from 2025 to 2035, the business is predicted to expand at a CAGR of 2.7%, followed by a slightly higher growth rate of 3.0% in the second half (H2) of the same year.

| Particular | Value CAGR |

|---|---|

| H1 | 2.7% (2025 to 2035) |

| H2 | 3.0% (2025 to 2035) |

| H1 | 2.8% (2025 to 2035) |

| H2 | 3.2% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 2.8% in the first half and remain relatively moderate at 3.1% in the second half. In the first half (H1) the market witnessed a decrease of 10 BPS while in the second half (H2), the market witnessed an increase of 20 BPS.

Growing Demand for Sustainable Cement Packaging Solutions

Sustainability has been the cornerstone for several years now and this trend has slowly penetrated the cement packaging space, with several manufacturers opting to utilize eco-friendly raw materials such as recycled polypropylene and PCR bags among others. For instance, in July 2025, UltraTech Cement, a key Indian manufacturer of cement and ready-mix concrete announced the development of cement packaging bags from recycled polypropylene.

Additionally, government and regulatory bodies all around the world have been enforcing stringent environmental standards which have forced businesses to adapt to environmental friendly materials which can help minimize carbon footprint and promote recyclability. Moreover, staying committed to ESG goals not only helps the manufacturers align with sustainability directives but also enhances their brand image and consequently demand amongst consumers.

Expansion of the Infrastructural Sector Reshaping Cement Packaging Market Growth

The positive growth trend in infrastructure and construction, as well as the regional economic forecasts, are poised to significantly impact the market for cement packaging in the long term. Infrastructure sector was the fastest growing industry globally in 2025 growing at a rate of over 6% y-o-y, as per data from the Chartered Institute of Building (CIOB). Infrastructure projects are one of the key drivers of cement demand, thereby influencing the need for cement packaging materials. Moreover, the shift towards higher growth rates in emerging markets along with already high growth rates in developed markets in the long term, suggests increasing demand for cement and subsequently for packaging solutions in these regions.

For instance, Africa's robust growth forecast at over 30% annually indicates rapid infrastructure development, thereby driving demand for cement and its packaging. Furthermore, the global output is poised to expand at a CAGR of almost 3% annually through 2035, consequently helping the cement packaging market grow in tandem, driven by infrastructure investments, regional economic dynamics, and the ongoing transition towards sustainable packaging solutions.

Growing Consumer Preference for Bulk Handling may Restrict Market Growth

The growing consumer preference for bulk handling can potentially hamper the growth of the cement packaging market. In recent times, construction firms and contractors across developed and certain developing regions have been opting for bulk handling of cement due to its cost-effectiveness and efficiency in large-scale projects. This is owing to the fact that bulk handling not only minimizes packaging waste but also reduces transportation costs, and streamlines logistics, thereby gaining the preference of companies aiming to optimize operations and overall environmental impact.

Consequently, this trend is hampering the potential sales of traditional cement packaging solutions, such as bags and containers, which are considered as less efficient and environmentally friendly as compared to bulk handling solutions. This changing outlook towards cement packaging and growing preference for bulk handling may hamper the market’s growth in the long run.

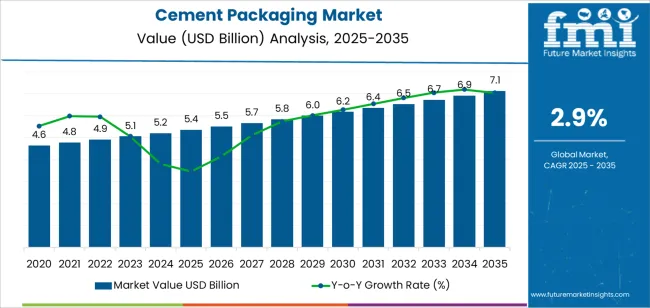

The global cement packaging industry recorded a CAGR of 2.0% during the historical period between 2020 and 2025. The growth of cement packaging industry was positive as it reached a value of USD 5.4 billion in 2025, from USD 4.6 billion in 2020. The construction boom across several regions which include Asia, Africa, and Latin America was a major driver of the cement packaging market in the historic period.

Additionally, several countries started witnessing rapid economic growth during the historic period, leading to increased investments on infrastructure such as roadways, buildings as well as public facilities, from not only public entities but also from private corporations. This consequently propelled the demand for cement which pulled up the demand for cement packaging.

Several of the above factors have persisted and have become some of the key factors driving the market throughout the forecast period. Additionally, rapid urbanization across both developing and developed nations, as well as advancements in packaging technology are some of the major drivers influencing the cement packaging market. Overall, the cement packaging market is projected to expand at a faster pace during the forecast period (2025 to 2035).

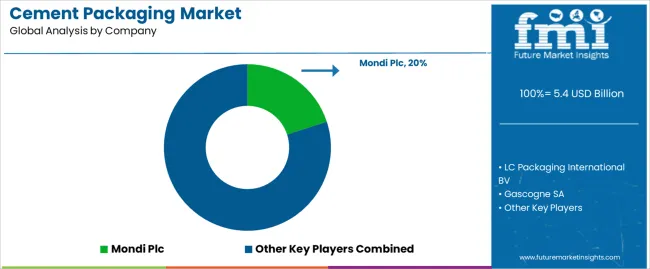

Tier 1 companies comprise market leaders with market revenue of above USD 50 million capturing a significant market share of 10% to 15% in the global market. These market leaders are distinguished by their extensive expertise in manufacturing cement packaging across multiple types of capacities for different packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of products and solutions for multiple industries and have extensive distribution and service networks across the globe. Companies in Tier 1 comprise of Mondi Group Plc., Berry Global Inc. and Bischof+Klein SE & Co. KG.

Tier 2 companies include mid-size players with revenue of USD 10 to 50 million having presence in specific regions and highly influencing the local market. These are characterized by a nominal presence overseas and well maintained market knowledge.

These market players have good technology but not the most advanced one and provide certain types of cement packaging for specific industries. Prominent companies in tier 2 include LC Packaging International BV, Uflex Ltd., ProAmpac LLC, and NNZ Group BV among others.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets having revenue below USD 10 million. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

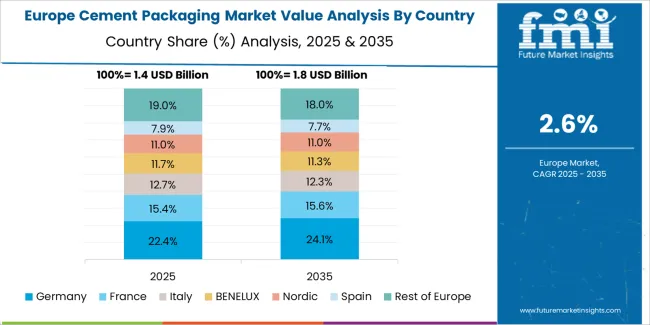

The section below covers the industry analysis for the cement packaging market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Western Europe, Eastern Europe, and others, is provided.

The United States is anticipated to remain at the forefront in North America, with a value share of over 65% through 2035. In South Asia Pacific, India is projected to witness a remarkable CAGR of 5.5% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 5.4.4% |

| Spain | 2.5% |

| France | 5.4.9% |

| India | 5.5% |

| UK | 5.4.2% |

| Japan | 5.4.5% |

| KSA | 3.9% |

| China | 4.4% |

As per FMI, the Spain cement packaging market is estimated to grow at a CAGR of 2.5% till 2035 along. Growth in the market is attributed to stable consumption of cement across the country. According to data from the Spanish Cement Manufacturers Association (CMA), cement consumption has increased by 5.45.4.5% y-o-y in April 2025, which is around 5.430,000t more than April 2025.

As one of the primary consumers of cement, the growth and expansion of the construction industry has had a significant influence on the demand for cement, and consequently cement packaging. Moreover, the consistent rise in the urban population of Spain has also led to investments in infrastructure projects, residential housing developments, and commercial construction activities, all of which have contributed to the growing demand for cement and thus packaging materials.

The cement packaging market in India is anticipated to grow at a CAGR of 5.5% throughout the forecast period.

One of the most important factors driving the cement packaging market in India is the consistent investments made towards the construction industry in the country. The construction industry in India consists of the real estate as well as the urban development segment.

According to Invest India, under the National Infrastructure Pipeline of India, the country has an investment budget of USD 5.4.4 Tn on infrastructure. Additionally, real estate demand is forecasted to grow by over 5.45 sq. ft. by 2025 across major cities. The Government has also allocated over USD 5.4 billion in the Union Budget 2025 for the construction of urban infrastructure in tier 2 & 3 cities.

Additionally, the construction sector of India is one of the leading recipients of foreign direct investment (FDI) in the country. Between April 2000 and 2025, infrastructure related investments reached almost USD 35 billion across the country with more investments expected in the next 5 years.

The section contains information about the leading segments in the industry. By material, plastic cosmetics droppers are estimated to grow at a CAGR of 3.4% throughout 2035. Additionally, the hair care industry is projected to expand at 4.6% till 2035.

| Material | Plastic |

|---|---|

| Value Share (2035) | 65.3% |

Cement packaging made of plastic dominates the market in terms of revenue, accounting for almost 70% of the market share contributing around USD 7.1 billion incremental dollar opportunity through 2035.

Cement packaging made of plastic is more resilient as compared to its counterparts and is more resistant to tears, puncture and moisture leakage as compared to paper and jute. Moreover, the lower cost of plastic cement packaging makes it a popular choice amongst customers operating in developing and underdeveloped nations.

However, there is recurrent demand from developed countries as well owing to its lightweight feature which makes them easier to handle during logistics and transportation.

| Packaging Format | Sacks |

|---|---|

| Value Share (2035) | 57.1.2% |

Amongst the packaging format, sacks is anticipated to account for over 50% of the market share in the cement packaging market by 2035 end. It is also poised to expand at a CAGR of 3.6% across the forecast period.

Sacks made for cement packaging are usually manufactured from strong woven plastic or paper which makes them highly resistant against wear and tear, and also makes them stackable which consequently helps with the economies of scale during transportation.

Additionally, sacks have always been known to be one of the most efficient choice for overall handling. Moreover, familiarity of use amongst construction workers is another factor helping the sacks segment dominate across multiple regions.

The majority of the manufacturers operating in the global market are focusing on the development of cement packaging that can satisfy the regulatory requirements of multiple regions at once. Some of the other key players are aiming to come up with cement packaging which can satiate the ESG goals of customers. Meanwhile, a few other firms are striving for additional capital to broaden their operations and aiming to generate more sales and attract a large customer base globally.

Key manufacturers in the market are focusing on expanding their geographical presence, technological innovations, meeting sustainability goals, performing mergers and acquisitions, and improving customer service to maintain their competitive edge.

Recent Industry Developments in Cement Packaging Market

In terms of material, the industry is divided into plastic, paper, and jute.

In terms of capacity, the industry is segregated into less than 5 kg, 5 kg - 20 kg, 21 kg - 50 kg, and above 50 kg.

In terms of packaging format, the industry is segregated into bags, sacks, pouches, boxes, and other packaging formats.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and Middle East and Africa (MEA) have been covered in the report.

The global cement packaging market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the cement packaging market is projected to reach USD 7.1 billion by 2035.

The cement packaging market is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in cement packaging market are plastic, paper and jute.

In terms of capacity, 5 kg - 20 kg segment to command 40.0% share in the cement packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Cement Packaging Market Analysis – Trends & Forecast 2024-2034

North America Cement Packaging Industry Analysis – Trends & Forecast 2024-2034

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Cement Consistometer Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Cement Paints Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA