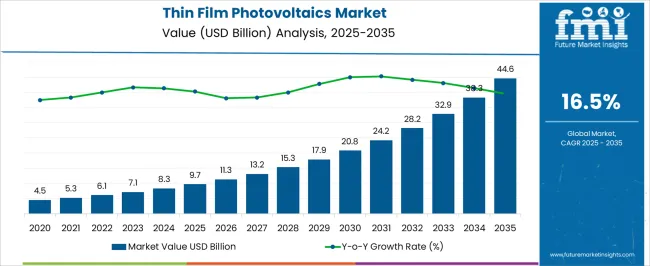

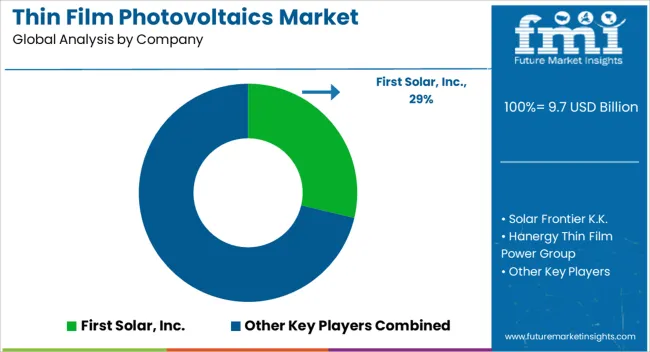

The thin film photovoltaics (PV) market is anticipated to grow from USD 9.7 billion in 2025 to USD 44.6 billion by 2035, with a CAGR of 16.5%. The contribution of volume and price growth plays a significant role in this market expansion. As thin film PV technology becomes more widespread, volume growth is expected to be a dominant factor, driven by increasing global demand for renewable energy solutions and falling production costs.

The continued adoption of solar power in both residential and commercial sectors, particularly in emerging markets, is expected to significantly boost the volume of thin film photovoltaics deployed globally. This shift is particularly evident in countries aiming to meet renewable energy targets and reduce dependence on fossil fuels. On the other hand, price growth is projected to experience steady but less pronounced increases. Advances in manufacturing processes, economies of scale, and improved materials are likely to drive down the cost of production, further enhancing the affordability of thin film photovoltaics.

As a result, the overall cost per watt of electricity produced from thin film solar panels is expected to decrease, making them more attractive for large-scale solar projects. Volume expansion and gradual price reductions will support the growth trajectory of the thin film PV market, ensuring its competitive edge in the global energy transition.

| Metric | Value |

|---|---|

| Thin Film Photovoltaics Market Estimated Value in (2025 E) | USD 9.7 billion |

| Thin Film Photovoltaics Market Forecast Value in (2035 F) | USD 44.6 billion |

| Forecast CAGR (2025 to 2035) | 16.5% |

The thin film photovoltaics (PV) market is strongly shaped by five interconnected parent markets, each contributing differently to overall demand and growth. The solar energy market holds the largest share at 45%, driven by increasing demand for renewable energy and the global push towards clean, sustainable power generation. The commercial and industrial sectors contribute 25%, where thin film PV technology is increasingly being adopted for large-scale rooftop and ground-mounted solar installations, particularly in regions with high solar radiation. The residential solar market accounts for 15%, as homeowners and developers look for cost-effective, efficient solar solutions that can be seamlessly integrated into building designs.

The research and development (R&D) market holds a 10% share, driven by ongoing innovation in materials and manufacturing techniques that aim to enhance the efficiency and longevity of thin film PV panels. The government and infrastructure market represents 5%, where thin film PVs are being incorporated into public infrastructure projects, particularly in urban environments where space and energy demands are high. The solar energy, commercial, and industrial sectors account for 85% of the overall demand, highlighting that large-scale energy production and commercial adoption remain the primary growth drivers, while R&D and infrastructure applications provide complementary opportunities for market expansion globally.

The thin film photovoltaics market is experiencing steady growth driven by the increasing demand for lightweight, flexible, and cost-effective solar energy solutions. Growing investments in renewable energy infrastructure and supportive government policies aimed at reducing carbon emissions are accelerating adoption.

Technological advancements in thin film efficiency, durability, and manufacturing processes have improved the commercial viability of these systems. The ability of thin film photovoltaics to perform well under low light and high temperature conditions has expanded their use in diverse climates and applications.

Additionally, reduced material consumption compared to traditional crystalline silicon panels offers cost and environmental benefits. The market outlook remains positive as global initiatives toward clean energy transition continue to boost demand across utility-scale, commercial, and residential installations.

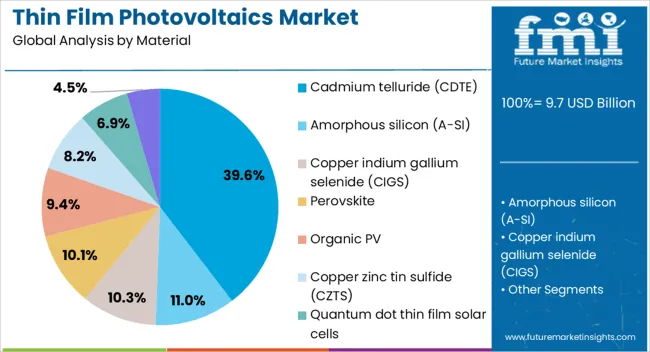

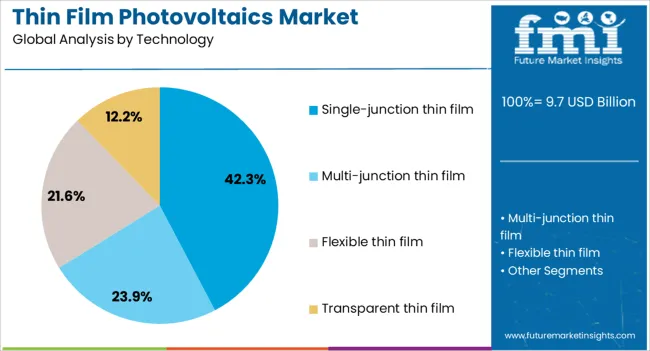

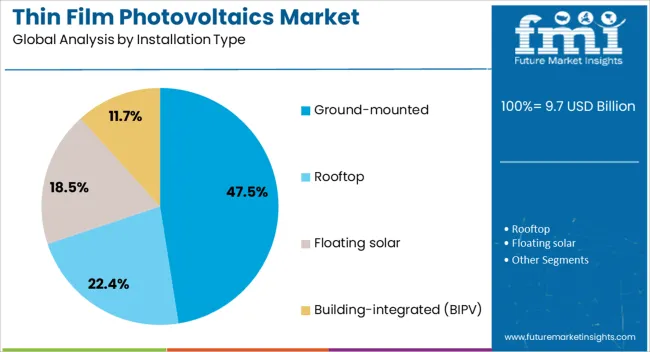

The thin film photovoltaics market is segmented by material, technology, installation type, application, end-use industry, and geographic regions. By material, thin film photovoltaics market is divided into Cadmium telluride (CDTE), Amorphous silicon (A-SI), Copper indium gallium selenide (CIGS), Perovskite, Organic PV, Copper zinc tin sulfide (CZTS), Quantum dot thin film solar cells, and All-silicon tandem.

In terms of technology, thin film photovoltaics market is classified into Single-junction thin film, Multi-junction thin film, Flexible thin film, and Transparent thin film. Based on installation type, thin film photovoltaics market is segmented into Ground-mounted, Rooftop, Floating solar, and Building-integrated (BIPV). By application, thin film photovoltaics market is segmented into Utility-scale power generation, Building-integrated Photovoltaics (BIPV), Wearable devices, and Others. By end-use industry, thin film photovoltaics market is segmented into Agricultural, Automotive, Commercial & Industrial, Consumer electronics, Residential, Utility, and Others. Regionally, the thin film photovoltaics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cadmium telluride material segment is expected to hold 39.60% of the total market revenue by 2025, making it the leading material type. This growth is driven by its low production cost, short energy payback time, and high performance in various environmental conditions.

Cadmium telluride modules require less semiconductor material and offer strong efficiency under diffuse light, making them attractive for large-scale deployments. Advances in manufacturing processes and recycling technologies have also enhanced its adoption by addressing environmental concerns.

As the demand for cost-effective and high-output thin film solutions grows, cadmium telluride continues to maintain its leadership position in the material segment.

The single-junction thin film technology segment is projected to capture 42.30% of market revenue by 2025, establishing it as the dominant technology type. Its simplicity in manufacturing, lower production cost, and reliable efficiency in a variety of installation environments have contributed to its widespread adoption.

This technology is well-suited for large-scale projects where cost efficiency is prioritized over achieving the maximum theoretical efficiency. Continuous improvements in deposition techniques and material quality are enhancing overall performance, while scalability in manufacturing is helping meet the growing global demand.

These factors collectively reinforce its leadership in the technology segment.

The ground-mounted installation type is anticipated to account for 47.50% of total market revenue by 2025, making it the most significant installation category. Its dominance is attributed to the suitability of ground-mounted systems for utility-scale projects, offering optimal panel orientation, ease of maintenance, and scalability.

This installation type allows for the deployment of large capacities in open areas, maximizing energy generation potential. Additionally, falling installation costs and favorable government incentives for large-scale renewable projects have further encouraged adoption.

As global solar capacity expansion continues, ground-mounted systems remain the preferred choice for achieving high energy output and long-term operational stability.

Thin film photovoltaics are seeing strong growth driven by increased demand for renewable energy, cost advantages, and adoption in commercial sectors. Ongoing R&D is expected to enhance efficiency and further propel market expansion.

The growing global focus on reducing carbon emissions has significantly boosted demand for renewable energy solutions. Thin film photovoltaics are gaining traction due to their ability to generate electricity with minimal space and lower material costs compared to traditional solar panels. As countries and corporations aim to meet renewable energy targets, thin film PVs are increasingly being adopted for both large-scale power plants and residential installations. This shift is particularly noticeable in regions with abundant sunlight but limited available space for traditional solar farms. Governments worldwide are providing incentives, rebates, and favorable policies, making thin film photovoltaics more economically viable for consumers and businesses alike.

One of the major driving factors for the growth of thin film photovoltaics is their lower production costs compared to traditional crystalline silicon-based solar panels. As production methods improve and scale up, manufacturers can lower the cost per watt of electricity produced. Thin film PV technology uses fewer raw materials and can be manufactured in a variety of environments, making it a more affordable and flexible option for large-scale installations. This cost efficiency is making thin film photovoltaics increasingly popular for both developed and emerging markets, where price competitiveness is key to widespread adoption.

Thin film photovoltaics are experiencing significant adoption in commercial and industrial sectors due to their high performance in areas where space and weight are limitations. These markets are driven by the need for reliable and cost-effective energy sources that can be easily integrated into existing infrastructures. Thin film PVs are ideal for large commercial rooftop installations, building-integrated photovoltaics (BIPV), and off-grid solutions. As companies seek to lower energy costs and reduce environmental impact, thin film PVs offer an attractive alternative with the potential for quick returns on investment. Increasing awareness of long-term savings is fueling growth in this segment.

Research and development in thin film photovoltaics continue to push the boundaries of efficiency and durability. Efforts are focused on developing new materials, such as cadmium telluride (CdTe) and copper indium gallium selenide (CIGS), which offer superior performance while reducing costs.

Advancements in manufacturing processes, such as roll-to-roll processing, are making mass production more efficient and scalable. R&D is also focused on improving the lifetime and energy conversion rates of thin film solar panels to make them more competitive with traditional crystalline silicon-based products. These developments play a crucial role in driving down costs and increasing the commercial appeal of thin film photovoltaics.

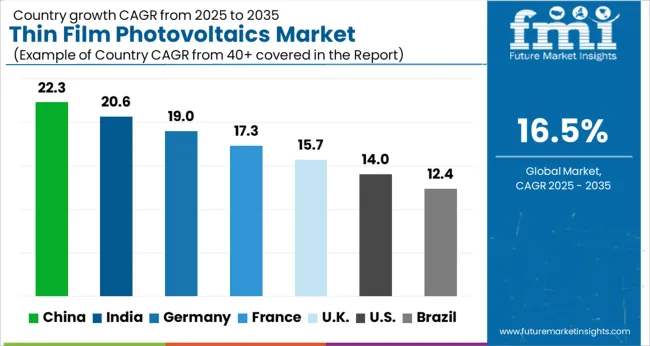

| Country | CAGR |

|---|---|

| China | 22.3% |

| India | 20.6% |

| Germany | 19.0% |

| France | 17.3% |

| UK | 15.7% |

| USA | 14.0% |

| Brazil | 12.4% |

The global thin film photovoltaics (PV) market is projected to grow at a CAGR of 16.5% from 2025 to 2035. China leads with 22.3%, followed by India (20.6%), Germany (19.0%), the UK (15.7%), and the USA (14.0%). Growth in these countries is driven by a strong shift towards renewable energy sources, with China and India leading the charge in expanding solar power capacity. Both countries are ramping up solar installations due to favorable government policies, a growing demand for clean energy, and significant investments in large-scale solar farms. Germany, the UK, and the USA focus on upgrading existing solar infrastructure and integrating thin film PVs into commercial, industrial, and residential applications. The adoption of energy-efficient, low-cost thin film technologies is also expected to grow in these mature markets as part of their transition to cleaner energy sources. The analysis includes over 40+ countries, with the leading markets detailed below.

The thin film photovoltaics (PV) market in China is projected to grow at a CAGR of 22.3% from 2025 to 2035, driven by strong renewable energy adoption and government incentives. The country is heavily investing in solar energy to meet environmental goals and reduce dependence on traditional energy sources. Domestic manufacturers are ramping up production of thin film PV panels due to their cost-efficiency and suitability for large-scale installations. Commercial and residential sectors are increasingly adopting thin film PV solutions, particularly in regions with abundant sunlight. China’s export capabilities also bolster its market share, with the country becoming a key global supplier of thin film technology. As the market expands, investments in manufacturing technologies and research will further drive growth.

The thin film photovoltaics (PV) market in India is expected to grow at a CAGR of 20.6% from 2025 to 2035, driven by the country's ambitious renewable energy targets and growing energy needs. India’s solar energy market is expanding rapidly, with both commercial and residential sectors embracing thin film PVs for their affordability and space-saving characteristics. The Indian government’s initiatives, such as tax incentives and subsidies for solar installations, are accelerating market adoption. As rural and urban areas look for off-grid and cost-effective energy solutions, thin film PVs are becoming a popular choice. Manufacturers are focusing on improving the performance and durability of thin film PVs while reducing costs, ensuring widespread adoption across the nation.

The thin film photovoltaics (PV) market in Germany is expected to grow at a CAGR of 19.0% from 2025 to 2035, fueled by the country’s transition to a renewable energy-driven economy. Germany’s commitment to achieving its energy transition (Energiewende) has led to increased demand for solar energy systems, with thin film PVs gaining popularity due to their versatility and performance in various weather conditions. The commercial and residential sectors are embracing thin film technology for large-scale rooftop installations and building-integrated solar solutions. Germany’s strict regulations on energy efficiency and emissions reductions are supporting the adoption of thin film PV panels. As the country continues its decarbonization efforts, thin film PV will remain a crucial component of its clean energy future.

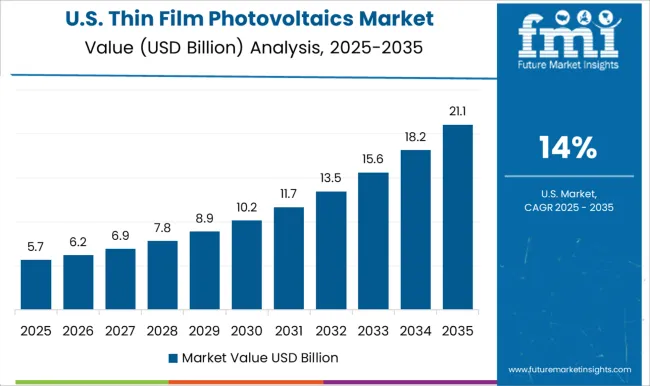

The thin film photovoltaics (PV) market in the USA is expected to grow at a CAGR of 14.0% from 2025 to 2035, supported by ongoing efforts to transition to clean energy and reduce carbon emissions. The USA solar market continues to grow with strong demand for thin film PV technology, particularly in commercial and industrial sectors, where space constraints and energy efficiency are key factors. Government incentives, including tax credits and grants for solar energy projects, further boost adoption. Additionally, thin film PV technology is increasingly being integrated with energy storage solutions, allowing for greater energy autonomy. As the USA seeks to meet ambitious renewable energy goals, thin film photovoltaics will remain a key solution for both large-scale and residential solar installations.

The thin film photovoltaics (PV) market in the UK is projected to grow at a CAGR of 15.7% from 2025 to 2035, supported by the country’s climate change goals and the transition to cleaner energy. The UK government’s policies, including carbon reduction targets and subsidies for solar power systems, are driving demand for thin film PV solutions. Thin film technology is well-suited to commercial buildings and large residential rooftop installations, where space is at a premium. Additionally, increasing awareness of solar energy’s cost-saving potential in reducing utility bills is fueling demand. The market will continue to benefit from technological improvements and advancements in energy storage, allowing thin film PV systems to become an even more viable and efficient solution for the UK

The thin film photovoltaics (PV) market is highly competitive, driven by a mix of established solar technology companies and emerging players specializing in advanced thin-film modules. Key market leaders such as First Solar, Solar Frontier, Hanergy, Avancis, and MiaSolé dominate through their expertise in cadmium telluride (CdTe), copper indium gallium selenide (CIGS), and amorphous silicon (a-Si) technologies. These companies compete by offering high efficiency, lightweight, and flexible modules that are suitable for utility-scale, commercial rooftop, and building-integrated photovoltaic (BIPV) installations.

Competitive dynamics are influenced by factors such as conversion efficiency, manufacturing cost, module durability, and scalability. Large firms invest heavily in R&D to enhance power output and reduce levelized cost of energy (LCOE), while smaller players focus on niche applications and customized solutions. Vertical integration strategies, long-term supply contracts, and partnerships with EPC firms and project developers provide larger players with a competitive edge. As crystalline silicon modules continue to dominate global solar capacity, thin film producers differentiate themselves by targeting markets where weight, aesthetics, and partial shading performance are crucial.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.7 Billion |

| Material | Cadmium telluride (CDTE), Amorphous silicon (A-SI), Copper indium gallium selenide (CIGS), Perovskite, Organic PV, Copper zinc tin sulfide (CZTS), Quantum dot thin film solar cells, and All-silicon tandem |

| Technology | Single-junction thin film, Multi-junction thin film, Flexible thin film, and Transparent thin film |

| Installation Type | Ground-mounted, Rooftop, Floating solar, and Building-integrated (BIPV) |

| Application | Utility-scale power generation, Building-integrated Photovoltaics (BIPV), Wearable devices, and Others |

| End-use Industry | Agricultural, Automotive, Commercial & Industrial, Consumer electronics, Residential, Utility, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | First Solar, Inc., Solar Frontier K.K., Hanergy Thin Film Power Group, MiaSolé Hi-Tech Corp., Ascent Solar Technologies, Inc., Solibro GmbH, and Global Solar Energy, Inc. |

| Additional Attributes | Dollar sales by technology (CdTe, CIGS, etc.), regional share, and cost dynamics. |

The global thin film photovoltaics market is estimated to be valued at USD 9.7 billion in 2025.

The market size for the thin film photovoltaics market is projected to reach USD 44.6 billion by 2035.

The thin film photovoltaics market is expected to grow at a 16.5% CAGR between 2025 and 2035.

The key product types in thin film photovoltaics market are cadmium telluride (cdte), amorphous silicon (a-si), copper indium gallium selenide (cigs), perovskite, organic pv, copper zinc tin sulfide (czts), quantum dot thin film solar cells and all-silicon tandem.

In terms of technology, single-junction thin film segment to command 42.3% share in the thin film photovoltaics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thin Insulation Market Size and Share Forecast Outlook 2025 to 2035

Thin Wall Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thin Wafer Processing and Dicing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thin Wall Plastic Container Market Analysis - Size, Share, and Forecast 2025 to 2035

Thinned Starch Market Size, Growth, and Forecast for 2025 to 2035

Thin Wafers Market Analysis - Size, Demand & Growth 2025 to 2035

Market Share Breakdown of Thin Wall Plastic Container Providers

Thin Client Market

Thin Paper Market

Thin Wall Mould Market

Thin Wall Glass Container Market

Thin Film Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thin-film Platinum Resistance Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Platinum Resistance Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Solar Cells Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Solar PV Backsheet Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Encapsulation TFE Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Battery Market Size and Share Forecast Outlook 2025 to 2035

Thin Film and Printed Batteries Market Trends - Growth & Forecast 2025 to 2035

Thin Film Photovoltaic Modules Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA