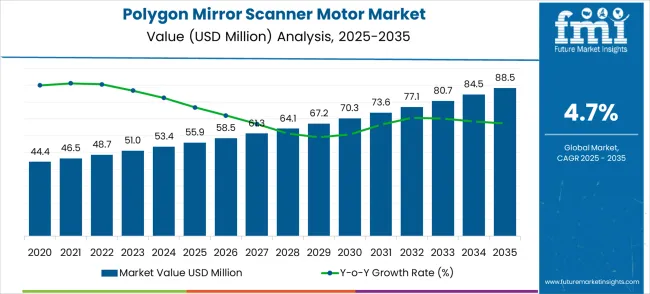

The global polygon mirror scanner motor market is projected to reach USD 88.5 million by 2035, recording an absolute increase of USD 32.6 million over the forecast period. The market is valued at 55.9 million in 2025 and is set to rise at a CAGR of 4.7% during the assessment period.

The market size is expected to grow by nearly 1.6 times during the same period, supported by increasing adoption of advanced scanning technologies and digital transformation initiatives across the printing and office equipment sectors. High initial investment costs and the complexity of integrating new motor technologies with existing scanner systems may pose challenges to market expansion.

Between 2025 and 2030, the polygon mirror scanner motor market is projected to expand from USD 55.9 million to USD 70.3 million, resulting in a value increase of USD 14.4 million, which represents 44.2% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for high-precision scanning solutions, product innovation in motor technologies and control systems, as well as expanding integration with advanced imaging and printing technologies. Companies are establishing competitive positions through investment in brushless DC motor technologies, precision control capabilities, and strategic market expansion across printer, copier, and fax machine applications.

From 2030 to 2035, the market is forecast to grow from USD 70.3 million to USD 88.5 million, adding another USD 18.2 million, which constitutes 55.8% of the ten-year expansion. This period is expected to be characterized by the expansion of specialized motor systems, including advanced servo and piezoelectric motor technologies tailored for specific scanning applications, strategic collaborations between technology providers and office equipment manufacturers, and an enhanced focus on energy efficiency and performance optimization. The growing emphasis on digital documentation and high-speed scanning capabilities will drive demand for intelligent motor solutions across diverse office equipment and imaging applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 55.9 million |

| Market Forecast Value (2035) | USD 88.5 million |

| Forecast CAGR (2025-2035) | 4.7% |

The polygon mirror scanner motor market grows by enabling equipment manufacturers to achieve high-precision scanning performance through advanced motor technologies and intelligent control systems. Office equipment facilities face mounting pressure to improve scanning speed and accuracy, with modern printers and copiers typically requiring precise polygon mirror rotation for optimal image quality, making advanced motor systems essential for competitive performance.

The imaging sector's need for continuous operation - scanners must maintain consistent rotational speed for extended periods - creates demand for reliable motor technologies that can operate without performance degradation while maintaining precise control over scanning parameters.

Energy efficiency regulations and operational cost optimization requirements drive adoption in the printer and copier sectors, where motor efficiency directly impacts power consumption and operational costs. Budget constraints for equipment upgrades and the complexity of retrofitting legacy scanning systems with advanced motor technologies may limit adoption rates among smaller office equipment manufacturers.

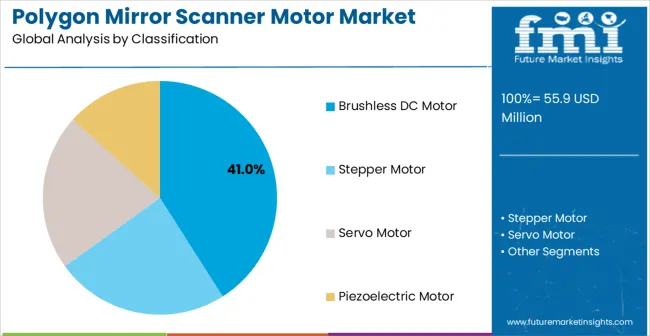

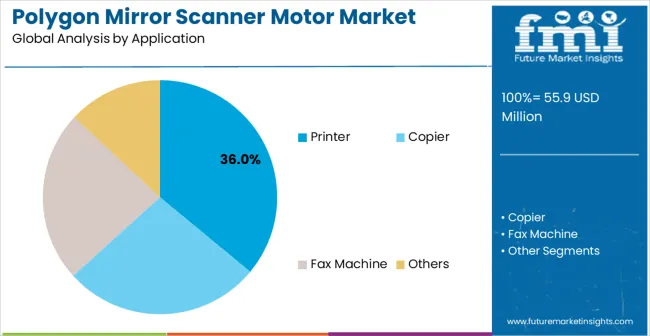

The market is segmented by motor type, application, end user, and region. By motor type, the market is divided into brushless DC motor, stepper motor, servo motor, and piezoelectric motor. Based on the application, the market is categorized into printers, copiers, fax machines, and others. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

Brushless DC Motor systems are projected to account for the largest share of the polygon mirror scanner motor market, with a market share of 41% in 2025. This dominant position is supported by the technology's ability to provide high-speed, precise rotational control with minimal maintenance requirements, enabling equipment manufacturers to achieve consistent scanning performance with extended operational life. The segment allows for stakeholders to benefit from superior speed control capabilities, reduced electromagnetic interference, and real-time performance monitoring for enhanced scanning accuracy.

Key advantages include:

Printer applications are expected to represent the dominant share of polygon mirror scanner motor applications, with a market share of 36% in 2025. This leading position reflects the critical role of polygon mirror scanners in laser printer operations, where precise beam control is essential for high-quality document reproduction and printing efficiency. The segment provides vital support for high-resolution printing and document processing in commercial and office environments where scanning precision directly impacts output quality. Growth drivers include the printing industry's focus on improving print quality, increasing printing speeds, and enhancing operational reliability in equipment that must maintain consistent performance across a wide range of document types.

Key market dynamics include:

The market is driven by three concrete demand factors tied to operational outcomes. First, scanning precision enhancement capabilities improve print quality by maintaining exact rotational speeds, with laser printers experiencing up to 20% improvement in image clarity through advanced brushless DC motor systems. Second, operational reliability optimization through precise motor control enables equipment manufacturers to achieve a 25% reduction in maintenance requirements while maintaining performance standards. Third, energy efficiency requirements and power consumption optimization create compelling adoption scenarios across printing sectors where motor efficiency directly impacts operational costs and environmental compliance.

Market restraints include high initial investment costs that can deter smaller equipment manufacturers from upgrading their motor systems, particularly in developing regions where capital allocation for precision technologies remains limited. Technical complexity poses another significant challenge, as implementing new motor technologies with existing scanning systems requires substantial engineering expertise and testing, potentially causing development delays during product transition periods. Rapid technological advancement creates continuous pressure for motor innovation, demanding ongoing research and development investments that strain organizational resources.

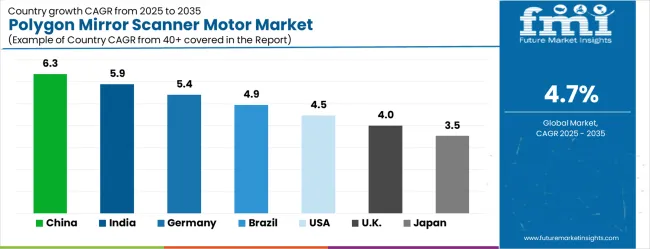

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where office equipment manufacturing and digital transformation initiatives drive motor system deployment. Design shifts toward intelligent motor control, IoT-enabled monitoring, and energy-efficient platforms enable scanning capabilities that transform equipment performance from standard to premium quality levels. The market thesis could face disruption if alternative scanning technologies or significant changes in printing methods reduce reliance on traditional polygon mirror scanner systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| Brazil | 4.9% |

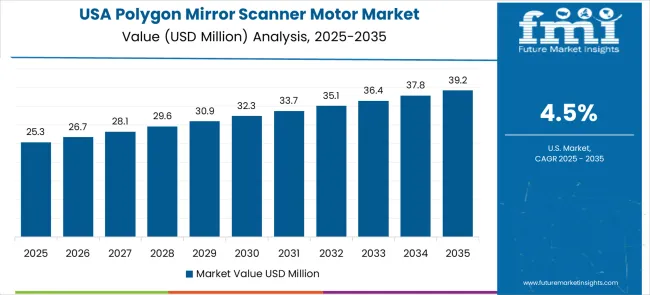

| USA | 4.5% |

| UK | 4.0% |

| Japan | 3.5% |

The polygon mirror scanner motor market is gathering pace worldwide, with China taking the lead thanks to rapid office equipment manufacturing expansion and technology advancement mandates. Close behind, India benefits from growing electronics manufacturing capacity and government initiatives promoting precision motor technologies, positioning itself as a strategic hub for growth.

Germany shows steady advancement, where integration of precision motor technologies strengthens its role in the European manufacturing supply chain. Brazil is sharpening its focus on office equipment efficiency and manufacturing optimization, signaling an ambition to capture niche opportunities in South American markets. Meanwhile, the USA stands out for its advanced adoption of motor technology, and the UK and Japan continue to record consistent progress. Together, China and India anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

The polygon mirror scanner motor market in China is projected to grow at a CAGR of 6.3% from 2025 to 2035. China’s expanding electronics, semiconductor, and laser-based equipment manufacturing sectors are driving strong adoption of polygon mirror scanner motors, which are critical components in high-speed laser scanning, printing, and imaging applications. The demand is further bolstered by the country’s rapid growth in 3D printing, optical communication, and industrial automation, where high-precision, high-speed scanning motors are required.

Domestic manufacturers are investing heavily in R&D to develop low-vibration, high-efficiency polygon motors with superior lifespan and precision. Government initiatives promoting advanced manufacturing and industrial automation create a favorable market environment. The increasing presence of both domestic and international laser equipment manufacturers in China ensures that demand remains steady, particularly in sectors such as electronics, packaging, and medical device manufacturing.

Key market factors:

The polygon mirror scanner motor market in India is anticipated to expand at a CAGR of 5.9% from 2025 to 2035. India’s growing electronics, printing, and industrial automation sectors are increasing the need for high-precision scanning motors. These motors are crucial in applications such as laser marking, barcode scanning, optical imaging, and high-speed printing systems. The rise of domestic electronics manufacturing, alongside government initiatives like “Make in India” and smart factory development, is further accelerating adoption.

Indian manufacturers are also exploring localized production of components to reduce import dependence and optimize costs. With increasing investment in industrial automation, packaging, and semiconductor manufacturing, the polygon mirror scanner motor market is poised to witness steady growth. Collaborations between Indian firms and international suppliers are enhancing access to advanced technologies, helping improve performance, speed, and reliability of motors used across multiple industrial applications.

The polygon mirror scanner motor market in Germany is expected to grow at a CAGR of 5.4% between 2025 and 2035. Germany’s advanced manufacturing, electronics, and automotive industries are major end-users for these motors, which are essential for high-speed laser scanning, optical inspection, and precise printing applications. The country’s strong focus on Industry 4.0, automation, and smart factory adoption further supports market growth. Polygon mirror scanner motors are integrated into automated production lines, 3D printing setups, and high-speed printing equipment, requiring high precision, low vibration, and reliability.

German firms, including OEMs and suppliers, invest in R&D to improve motor efficiency, durability, and integration with advanced control systems. Regulatory standards emphasizing energy efficiency and high-precision manufacturing ensure continuous demand for technologically advanced motors. As Germany maintains its position as a leader in precision manufacturing, adoption of polygon mirror scanner motors remains steady across multiple sectors.

Key development areas:

The polygon mirror scanner motor market in Brazil is projected to grow at a CAGR of 4.9% from 2025 to 2035. Brazil’s industrial and manufacturing sectors, including printing, packaging, and electronics, are gradually modernizing and increasingly adopting high-speed, precision polygon mirror motors. These motors are essential for laser scanning, imaging, and automated inspection systems, which help enhance production quality and efficiency. The country relies on imports for high-precision motors, though local distributors and system integrators are improving supply chains, technical support, and maintenance capabilities.

Growth in e-commerce and packaging industries also contributes to adoption, particularly for automated sorting and labeling systems. Government initiatives to promote industrial modernization, infrastructure development, and technology transfer are expected to support market expansion. While growth is moderate compared to Asia and Europe, Brazil’s polygon mirror scanner motor market is positioned for steady adoption in industrial automation and printing applications over the forecast period.

Market characteristics:

The polygon mirror scanner motor market in the USA is expected to grow at a CAGR of 4.5% from 2025 to 2035. The country’s mature industrial and electronics sectors, including laser equipment, high-speed printing, and semiconductor manufacturing, are driving demand for high-precision polygon mirror scanner motors. These motors are crucial for accurate laser scanning, imaging, optical inspection, and automated production processes. USA-based manufacturers and technology providers focus on motors that offer high rotational speeds, low vibration, and precise control for industrial and commercial applications.

Adoption is further supported by ongoing investment in automation, industrial robotics, and advanced printing technologies. The USA market is relatively mature, and continuous demand from research labs, semiconductor fabs, and packaging industries ensures steady growth. Collaborations with international component suppliers help maintain supply reliability and access to high-performance motors.

Leading market segments:

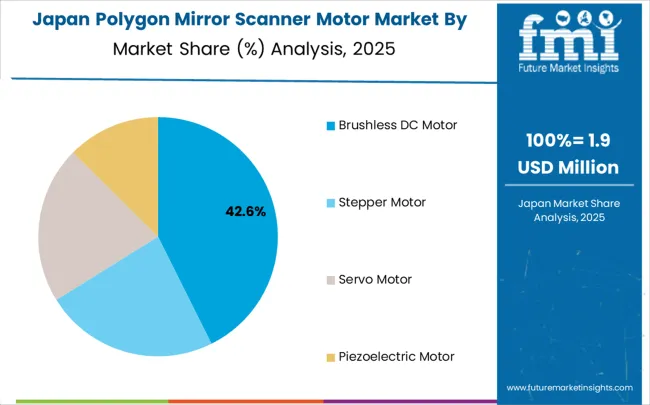

The polygon mirror scanner motor market in Japan is forecast to grow at a CAGR of 3.5% from 2025 to 2035. Japan’s established electronics, automotive, and precision manufacturing sectors drive demand for polygon mirror scanner motors used in laser scanning, imaging, and automated inspection systems. The country emphasizes high precision, low vibration, and long-life performance in industrial and commercial applications, making these motors critical for R&D, 3D printing, and high-speed printing equipment.

While Japan is a mature market with slower growth, investments in automation, semiconductor manufacturing, and EV-related production continue to meet demand. Domestic manufacturers focus on innovation in motor efficiency, size reduction, and integration with advanced control systems. Adoption is further supported by Japan’s commitment to high-quality manufacturing, precision engineering, and smart factory initiatives, ensuring steady but measured market expansion over the forecast period.

Key market characteristics:

The polygon mirror scanner motor market in the UK is anticipated to grow at a CAGR of 4.0% from 2025 to 2035. The UK’s electronics, printing, and industrial automation sectors are key end-users for these motors, which are essential in laser scanning, high-speed printing, and optical inspection applications. With increasing automation in manufacturing and distribution facilities, polygon mirror scanner motors are adopted to improve speed, precision, and operational efficiency. Key sectors driving adoption include packaging, pharmaceuticals, and advanced electronics manufacturing.

While the market is relatively mature and growth is moderate, investments in smart factory technologies and automation continue to support incremental demand. Collaboration with European and global motor suppliers ensures access to advanced motor designs and control systems, while regulatory focus on energy efficiency and high-precision manufacturing encourages adoption of reliable, high-performance polygon mirror motors.

Market development factors:

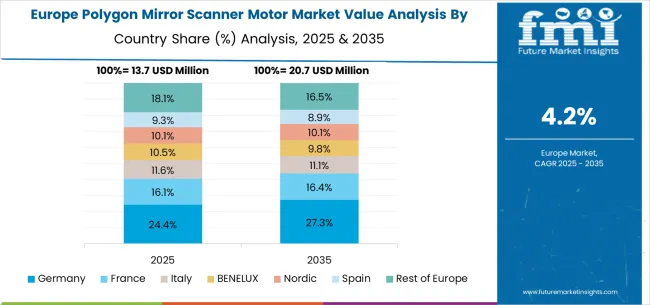

The Polygon Mirror Scanner Motor market in Europe is projected to grow from USD 14.8 million in 2025 to USD 23.4 million by 2035, registering a CAGR of 4.7% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, declining slightly to 30.6% by 2035, supported by its advanced precision manufacturing infrastructure and major industrial centers, including optical equipment and office machinery manufacturing hubs.

France follows with a 17.9% share in 2025, projected to reach 18.4% by 2035, driven by comprehensive manufacturing modernization programs and enhanced precision technology protocols across major equipment manufacturing facilities. The United Kingdom holds a 15.7% share in 2025, expected to decrease to 15.1% by 2035 due to post-Brexit manufacturing operational adjustments. Italy commands a 13.6% share, while Spain accounts for 10.8% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 10.8% to 12.4% by 2035, attributed to increasing motor system adoption in Nordic countries and emerging Eastern European manufacturing facilities implementing precision technology programs.

The Japanese Polygon Mirror Scanner Motor market demonstrates a mature and precision-focused landscape, characterized by sophisticated integration of brushless DC motor systems with existing equipment manufacturing infrastructure across printer, optical equipment, and precision machinery manufacturing facilities. Japan's emphasis on manufacturing excellence and continuous improvement drives demand for high-precision motor solutions that support kaizen initiatives and statistical process control requirements in equipment production.

The market benefits from strong partnerships between international technology providers like MinebeaMitsumi, NIDEC, and domestic precision manufacturing leaders, creating comprehensive service ecosystems that prioritize system reliability and operator training. Manufacturing centers in Tokyo, Osaka, and Nagoya showcase advanced precision implementations where motor systems achieve 97% operational reliability through integrated maintenance programs, while the country's focus on quality optimization and energy efficiency supports steady adoption of brushless DC motor technologies across diverse manufacturing sectors.

The South Korean Polygon Mirror Scanner Motor market is characterized by strong international technology provider presence, with companies like MinebeaMitsumi and NIDEC maintaining dominant positions through comprehensive system integration and maintenance services capabilities. The market is demonstrating a growing emphasis on localized technical support and rapid deployment capabilities, as Korean equipment manufacturers increasingly demand customized solutions that integrate with domestic manufacturing infrastructure and production processes.

Local precision manufacturing companies and regional distributors are gaining market share through strategic partnerships with global providers, offering specialized services, including training programs and certification services for technical personnel. The competitive landscape shows increasing collaboration between multinational motor system manufacturers and Korean manufacturing specialists, creating hybrid service models that combine international technology expertise with local market knowledge and customer relationship management, particularly in the country's concentrated industrial regions around Seoul, Busan, and Daegu, where electronics and precision manufacturing industries drive continuous demand for advanced motor solutions.

The Polygon Mirror Scanner Motor market features approximately 8-12 meaningful players with moderate concentration, where the top two companies control roughly 60-65% of global market share through established precision motor platforms and extensive equipment manufacturer relationships. Competition centers on technological differentiation, performance capabilities, and integration expertise rather than price competition alone.

Market leaders include MinebeaMitsumi and NIDEC, which maintain competitive advantages through comprehensive precision motor portfolios, global service networks, and deep expertise in manufacturing processes, creating high switching costs for customers. These companies leverage installed base relationships and ongoing service contracts to defend market positions while expanding into adjacent motor applications.

Regional players and emerging technology providers create competitive pressure through cost-effective solutions and specialized capabilities, particularly in high-growth markets including China and India, where local presence provides advantages in customer support and regulatory compliance. Market dynamics favor companies that combine advanced motor technologies with precision control systems and comprehensive service offerings that address the complete motor system lifecycle from design through ongoing optimization.

The global polygon mirror scanner motor market represents a specialized precision component segment within imaging and office equipment technology, projected to grow from USD 55.9 million in 2025 to USD 88.5 million by 2035 at a CAGR of 4.7%. Brushless DC motors dominate the market, serving primarily printer applications (the largest segment), followed by copier and fax machine systems that demand high-speed precision rotation, minimal maintenance, and consistent scanning performance. The market's expansion is driven by digital transformation initiatives, increasing demand for high-quality printing, and the need for energy-efficient precision motor solutions across office equipment manufacturing. The growth requires coordinated efforts across technology regulators, precision engineering standards bodies, motor manufacturers, equipment integrators, and investment partners.

Precision Manufacturing Infrastructure: Establish specialized industrial zones focused on precision motor and optical component manufacturing, including advanced machining facilities, clean room environments, and precision measurement laboratories that support domestic motor manufacturing capabilities for office equipment applications.

Technology Innovation Programs: Fund research initiatives focused on advanced motor control systems, energy-efficient brushless DC technologies, IoT-enabled motor monitoring, and precision control algorithms that enhance scanning accuracy and operational reliability in printing and imaging applications.

Manufacturing Standards & Certification: Develop national quality standards for precision motors aligned with international specifications (IEC, ISO 14644) and establish accredited testing facilities that enable domestic manufacturers to compete globally with certified precision motor products.

Skills Development Initiatives: Create specialized technical education programs in precision motor design, control systems engineering, electromagnetic compatibility testing, and quality assurance procedures essential for developing expertise in high-precision motor manufacturing.

Export Development Support: Establish trade promotion programs for precision motor manufacturers, including international market development assistance, technology transfer facilitation, and favorable export financing for companies serving global office equipment markets.

Performance Standards Development: Establish comprehensive quality standards for polygon mirror scanner motors covering rotational accuracy, speed stability, electromagnetic interference limits, and operational life requirements that ensure consistent performance across different equipment manufacturers.

Testing Protocols & Validation: Create standardized testing methodologies for motor performance evaluation, including speed accuracy measurement, vibration analysis, thermal stability testing, and longevity assessment procedures that support reliable procurement decisions.

Application Engineering Guidelines: Develop technical documentation for motor selection criteria, installation specifications, control system integration, and maintenance procedures that help equipment manufacturers optimize motor performance and extend operational life.

Electromagnetic Compatibility Standards: Establish EMI/EMC requirements and testing protocols specific to polygon mirror scanner motors to ensure compatibility with sensitive imaging equipment and compliance with international electromagnetic interference regulations.

Professional Development Programs: Create certification courses for motor application engineers, control system specialists, and quality assurance personnel to ensure industry-wide competency in precision motor technology and integration expertise.

Advanced Motor Technologies: Develop high-performance brushless DC motors with enhanced speed control accuracy, reduced electromagnetic interference, improved thermal management, and extended operational life that meet the demanding requirements of modern printing and imaging equipment.

Intelligent Control Systems: Incorporate advanced control algorithms, real-time speed monitoring, predictive maintenance capabilities, and IoT connectivity into motor systems to enable optimal performance, energy efficiency, and proactive maintenance scheduling.

Precision Manufacturing Capabilities: Invest in ultra-precision machining, automated assembly systems, advanced quality control technologies, and clean room manufacturing environments that ensure consistent production of high-accuracy motors meeting stringent specifications.

Application-Specific Solutions: Create specialized motor designs for specific applications, including laser printers, high-speed copiers, multifunction devices, and specialty imaging equipment that address unique performance requirements and integration challenges.

Technical Support Infrastructure: Establish comprehensive customer support, including motor selection software, application engineering services, integration assistance, and field technical support that helps equipment manufacturers achieve optimal motor system performance.

Integrated System Design: Develop motor integration strategies that optimize equipment design around precision motor capabilities, including proper mounting systems, vibration isolation, thermal management, and control system integration for maximum scanning performance.

Strategic Supplier Partnerships: Build collaborative relationships with motor manufacturers that provide early access to new technologies, joint product development opportunities, and guaranteed supply security for critical motor components requiring specialized performance characteristics.

Performance Optimization Systems: Implement advanced control systems that leverage intelligent motor technologies to optimize scanning quality, reduce power consumption, and enable predictive maintenance capabilities that improve equipment reliability.

Quality Assurance Programs: Establish comprehensive motor qualification procedures, including performance validation, reliability testing, environmental stress testing, and supplier auditing processes that ensure consistent quality across motor supply chains.

Energy Efficiency Integration: Develop motor system configurations that optimize power consumption, reduce heat generation, and meet energy efficiency regulations while maintaining or improving scanning performance and operational reliability.

Technical Distribution Capabilities: Establish specialized distribution networks with motor application expertise, inventory management systems for precision components, and rapid delivery capabilities that serve office equipment manufacturers and service providers effectively.

Value-Added Engineering Services: Provide motor selection assistance, control system integration support, custom mounting solutions, and performance optimization services that help customers achieve optimal motor system performance for specific applications.

Regional Support Networks: Develop localized technical support capabilities, including field application engineers, repair services, and replacement part inventory, that ensure rapid response to customer needs across global markets.

Digital Platform Integration: Create technical databases, motor selection software, and customer portals that provide easy access to motor specifications, performance data, and integration guidance for improved customer service efficiency.

Training and Certification Services: Offer technical training programs for customer engineers, installation certification courses, and ongoing education services that help customers maximize the value of precision motor investments.

Precision Manufacturing Expansion: Finance advanced production facilities, ultra-precision machining equipment, and clean room manufacturing systems that enable motor manufacturers to scale production capabilities and meet growing demand for high-precision components.

Technology Innovation Investment: Provide venture capital and development funding for advanced motor control technologies, smart motor systems, energy efficiency innovations, and manufacturing process improvements that advance motor performance capabilities.

Market Development Capital: Support international expansion initiatives, including regional manufacturing facilities, technical support infrastructure, distribution networks, and local partnerships in high-growth office equipment markets.

Supply Chain Integration: Finance vertical integration strategies that combine motor manufacturing with control electronics production, precision component supply, and distribution capabilities to create more efficient and competitive motor system supply chains.

Industry Consolidation Support: Facilitate strategic mergers and acquisitions that create larger, more capable motor organizations with enhanced R&D capabilities, broader product portfolios, and global reach necessary to serve major office equipment manufacturers effectively.

| Item | Value |

|---|---|

| Quantitative Units | USD 55.9 million |

| Motor Type | Brushless DC Motor, Stepper Motor, Servo Motor, Piezoelectric Motor |

| Application | Printer, Copier, Fax Machine, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, the U.S., the U.K., Japan, and 40+ countries |

| Key Companies Profiled | MinebeaMitsumi, NIDEC |

| Additional Attributes | Dollar sales by motor type and application categories, regional adoption trends across North America, Europe, and Asia-Pacific, competitive landscape with technology providers and system integrators, equipment manufacturer preferences and requirements, integration with precision manufacturing initiatives and automation platforms, innovations in motor control technology and performance analytics, and development of specialized motor applications with operational efficiency capabilities. |

The global polygon mirror scanner motor market is estimated to be valued at USD 55.9 million in 2025.

The market size for the polygon mirror scanner motor market is projected to reach USD 88.5 million by 2035.

The polygon mirror scanner motor market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in polygon mirror scanner motor market are brushless DC motor, stepper motor, servo motor and piezoelectric motor.

In terms of application, printer segment to command 36.0% share in the polygon mirror scanner motor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mirror Sheets Market Size and Share Forecast Outlook 2025 to 2035

Mirrored Glass Market

Smart Mirror Market Size and Share Forecast Outlook 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Fogless Mirror Market Growth - Trends & Industry Outlook 2025 to 2035

Bathroom Mirror Wiper Market Size and Share Forecast Outlook 2025 to 2035

Fog Free Mirrors Market Size and Share Forecast Outlook 2025 to 2035

Auto-Dimming Mirror Market Size and Share Forecast Outlook 2025 to 2035

Digital Micromirror Device (DMD) market Size and Share Forecast Outlook 2025 to 2035

Smart Fitness Mirror Market Size and Share Forecast Outlook 2025 to 2035

Convex Safety Mirrors Market Growth - Demand & Forecast 2025 to 2035

Automotive Rear View Mirror Market

Telescopic Inspection Mirror Market Size and Share Forecast Outlook 2025 to 2035

Automotive Auto Dimming Mirror Market Size and Share Forecast Outlook 2025 to 2035

Motor Bearing Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Fuel Hoses Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Drive Chain Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Wheels Market Size and Share Forecast Outlook 2025 to 2035

Motorized Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Motorhome Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA