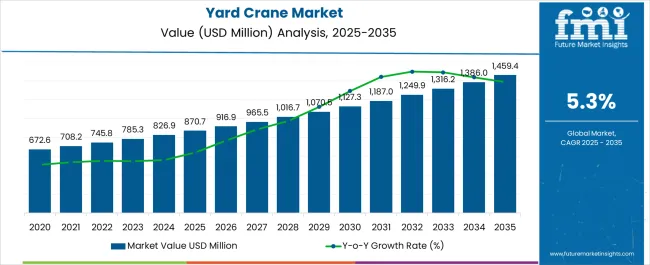

The yard crane market is projected to expand from USD 870.7 million in 2025 to USD 1,459.4 million by 2035, registering a 5.3% CAGR. In absolute terms, this equates to a compound increase of nearly USD 588.7 million over the forecast period, reflecting both baseline demand expansion and new infrastructure-driven adoption. Yard cranes, essential for container handling, port logistics, and intermodal freight operations, benefit directly from global trade activity, port modernization programs, and the scaling up of inland logistics hubs.

Compound absolute growth analysis highlights how incremental gains accumulate over successive years, generating long-term market momentum. Unlike percentage-based growth rates that only reflect proportional change, the compound absolute perspective shows the tangible value addition each year brings to the market size. Early years will see steady but moderate gains, while the compounding effect ensures a sharper increase in later years as reinvestments and capacity expansions align with rising throughput volumes. Asia Pacific contributes the highest share of absolute growth due to significant port automation and capacity expansion projects, while Europe and North America deliver consistent increments driven by efficiency upgrades and environmental compliance requirements. With USD 588.7 million in compounded gains, the market trajectory underscores a resilient and measurable expansion path supported by trade dynamics and infrastructure investments.

| Metric | Value |

|---|---|

| Yard Crane Market Estimated Value in (2025 E) | USD 870.7 million |

| Yard Crane Market Forecast Value in (2035 F) | USD 1459.4 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

The yard crane market is driven by five primary parent markets with specific shares. Port and container terminals lead with 40%, as yard cranes handle container stacking and movement efficiently. Logistics and freight distribution contribute 25%, supporting cargo management in inland depots and distribution hubs. Industrial applications account for 15%, where cranes manage bulk materials and heavy equipment. Rail yards represent 10%, using yard cranes for intermodal loading and unloading.

Construction projects hold 10%, employing cranes for heavy lifting and material handling. These segments collectively shape global demand for yard cranes, driving investment in automation and high-capacity lifting solutions. Recent developments in the yard crane market focus on automation, electrification, and digital integration. Manufacturers are introducing hybrid and electric cranes to reduce emissions and improve operational efficiency. Remote monitoring, IoT-enabled fleet management, and AI-based automation are enhancing safety, precision, and productivity. Semi-automated and fully automated yard cranes are gaining adoption in ports and terminals to meet rising cargo volumes. Structural enhancements and lightweight materials are improving durability and energy efficiency.

The yard crane market is advancing steadily, supported by the growth of global trade, containerized cargo movement, and port infrastructure modernization. Increasing demand for efficient cargo handling operations in shipping yards has driven the adoption of technologically advanced cranes with higher load capacities and operational flexibility.

The current market landscape reflects rising investments in automation, electrification, and remote monitoring systems to enhance throughput and reduce operational downtime. Sustainability initiatives, including the shift toward energy-efficient and low-emission crane systems, are further shaping procurement decisions.

Expansion of container ports, coupled with increasing vessel sizes, has intensified the need for cranes capable of handling larger volumes with precision. With ongoing port expansions and rising global freight activity, the yard crane market is positioned for continued growth across key maritime hubs.

The yard crane market is segmented by product, application - shipping yards, and geographic regions. By product, yard crane market is divided into Rubber-tired gantry (RTG) crane and Rail-mounted gantry (RMG) crane. In terms of application - shipping yards, yard crane market is classified into Application - Ports, Application - Rail yards, and Application - Container handling facilities. Regionally, the yard crane industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rubber-tired gantry (RTG) crane segment dominates the product category with approximately 57.6% share, supported by its versatility, mobility, and efficiency in container handling operations. RTG cranes are capable of stacking containers several rows high and wide, optimizing yard space utilization while allowing flexible movement across the terminal.

The segment benefits from technological upgrades such as hybrid power systems, automation integration, and real-time monitoring capabilities, which improve operational efficiency and reduce fuel consumption. Increasing demand for cost-effective and flexible container handling solutions in both large and medium-sized ports has reinforced the segment’s leadership.

With continued investments in port automation and sustainable crane technologies, RTG cranes are expected to maintain their dominant market position.

The shipping yards application segment holds approximately 23.6% share, reflecting its role as a primary operational environment for yard cranes. Shipping yards require efficient container handling to manage high cargo turnover and minimize vessel docking times.

The segment’s demand is supported by rising global trade volumes, expansion of port capacity, and the trend toward mega-ships requiring rapid loading and unloading operations. Technological advancements in crane control systems, safety features, and energy efficiency have enhanced operational performance in shipping yards.

With sustained growth in containerized shipping and increased investment in port infrastructure upgrades, the shipping yards application segment is projected to maintain steady demand within the yard crane market.

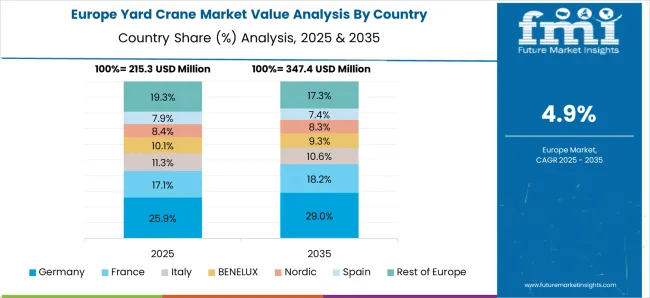

The yard crane market is expanding due to rising container traffic, port modernization, and logistics infrastructure investments. Asia Pacific accounts for over 45% of demand, with China, South Korea, and India upgrading port facilities. Europe emphasizes electrified and automated cranes to meet sustainability targets, while North America focuses on intermodal terminals and large-scale container yards. Rubber-tired gantry (RTG) cranes and rail-mounted gantry (RMG) cranes dominate adoption, supported by digital fleet management systems. Growing e-commerce trade and increasing container volumes continue to drive measurable market growth across global shipping and logistics hubs.

Containerized trade is the primary driver of the yard crane market. With global container volumes exceeding 850 million TEUs annually, ports and intermodal terminals require efficient handling systems. Asia Pacific leads the market with large-scale expansion projects in China’s coastal ports and India’s inland container depots. North America emphasizes intermodal logistics hubs, integrating yard cranes with rail freight systems. RTG cranes remain widely used due to flexibility, while RMG cranes are favored for automated container yards. Rising e-commerce demand and increasing reliance on just-in-time supply chains further accelerate yard crane adoption to improve operational efficiency and throughput capacity.

Opportunities in the yard crane market are shaped by automation, electrification, and digital technologies. Automated stacking cranes are being deployed in Europe’s advanced ports, reducing labor costs and enhancing safety. Asia Pacific ports are adopting hybrid-electric and fully electric RTG cranes to lower emissions and meet international energy efficiency standards. North America is exploring AI-driven fleet management systems for yard crane operations at intermodal hubs. Emerging markets in Africa and Latin America are investing in port modernization, creating opportunities for crane suppliers. Manufacturers offering energy-efficient, automated, and remote-controlled cranes are positioned to capture growth across global logistics infrastructure projects.

Key trends include deployment of IoT-enabled monitoring systems, fleet optimization software, and eco-friendly power solutions. Digitalization allows predictive maintenance, real-time crane performance tracking, and improved yard management efficiency. Hybrid and fully electric yard cranes are increasingly replacing diesel-powered models, reducing fuel consumption by up to 40%. Asia Pacific is rapidly deploying smart fleet management systems to handle rising container throughput, while Europe leads in adopting automation for sustainable operations. North America is focusing on upgrading existing crane fleets with hybrid retrofits. Global shipping operators are investing in digital twin technology to optimize yard crane performance and reduce downtime.

The yard crane market faces restraints related to high capital investment and infrastructure constraints. Modern automated stacking cranes and electrified RTG units involve higher upfront costs compared to conventional cranes, limiting adoption in smaller ports and developing economies. Infrastructure upgrades such as reinforced yard layouts, electrification, and digital systems integration add further expense. Operational challenges, including skilled workforce shortages and complex maintenance requirements, slow down adoption. In regions with limited container throughput, return on investment for advanced cranes remains uncertain. Addressing cost-efficiency, modular designs, and financing models will be essential to overcome these barriers and expand adoption globally.

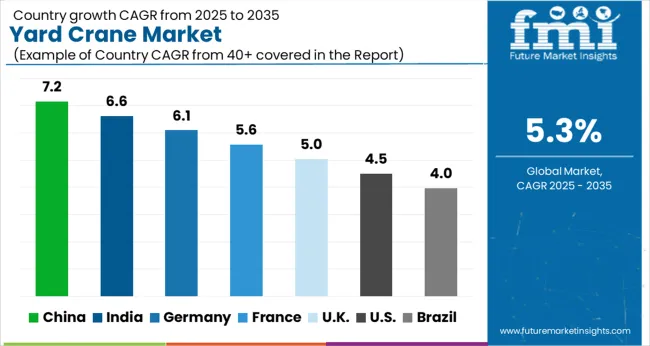

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The yard crane market is expected to grow at a global CAGR of 5.3% through 2035, supported by rising demand in ports, logistics, and industrial handling operations. China leads at 7.2%, a 1.36× multiple of the global benchmark, driven by BRICS-focused infrastructure expansion, industrial cargo handling, and port modernization. India follows at 6.6%, a 1.25× multiple, reflecting increased industrial activity, urban infrastructure growth, and logistics sector expansion. Germany records 6.1%, a 1.15× multiple, shaped by OECD-backed operational efficiency, smart port technologies, and industrial automation. The United Kingdom posts 5.0%, slightly below the global rate, with adoption concentrated in commercial ports and industrial facilities. The United States stands at 4.5%, 0.85× the benchmark, supported by steady demand in cargo handling, construction, and industrial logistics. BRICS countries drive volume expansion, OECD regions focus on technological advancement and efficiency, while ASEAN markets contribute through growing infrastructure and industrial activity. This report includes insights on 40+ countries; the top markets are shown here for reference.

The yard crane market in China is projected to grow at a CAGR of 7.2%, driven by rapid expansion of container ports, industrial logistics hubs, and e-commerce distribution centers. Manufacturers such as ZPMC, Shanghai Electric, and Liebherr are supplying automated, high-capacity, and energy-efficient yard cranes for container handling and heavy industrial operations. Adoption is concentrated in major coastal ports and inland depots with high throughput. Technological trends include electric and hybrid drives, automated stacking systems, and remote monitoring for enhanced operational efficiency. Government initiatives to modernize ports and support logistics infrastructure reinforce market growth, while increasing import-export volumes and demand from the e-commerce sector strengthen adoption.

Analysis of Yard Crane Market in India The yard crane market in India is expected to grow at a CAGR of 6.6%, supported by expansion of major ports, industrial clusters, and logistics parks. Manufacturers including BEML, Tata Projects, and Liebherr supply high-efficiency, long-life yard cranes for container and industrial handling. Adoption is concentrated in metropolitan ports and industrial corridors with high throughput requirements. Government initiatives such as the Sagarmala program and port modernization schemes are driving investment in advanced crane technologies. Technological innovations such as electric and automated systems enhance operational efficiency and reduce maintenance costs. Growth is further supported by rising e-commerce volumes and the increasing need for efficient industrial freight handling.

The yard crane market in Germany is projected to grow at a CAGR of 6.1%, driven by port modernization, industrial logistics automation, and adoption of energy-efficient solutions. Leading players such as Liebherr, Konecranes, and Kalmar are supplying high-capacity cranes for container terminals and industrial applications. Demand is concentrated in Hamburg, Bremen, and other major container ports. Technological trends include hybrid and electric drives, automated stacking cranes, and remote monitoring systems to improve operational efficiency. Industrial logistics in manufacturing and e-commerce sectors also contribute to growth. Environmental regulations promoting energy-efficient equipment encourage the adoption of hybrid and low-emission yard cranes.

The yard crane market in the United Kingdom is expected to expand at a CAGR of 5.0%, supported by container port modernization, industrial logistics projects, and automation initiatives. Suppliers including Liebherr, Kalmar, and Konecranes provide high-efficiency yard cranes suitable for container terminals and industrial hubs. Adoption is concentrated in ports such as Felixstowe, Southampton, and major inland logistics centers. Technological trends include electric and hybrid cranes, remote monitoring, and automated stacking systems for operational efficiency. Government investment in port upgrades and energy-efficient solutions encourages adoption, while rising e-commerce logistics demand strengthens market growth.

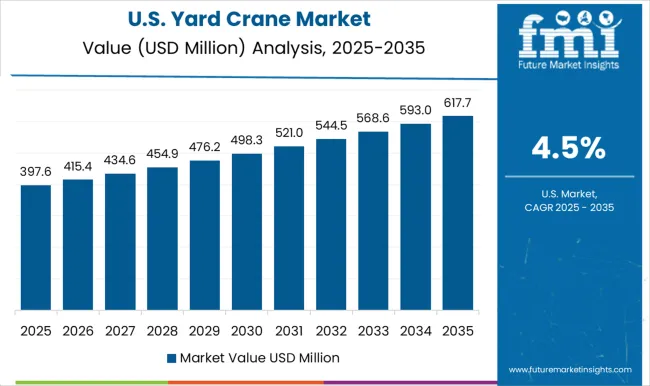

The yard crane market in the United States is projected to grow at a CAGR of 4.5%, supported by container port expansion, industrial logistics growth, and automation adoption. Key manufacturers such as Liebherr, Konecranes, and Terex supply high-capacity, energy-efficient yard cranes with advanced control systems. Adoption is concentrated in major ports including Los Angeles, Long Beach, Savannah, and inland logistics hubs. Technological trends include hybrid and electric drive systems, automated stacking, and remote monitoring solutions. Investments in energy-efficient and low-maintenance cranes support sustainable operations. Rising import-export volumes, e-commerce logistics, and industrial freight handling reinforce steady market demand.

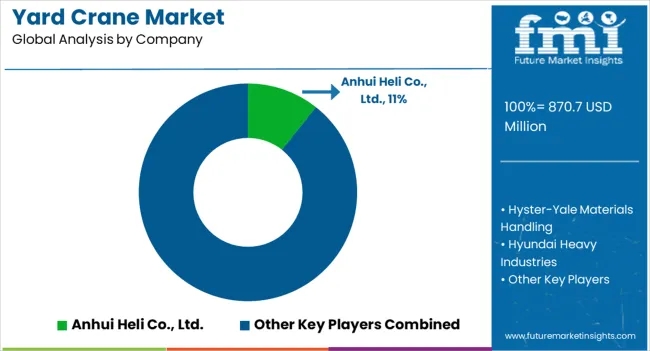

Competition in the yard crane market is driven by global heavy equipment manufacturers and specialized lifting solution providers, focusing on load capacity, operational efficiency, and durability. Liebherr Group, Konecranes, and Mitsubishi Heavy Industries lead with high-capacity cranes designed for ports, container yards, and industrial terminals, emphasizing precision control, safety features, and energy-efficient operation in their brochures. Hyundai Heavy Industries, SANY Group, and Terex Corporation offer versatile models for varied lifting requirements, highlighting reliability and minimal maintenance needs. Anhui Heli Co., Ltd., Hyster-Yale Materials Handling, and Toyota Industries Corporation focus on compact and maneuverable yard cranes, targeting smaller terminals and warehouses. KION Group combines automation and ergonomic design, promoting intelligent lifting solutions suitable for modern logistics operations. Brochures detail load charts, operational specifications, maintenance schedules, and safety certifications, enabling buyers to assess performance and suitability. Marketing materials shape competitive advantage, combining technical schematics, operational guidance, and real-world application examples.

Frequent updates reflect evolving safety regulations, energy efficiency improvements, and technological enhancements such as automation and remote monitoring. Large firms leverage global distribution networks and brand recognition, while smaller players emphasize flexibility, customization, and rapid deployment. Market leadership depends on how effectively brochures communicate load capacity, operational reliability, and long-term value in yard crane solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 870.7 Million |

| Product | Rubber-tired gantry (RTG) crane and Rail-mounted gantry (RMG) crane |

| Application - Shipping yards | Application - Ports, Application - Rail yards, and Application - Container handling facilities |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Anhui Heli Co., Ltd., Hyster-Yale Materials Handling, Hyundai Heavy Industries, KION Group, Konecranes, Liebherr Group, Mitsubishi Heavy Industries, SANY Group, Terex Corporation, and Toyota Industries Corporation |

| Additional Attributes | Dollar sales by beverage type and end use, demand dynamics across retail, foodservice, and online channels, regional trends in organic consumption and health awareness, innovation in flavors, functional ingredients, and packaging, environmental impact of sourcing and production, and emerging use cases in plant-based, functional, and ready-to-drink beverages. |

The global yard crane market is estimated to be valued at USD 870.7 million in 2025.

The market size for the yard crane market is projected to reach USD 1,459.4 million by 2035.

The yard crane market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in yard crane market are rubber-tired gantry (rtg) crane and rail-mounted gantry (rmg) crane.

In terms of application - shipping yards, _rubber-tired gantry (rtg) crane segment to command 23.6% share in the yard crane market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Crane Cabin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Crane Rental Market Analysis by Product Type, End-Use Industry, and Region through 2035

Crane Motors Market Growth – Trends & Forecast 2025 to 2035

Crane Aftermarket Growth – Trends & Forecast 2025 to 2035

Crane Market Growth - Trends & Forecast 2025 to 2035

Key Companies & Market Share in Crane Scales Industry

Crane Scales Market Analysis – Growth, Demand & Forecast 2024-2034

Mini Cranes Market Size and Share Forecast Outlook 2025 to 2035

Global Mini Cranes Market Share Analysis – Growth, Trends & Forecast 2025–2035

Fixed Cranes Market Size and Share Forecast Outlook 2025 to 2035

Tower Crane Rental Market Growth – Trends & Forecast 2025 to 2035

Tower Crane Market Growth - Trends & Forecast 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Marine Cranes Market Growth - Trends & Forecast 2025 to 2035

Spider Cranes Market Analysis based on Lifting Capacity, Operation, Control System, Application, Ownership and Region: A Forecast from 2025 to 2035

Stacker Crane Market Growth – Trends & Forecast 2025 to 2035

Lattice Cranes Market

Stiffleg Crane Market Size and Share Forecast Outlook 2025 to 2035

Overhead Crane Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA