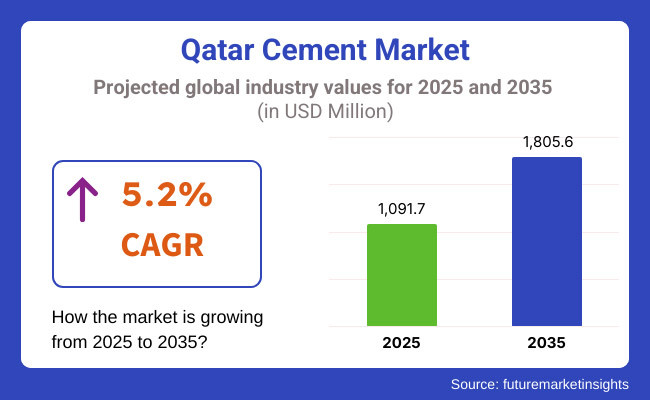

The Qatar cement market is anticipated to be valued at USD 1,091.7 million in 2025. It is expected to grow at a CAGR of 5.2% during the forecast period and reach a value of USD 1,805.6 million in 2035.

Within the cement sector in Qatar, steady growth persisted in 2024, with the impetus coming from expansive, large-scale infrastructure projects, along with urban development and a still-rising demand curve from the real estate sector. In that year, demand played a crucial role in fueling construction efforts aimed at blazing ahead with not just high-end commercial developments but also with residential ones; the two main poles of such projects continued to be Qatar's capital, Doha, and the near-Dohaland of Al Rayyan.

Key drivers of government spending on civic infrastructure remained. This included expanded roadways, bridges, and healthcare facilities. The marine and industrial sectors exhibited strong cement consumption, too, mainly because of port expansions and new industrial zones in Umm Salal and Al Khor. But a global supply chain that's in disarray is impacting raw material costs. And that, of course, is affecting prices.

From 2025 onward, investments in energy-efficient technologies and greater foreign participation in Qatar's construction sector are expected to benefit the nation's cement market. Continued infrastructure expansion driven by Qatar's World Expo ambitions and long-term Vision 2030 projects will also help. From market dynamics influenced by local and global players in imminent mergers, acquisitions, and joint ventures, the GCC cement industry is expected to benefit.

A recent survey conducted by Future Market Insights (FMI) with key stakeholders in the Qatar cement industry revealed strong optimism regarding future demand growth. Over 70% of respondents, including manufacturers, suppliers, and contractors, highlighted ongoing infrastructure projects as the primary driver of cement consumption.

Notably, government-backed smart city initiatives and road expansions emerged as pivotal factors influencing purchase decisions. Real estate developers also indicated an increasing preference for sustainable and blended cement variants to meet evolving regulatory standards.

The survey further identified pricing volatility and raw material costs as major concerns among industry participants. Over 60% of manufacturers reported supply chain disruptions affecting their production costs, particularly in clinker imports. However, many industry leaders believe that strategic collaborations with international suppliers and investments in domestic clinker production could mitigate these challenges over the next five years.

Another key takeaway was the growing interest in energy-efficient cement production. More than 50% of manufacturers confirmed plans to adopt alternative fuel sources and carbon-reduction techniques to align with Qatar’s sustainability goals.

This shift is expected to create new revenue streams, especially as government policies increasingly favor green construction materials.Get in touch with FMI’s analysts today to gain data-driven insights and stay ahead in this dynamic market.

| 2020 to 2024 (Historical Analysis) | 2025 to 2035 (Future Outlook) |

|---|---|

| The market witnessed steady growth, primarily driven by infrastructure projects for FIFA World Cup 2022. Major developments included stadium construction, road networks, metro expansion, and urban projects. | Cement demand is expected to remain strong, supported by smart city initiatives, industrial expansion, and new transportation infrastructure. The shift towards sustainable and blended cement will further drive market evolution. |

| Government spending on infrastructure remained high, with over USD 100 billion allocated to major projects. | Ongoing economic diversification efforts are expected to sustain high construction activity, reducing Qatar’s reliance on oil and gas revenues. |

| Supply chain disruptions due to the COVID-19 pandemic led to short-term price fluctuations and delays in project completion. | Increased domestic production capacity and strategic partnerships with international suppliers will enhance supply stability and cost efficiency. |

| Ordinary Portland Cement (OPC) dominated the market, while blended cement adoption remained limited due to lower awareness and a regulatory push. | Blended cement demand is expected to surge, driven by Qatar’s sustainability targets and environmental regulations, making it the fastest-growing product category. |

| Civic infrastructure projects, including ports, bridges, and metro expansions, were major consumers of cement. | Real estate, commercial buildings, and industrial construction will emerge as major growth drivers, complementing ongoing infrastructure developments. |

Blended cement is the fastest-growing segment in Qatar’s cement market, propelled by sustainability initiatives and regulatory support for eco-friendly construction materials. With higher durability, lower emissions, and cost efficiency, blended cement is increasingly favored in infrastructure and residential projects, replacing conventional cement in many large-scale developments.

Government policies promoting low-carbon construction and corporate sustainability commitments are further accelerating adoption. As Qatar continues investing in green building projects and modern infrastructure, the demand for blended cement is expected to rise significantly, positioning it as a key growth driver in the cement industry over the next decade.

The civic infrastructure segment is the largest consumer of cement in Qatar, expanding at a CAGR of 5.5%. Massive government investments in roads, ports, bridges, and tunnels are driving demand. The FIFA World Cup 2022 significantly accelerated infrastructure projects, and Qatar continues to modernize its transportation and urban development sectors.

Ongoing initiatives, including smart city projects, metro expansions, and expressway developments, are driving cement consumption. The government's push for economic diversification and its effort to reduce reliance on oil and gas further boost construction activity. With large-scale projects in the pipeline, the civic infrastructure sector will remain a key growth driver through 2035.

Government regulations are shaping Qatar’s cement market by enforcing strict quality standards and sustainability goals under Qatar National Vision 2030. Authorities mandate compliance with QCS 2014 and GSO standards, while policies promote low-carbon cement and alternative fuels, ensuring industry alignment with infrastructure growth and environmental commitments.

| Country | Government Policies, Regulations & Mandatory Certifications |

|---|---|

| Qatar |

|

Expansion into Sustainable Cement Production

According to the sustainability legislation imposed by Qatar, one of the best investment options for stakeholders is mixed cement production. Taking partnerships with concerned government institutions to advance development for solutions in low-carbon cement can positively place a public paradigm in competitive advantage. Extended R&D on alternatives like geopolymer cement can also work towards snatching the rapidly advancing market for green building materials.

Capitalizing on Smart City & Infrastructure Projects

Qatar’s smart city initiatives (such as Lusail and Msheireb Downtown Doha) require high-performance cement for durable infrastructure. The manufacturers of cement also develop specialty products designed for high-rise buildings, energy-efficient buildings, and advanced transport systems. Partnerships with construction companies developing metro expansion projects and industrial zone projects would create consistent demand.

Enhancing Local Production & Supply Chain Efficiency

To reduce import dependency and mitigate supply chain risks, cement manufacturers should invest in local raw material sourcing and energy-efficient production plants. It will be necessary to start building strategic stockpiles for key inputs such as clinker and gypsum to stabilize prices and meet surging demand for these items during peak construction cycles.

Targeting High-Growth Segments like Marine & Industrial Construction

The marine and industrial construction sectors in Qatar are expanding and are driven by new ports, offshore projects, and industrial cities. Cement suppliers should actively adapt the products to sulfate resistance for durability under harsh marine environments. This way, specialized formulations for power plants and oil and gas infrastructure could cause new sources of revenue.

As of 2024, the market has experienced dynamic growth, driven by infrastructure development, urbanization, and preparations for major events like the 2022 FIFA World Cup. Market key players are Qatar National Cement Company (QNCC), LafargeHolcim, Al Khalij Cement Company, and Qatar Raw Materials. These companies have engaged in strategic initiatives to satisfy the country's cement demand growth.

Another major player, Al Khalij Cement Company, engages in diversification and innovation. A new line of low-carbon cement products that target environmentally conscious construction projects was presented by Al Khalij Cement Company in early 2024. These products were well-received, especially for government infrastructure projects that give priority to sustainability. Al Khalij Cement Company has also strengthened its distribution network to ensure timely deliveries to construction sites across Qatar.

Major partnerships characterized the Qatar cement industry in 2024. In March 2024, LafargeHolcim partnered with a construction firm from Qatar to formulate advanced cement solutions for high-rise buildings as well as mega-projects. The Gulf Times reported that this partnership seeks to leverage LafargeHolcim's global expertise in construction materials and provide support for Qatar's ambitious infrastructure plans. Such cooperation brings to light an increased focus on innovation and quality within the industry itself.

In another major development in 2024, the expanded use of alternative raw materials in cement production was observed. Companies such as Qatar Raw Materials have funded research to develop cement blends using industrial by-products such as fly ash and slag. This reduces production costs, but with further appeal, it contributes to the demand for sustainable construction materials. Moreover, these blended cements have environmentally friendly features.

The cement industry of Qatar massively benefitted from the government's impetus for local manufacturing. In 2024, an incentive was provided by the Qatari government for companies that source raw materials locally and adopt green manufacturing. These policies persuaded cement manufacturers to invest in local supply chains rather than being dependent on imports.

In general, the Qatari cement sector in 2024 will be defined by capacity expansions, sustainability initiatives, and strategic partnerships. Major players like QNCC, Al Khalij Cement Company, and LafargeHolcim are tapping these trends to further entrench their positions in the market and support Qatar's infrastructure development goals. Innovation and sustainability will be the hallmarks propelling further growth in the forthcoming years.

The Qatar cement market falls under construction materials, which work under the influence of infrastructure works, expansion of real estate, and industrial development. The cement industry is a commodity-driven industry affected by government expenditure on macroeconomic parameters, such as global raw material prices and energy prices.

Our major focus is to develop Qatar's economy, which depends mainly on oil and gas revenue, with the Qatar National Vision 2030 projecting the development of infrastructure and industrialization. This is sustained by heavy investments in housing, transportation, and commercial projects through both the public and private sectors. The post-FIFA 2022 development agenda continued to emphasize the government to advance projects related to urbanization, smart cities, and industrial zones, which further bolster demand.

At an international level, cement production costs are affected by changes in commodity prices, energy prices, and supply chain constraints. However, in light of Qatar's excellent fiscal position, coupled with strategic projects for infrastructure development and a formal government initiative, the sector has the stability to weather such storms in the long term.

On the other hand, environmental trends such as carbon-neutral construction and green building materials are currently becoming a major driving force for the industry. Thus, we note that an increase in demands emanating from blended cement and low-carbon cement will give way to sustainability. Economic diversification, foreign investments, and continuing infrastructure development will mark the growth of the cement industry in Qatar from now until 2035.

By product type, the market is segmented into ordinary Portland cement, Portland pozzolana cement (PPC), sulphate resistant Portland cement, blended cement, white cement, Portland slag cement (PSC), super grade cement, and hydrophobic Portland cement.

Based on end use, the market is segmented into residential and commercial building, civic infrastructure, and industrial and marine construction.

Large-scale infrastructure projects, government investments, and sustainability initiatives are major growth drivers.

Blended cement is growing rapidly due to its environmental benefits and government policies promoting sustainable construction.

Regulations are pushing for lower carbon emissions, sustainable materials, and stricter quality standards, encouraging manufacturers to adopt eco-friendly production methods.

Civic infrastructure, including roads, bridges, tunnels, and ports, remains a primary consumer of cement, with sustained investments driving long-term demand.

Major companies include Qatar National Cement Company, Al Khalij Cement Company, and United Gulf Cement Company, among others.

Table 01: Market Size Volume (kilo tons) Forecast By Product Type, 2017 to 2032

Table 02: Market Size Value (US$ million) Forecast By Product Type, 2017 to 2032

Table 03: Market Size Volume (kilo tons) Forecast By End Use, 2017 to 2032

Table 04: Market Size Value (US$ million) Forecast By End Use, 2017 to 2032

Table 05: Market Size Volume (kilo tons) and Value (US$ million) Forecast By Country, 2017 to 2032

Table 06: Al Shamal Cement Market Size Volume (kilo tons) Forecast By Product Type, 2017 to 2032

Table 07: Al Shamal Cement Market Size Value (US$ million) Forecast By Product Type, 2017 to 2032

Table 08: Al Shamal Cement Market Size Volume (kilo tons) Forecast By End Use, 2017 to 2032

Table 09: Al Shamal Cement Market Size Value (US$ million) Forecast By End Use, 2017 to 2032

Table 10: Al Khor Cement Market Size Volume (kilo tons) Forecast By Product Type, 2017 to 2032

Table 11: Al Khor Cement Market Size Value (US$ million) Forecast By Product Type, 2017 to 2032

Table 12: Al Khor Cement Market Size Volume (kilo tons) Forecast By End Use, 2017 to 2032

Table 13: Al Khor Cement Market Size Value (US$ million) Forecast By End Use, 2017 to 2032

Table 14: Al Sheehaniya Cement Market Size Volume (kilo tons) Forecast By Product Type, 2017 to 2032

Table 15: Al Sheehaniya Cement Market Size Value (US$ million) Forecast By Product Type, 2017 to 2032

Table 16: Al Sheehaniya Cement Market Size Volume (kilo tons) Forecast By End Use, 2017 to 2032

Table 17: Al Sheehaniya Cement Market Size Value (US$ million) Forecast By End Use, 2017 to 2032

Table 18: Umm Salal Cement Market Size Volume (kilo tons) Forecast By Product Type, 2017 to 2032

Table 19: Umm Salal Cement Market Size Value (US$ million) Forecast By Product Type, 2017 to 2032

Table 20: Umm Salal Cement Market Size Volume (kilo tons) Forecast By End Use, 2017 to 2032

Table 21: Umm Salal Cement Market Size Value (US$ million) Forecast By End Use, 2017 to 2032

Table 22: Al Dhaayen Cement Market Size Volume (kilo tons) Forecast By Product Type, 2017 to 2032

Table 23: Al Dhaayen Cement Market Size Value (US$ million) Forecast By Product Type, 2017 to 2032

Table 24: Al Dhaayen Cement Market Size Volume (kilo tons) Forecast By End Use, 2017 to 2032

Table 25: Al Dhaayen Cement Market Size Value (US$ million) Forecast By End Use, 2017 to 2032

Table 26: Doha Cement Market Size Volume (kilo tons) Forecast By Product Type, 2017 to 2032

Table 27: Doha Cement Market Size Value (US$ million) Forecast By Product Type, 2017 to 2032

Table 28: Doha Cement Market Size Volume (kilo tons) Forecast By End Use, 2017 to 2032

Table 29: Doha Cement Market Size Value (US$ million) Forecast By End Use, 2017 to 2032

Table 30: Al Rayyan Cement Market Size Volume (kilo tons) Forecast By Product Type, 2017 to 2032

Table 31: Al Rayyan Cement Market Size Value (US$ million) Forecast By Product Type, 2017 to 2032

Table 32: Al Rayyan Cement Market Size Volume (kilo tons) Forecast By End Use, 2017 to 2032

Table 33: Al Rayyan Cement Market Size Value (US$ million) Forecast By End Use, 2017 to 2032

Table 34: Al Wakrah Cement Market Size Volume (kilo tons) Forecast By Product Type, 2017 to 2032

Table 35: Al Wakrah Cement Market Size Value (US$ million) Forecast By Product Type, 2017 to 2032

Table 36: Al Wakrah Cement Market Size Volume (kilo tons) Forecast By End Use, 2017 to 2032

Table 37: Al Wakrah Cement Market Size Value (US$ million) Forecast By End Use, 2017 to 20

Figure 01: Market Historical Volume (kilo tons), 2017 to 2021

Figure 02: Market Current and Forecast Volume (kilo tons), 2022 to 2032

Figure 03: Market Historical Value (US$ million), 2017 to 2021

Figure 04: Market Current and Forecast Value (US$ million), 2022 to 2032

Figure 05: Market Incremental $ Opportunity (US$ million), 2022 to 2032

Figure 06: Market Share and BPS Analysis By Product Type– 2022 and 2032

Figure 07: Market Y-o-Y Growth Projections By Product Type, 2022 to 2032

Figure 08: Market Attractiveness Analysis By Product Type, 2022 to 2032

Figure 09: Market Absolute $ Opportunity by Ordinary Portland Cement Segment, 2017 to 2032

Figure 10: Market Absolute $ Opportunity by Portland Pozzolana Cement (PPC) Segment, 2017 to 2032

Figure 11: Market Absolute $ Opportunity by Sulfate Resistant Portland Cement Segment, 2017 to 2032

Figure 12: Market Absolute $ Opportunity by Blended Cement Segment, 2017 to 2032

Figure 13: Market Absolute $ Opportunity by White Cement Segment, 2017 to 2032

Figure 14: Market Absolute $ Opportunity by Portland Slag Cement (PSC) Segment, 2017 to 2032

Figure 15: Market Absolute $ Opportunity by Super Grade Cement Segment, 2017 to 2032

Figure 16: Market Absolute $ Opportunity by Hydrophobic Portland Cement Segment, 2017 to 2032

Figure 17: Market Share and BPS Analysis By End Use– 2022 and 2032

Figure 18: Market Y-o-Y Growth Projections By End Use, 2022 to 2032

Figure 19: Market Attractiveness Analysis By End Use, 2022 to 2032

Figure 20: Market Absolute $ Opportunity by Residential and Commercial Buildings Segment, 2017 to 2032

Figure 21: Market Absolute $ Opportunity by Civic Infrastructure Segment, 2017 to 2032

Figure 22: Market Absolute $ Opportunity by Industrial and Marine Construction Segment, 2017 to 2032

Figure 23: Market Share and BPS Analysis By Country– 2022 and 2032

Figure 24: Market Y-o-Y Growth Projections By Country, 2022 to 2032

Figure 25: Market Attractiveness Analysis By Country, 2022 to 2032

Figure 26: Market Absolute $ Opportunity by Al Shamal Segment, 2017 to 2032

Figure 27: Market Absolute $ Opportunity by Al Khor Segment, 2017 to 2032

Figure 28: Market Absolute $ Opportunity by Al Sheehaniya Segment, 2017 to 2032

Figure 29: Market Absolute $ Opportunity by Umm Salal Segment, 2017 to 2032

Figure 30: Market Absolute $ Opportunity by Al Dhaayen Segment, 2017 to 2032

Figure 31: Market Absolute $ Opportunity by Doha Segment, 2017 to 2032

Figure 32: Market Absolute $ Opportunity by Al Rayyan Segment, 2017 to 2032

Figure 33: Market Absolute $ Opportunity by Al Wakrah Segment, 2017 to 2032

Figure 34: Al Shamal Cement Market Share and BPS Analysis By Product Type– 2022 and 2032

Figure 35: Al Shamal Cement Market Y-o-Y Growth Projections By Product Type, 2022 to 2032

Figure 36: Al Shamal Cement Market Attractiveness Analysis By Product Type, 2022 to 2032

Figure 37: Al Shamal Cement Market Share and BPS Analysis By End Use– 2022 and 2032

Figure 38: Al Shamal Cement Market Y-o-Y Growth Projections By End Use, 2022 to 2032

Figure 39: Al Shamal Cement Market Attractiveness Analysis By End Use, 2022 to 2032

Figure 40: Al Khor Cement Market Share and BPS Analysis By Product Type– 2022 and 2032

Figure 41: Al Khor Cement Market Y-o-Y Growth Projections By Product Type, 2022 to 2032

Figure 42: Al Khor Cement Market Attractiveness Analysis By Product Type, 2022 to 2032

Figure 43: Al Khor Cement Market Share and BPS Analysis By End Use– 2022 and 2032

Figure 44: Al Khor Cement Market Y-o-Y Growth Projections By End Use, 2022 to 2032

Figure 45: Al Khor Cement Market Attractiveness Analysis By End Use, 2022 to 2032

Figure 46: Al Sheehaniya Cement Market Share and BPS Analysis By Product Type– 2022 and 2032

Figure 47: Al Sheehaniya Cement Market Y-o-Y Growth Projections By Product Type, 2022 to 2032

Figure 48: Al Sheehaniya Cement Market Attractiveness Analysis By Product Type, 2022 to 2032

Figure 49: Al Sheehaniya Cement Market Share and BPS Analysis By End Use– 2022 and 2032

Figure 50: Al Sheehaniya Cement Market Y-o-Y Growth Projections By End Use, 2022 to 2032

Figure 51: Al Sheehaniya Cement Market Attractiveness Analysis By End Use, 2022 to 2032

Figure 52: Umm Salal Cement Market Share and BPS Analysis By Product Type– 2022 and 2032

Figure 53: Umm Salal Cement Market Y-o-Y Growth Projections By Product Type, 2022 to 2032

Figure 54: Umm Salal Cement Market Attractiveness Analysis By Product Type, 2022 to 2032

Figure 55: Umm Salal Cement Market Share and BPS Analysis By End Use– 2022 and 2032

Figure 56: Umm Salal Cement Market Y-o-Y Growth Projections By End Use, 2022 to 2032

Figure 57: Umm Salal Cement Market Attractiveness Analysis By End Use, 2022 to 2032

Figure 58: Al Dhaayen Cement Market Share and BPS Analysis By Product Type– 2022 and 2032

Figure 59: Al Dhaayen Cement Market Y-o-Y Growth Projections By Product Type, 2022 to 2032

Figure 60: Al Dhaayen Cement Market Attractiveness Analysis By Product Type, 2022 to 2032

Figure 61: Al Dhaayen Cement Market Share and BPS Analysis By End Use– 2022 and 2032

Figure 62: Al Dhaayen Cement Market Y-o-Y Growth Projections By End Use, 2022 to 2032

Figure 63: Al Dhaayen Cement Market Attractiveness Analysis By End Use, 2022 to 2032

Figure 64: Doha Cement Market Share and BPS Analysis By Product Type– 2022 and 2032

Figure 65: Doha Cement Market Y-o-Y Growth Projections By Product Type, 2022 to 2032

Figure 66: Doha Cement Market Attractiveness Analysis By Product Type, 2022 to 2032

Figure 67: Doha Cement Market Share and BPS Analysis By End Use– 2022 and 2032

Figure 68: Doha Cement Market Y-o-Y Growth Projections By End Use, 2022 to 2032

Figure 69: Doha Cement Market Attractiveness Analysis By End Use, 2022 to 2032

Figure 70: Al Rayyan Cement Market Share and BPS Analysis By Product Type– 2022 and 2032

Figure 71: Al Rayyan Cement Market Y-o-Y Growth Projections By Product Type, 2022 to 2032

Figure 72: Al Rayyan Cement Market Attractiveness Analysis By Product Type, 2022 to 2032

Figure 73: Al Rayyan Cement Market Share and BPS Analysis By End Use– 2022 and 2032

Figure 74: Al Rayyan Cement Market Y-o-Y Growth Projections By End Use, 2022 to 2032

Figure 75: Al Rayyan Cement Market Attractiveness Analysis By End Use, 2022 to 2032

Figure 76: Al Wakrah Cement Market Share and BPS Analysis By Product Type– 2022 and 2032

Figure 77: Al Wakrah Cement Market Y-o-Y Growth Projections By Product Type, 2022 to 2032

Figure 78: Al Wakrah Cement Market Attractiveness Analysis By Product Type, 2022 to 2032

Figure 79: Al Wakrah Cement Market Share and BPS Analysis By End Use– 2022 and 2032

Figure 80: Al Wakrah Cement Market Y-o-Y Growth Projections By End Use, 2022 to 2032

Figure 81: Al Wakrah Cement Market Attractiveness Analysis By End Use, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cement Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cement Consistometer Market Size and Share Forecast Outlook 2025 to 2035

Cement Paints Market Size and Share Forecast Outlook 2025 to 2035

Cement Sacks Market Growth – Demand & Forecast 2025 to 2035

Cement Kiln Co-Processing Fuels Market Growth – Trends & Forecast 2024-2034

Europe Cement Packaging Market Analysis – Trends & Forecast 2024-2034

North America Cement Packaging Industry Analysis – Trends & Forecast 2024-2034

Cement Boards Market

Cement and Mortar Testing Equipment Market Growth – Trends & Forecast 2018-2027

Biocement Market Size and Share Forecast Outlook 2025 to 2035

GCC Cement Market Growth – Trends & Forecast 2025 to 2035

Replacement Sheets Market Analysis - Size, Share & Forecast 2025 to 2035

Bone Cement Delivery System Market Trends – Growth & Forecast 2024-2034

Bone Cement Mixers Market

Green Cement Market Size and Share Forecast Outlook 2025 to 2035

Resin Cement for Luting Market Size and Share Forecast Outlook 2025 to 2035

Fiber Cement Market Analysis by Raw Materials, End User, Application, and Region through 2025 to 2035

Fiber Cement Board Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of White Cement Market Share

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA