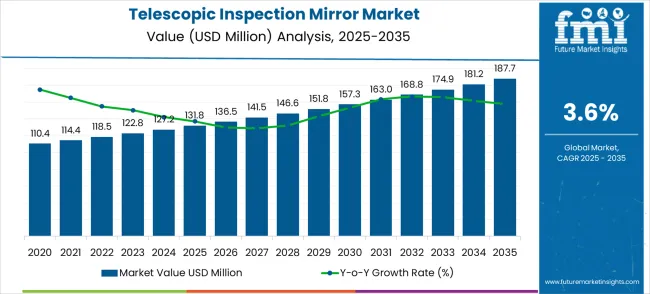

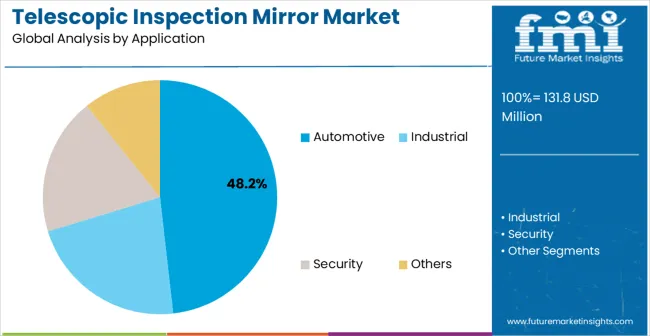

The telescopic inspection mirror market is projected to grow from USD 131.8 million in 2025 to USD 187.7 million by 2035, advancing at a CAGR of 3.6%. Growth is supported by increasing precision requirements in automotive servicing, industrial maintenance, and security inspection workflows, where technicians must visually access confined or obscured areas. Automotive applications remain the largest segment with 48.2% share, driven by rising EV servicing needs, complex underbody inspections, and expanding workshop networks across emerging economies. Industrial facilities also accelerate adoption as preventive maintenance programs emphasize detailed visual checks for quality assurance and safety compliance.

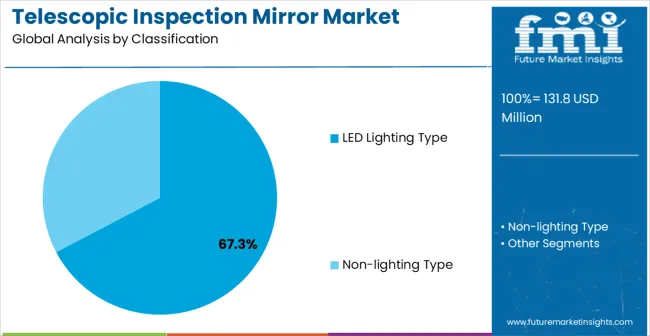

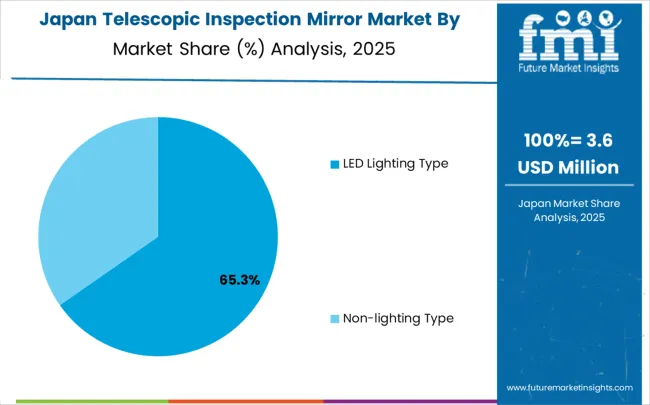

LED lighting-type inspection mirrors dominate with 67.3% market share, as integrated illumination improves clarity in low-light environments and reduces dependence on external lighting tools. These mirrors also benefit from advancements in LED efficiency, ergonomic handle designs, and enhanced mirror clarity that increase technician accuracy and reduce fatigue during extended use. Non-lighting mirrors continue to serve cost-sensitive and basic inspection tasks but grow more slowly due to limited functionality.

Rising demand from law enforcement, border security, and defense sectors. Security personnel use telescopic inspection mirrors to inspect vehicles, luggage, undercarriages, and suspicious objects during surveillance and security checks. With global concerns around security threats continuing to rise, agencies are adopting more rigorous inspection protocols, fueling the need for reliable, lightweight, and adjustable inspection mirrors. The demand is especially strong in airports, ports, warehouses, and checkpoints where non-invasive visual inspection tools are essential.

Technological advancements in mirror design and materials are also driving market expansion. Modern telescopic inspection mirrors feature improved durability, lightweight construction, shatter-resistant glass, LED illumination for low-light environments, and ergonomic handles for comfortable use. The integration of illumination, in particular, significantly improves visibility during inspection tasks and has become a standard feature in many high-performance models. As manufacturers continue to innovate, the availability of more efficient, user-friendly, and versatile products will support wider adoption across industries.

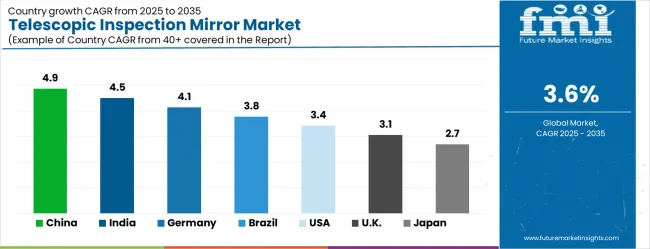

Regionally, Asia Pacific leads expansion, with China and India posting the highest growth owing to vehicle parc expansion, industrialization, and the proliferation of service centers. Europe and North America maintain steady replacement-driven demand, supported by mature automotive service ecosystems, strict tool quality standards, and adoption of premium LED-integrated tools. Competitive dynamics increasingly revolve around ergonomic innovation, illumination technology, durability engineering, and distribution network strength, with global players such as General Tools & Instruments, Snap-on, Carl Kammerling International, and Stanley Black & Decker shaping the premium tier of the market.

| Metric | Value |

|---|---|

| Market Value (2025) → | USD 131.8 million |

| Market Forecast (2035) ↑ | USD 187.7 million |

| Growth Rate ★ | 3.6% CAGR |

| Leading Product Type → | LED Lighting Type |

| Primary Application → | Automotive |

The competitive landscape evolves from early market development to established player positioning. The first period prioritizes market education and reducing adoption barriers within traditional automotive service applications. The second period witnesses intensified competition for premium market segments and expansion of geographical territories. Market maturation factors include standardized quality requirements, automated manufacturing integration capabilities, and cross-industry application development across automotive, industrial, and security inspection sectors.

Market expansion rests on four fundamental shifts driving industrial demand acceleration:

1. Automotive Service Industry Evolution: Service centers demand enhanced visual inspection capabilities for modern vehicle maintenance and diagnostic procedures. Electric vehicle servicing requires precise component accessibility tools to meet operational efficiency standards. Advanced automotive technologies necessitate detailed visual inspection for battery systems, hybrid components, and electronic system diagnostics.

2. Industrial Maintenance Modernization: Manufacturing facilities integrate telescopic inspection mirrors with preventive maintenance programs for equipment monitoring and quality assurance. Aerospace and heavy machinery sectors enable precise visual access to confined spaces and hard-to-reach areas. Safety protocols require consistent visual inspection capabilities for automated maintenance procedures and regulatory compliance.

3. Security and Safety Applications: Law enforcement agencies utilize advanced inspection mirrors for vehicle searches, building security, and threat detection applications. Border security initiatives require portable visual inspection tools for comprehensive screening procedures. Emergency response teams require reliable inspection equipment for rescue operations and assessing hazardous environments.

4. Professional Tool Advancement: Hand tool manufacturers enhance product features through LED lighting integration, ergonomic design improvements, and durability enhancements. Quality assurance demands consistent visual inspection capabilities for professional applications and technical training. Manufacturing efficiency improvements increase tool functionality through enhanced mirror clarity and adjustable positioning systems.

The growth faces headwinds from smartphone camera alternatives and basic mirror competition. Traditional manual inspection methods maintain cost advantages for simple applications. Market maturation creates pricing pressure from established manufacturers with extensive distribution networks.

Primary Classification: The market segments by product type into LED lighting type and non-lighting type, representing the transition from traditional inspection systems toward advanced LED-based solutions that deliver superior efficiency, durability, and precision across diverse operational environments.

Secondary Breakdown: Application segmentation divides the market into automotive, industrial, security, and others, reflecting distinct performance requirements and sector-specific adoption. Automotive leads due to high demand for precision inspection in production processes, industrial applications account for professional usage in manufacturing environments, security prioritizes enforcement and monitoring functions, while others highlight diverse inspection activities requiring adaptable solutions.

Geographic Segmentation: Regional market distribution encompasses the Asia Pacific, Europe, North America, and Latin America, each exhibiting distinct adoption patterns and growth dynamics. Asia Pacific leads with China and India demonstrating solid growth rates, Germany’s industrial applications drive Europe, North America records steady expansion through the USA, and Latin America records constant growth supported by Brazil’s increasing demand for inspection technologies.

Market Position: LED lighting telescopic inspection mirrors establish clear market leadership through superior illumination capabilities and enhanced visual clarity benefits. Advanced LED integration systems eliminate lighting limitations in challenging inspection environments. Consistent lighting performance capabilities enable precise visual assessment, where traditional mirrors cannot achieve the required visibility specifications.

Value Drivers: Improvements in LED technology enhance battery efficiency and reduce power consumption, while providing superior illumination quality. Ergonomic design integration provides comfortable handling and precise positioning capabilities. Specialized optical systems accommodate multiple inspection requirements within single tool configurations for operational efficiency and cost optimization.

Competitive Advantages: LED lighting systems offer enhanced visibility compared to non-lighting alternatives requiring external illumination sources. Superior inspection accuracy increases diagnostic capabilities through improved visual detail recognition in confined spaces. Premium pricing justification occurs through total cost of ownership advantages and productivity benefits for professional applications.

Market Challenges: Higher manufacturing costs compared to basic mirror alternatives impact price sensitivity in cost-conscious market segments. Battery maintenance requirements demand periodic replacement and charging protocols. Market positioning challenges occur when competing against smartphone-based inspection solutions offering similar lighting capabilities.

Strategic Market Importance: Automotive service and repair represent the primary demand driver for telescopic inspection mirror applications across global service facilities. Vehicle maintenance, diagnostic procedures, and quality assurance applications require precise visual access for operational efficiency. Professional service standards mandate consistent inspection capabilities for customer satisfaction and regulatory compliance.

Market Dynamics Q&A:

Business Logic: Automotive service facilities prioritize diagnostic accuracy and service efficiency, making telescopic inspection mirrors essential for meeting customer service standards and productivity targets. Cost justification occurs through reduced service time and enhanced diagnostic capabilities. Professional service requirements demand consistent visual access tools for operational continuity and quality assurance.

Forward-looking Implications: The adoption of electric vehicles creates new application requirements for specialized inspection tools with enhanced lighting capabilities for battery system maintenance. Autonomous vehicle development demands precision visual inspection capabilities for sensor cleaning and calibration procedures. Global automotive service expansion sustains market demand across emerging regions, driven by increasing vehicle ownership and expanding service infrastructure.

The market is primarily driven by increasing demand from automotive service centers and industrial maintenance operations requiring enhanced visual access capabilities. Applications in vehicle diagnostics, equipment maintenance, and security inspections necessitate tools that provide clear visibility in confined spaces and hard-to-reach areas, making telescopic mirrors an attractive solution. The integration of LED lighting technology into inspection tools further prioritizes the need for improved illumination and visual clarity, ensuring consistent performance standards. The stringent safety regulations across automotive and industrial sectors encourage the use of professional inspection tools that reduce operational risks and improve maintenance accuracy. Telescopic mirrors' compliance with professional tool standards also makes them preferred choices for commercial applications, where documented quality and reliability are essential for operational efficiency, creating a stable demand pipeline globally.

Despite advantages, the market faces several growth inhibitors. Competition from smartphone-based inspection solutions creates alternative options with similar lighting and recording capabilities, potentially reducing demand for traditional inspection mirrors. The cost differential between basic mirrors and LED-equipped models may discourage adoption in price-sensitive segments and budget-conscious operations. Limited application scope compared to more versatile digital inspection tools further constrains market expansion opportunities. The maintenance requirements for LED lighting systems and battery replacement needs add to operational costs and user complexity. These challenges collectively slow market penetration, particularly in consumer segments or basic inspection applications, restraining overall market growth despite rising demand for professional inspection solutions.

The market is evolving steadily, driven by technological improvements and ergonomic enhancements. LED lighting integration represents a significant trend, enabling enhanced illumination, extended battery life, and improved visual clarity for professional applications. Ergonomic design improvements are gaining traction, promoting user comfort, reducing fatigue, and enhancing precision during extended use periods. Durability and weather resistance initiatives focus on developing mirrors suitable for harsh working environments and demanding professional applications. Furthermore, there is increasing demand for compact and portable designs tailored to mobile service requirements, offering operational flexibility while maintaining inspection quality standards.

Global market dynamics reveal distinct performance tiers reflecting regional automotive service capabilities and industrial development levels. Growth Leaders including China (4.9% market share) and India (4.5% share) demonstrate expanding automotive service ecosystems with professional tool adoption, while Germany (4.1% share) represents European manufacturing excellence in professional tool applications. Steady Performers such as Brazil (3.8% share) and the United States (3.4% share) show consistent demand growth aligned with automotive service modernization requirements. Mature Markets including the United Kingdom (3.1% share) and Japan (2.7% share) display established market participation reflecting advanced automotive service integration and professional tool standardization.

Regional synthesis indicates Asia Pacific leadership through automotive service expansion and manufacturing growth. European markets prioritize quality standards and professional tool applications. North American demand reflects automotive service modernization and industrial maintenance advancement initiatives.

| Country | Market Share (%) |

|---|---|

| China | 4.9 |

| India | 4.5 |

| Germany | 4.1 |

| Brazil | 3.8 |

| USA | 3.4 |

| UK | 3.1 |

| Japan | 2.7 |

China establishes market leadership with a commanding 4.9% market share through the expansion of its automotive service sector across vehicle maintenance facilities, industrial manufacturing operations, and professional tool distribution networks. The nation's extensive automotive service capacity and growing vehicle ownership rates drive consistent demand for professional inspection tools, supported by comprehensive service industry modernization and government automotive development initiatives. Market dynamics center on electric vehicle adoption creating new inspection requirements for battery system maintenance and electronic component accessibility. The growth of the manufacturing sector promotes the widespread adoption of industrial inspection tools for quality assurance and maintenance applications across diverse production facilities. Automotive service concentration in major urban centers creates significant demand density for professional inspection mirrors, while industrial development policies specifically include professional tool requirements for comprehensive service quality improvement initiatives. Export manufacturing demands necessitate strict quality control standard adherence through documented inspection procedures and professional tool certification processes.

India demonstrates robust growth potential with a 4.5% market share through rapidly expanding automotive service capabilities and comprehensive government promotion of domestic vehicle manufacturing initiatives under various industrial development programs. The market reflects increasing automotive service sophistication and widespread professional tool adoption across service facilities, with automotive sector growth creating consistent demand for inspection tools across both organized service chains and independent service providers. Commercial vehicle maintenance expansion drives significant secondary demand through stringent inspection requirements for fleet operations and logistics service providers. Government automotive development mandates actively promote professional service standards for enhanced customer satisfaction and international service quality compliance, while major infrastructure development projects increase industrial equipment maintenance volumes requiring professional inspection applications. Market activity centers on comprehensive technology transfer agreements bringing international automotive service standards to domestic service facilities. Foreign automotive investment introduces advanced service requirements for improved operational efficiency and competitive service delivery.

Germany maintains a 4.1% market share through exceptional engineering excellence and established professional tool manufacturing traditions across diverse automotive and industrial sectors. An established automotive service base with advanced diagnostic capabilities and precision industrial maintenance expertise supports the nation's sustained market demand. This expertise creates consistent demand for professional inspection tools across vehicle maintenance and specialized automotive system servicing applications. Industrial equipment manufacturing requires extensively certified inspection tools for strict export compliance and international quality standards adherence, while automotive engineering services utilize precision inspection mirrors for advanced prototype development and comprehensive testing applications. Quality standard development significantly influences global inspection practices requiring advanced tool adoption and professional service innovation programs. Advanced automotive research initiatives continuously develop innovative applications for inspection tools across emerging vehicle technologies, with export service leadership necessitating comprehensive quality documentation supporting international service standards and regulatory compliance requirements.

Brazil represents a significant emerging market with 3.8% market share through comprehensive automotive industry development initiatives and service sector expansion across domestic and regional markets. The market reflects increasing automotive service sophistication and professional tool adoption driven by government policies promoting domestic vehicle production capabilities and service infrastructure development, while automotive manufacturing growth creates consistent demand for inspection tools across vehicle assembly facilities and service operations. Commercial vehicle fleet expansion drives primary market demand through domestic transportation growth and regional logistics requirements for Latin American markets, with industrial sector development creating substantial opportunities for maintenance inspection applications and professional tool solutions. Infrastructure development significantly increases automotive service facility construction requiring professional inspection tools and service equipment modernization. Market development benefits from government automotive promotion supporting domestic service capabilities and strategic regional positioning for automotive market access, while infrastructure projects support automotive service sector growth requiring professional inspection capabilities and facility modernization. Regional automotive agreements facilitate improved market access for professional inspection tools and automotive service equipment.

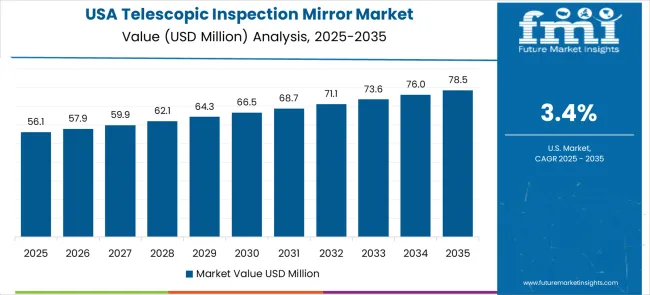

The United States demonstrates steady growth with a 3.4% market share through comprehensive automotive service leadership and strategic professional tool manufacturing initiatives supporting domestic service capabilities. The market reflects an established automotive service base with significant fleet management strength and advanced automotive maintenance capabilities, where commercial fleet operations create substantial demand for professional inspection tools and comprehensive vehicle maintenance systems meeting stringent operational requirements. Automotive service industry leadership requires precision inspection tools for critical vehicle diagnostic procedures and specialized maintenance system applications, while professional tool manufacturing maintains consistent demand for high-quality inspection mirrors supporting automotive service training programs and technician certification applications. Professional service innovation adoption creates integration requirements for inspection tools with sophisticated diagnostic equipment and automotive service management systems. Automotive service competitiveness initiatives encourage substantial investment in professional tool technologies and service facility enhancement capabilities, with automotive training programs requiring extensively documented inspection procedures supporting comprehensive certification applications and industry standards compliance.

The United Kingdom demonstrates market stability with a 3.1% market share through comprehensive automotive service modernization and strategic professional tool sector initiatives across key automotive and industrial applications. The established automotive service base prioritizes quality standards and precision diagnostic applications, where automotive service sector strength creates substantial demand for professional inspection tools in critical vehicle maintenance and high-performance automotive system servicing applications. The professional tool sector requires precision inspection instruments for advanced automotive diagnostic procedures and technical training hardware meeting stringent professional standards and certification requirements, while automotive service research initiatives continuously develop innovative applications for professional inspection tools and diagnostic equipment. Automotive service modernization maintains strict quality standard requirements for international service competitiveness and customer satisfaction excellence. Post-Brexit considerations create significant opportunities for domestic professional tool adoption, requiring precision automotive service capabilities and professional equipment solutions, with government automotive strategy initiatives actively supporting professional service technology adoption and excellence development. Strategic automotive sector policies prioritize domestic service capability development and professional tool technology investment forthe automotive and industrial sectors.

Japan maintains technological leadership with a 2.7% market share through exceptional precision manufacturing excellence and comprehensive quality standard development across diverse automotive and industrial sectors. The mature market features the adoption of established professional tools across industries and sophisticated automotive service capabilities, where automotive industry leadership consistently creates demand for precision inspection technologies and professional diagnostic tools that meet strict quality and operational requirements. Industrial automation manufacturing requires precision inspection tools for component production and comprehensive testing applications, ensuring reliable performance and automotive service excellence. The automotive electronics industry, on the other hand, utilizes specialized inspection mirrors for advanced vehicle system maintenance and precision diagnostic applications. Quality management system development significantly influences global inspection practices and professional tool adoption worldwide. Automotive technology exports include precision inspection tool requirements for international service facilities and automotive technology transfer programs, with research initiatives continuously advancing inspection tool processing and automotive application technologies. Automotive service development presents substantial opportunities for integrating precision inspection tools and utilizing advanced diagnostic equipment.

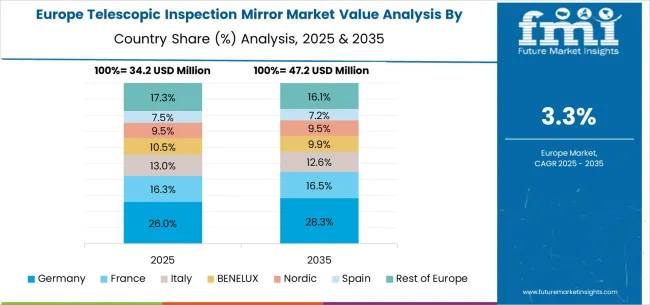

The European telescopic inspection mirror market is projected to grow steadily, driven by strong demand for automotive services and industrial maintenance modernization initiatives. The European market value is estimated at USD 21.4 million in 2025, representing 16.2% of the global market. Germany leads the region with USD 5.4 million (25.2% European share), driven by its robust automotive service infrastructure, precision tool manufacturing excellence, and advanced industrial maintenance standards across diverse applications. The United Kingdom follows with USD 4.1 million (19.2% European share), benefiting from professional service modernization initiatives, stringent automotive service quality standards, and comprehensive tool quality requirements. France holds USD 3.2 million (15.0% European share), supported by the expansion of automotive services, industrial maintenance investments, and the adoption of professional tools across multiple sectors. Italy contributes USD 2.4 million (11.2% of the European share), driven by the development of automotive service facilities and the growing adoption of professional inspection tools in service operations. Spain represents USD 1.8 million (8.4% European share), driven by automotive service modernization and industrial facility upgrades. The Rest of Europe, including Nordic countries (Sweden, Denmark, Norway), the BENELUX region (Netherlands, Belgium, Luxembourg), and Eastern European nations, accounts for USD 4.5 million (21.0% European share), backed by specialized automotive service applications, expanding professional tool adoption, and increasing industrial maintenance requirements.

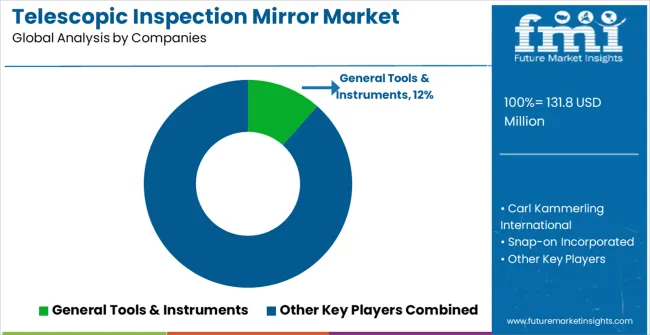

The telescopic inspection mirror market consists of 18–24 active global and regional manufacturers, with the top five companies holding 50–55% of global market share. Demand is driven by the expansion of automotive repair, aerospace maintenance, industrial inspection, law enforcement, HVAC servicing, and facility diagnostics, where visibility in confined or obstructed spaces is essential. Competition centers on mirror clarity, handle durability, articulation precision, LED illumination options, and ergonomic design, rather than price alone. General Tools & Instruments leads the market with an 12% share, reinforced by its long-standing reputation in precision inspection tools and its extensive presence across industrial, automotive, and professional maintenance channels.

Other major players such as Carl Kammerling International, Snap-on Incorporated, Stanley Black & Decker, and LELab maintain strong competitive positions through high-quality telescopic mechanisms, impact-resistant materials, and advanced features like 360° swivel heads and integrated lighting, which are widely preferred by technicians and industrial workers.

Challengers including Facom, Apex Tool Group, Stahlwille, Mac Tools, Matco Tools, Klein Tools, Milwaukee Tool, DEWALT, Ridgid, OTC Tools, Lisle Corporation, Proto Tools, GearWrench, and Cornwell Tools strengthen the market landscape through specialized inspection mirrors optimized for automotive diagnostics, aircraft maintenance, and industrial MRO workflows.

Premium European toolmakers such as Williams Tools, Bahco, Gedore, Beta Tools, Hazet, Knipex, and Wera Tools focus on precision engineering, rugged construction, and ergonomic telescopic systems suited for demanding professional applications. Meanwhile, TEKTON broadens accessibility with cost-effective, reliable inspection mirrors for consumer, DIY, and light industrial users—supporting overall market expansion across varied customer segments.

The telescopic inspection mirror market is central to automotive service excellence, industrial maintenance efficiency, security operations, and professional tool applications. With increasing demands for visual accessibility, diagnostic accuracy, and operational safety, the sector faces pressure to balance tool affordability, inspection quality levels, and comprehensive professional support services. Coordinated action from governments, industry bodies, OEMs/tool manufacturers, suppliers, and investors is essential to transition toward technologically advanced, ergonomically optimized, and globally accessible telescopic inspection mirror systems.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Tool Manufacturers Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 131.8 million |

| Product Type | Non-lighting Type, LED Lighting Type |

| Application | Automotive, Industrial, Security, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, China, Japan, South Korea, India, ASEAN, Australia, New Zealand, Brazil, Chile, Kingdom of Saudi Arabia, GCC Countries, Turkey, South Africa |

| Key Companies Profiled | General Tools & Instruments, Carl Kammerling International, Snap-on Incorporated, Stanley Black & Decker, LELab, Facom, Apex Tool Group, Stahlwille, Mac Tools, Matco Tools, Klein Tools, Milwaukee Tool, DEWALT, Ridgid, OTC Tools, Lisle Corporation, Proto Tools, GearWrench, Cornwell Tools, Williams Tools, Bahco, Gedore, Beta Tools, Hazet, Knipex, Wera Tools, and TEKTON |

The global telescopic inspection mirror market is estimated to be valued at USD 131.8 million in 2025.

The market size for the telescopic inspection mirror market is projected to reach USD 187.7 million by 2035.

The telescopic inspection mirror market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in telescopic inspection mirror market are led lighting type and non-lighting type.

In terms of application, automotive segment to command 48.2% share in the telescopic inspection mirror market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Telescopic Masts Market Size and Share Forecast Outlook 2025 to 2035

Telescopic Crane Market Size and Share Forecast Outlook 2025 to 2035

Telescopic Tool Boxes Market Growth - Demand & Forecast 2025 to 2035

Industry Share Analysis for Telescopic Masts Companies

Inspection Drone in Oil and Gas Market Size and Share Forecast Outlook 2025 to 2035

Inspection Management Software Market Size and Share Forecast Outlook 2025 to 2035

Inspection Robots Market Size and Share Forecast Outlook 2025 to 2035

Inspection and Inventory Labels Market Size and Share Forecast Outlook 2025 to 2035

Inspection Lighting Fixture Market Size and Share Forecast Outlook 2025 to 2035

Inspection & Weighing Machine Industry Analysis in ASEAN and Gulf Countries Analysis - Size, Share, and Forecast 2025 to 2035

Examining Market Share Trends in Inspection and Inventory Labels

Inspection Machines Market Growth – Trends & Forecast 2025 to 2035

PCB Inspection Microscope Market Size and Share Forecast Outlook 2025 to 2035

Bar Inspection System Market Size and Share Forecast Outlook 2025 to 2035

Tire Inspection System Market - Outlook 2025 to 2035

Pipe Inspection Robot Market Growth – Trends & Forecast 2025 to 2035

Field Inspection Tester Market Size and Share Forecast Outlook 2025 to 2035

Drone Inspection and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cargo Inspection Market Size and Share Forecast Outlook 2025 to 2035

Wafer Inspection Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA