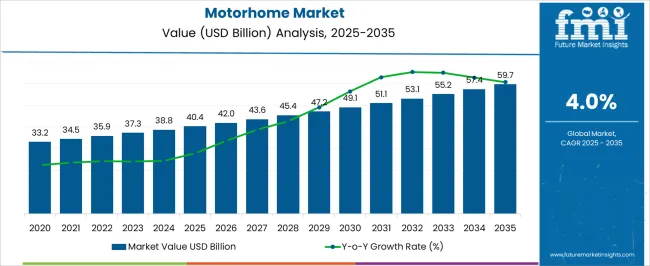

The motorhome market, estimated at USD 40.4 billion in 2025 and projected to reach USD 59.7 billion by 2035 with a CAGR of 4.0%, exhibits characteristics indicative of a market in the late growth to early maturity stage of the adoption lifecycle. Initial adoption is driven by consumers seeking flexible travel experiences and lifestyle mobility, with early adopters influencing broader acceptance through demonstration of utility and convenience.

The modest yet steady annual growth reflects gradual mainstream acceptance, supported by incremental innovations in vehicle design, fuel efficiency, and onboard technology, which enhance user experience and maintain relevance in the competitive recreational vehicle sector. The market trajectory indicates a smooth S-curve progression, with the initial rapid uptake now transitioning into a more stabilized growth pattern.

Penetration remains concentrated in regions with strong travel culture and infrastructure, while emerging regions contribute to sustained but moderate expansion. As early majority consumers continue to embrace motorhomes, manufacturers focus on enhancing features, offering diversified models, and optimizing service networks to capture latent demand. The market shows signs of approaching saturation among established user segments, with growth increasingly influenced by replacement cycles, product upgrades, and lifestyle trends.

The motorhome market demonstrates a measured adoption progression, combining steady growth, widening consumer base, and gradual movement toward full market maturity by 2035, reflecting a stabilized yet resilient sector poised for incremental innovations and sustained demand.

| Metric | Value |

|---|---|

| Motorhome Market Estimated Value in (2025 E) | USD 40.4 billion |

| Motorhome Market Forecast Value in (2035 F) | USD 59.7 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The motorhome market is regarded as a key segment within recreational vehicles and leisure mobility solutions. It is estimated to hold 16.3% of the recreational vehicles market, reflecting growing interest in road trips and mobile accommodations. Within the automotive industry, a 2.7% share is observed, driven by specialized vehicle design and chassis integration. The tourism and leisure vehicles sector contributes 4.8%, supported by domestic and international travel demand.

Camping and outdoor equipment accounts for 3.5%, reflecting synergies with portable and modular amenities in motorhomes. Specialty vehicle manufacturing represents 2.1%, encompassing engineering, custom builds, and conversions of standard vehicles into motorhomes. Recent industry trends have been shaped by electrification, smart vehicle integration, and lightweight construction materials. Groundbreaking developments include electric and hybrid motorhomes, solar powered systems, modular interiors, and AI enabled energy management for onboard utilities. Key players are pursuing partnerships with technology providers, component suppliers, and rental platforms to enhance functionality and accessibility.

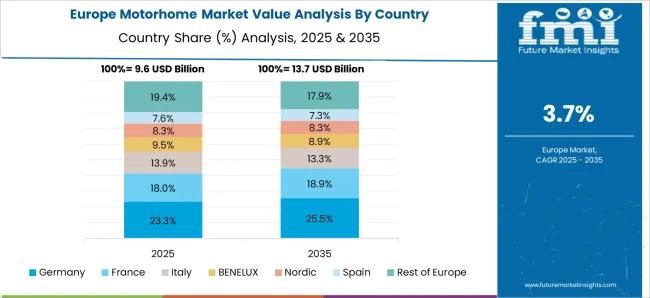

Strategic initiatives include expansion into emerging markets, customizable designs for consumer preference, and integration of IoT devices for navigation, monitoring, and comfort control. Europe and North America lead regional growth due to strong recreational culture, while Asia Pacific is witnessing gradual adoption driven by rising tourism and outdoor activity trends.

The motorhome market is witnessing consistent expansion, supported by increasing consumer inclination toward recreational travel, lifestyle-based mobility, and long-distance touring solutions. Demand has been reinforced by the integration of advanced features, enhanced comfort levels, and improved fuel efficiency across models, catering to evolving buyer expectations. Market growth is being sustained by favorable financing options, wider dealership networks, and targeted marketing strategies that promote the leisure and adventure segments.

Seasonal demand peaks in regions with strong camping and outdoor tourism cultures have influenced production and inventory strategies, ensuring supply alignment with consumer patterns. Regulatory developments around emissions and safety have prompted manufacturers to innovate with lighter materials and efficient powertrains, enhancing long-term competitiveness.

The market is set to benefit from increasing discretionary spending, expanding rental fleets, and growing adoption among younger demographics seeking flexible, self-contained travel experiences. Technological upgrades in connectivity, safety systems, and energy management are anticipated to enhance further the value proposition of motorhomes across both domestic and international markets.

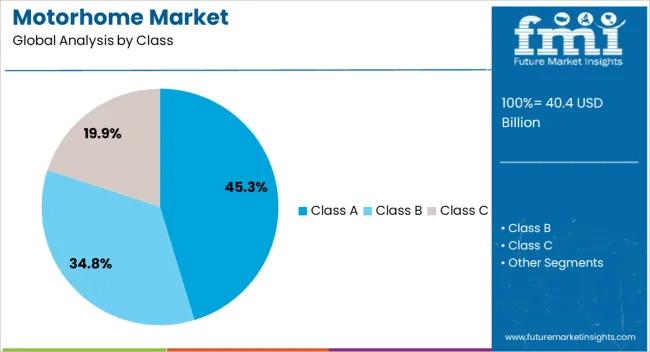

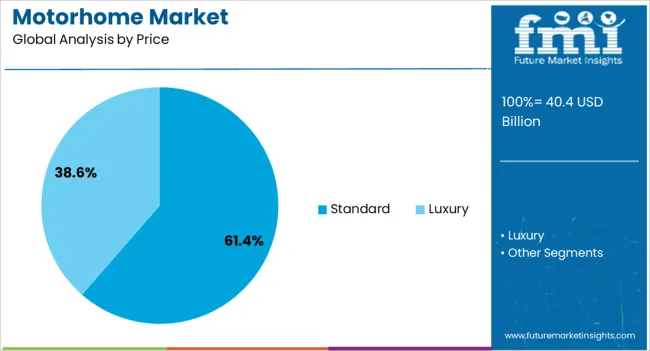

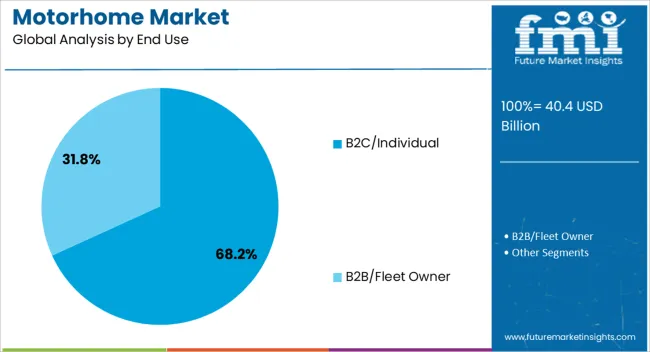

The motorhome market is segmented by class, price, end use, fuel, and geographic regions. By class, motorhome market is divided into Class A, Class B, and Class C. In terms of price, motorhome market is classified into Standard and Luxury. Based on end use, motorhome market is segmented into B2C/Individual and B2B/Fleet Owner. By fuel, motorhome market is segmented into Gasoline and Diesel. Regionally, the motorhome industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Class A motorhomes, holding 45.30% of the class category, dominate due to their premium build quality, spacious interiors, and comprehensive amenities that cater to long-distance travel and extended stays. The segment’s strong share is supported by high adoption among affluent buyers and full-time travelers who value comfort and durability.

Manufacturing advancements have allowed for improved aerodynamics and weight optimization, resulting in better fuel efficiency without compromising luxury features. The segment has also benefited from consistent demand within the rental market, where Class A models serve as flagship offerings for premium travel experiences.

Distribution networks have been strengthened to cater to niche customer bases, while aftersales support and customization options have reinforced brand loyalty. Despite higher upfront costs, the perceived value in terms of longevity, functionality, and travel flexibility has ensured sustained preference for Class A motorhomes, maintaining their competitive edge in a market with diverse consumer profiles.

The standard price range, capturing 61.40% of the price category, leads the market as it strikes a balance between affordability and essential features, appealing to a broad consumer base. This segment benefits from consistent uptake among first-time buyers, budget-conscious travelers, and rental fleet operators seeking cost-efficient yet well-equipped motorhomes.

Market competitiveness has been enhanced by manufacturers offering flexible configurations, financing plans, and value-added features without significant price escalation. Strong distribution through multi-brand dealerships and online sales platforms has widened accessibility, while promotional campaigns have reinforced the affordability narrative.

Operational cost efficiency, in terms of fuel consumption and maintenance, has further supported adoption in this segment. As demand grows among younger and middle-income consumers, the standard price category is expected to sustain its leadership through incremental feature enhancements, improved energy efficiency, and tailored financing packages that reduce the ownership barrier.

The B2C/Individual category, representing 68.20% of the end-use segment, leads due to high ownership rates among private users seeking autonomy, flexibility, and convenience in travel. The segment’s dominance is fueled by increased interest in self-contained vacations, avoidance of crowded public transport, and the growing appeal of mobile living.

Manufacturers have tailored marketing strategies toward lifestyle branding, emphasizing freedom, exploration, and personalization. High resale value and the potential for customization have further attracted long-term buyers, while post-purchase services such as maintenance contracts and upgrade packages have strengthened customer relationships.

Online communities and user-generated content showcasing travel experiences have amplified demand within this segment, inspiring new entrants into the market. The B2C/Individual share is anticipated to remain robust as remote work trends, multi-generational travel, and outdoor recreation continue to influence purchase decisions, ensuring this segment remains a cornerstone of motorhome market expansion.

The market has been expanding rapidly due to increasing interest in recreational travel, flexibility, and lifestyle mobility. Motorhomes, encompassing Class A, B, and C vehicles, are used for leisure, tourism, and seasonal travel, providing accommodation and transport in a single unit. Market growth is supported by rising disposable incomes, tourism development, and the popularity of road trips as an alternative to conventional lodging. Technological advancements in interior design, energy efficiency, and safety systems have enhanced user experience, while growing rental and sharing services are increasing accessibility.

The surge in recreational tourism has significantly driven motorhome adoption. Consumers increasingly prefer road trips and camping holidays for flexibility, comfort, and personalized travel experiences. Popularity of national parks, scenic routes, and outdoor tourism has encouraged families and adventure travelers to invest in motorhomes. Rental and subscription models have lowered entry barriers for occasional users, while private ownership continues to grow among high-income segments. Tourism boards and recreational organizations promote motorhome-friendly routes, parking facilities, and campgrounds, further supporting usage. This trend has led manufacturers to offer vehicles with enhanced amenities, modern interiors, and customized layouts to meet diverse consumer needs across leisure travel and long-distance exploration.

Technological advancements have improved the comfort, safety, and operational efficiency of motorhomes. Modern vehicles are equipped with energy-efficient appliances, solar power integration, smart climate control, and advanced infotainment systems. Lightweight materials, aerodynamic designs, and fuel-efficient engines optimize performance while reducing operational costs. Safety features such as collision avoidance systems, electronic stability control, and adaptive cruise control have increased reliability during long journeys. Interior layouts are enhanced with modular furniture, multifunctional spaces, and ergonomic designs to maximize usability within compact dimensions. These innovations have made motorhomes more appealing to consumers seeking convenience, sustainability, and high-quality travel experiences, further strengthening market demand.

The growth of motorhome rental and sharing platforms has broadened market reach, making these vehicles accessible to a wider audience. Peer-to-peer rental platforms, vacation rental companies, and fleet-based services allow travelers to experience motorhome travel without full ownership costs. Short-term and seasonal rentals cater to domestic tourists and adventure travelers, while corporate and luxury rental services target niche markets. These models provide manufacturers and operators with additional revenue streams and support adoption in regions with lower ownership penetration. Increased accessibility also drives consumer awareness, encourages trial usage, and boosts long-term adoption as rental users often transition to ownership, sustaining market growth over time.

High purchase costs, maintenance requirements, and fuel expenses remain key challenges in the motorhome market. Consumers may be deterred by initial investment, insurance, and ongoing operational costs, especially in regions with fluctuating fuel prices. Licensing requirements, storage needs, and maintenance expertise can further limit accessibility. Manufacturers and rental operators address these barriers through financing options, affordable rental schemes, modular designs, and fuel-efficient or hybrid engine solutions. Strategic partnerships and after-sales support improve convenience, reduce ownership burden, and enhance vehicle lifespan. Managing cost-effectiveness and operational efficiency remains crucial for sustaining adoption and supporting market growth across diverse consumer segments.

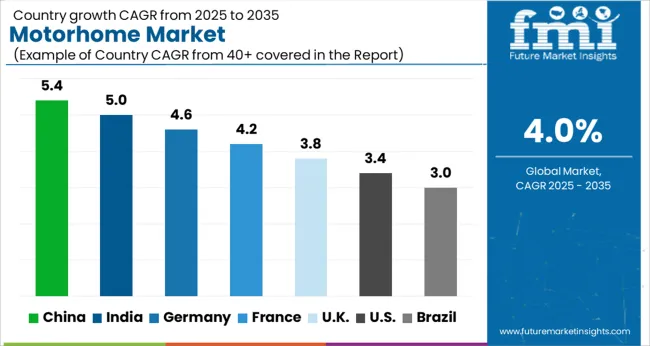

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

China leads the market with a forecast CAGR of 5.4%, driven by growing domestic tourism and expanding recreational vehicle manufacturing. India follows at 5.0%, supported by rising interest in leisure travel and increasing disposable income. Germany records 4.6%, benefiting from advanced engineering, high-quality production, and strong European demand. The United Kingdom posts 3.8%, where customization and premium offerings support steady growth. The United States registers 3.4%, with consistent market activity fueled by established RV culture and recreational trends. These countries collectively represent significant manufacturing, adoption, and innovation influence in the global motorhome market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 5.4% in the market, supported by increasing domestic travel and tourism activities. Rising disposable incomes and a shift toward recreational lifestyles are encouraging consumers to invest in motorhomes for leisure travel. The growing popularity of road trips and customized travel experiences drives demand for both compact and luxury motorhome models. Manufacturers are focusing on innovative designs, energy-efficient solutions, and smart connectivity features to attract buyers. Urban-to-rural travel trends and tourism infrastructure development further support market expansion in China.

India is expected to register a CAGR of 5.0% in the market as travel culture evolves and road trip experiences gain popularity. Increasing disposable incomes and a growing middle-class population are facilitating adoption of recreational vehicles. Manufacturers are introducing motorhomes with modular interiors, smart technology, and energy-efficient systems to appeal to tech-savvy and adventure-oriented consumers. Tourism campaigns promoting local destinations and scenic routes are further stimulating demand. The market is also supported by rising awareness of leisure and family travel, creating steady opportunities for growth in India.

Germany is anticipated to experience a CAGR of 4.6% in the market, fueled by strong demand for recreational vehicles and the popularity of family-oriented vacations. Consumers favor versatile motorhomes equipped with energy-efficient systems, advanced interiors, and compact designs suitable for European roads. Regulatory support, high-quality manufacturing standards, and innovation in eco-friendly powertrains encourage adoption. The trend of domestic tourism combined with growing disposable incomes strengthens demand. Rental and second-hand motorhome services also provide alternative growth opportunities, making Germany a steady and sustainable market for motorhome manufacturers.

The United Kingdom is projected to grow at a CAGR of 3.8% in the market, supported by the rising popularity of road trips and domestic vacations. Consumers increasingly prefer versatile and technologically advanced motorhomes for leisure and short-term travel. Eco-friendly features and energy-efficient designs are becoming key selling points. Manufacturers are focusing on connectivity, smart interiors, and compact models suitable for urban and rural travel. Tourism infrastructure improvements and local camping site development enhance accessibility and adoption of motorhomes across the country.

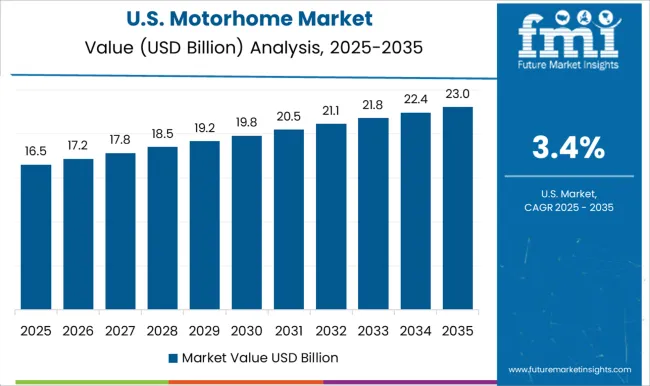

The United States is expected to register a CAGR of 3.4% in the market due to a strong culture of road trips and recreational vehicle usage. Consumers increasingly invest in motorhomes for family vacations, outdoor adventures, and long-term travel experiences. Manufacturers are offering models with modular interiors, advanced safety features, and integrated smart technology. Growth is further supported by a well-developed tourism infrastructure, highway networks, and widespread availability of camping and RV parks. The second-hand and rental market segments also contribute to steady adoption, providing additional avenues for market expansion in the United States.

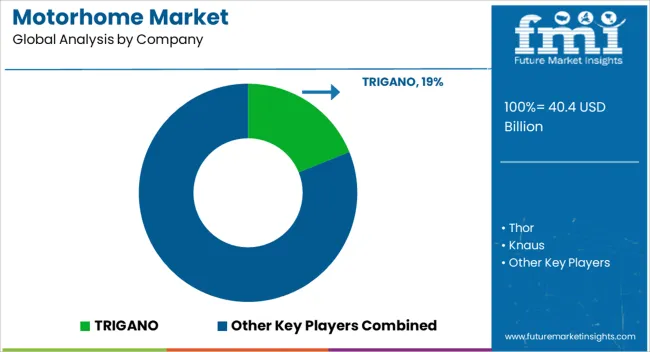

The motorhome market is competitive, with a mix of global manufacturers, regional specialists, and niche luxury brands catering to diverse customer segments. Competition is shaped by vehicle design, build quality, fuel efficiency, technological integration, comfort features, and customization options. Key players focus on innovation in interior layouts, lightweight construction, energy-efficient systems, and connected vehicle technologies to attract consumers seeking mobility combined with convenience and comfort.

Leading companies such as Thor Industries, Winnebago Industries, Hymer, REV Group, and Forest River dominate the global market, offering a wide range of motorhome models from entry-level to premium luxury units. Regional and boutique manufacturers, including Adria Mobil, Laika, and Pilote, compete through unique designs, advanced amenities, and specialized features tailored to local preferences. The market is further influenced by trends such as electric and hybrid motorhomes, smart control systems, and the integration of renewable energy solutions like solar panels. Strategic partnerships, dealer networks, and after-sales service quality serve as crucial competitive levers. Companies that successfully balance innovation, reliability, and cost-effectiveness are gaining stronger positions in this evolving market.

| Item | Value |

|---|---|

| Quantitative Units | USD 40.4 Billion |

| Class | Class A, Class B, and Class C |

| Price | Standard and Luxury |

| End Use | B2C/Individual and B2B/Fleet Owner |

| Fuel | Gasoline and Diesel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TRIGANO, Thor, Knaus, Swift, Kabe AB, Bailey of Bristol, Auto-Sleepers, Burstner, Compass, and Dethleffs |

| Additional Attributes | Dollar sales by vehicle type and size, demand dynamics across recreational, travel, and luxury segments, regional trends in motorhome adoption, innovation in fuel efficiency, interior design, and connectivity features, environmental impact of emissions and material usage, and emerging use cases in eco-tourism, mobile living, and adventure travel experiences. |

The global motorhome market is estimated to be valued at USD 40.4 billion in 2025.

The market size for the motorhome market is projected to reach USD 59.7 billion by 2035.

The motorhome market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in motorhome market are class a, class b and class c.

In terms of price, standard segment to command 61.4% share in the motorhome market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA