The Telescopic Crane Market is estimated to be valued at USD 6.5 billion in 2025 and is projected to reach USD 11.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

This steady expansion reflects the increasing reliance on telescopic cranes for infrastructure projects, industrial maintenance, and heavy lifting applications where flexibility and mobility are critical. Between 2025 and 2030, demand will be driven by road construction, high-rise building projects, and energy sector installations, pushing the market above USD 8.5 billion.

From 2030 to 2035, the trajectory will continue upward as modernization of transport networks, urban redevelopment, and renewable energy projects sustain equipment requirements, taking the market to USD 11.0 billion. The incremental growth of USD 4.5 billion highlights a consistent replacement cycle and rising preference for cranes with improved lifting capacity, faster setup times, and advanced control systems. Competitive dynamics will be shaped by global manufacturers focusing on cost efficiency, operator safety, and the integration of digital monitoring. With Asia-Pacific expected to lead demand due to large-scale infrastructure activity, and North America and Europe maintaining steady replacement demand, telescopic cranes are set to remain a vital component of the global construction equipment sector.

| Metric | Value |

|---|---|

| Telescopic Crane Market Estimated Value in (2025 E) | USD 6.5 billion |

| Telescopic Crane Market Forecast Value in (2035 F) | USD 11.0 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The telescopic crane market is expanding steadily, supported by increasing infrastructure development, rapid urbanization, and rising demand for versatile lifting equipment across construction, logistics, and mining sectors. These cranes are favored for their ability to extend or retract booms for variable reach, enhancing operational flexibility in confined and dynamic job sites.

Investments in energy and transportation infrastructure have further driven equipment demand, especially in projects requiring high lifting efficiency and precision. Technological advancements such as enhanced load monitoring systems, remote operation features, and improved safety mechanisms have strengthened the market presence of telescopic cranes.

As industries continue to prioritize equipment versatility, ease of deployment, and compact design for heavy lifting operations, the market outlook remains optimistic with growing adoption across developing and developed regions alike.

The telescopic crane market is segmented by product, lifting capacity, operating mode, application, end-use, and geographic region. By product, the telescopic crane market is divided into Truck-mounted telescopic cranes, Rough terrain telescopic cranes, All-terrain telescopic cranes, and Crawler telescopic cranes. In terms of lifting capacity, telescopic crane market is classified into Up to 20 tons, 21 to 50 tons, 51 to 100 tons, and Above 100 tons.

Based on operation mode, the telescopic crane market is segmented into Hydraulic telescopic cranes and Electric telescopic cranes. By application, the telescopic crane market is segmented into Cargo loading/unloading, Steel structure erection, Heavy equipment lifting, and Prefabricated component assembly. By end use, the telescopic crane market is segmented into Construction, Manufacturing, Oil & gas, Mining, Shipbuilding, Utilities, and Others. Regionally, the telescopic crane industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The truck mounted telescopic cranes segment is expected to contribute 39.60% of total market revenue by 2025 within the product category, making it the leading segment. This dominance is driven by the mobility and quick deployment capabilities of truck mounted cranes, which enable efficient lifting solutions across various urban and remote project sites.

These cranes are widely adopted due to their ease of transportation, minimal setup time, and flexibility in performing multiple tasks without the need for dedicated trailers or additional equipment. Industries favor this segment for short duration lifting needs and rapid job turnover, particularly in construction, telecom, and utility sectors.

The growing demand for multipurpose mobile lifting units has reinforced the leadership of truck mounted telescopic cranes in the product landscape.

The up to 20 tons segment is projected to account for 26.30% of total market revenue by 2025 in the lifting capacity category. This segment's strength lies in its suitability for light to medium duty applications, which are common in commercial construction, maintenance, and logistics operations.

Equipment in this range is easier to operate, requires less permitting, and is ideal for urban job sites with restricted access. The affordability, compact design, and reduced fuel consumption of cranes within this capacity band contribute to their broad adoption.

As small to mid scale construction projects continue to rise, especially in emerging economies, the demand for up to 20 tons lifting solutions is expected to remain strong.

The hydraulic telescopic cranes segment is anticipated to hold 64.80% of total market revenue by 2025 under the operation mode category, reflecting its dominant position. This leadership is attributed to the precision, power, and control provided by hydraulic systems, making them suitable for a wide range of lifting tasks.

These cranes enable smooth and controlled boom extension, reducing risk and improving load handling accuracy in dynamic environments. Their lower maintenance requirements and ability to perform in harsh weather or terrain conditions enhance their appeal across industries.

Continued innovation in hydraulic systems, including better energy efficiency and automated control features, has reinforced the segment’s value proposition, securing its top position in the telescopic crane market.

The telescopic crane market is expanding due to increasing demand in construction and industrial sectors, driven by cost efficiency, productivity, and regulatory compliance. The rental and industrial segments are crucial to this growth, with evolving safety standards pushing for innovation in crane design.

The telescopic crane market is driven by the growing demand for efficient lifting equipment in construction and infrastructure projects. As construction sites become more complex and confined, the need for versatile cranes that can reach high altitudes and navigate tight spaces is increasing. Telescopic cranes are ideal for urban environments, where space is limited, and for projects that require quick and efficient lifting capabilities. With global infrastructure development expanding, particularly in emerging economies, the demand for these cranes is expected to rise. This trend is further fueled by the shift toward modular and multi-functional equipment that can handle various lifting needs.

One of the primary factors driving growth in the telescopic crane market is the cost efficiency they offer in large-scale projects. These cranes help reduce operational costs by minimizing downtime and providing increased versatility. Their ability to reach extended heights without the need for additional support equipment reduces the overall project costs and increases productivity. Additionally, telescopic cranes require fewer operators than traditional cranes, contributing to labor cost savings. Their efficiency in material handling and quick deployment enhances overall site performance, making them a preferred choice for projects with tight timelines and budgets.

The industrial and rental segments are crucial to the growth of the telescopic crane market. Telescopic cranes are widely used in industrial applications such as warehouses, factories, and ports, where their ability to lift heavy loads over long distances is essential. Moreover, the rental market is expanding, as companies prefer to lease rather than purchase cranes for short-term or specific projects. This trend is particularly notable in the construction and energy sectors, where project durations may vary, and owning equipment may not be cost-effective. Rental companies are increasingly investing in high-performance telescopic cranes to cater to the growing demand.

Government regulations and safety standards significantly influence the development of the telescopic crane market. As construction and industrial projects become more complex, adherence to safety regulations is essential. Telescopic cranes are required to meet stringent safety standards for operation, load handling, and stability, ensuring worker safety and reducing accident rates. Regulatory bodies continually update safety protocols, prompting manufacturers to develop cranes that comply with these evolving requirements. Government-backed infrastructure projects, which prioritize safety and efficiency, are expected to further drive demand for high-quality telescopic cranes, particularly in regulated sectors such as energy and transportation.

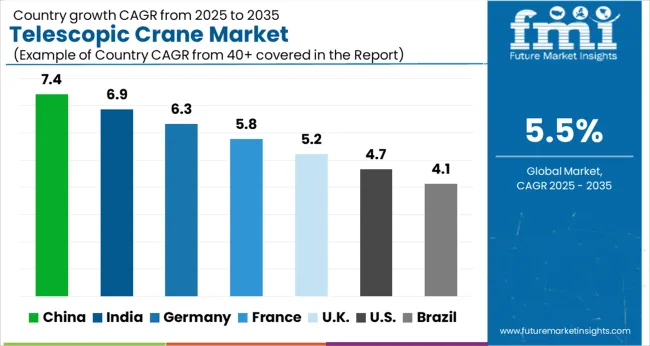

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The telescopic crane market is projected to grow globally at a CAGR of 5.5% from 2025 to 2035, driven by increasing demand in construction, infrastructure, and industrial applications. China leads with a CAGR of 7.4%, fueled by the rapid growth of the construction and infrastructure sectors, as well as increasing investments in renewable energy projects. India follows with a 6.9% CAGR, supported by rising urbanization and expanding industrial activities, which require efficient and versatile lifting solutions. France achieves a 5.8% CAGR, influenced by infrastructure development projects and the adoption of more specialized lifting equipment in urban construction. The UK records a 5.2% CAGR, aided by ongoing investments in construction and industrial sectors, with a focus on versatile and compact cranes. The USA maintains a 4.7% CAGR, driven by infrastructure projects, material handling in warehouses, and the increasing adoption of compact cranes in tight spaces. This growth outlook highlights the strong demand for telescopic cranes in Asia-Pacific, with steady adoption continuing in Europe and North America based on infrastructure developments and expanding industrial projects.

The CAGR for the telescopic crane market in the United Kingdom was around 4.8% during 2020–2024 and is projected to rise to 5.2% for 2025–2035. The slower growth in the earlier phase can be attributed to market constraints, such as high initial costs, limited demand for compact cranes in construction, and slow adoption in certain sectors. However, from 2025 onward, the market is expected to experience a stronger trajectory as the construction industry seeks more efficient, space-saving, and versatile lifting solutions. The need for cranes in urban construction, infrastructure, and renewable energy projects will increase demand. The rise in industrial and rental market adoption also contributes to this upward trend. Continued infrastructure investment, coupled with an emphasis on cost-effective and compact equipment, is likely to fuel growth in the coming years, with a focus on cranes that provide high reach and load-bearing capacity for confined spaces and complex projects.

China's telescopic crane market is projected to grow at a 7.4% CAGR from 2025 to 2035. The earlier phase, from 2020 to 2024, saw a growth rate of approximately 6.2%, influenced by the rapid expansion of large-scale construction projects, urban development, and infrastructure needs. With a booming construction sector and an increasing number of renewable energy projects, China has become a key player in the market. The demand for telescopic cranes is further driven by the country's focus on compact machinery capable of operating in limited spaces, which is vital in densely populated urban environments. With continued investment in infrastructure and industrial activities, this market is poised for accelerated growth in the coming decade. The shift to more versatile, space-efficient, and fuel-efficient cranes will be a driving force in China’s growth.

India's telescopic crane market is expected to grow at a 6.9% CAGR from 2025 to 2035. The earlier period from 2020 to 2024 saw a growth rate of approximately 6.0%, driven by rising construction, industrial expansion, and infrastructure development. As India continues to build its urban centers and industrial infrastructure, the demand for efficient and versatile cranes is increasing. Telescopic cranes are particularly suited for tight spaces, where their extended reach is a valuable asset. The growth is further supported by the rise of renewable energy projects and the need for cranes capable of lifting heavy loads in these challenging environments. With favorable government initiatives aimed at improving infrastructure and industrial capacities, the telescopic crane market in India is set for significant expansion in the coming years.

France is positioned for consistent expansion at a 5.4% CAGR through 2035 as OEMs emphasize occupant protection across compact crossovers and electrified models. Euro NCAP targets have steered manufacturers toward multi-airbag strategies, including center airbags in vehicles with wider cabins and bench-style rears. The supply base benefits from strong European manufacturing of inflators, textiles, and gas generators, which stabilizes lead times. Replacement flows remain supported by insurance-approved channels that favor certified modules and traceable serials. Exports of French-built models with richer safety content lift aggregate module demand beyond domestic registrations. The landscape rewards suppliers demonstrating reliable deployment curves across a wide range of seating positions and occupant sizes, a capability that has become a commercial differentiator.

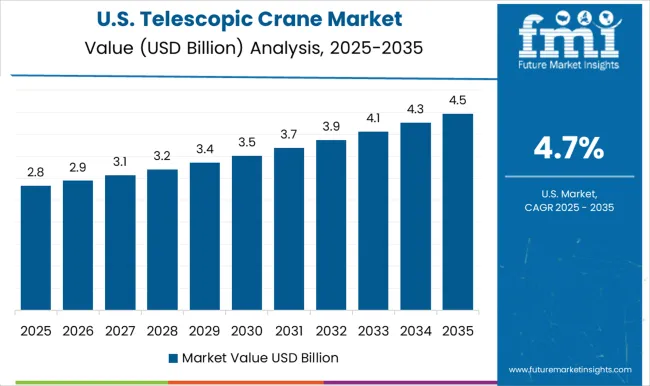

The USA telescopic crane market is projected to grow at a CAGR of 4.7% from 2025 to 2035, following a growth rate of approximately 4.2% during 2020–2024. The slower growth in the earlier period can be attributed to the saturation of mature markets and the focus on more established forms of lifting equipment in certain industries. However, the USA market is expected to experience steady growth due to an increasing emphasis on construction and industrial infrastructure, where telescopic cranes offer versatility and high reach. These cranes are particularly useful in industries like energy, logistics, and manufacturing, where heavy loads need to be moved in restricted spaces. The USA government's continued focus on infrastructure improvements, alongside private sector growth in renewable energy projects, will drive the adoption of telescopic cranes. The rental sector will also remain a key contributor to market expansion as businesses prefer to rent equipment for short-term projects rather than make significant capital investments in crane purchases.

The telescopic crane market is shaped by a combination of leading global crane manufacturers and specialized equipment producers delivering versatile lifting solutions for the construction and industrial sectors. Liebherr-International AG maintains a strong presence in the market with a focus on high-performance telescopic cranes designed for heavy-duty applications and urban construction.

Sany Group Co., Ltd. is a dominant player, offering cost-effective, reliable telescopic cranes that are widely used in construction and mining projects worldwide. Tadano Ltd. combines decades of engineering expertise with robust designs for its telescopic cranes, emphasizing reliability and efficiency in its product offerings. The Manitowoc Company, Inc. brings innovative, rugged telescopic cranes to the market, serving various industries, including infrastructure and energy.

Xuzhou Construction Machinery Group Co., Ltd. (XCMG) has become a major player, leveraging advanced technology to produce durable, multifunctional cranes suitable for diverse lifting applications. Zoomlion Heavy Industry Science and Technology Co., Ltd. offers advanced telescopic crane solutions with a focus on heavy-duty lifting capacity and enhanced reach. Competitors like Terex Corporation, Hitachi Sumitomo Heavy Industries, and Kobelco Construction Machinery Co., Ltd. also contribute to market diversity, with products tailored for high-efficiency and cost-effective operations in industries like construction and logistics.

Key competitive strategies in this market include technological innovation in crane performance, emphasis on multi-functionality and mobility, and a focus on expanding market presence through strong dealer networks. Manufacturers are also increasing their focus on providing tailored solutions for niche industries, such as renewable energy and large-scale infrastructure projects, to differentiate their products and meet the evolving needs of their customers.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.5 Billion |

| Product | Truck-mounted telescopic cranes, Rough terrain telescopic cranes, All-terrain telescopic cranes, and Crawler telescopic cranes |

| Lifting Capacity | Up to 20 tons, 21 to 50 tons, 51 to 100 tons, and Above 100 tons |

| Operation Mode | Hydraulic telescopic cranes and Electric telescopic cranes |

| Application | Cargo loading/unloading, Steel structure erection, Heavy equipment lifting, and Prefabricated component assembly |

| End Use | Construction, Manufacturing, Oil & gas, Mining, Shipbuilding, Utilities, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Liebherr-International AG, Furukawa UNIC Corporation, Hitachi Sumitomo Heavy Industries Construction Crane Co., Ltd., Kobelco Construction Machinery Co., Ltd., Manitex International, Inc., Sany Group Co., Ltd., Tadano Ltd., Terex Corporation, The Manitowoc Company, Inc., Xuzhou Construction Machinery Group Co., Ltd. (XCMG), and Zoomlion Heavy Industry Science and Technology Co., Ltd. |

| Additional Attributes | Dollar sales projections, market share by region and application, growth trends in construction and industrial sectors, competitive landscape, and demand for cranes in rental markets. |

The global telescopic crane market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the telescopic crane market is projected to reach USD 11.0 billion by 2035.

The telescopic crane market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in telescopic crane market are truck-mounted telescopic cranes, rough terrain telescopic cranes, all-terrain telescopic cranes and crawler telescopic cranes.

In terms of lifting capacity, up to 20 tons segment to command 26.3% share in the telescopic crane market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Telescopic Masts Market Size and Share Forecast Outlook 2025 to 2035

Telescopic Inspection Mirror Market Size and Share Forecast Outlook 2025 to 2035

Telescopic Tool Boxes Market Growth - Demand & Forecast 2025 to 2035

Industry Share Analysis for Telescopic Masts Companies

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Crane Cabin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Crane Rental Market Analysis by Product Type, End-Use Industry, and Region through 2035

Crane Aftermarket Growth – Trends & Forecast 2025 to 2035

Crane Motors Market Growth – Trends & Forecast 2025 to 2035

Crane Market Growth - Trends & Forecast 2025 to 2035

Key Companies & Market Share in Crane Scales Industry

Crane Scales Market Analysis – Growth, Demand & Forecast 2024-2034

Mini Cranes Market Size and Share Forecast Outlook 2025 to 2035

Yard Crane Market Size and Share Forecast Outlook 2025 to 2035

Global Mini Cranes Market Share Analysis – Growth, Trends & Forecast 2025–2035

Fixed Cranes Market Size and Share Forecast Outlook 2025 to 2035

Tower Crane Rental Market Growth – Trends & Forecast 2025 to 2035

Tower Crane Market Growth - Trends & Forecast 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Marine Cranes Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA