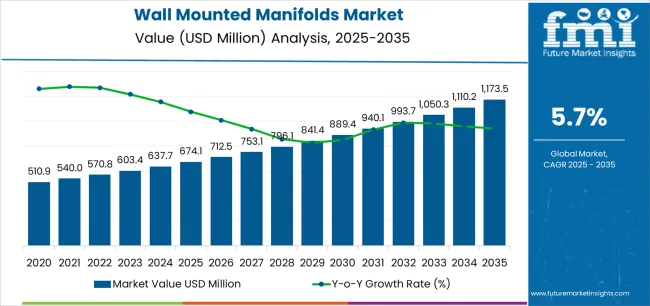

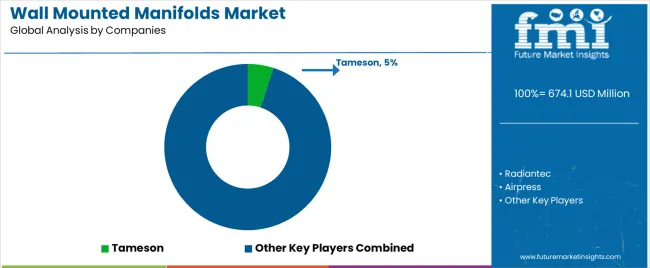

The global wall mounted manifolds market is projected to grow from USD 674.1 million in 2025 to approximately USD 1,173.5 million by 2035, recording an absolute increase of USD 499.5 million over the forecast period. This translates into a total growth of 74.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.7% between 2025 and 2035.

he overall market size is expected to grow by nearly 1.7X during the same period, supported by increasing global demand for efficient fluid and gas distribution systems, growing adoption of compressed air infrastructure in industrial facilities, and rising requirements for organized piping solutions across manufacturing plants, laboratories, and HVAC installations driven by operational efficiency objectives, space optimization needs, and safety standardization initiatives addressing leak prevention, pressure regulation, and systematic distribution management across diverse industrial and commercial applications.

The market's steady expansion trajectory reflects fundamental shifts in industrial infrastructure management, with wall mounted manifolds offering critical advantages in centralized distribution, simplified maintenance access, and organized piping architecture that traditional floor-mounted or scattered distribution systems cannot provide. Modern manifold systems integrate multiple inlet and outlet connections in compact, wall-mounted configurations enabling efficient space utilization in crowded facilities, simplified visual inspection for leak detection, and standardized connection points supporting quick-change tooling and equipment reconfiguration.

The manufacturing sector drives substantial demand as automotive assembly plants, electronics production facilities, and general manufacturing operations implement compressed air networks, hydraulic systems, and cooling water distribution requiring reliable manifold infrastructure supporting pneumatic tools, automated machinery, and process cooling applications. Additionally, the laboratory and pharmaceutical sectors increasingly adopt wall mounted manifolds for gas distribution, vacuum systems, and cleanroom environments where organized, contamination-free piping systems prove essential for research operations, quality control testing, and regulated production processes requiring validated fluid handling infrastructure.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 674.1 million |

| Market Forecast Value (2035) | USD 1,173.5 million |

| Forecast CAGR (2025-2035) | 5.7% |

Regional market dynamics reveal diverse adoption patterns influenced by industrialization levels, manufacturing sophistication, and building infrastructure standards, with Europe maintaining leadership through advanced manufacturing capabilities, comprehensive industrial standards, and stringent safety regulations driving adoption of certified manifold systems across automotive, pharmaceutical, and precision manufacturing sectors.

North America demonstrates strong market presence through established industrial base, laboratory infrastructure modernization, and HVAC system sophistication supporting residential and commercial building applications. Asia Pacific exhibits the strongest growth potential driven by rapid industrialization in China and India, expanding manufacturing capacity requiring compressed air infrastructure, and growing pharmaceutical and electronics sectors implementing cleanroom facilities and precision fluid distribution systems.

The competitive landscape intensifies as specialized manifold manufacturers, compressed air system integrators, and HVAC component suppliers compete through product customization capabilities, material innovation, and integrated system offerings.

Technology development focuses on modular designs enabling flexible configuration and scalable expansion, advanced materials including stainless steel and engineered polymers providing corrosion resistance and extended service life, and integrated monitoring capabilities incorporating pressure sensors, flow meters, and leak detection systems supporting predictive maintenance and operational efficiency optimization across industrial facilities, commercial buildings, and specialized applications requiring reliable, organized fluid and gas distribution infrastructure.

| INDUSTRIAL EFFICIENCY DRIVERS | INFRASTRUCTURE & SAFETY FACTORS | TECHNOLOGY & APPLICATION EXPANSION |

|---|---|---|

| Manufacturing Automation Growth Accelerating industrial automation and pneumatic system adoption across manufacturing facilities requiring organized compressed air distribution with wall mounted manifolds providing centralized connection points supporting production equipment, assembly tools, and automated machinery. Space Optimization Requirements Growing emphasis on facility space efficiency in high-cost industrial and urban environments driving adoption of wall-mounted solutions maximizing floor space availability while maintaining accessible distribution infrastructure for maintenance and operational visibility. Operational Efficiency Focus Increasing emphasis on minimizing air leakage, optimizing pressure distribution, and reducing energy consumption in compressed air systems with centralized manifolds enabling systematic leak detection, pressure monitoring, and efficient distribution management. | Safety Regulation Compliance Stringent industrial safety standards governing compressed gas handling, pressure vessel regulations, and workplace safety requirements driving adoption of certified manifold systems with proper pressure relief, visual inspection capabilities, and standardized connection protocols. Facility Modernization Programs Ongoing industrial facility upgrades, laboratory renovations, and building infrastructure improvements replacing aging piping systems with modern manifold solutions providing enhanced reliability, improved safety features, and simplified maintenance access. Building Code Evolution Advancing building codes and HVAC standards incorporating manifold requirements for hydronic heating systems, radiant floor installations, and zoned climate control applications supporting energy efficiency and comfort optimization objectives. | Smart Monitoring Integration Development of intelligent manifold systems incorporating pressure sensors, flow monitoring, and IoT connectivity enabling real-time system performance tracking, predictive maintenance alerts, and energy optimization supporting Industry 4.0 and smart building initiatives. Material Innovation Advanced materials including corrosion-resistant alloys, engineered polymers, and composite constructions extending service life, reducing maintenance requirements, and enabling applications in aggressive chemical environments and extreme temperature conditions. Modular Design Evolution Engineered modular manifold platforms enabling flexible configuration, tool-free assembly, and future expansion capabilities supporting phased facility development and adaptive manufacturing layouts responding to changing production requirements. |

| Category | Segments Covered |

|---|---|

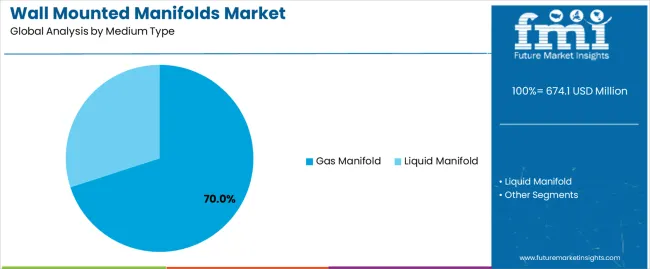

| By Medium Type | Gas Manifold, Liquid Manifold |

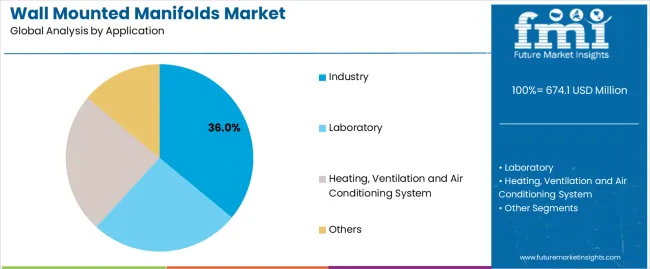

| By Application | Industry, Laboratory, Heating Ventilation and Air Conditioning System, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Gas Manifold | Dominant segment representing critical infrastructure for compressed air distribution, industrial gas delivery, and pneumatic system networks across manufacturing facilities, laboratories, and specialized applications. Comprehensive deployment supporting compressed air tools, pneumatic automation, inert gas distribution for welding operations, and laboratory gas systems for analytical instruments and research operations. Modern gas manifolds incorporating brass, stainless steel, or aluminum construction with NPT or quick-connect fittings enabling tool-free connections and simplified reconfiguration. Momentum: strong growth through 2035 driven by manufacturing automation expansion, pharmaceutical cleanroom construction, and electronics manufacturing requiring organized gas distribution infrastructure. Innovation focus on integrated shut-off valves enabling zone isolation for maintenance without system-wide shutdowns, pressure regulation capabilities maintaining consistent outlet pressures across multiple connection points, and leak detection features incorporating visual indicators or electronic monitoring supporting proactive maintenance. Safety certifications meeting industrial gas handling standards and workplace safety requirements prove essential for market acceptance. Watchouts: pressure drop concerns in systems with excessive outlet quantities or inadequate sizing requiring proper engineering design, material compatibility requirements for specific gases including oxygen, acetylene, or corrosive applications, maintenance access considerations in crowded facilities where wall mounting height affects serviceability. |

| Liquid Manifold | Significant segment serving hydronic heating systems, cooling water distribution, hydraulic circuits, and process liquid distribution across industrial, commercial, and residential applications. Primary deployment in radiant floor heating installations, chilled water systems, and manufacturing process cooling requiring organized distribution and return piping with flow balancing capabilities. Modern liquid manifolds incorporating flow meters, temperature sensors, and actuator connections enabling individual zone control and energy optimization. Momentum: moderate-to-strong growth driven by energy-efficient building construction emphasizing radiant heating systems, industrial process cooling requirements, and hydraulic system sophistication in manufacturing automation. Technology advancement in thermoplastic manifolds offering corrosion resistance and reduced weight compared to metal alternatives, integrated balancing valves enabling hydraulic optimization without external components, and modular designs supporting future expansion and zone additions. Geographic strength in European markets with established hydronic heating traditions and North American premium residential construction. Watchouts: thermal expansion considerations requiring proper mounting techniques and expansion compensation, pressure rating limitations in high-pressure hydraulic applications, fouling and corrosion risks in open-loop cooling systems requiring water treatment and material selection considerations. |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Industry | Dominant application segment encompassing manufacturing facilities, automotive assembly plants, electronics production, food processing operations, and general industrial environments requiring compressed air distribution, hydraulic systems, and process fluid management. Diverse deployment contexts from small job shops with handful of pneumatic tools to massive automotive plants with hundreds of connection points supporting robotic welding, painting booths, assembly tools, and material handling equipment. Emphasis on reliability, durability, and maintenance accessibility supporting continuous production operations where system failures result in costly downtime and production losses. Momentum: strong growth through 2035 driven by industrial automation expansion, emerging market manufacturing capacity growth, and facility modernization replacing aging infrastructure. Innovation focus on high-flow capacity manifolds supporting increased air consumption from automation equipment, vibration-resistant mounting systems ensuring connection integrity in high-vibration environments, and color-coded or labeled outlet identification supporting maintenance efficiency and troubleshooting. Industry 4.0 integration incorporating manifold-level monitoring providing consumption data, leak detection analytics, and predictive maintenance insights. Watchouts: harsh operating environments with temperature extremes, chemical exposure, or particulate contamination requiring ruggedized construction and appropriate material selection, pressure surge risks from rapid valve cycling in automated equipment requiring surge protection or pressure regulation, retrofitting challenges in existing facilities with space constraints and established piping configurations. |

| Heating, Ventilation and Air Conditioning System | Significant segment serving hydronic heating distribution, radiant floor systems, snow melting applications, and multi-zone climate control in residential, commercial, and institutional buildings. Wall mounted manifolds enabling individual zone control, flow balancing, and temperature management supporting energy efficiency and occupant comfort optimization. Primary applications include residential radiant floor heating, commercial building zone control, and institutional facility climate management requiring reliable, long-term performance in concealed or semi-concealed installations. Momentum: moderate-to-strong growth driven by energy-efficient building construction, radiant heating adoption in premium residential construction, and retrofit applications upgrading conventional forced-air systems. Geographic strength in cold-climate regions with heating season priorities and European markets with established hydronic traditions. Innovation in manifold-integrated controls combining flow regulation, temperature sensing, and actuator interfaces enabling smart building integration and occupancy-based optimization. Watchouts: concealed installation challenges requiring proper access provision for future maintenance and service, thermal efficiency losses from improper insulation around manifold installations, compatibility requirements with diverse actuator types and building automation protocols affecting system integration complexity. |

| Laboratory | Specialized segment serving research laboratories, pharmaceutical cleanrooms, hospital surgical suites, and quality control facilities requiring organized gas distribution for analytical instruments, safety equipment, and process applications. Critical infrastructure supporting gas chromatography, mass spectrometry, atomic absorption spectroscopy, and other analytical techniques requiring reliable supply of carrier gases, calibration gases, and combustion support gases. Emphasis on contamination prevention, leak-free operation, and regulatory compliance supporting GLP, GMP, and laboratory accreditation requirements. Momentum: steady growth driven by pharmaceutical research expansion, biotechnology facility construction, and hospital infrastructure modernization. Technology requirements emphasizing ultra-high purity materials, validated leak-free connections, and comprehensive documentation supporting regulatory inspections and quality audits. Innovation in manifold-integrated purity monitoring, automatic changeover systems ensuring uninterrupted gas supply during cylinder changes, and color-coded or gas-specific connections preventing cross-contamination risks. Watchouts: stringent purity requirements demanding electropolished stainless steel construction and specialized sealing materials, regulatory complexity requiring validation documentation and change control procedures, high stakes of system failures affecting research validity or patient safety in critical applications. |

| Others | Diverse application category encompassing specialty installations including medical facilities, dental clinics, veterinary hospitals, automotive service centers, and niche industrial applications requiring organized fluid or gas distribution in unique contexts. Medical gas distribution supporting patient care areas, operating rooms, and recovery facilities requiring medical-grade manifolds meeting healthcare regulations and safety standards. Automotive service applications including compressed air for tire inflation, pneumatic tools, and lift operations. Agricultural applications supporting dairy operations, greenhouse climate control, and irrigation management. Momentum: selective growth in specific segments with healthcare facility construction, veterinary practice modernization, and specialty applications driving opportunities. Innovation opportunities in application-specific configurations addressing unique requirements including medical gas regulations, automotive service efficiency, or agricultural environment challenges. Watchouts: fragmented market with diverse purchasing authorities and procurement processes across application segments, specialized regulatory requirements varying by application type and jurisdiction, limited market size in individual specialty segments potentially constraining manufacturer focus and product development investment. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Industrial Automation Expansion Continuous growth of automated manufacturing, robotic systems, and pneumatic automation driving sustained demand for organized compressed air distribution infrastructure with wall mounted manifolds providing efficient connection points supporting production equipment and assembly operations. Energy Efficiency Initiatives Growing emphasis on compressed air system efficiency and leak reduction programs driving adoption of centralized manifold systems enabling systematic monitoring, maintenance access, and leak detection supporting energy cost reduction and sustainability objectives. Infrastructure Modernization Ongoing facility upgrades replacing aging piping systems, laboratory renovations implementing modern gas distribution, and building retrofits incorporating energy-efficient hydronic heating creating sustained demand for manifold replacement and new installations. | Price Sensitivity Competitive pressures and commodity manufacturing characteristics creating margin constraints particularly in standard industrial applications where functional alternatives and price competition limit premium pricing opportunities. Installation Complexity Specialized mounting requirements, pressure testing protocols, and system commissioning needs requiring skilled installation labor potentially increasing total project costs and creating adoption barriers particularly in smaller facilities with limited technical resources. Retrofitting Challenges Existing facility constraints including limited wall space, inaccessible mounting locations, and integration complexity with legacy piping systems creating implementation barriers for manifold adoption in renovation projects compared to new construction. | Smart Manifold Systems Integration of IoT sensors, wireless connectivity, and cloud-based monitoring platforms enabling real-time pressure monitoring, flow tracking, and predictive maintenance alerts supporting operational efficiency and proactive system management. Sustainable Materials Development of recyclable manifold materials, reduced environmental impact manufacturing processes, and extended product lifecycles addressing corporate sustainability commitments and environmental regulations. Rapid Connection Technologies Evolution of tool-free, push-to-connect fittings and quick-change coupling systems enabling simplified installation, reduced labor requirements, and faster equipment reconfiguration supporting flexible manufacturing and agile facility layouts. Modular Architecture Engineered platform designs enabling standardized components, flexible configurations, and future expansion capabilities supporting phased facility development and adaptive infrastructure responding to changing operational requirements. |

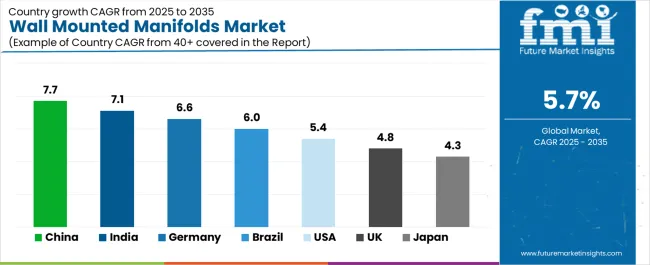

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| Brazil | 6.0% |

| United States | 5.4% |

| United Kingdom | 4.8% |

| Japan | 4.3% |

Revenue from Wall Mounted Manifolds in China is projected to exhibit strong growth with a market value of USD 312.4 million by 2035, driven by massive manufacturing capacity expansion across automotive, electronics, machinery, and consumer goods sectors requiring comprehensive compressed air infrastructure and organized fluid distribution systems supporting production equipment and automated assembly operations. The country's position as global manufacturing hub combined with ongoing industrial automation initiatives including Made in China 2025 programs create sustained demand for efficient pneumatic distribution infrastructure. Domestic manufacturing capability in manifold production supporting cost-competitive offerings and rapid delivery timelines serving diverse industrial customers.

Industrial park development and manufacturing cluster expansion require comprehensive compressed air systems with wall mounted manifolds providing organized distribution supporting multiple production zones and equipment areas. Pharmaceutical and electronics manufacturing growth requiring cleanroom facilities and precision gas distribution drives specialized manifold applications. Laboratory infrastructure expansion supporting research institutions and quality control facilities creates demand for analytical gas distribution systems. Domestic manufacturers developing competitive products alongside international suppliers create dynamic market with diverse price points and specification options serving various industrial segments from cost-sensitive general manufacturing to premium applications requiring certified materials and validated performance.

Revenue from Wall Mounted Manifolds in India is expanding to reach USD 274.6 million by 2035, supported by rapid industrial expansion, Make in India manufacturing initiatives, and growing pharmaceutical and automotive sectors requiring organized compressed air and fluid distribution infrastructure across production facilities, laboratories, and specialized applications. The country's developing manufacturing base transitioning from traditional methods toward modern automated production creates opportunities for infrastructure investment including pneumatic distribution systems. Government policies promoting industrial development and foreign direct investment facilitate manufacturing capacity expansion requiring supporting infrastructure.

Automotive manufacturing expansion by domestic producers and international companies establishing Indian operations drives compressed air infrastructure requirements. Pharmaceutical industry strength including generic drug manufacturing, API production, and research facilities requires laboratory gas distribution and cleanroom compressed air systems. Growing industrial automation adoption in manufacturing sectors including machinery, electronics, and consumer goods creates pneumatic system requirements. HVAC system sophistication in commercial construction and premium residential developments drives hydronic manifold adoption for radiant heating and cooling applications. Domestic and international suppliers compete across segments with localized service support and competitive pricing proving critical factors in cost-sensitive market.

Demand for Wall Mounted Manifolds in Germany is projected to reach USD 252.4 million by 2035, supported by the country's advanced manufacturing capabilities, automotive industry leadership, and comprehensive industrial infrastructure emphasizing efficiency, quality, and systematic organization. German industrial culture prioritizing optimized workflows, organized facilities, and systematic maintenance practices creates favorable environment for manifold adoption. The market is characterized by sophisticated specifications, quality expectations, and emphasis on long-term reliability and energy efficiency.

Automotive industry strength including vehicle assembly, component manufacturing, and Industry 4.0 implementations requires comprehensive compressed air infrastructure with advanced monitoring and energy optimization capabilities. Pharmaceutical and chemical manufacturing sectors require validated fluid handling systems meeting regulatory standards. Machine tool manufacturing and precision engineering operations demand reliable compressed air and hydraulic distribution. HVAC market maturity with established hydronic heating traditions drives manifold adoption in residential and commercial buildings. Premium residential construction emphasizing energy efficiency and comfort drives radiant floor heating adoption. Domestic manufacturing excellence through established suppliers maintains strong market presence with comprehensive product portfolios and technical support capabilities.

Revenue from Wall Mounted Manifolds in Brazil is growing to reach USD 232.8 million by 2035, driven by expanding manufacturing sector, automotive industry presence, and growing emphasis on industrial efficiency and organized facility infrastructure supporting production operations across diverse manufacturing segments. The country's large domestic market and regional manufacturing hub position create opportunities for industrial infrastructure investment. Foreign manufacturing investment and domestic industrial expansion drive facility construction and modernization requiring compressed air systems and fluid distribution infrastructure.

Automotive manufacturing including major international producers operating Brazilian facilities drives pneumatic infrastructure requirements. Food and beverage processing industry strength requires compressed air for packaging equipment, conveying systems, and process automation. Oil and gas sector including offshore operations and refining facilities creates industrial manifold demand. Building construction activity in commercial and residential segments drives HVAC manifold adoption particularly in premium developments. Regional suppliers and international manufacturers compete with import duties and local content considerations influencing equipment sourcing decisions. Distribution network development and technical service availability prove critical factors in market penetration and customer support.

Revenue from Wall Mounted Manifolds in United States is projected to reach USD 214.6 million by 2035, driven by established manufacturing base, comprehensive laboratory infrastructure, and sophisticated HVAC systems across industrial, commercial, and residential applications requiring organized fluid and gas distribution solutions. The country's mature industrial economy combines ongoing facility modernization with new construction activity. Diverse manufacturing sectors from automotive to food processing require compressed air infrastructure. Extensive research laboratory infrastructure across universities, pharmaceutical companies, and government facilities creates analytical gas distribution requirements.

Manufacturing facility upgrades and automation implementations drive compressed air system improvements including manifold installations. Pharmaceutical and biotechnology sectors require laboratory gas distribution and cleanroom compressed air systems meeting regulatory standards. Premium residential construction in northern climates adopts radiant floor heating systems requiring hydronic manifolds. Commercial building construction incorporates advanced HVAC systems with zone control capabilities. Energy efficiency programs and industrial optimization initiatives drive compressed air system improvements including organized distribution and leak reduction. Established distribution networks and comprehensive technical support infrastructure support market maturity with diverse supplier options serving various application segments and geographic regions.

Demand for Wall Mounted Manifolds in United Kingdom is projected to reach USD 197.8 million by 2035, expanding at a CAGR of 4.8%, driven by manufacturing sector presence, pharmaceutical industry strength, and building renovation programs incorporating energy-efficient heating systems including hydronic distribution requiring manifold infrastructure. Industrial applications span automotive components, food processing, pharmaceutical manufacturing, and general engineering requiring compressed air distribution. Building sector emphasis on energy efficiency and carbon reduction drives radiant heating adoption in residential and commercial applications.

Pharmaceutical industry concentration including major international companies operating UK facilities drives laboratory gas distribution and cleanroom compressed air requirements meeting GMP standards. Manufacturing facilities implementing Industry 4.0 initiatives and automation upgrades require organized pneumatic distribution infrastructure. Residential renovation market and premium home construction adopts hydronic heating systems with manifold-based zone control. Commercial building retrofits incorporating energy-efficient HVAC systems drive manifold adoption. Sustainability emphasis and building regulation evolution influence equipment selection toward efficient distribution systems minimizing energy losses. Established suppliers maintain market presence with comprehensive product ranges and technical support capabilities serving diverse application requirements.

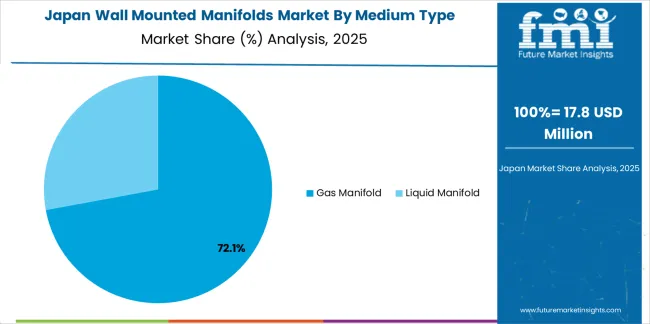

Demand for Wall Mounted Manifolds in Japan is projected to reach USD 182.4 million by 2035, supported by the country's advanced manufacturing capabilities, precision engineering standards, and comprehensive quality requirements ensuring reliable performance across industrial and building applications. Japanese industrial culture emphasizing systematic organization, preventive maintenance, and operational efficiency creates favorable environment for manifold adoption supporting organized facility infrastructure. The market demonstrates preference for high-quality equipment with proven reliability and comprehensive technical documentation.

Manufacturing sectors including automotive components, electronics, precision machinery, and robotics require reliable compressed air distribution supporting automated production equipment. Pharmaceutical and chemical industries demand validated fluid handling systems meeting regulatory standards. Laboratory infrastructure across research institutions and corporate R&D facilities requires analytical gas distribution. Building sector applications include HVAC systems in commercial facilities and premium residential construction. Earthquake engineering considerations influence mounting specifications and seismic certification requirements. Domestic manufacturers and international suppliers compete with preference for established reliability records and responsive technical support. Conservative procurement approaches favor proven suppliers with comprehensive track records serving Japanese quality expectations.

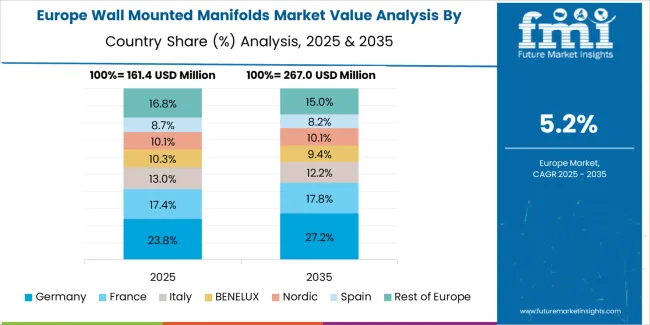

The wall mounted manifolds market in Europe is projected to grow from USD 212.8 million in 2025 to USD 364.2 million by 2035, registering a CAGR of 5.5% over the forecast period. Germany is expected to maintain its leadership position with a 36.8% market share in 2025, projected to reach 38.2% by 2035, supported by its advanced manufacturing sector, automotive industry dominance, and comprehensive industrial infrastructure emphasizing systematic organization and energy efficiency.

The United Kingdom follows with a 23.4% share in 2025, expected to reach 24.6% by 2035, driven by pharmaceutical industry strength, manufacturing sector presence, and building efficiency programs incorporating hydronic heating systems. France holds a 16.8% share in 2025, projected to reach 17.4% by 2035, supported by automotive manufacturing, pharmaceutical production, and commercial building construction. Italy commands a 12.6% share benefiting from manufacturing sector diversity and HVAC system sophistication, while Netherlands accounts for 7.8% in 2025 driven by industrial infrastructure and greenhouse climate control applications. The Rest of Europe region is anticipated to expand to 2.6% share by 2035, attributed to increasing industrial development in Eastern European countries, Nordic manufacturing capabilities, and Southern European building construction activity.

Japanese wall mounted manifolds operations reflect the country's emphasis on precision engineering, comprehensive quality management, and systematic facility organization ensuring reliable performance across demanding industrial and building applications. Major equipment manufacturers and distributors maintain rigorous quality control processes, extensive product testing protocols, and comprehensive technical documentation ensuring consistent performance and regulatory compliance. Seismic engineering considerations mandate specialized mounting systems and vibration-resistant designs addressing earthquake risks and ensuring operational continuity during natural disasters.

The Japanese market demonstrates unique requirements including compact configurations optimized for space-constrained facilities, precision-machined components ensuring tight tolerances and leak-free operation, and comprehensive material traceability supporting quality audits and regulatory compliance. Equipment procurement emphasizes long-term reliability, manufacturer stability, and responsive technical support ensuring sustained service throughout extended equipment lifecycles.

Regulatory oversight establishes comprehensive industrial safety standards, pressure vessel regulations, and building codes incorporating manifold specifications. Industrial customers emphasize proven track records, reference installations, and comprehensive warranty provisions. Supplier relationships involve extensive pre-qualification processes, factory inspections, and ongoing performance monitoring. Conservative procurement approaches favor established manufacturers with demonstrated reliability and comprehensive support capabilities serving Japanese quality expectations and regulatory requirements.

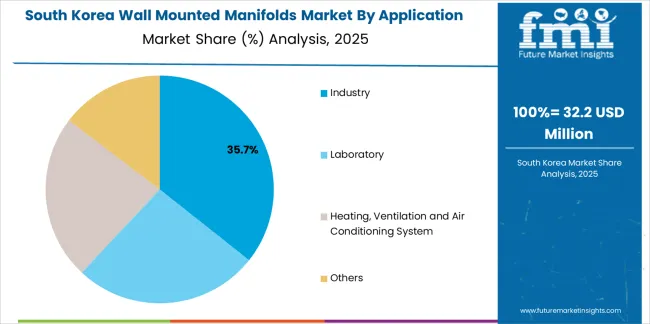

South Korean wall mounted manifolds operations reflect the country's advanced manufacturing capabilities and growing industrial sophistication driving adoption of organized fluid distribution infrastructure supporting production efficiency and facility optimization objectives. Major industrial companies and facility managers implement comprehensive compressed air systems and fluid distribution networks supporting automated production equipment and process requirements. Manufacturing sector strength including automotive, electronics, shipbuilding, and heavy machinery creates diverse application opportunities.

The Korean market demonstrates growing emphasis on industrial efficiency with facilities implementing energy optimization programs, systematic leak detection, and organized distribution infrastructure supporting operational excellence initiatives. Automation expansion and Industry 4.0 implementations require reliable compressed air distribution with wall mounted manifolds providing organized connection points and maintenance accessibility. Building sector development including commercial construction and premium residential projects incorporates advanced HVAC systems with hydronic distribution requiring manifold infrastructure.

Regulatory frameworks establish industrial safety standards and building codes incorporating fluid distribution requirements. Equipment procurement emphasizes performance validation, energy efficiency characteristics, and comprehensive technical support. Domestic manufacturers and international suppliers compete through product innovation, competitive pricing, and responsive service networks. Industrial facility development and manufacturing capacity expansion create sustained demand across diverse sectors supporting market growth and technology adoption.

The wall mounted manifolds market exhibits moderate fragmentation with specialized manufacturers including Tameson, Radiantec, Airpress, and GEOTERM.PRO maintaining presence through focused product portfolios, application expertise, and customer relationships across industrial, laboratory, and HVAC segments. Profit pools concentrate in specialized segments where custom configurations, premium materials, and integrated features enable differentiation beyond commodity manifold offerings, while distribution partnerships, technical support services, and complementary product offerings create value-added propositions supporting customer retention.

Several competitive archetypes shape market dynamics: specialized manifold manufacturers focusing exclusively on distribution systems with deep engineering expertise and application-specific product development; compressed air system integrators offering manifolds as components within comprehensive pneumatic solutions leveraging existing customer relationships and project-based sales; HVAC equipment suppliers including manifolds within broader hydronic system portfolios serving building construction and renovation markets; and industrial component distributors providing manifolds alongside valves, fittings, and piping materials through established distribution networks. Market success requires balancing product customization capabilities with manufacturing efficiency supporting diverse customer requirements, establishing distribution channels reaching fragmented customer bases across industrial, commercial, and residential segments, and providing technical support including sizing assistance, installation guidance, and troubleshooting expertise supporting customer success and minimizing field failures.

Switching costs remain moderate as manifolds represent relatively standardized components with interchangeable mounting and connection specifications, while competitive pricing and availability considerations create opportunities for supplier displacement. However, established supplier relationships, proven reliability, and responsive technical support create stickiness particularly in critical applications where system failures create significant operational or safety consequences. Market dynamics favor manufacturers demonstrating comprehensive product testing, appropriate certifications for regulated applications, and consistent quality delivery addressing customer risk management concerns.

Innovation focus centers on modular platform designs enabling flexible configurations, standardized components, and future expansion capabilities supporting phased facility development and adaptive infrastructure requirements, advanced materials including corrosion-resistant alloys, high-temperature polymers, and composite constructions extending service life and enabling challenging applications, and integrated monitoring capabilities incorporating pressure sensors, flow meters, and IoT connectivity providing real-time performance visibility and predictive maintenance insights. Smart manifold development incorporating digital pressure regulation, automated zone control, and data analytics represents emerging opportunity supporting Industry 4.0 and smart building integration. Service model evolution toward comprehensive system design assistance, installation support, and lifecycle management creates differentiated value propositions beyond transactional equipment sales supporting customer relationships and recurring revenue opportunities.

| Items | Values |

|---|---|

| Quantitative Units | USD 674.1 million |

| Medium Type | Gas Manifold, Liquid Manifold |

| Application | Industry, Laboratory, Heating Ventilation and Air Conditioning System, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, United Kingdom, France, Brazil, China, India, Japan, South Korea, and other 40+ countries |

| Key Companies Profiled | Tameson, Radiantec, Airpress, GEOTERM.PRO, Comet, Prevost, Calefactio, Sorotec GmbH, AIRnet, TOPRING |

| Additional Attributes | Dollar sales by medium type/application, regional demand (NA, EU, APAC), competitive landscape, gas vs. liquid manifold adoption patterns, industrial vs. building application dynamics, and technology innovation driving smart monitoring, modular design, and material advancement supporting operational efficiency, energy optimization, and systematic fluid distribution management |

By Medium Type

The global wall mounted manifolds market is estimated to be valued at USD 674.1 million in 2025.

The market size for the wall mounted manifolds market is projected to reach USD 1,173.5 million by 2035.

The wall mounted manifolds market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in wall mounted manifolds market are gas manifold and liquid manifold.

In terms of application, industry segment to command 36.0% share in the wall mounted manifolds market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wall Covering Product Market Forecast and Outlook 2025 to 2035

Wall Blower Market Size and Share Forecast Outlook 2025 to 2035

Wall Repair Roller Paint Market Size and Share Forecast Outlook 2025 to 2035

Wallets & Little Cases Market Size and Share Forecast Outlook 2025 to 2035

Wall Art Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Wall Decor Market Insights – Growth & Demand 2025–2035

Market Leaders & Share in the Wallets & Little Cases Industry

Market Share Distribution Among Wall Covering Product Manufacturers

Wall Mounted Paper Napkin Dispensers Market Growth - Demand & Forecast 2025 to 2035

In-Wall Bottle Filling Station Market Size and Share Forecast Outlook 2025 to 2035

Firewall as a Service Market

Thin Wall Packaging Market Size and Share Forecast Outlook 2025 to 2035

Soft Wall Military Shelter Market Size and Share Forecast Outlook 2025 to 2035

Thin Wall Plastic Container Market Analysis - Size, Share, and Forecast 2025 to 2035

Multiwall Bags Market Trends - Growth & Demand 2025 to 2035

Market Share Breakdown of Thin Wall Plastic Container Providers

Thin Wall Mould Market

Thin Wall Glass Container Market

Heavy Wall Bottles Market Size, Share & Forecast 2025 to 2035

Korea Wall Décor Market Analysis – Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA