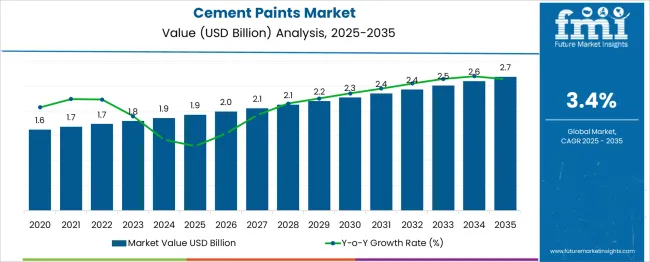

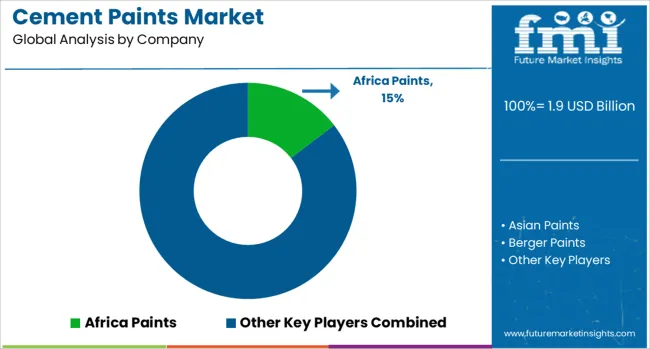

The Cement Paints Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

| Metric | Value |

|---|---|

| Cement Paints Market Estimated Value in (2025 E) | USD 1.9 billion |

| Cement Paints Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

Rising construction activities, particularly in emerging economies, are contributing to increased demand for cement-based coatings for both protective and aesthetic purposes.

Cement paints are preferred for their resistance to algae, moisture, and UV degradation, making them ideal for harsh climatic conditions. The shift towards low-maintenance finishes and surface-protective applications in modern architecture also influences the market.

With growing emphasis on infrastructure modernization and housing developments, manufacturers are investing in new formulations that offer better coverage, color retention, and environmental compliance. The market outlook remains positive, with strong support from government housing initiatives and urban development programs projected to sustain demand across residential and commercial segments.

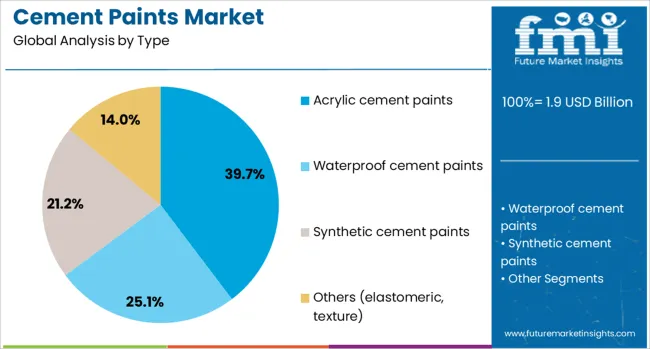

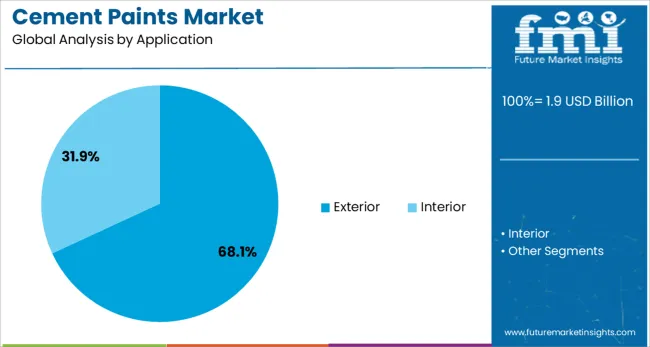

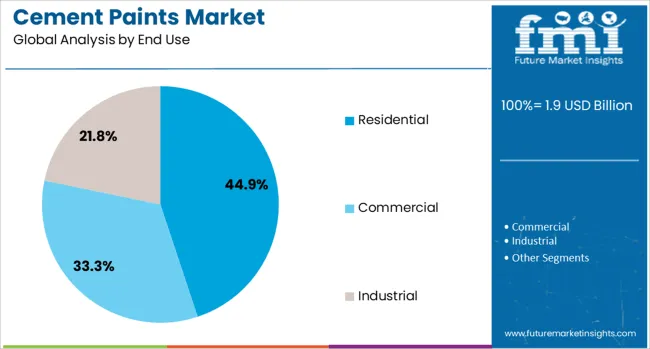

The cement paints market is segmented by type, application, and end use and geographic regions. The cement paints market is divided by type into Acrylic cement paints, Waterproof cement paints, Synthetic cement paints, and Others (elastomeric, texture). In terms of application, the cement paints market is classified into Exterior and Interior. Based on end use, the cement paints market is segmented into Residential, Commercial, and Industrial. Regionally, the cement paints industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The acrylic cement paints segment leads the type category with a 39.7% market share, driven by its superior binding properties, enhanced durability, and aesthetic versatility. Acrylic formulations provide excellent adhesion to concrete and masonry surfaces, delivering resistance to weathering, fungal growth, and alkali attacks.

This segment has gained traction among consumers and contractors due to its ease of application, fast drying times, and availability in a wide color range. Additionally, the compatibility of acrylic cement paints with both interior and exterior surfaces increases their functional appeal.

Manufacturers are also introducing eco-friendly and low-VOC variants to meet regulatory standards and environmental concerns. As consumers prioritize long-term surface protection and visual appeal, acrylic cement paints are expected to remain a preferred choice in new constructions and renovation projects.

Exterior applications dominate the cement paints market with a commanding 68.1% share, reflecting the material’s core utility in protecting external surfaces from environmental damage. Cement paints are widely adopted for exterior facades due to their toughness, water repellency, and ability to withstand temperature fluctuations.

The need to maintain the appearance and structural integrity of buildings under varying weather conditions has fueled their application across residential, industrial, and commercial projects. Infrastructural developments and restoration activities, particularly in regions with extreme climates, further reinforce demand in this segment.

Growth is also supported by increased investments in affordable housing and government infrastructure schemes, which often specify low-cost, durable coatings. With consistent product enhancements and widespread construction activities, exterior applications are expected to remain the primary growth engine of the cement paints market.

The residential segment accounts for 44.9% of the cement paints market by end use, highlighting the sector’s significant contribution to overall demand. Growth in this segment is driven by rapid urbanization, rising disposable incomes, and growing consumer interest in maintaining durable and visually appealing home exteriors. Cement paints are favored in residential settings for their affordability, ease of maintenance, and protection against environmental wear.

Homeowners increasingly opt for weather-resistant and decorative coatings that offer long-lasting finish without frequent repainting. Additionally, the renovation of aging residential structures and expansion of suburban housing projects have created sustained demand.

The residential sector’s dominance is further supported by large-scale government housing initiatives aimed at expanding low-income housing, especially in developing regions. This segment is expected to maintain strong momentum as cement paints continue to serve as a cost-efficient solution for protective and decorative residential coatings.

Demand for cement paints is rising across infrastructure and industrial construction as end users seek both decorative appeal and protective performance. Sales of polymer-modified and anti-carbonation coatings are accelerating in regions with high humidity and rapid urban redevelopment. Asia, Latin America, and the Middle East are driving growth as demand shifts toward durable, climate-resilient solutions.

In 2025, demand for polymer-modified cement paints surged by 24% due to increased infrastructure investment and urban facade restorations. These high-build coatings improve crack bridging and moisture resistance by over 40% compared to standard cement paints. Southeast Asian and Gulf region developments increasingly specify tinted variants for dual structural and aesthetic performance. Use of these paints extended repainting intervals from five to eight years and cut maintenance events by 27%, reducing lifetime costs. Products designed for tropical climates and strong UV exposure gained traction across both residential and commercial refurbishments.

Sales of anti-carbonation cement paints climbed by 29% year-on-year in 2025, particularly in coastal and industrial regions with high moisture exposure. Products enhanced with silica microspheres and hydrophobic additives boosted substrate protection by over 60% compared to traditional lime-based finishes. In marine-exposed buildings across Latin America and coastal China, rebar corrosion and carbon migration were reduced by 18%. Lightweight waterproofing cement paints gained adoption in swimming pool infrastructure and wastewater treatment plants, cutting repeat application costs by 21%. Vendors offering low-alkalinity, color-customized coatings command a 15 to 20% price premium in the premium construction segment.

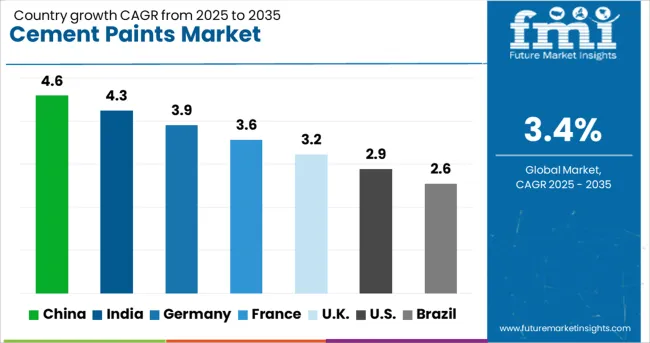

| Country | CAGR |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| France | 3.6% |

| UK | 3.2% |

| USA | 2.9% |

| Brazil | 2.6% |

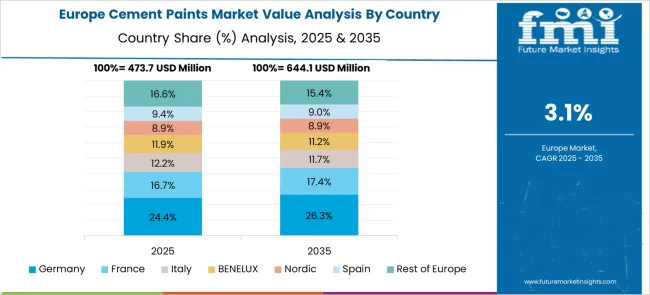

The global market is projected to grow at a CAGR of 3.4% from 2025 to 2035, driven by construction sector resilience, demand for weather-resistant coatings, and growth in affordable housing. China will lead with a CAGR of 4.6%, supported by its expanding rural construction programs and uptake of cost-effective exterior coatings in low-rise buildings. India follows at 4.3%, backed by strong demand in Tier 2 and Tier 3 cities, government incentives for low-income housing, and growth in small-scale manufacturing units using cement paints. Germany is set to grow at 3.9%, where heritage building renovations and energy-efficient coatings contribute to steady demand.

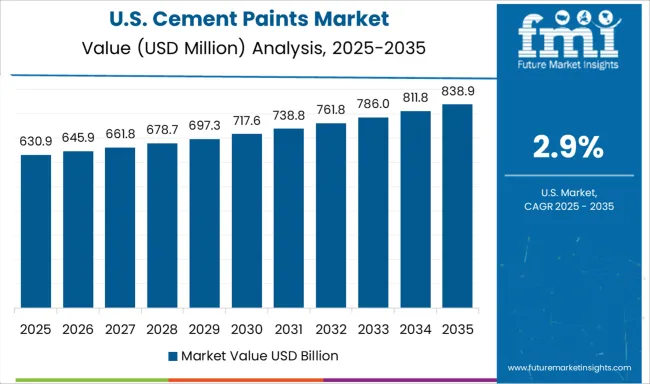

The UK is expected to grow at 3.2%, driven by renovation trends in mid-income housing. The USA trails at 2.9%, with modest growth tied to public infrastructure repainting projects in sunbelt states. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is expected to grow at a 4.6% CAGR, leading globally due to its expanding rural construction initiatives and affordable housing programs. Demand is concentrated in low-rise residential and community buildings where cost-effective exterior coatings are preferred over premium alternatives. Local manufacturers focus on offering weather-resistant cement paints tailored for varying climatic zones. Infrastructure modernization in western provinces and repainting of rural housing stock support long-term consumption. Export of low-cost cement paint formulations to Southeast Asia is also strengthening China’s position in regional trade. Increased adoption of mechanized application methods improves efficiency, further driving market penetration across small construction projects.

India is forecast to grow at a 4.3% CAGR, driven by rising housing construction in Tier 2 and Tier 3 cities. Government-backed schemes like Pradhan Mantri Awas Yojana boost cement paint demand in low-cost housing. The product’s durability and affordability make it a preferred option for rural and semi-urban markets. Manufacturers are innovating with quick-drying, water-repellent variants suited for monsoon-prone regions. Growth in small-scale manufacturing units and warehousing segments further adds to consumption. E-commerce platforms are expanding availability of ready-to-use cement paints, aiding penetration into remote areas. Partnerships between paint brands and micro-finance institutions support adoption among low-income households.

Germany is projected to grow at a 3.9% CAGR, supported by heritage restoration and demand for energy-efficient coatings. Cement paints are preferred for historic facades due to their breathability and long-lasting finish. Stricter EU guidelines on eco-friendly construction materials are driving demand for low-VOC cement paint formulations. Renovation activities in municipal buildings and rural housing clusters reinforce steady consumption. German manufacturers emphasize high-performance coatings with enhanced UV resistance for exterior applications. Growth is further supported by emerging demand in prefabricated structures and energy-compliant construction projects. The premium market remains small, but specialized cement-based coatings command higher pricing in heritage projects.

The United Kingdom is projected to grow at a 3.2% CAGR, driven by renovations in mid-income housing and refurbishment of municipal buildings. Cement paints appeal to budget-conscious consumers for their durability and low maintenance needs. Increasing adoption in outdoor garden structures and utility areas adds to incremental demand. Manufacturers are targeting DIY-focused consumers with easy-application cement paint kits. Growth in digital sales channels ensures wider availability of specialized formulations. While premium decorative paints dominate urban markets, cement-based coatings hold a niche position in rural and suburban housing renovations where functional benefits take priority.

The United States is forecast to grow at a 2.9% CAGR, supported by public infrastructure repainting programs in southern states and modest housing renovations. Cement paints are commonly applied in budget-conscious projects for industrial and municipal structures where cost and durability are prioritized. Manufacturers focus on developing quick-curing formulations for large-scale projects with tight timelines. Adoption remains steady in low-income housing refurbishments and rural community buildings. Opportunities for cement paint expansion in decorative applications remain limited, as acrylic and latex paints dominate the residential segment. Export-oriented production targeting Latin America adds incremental growth for USA-based suppliers.

Africa Paints holds the largest global market share at a significant level in 2025, with strong distribution across East and West Africa and climate-adapted formulations for humid zones. Asian Paints and Berger Paints dominate South Asia with products suited for both mass housing and institutional repainting. Birla White is expanding its reach in Tier II and III cities by leveraging synergies with UltraTech’s cement business. Kansai Nerolac Paints and Nippon Paint are targeting Southeast Asia with exterior-grade offerings focused on long-term durability. In Europe, Farrow & Ball and Kreidezeit cater to the premium segment with eco-certified, heritage-focused cement paint solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Type | Acrylic cement paints, Waterproof cement paints, Synthetic cement paints, and Others (elastomeric, texture) |

| Application | Exterior and Interior |

| End Use | Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Africa Paints, Asian Paints, Berger Paints, Birla White, Farrow & Ball, Johnson Paints, Kansai Nerolac Paints, Kreidezeit, Nippon Paint, and Tata Pigments |

| Additional Attributes | Dollar sales by cement paint type (oil‑based, acrylic, synthetic) and application (interior vs exterior), demand dynamics across residential, commercial, and infrastructure segments, regional leadership in Asia‑Pacific and North America, innovation in low-VOC and reflective coatings, and environmental impact of energy-efficient formulations and VOC reduction. |

The global cement paints market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the cement paints market is projected to reach USD 2.7 billion by 2035.

The cement paints market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in cement paints market are acrylic cement paints, waterproof cement paints, synthetic cement paints and others (elastomeric, texture).

In terms of application, exterior segment to command 68.1% share in the cement paints market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cement Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cement Consistometer Market Size and Share Forecast Outlook 2025 to 2035

Cement Sacks Market Growth – Demand & Forecast 2025 to 2035

Cement Kiln Co-Processing Fuels Market Growth – Trends & Forecast 2024-2034

Europe Cement Packaging Market Analysis – Trends & Forecast 2024-2034

North America Cement Packaging Industry Analysis – Trends & Forecast 2024-2034

Cement Boards Market

Cement and Mortar Testing Equipment Market Growth – Trends & Forecast 2018-2027

Biocement Market Size and Share Forecast Outlook 2025 to 2035

GCC Cement Market Growth – Trends & Forecast 2025 to 2035

Replacement Sheets Market Analysis - Size, Share & Forecast 2025 to 2035

Bone Cement Delivery System Market Trends – Growth & Forecast 2024-2034

Bone Cement Mixers Market

Green Cement Market Size and Share Forecast Outlook 2025 to 2035

Resin Cement for Luting Market Size and Share Forecast Outlook 2025 to 2035

Fiber Cement Market Analysis by Raw Materials, End User, Application, and Region through 2025 to 2035

Fiber Cement Board Market Growth - Trends & Forecast 2025 to 2035

Qatar Cement Market Analysis by Product Type, End Use, and Region Forecast Through 2025 to 2035

Competitive Overview of White Cement Market Share

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA