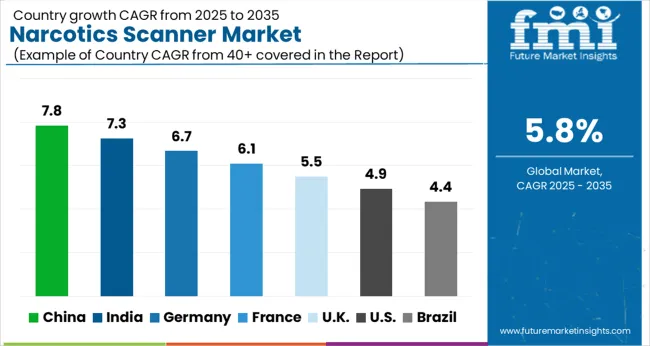

The Narcotics Scanner Market is estimated to be valued at USD 8.8 billion in 2025 and is projected to reach USD 15.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Narcotics Scanner Market Estimated Value in (2025 E) | USD 8.8 billion |

| Narcotics Scanner Market Forecast Value in (2035 F) | USD 15.4 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The narcotics scanner market is experiencing accelerated growth due to heightened global focus on border security, drug trafficking control, and rapid threat detection capabilities. Increased incidents of synthetic drug smuggling, cross-border narcotics flow, and heightened geopolitical vigilance have prompted governments and security agencies to invest in advanced detection systems.

Enhanced funding allocations and technological integration in national security infrastructure have further contributed to market expansion. Developments in miniaturization, real-time analytics, and cloud-based reporting are enabling faster decision-making and wider deployment.

The rise in air passenger volume, seaport traffic, and international logistics has elevated the importance of portable, reliable, and multi-sample scanning systems. Future opportunities are expected to emerge from the convergence of AI with trace detection, automation in threat identification, and broader application across civilian checkpoints and critical infrastructure.

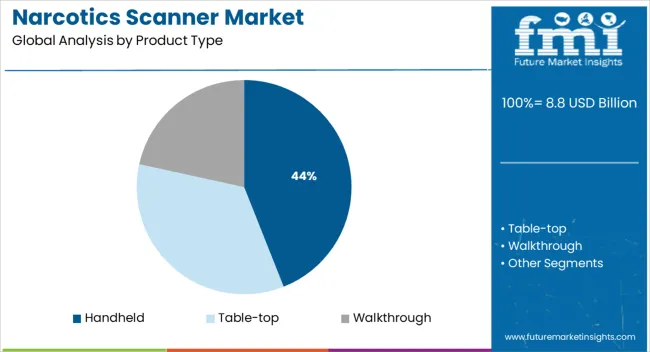

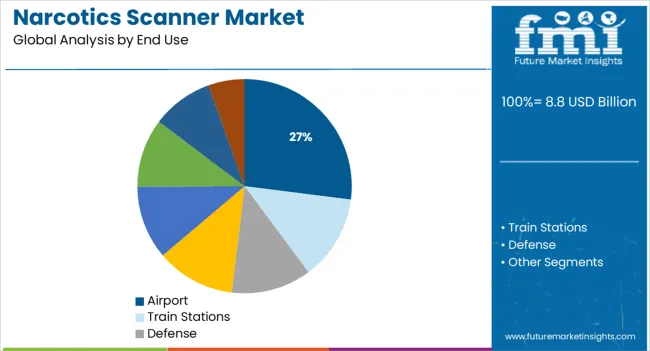

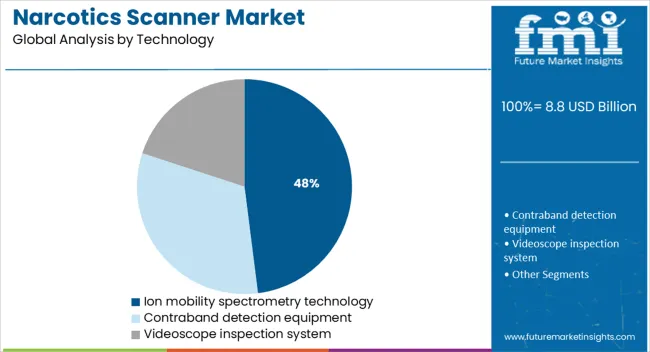

The market is segmented by Product Type, End Use, and Technology and region. By Product Type, the market is divided into Handheld, Table-top, and Walkthrough. In terms of End Use, the market is classified into Airport, Train Stations, Defense, Cargo, Military, Transportation, Law enforcement, and Critical infrastructure access control. Based on Technology, the market is segmented into Ion mobility spectrometry technology, Contraband detection equipment, and Videoscope inspection system. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Handheld scanners are anticipated to contribute 44.0% of the total market revenue in 2025, making them the dominant product type. This leadership is being supported by their portability, ease of operation, and ability to provide immediate results in field inspections.

Law enforcement agencies and customs personnel have increasingly adopted handheld models due to their low training requirements and operational flexibility in unpredictable environments. Advancements in battery life, rugged design, and user interfaces have enhanced usability in mobile screening scenarios.

These scanners are also favored for their cost efficiency and rapid deployment in both temporary and permanent security operations. As demand grows for flexible, frontline narcotics detection tools, handheld scanners continue to lead as a critical asset in real-time enforcement strategies.

Airports are projected to account for 27.0% of the overall market share in 2025, establishing them as the primary end use environment for narcotics scanners. Their dominance stems from strict compliance requirements, increasing international travel, and the persistent risk of narcotics smuggling through passenger and cargo terminals.

Regulatory bodies have intensified inspections and surveillance mandates, compelling airport operators to adopt high-sensitivity scanning technologies. Integration of scanners with centralized monitoring systems and customs databases has improved operational efficiency and interdiction success.

Additionally, scanner deployments have expanded to include baggage claim zones, air cargo checkpoints, and employee access points. As air travel rebounds globally, continued investments in narcotics detection infrastructure are expected to support airport security modernization efforts.

Ion mobility spectrometry (IMS) technology is forecast to hold 48.0% of the total revenue share in 2025, leading all other detection methods. This technology’s growth has been driven by its high sensitivity, fast detection time, and ability to identify a wide spectrum of narcotics with minimal sample preparation.

IMS systems have become essential for frontline narcotics detection due to their low false alarm rate and rapid trace-level identification. The technique’s suitability for handheld and fixed installations alike makes it adaptable across varied use cases including airports, border checkpoints, and customs offices.

Continuous improvements in ionization techniques, miniaturization of analyzers, and integration with AI for automated substance classification have further strengthened its appeal. As regulatory expectations grow for precise, real-time drug detection capabilities, IMS is expected to remain a cornerstone technology in narcotics scanning operations.

Due to the region's high drug consumption, which includes the United States of America and Mexico, North America is expected to dominate the market, with a predicted market share of 29.3% in 2025.

North America is the region with the most opioid consumption, according to the World Drug Report 2020 from the UN Office on Drugs and Crime. Furthermore, opioid overdose deaths caused 47,000 fatalities in the USA in 2020. As a result, the demand for narcotics scanners has increased in North America in an effort to lower the fatality rate from a drug overdose.

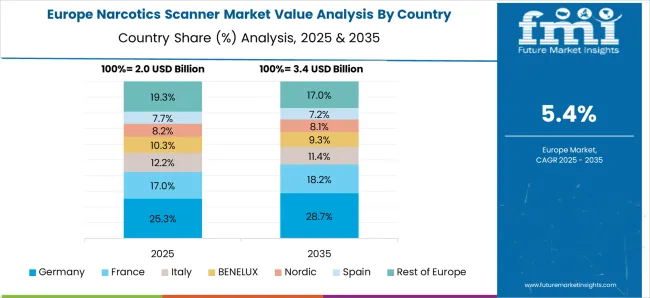

In 2025, it is anticipated that Europe would hold a 21.0% narcotics scanner market share.

Due to the strict government regulations that have been put in place regarding the distribution of illegal drugs, a market expansion in Europe is projected.

Due to the increasing drug use activities in the United Kingdom and Northern Ireland, it is projected that the demand for narcotics scanners would increase during the projection period.

Leading suppliers of narcotics scanners are focusing on the release of advanced screening technologies to support drug control initiatives by law enforcement organizations. These businesses are also making focused expenditures to expand their worldwide narcotics scanner industry footprint by releasing next-generation scanners in emerging economies.

The company is able to maintain its market position due to the ongoing investments in Research and Development operations, a strong emphasis on product innovation, and long-term partnerships with governmental and authorized authorities.

The other major companies in the market are concentrating on implementing cutting-edge technology, such as artificial intelligence, to improve the manufacturing of these scanners.

| Start-ups/Companies | Development |

|---|---|

| Xerra | Xerra, a business established in 2020 with funding from the Ministry of Business, Innovation, and Employment, currently counts the Ministry of Primary Industries (MPI), New Zealand Customs, the Australian Fisheries Management Authority, and the Pacific Islands Forum Fisheries Agency among its clients. |

| Smiths Detection Group Ltd. | Smiths Detection Group Ltd. announced in April 2024 that it has been awarded an IDIQ contract for the supply of the HCVPTMZ60 drive-through X-ray inspection system. This contract has been given to the USA Department of Homeland Security and Customs and Border Protection (CBP). By September 2025, the HCVPTMZ60 system at a Border Patrol checkpoint in Laredo, Texas, will be rectified. |

| OSI Systems Inc. | December 2024 - OSI Systems Inc. reported that it has been awarded a USD 13 million contract by two major Scandinavian airport operators to supply Orion baggage scanners, Meteor 900M walk-through metal detectors, and 920 CT checkpoint baggage scanners, as well as an integration software. |

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.8% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product Type, Technology, End Use, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; The Asia Pacific excluding Japan; Japan; The Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, GCC Countries, South Africa |

| Key Companies Profiled | Argos Security Services, Inc.; Safran SA; Smiths Group plc; OSI Systems, Inc.; FLIR Systems, Inc.; L-3 Communications Security and Detection Systems Inc.; Aventura Technologies, Inc.; LaserShield Systems, Inc.; Klipper Enterprises, KeTech Group Limited; Chemring Group PLC; MATRIX Security and Surveillance Pvt. Ltd.; CDex Inc, Bruker Corporation; Teknicom Solutions, Mistral Solution; Jamal Jaroudi Group |

| Customization | Available Upon Request |

The global narcotics scanner market is estimated to be valued at USD 8.8 billion in 2025.

The market size for the narcotics scanner market is projected to reach USD 15.4 billion by 2035.

The narcotics scanner market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in narcotics scanner market are handheld, table-top and walkthrough.

In terms of end use, airport segment to command 27.0% share in the narcotics scanner market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Scanners Market Size and Share Forecast Outlook 2025 to 2035

DXA Scanner Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Scanner Market Size and Share Forecast Outlook 2025 to 2035

Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mineral Scanner Market Size and Share Forecast Outlook 2025 to 2035

Baggage Scanner Market Growth, Trends & Forecast 2025 to 2035

Thermal Scanner Market Growth – Trends & Forecast 2020-2030

3D Laser Scanner Market Growth - Trends & Forecast 2025 to 2035

Micro-CT Scanners Market

Intraoral Scanner Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Full Body Scanner Market Analysis - Size, Share & Forecast 2025 to 2035

Safety Laser Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mobile LiDAR Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Robotic X-ray Scanner Market Size and Share Forecast Outlook 2025 to 2035

Global Intraoral IOL Scanner Market Analysis – Size, Share & Forecast 2024-2034

Polygon Mirror Scanner Motor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fixed Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Retinal Scanners Market

In-Counter Barcode Scanners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA