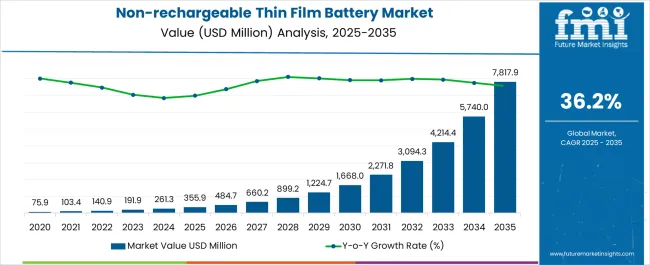

The non-rechargeable thin film battery market, valued at 355.9 USD million in 2025, is projected to reach 7,817.9 USD million by 2035, reflecting a CAGR of 36.2% over the period. The market maturity curve demonstrates early adoption from 2020–2024, when limited applications and pilot deployments defined demand, with annual market size growing from 75.9 to 261.3 USD million. By 2025, the curve steepens as adoption spreads across electronics, medical devices, and wearable sectors. From 2025–2030, market size accelerates to 1,668 USD million, indicating scaling with wider adoption, higher production capacity, and growing order volumes. Beyond 2030, growth moderates as the market approaches consolidation, with established suppliers dominating demand. The adoption lifecycle follows this progression. During 2020–2024, early adopters validate reliability, form reference cases, and refine supply chains.

Between 2025–2030, mainstream buyers expand purchases, production capacities are optimized, and standardized contracts emerge, driving rapid market expansion. In 2030–2035, consolidation sets in, with late entrants adopting proven business models, strategic partnerships shaping competitive dynamics, and procurement focusing on cost efficiency. The market evolves from experimental adoption to broad replication and finally to an organized, predictable phase, with high-volume players controlling supply and demand stabilization defining industry norms.

| Metric | Value |

|---|---|

| Non-rechargeable Thin Film Battery Market Estimated Value in (2025 E) | USD 355.9 million |

| Non-rechargeable Thin Film Battery Market Forecast Value in (2035 F) | USD 7817.9 million |

| Forecast CAGR (2025 to 2035) | 36.2% |

Seasonality in the non-rechargeable thin film battery market is influenced by product launch cycles, consumer electronics release schedules, and medical device production timelines. Data shows that Q3 and Q4 account for 40–45% of annual shipments, coinciding with peak electronics launches and holiday demand. Conversely, Q1 typically records 15–20% lower activity, as manufacturers adjust inventories post-holiday season. Certain medical and wearable device rollouts are clustered in specific quarters, creating short-term demand spikes of 10–15% above baseline quarterly levels. Suppliers plan production and logistics around these seasonal peaks to ensure timely delivery while avoiding overstock during lower-demand periods. Cyclicality reflects investment and technology adoption patterns.

Large-scale procurement often follows 3–5 year product refresh cycles, leading to periodic surges that can double demand in a single year. Similarly, regulatory approvals for medical devices or certifications for industrial electronics can temporarily accelerate orders by 20–25%, creating cyclical bursts. Over the decade, these cycles overlay the high CAGR of 36.2%, producing alternating periods of rapid growth and moderate stabilization.

Demand is being driven by the need for lightweight and ultra-thin batteries that can be seamlessly embedded into small-scale products without compromising energy efficiency. The ability of thin-film batteries to deliver consistent voltage, maintain long shelf life, and operate under a wide temperature range has reinforced their adoption in applications where reliability is critical. Advancements in solid-state materials and manufacturing processes are enabling enhanced capacity and energy density, making these batteries more suitable for next-generation devices.

Additionally, the growing use of IoT-enabled systems and the expansion of miniaturized electronics across multiple sectors are creating new growth opportunities. With ongoing investments in material innovation and scalable production capabilities, the market is set to benefit from increasing adoption in niche and high-value applications, ensuring a positive long-term outlook.

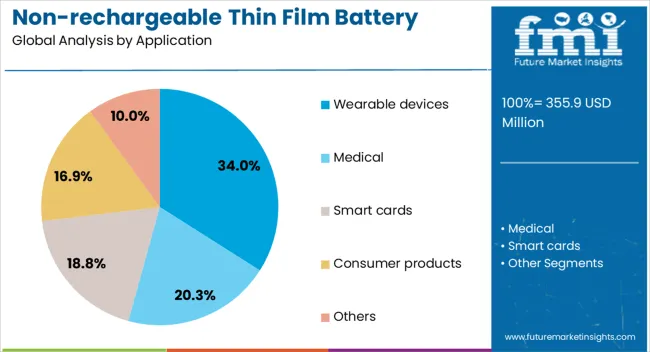

The non-rechargeable thin film battery market is segmented by application and geographic regions. By application, the non-rechargeable thin film battery market is divided into Wearable devices, Medical, Smart cards, Consumer products, and Others. Regionally, the non-rechargeable thin film battery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wearable devices application segment is projected to hold 34% of the non-rechargeable thin-film battery market revenue share in 2025, positioning it as the leading application segment. This growth has been attributed to the rising demand for compact, lightweight power solutions in fitness trackers, smartwatches, medical monitoring devices, and other wearable electronics. The thin profile of these batteries allows seamless integration into slim and flexible device designs, enhancing both comfort and portability for users.

Their high energy efficiency and stable performance over extended periods have supported their adoption in wearables that require long operational life without frequent replacements. The capability to operate reliably under varying environmental conditions has further strengthened their suitability for wearable use.

Additionally, the growing consumer preference for continuous health monitoring and connected lifestyle devices has fueled the need for dependable, maintenance-free power sources. As the wearable technology market continues to expand, the adoption of non-rechargeable thin film batteries in this segment is expected to remain robust.

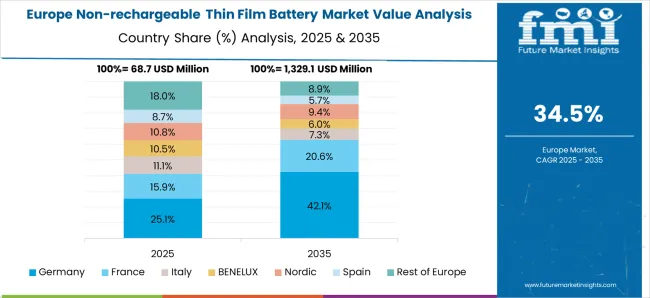

The non-rechargeable thin film battery market is growing due to increasing demand in compact electronics, medical devices, and smart sensors. These batteries offer high energy density, long shelf life, and low self-discharge, making them ideal for low-power and thin-profile applications. Asia-Pacific leads production and consumption due to electronics manufacturing growth, while North America and Europe focus on precision devices. Manufacturers emphasize miniaturization, consistent output, and integration with flexible electronics, IoT, and wearable technologies to meet emerging application requirements.

Non-rechargeable thin film batteries are widely used in wearable devices, smart sensors, and IoT applications requiring compact form factors and reliable energy for long durations. Their thin profile allows seamless integration into medical monitors, fitness trackers, and smart cards without adding bulk. Long shelf life and low self-discharge rates ensure the battery remains functional over extended periods, which is critical for devices that are not frequently accessed. Until alternative energy solutions such as micro-supercapacitors or thin-film rechargeable batteries achieve comparable reliability, energy density, and miniaturization, non-rechargeable thin film batteries will continue to dominate low-power electronics applications.

Medical devices, including implantable sensors, diagnostic tools, and monitoring systems, increasingly rely on non-rechargeable thin film batteries for reliable energy supply. Safety, biocompatibility, and stable voltage output are essential for accurate device operation. Batteries must perform consistently under varying temperature and humidity conditions while maintaining a long shelf life. Manufacturers offering ultra-thin, flexible, and high-energy-density batteries gain preference among medical device producers. Until alternative power sources provide the same combination of reliability, safety, and miniaturization, non-rechargeable thin film batteries will remain critical for powering precision and implantable medical devices.

Non-rechargeable thin film batteries are employed in industrial sensors, environmental monitors, and remote telemetry devices where frequent replacement or recharging is impractical. These batteries provide long-term, maintenance-free power in harsh or hard-to-access locations. Stable voltage and resistance to temperature fluctuations ensure consistent performance for industrial IoT systems. Suppliers offering batteries with high energy density, robustness, and predictable discharge characteristics gain a competitive edge. Until alternative power sources can reliably deliver similar operational lifespan and environmental tolerance, non-rechargeable thin film batteries will continue to be preferred for industrial and remote monitoring applications.

The shift toward thinner, lighter, and flexible electronic devices drives demand for non-rechargeable thin film batteries. These batteries can be integrated into flexible displays, smart labels, and compact sensors without affecting form factor or device design. Uniform energy output and mechanical resilience are key for applications involving bending, folding, or continuous movement. Manufacturers focusing on ultra-thin, customizable shapes, and high mechanical flexibility can address emerging electronics markets. Until alternative micro-power solutions combine flexibility, miniaturization, and consistent performance, non-rechargeable thin film batteries will remain crucial for enabling next-generation portable and wearable electronic devices.

| Country | CAGR |

|---|---|

| China | 48.9% |

| India | 45.3% |

| Germany | 41.6% |

| France | 38.0% |

| UK | 34.4% |

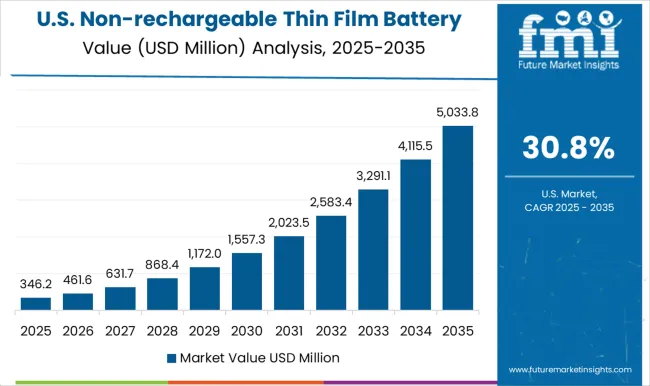

| USA | 30.8% |

| Brazil | 27.2% |

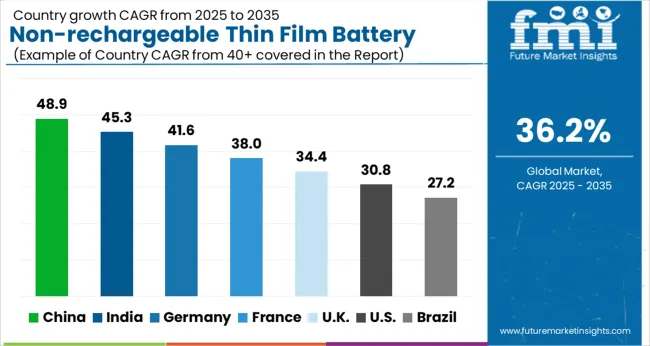

The global non-rechargeable thin film battery market is projected to grow at a CAGR of 36.2% through 2035, supported by increasing demand across medical devices, consumer electronics, and industrial sensors. Among BRICS nations, China has been recorded with 48.9% growth, driven by large-scale production and deployment in compact electronics and specialized medical applications, while India has been observed at 45.3%, supported by rising utilization in consumer electronics and industrial sensing devices. In the OECD region, Germany has been measured at 41.6%, where production and adoption for medical, consumer, and industrial applications have been steadily maintained. The United Kingdom has been noted at 34.4%, reflecting consistent use in electronic, medical, and industrial sectors, while the USA has been recorded at 30.8%, with production and utilization across medical, industrial, and consumer applications being steadily increased. This report includes insights on 40+ countries; the top markets are shown here for reference.

The non-rechargeable thin film battery market in China is growing at a CAGR of 48.9%, driven by rising adoption in wearable electronics, medical devices, and IoT applications. Increasing demand for compact, lightweight, and high-performance energy solutions supports market expansion. The electronics industry’s rapid growth, coupled with technological advancements in battery efficiency, voltage stability, and shelf life, enhances product adoption. Investments in R&D for flexible and miniature battery solutions further fuel market growth. Government initiatives promoting advanced manufacturing and smart electronics accelerate deployment in industrial and consumer applications. Rising awareness about battery safety, durability, and eco-friendly disposal practices also encourages adoption. The large-scale manufacturing ecosystem and growing consumer electronics penetration position China as a dominant player in the non-rechargeable thin film battery market.

The non-rechargeable thin film battery market in India is expanding at a CAGR of 45.3%, driven by increasing use in medical, consumer electronics, and IoT devices. Rising demand for compact and long-lasting batteries supports market growth. Investments in R&D and production facilities for miniature and flexible battery solutions enhance technological capabilities. Industrial adoption in healthcare monitoring devices, smart sensors, and wearable gadgets contributes to steady demand. Government initiatives encouraging electronics manufacturing, innovation, and smart device integration further boost growth. Technological advancements in energy density, safety, and shelf life improve product performance and reliability. With growing awareness of battery disposal standards and eco-friendly practices, India’s non-rechargeable thin film battery market is poised for strong growth in both domestic and export sectors.

The non-rechargeable thin film battery market in Germany is growing at a CAGR of 41.6%, driven by industrial automation, medical devices, and consumer electronics applications. Demand is supported by increasing adoption of compact and energy-efficient power sources. Technological advancements in voltage stability, energy density, and safety features enhance market acceptance. Germany’s focus on renewable and eco-friendly technologies encourages the development of sustainable battery solutions. Industrial players invest in R&D to improve reliability, miniaturization, and shelf life. Applications in wearable medical devices, smart sensors, and IoT systems contribute to steady demand. Government regulations promoting energy efficiency, environmental compliance, and technological innovation further strengthen the market. Germany’s well-established electronics and industrial sector positions the country as a key player in the non-rechargeable thin film battery industry.

The non-rechargeable thin film battery market in the United Kingdom is expanding at a CAGR of 34.4%, driven by wearable devices, medical applications, and smart electronics. Rising demand for compact, reliable, and high-performance batteries supports steady market growth. Technological improvements in energy density, shelf life, and safety enhance adoption in industrial and consumer applications. Investments in R&D for flexible and miniature batteries encourage innovation and market penetration. Government initiatives promoting electronics manufacturing, sustainability, and smart device deployment further support expansion. Growing consumer awareness regarding eco-friendly battery disposal and energy efficiency also contributes to market development. With increasing deployment across healthcare, IoT, and wearable sectors, the non-rechargeable thin film battery market in the UK is expected to maintain strong growth over the forecast period.

The non-rechargeable thin film battery market in the United States is growing at a CAGR of 30.8%, fueled by adoption in consumer electronics, IoT, and medical devices. Increasing demand for compact, lightweight, and long-lasting power sources drives growth. Technological innovations enhance energy density, voltage stability, and shelf life, improving reliability. Industrial use in wearable electronics, smart sensors, and healthcare devices contributes to steady consumption. Government initiatives promoting advanced manufacturing, energy efficiency, and eco-friendly disposal practices encourage market expansion. Investments in R&D for flexible and miniature battery technologies further strengthen capabilities. With rising consumer and industrial adoption across electronics, medical, and IoT sectors, the non-rechargeable thin film battery market in the United States is positioned for sustained growth and technological advancement.

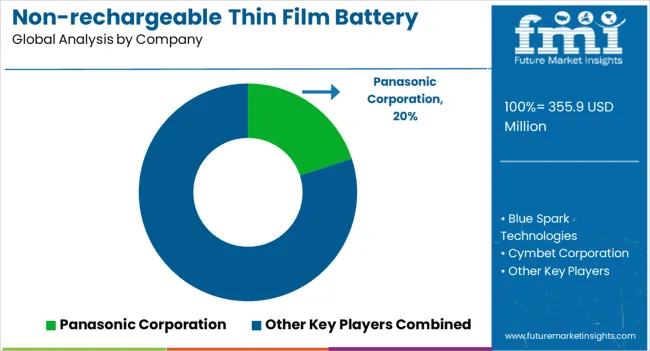

The non-rechargeable thin film battery market plays a pivotal role in powering compact, low-energy devices such as medical implants, IoT sensors, smart cards, and wearable electronics. These batteries are valued for their long shelf life, stable voltage, and ability to operate in extreme environments, making them essential for applications where frequent replacement is impractical. Growing demand for miniaturized electronics and the proliferation of IoT devices are key factors driving market growth. Panasonic Corporation is a major player, offering high-performance thin film batteries with reliable energy density and long-term stability. Blue Spark Technologies specializes in microbattery solutions for small-scale electronics, combining high efficiency with miniaturized form factors. Cymbet Corporation provides solid-state thin film batteries that emphasize low power consumption and enhanced safety. Enfucell Oy focuses on flexible and printable thin film batteries, catering to wearable electronics and smart packaging applications.

Ultralife Corporation and BrightVolt Inc. deliver advanced thin film battery solutions for industrial, defense, and consumer applications, emphasizing durability and compact designs. Excellatron Solid State also contributes to the market with innovative solid-state thin film technologies that offer extended shelf life and high energy efficiency. Collectively, these companies are driving innovation in non-rechargeable thin film batteries, focusing on enhanced performance, safety, and adaptability for emerging electronic applications. As IoT adoption and wearable technology continue to expand, the market for non-rechargeable thin film batteries is expected to witness strong growth in the coming years.

| Item | Value |

|---|---|

| Quantitative Units | USD 355.9 Million |

| Application | Wearable devices, Medical, Smart cards, Consumer products, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Panasonic Corporation, Blue Spark Technologies, Cymbet Corporation, Enfucell Oy, Ultralife Corporation, BrightVolt Inc., and Excellatron Solid State |

| Additional Attributes | Dollar sales by type including lithium, silver oxide, and zinc-air batteries, application across medical devices, smart cards, RFID tags, and wearable electronics, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing demand for compact, lightweight, and long-life power sources in miniaturized electronic devices. |

The global non-rechargeable thin film battery market is estimated to be valued at USD 355.9 million in 2025.

The market size for the non-rechargeable thin film battery market is projected to reach USD 7,817.9 million by 2035.

The non-rechargeable thin film battery market is expected to grow at a 36.2% CAGR between 2025 and 2035.

The key product types in non-rechargeable thin film battery market are wearable devices, medical, smart cards, consumer products and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thin Insulation Market Size and Share Forecast Outlook 2025 to 2035

Thin Wall Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thin Wafer Processing and Dicing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thin Wall Plastic Container Market Analysis - Size, Share, and Forecast 2025 to 2035

Thinned Starch Market Size, Growth, and Forecast for 2025 to 2035

Thin Wafers Market Analysis - Size, Demand & Growth 2025 to 2035

Market Share Breakdown of Thin Wall Plastic Container Providers

Thin Client Market

Thin Paper Market

Thin Wall Mould Market

Thin Wall Glass Container Market

Thin Film Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thin-film Platinum Resistance Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Platinum Resistance Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Solar Cells Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Photovoltaics Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Solar PV Backsheet Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Encapsulation TFE Market Size and Share Forecast Outlook 2025 to 2035

Thin Film and Printed Batteries Market Trends - Growth & Forecast 2025 to 2035

Thin Film Photovoltaic Modules Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA