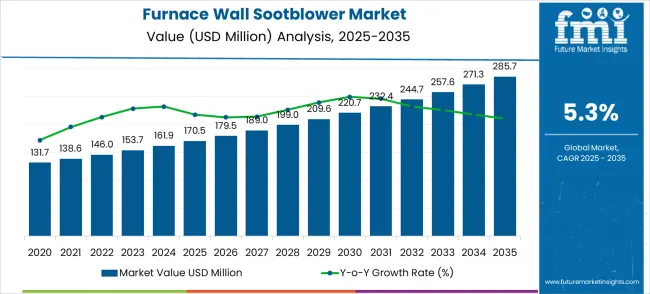

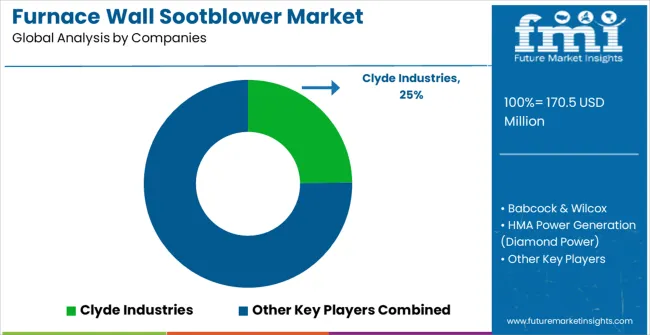

The global furnace wall sootblower market is projected to grow from USD 170.5 million in 2025 to approximately USD 285.7 million by 2035, recording an absolute increase of USD 115.2 million over the forecast period. This translates into a total growth of 67.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.3% between 2025 and 2035. The overall market size is expected to grow by nearly 1.68X during the same period, supported by the rising adoption of advanced boiler cleaning technologies and increasing demand for efficient furnace maintenance solutions across industrial applications.

Between 2025 and 2030, the furnace wall sootblower market is projected to expand from USD 170.5 million to USD 220.7 million, resulting in a value increase of USD 50.2 million, which represents 43.6% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of automated cleaning systems in industrial facilities, increasing boiler maintenance requirements, and growing awareness among facility managers about the importance of proper furnace cleaning. Service providers are expanding their sootblower manufacturing capabilities to address the growing complexity of modern industrial boiler systems.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 170.5 million |

| Forecast Value in (2035F) | USD 285.7 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

The furnace wall sootblower market has carved out a significant role within industrial and power generation sectors, where maintaining operational efficiency in high-temperature environments is critical. In the industrial cleaning equipment market, this segment contributes approximately 8.4%, as sootblowers are essential for cleaning furnace walls in various industries. Within the boiler and furnace market, the share is around 11.1%, reflecting the widespread use of sootblowers in ensuring boiler efficiency and preventing fouling. The power generation equipment market records a 9.8% share, as these devices are crucial for maintaining optimal performance in power plants.

In the steam generation systems market, the contribution stands at about 7.3%, highlighting the role of sootblowers in steam production units. The process equipment maintenance market adds another 8.2%, with furnace wall sootblowers being integral to regular maintenance and cleaning tasks in industrial plants. Collectively, these parent markets account for 44.8%, underscoring the criticality of furnace wall sootblowers in ensuring sustained performance, safety, and energy efficiency in industrial operations. This market is recognized for its essential role in improving furnace reliability, reducing downtime, and maximizing energy output.

The furnace wall sootblower market is on the cusp of modernization, fueled by boiler efficiency upgrades, emissions compliance, and industrial expansion. By 2035, these pathways together unlock USD 115–120 million in incremental revenue opportunities.

Pathway A – Retrofit & Asset Replacement. Aging boilers and heat-recovery systems require fixed and non-fixed sootblower replacements and upgrades. The largest near-term opportunity worth USD 35–45 million.

Pathway B – Power Generation Upgrades. Utility and independent power plants are investing in sootblowing retrofits for efficiency gains and stricter emissions compliance. Expected pool: USD 20–28 million.

Pathway C – Petrochemical & Smelting Intensification. High-fouling petrochemical and smelting furnaces demand robust non-fixed and specialty sootblowers. Incremental pool: USD 18–24 million.

Pathway D – Automated & Smart Sootblowing. Integration of online sensors, model-based control, and sequencing reduces fuel use, downtime, and maintenance costs. Pool: USD 10–15 million.

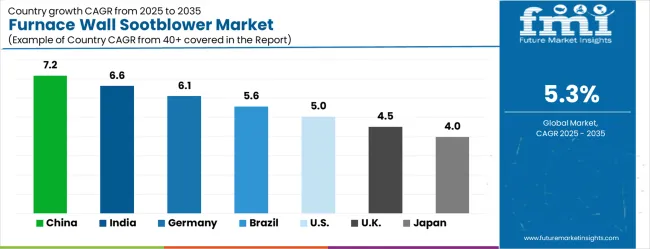

Pathway E – Emerging Market Industrialization. China (7.2% CAGR), India (6.6%), and Brazil (5.6%) lead growth through industrial expansion, new-build boilers, and long-term service contracts. Opportunity: USD 12–18 million.

Pathway F – Service, Spare Parts & Performance Guarantees. Recurring revenues through service contracts, spare-part packages, and performance guarantees. Pool: USD 8–12 million.

Market expansion is being supported by the rapid increase in industrial boiler installations worldwide and the corresponding need for specialized cleaning equipment to maintain operational efficiency. Modern industrial facilities rely on precise sootblowing systems to remove ash deposits and maintain optimal heat transfer rates in furnaces and boilers. Regular cleaning prevents tube erosion, reduces fuel consumption, and ensures compliance with environmental regulations governing industrial emissions.

The growing complexity of industrial heating systems and increasing focus on energy efficiency are driving demand for advanced sootblowing solutions from certified manufacturers with appropriate technology and expertise. Power generation facilities are increasingly requiring sophisticated cleaning systems that can operate under high-temperature conditions while maintaining equipment reliability. Regulatory requirements and industrial standards are establishing standardized cleaning procedures that require specialized sootblowers and trained maintenance personnel.

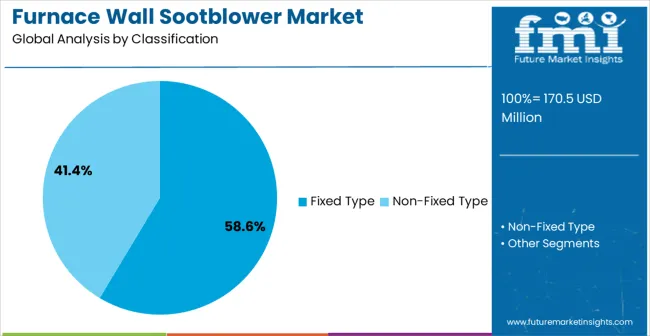

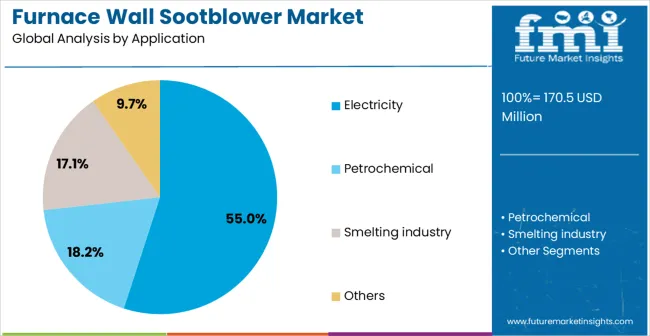

The market is segmented by type, application, and region. By type, the market is divided into fixed type and non-fixed type sootblowers. Based on application, the market is categorized into electricity, petrochemical, smelting industry, industrial boilers, and others. Regionally, the market is divided into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

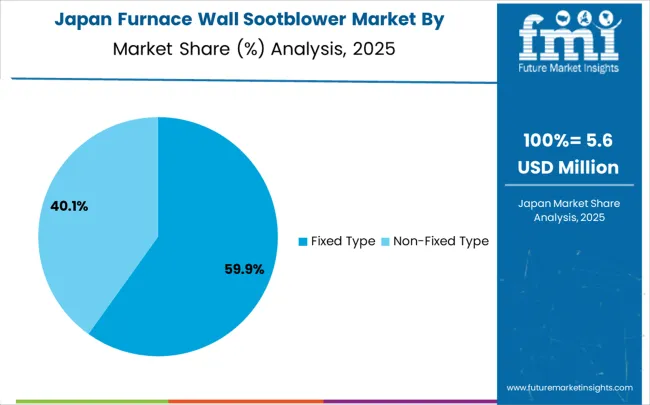

Fixed type sootblowers are projected to account for 58.6% of the Furnace Wall Sootblower market in 2025. This leading share is supported by the widespread adoption of stationary cleaning systems in power generation facilities, which require reliable, continuous-duty sootblowing equipment. Fixed type systems provide consistent cleaning performance and are preferred for large-scale industrial applications where equipment reliability is paramount. The segment benefits from established installation procedures and comprehensive maintenance support from multiple equipment suppliers.

Electricity generation applications are expected to represent 55% of furnace wall sootblower demand in 2025. This dominant share reflects the extensive use of coal-fired and biomass power plants that require regular furnace cleaning to maintain heat transfer efficiency. Modern power generation facilities feature multiple boiler systems that require coordinated sootblowing to prevent ash buildup and maintain optimal combustion conditions. The segment benefits from stringent operational requirements and increasing emphasis on plant efficiency optimization.

The furnace wall sootblower market is witnessing growing demand driven by increasing need for efficient combustion processes, reduced downtime, and improved thermal efficiency in industries such as power generation and cement manufacturing. Opportunities are expanding due to rising investments in infrastructure, stricter environmental regulations, and the focus on optimizing fuel use in industrial furnaces. However, challenges persist with system integration complexities, high installation costs, and ongoing maintenance requirements. The market’s growth is contingent on addressing these issues and offering cost-effective, reliable sootblowing solutions for diverse industrial applications.

The demand for furnace wall sootblowers has been driven by the need for enhanced operational efficiency, reduced maintenance downtime, and optimized combustion in industrial furnace operations. In opinion, industries such as power generation, cement, and steel manufacturing rely heavily on sootblowers to maintain heat transfer efficiency and prevent slag buildup on furnace walls. Soot accumulation impedes furnace performance, increasing fuel consumption and emissions. Therefore, the growing pressure to meet environmental regulations and enhance furnace output has significantly bolstered the demand for advanced sootblowing solutions. The trend toward continuous process optimization is expected to further drive demand, as industries seek to improve productivity while minimizing operational costs.

Opportunities in the furnace wall sootblower market are expanding as industries focus on improving operational efficiency and adhering to stricter environmental regulations. In opinion, the growing need for optimized furnace performance across various industrial sectors, such as power plants, cement factories, and refineries, has opened doors for more advanced sootblowing technologies. These systems help minimize fuel consumption and prevent excess emissions by ensuring clean heat exchangers and furnace walls. With governments worldwide enforcing stringent environmental standards for emissions control, the demand for high-efficiency sootblowers capable of reducing particulate matter and soot accumulation is expected to rise. The increased focus on energy-efficient infrastructure and process automation in industrial plants also presents substantial opportunities for market growth.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| Brazil | 5.6% |

| United States | 5% |

| United Kingdom | 4.5% |

| Japan | 4% |

The furnace wall sootblower market is growing rapidly, with China leading at a 7.2% CAGR through 2035, driven by massive industrial expansion, power generation capacity additions, and comprehensive boiler modernization programs. India follows at 6.6%, supported by expanding manufacturing sector and increasing power plant installations requiring advanced cleaning systems. Germany records 6.1%, emphasizing precision engineering, advanced technology integration, and stringent operational standards. Brazil grows at 5.6%, integrating sootblowing systems into established industrial operations. The United States shows 5% growth, focusing on equipment modernization and efficiency improvements. The United Kingdom and Japan demonstrate steady growth at 4.5% and 4% respectively, driven by industrial facility upgrades and maintenance system improvements. The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

The furnace wall sootblower market in China is expanding at a CAGR of 7.2%, supported by rising energy demand and growing industrial activities. China’s strong reliance on coal-fired power plants and heavy industries fuels the requirement for efficient sootblowing solutions to optimize boiler performance. Government policies encouraging operational efficiency and emission reduction contribute to market expansion. The country’s large-scale manufacturing base and continuous investments in power generation infrastructure further strengthen its position as the leading market for furnace wall sootblowers.

The furnace wall sootblower market in India is projected to grow at a CAGR of 6.6%, driven by increasing energy needs and the reliance on thermal power plants. India’s industrial sector expansion creates strong demand for reliable sootblowing solutions to ensure operational efficiency and reduced downtime. Supportive government initiatives promoting efficient energy usage and industrial modernization further encourage adoption. The integration of advanced sootblowing technologies in both power and heavy industries reflects India’s focus on reducing energy waste and enhancing productivity.

The furnace wall sootblower market in Germany is growing at a CAGR of 6.1%, supported by the country’s emphasis on energy efficiency and strict emission regulations. Germany’s focus on cleaner power generation and industrial optimization drives the demand for advanced sootblowing systems. The presence of a technologically advanced industrial base and the transition towards automated boiler maintenance systems also support adoption. Growth is steady as industries integrate modern sootblower technologies to reduce operational costs and meet regulatory standards.

The furnace wall sootblower market in Brazil is expanding at a CAGR of 5.6%, driven by industrialization and growing demand for reliable power infrastructure. Brazil’s reliance on energy-intensive industries such as cement, steel, and power generation underpins the need for efficient sootblowing technologies. Investments in improving operational efficiency and reducing maintenance downtime further accelerate market adoption. As Brazil focuses on enhancing its industrial productivity, the role of sootblowers in maintaining efficient boiler operations becomes increasingly significant.

The furnace wall sootblower market in the United States is projected to grow at a CAGR of 5%, supported by demand from power generation, refining, and heavy manufacturing industries. USA companies focus on enhancing efficiency and reducing emissions, which drives the adoption of advanced sootblower systems. Strong investments in upgrading existing infrastructure, along with regulatory requirements for efficiency and emission control, contribute to market expansion. The shift towards automation and predictive maintenance also supports the steady adoption of modern furnace wall sootblowers.

The furnace wall sootblower market in the United Kingdom is growing at a CAGR of 4.5%, with adoption largely focused on efficiency improvements in existing infrastructure. The UK emphasizes emission control and cost efficiency, driving the need for modern sootblower systems. The market is shaped by steady industrial demand and integration of automation technologies into power and manufacturing sectors. Growth is moderate compared to emerging economies but remains consistent due to regulatory support for efficiency and operational reliability.

The furnace wall sootblower market in Japan is expanding at a CAGR of 4%, driven by the country’s focus on operational efficiency and technological modernization. Japan’s industrial and power generation sectors rely on advanced sootblowing solutions to maintain efficiency and reduce downtime. The country’s emphasis on precision, automation, and reliability continues to drive demand. Growth remains moderate but steady, reflecting Japan’s mature industrial environment and focus on enhancing existing infrastructure with advanced solutions.

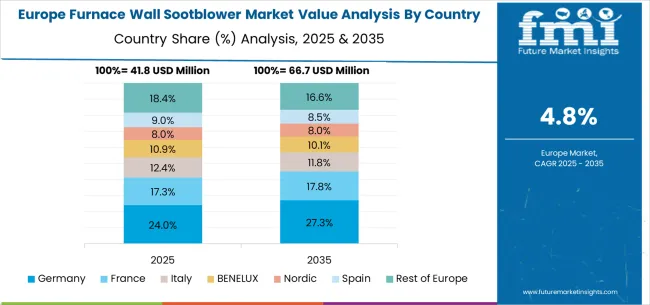

The furnace wall sootblower market in Europe is projected to grow from USD 41.8 million in 2025 to USD 66.7 million by 2035, registering a CAGR of 4.8% over the forecast period. Germany will remain the largest market, with its share rising from 24.0% in 2025 to 27.3% by 2035, supported by its extensive industrial base, power generation expansion, and advanced manufacturing capabilities.

France is projected to contribute 17.3% in 2025, increasing slightly to 17.8% by 2035, driven by modernization of industrial heating systems and large-scale energy infrastructure. Italy is expected to hold 12.4% in 2025, softening to 11.7% by 2035, reflecting stable demand in cement, ceramics, and heavy industries.

The BENELUX region is forecast to represent 10.9% in 2025, expanding to 10.1% by 2035, supported by its industrial clusters and energy technology adoption. The Nordic countries will account for 8.0% in 2025, growing to 8.6% by 2035, underpinned by renewable energy integration and sustainable industrial operations.

Spain will capture 9.0% in 2025, easing slightly to 8.0% by 2035, due to moderate adoption across energy and construction industries. Meanwhile, the Rest of Europe will decline from 18.4% in 2025 to 16.6% by 2035, reflecting gradual consolidation and slower modernization in Eastern and Southern European industries.

The furnace wall sootblower market is defined by competition among specialized equipment manufacturers, industrial boiler service providers, and power generation technology companies. Companies are investing in advanced cleaning technologies, automated control systems, precision manufacturing capabilities, and technical service expertise to deliver reliable, efficient, and cost-effective sootblowing solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Clyde Industries, USA-based, offers advanced retractable and rotary sootblowing systems with focus on precision cleaning, operational reliability, and technical expertise. Babcock & Wilcox, operating globally, provides comprehensive sootblowing solutions integrated with industrial boiler systems and power generation equipment. HMA Power Generation (Diamond Power), USA, delivers technologically advanced cleaning systems with standardized procedures and intelligent control integration. Control Concepts Inc., USA, emphasizes automated control systems and comprehensive coverage for power generation applications.

Emperor Trust Well LPR Global, China, offers sootblowing solutions integrated with comprehensive industrial boiler operations. Hubei Huaxin Machinery Development Co. Ltd, China, provides specialized cleaning equipment with advanced manufacturing capabilities. Zhejiang Lemond Power Equipment Co. Ltd, China, delivers sootblowing systems alongside power generation equipment solutions. Hubei Huaxing Machinery Technology Co. Ltd., Zhuhai Nanfang Electric Power Equipment Co. Ltd., Hubei Jinshan Electric Power Equipment Co. Ltd., and Zhejiang Laimengde POWER Equipment Co. Ltd. offer specialized sootblowing expertise, standardized manufacturing procedures, and service reliability across regional and domestic networks.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 170.5 million |

| Type | Fixed Type, Non-Fixed Type |

| Application | Electricity, Petrochemical, Smelting industry, Industrial Boilers, Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Clyde Industries, Babcock & Wilcox, HMA Power Generation (Diamond Power), Control Concepts Inc., Emperor Trust Well LPR Global, Hubei Huaxin Machinery Development Co. Ltd, Zhejiang Lemond Power Equipment Co. Ltd, Hubei Huaxing Machinery Technology Co. Ltd., Zhuhai Nanfang Electric Power Equipment Co. Ltd., Hubei Jinshan Electric Power Equipment Co. Ltd., Zhejiang Laimengde POWER Equipment Co. Ltd. |

| Additional Attributes | Dollar sales by type and application segments, regional demand trends across Asia-Pacific, North America, and Europe, competitive landscape with established manufacturers and emerging technology providers, customer preferences for fixed versus retractable systems |

The global furnace wall sootblower market is estimated to be valued at USD 170.5 million in 2025.

The market size for the furnace wall sootblower market is projected to reach USD 285.7 million by 2035.

The furnace wall sootblower market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in furnace wall sootblower market are fixed type and non-fixed type.

In terms of application, electricity segment to command 55.0% share in the furnace wall sootblower market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Furnace Market Size and Share Forecast Outlook 2025 to 2035

Vertical Furnace Tube Cleaning Machine Market Size and Share Forecast Outlook 2025 to 2035

Induction Furnace Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Furnaces Market Analysis - Size, Share, and Forecast 2025 to 2035

Submerged ARC Furnaces Market Size and Share Forecast Outlook 2025 to 2035

Anode Refining Furnace Market Size and Share Forecast Outlook 2025 to 2035

Atmosphere Roller Furnace Market Size and Share Forecast Outlook 2025 to 2035

Demand for Vertical Furnace Tube Cleaning Machine in USA Size and Share Forecast Outlook 2025 to 2035

Quantitative Casting Furnace Market Size and Share Forecast Outlook 2025 to 2035

Biomass Hot Air Generator Furnace Market Size and Share Forecast Outlook 2025 to 2035

Demand for Biomass Hot Air Generator Furnace in Middle East & Africa Size and Share Forecast Outlook 2025 to 2035

Industrial High-Temperature Graphitization Furnaces Market Size and Share Forecast Outlook 2025 to 2035

Wall Mounted Manifolds Market Size and Share Forecast Outlook 2025 to 2035

Wall Covering Product Market Forecast and Outlook 2025 to 2035

Wall Blower Market Size and Share Forecast Outlook 2025 to 2035

Wall Repair Roller Paint Market Size and Share Forecast Outlook 2025 to 2035

Wallets & Little Cases Market Size and Share Forecast Outlook 2025 to 2035

Wall Art Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA