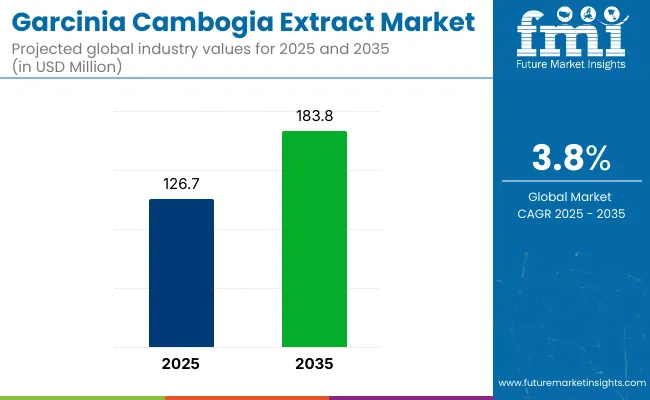

The garcinia cambogia extract is projected to grow from USD 126.7 million in 2025, and an outlook of USD 183.8 million has been projected for 2035 under a 3.8% CAGR during the forecast period.

The trajectory has been underpinned by steady ingredient adoption in weight-management formulations across North America, Europe, and emerging Asian nutraceutical hubs. Crossing the USD 100 million threshold three years ago established volume scale that now supports cost efficiencies in extraction and purification.

Currency-adjusted exports continued to trend upward despite sporadic shipping bottlenecks, while online specialist retailers bolstered unit throughput with targeted promotions during peak dieting seasons. Profitability has been maintained through portfolio premiumisation and disciplined control of hydroxycitric-acid potency specifications.

The industry accounts for 3.1% of the functional food ingredients market, 2.6% of the dietary supplements market, and 4.4% within botanical extracts, owing to its widespread use as a natural appetite suppressant. In the weight management ingredients segment, its share reaches around 6.7%, driven by high HCA content promoting fat metabolism. Within the broader nutraceuticals market, it holds a modest 1.9% share due to the vast ingredient diversity in that category.

Its concentration is strongest where botanical extracts intersect with slimming supplements. Demand for stimulant-free weight control, clean-label formulations, and tropical-source ingredients has elevated its position among botanicals, though competition from berberine, CLA, and green tea extract continues to moderate its advance beyond niche supplement channels.

The principal demand driver has been the global prevalence of obesity and metabolic-syndrome comorbidities, which has triggered proactive weight-control behaviour among adults aged twenty-five to fifty-four. In that demographic, over-the-counter nutraceuticals based on plant derivatives have been preferred over stimulant-centric thermogenics.

Clinical evidence indicating that hydroxycitric acid may inhibit ATP-citrate lyase has been circulated broadly in fitness podcasts and practitioner webinars, cultivating trust. Parallel to health motivations, the extract has been perceived as a natural adjunct to intermittent-fasting and ketogenic protocols. Regulatory scrutiny has been intensifying; however, compliance has been managed through third-party testing and dossier submission to authorities such as the United States Food and Drug Administration and the European Food Safety Authority, turning quality assurance into a branding asset.

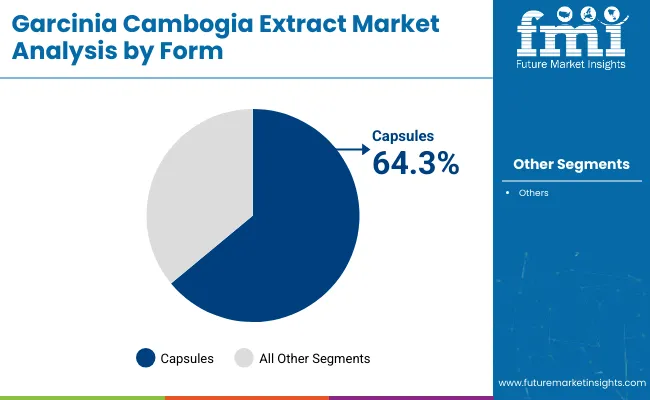

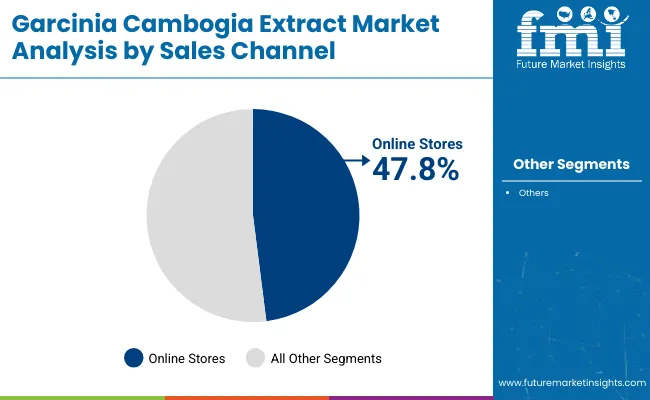

Capsule delivery is preferred for products owing to dosage accuracy, long shelf life, and user familiarity that suit both e-commerce and pharmacy outlets. Online stores are favored as the chief distribution route, with global reach, extensive SKU visibility, influencer promotion, and rapid listing agility boosting consumer trust and repeat purchases. These choices reveal a clear alignment with portable supplementation formats and digitally driven retail behavior.

Capsules dominate the garcinia cambogia extract market, accounting for an estimated 64.3% share in 2025. This form offers convenient dosage control, extended shelf stability, and compatibility with standardized hydroxycitric acid concentrations, which are critical for regulatory compliance and consumer trust.

Online stores are expected to lead sales of garcinia cambogia extract in 2025, capturing nearly 47.8% of total revenue in 2025.

Rising obesity rates and demand for botanical, non-stimulant solutions are driving long-term adoption of products. Online retail growth and stricter regulations are reshaping sales channels and manufacturing practices.

Weight Management Demand and Botanical Preference Drive Adoption

Growth has been largely driven by lifestyle-related health concerns, particularly the rising incidence of obesity and metabolic disorders. The preference for stimulant-free botanical supplements has elevated garcinia cambogia extract as a favored option in weight management protocols. Consumers are actively seeking non-synthetic solutions that align with label transparency and digestive comfort. Its compatibility with ketogenic and intermittent fasting routines has further widened the appeal.

E-Commerce Expansion and Evolving Regulatory Landscape

The shift toward online retail and evolving e-commerce dynamics continues to redefine sales performance. Market accessibility has been amplified through third-party platforms, while social media and health influencers enhance brand reach. Growing regulatory scrutiny is pushing manufacturers toward third-party testing, ingredient standardization, and GMP-certified operations, driving consumer trust but raising compliance costs.

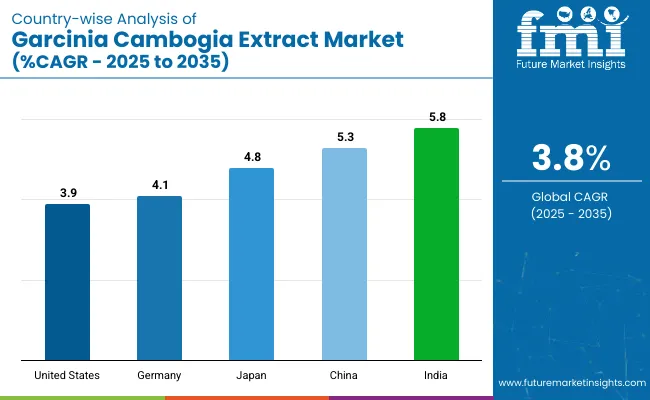

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.9% |

| Germany | 4.1% |

| Japan | 4.8% |

| China | 5.3% |

| India | 5.8% |

The garcinia cambogia extract industry, projected to expand at a global CAGR of 3.8% from 2025 to 2035, presents varied growth trajectories across key nations. India, a BRICS member, is advancing at a 5.8% CAGR, driven by increased use of Ayurvedic positioning and sachet-format supplements across e-pharmacy and modern retail.

China, also part of the BRICS group, is registering a 5.3% CAGR as social-commerce livestreaming pushes cross-border sales of high-HCA capsules and powders. Japan, an OECD country, shows a 4.8% CAGR with ready-to-drink formats benefiting from FOSHU-backed approvals in midlife dietary management.

Germany, another OECD member, is expected to see a 4.1% CAGR as clean-label botanical formats are promoted in pharmacy-linked wellness programs. The United States, also in the OECD group, follows with a 3.9% CAGR, supported by regulated, GMP-certified capsules available through high-traffic e-commerce portals. While OECD markets maintain regulated growth with quality controls, BRICS economies are scaling faster on the back of retail digitization and herbal acceptance.

The report includes insights across 40+ countries, with the above five markets serving as core reference points.

The USA garcinia cambogia extract market is expected to grow at 3.9% CAGR during the forecast period. Rising prevalence of overweight adults, now topping 70% of the population, has been prompting physicians and fitness coaches to recommend non-stimulant botanical aids over caffeine-heavy thermogenics. Capsules standardized to 60% hydroxycitric acid (HCA) have been granted wide shelf presence because cGMP-audited plants in Utah, California, and New Jersey supply retailers with consistent potency certificates.

Subscription bundles on Amazon and iHerb have been incentivizing repeat orders through tiered pricing, while coupon-driven loyalty programs push higher unit throughput. Privacy-minded consumers prefer discreet doorstep delivery, reinforcing the channel’s hold on nearly half of national revenue.

Marketing claims must pass Federal Trade Commission scrutiny, yet brands use peer-reviewed citations to defend efficacy, fostering credibility among dietitians. Companion stacks that combine garcinia cambogia with CLA or apple-cider-vinegar gummies are being featured in influencer videos, driving incremental trial without breaching dosage caps under FDA dietary-supplement regulations.

The German garcinia cambogia extract market is estimated to grow at 4.1% CAGR from 2025 to 2035. Germany’s statutory health insurers permit partial reimbursement for weight-management counseling, and pharmacists routinely position botanical supplements beside glucomannan and glucomate tablets. Demand has been shaped by consumer insistence on TÜV-certified raw-material testing, encouraging importers to secure certified organic fruit from Kerala and Sri Lanka.

Brick-and-click pharmacy chains such as DocMorris and Shop-Apotheke showcase HCA titration data, aligning with rigorous Bundesinstitut für Arzneimittel und Medizinprodukte (BfArM) labeling guidance. Low-sugar lifestyle shifts have sparked companionship between garcinia cambogia and keto-friendly snack lines in drugstores.

Marketing is being conducted in passive-voice educational formats on compliance-approved social media channels, avoiding overstated claims. Public health agencies highlight plant-derived options to reduce reliance on synthetic appetite suppressants, reinforcing demand while keeping daily doses within the 1,500 mg advisory ceiling established by the Federal Institute for Risk Assessment.

The Chinese garcinia cambogia extract market is projected to grow at 5.3% CAGR during the forecast period. Social-commerce livestreams on Douyin and Kuaishou are amplifying cross-border sales of garcinia cambogia capsules formulated in the United States and Australia, with bonded-warehouse logistics shortening delivery windows to forty-eight hours in Tier-1 cities. Domestic producers in Hunan and Guangxi have upgraded spray-drying lines to meet ISO 22000 audits demanded by leading pharmacy app JD Health, securing “Blue-Hat” registration for single-ingredient HCA products.

Rising disposable spending among young professionals has accelerated trial, yet compliance with State Administration for Market Regulation rules requires non-therapeutic language, funneling brands toward peer-reviewed efficacy citations. Companion blends featuring berberine and green-tea polyphenols are marketed during “618” and “Singles’ Day” events, capitalizing on discount-driven buying frenzies. Offline, Watsons and Ole’ boutiques curate sachet powders that dissolve into bottled water-an appealing format for office workers following portion-controlled meal plans.

The Japanese garcinia cambogia extract market is anticipated to grow at 4.8% between 2025 and 2035. Functional Food for Specified Health Use (FOSHU) approvals have permitted limited-dose garcinia cambogia inclusion in ready-to-drink beverages and jelly pouches, admired by a middle-aged demographic seeking mild satiety aids. Domestic contract manufacturers in Shizuoka prefecture deliver microencapsulated HCA that withstands thermal filling, enabling shelf-stable convenience-store offerings.

Retailers promote weight-control gummies in “beauty and health” aisles alongside collagen peptides, leveraging QR-coded traceability that links consumers to batch-test certificates. Drugstores such as Matsumoto Kiyoshi rely on pharmacist guidance to recommend daily HCA intake below 2,000 mg, easing safety concerns. Smartphone apps tracking calorie deficits integrate coupon links to endorsed brands, encouraging repeat purchase. Cultural focus on incremental, sustainable shape management, rather than crash dieting, encourages steady demand that aligns with long-term demographic health objectives.

The Indian garcinia cambogia extract market is valued at a 5.8% CAGR during the forecast period. Ayurvedic positioning resonates strongly, with garcinia cambogia (Kokum) referenced in classical texts, allowing manufacturers to market herbal legitimacy without prescription hurdles. Domestic extraction hubs in Kerala benefit from abundant fruit availability and low labor costs, supporting sachet and tablet formats priced below INR 10 for rural chemists.

Digital-first pharmacy portals such as PharmEasy bundle garcinia cambogia with diabetes-control packs, tapping into rising metabolic-syndrome awareness. The Food Safety and Standards Authority of India is rolling out nutraceutical labeling norms that mandate disclosure of plant part used, prompting brands to showcase rind-only sourcing for higher HCA yields.

The garcinia cambogia extract industry is driven by a blend of legacy nutraceutical brands and emerging players focused on clean-label formulations, standardized HCA potency, and diversified supplement delivery formats. Key companies like Power up Health, Nature Wise, and BioGanix lead with high-potency capsules aimed at weight-conscious consumers across North America and Europe.

Naturabest and Top Secret Nutrition target active-lifestyle users through blended botanical stacks. NOW Foods and Natrol, both GMP-certified, maintain a presence in pharmacy and online channels with verified quality. St.Botanica and NutraValley Biotech, Inc. drive India-based expansion through Ayurvedic branding and e-commerce bundling. Jiaherb, Inc. and Global Health Ideas support ingredient supply and private-label manufacturing, reinforcing B2B integration across global distribution hubs.

Recent Garcinia Cambogia Extract Industry News

Nature Wise has focused on multi-channel marketing and high street retail partnerships to promote its Garcinia Cambogia supplements as weight management solutions. In 2024 and 2025, the company strengthened its presence in specialty health and wellness stores and expanded its online sales channels, capitalizing on the growing preference for plant-based and natural supplement

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 126.7 million |

| Projected Market Size (2035) | USD 183.8 million |

| CAGR (2025 to 2035) | 3.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and volume in metric tons |

| Form Analyzed (Segment 1) | Capsules, Liquid, and Powder. |

| Sales Channel Analyzed (Segment 2) | Supermarkets/Hypermarkets, Convenience Stores, Medical Stores, and Online Stores. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Power up health, Nature Wise, BioGanix, Naturabest, Top Secret Nutrition, NOW Foods, Global Health Ideas, Natrol, St.Botanica, Jiaherb, Inc., NutraValley Biotech, Inc. |

| Additional Attributes | Dollar sales, share by form and channel, regional demand patterns, competitor pricing, HCA concentration trends, regulatory shifts, and future growth forecasts. |

The industry is segmented into capsules, liquid, and powder.

The industry is segmented into supermarkets/hypermarkets, convenience stores, medical stores, and online stores.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 126.7 million in 2025.

It is forecasted to reach USD 183.8 million by 2035.

The industry is anticipated to grow at a CAGR of 3.8% during this period.

Capsules are projected to lead the market with a 64.3% share in 2025.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 5.8%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Sage Extract Market Size and Share Forecast Outlook 2025 to 2035

Fume Extractor Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Kale Extract Skincare Market Size and Share Forecast Outlook 2025 to 2035

Wine Extract Market Size and Share Forecast Outlook 2025 to 2035

Amla Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dust Extractor Market Growth – Trends & Forecast 2025 to 2035

Data Extraction Software Market

Peony Extract Brightening Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peony Extracts for Brightening Market Size and Share Forecast Outlook 2025 to 2035

Algae Extracts Market Size and Share Forecast Outlook 2025 to 2035

Juice Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Yucca Extract Market Size and Share Forecast Outlook 2025 to 2035

Maple Extracts Market Size and Share Forecast Outlook 2025 to 2035

Yeast Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

Basil Extract Market Size, Growth, and Forecast for 2025 to 2035

Understanding Yeast Extract Market Share & Key Players

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA