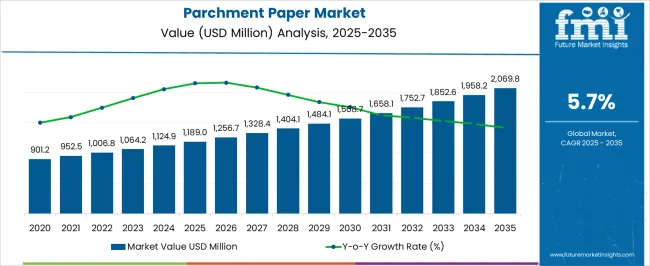

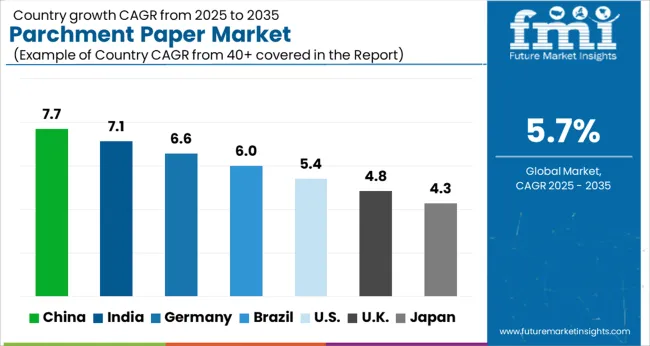

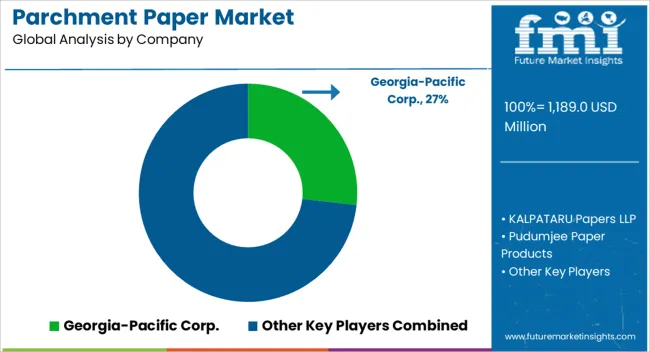

The Parchment Paper Market is estimated to be valued at USD 1189.0 million in 2025 and is projected to reach USD 2069.8 million by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

| Metric | Value |

|---|---|

| Parchment Paper Market Estimated Value in (2025 E) | USD 1189.0 million |

| Parchment Paper Market Forecast Value in (2035 F) | USD 2069.8 million |

| Forecast CAGR (2025 to 2035) | 5.7% |

The parchment paper market is gaining strong traction as demand rises for convenient, non-stick, and sustainable packaging and baking solutions. Increased consumer focus on health and hygiene, coupled with the trend of at-home cooking and baking, is creating significant opportunities for parchment paper adoption.

Manufacturers are emphasizing recyclable and biodegradable paper solutions to align with global sustainability regulations and shifting consumer preferences away from plastic-based alternatives. Innovations in grease resistance, heat endurance, and printability have further expanded usage across bakery, confectionery, and foodservice industries.

Additionally, the growth of quick service restaurants, packaged food, and e-commerce food delivery is bolstering demand. The outlook remains positive as parchment paper continues to serve both as a functional and eco-friendly solution, meeting regulatory requirements and consumer expectations for safe and sustainable food contact materials.

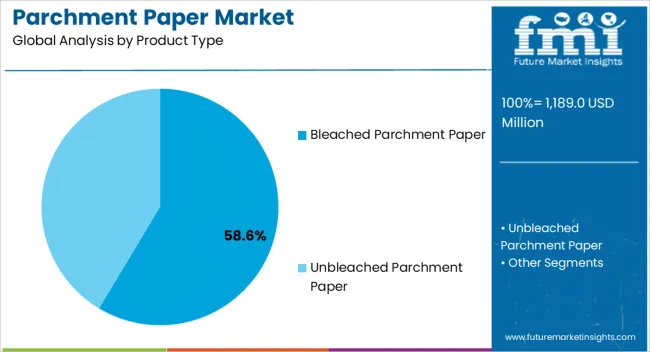

The bleached parchment paper segment is expected to account for 58.60% of total revenue by 2025 within the product type category, making it the dominant choice. Its popularity is supported by the ability to offer a clean, bright appearance that enhances product presentation in food packaging and bakery applications.

Strong demand from premium foodservice outlets and packaged food manufacturers has reinforced its position, as aesthetics and hygiene play a critical role in consumer preference. Enhanced grease resistance, improved printability, and compliance with food safety standards have further driven adoption.

These advantages continue to strengthen the leading role of bleached parchment paper in the product type category.

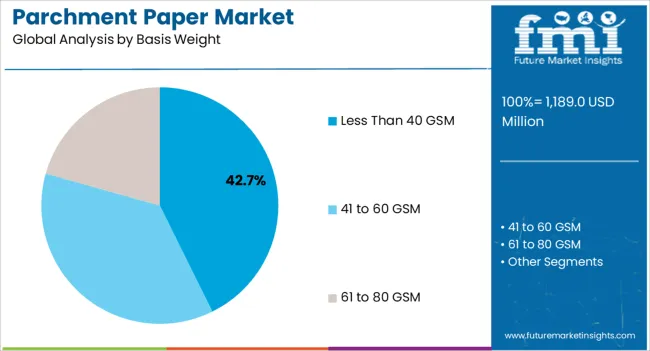

The less than 40 GSM segment is projected to contribute 42.70% of total market revenue by 2025 under the basis weight category, making it the most significant segment. Its lightweight structure supports cost efficiency and broad usability across baking and food packaging.

It has been widely chosen by bakeries and food manufacturers due to its flexibility, ease of handling, and suitability for single-use food preparation. Additionally, its alignment with sustainability goals through reduced material usage has contributed to its adoption.

With the growing preference for lightweight, efficient, and eco-friendly food contact materials, this segment continues to dominate the basis weight category.

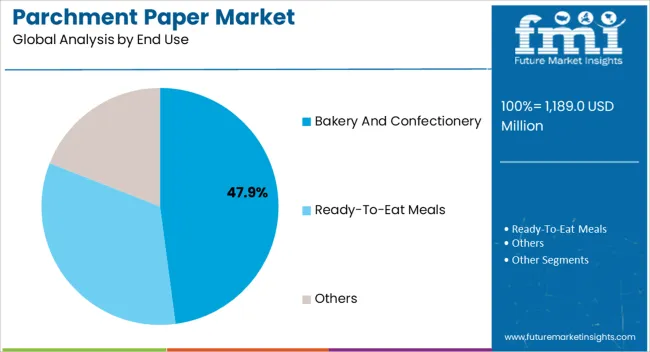

The bakery and confectionery segment is anticipated to hold 47.90% of the total market revenue by 2025 within the end use category, positioning it as the leading application. The demand is being fueled by rising global consumption of baked goods, confectionery items, and ready-to-eat snacks.

Parchment paper plays a vital role in ensuring non-stick baking, uniform heat distribution, and hygienic handling of products. Its utility extends to both industrial and household baking, supported by the growing popularity of artisanal and premium baked goods.

Continuous innovations in oven-safe, grease-resistant parchment paper have further strengthened its relevance in this sector. These factors collectively establish bakery and confectionery as the primary growth driver within the end use category.

The market for parchment paper was worth USD 901.2.0 million in 2020. It accumulated a market value of USD 1,008.7 million in 2025 while growing at a CAGR of 3.5% from 2020 to 2025.

The rising inclination of restaurants, bakeries, and food delivery services toward adopting biodegradable material as their packaging solution is changing the demand outlook of the market. Vendors are leveraging the use of parchment paper due to the implementation of stringent environmental laws, especially on the usage of plastic and other non-biodegradable materials.

Various restaurants are leveraging the use of parchment paper as their marketing and brand promotion tool by printing their logos on these papers. The growing use of parchment paper as a fancy and convenient packaging style is expected to transform growth outlook of the market.

Parchment baking paper has emerged as a perfect alternative to clamshell packaging. To cut the transportation cost, manufacturers are working towards cutting down the use of clamshell as a primary source of packaging. This trend is predicted to continue for the next ten years, presenting a favorable environment for the growth of parch paper sales.

After a comprehensive analysis of above-mentioned factors, the revenue growth of parchment paper market is projected to be worth USD 1,789 million by end of the forecast period, while exhibiting a CAGR of 5.7%.

Eco-friendliness of parchment paper expected to proliferate product sales

The wide use of these papers in food service wraps and laminating with other materials where paper forms one layer in composite packaging is expected to drive its product demand.

Parchment papers can be used in microwaves, are biodegradable, and recyclable in nature which makes them a suitable packaging solution. The bakery industry is also expected to make good use of parchment papers. The eco-friendliness and cost-effective characteristics make it a more viable option as a packaging solution. They do not have any adverse effect on food quality and health which is expected to propel its sales in the coming years.

According to Central Pollution Control Board, more than 4 million tons of garbage is disposed of every day, out of which around 15% comprises plastics. Plastics are estimated to be responsible for over 20% of the entire pollution in the next 25 years, as compared to an estimated 7% currently. These factors are anticipated to pave the way for biodegradable and recyclable options like parchment paper, which in turn is expected to drive market growth.

Rising cost and environmental risks might restrain market growth

The high cost of parchment paper makes it difficult to be used daily by consumers. Increasing the manufacturing of paper results may result in deforestation and negatively affects the environment. These factors are expected to restrain market expansion over the forecast period.

North America to dominate the market with maximum share

North America accounted for 23.1% of revenue share in 2025, in the parchment paper market. The region is projected to accumulate a 24.2% market share by end of 2025. The market in this region is further expected to command over 36% market share by end of the forecast period.

The growth is attributed to factors such as thriving packaging industry, rising popularity and demand for packaged foods, and rising investment in the food & beverage sector.

The implementation of strict food safety norms is expected to boost the market for safe and hygienic food packaging solutions such as unbleached parchment paper. Unbleached paper is mostly used for wrapping food products like burgers, bakery & confectionery products in this region.

Many end users in this region are opting for parchment paper while transporting food products, as this paper retains food quality and keeps the product intact for a longer duration. Thus, parchment paper has become the most favored choice for transporting confectionary products in bulk across the continent.

The United States is anticipated to accumulate over 72% of North American market by the end of 2035. Increasing bakery sales and other confectionary products are leading to increased consumption of parchment paper which is driving growth in the region.

Extensive Deployment expected in the Foodservice Packaging Industry

India is expected to hold a significant market share of over 25% by end of the forecast period. Increasing population and rising consumption of packaged food in India are expected to be the driving wheels for the market.

Sales in India are expected to proliferate at a high pace, backed by the expansion of food service industry at a fast pace. Along with this, increasing focus on sustainable packaging solutions is expected to remain a chief growth driving factor.

The growing demand for convenience products from end-use industries like baking and confectionery is expected to fuel product sales across the country. The production of food services products in this country is witnessing ever-increasing growth, which is sculpting the demand for paper packaging solutions such as parchment papers.

Also, prominent food and food services players across the country are embracing the transitional change from clamshell products to parchment paper which is sustainable to reduce carbon footprint.

Unbleached Parchment Paper leading the segment with the Maximum Share

The Unbleached parchment paper accounted for 51.9% of revenue share in 2025. It is anticipated to account for 53.1% market share in 2025. It is further expected to retain its trend of dominance by accumulating over 72% market share by end of the forecast period.

The growth is attributed to the rising preference for unbleached parchment paper in the market. A little to no presence of fluorochemicals in this paper is driving its use.

Strict rules are being followed on the use of bleached paper in food packaging industry to reduce the cases of food poisoning. This might restrict sales of bleached parchment paper and boost the sales of unbleached parchment paper in the coming years.

Also, bleached paper, if exposed to sunlight reacts with fluorochemicals present on paper with ultraviolet light. It could also leave chemical traces on food products which can cause food poisoning. Considering these factors, usage of unbleached parchment paper is projected to grow with a CAGR of 6.4% during from 2025 to 2035.

Ready-to-eat meals leading the segment with maximum share

The ready-to-eat meals segment dominated the market by end-use by accumulating over 32.5% revenue share in 2025. An increase in purchasing power of middle-class families, especially in emerging economies is expected to garner over 40% market share by end of the projection period. The high consumption of bakeries and confectionaries in mature markets of North America and Europe is responsible for the segment’s growth.

Start-ups help in determining future growth opportunities in any market. These new entities have the potential to generate high returns which directly benefits the expansion of any industry.

These start-ups are typically more productive at transforming inputs into outputs with more flexibility and adaptability in nature, ability to shift quickly in response to volatile market conditions. Some of the start-ups that will fuel the expansion of the parchment paper market are:

The parchment paper market is extremely competitive and consists of various key industry players. These players are heavily investing in manufacturing parchment paper.

The key industry players are: Georgia-Pacific Corp., JK Paper, Ahlstrom Munksjo Oyj., Delfort Group AG, METSA Tissue, McNarin Packaging, KALPATARU Papers LLP, Pudumjee Paper Products, Awa Paper and Technological Co. Inc., Cosmoplast, Nordic Paper AS, The GRIFF Network, KRPA Paper AS.

Some recent developments in the market are:

Key market players are leveraging on inorganic growth strategies like acquisition, mergers, partnerships, and collaboration in order to enhance their product portfolio. This is expected to fuel the global Parchment Paper Market.

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 1189.0 million |

| Market Value in 2035 | USD 2069.8 million |

| Growth Rate | CAGR of 5.7% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product, Basis Weight, End Use, Distribution Channel, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, China, Japan, South Korea, Singapore, Thailand, Indonesia, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Georgia-Pacific Corp.; KALPATARU Papers LLP; Pudumjee Paper Products; JK Paper; Ahlstrom Munksjo Oyj.; Delfort Group AG; METSA Tissue; McNarin Packaging; Awa Paper and Technological Co. Inc.; Cosmoplast; Nordic Paper AS; The GRIFF Network; KRPA Paper AS |

| Customization | Available Upon Request |

The global parchment paper market is estimated to be valued at USD 1,189.0 million in 2025.

The market size for the parchment paper market is projected to reach USD 2,069.8 million by 2035.

The parchment paper market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in parchment paper market are bleached parchment paper and unbleached parchment paper.

In terms of basis weight, less than 40 gsm segment to command 42.7% share in the parchment paper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegetable Parchment Paper Market Size, Share & Forecast 2025 to 2035

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Release Liners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA