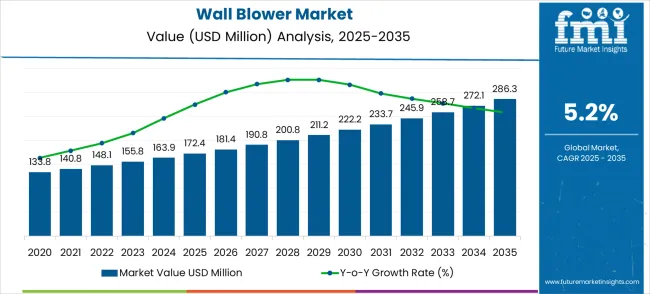

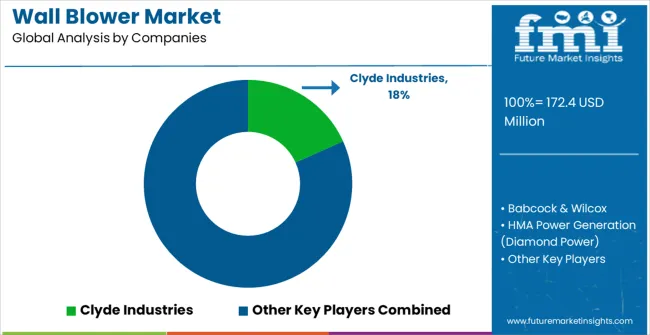

The wall blower market is forecasted to rise from USD 172.4 million in 2025 to USD 286.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.2%. Year-on-year analysis indicates a consistent upward trend, with values steadily increasing from USD 181.4 million in 2026 to USD 286.3 million by 2035. This stable progression highlights the market’s resilience and expanding use across both residential and commercial settings. Wall blowers are regarded as critical devices for maintaining air circulation, improving indoor comfort, and ensuring ventilation in confined spaces.

The YoY increments reflect gradual adoption supported by demand from construction, hospitality, and office infrastructure projects, where efficient air management is prioritized. This pattern of reliable growth demonstrates that the market is unlikely to face sudden volatility, instead showcasing incremental acceptance and integration across diverse applications.

Growth in the wall blower market is also shaped by rising interest in improved energy efficiency and compact airflow solutions. The year-on-year growth analysis confirms steady momentum, with the market consistently adding value without steep fluctuations. By 2030, the market is projected to cross USD 222.2 million, further strengthening its position within the broader ventilation and air handling equipment segment.

Industries are increasingly recognizing the importance of localized air distribution, where wall blowers are used as a cost-effective and durable solution compared to large-scale ventilation systems. Their adaptability to varied environments, including residential apartments, retail spaces, and small-scale industrial settings, is expected to reinforce market confidence over the coming decade. The trajectory signals long-term adoption, with consistent YoY increases reflecting how wall blowers have been positioned as indispensable components of modern airflow management.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 172.4 million |

| Forecast Value in (2035F) | USD 286.3 million |

| Forecast CAGR (2025 to 2035) | 5.2% |

The wall blower market is positioned as a critical segment within multiple parent domains, demonstrating a distinct role in air circulation and ventilation processes. It holds approximately 6.3% of the industrial air handling equipment market, as these blowers are frequently employed for targeted airflow in industrial environments. Within the HVAC systems market, the share is 5.7%, reflecting the adoption of wall blowers for effective heating, cooling, and air distribution in commercial and industrial spaces. In the ventilation equipment market, it represents 6.9%, highlighting the demand for reliable, wall-mounted solutions that enhance airflow and reduce energy strain. The industrial fans and blowers market sees a 4.8% contribution, as wall blowers complement other fan solutions for operational efficiency.

Within the building equipment market, it contributes 5.5%, showing adoption in both retrofitted and new installations. Collectively, these parent markets represent a combined share of 29.2%, emphasizing the wall blower market’s relevance in improving airflow management, operational performance, and air quality across diverse industrial and commercial applications.

Market expansion is being supported by the rapid increase in power generation activities worldwide and the corresponding need for efficient boiler cleaning systems that can maintain optimal heat transfer and operational efficiency. Modern power plants and industrial facilities require continuous removal of soot deposits and ash buildup from boiler surfaces to prevent efficiency losses and equipment damage. Even minor accumulation of deposits can cause significant reductions in heat transfer efficiency and increased fuel consumption if proper cleaning systems are not implemented.

The growing complexity of modern boiler systems and increasing emphasis on operational efficiency are driving demand for advanced wall blower technologies from certified suppliers with proven cleaning performance and reliability. Power generation facilities are increasingly recognizing that proper boiler maintenance is essential for maximizing fuel efficiency, reducing emissions, and ensuring long-term equipment reliability. Industry standards and environmental regulations are establishing stringent efficiency requirements that necessitate comprehensive boiler cleaning systems with superior performance characteristics.

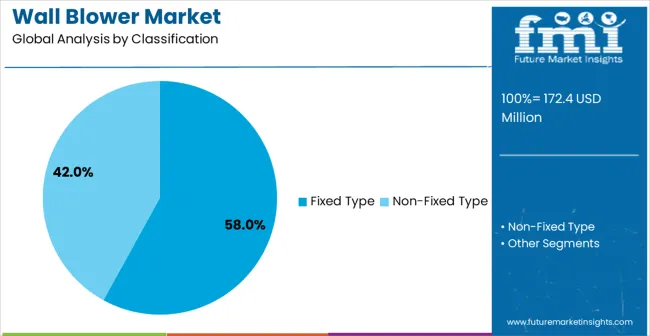

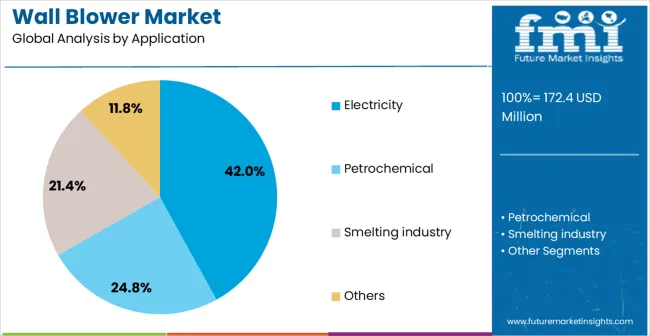

The market is segmented by type, application, and region. By type, the market is divided into fixed type, non-fixed type, and others. Based on application, the market is categorized into electricity, petrochemical, smelting industry, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Fixed type wall blowers are projected to account for 58% of the market in 2025. This leading share is supported by the widespread installation of permanent soot blowing systems in large-scale power generation facilities and industrial boilers. Fixed type systems provide consistent cleaning performance and reliable operation with minimal maintenance requirements, making them ideal for continuous operation environments. The segment benefits from continuous technological improvements in nozzle design and control system integration that enhance overall cleaning efficiency and operational reliability.

Electricity generation applications are expected to represent 42% of wall blower demand in 2025. This dominant share reflects the critical importance of maintaining boiler efficiency in power plants and the widespread adoption of soot blowing systems across thermal power generation facilities. Modern power plants require comprehensive cleaning systems to ensure optimal combustion efficiency and heat transfer performance while meeting environmental compliance requirements. The segment benefits from growing global electricity demand and increasing emphasis on power generation efficiency and environmental protection standards.

The wall blower market is experiencing significant growth due to increasing demand for efficient air circulation and ventilation solutions in industrial, commercial, and residential sectors. Opportunities are rising with expanding construction activities, indoor air quality regulations, and retrofitting projects. Trends indicate a shift toward energy-efficient and high-performance wall blower systems with advanced control features. Challenges persist in high installation costs, maintenance complexities, and noise management. Companies focusing on robust, durable, and customizable solutions are best positioned to capture market share and address the evolving needs of end-users.

The wall blower market is witnessing trends emphasizing high-performance and energy-efficient systems with advanced control mechanisms. Industries and commercial establishments are increasingly seeking blowers that provide superior airflow while minimizing energy consumption and operational costs. Integration with smart building management systems and variable speed controls is gaining traction, allowing users to regulate airflow according to demand and maintain comfort levels efficiently. In addition, modular and compact designs are being favored for ease of installation and space optimization. These trends indicate that manufacturers who focus on delivering technologically robust, energy-efficient, and adaptable wall blowers are likely to secure a competitive edge in the evolving market landscape.

The wall blower market faces challenges related to high acquisition and installation costs, along with managing noise levels in sensitive environments. Premium-quality wall blowers with durable materials and advanced features often come with a significant price tag, which can limit adoption among cost-sensitive users. Maintenance complexity, particularly in industrial settings, also adds to operational challenges. Noise management remains a critical concern, particularly in offices, hospitals, and educational facilities, where excessive sound levels can impact productivity and comfort. Manufacturers are required to balance performance, durability, and quiet operation to overcome these challenges and meet the diverse needs of end-users.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7% |

| India | 6.5% |

| Germany | 6% |

| Brazil | 5.5% |

| United States | 4.9% |

| United Kingdom | 4.4% |

| Japan | 3.9% |

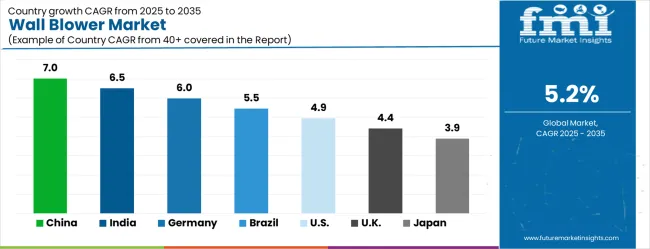

The wall blower market is experiencing strong growth globally, with China leading at a 7% CAGR through 2035, driven by massive power generation expansion, industrial development, and increasing emphasis on operational efficiency. India follows at 6.5%, supported by growing electricity demand and expanding thermal power capacity. Germany records 6.0% growth, emphasizing advanced power generation technologies and industrial facility modernization. Brazil maintains 5.5% growth, driven by expanding power infrastructure and industrial development projects. The United States shows 4.9% growth, focusing on power plant efficiency improvements and industrial modernization. The United Kingdom demonstrates 4.4% growth, driven by power generation modernization and industrial facility upgrades. Japan exhibits mature market characteristics with 3.9% growth, emphasizing advanced efficiency technologies and precision maintenance applications.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The wall blower market in China is growing at a CAGR of 7%, driven by the country’s rapid industrialization and increasing infrastructure development. Wall blowers are widely used in industrial manufacturing, HVAC systems, and residential applications, making them an essential part of China's growing urbanization. As China continues to focus on enhancing energy efficiency and air handling solutions in various sectors, the demand for high-performance wall blowers is expected to rise significantly.

The wall blower market in India is projected to grow at a CAGR of 6.5%, driven by the country’s booming industrial and residential sectors. With rising investments in manufacturing, commercial spaces, and construction projects, the demand for wall blowers in HVAC systems and ventilation applications is steadily increasing. The push for sustainable energy solutions also supports the adoption of energy-efficient wall blowers in industrial and residential buildings.

The wall blower market in Germany is expanding at a CAGR of 6%, driven by strong demand from industrial and residential applications. Germany’s focus on improving energy efficiency and sustainable building practices is supporting the increased adoption of wall blowers. The country’s well-established industrial base and growing commercial infrastructure further contribute to the demand for advanced air handling systems.

The wall blower market in Brazil is projected to grow at a CAGR of 5.5%, driven by the increasing demand for air conditioning systems and HVAC solutions in residential, commercial, and industrial buildings. As Brazil’s construction and infrastructure sectors continue to expand, the need for reliable and energy-efficient wall blowers is on the rise. The country’s focus on modernization and urbanization supports steady growth in the market.

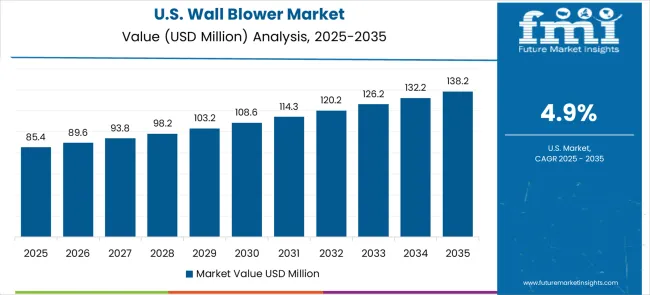

The wall blower market in the United States is expected to grow at a CAGR of 4.9%, driven by the steady demand for energy-efficient air handling systems in both residential and commercial sectors. The USA government’s push for greener buildings and energy efficiency standards is fueling the adoption of advanced wall blowers. Additionally, the growing need for reliable air circulation systems in industrial environments also supports the market’s growth.

The wall blower market in the United Kingdom is growing at a CAGR of 4.4%, driven by the increasing demand for ventilation and air conditioning systems in residential and commercial buildings. As the UK continues to emphasize energy-efficient solutions and indoor air quality, the adoption of advanced wall blowers is rising. The country’s focus on sustainable construction practices and efficient air handling technologies further supports market growth.

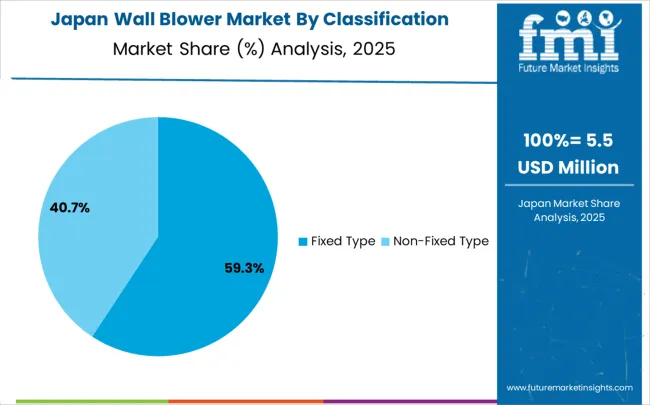

The wall blower market in Japan is projected to grow at a CAGR of 3.9%, with a steady increase in demand driven by energy-efficient solutions in residential, commercial, and industrial applications. Japan’s strong commitment to technological innovation and sustainable building practices is fostering the adoption of wall blowers. As the country focuses on improving indoor air quality and enhancing energy efficiency, the market for air handling systems is expected to grow steadily.

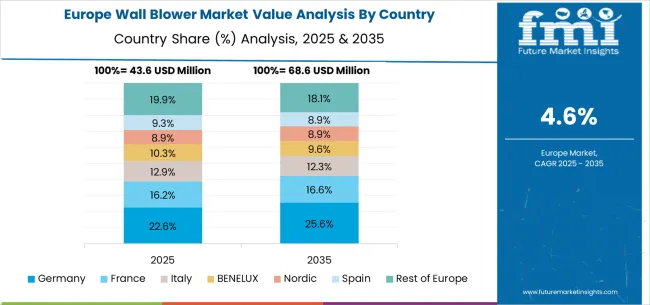

The wall blower market in Europe is projected to grow from USD 43.1 million in 2025 to USD 71.6 million by 2035, registering a CAGR of 5.2% over the forecast period. Germany is expected to maintain its leadership despite a slight reduction in share from 29.8% in 2025 to 29.2% by 2035, supported by its extensive power generation infrastructure and advanced industrial manufacturing ecosystem.

The United Kingdom is projected to maintain stable market position with 18.7% share in 2025, declining marginally to 18.3% by 2035, driven by ongoing power plant modernization and industrial facility upgrades. France is anticipated to hold 16.2% market share in 2025, expected to grow to 16.6% by 2035, attributed to expanding nuclear power maintenance and industrial steam generation applications. Italy is projected to account for 12.8% in 2025, growing to 13.2% by 2035, supported by petrochemical industry development and power generation modernization.

Spain is expected to contribute 9.5% of the market in 2025, expanding to 9.8% by 2035, driven by renewable energy integration and industrial facility modernization projects. The Nordic region is projected to hold 7.1% share in 2025, growing to 7.4% by 2035, supported by advanced power generation technologies and environmental protection initiatives. The Rest of Europe region is anticipated to account for 5.9% in 2025, declining to 5.5% by 2035, reflecting consolidation in Eastern European power generation markets.

The wall blower market is defined by competition among specialized industrial equipment manufacturers, power generation technology companies, and boiler maintenance solution providers. Companies are investing in advanced manufacturing technologies, specialized engineering capabilities, comprehensive technical support, and global service networks to deliver reliable, efficient, and cost-effective soot blowing solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Clyde Industries offers comprehensive wall blower systems with focus on reliability and application-specific design solutions for power generation applications. Babcock & Wilcox provides integrated boiler cleaning technologies with emphasis on efficiency optimization and environmental compliance. HMA Power Generation (Diamond Power) delivers advanced soot blowing systems with focus on precision control and operational reliability. Control Concepts Inc. specializes in automated control systems and monitoring technologies for enhanced cleaning performance.

Industrial Boilers America focuses on comprehensive boiler maintenance solutions with specialized expertise in power generation applications. Chinese manufacturers including Emperor Trust Well, LPR Global, Hubei Huaxin Machinery Development Co Ltd, and others provide cost-effective solutions with regional expertise and manufacturing capabilities, supporting diverse industrial applications across emerging markets.

Wall blowers are critical industrial components that provide forced air circulation in high-temperature environments, primarily serving power generation, petrochemical processing, and metallurgical operations. With the market valued at $172.4 million in 2024 and projected to reach $286.3 million by 2030 at a 5.2% CAGR, this sector faces pressures from energy efficiency mandates, industrial decarbonization, and aging infrastructure replacement cycles. Success requires coordinated efforts across equipment manufacturers, end-users, technology innovators, and policy frameworks.

How Governments Could Drive Market Modernization and Efficiency?

How Industry Bodies Could Strengthen Market Standards?

How OEMs and Technology Innovators Could Advance the Ecosystem?

How End-Users Could Optimize Their Operations?

How Financial Partners Could Enable Market Growth?

The wall blower market's steady growth reflects ongoing industrial expansion and the need for more efficient, reliable equipment. Success requires balancing cost pressures with performance demands while navigating the transition toward smarter, more sustainable industrial operations.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 172.4 million |

| Type | Fixed type, non-fixed type, and others |

| Application | Electricity, petrochemical, smelting industry, and others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Clyde Industries, Babcock & Wilcox, HMA Power Generation (Diamond Power), Control Concepts Inc., Industrial Boilers America, Emperor Trust Well, LPR Global, Hubei Huaxin Machinery Development Co Ltd, Zhejiang Lemond Power Equipment Co Ltd, Hubei Huaxing Machinery Technology Co Ltd, Zhuhai Nanfang Electric Power Equipment Co Ltd, Hubei Jinshan Electric Power Equipment Co Ltd, Zhejiang Laimengde POWER Equipment Co Ltd |

| Additional Attributes | Dollar sales by type and application sectors, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established industrial equipment manufacturers and power generation technology providers, performance comparisons across different wall blower configurations, integration with advanced boiler systems and control technologies |

The global wall blower market is estimated to be valued at USD 172.4 million in 2025.

The market size for the wall blower market is projected to reach USD 286.3 million by 2035.

The wall blower market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in wall blower market are fixed type and non-fixed type.

In terms of application, electricity segment to command 42.0% share in the wall blower market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Furnace Wall Sootblower Market Size and Share Forecast Outlook 2025 to 2035

Wall Mounted Manifolds Market Size and Share Forecast Outlook 2025 to 2035

Wall Covering Product Market Forecast and Outlook 2025 to 2035

Wall Repair Roller Paint Market Size and Share Forecast Outlook 2025 to 2035

Wallets & Little Cases Market Size and Share Forecast Outlook 2025 to 2035

Wall Art Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Wall Mounted Paper Napkin Dispensers Market Growth - Demand & Forecast 2025 to 2035

Wall Decor Market Insights – Growth & Demand 2025–2035

Market Leaders & Share in the Wallets & Little Cases Industry

Market Share Distribution Among Wall Covering Product Manufacturers

In-Wall Bottle Filling Station Market Size and Share Forecast Outlook 2025 to 2035

Firewall as a Service Market

Thin Wall Packaging Market Size and Share Forecast Outlook 2025 to 2035

Soft Wall Military Shelter Market Size and Share Forecast Outlook 2025 to 2035

Thin Wall Plastic Container Market Analysis - Size, Share, and Forecast 2025 to 2035

Multiwall Bags Market Trends - Growth & Demand 2025 to 2035

Market Share Breakdown of Thin Wall Plastic Container Providers

Thin Wall Mould Market

Thin Wall Glass Container Market

Heavy Wall Bottles Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA