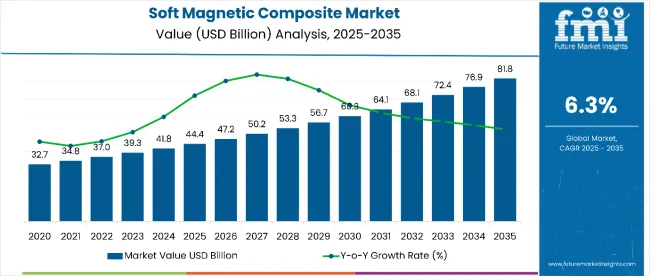

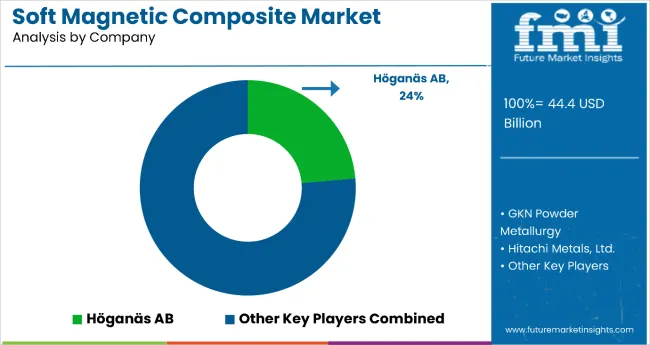

The global soft magnetic composite market is valued at USD 44.4 billion in 2025 and is slated to reach USD 81.9 billion by 2035, recording an absolute increase of USD 37.5 billion over the forecast period. This translates into a total growth of 84.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.3% between 2025 and 2035. The overall market size is expected to grow by nearly 1.8X during the same period, supported by increasing adoption of electric vehicles, rising demand for energy-efficient motors, and growing focus on renewable energy systems and industrial automation.

Soft Magnetic Composite Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 44.4 billion |

| Forecast Value in (2035F) | USD 81.9 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

Between 2025 and 2030, the soft magnetic composite market is projected to expand from USD 44.4 billion to USD 61.2 billion, resulting in a value increase of USD 16.8 million, which represents 44.8% of the total forecast growth for the decade. This phase of growth will be shaped by rising adoption of electric vehicle technology, increasing demand for energy-efficient power systems, and growing penetration of renewable energy infrastructure in emerging markets. Manufacturing companies are expanding their soft magnetic composite product portfolios to address the growing demand for high-performance magnetic materials in automotive and industrial applications.

From 2030 to 2035, the market is forecast to grow from USD 61.2 billion to USD 81.9 billion, adding another USD 20.7 billion, which constitutes 55.2% of the overall ten-year expansion. This period is expected to be characterized by expansion of Industry 4.0 technologies, integration of advanced powder metallurgy systems in formulations, and development of next-generation magnetic materials. The growing adoption of smart manufacturing trends and AI-enabled design automation will drive demand for premium soft magnetic composites with enhanced efficiency and performance profiles.

Between 2020 and 2025, the soft magnetic composite market experienced robust expansion, driven by increasing focus on electrification initiatives and growing awareness of energy efficiency requirements. The market developed as manufacturers recognized the need for effective magnetic solutions to support electric vehicle adoption, renewable energy integration, and industrial automation concerns. Technological advancements and government policies began emphasizing the importance of soft magnetic composites in achieving energy efficiency goals and sustainable manufacturing practices.

Market expansion is being supported by the increasing adoption of electric vehicles and the corresponding demand for efficient magnetic materials in motor applications. Modern manufacturers are increasingly focused on energy-efficient solutions that can deliver superior electromagnetic performance, reduced core losses, and enhanced operational reliability. Soft magnetic composites' proven efficacy in providing low eddy current losses and supporting high-frequency operations makes them a preferred material in automotive and industrial applications.

The growing emphasis on renewable energy systems and smart grid technologies is driving demand for soft magnetic composites in transformer and inductor applications. Manufacturing preference for materials that combine magnetic efficiency with cost-effectiveness is creating opportunities for innovative formulations. The rising influence of Industry 4.0 technologies and automation trends is also contributing to increased product adoption across different industrial sectors and applications.

The market is segmented by material, type, application, end use, and region. By material, the market is divided into electrical steel, soft ferrite, and iron powder. Based on type, the market is categorized into 1P, 3P, and 5P. In terms of application, the market is segmented into electrical coils, motors, generators, transformers, inductors, sensors, and others. By end use, the market is classified into automotive, industrial machinery and equipment, consumer goods, power generation, and others. Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa.

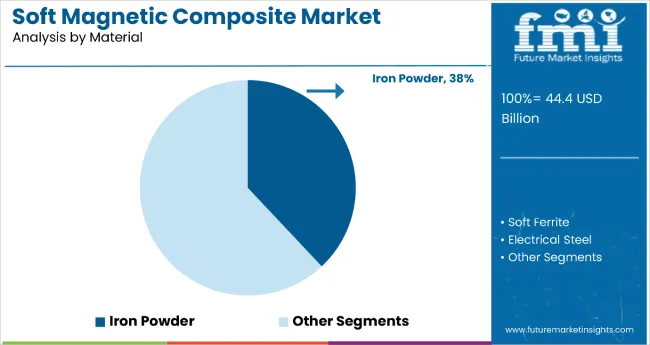

The iron powder material segment is projected to account for 38.0% of the soft magnetic composite market in 2025, reaffirming its position as the category's leading material choice. Manufacturers increasingly understand the benefits of iron powder's widespread availability, cost-effectiveness, and favorable magnetic properties that make it highly suitable for electric motors, inductors, transformers, and magnetic cores across automotive and industrial applications.

This material forms the foundation of most product formulations, as it represents the most accessible and performance-reliable option for soft magnetic composite manufacturing. Engineering validation and ongoing cost optimization continue to strengthen adoption of iron powder formulations. With manufacturing processes becoming more sophisticated and quality requirements increasing, iron powder aligns with both performance and economic objectives. Its broad compatibility across applications ensures sustained dominance, making it the central growth driver of soft magnetic composite material demand.

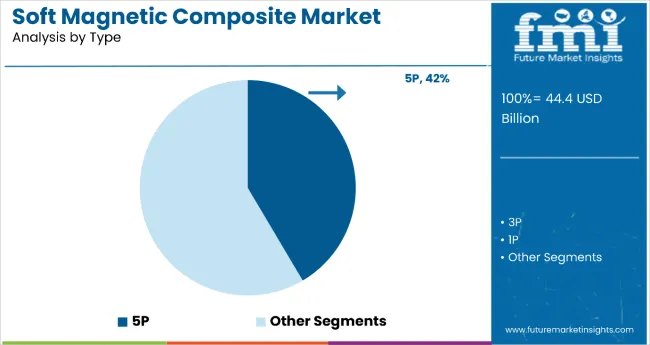

The 5P type segment is projected to represent 42% of soft magnetic composite demand in 2025, underscoring its role as the preferred type for high-performance magnetic applications. Manufacturers gravitate toward 5P composites for their superior performance characteristics, enhanced permeability, and minimal core losses that maximize the effectiveness of magnetic systems. Positioned as premium, advanced materials, 5P composites offer both operational benefits, such as improved thermal stability, and performance benefits, including enhanced magnetic efficiency.

The segment is supported by the rising adoption of next-generation electric propulsion systems and high-efficiency industrial equipment that require advanced magnetic materials. Additionally, manufacturers are increasingly combining 5P composites with complementary technologies and optimized designs, enhancing performance and justifying premium positioning. As engineering-focused customers prioritize efficiency and reliability, 5P-based soft magnetic composites will continue to dominate demand, reinforcing their advanced technology positioning within the magnetic materials market.

The soft magnetic composite market is advancing rapidly due to increasing adoption of electric vehicle technology and growing demand for energy-efficient magnetic materials. However, the market faces challenges including high manufacturing costs, raw material price volatility, and competition from alternative magnetic solutions. Innovation in powder metallurgy and Industry 4.0 integration continue to influence product development and market expansion patterns.

Advancements in Powder Metallurgy and Manufacturing Technologies

The growing adoption of advanced powder metallurgy techniques is enabling manufacturers to improve product quality and reduce production costs. Modern manufacturing processes offer enhanced control over material properties, improved consistency, and better performance characteristics. Advanced compaction and sintering technologies are driving efficiency gains and enabling development of next-generation soft magnetic composites with superior magnetic properties.

Integration with Industry 4.0 and Smart Manufacturing Systems

Modern soft magnetic composite manufacturers are incorporating Industry 4.0 technologies such as machine learning, robotics, and data analytics to enhance production control and reduce waste. These technologies improve manufacturing precision while extending operational efficiency and providing better user experience. Smart manufacturing integration also enables development of customized solutions that deliver multiple performance benefits in single applications.

| Countries | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.7% |

| United States | 6.5% |

| France | 5.7% |

| United Kingdom | 6.1% |

| Japan | 5.9% |

| China | 6.3% |

| Germany | 6% |

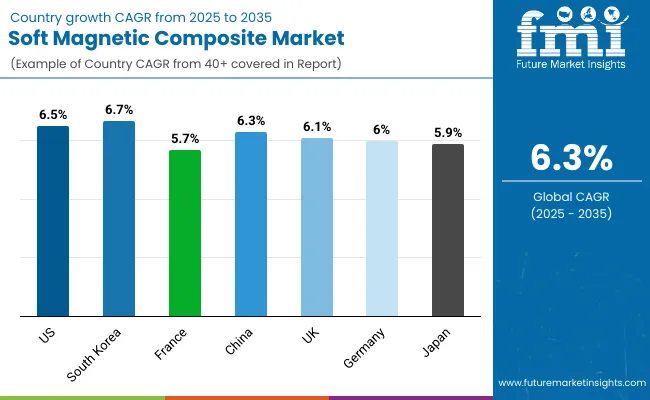

The soft magnetic composite market is experiencing robust growth globally, with South Korea leading at a 6.7% CAGR through 2035, driven by strong semiconductor and electronics industries, expanding electric vehicle sector, and government incentives supporting green technology investment. The United States follows closely at 6.5%, supported by increasing utilization of energy-efficient electric motors and government programs directed at energy-saving initiatives. The European Union shows steady growth at 6.4%, emphasizing environmental regulations and electric vehicle market leadership. The UK records 6.1%, focusing on renewable energy investment and automotive electrification. Japan shows growth at 5.9%, prioritizing advanced motor technology and consumer electronics applications.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from soft magnetic composites in South Korea is projected to exhibit strong growth with a CAGR of 6.7% through 2035, driven by the country's strong automotive, consumer electronics, and semiconductor industries. The remarkable development of electric vehicle and renewable energy infrastructures, along with government benefits for green technologies, inflates the demand for advanced magnetic materials. Progress in nanocrystalline and amorphous magnetic materials has a substantial impact on market competitiveness.

Demand for soft magnetic composites in the USA is projected to grow at a CAGR of 6.5%, supported by increased utilization of energy-efficient electric motors and transformers in the flourishing electric vehicle sector and renewable energy applications. Government programs directed at energy-saving initiatives and continuing developments in additive manufacturing processes are contributing to market growth. The transition from traditional to lightweight and high-tech materials in manufacturing of industrial and consumer electronics is another determining factor.

Revenue from soft magnetic composites in France is projected to grow at a CAGR of 5.7% through 2035, supported by the country's strong industrial manufacturing heritage and growing investment in renewable energy systems. French manufacturers are increasingly focusing on sustainable technologies and advanced materials that support the transition to clean energy and electric mobility. The aerospace and defense sectors also contribute to demand for specialized magnetic materials.

Revenue from soft magnetic composites in the UK is projected to grow at a CAGR of 6.1% through 2035, supported by financing in sustainable energies, electrification of transport, and developments in modern power electronics. Strong environmental pressure has created high demand for soft magnetic composites to replace inductors and motors in next-generation equipment for electric vehicles and wind energy applications.

Revenue from soft magnetic composites in Japan is projected to grow at a CAGR of 5.9% through 2035, supported by the nation's advanced manufacturing ecosystem and leadership in electric motor technology. The emphasis on miniaturization and high-efficiency power systems, especially for hybrid and electric vehicles, leads to increased demand for soft magnetic composites in automotive applications.

Revenue from soft magnetic composites in China is projected to grow at a CAGR of 6.3% through 2035, driven by the country's massive manufacturing capabilities and rapid adoption of electric vehicle technology. China's position as a global manufacturing hub for electronics and automotive components creates substantial demand for high-performance magnetic materials. The government's strong commitment to green energy transition and electric mobility is accelerating market growth across industrial sectors.

Revenue from soft magnetic composites in Germany is projected to grow at a CAGR of 6% through 2035, supported by the country's advanced automotive industry and sophisticated understanding of magnetic materials technology. German manufacturers consistently demand superior quality materials that deliver exceptional performance while maintaining strict engineering standards. The transition to electric mobility and Industry 4.0 integration is driving innovation in magnetic material applications.

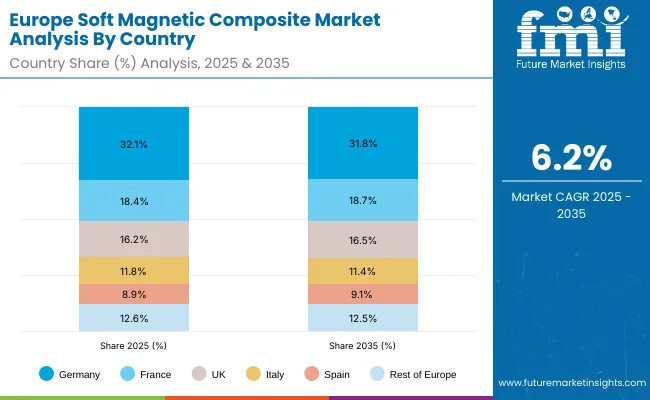

The soft magnetic composite market in Europe is projected to grow at a CAGR of 6.2% over the forecast period. Germany is expected to lead the region with 32.1% market share in 2025, moderating slightly to 31.8% by 2035, supported by its advanced automotive industry, sophisticated understanding of magnetic materials technology, and strong presence of major automotive manufacturers driving electric vehicle adoption.

France follows with 18.4% in 2025, rising to 18.7% by 2035, driven by its industrial manufacturing heritage, growing focus on renewable energy systems, and companies pioneering premium soft magnetic composite solutions. The United Kingdom accounts for 16.2% in 2025, edging to 16.5% by 2035 as clean energy technologies and electric vehicle development drive demand for high-performance soft magnetic composites. Italy holds 11.8% in 2025, easing to 11.4% by 2035, with growth concentrated in automotive electrification solutions and premium magnetic material applications.

Spain represents 8.9% in 2025, moving to 9.1% by 2035, supported by expanding automotive sector and renewable energy infrastructure development. The remainder of Europe (Nordic countries, BENELUX, Eastern Europe and other markets) collectively contributes 12.6% in 2025, adjusting to 12.5% by 2035, reflecting steady growth in advanced manufacturing technologies and expanding access to premium magnetic materials across diverse industrial sectors.

The soft magnetic composite market is characterized by competition among established materials manufacturers, specialty magnetic companies, and emerging technology providers. Companies are investing in advanced powder metallurgy technologies, sustainable manufacturing practices, premium product positioning, and strategic partnerships to deliver effective, reliable, and accessible magnetic material solutions. Material innovation, manufacturing efficiency, and application expansion are central to strengthening product portfolios and market presence.

Höganäs AB leads the market with significant global presence, offering comprehensive soft magnetic composite solutions with focus on powder metallurgy expertise and industrial applications. Rio Tinto Metal Powders provides specialized magnetic materials with emphasis on high-quality metal powders and supply chain reliability. Hitachi Metals Ltd. delivers advanced magnetic solutions with focus on automotive and electronics applications. GKN Powder Metallurgy focuses on engineered materials that combine powder metallurgy expertise with application-specific performance.

Sumitomo Electric Industries and PMG Group, operating globally, provide comprehensive soft magnetic composite ranges across multiple industrial sectors and distribution channels. Carpenter Technology Corporation emphasizes specialty alloys and advanced materials with premium positioning. Hitachi Chemical offers technology-driven solutions with focus on performance optimization and application engineering. Magnetec GmbH and HöferMetallTechnik GmbH provide specialized magnetic materials with focus on European markets and custom applications.

The future looks powerful for soft magnetic composites. As sectors from automotive to industrial automation to renewable energy demand higher efficiency, lighter weight, and compact, high-frequency magnetic components, SMCs are being positioned as a core enabling material. Their advantages, including reduced eddy-current losses, isotropic magnetic behavior, flexible 3D design, good thermal profiles, align well with global decarbonization and electrification trends.

Pathways A through H represent eight critical drivers through which incremental value can be captured-whether by catering to the EV surge, pushing into power electronics, or innovating in material science and manufacturing.

Key Players in the Soft Magnetic Composite Market

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 44.4 billion |

| Material | Electrical Steel, Soft Ferrite, Iron Powder |

| Type | 1P, 3P, 5P |

| Application | Electrical Coils, Motors, Generators, Transformers, Inductors, Sensors, Others |

| End Use | Automotive, Industrial Machinery and Equipment, Consumer Goods, Power Generation, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Höganäs AB, Rio Tinto Metal Powders, Hitachi Metals Ltd., GKN Powder Metallurgy, Sumitomo Electric Industries, PMG Group, Carpenter Technology Corporation, Hitachi Chemical, Magnetec GmbH, and Höfer Metall Technik GmbH |

| Additional Attributes | Market driven by EV adoption, renewable energy expansion, and industrial automation; electrical steel segment analysis, regional demand trends, competitive landscape, technological innovations in powder metallurgy, integration with smart manufacturing, and sustainable material development practices |

The global market is projected to reach USD 44.4 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 6.3% over the forecast period.

By 2035, the market is expected to reach USD 81.9 billion.

The electrical steel segment is expected to dominate the market due to its high magnetic permeability, low core losses, and critical role in enhancing efficiency across motors, transformers, and generators.

Key players in the soft magnetic composite market include Höganäs AB, Rio Tinto Metal Powders, Hitachi Metals, Ltd., GKN Powder Metallurgy, Sumitomo Electric Industries.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Soft Magnetic Composites in EU Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Soft Start Resistor Market Size and Share Forecast Outlook 2025 to 2035

Soft Touch Lamination Film Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Soft Ferrite Core Market Size and Share Forecast Outlook 2025 to 2035

Soft Gripper Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Softwood Veneer and Plywood Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Soft Wall Military Shelter Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Soft Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA