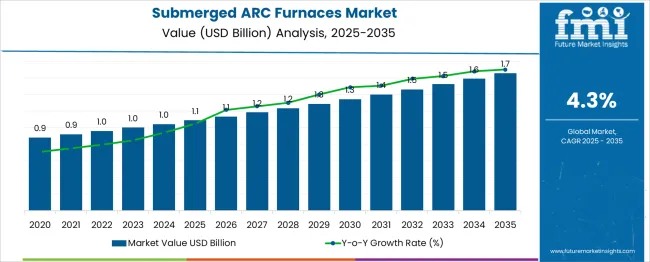

The Submerged ARC Furnaces Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Submerged ARC Furnaces Market Estimated Value in (2025 E) | USD 1.1 billion |

| Submerged ARC Furnaces Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

Industry focus on energy-efficient and high-capacity furnaces has driven investments in advanced furnace technologies. The growth in infrastructure and manufacturing sectors has spurred demand for ferroalloys, which are essential in steelmaking and other metallurgical processes. Technological improvements have enhanced furnace durability and operational efficiency, leading to cost reductions and better product quality.

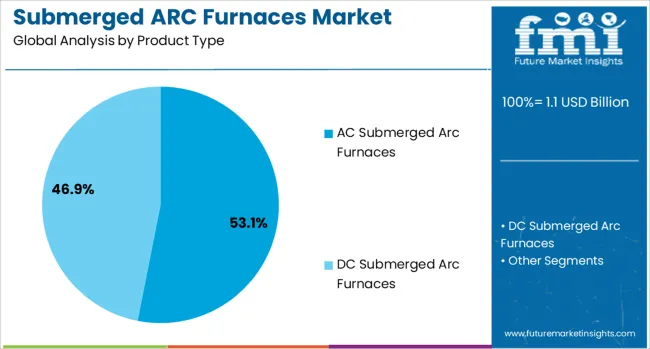

The market outlook is positive as raw material availability improves and environmental regulations push for cleaner, more efficient production methods. Increased adoption of automated control systems also supports process optimization. Segment growth is expected to be led by AC submerged arc furnaces because of their established reliability and widespread application. Ferroalloy production remains the primary application driving the market due to its crucial role in steel manufacturing.

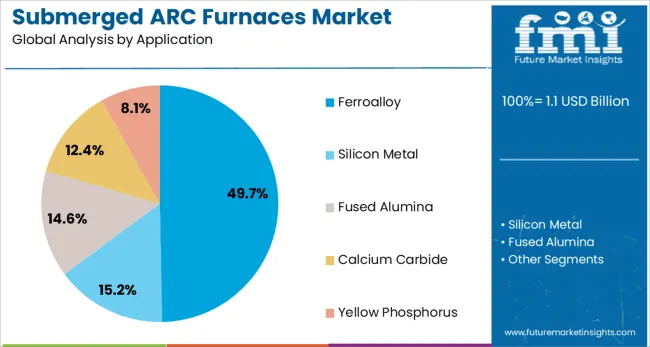

The submerged arc furnaces market is segmented by product type and application and geographic regions. By product type of the submerged arc furnaces market is divided into AC Submerged Arc Furnaces and DC Submerged Arc Furnaces. In terms of application of the submerged arc furnaces market is classified into Ferroalloy, Silicon Metal, Fused Alumina, Calcium Carbide, and Yellow Phosphorus. Regionally, the submerged arc furnaces industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The AC submerged arc furnaces segment is projected to account for 53.1% of the market revenue in 2025, maintaining its position as the leading product type. This segment has grown due to the AC furnace’s proven capability in delivering consistent high-temperature performance required for melting and alloying operations.

Their robust design and adaptability to different raw material inputs make them favorable among metallurgical plants. The segment’s growth is supported by the furnace’s energy efficiency and relatively lower maintenance needs compared to alternatives.

Furthermore, advancements in control systems have improved process stability and product quality. These factors have reinforced the dominance of AC submerged arc furnaces in industrial smelting applications.

The ferroalloy application segment is expected to contribute 49.7% of the market revenue in 2025, retaining its lead as the largest application area. The demand for ferroalloys continues to grow in parallel with the steel industry, as they are essential additives for improving steel strength, durability, and corrosion resistance.

The expansion of construction, automotive, and infrastructure sectors has directly fueled ferroalloy production. Submerged arc furnaces are widely used in producing ferroalloys like ferrochrome, ferromanganese, and ferrosilicon due to their ability to handle high-temperature processes efficiently.

Additionally, manufacturers focus on optimizing furnace operation to reduce energy consumption and emissions, which aligns with industry sustainability goals. The ferroalloy segment is anticipated to remain critical for market growth in the foreseeable future.

Growing infrastructure projects in Asia Pacific and modernization in Europe and North America support adoption. Environmental regulations are pushing energy-efficient and low-emission furnace designs, while automation, AI integration, and predictive maintenance improve productivity. Shifts toward green steel and electric arc processes indirectly favor SAF demand. Key players such as Danieli, SMS Group, and Tenova focus on capacity expansion and strategic partnerships to strengthen market presence and regional competitiveness globally.

SAF systems have been widely adopted for large-scale production of ferroalloys such as ferrosilicon and silicomanganese due to their efficiency in submerged arc energy utilization and accurate raw material blending. Advanced electrode positioning systems, automated slag removal, and inline composition monitoring have enabled greater smelting precision and yield improvements. These technologies minimize reversion losses and optimize chemical uniformity under high-temperature operations. Off-gas scrubbing units and waste heat recovery systems contribute to energy conservation and regulatory compliance. Continuous operation models with electrode replacement automation have improved plant safety and throughput. Favorable power availability and raw material proximity in certain regions drive furnace deployments, allowing manufacturers to achieve competitive cost structures and meet growing demand in steelmaking and non-ferrous alloy industries.

High capital investment remains a major barrier to deploying submerged arc furnace systems, including costs for furnace shell construction, electrode handling, and refractory lining. Operational complexity increases due to requirements for skilled labor to manage electrode alignment, slag chemistry, and thermal stability. Maintenance downtime during electrode replacement and refractory relining adds further production losses, as these processes must occur under controlled cooling conditions. Energy spikes during startup cycles cause grid load fluctuations and raise operating costs. Environmental regulations around slag disposal and off-gas treatment necessitate additional infrastructure and investment. Smaller ferroalloy producers often struggle with financing, project approvals, and return on investment timelines, limiting large-scale adoption despite the growing demand for high-purity alloys in global markets.

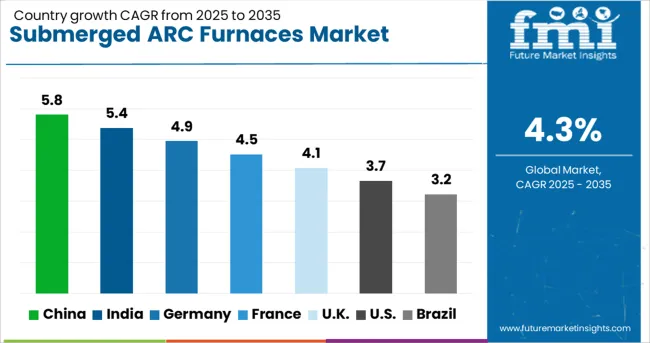

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

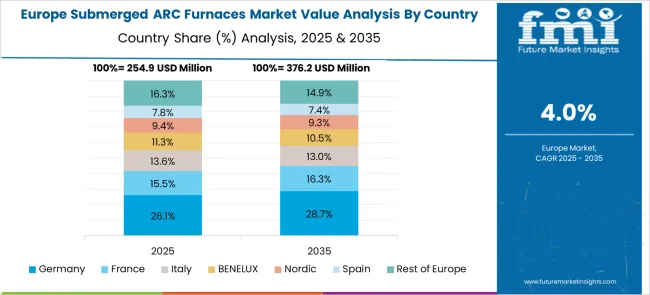

The global submerged arc furnaces market is projected to grow at a 4.3% CAGR from 2025 to 2035, driven by demand for ferroalloys, silicon metal, and energy-efficient metallurgical processes. BRICS nations lead growth, with China at 5.8% and India at 5.4%, supported by large-scale steel and ferroalloy production for infrastructure and export. In OECD regions, Germany grows at 4.9%, emphasizing automation in smelting operations, while France at 4.5% focuses on upgrading furnace technologies for specialty alloys. The United Kingdom, at 4.1%, prioritizes modernization of existing plants and integration of hybrid power systems to meet emission standards. The report includes analysis of over 40 countries, with five profiled below for reference.

China is projected to grow at a 5.8% CAGR, driven by robust demand for ferroalloys and silicon metal in steelmaking and industrial applications. Large-scale investments in electric furnace technology are enhancing efficiency in smelting manganese, chromium, and ferro-silicon alloys. Domestic manufacturers are developing advanced electrode systems and digital control units to optimize power consumption in submerged arc furnaces. Environmental regulations are encouraging the shift to closed-type furnaces with automated emission control systems. Growth in renewable energy sectors also drives demand for metallurgical-grade silicon for photovoltaic applications. China’s position as the largest global steel producer reinforces the use of submerged arc furnaces across integrated plants.

India is expected to grow at a 5.4% CAGR, supported by infrastructure-driven steel demand and expansion of ferroalloy manufacturing. Submerged arc furnaces are widely deployed in manganese and chromium smelting units across Odisha, Chhattisgarh, and Jharkhand. Government-led programs like Make in India and PLI schemes are encouraging investment in electric furnace technology to improve energy efficiency. Domestic suppliers are introducing cost-effective furnace designs with enhanced thermal insulation and electrode positioning systems. Growth in export-oriented ferroalloy production strengthens demand for large-capacity submerged arc furnaces. Adoption of semi-automatic control systems is increasing to reduce production downtime and ensure consistent alloy quality.

Germany is forecast to grow at a 4.9% CAGR, driven by demand for specialty steels and high-purity ferroalloys in automotive and engineering sectors. Submerged arc furnaces are being integrated with automated material feeding systems and advanced electrode regulation for process precision. Emphasis on energy optimization has led to adoption of closed-type furnaces equipped with waste heat recovery systems. German furnace manufacturers are investing in digital monitoring tools for predictive maintenance and enhanced operational safety. The country’s strong focus on high-value metallurgical products ensures continued use of submerged arc technology in electric steelmaking and ferroalloy plants.

France is projected to grow at a 4.5% CAGR, supported by modernization in specialty alloy manufacturing and tighter environmental regulations. Furnace upgrades include advanced refractory linings, low-emission exhaust systems, and automated electrode control technologies. French metallurgical plants are focusing on energy-efficient furnace operations to reduce operational costs under EU energy directives. Growth in aerospace-grade alloy production is stimulating demand for precise thermal control during smelting. Domestic furnace technology providers are partnering with European steelmakers to develop customized solutions for integrated plants and mini-mills. The push toward green metallurgy encourages the use of closed furnace designs with energy recovery.

The United Kingdom is expected to grow at a 4.1% CAGR, with emphasis on plant retrofitting and hybrid energy integration in metallurgical operations. Submerged arc furnaces are primarily used in steel recycling, ferroalloy production, and niche casting industries. UK-based firms are adopting modular furnace designs to support small and medium-scale alloy producers. Rising demand for eco-compliant solutions encourages the development of energy-efficient furnaces with integrated emission treatment systems. Advanced electrode management systems are improving furnace life and reducing maintenance downtime. Increased adoption of automation enhances consistency in smelting processes for critical applications like aerospace components.

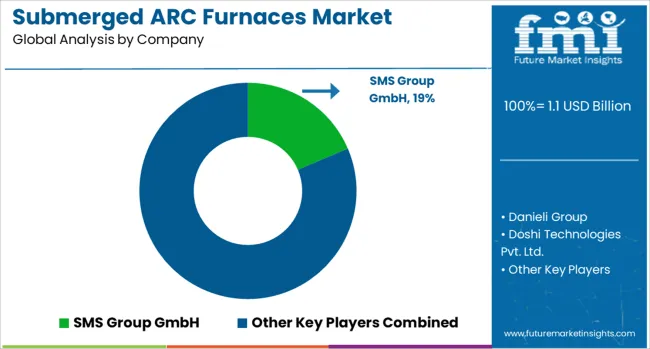

The submerged arc furnaces market is primarily led by SMS Group GmbH, holding a significant share thanks to its robust engineering and turnkey solutions for ferroalloy and silicon metal production. Global EPC stalwarts like Metso Outotec Corporation, Danieli Group, and Primetals Technologies Limited follow closely, offering integrated furnace systems with energy efficiency and emissions control features. Siemens AG and Hatch Ltd. contribute critical automation, power supply, and process optimization components. Leading OEMs from Asia, such as Shanghai Electric Group and Xi’an Abundance Electric Technology Co., Ltd., cater to regional demand with cost-competitive designs.

Doshi Technologies Pvt. Ltd. and Electrotherm focus on the Indian market needs with localized manufacturing and service support. Others like Paul Wurth S.A., Tenova, Thermtronix Corporation, and Thyssenkrupp Industrial Solutions enhance capacity through retrofits, advanced materials handling, and custom-built furnace models. Competition centers on furnace scale, energy efficiency, emissions compliance, and lifecycle service packages.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Product Type | AC Submerged Arc Furnaces and DC Submerged Arc Furnaces |

| Application | Ferroalloy, Silicon Metal, Fused Alumina, Calcium Carbide, and Yellow Phosphorus |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SMS Group GmbH, Danieli Group, Doshi Technologies Pvt. Ltd., Electrotherm, Hatch Ltd., Metso Outotec Corporation, Outotec Oyj, Paul Wurth S.A., Primetals Technologies Limited, Shanghai Electric Group Co., Ltd., Siemens AG, Tenova, Thermtronix Corporation, Thyssenkrupp Industrial Solutions AG, and Xi’an Abundance Electric Technology Co., Ltd. |

| Additional Attributes | Dollar sales in the submerged arc furnaces market are segmented by product type AC, DC, and twin-electrode models, with AC units leading due to lower operating costs and broad application flexibility. Demand growth is linked to ferroalloy, silicon metal, and calcium carbide production. Asia-Pacific dominates adoption, supported by rapid industrial expansion and large-scale infrastructure projects. |

The global submerged arc furnaces market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the submerged arc furnaces market is projected to reach USD 1.7 billion by 2035.

The submerged arc furnaces market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in submerged arc furnaces market are ac submerged arc furnaces and dc submerged arc furnaces.

In terms of application, ferroalloy segment to command 49.7% share in the submerged arc furnaces market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Submerged Chain Conveyor Market Size and Share Forecast Outlook 2025 to 2035

Submerged Drag Chain Conveyor Market Size and Share Forecast Outlook 2025 to 2035

Helical Submerged Arc Welded (HSAW) Pipes Market Analysis by Outer Diameter, End-Use, and Region through 2035

Stainless Steel Submerged Arc Welding Wire Market Size and Share Forecast Outlook 2025 to 2035

Arch Top Casement Window Market Size and Share Forecast Outlook 2025 to 2035

Arc Flash Risk Assessment Market Size and Share Forecast Outlook 2025 to 2035

Arch Top Door Market Size and Share Forecast Outlook 2025 to 2035

Architectural Metal Coating Market Forecast Outlook 2025 to 2035

Architectural Membranes Market Size and Share Forecast Outlook 2025 to 2035

Architectural Flat Glass Market Size and Share Forecast Outlook 2025 to 2035

Arc-based Plasma Lighting Market Size and Share Forecast Outlook 2025 to 2035

Arc Fault Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Arc Ferrite Magnet Market

Architectural Lighting Market

Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Parcel Insulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Parchment Paper Market Size and Share Forecast Outlook 2025 to 2035

Parcel Delivery Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Narcotics Scanner Market Size and Share Forecast Outlook 2025 to 2035

Garcinia Cambogia Extract Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA