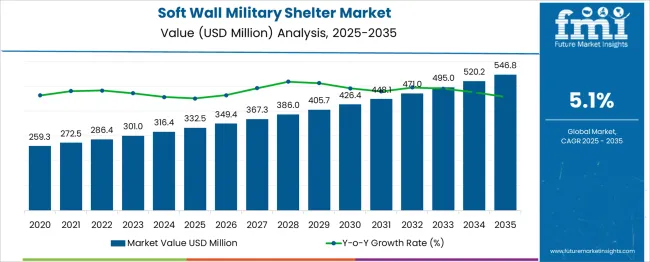

The Soft Wall Military Shelter Market is estimated to be valued at USD 332.5 million in 2025 and is projected to reach USD 546.8 million by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. The market follows a typical technology adoption lifecycle, driven by the need for rapid deployment, portability, and cost-effective protection in military and defense operations.

From 2020 to 2024, the market is in the early adoption phase, growing from USD 259.3–316.4 million. During this period, conventional canvas and modular fabric shelters dominate, analogous to “hydraulic” technologies-well-established, reliable, and widely deployed. Advanced materials and insulated or deployable shelter variants, comparable to electric hydraulic and EPS segments, remain niche due to higher costs and specialized requirements.

From 2025 to 2030, the market enters the scaling phase, expanding from USD 332.5 to USD 426.4 million. Adoption accelerates as military forces increasingly require lightweight, rapidly deployable, and climate-resilient shelters. Electric, hydraulic-like innovations, such as semi-rigid or composite fabric shelters, are gaining traction in tactical and expeditionary operations. EPS-like solutions, including fully integrated smart shelters with environmental control, communication, and power systems, are beginning to be deployed in specialized missions. Between 2030 and 2035, the market transitions to consolidation, reaching a value of USD 546.8 million.

Growth moderates as procurement stabilizes, with conventional soft wall shelters retaining dominance for general deployments while advanced and smart shelters serve high-value, strategic applications. The overall market maturity curve is sigmoid-shaped, reflecting early experimentation, scaling adoption, and eventual stabilization, with segments mapped by readiness, cost, and operational complexity.

| Metric | Value |

|---|---|

| Soft Wall Military Shelter Market Estimated Value in (2025 E) | USD 332.5 million |

| Soft Wall Military Shelter Market Forecast Value in (2035 F) | USD 546.8 million |

| Forecast CAGR (2025 to 2035) | 5.1% |

The soft wall military shelter market is witnessing strong momentum as defense forces increasingly prioritize rapid deployability, modularity, and cost-effective infrastructure solutions for forward-operating environments. These shelters are becoming essential in tactical operations due to their lightweight structure, ease of transport, and fast installation compared to traditional rigid shelters.

The growing frequency of multinational exercises, humanitarian missions, and emergency response operations is encouraging the procurement of scalable shelter systems that can be configured for command centers, medical units, and equipment housing. Advancements in thermal insulation, UV resistance, and integrated HVAC capabilities have further enhanced operational readiness in extreme climate zones.

Strategic defense modernization programs across NATO, Asia Pacific, and the Middle East are favoring investments in flexible infrastructure that reduces setup time while maintaining protection standards. As militaries shift toward expeditionary capabilities, soft wall shelter systems are expected to play an increasingly central role in supporting dynamic mission requirements across diverse terrains and conflict scenarios.

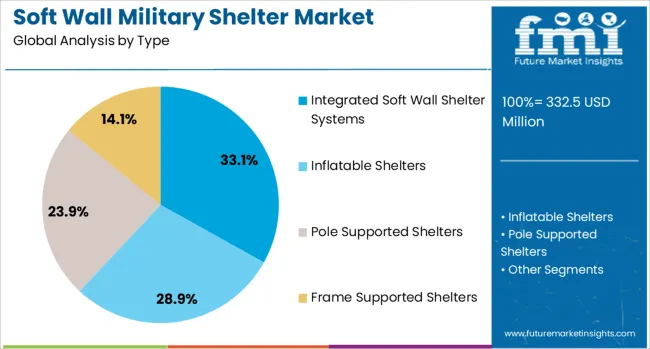

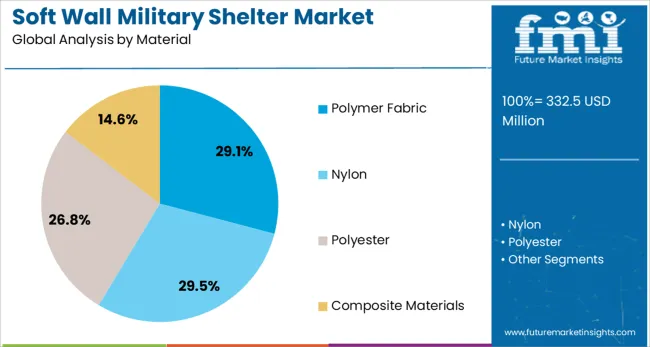

The soft wall military shelter market is segmented by type, material, size, application, deployment type, and geographic regions. By type, the soft wall military shelter market is segmented into Integrated Soft Wall Shelter Systems, Inflatable Shelters, Pole-Supported Shelters, and Frame-Supported Shelters. In terms of material, the soft wall military shelter market is classified into Polymer Fabric, Nylon, Polyester, and Composite Materials. Based on size, the soft wall military shelter market is segmented into Medium (6 to 20 meters), Large (above 20 meters), and Small (up to 6 meters).

By application, the soft wall military shelter market is segmented into Military Command Posts, Medical Facilities, Personnel Accommodation, vehicle maintenance, storage, and logistics. By deployment type, the soft wall military shelter market is segmented into Rapid Deployment Shelters and Semi-Permanent Shelters. Regionally, the soft wall military shelter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Integrated soft wall shelter systems are projected to account for 33.1% of the overall market revenue in 2025, making it the leading segment by type. This leadership is attributed to their all-in-one configuration, which enables faster deployment, reduced logistical complexity, and improved field efficiency.

These systems are designed to provide structural integrity, electrical connectivity, and climate control within a single integrated unit, allowing military units to operate in remote or austere conditions with minimal setup time. The growing demand for unified solutions that minimize external dependencies and enhance troop readiness has driven adoption among rapid response teams and mobile command operations.

Their compatibility with transport platforms and ability to be redeployed multiple times without compromising structural performance has further supported their dominance. As defense procurement strategies emphasize multi-mission flexibility and lifecycle cost savings, integrated systems have emerged as a preferred choice for long-term infrastructure support in both combat and peacekeeping missions.

The polymer fabric segment is expected to represent 29.1% of total revenue in the soft wall military shelter market in 2025, reflecting its widespread use due to superior performance characteristics. The increasing reliance on polymer-based materials is being driven by their lightweight properties, enhanced durability, and resistance to harsh environmental conditions.

These fabrics offer excellent tensile strength, UV protection, and waterproofing, making them suitable for use in diverse geographic settings including deserts, mountains, and high-humidity regions. The material’s adaptability to modular frame structures and compatibility with camouflage coatings has made it ideal for military applications.

Moreover, the ease of cleaning, storage, and transport of polymer fabrics has contributed to operational efficiency during deployment and recovery. With continuous innovation in fire-retardant coatings and thermal regulation layers, polymer fabrics are supporting the development of next-generation shelters that meet stringent military specifications for protection, mobility, and reusability.

Medium-sized shelters ranging from 6 to 20 meters are anticipated to hold 39.2% of the market share in 2025, leading the size segment. Their dominance is supported by their optimal balance between mobility and capacity, making them suitable for a wide array of tactical and support operations.

These shelters are commonly used for troop accommodation, field hospitals, and mobile command units due to their ability to house both personnel and essential equipment within a manageable footprint. The medium size category has gained preference for its compatibility with standard military transport vehicles and reduced time for assembly and disassembly.

As mission requirements increasingly demand versatile and quickly adaptable shelter solutions, medium-sized shelters have become integral to forward-deployed bases and rapid-response scenarios. Their scalability, cost-efficiency, and structural reliability have positioned them as a core component of modern expeditionary infrastructure across global defense programs.

The soft wall military shelter market is expanding due to rising defense modernization and rapid deployment requirements. Lightweight, portable, and versatile shelters are widely used for troop accommodation, command centers, medical units, and storage. North America and Europe lead the market with advanced defense infrastructure, while Asia-Pacific shows growth driven by increasing military budgets. The integration of modular designs, climate-resilient materials, and quick-setup features enhances operational efficiency. Rising focus on field-ready solutions and expeditionary forces is supporting global market growth.

Soft wall military shelters are preferred for their portability, ease of assembly, and minimal logistical footprint. Military forces require shelters that can be quickly deployed in remote locations for operations, training, or disaster response. These shelters reduce setup time and manpower requirements, providing flexible solutions for temporary bases. The need for mobile medical units, command posts, and storage facilities in field operations drives adoption. Governments and defense agencies prioritize high-performance shelters that withstand harsh weather and provide reliable protection, ensuring continuous growth of soft wall shelter applications in tactical and support operations worldwide.

Manufacturers are using high-strength fabrics, flame-retardant coatings, and insulated materials to enhance shelter longevity and performance. Weatherproof designs protect personnel and equipment from extreme temperatures, rain, and wind. Modular and expandable configurations allow flexible space utilization and easy transportation. Integration of lightweight aluminum or composite frames reduces weight while maintaining structural stability. Continuous improvements in fabric tensile strength, UV resistance, and thermal insulation ensure shelters meet diverse operational requirements. Enhanced durability and functionality increase confidence in soft wall shelters for long-term military missions, expanding their adoption across global defense forces.

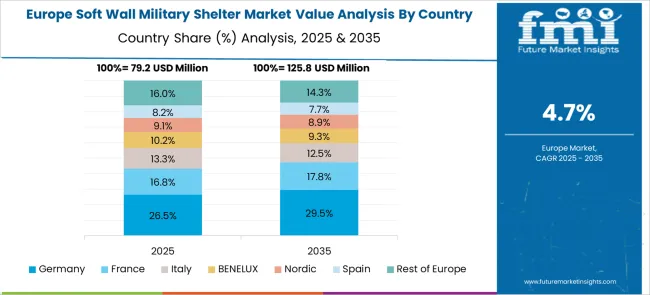

North America and Europe dominate due to advanced defense technology adoption, existing military infrastructure, and frequent field exercises. Asia-Pacific is witnessing growth as countries expand military budgets and invest in rapid deployment capabilities. Regional demand is influenced by geopolitical tensions, disaster response preparedness, and peacekeeping operations. Local defense procurement policies and government contracts impact market penetration. Manufacturers targeting emerging regions are focusing on cost-effective, lightweight solutions compatible with local military requirements. Growing demand for expeditionary forces and mobile military infrastructure across regions continues to drive global adoption of soft wall military shelters.

Defense contractors are partnering with material suppliers, logistics providers, and military organizations to enhance product quality and availability. Collaborations allow development of shelters tailored to specific operational needs, including medical units, command centers, and troop accommodations. Strategic alliances facilitate rapid deployment, regional distribution, and adherence to government standards. Joint ventures also support research on innovative materials, modular designs, and protective coatings. By leveraging these partnerships, companies enhance credibility, expand market access, and provide comprehensive solutions, supporting adoption by military forces worldwide.

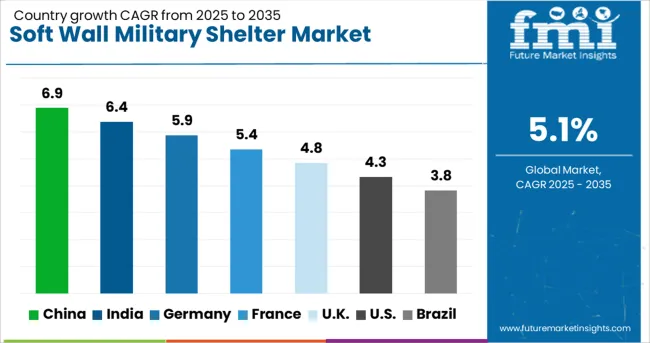

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

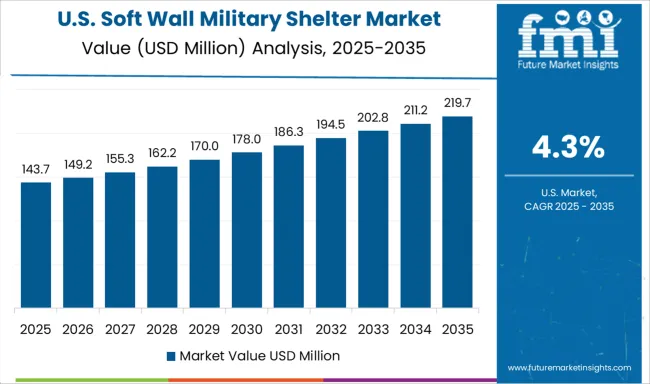

| USA | 4.3% |

| Brazil | 3.8% |

The soft wall military shelter market is expected to grow at a CAGR of 5.1%, driven by demand for mobile, rapid-deployment structures for defense and emergency operations. China leads with a growth rate of 6.9%, supported by extensive defense modernization programs and domestic manufacturing capabilities. India follows at 6.4%, with increasing focus on border infrastructure and tactical deployments. Germany, at 5.9%, leverages advanced materials and engineering to produce durable, high-performance shelters. The UK, growing at 4.8%, maintains steady demand through defense procurement and logistical support, while the USA, at 4.3%, continues to adopt modular, transportable shelters for military and disaster-response operations. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the soft wall military shelter market with a 6.9% growth rate, driven by rising defense spending and modernization of military infrastructure. Compared to India, China has larger-scale production facilities and stronger supply chains, enabling mass deployment of mobile shelters for troops and equipment. Demand is fueled by the need for rapid deployment solutions in border areas and emergency situations. Investments in lightweight, durable, and weather-resistant materials enhance product reliability. Research and development focus on modular designs, quick assembly, and multifunctionality. Export opportunities to neighboring countries also contribute to market growth. The expanding military infrastructure, coupled with government initiatives to improve tactical mobility, ensures steady market expansion. Continuous technological upgrades and emphasis on operational efficiency strengthen China’s position as a leading market for soft wall military shelters.

India’s market grows at 6.4%, supported by increased defense budgets and modernization programs. Compared to Germany, India emphasizes cost-effective manufacturing while maintaining operational efficiency. Rising border security requirements and disaster management preparedness drive demand for deployable shelters. Domestic manufacturers invest in advanced materials and modular designs to improve portability and weather resistance. Training facilities, military bases, and strategic installations adopt soft wall shelters for rapid deployment. Government initiatives promoting indigenous defense production further boost market growth. Export opportunities to friendly nations enhance revenue streams. Continuous innovation in shelter technology, combined with military modernization projects, ensures sustainable expansion of the Indian market. The focus remains on durability, lightweight construction, and rapid assembly to meet operational demands.

Germany’s market grows at 5.9%, driven by demand from military and emergency response sectors. Compared to the UK, Germany emphasizes high-quality materials, structural reliability, and compliance with strict safety standards. The market benefits from technological innovations such as flame-retardant fabrics, insulation, and modular construction. Military bases and international peacekeeping missions adopt these shelters for mobility and operational efficiency. Export demand across Europe adds growth potential. Manufacturers focus on lightweight yet durable solutions to reduce transportation costs and enhance deployment speed. Continuous R&D ensures improvements in weather resistance, structural integrity, and multifunctionality. Germany’s market stability is supported by strong defense infrastructure, innovation capabilities, and adherence to environmental and safety regulations, maintaining steady adoption of soft wall military shelters.

The UK market grows at 4.8%, driven by military modernization and civil defense applications. Compared to the US, the UK emphasizes regulatory compliance, operational safety, and material durability. Demand arises from military training facilities, disaster management, and peacekeeping missions. Manufacturers focus on modular, weather-resistant, and lightweight designs for rapid assembly and mobility. Research investments aim to improve thermal insulation, fire resistance, and portability. Collaboration with defense contractors and government initiatives promote adoption across armed forces. Export opportunities in Europe provide additional growth avenues. The UK market remains stable due to consistent military procurement, technological advancement, and strategic focus on deployable shelter solutions.

The USA market grows at 4.3%, driven by military modernization, disaster relief, and rapid deployment needs. Compared to China, the US emphasizes premium quality, multifunctional shelters, and advanced material innovation. Demand arises from military bases, training camps, and humanitarian missions. Manufacturers focus on lightweight, durable, and modular designs to optimize mobility and operational efficiency. R&D investments enhance thermal insulation, structural integrity, and portability. Export opportunities to allied nations further support market growth. Strategic defense initiatives and government procurement programs maintain steady adoption. Overall, the US market continues to expand, driven by technological innovation, operational flexibility, and high standards for safety and durability in military shelter solutions.

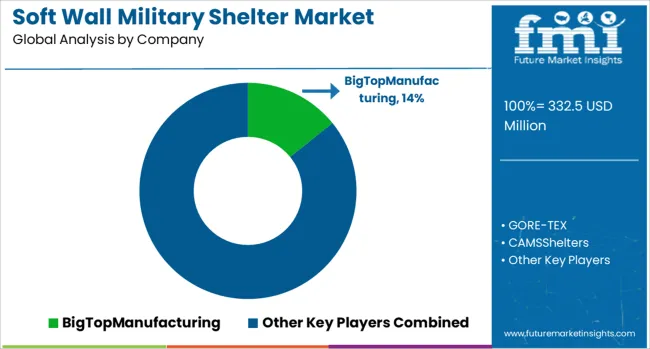

The soft wall military shelter market is characterized by a mix of established defense solution providers and specialized modular shelter manufacturers, with companies such as BAE Systems, Oshkosh Defense, and Tempest Technology Solutions leading the segment through extensive product portfolios and global defense contracts. These companies focus on delivering durable, rapidly deployable shelters designed for field operations, emergency response, and mobile command centers. Key differentiation levers include modularity, ease of transport, rapid assembly, climate adaptability, ballistic protection, and integration with power and communication systems. Historical strategies have emphasized long-term defense procurement contracts, partnerships with armed forces, and continuous innovation in shelter materials and design to enhance operational performance.

Regional expansion has been pursued through government tenders, strategic alliances with local defense contractors, and deployment support in North America, Europe, and the Middle East, where demand for tactical and expeditionary shelters is significant. Emerging players such as Rotaflex Defense Systems, ConXTech, and Shelter Systems International are leveraging lightweight materials, deployable structures, and customization for specialized missions to capture niche demand. Market challenges include high regulatory compliance, material sourcing for extreme environmental conditions, logistical constraints in deployment, and competition from hard-wall and hybrid shelter solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 332.5 Million |

| Type | Integrated Soft Wall Shelter Systems, Inflatable Shelters, Pole Supported Shelters, and Frame Supported Shelters |

| Material | Polymer Fabric, Nylon, Polyester, and Composite Materials |

| Size | Medium (6 to 20 meters), Large (above 20 meters), and Small (up to 6 meters) |

| Application | Military Command Posts, Medical Facilities, Personnel Accommodation, Vehicle Maintenance, and Storage & Logistics |

| Deployment Type | Rapid Deployment Shelters, Semi-Permanent Shelters, and ` |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BigTopManufacturing, GORE-TEX, CAMSShelters, HDTGlobal, CelinaTent, RoderHTSHockerGmbh, GillardSAS, AlaskaStructuresInc., and Weatherhaven |

| Additional Attributes | Dollar sales in the Soft Wall Military Shelter Market vary by type including inflatable, modular, and rigid-frame shelters, application across military operations, disaster relief, and field hospitals, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing defense expenditure, demand for rapid deployable infrastructure, and advancements in lightweight, durable materials. |

The global soft wall military shelter market is estimated to be valued at USD 332.5 million in 2025.

The market size for the soft wall military shelter market is projected to reach USD 546.8 million by 2035.

The soft wall military shelter market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in soft wall military shelter market are integrated soft wall shelter systems, inflatable shelters, pole supported shelters and frame supported shelters.

In terms of material, polymer fabric segment to command 29.1% share in the soft wall military shelter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Deployable Military Shelter Systems Market Size and Share Forecast Outlook 2025 to 2035

Deployable Military Shelter Market Growth - Trends & Forecast 2025 to 2035

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Soft Start Resistor Market Size and Share Forecast Outlook 2025 to 2035

Wall Mounted Manifolds Market Size and Share Forecast Outlook 2025 to 2035

Soft Touch Lamination Film Market Size and Share Forecast Outlook 2025 to 2035

Wall Covering Product Market Forecast and Outlook 2025 to 2035

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wall Blower Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Soft Ferrite Core Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Soft Gripper Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Soft Magnetic Composite Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA