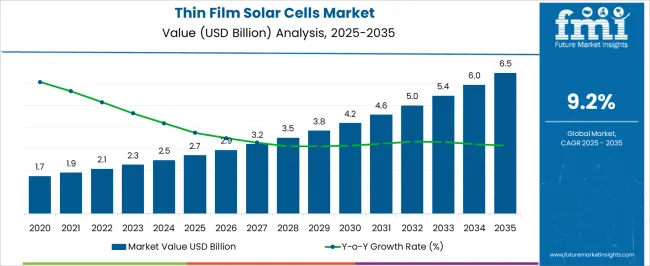

The thin film solar cells market is valued at USD 2.7 billion in 2025 and is expected to reach USD 6.5 billion by 2035, advancing at a CAGR of 9.2%. Analysis of the growth contribution index highlights how different periods and factors drive market expansion over the decade. From 2021 to 2025, the market grows from USD 1.7 billion to 2.7 billion, with incremental values of USD 1.9 billion, 2.1 billion, 2.3 billion, and 2.5 billion. This early phase contributes significantly due to technology adoption in building-integrated photovoltaics (BIPV), government incentives, and declining module costs, forming a baseline for long-term growth. Between 2026 and 2030, values rise from USD 2.7 billion to 4.2 billion, passing through USD 2.9 billion, 3.2 billion, 3.5 billion, and 3.8 billion.

Contribution during this block is driven by increased utility-scale installations, corporate sustainability initiatives, and rising efficiency of thin film technologies in diverse climates, marking an acceleration in market value addition. This phase accounts for the highest growth contribution, reflecting global deployment in residential, commercial, and industrial sectors, continued cost reductions, and innovations in flexible and lightweight thin film modules.

| Metric | Value |

|---|---|

| Thin Film Solar Cells Market Estimated Value in (2025 E) | USD 2.7 billion |

| Thin Film Solar Cells Market Forecast Value in (2035 F) | USD 6.5 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The thin film solar cells market is driven by five parent markets that collectively define its growth, adoption, and technological innovation across renewable energy and electronic applications. The photovoltaic and solar power generation market contributes the largest share, about 28-32%, as thin film solar cells offer lightweight, flexible, and cost-effective solutions for utility-scale and rooftop solar installations. The building-integrated photovoltaics (BIPV) market adds approximately 20-24%, where thin film modules are integrated into facades, windows, and roofing materials to generate clean energy while maintaining architectural aesthetics. The electronics and consumer devices market contributes around 15-18%, with thin film solar cells used in calculators, wearable devices, sensors, and other low-power electronics due to their compact size and energy efficiency. The automotive and transportation market accounts for roughly 12-15%, as thin film solar technology is applied in electric vehicles, buses, and charging stations to supplement power and improve energy efficiency. Finally, the off-grid and rural electrification market represents about 8-10%, leveraging thin film solar cells in standalone systems, portable panels, and mini-grids to provide electricity in remote and underserved areas.

The thin film solar cells market is growing steadily, supported by the increasing adoption of renewable energy solutions, advancements in photovoltaic technology, and supportive government policies aimed at decarbonization. Industry updates and corporate disclosures have highlighted the role of thin film solar cells in enabling cost-effective and lightweight solar energy installations. Their flexibility and lower manufacturing costs compared to traditional silicon-based cells have positioned them as a preferred choice in specific applications where weight and form factor are critical.

Ongoing research has improved efficiency rates and stability, widening their suitability for commercial and residential projects. Incentives and subsidies for clean energy deployment have further encouraged investment in thin film solar technologies.

The market is expected to expand as urban infrastructure projects and building-integrated photovoltaic (BIPV) systems increasingly integrate thin film panels into design and construction, driving demand for technologies such as cadmium telluride (CdTe).

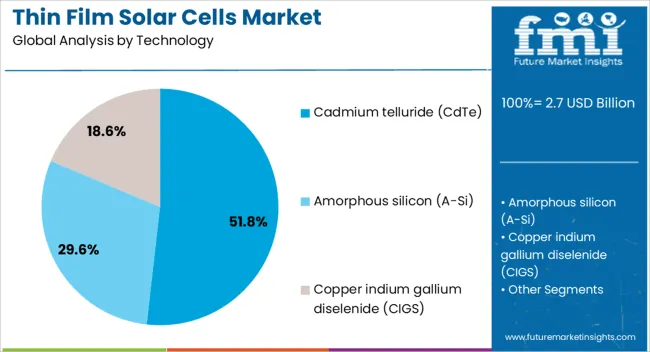

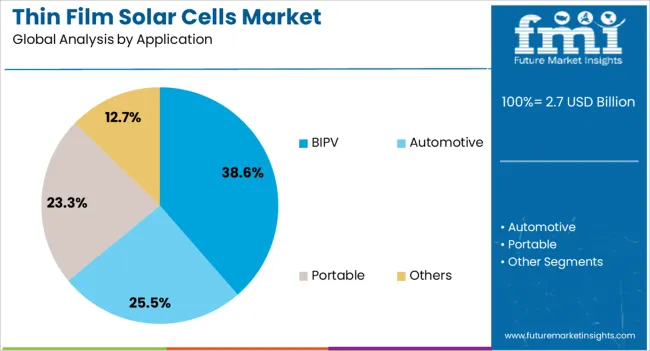

The thin film solar cells market is segmented by technology, application, and geographic regions. By technology, thin film solar cells market is divided into Cadmium telluride (CdTe), Amorphous silicon (A-Si), and Copper indium gallium diselenide (CIGS). In terms of application, thin film solar cells market is classified into BIPV, Automotive, Portable, and Others. Regionally, the thin film solar cells industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Cadmium Telluride (CdTe) segment is projected to contribute 51.8% of the thin film solar cells market revenue in 2025, making it the leading technology type. This segment’s dominance is attributed to its high energy conversion efficiency, low production cost, and strong performance under low-light and high-temperature conditions.

CdTe modules are recognized for their relatively short energy payback time, which enhances their appeal for sustainable energy projects. Manufacturers have focused on scaling production capacity for CdTe panels due to their favorable manufacturing economics and competitive levelized cost of electricity (LCOE) compared to other photovoltaic technologies.

Additionally, the ability to produce CdTe modules using less semiconductor material has reduced raw material dependency and improved supply chain resilience. These performance and cost advantages have secured CdTe’s leading position in utility-scale and integrated solar installations.

The BIPV (Building-Integrated Photovoltaics) segment is expected to hold 38.6% of the thin film solar cells market revenue in 2025, maintaining a prominent role in application adoption. Growth in this segment is driven by the increasing integration of solar technology into building materials such as façades, rooftops, and windows, enabling energy generation without compromising architectural aesthetics.

Thin film solar cells, particularly flexible and lightweight variants, are well-suited for BIPV due to their adaptability to various surfaces and design requirements. Urban sustainability initiatives and green building certifications have accelerated the adoption of BIPV systems in both commercial and residential sectors.

Advances in color customization, transparency levels, and module design have further expanded BIPV’s appeal to architects and developers. As cities strive to meet net-zero energy goals, the BIPV segment is anticipated to remain a critical driver of thin film solar cell deployment in modern construction projects.

The thin film solar cells market is growing due to rising adoption in renewable energy, building-integrated photovoltaics, and portable solar applications. Products including CdTe, CIGS, and amorphous silicon enable lightweight, flexible, and efficient energy solutions. Challenges include raw material costs, lower efficiency compared to crystalline silicon, and regulatory compliance for toxic materials. Opportunities exist in BIPV, utility-scale solar farms, hybrid energy systems, and energy storage integration. Manufacturers providing high-performance, durable, and digitally monitored thin film solar modules are best positioned to capture market growth. Asia-Pacific, Europe, and North America lead adoption due to electrification and renewable energy initiatives.

Thin film solar cells, including cadmium telluride (CdTe), amorphous silicon (a-Si), and copper indium gallium selenide (CIGS), are valued for their lightweight, flexible, and low-profile design, enabling integration into building facades, rooftops, and portable solar devices. Growth is driven by rising electricity demand, government incentives, and decreasing manufacturing costs across Asia-Pacific, North America, and Europe. Manufacturers focus on improving efficiency, durability, and installation flexibility. Advancements in manufacturing processes, including roll-to-roll deposition and high-throughput production, enhance scalability. Increasing investment in off-grid and rooftop solar systems, combined with urban electrification projects, further supports the adoption of thin film solar technology globally.

Lower efficiency compared to crystalline silicon and sensitivity to temperature and light conditions limit some applications. Manufacturing processes require precise thin-layer deposition, vacuum conditions, and quality control, increasing technical complexity. Compliance with environmental and safety regulations, including handling toxic materials and electronic waste management, adds further challenges for producers. Buyers increasingly demand certified, durable, and high-performance solar cells with predictable lifespans. Manufacturers investing in process optimization, advanced deposition technologies, and rigorous quality assurance are better positioned to overcome technical, regulatory, and cost-related challenges while expanding market share globally.

Flexible and lightweight characteristics make them ideal for commercial rooftops, urban infrastructure, and off-grid applications. Expansion of renewable energy policies in Asia-Pacific, Europe, and North America enhances adoption. Companies offering high-efficiency, durable, and customizable thin film modules gain a competitive advantage. Opportunities also exist in hybrid solar systems and integration with energy storage solutions. Collaboration with construction firms, developers, and energy utilities enables large-scale deployment. Increasing urbanization, electrification, and demand for decentralized renewable energy infrastructure further position thin film solar cells as a key technology for global solar energy expansion.

Innovations in CIGS, CdTe, and perovskite materials enable higher power conversion and longer lifespans. Integration with digital monitoring systems allows real-time performance tracking, predictive maintenance, and energy optimization. Manufacturing trends focus on roll-to-roll processing, vacuum deposition, and large-area modules to reduce production costs. Companies are also developing lightweight, flexible modules for portable and building-integrated applications. Manufacturers providing high-quality, certified, and digitally supported thin film solar solutions are positioned to meet increasing global demand. Advancements in materials, process optimization, and integration with smart grids enhance adoption across residential, commercial, and utility-scale projects.

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

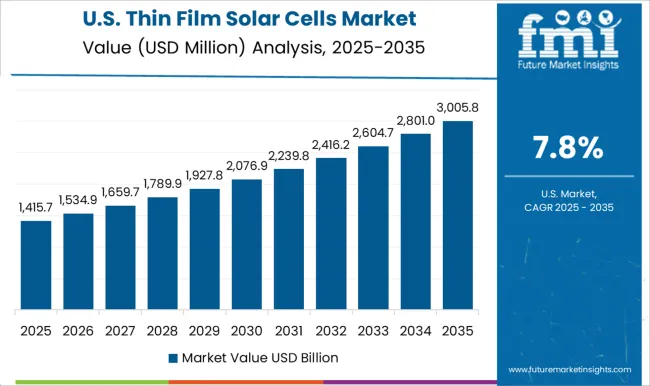

| USA | 7.8% |

| Brazil | 6.9% |

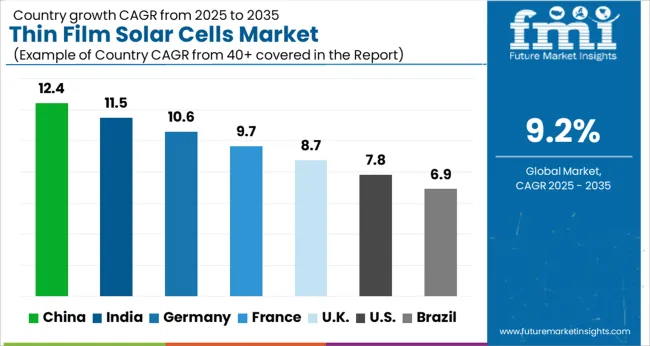

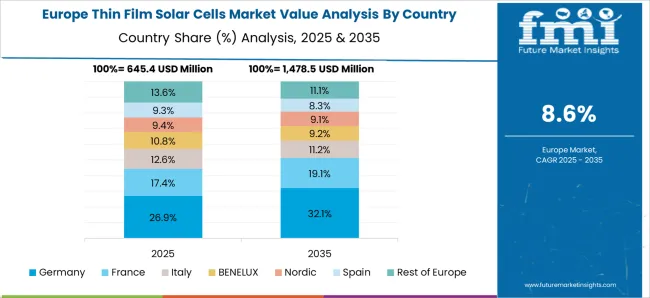

The global thin film solar cells market is projected to expand at a CAGR of 9.2% from 2025 to 2035. China (12.4%) and India (11.5%) are the fastest-growing markets, driven by large-scale solar deployments, rooftop adoption, and government incentives. Germany (10.6%) emphasizes building-integrated photovoltaics and advanced module efficiency, while the UK (8.7%) and USA (7.8%) show steady adoption across commercial, residential, and utility-scale projects. Growth drivers include declining module costs, technological advancements, energy storage integration, and renewable energy targets. Manufacturers focus on flexible, lightweight, and high-performance modules, along with strategic partnerships and local production scale-up to capture market share. The analysis spans over 40+ countries, with the leading markets shown below.

The thin film solar cells market in China is projected to grow at a CAGR of 12.4% from 2025 to 2035, driven by aggressive solar energy deployment, government incentives, and large-scale renewable projects. Rising demand for distributed solar installations, utility-scale plants, and building-integrated photovoltaics is fueling adoption. Manufacturers are focusing on high-efficiency, low-cost thin film modules with advanced deposition techniques to meet energy targets. Expansion in rooftop installations, urban solar grids, and industrial solar solutions further supports market growth. Technological innovations, including lightweight and flexible modules, are increasing penetration in commercial and residential segments. Local production scale-up, partnerships with EPC companies, and integration with energy storage systems enhance competitiveness.

The thin film solar cells market in India is expected to grow at a CAGR of 11.5% from 2025 to 2035, supported by renewable energy targets, solar park development, and government-backed policies. Rising adoption of rooftop solar, commercial installations, and utility-scale solar projects is increasing demand for thin film technologies due to their lightweight and flexible characteristics. Manufacturers are focusing on improving efficiency, reducing production costs, and integrating modules with energy storage solutions. Increasing industrial and residential electrification, combined with declining costs of thin film technology, is accelerating deployment. India’s commitment to achieving net-zero goals and expanding renewable capacity further boosts market growth. The market benefits from collaborations between domestic manufacturers, EPC companies, and international technology partners to enhance production and project implementation.

The thin film solar cells market in Germany is projected to grow at a CAGR of 10.6% from 2025 to 2035, driven by solar adoption in residential, commercial, and industrial segments. Government incentives, feed-in tariffs, and renewable integration targets support market expansion. Thin film technology is increasingly preferred for building-integrated photovoltaics, facades, and rooftop applications due to its lightweight, flexible, and aesthetically compatible nature. Manufacturers are focusing on improving module efficiency, durability, and integration with smart energy systems. Replacement of aging photovoltaic systems and adoption of energy-efficient solutions in urban construction projects are further boosting demand. Collaboration between research institutes, technology providers, and construction companies accelerates development of next-generation thin film modules.

The UK thin film solar cells market is expected to grow at a CAGR of 8.7% from 2025 to 2035, supported by solar rooftop adoption, commercial projects, and government-backed renewable energy initiatives. Thin film modules are favored for flexible and lightweight installations where traditional crystalline panels are less suitable. Manufacturers are focusing on improving efficiency, reducing costs, and integrating modules with smart energy systems and storage. Rising interest in self-consumption, commercial PV adoption, and net-zero energy commitments are boosting deployment. Partnerships between local installers, manufacturers, and research institutions enhance technology availability.>

The USA thin film solar cells market is projected to grow at a CAGR of 7.8% from 2025 to 2035, driven by increasing solar capacity in residential, commercial, and utility-scale projects. Thin film technology is increasingly adopted for large rooftops, solar farms, and innovative building-integrated applications. Manufacturers focus on enhancing efficiency, lowering production costs, and developing lightweight, flexible modules compatible with diverse installations. Renewable energy incentives, corporate sustainability programs, and declining module costs are fueling market expansion. Collaboration between domestic producers and international technology partners ensures rapid deployment. Integration with energy storage and smart grid systems further strengthens adoption, making thin film solar cells a viable solution across varied geographies.

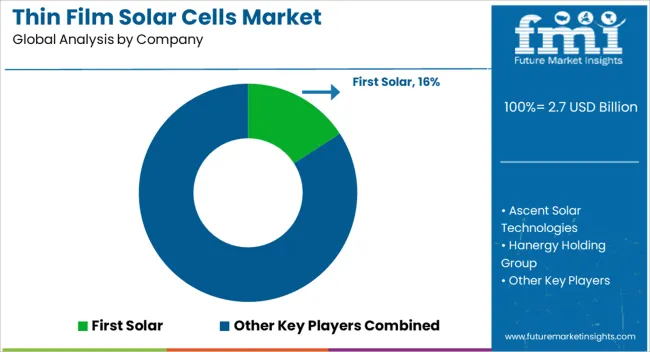

Competition in the thin film solar cells market is shaped by efficiency, material innovation, and manufacturing scale. First Solar maintains a strong position with cadmium telluride (CdTe) modules, emphasizing low cost, high reliability, and large-scale utility deployment. Ascent Solar Technologies focuses on flexible, lightweight thin film solutions suitable for building-integrated photovoltaics (BIPV) and portable energy applications. Hanergy Holding Group competes through high-efficiency copper indium gallium selenide (CIGS) modules and integrated energy solutions, targeting both commercial and residential applications. Hanwha Q Cells combines polycrystalline and thin film technologies, emphasizing quality assurance, long-term performance, and global distribution networks. JINERGY and Kaneka Corporation differentiate through CIGS and amorphous silicon technologies, offering flexible and semi-transparent modules for architectural and specialty applications. MiaSole Hi-Tech Corporation focuses on lightweight, flexible CIGS cells designed for BIPV and mobile energy solutions. Nanosolar develops thin film modules optimized for large-scale deployment with cost-effective production techniques. REC Solar Holdings integrates thin film with conventional PV solutions, targeting commercial rooftops and utility-scale projects. Tongwei and Trony Solar compete on production scale and competitive pricing for emerging markets, emphasizing efficiency and reliability. Vikram Solar focuses on hybrid thin film solutions and customizable module designs for industrial and rooftop applications. Strategies across the market prioritize efficiency improvements, flexible and lightweight module development, and cost-effective mass production. Product brochures highlight CdTe, CIGS, and amorphous silicon thin film cells, flexible and semi-transparent modules, BIPV integration, lightweight framing, high temperature tolerance, and durability under diverse environmental conditions. Collectively, these offerings demonstrate a market where innovation, material expertise, and scalable production define competitiveness, with players striving to balance cost, efficiency, and application versatility for residential, commercial, and utility-scale deployments.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| Technology | Cadmium telluride (CdTe), Amorphous silicon (A-Si), and Copper indium gallium diselenide (CIGS) |

| Application | BIPV, Automotive, Portable, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | First Solar, Ascent Solar Technologies, Hanergy Holding Group, Hanwha Q Cells, JINERGY, Kaneka corporation, MiaSole Hi-Tech Corporation, Nanosolar, REC Solar Holdings, Tongwei, Trony Solar, and Vikram Solar |

| Additional Attributes | Dollar sales by solar cell type (CdTe, CIGS, a-Si, multi-junction), application (residential, commercial, utility-scale, BIPV), and module form (rigid, flexible). Demand dynamics are driven by renewable energy adoption, government incentives, and sustainable energy targets. Regional trends show strong growth in North America, Europe, and Asia-Pacific, supported by solar installations, energy transition policies, and declining module costs. |

The global thin film solar cells market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the thin film solar cells market is projected to reach USD 6.5 billion by 2035.

The thin film solar cells market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in thin film solar cells market are cadmium telluride (cdte), amorphous silicon (a-si) and copper indium gallium diselenide (cigs).

In terms of application, bipv segment to command 38.6% share in the thin film solar cells market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thin Insulation Market Size and Share Forecast Outlook 2025 to 2035

Thin Wall Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thin Wafer Processing and Dicing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thin Wall Plastic Container Market Analysis - Size, Share, and Forecast 2025 to 2035

Thinned Starch Market Size, Growth, and Forecast for 2025 to 2035

Thin Wafers Market Analysis - Size, Demand & Growth 2025 to 2035

Market Share Breakdown of Thin Wall Plastic Container Providers

Thin Client Market

Thin Paper Market

Thin Wall Mould Market

Thin Wall Glass Container Market

Thin Film Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thin-film Platinum Resistance Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Platinum Resistance Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Photovoltaics Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Encapsulation TFE Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Battery Market Size and Share Forecast Outlook 2025 to 2035

Thin Film and Printed Batteries Market Trends - Growth & Forecast 2025 to 2035

Thin Film Photovoltaic Modules Market

Thin Film Solar PV Backsheet Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA