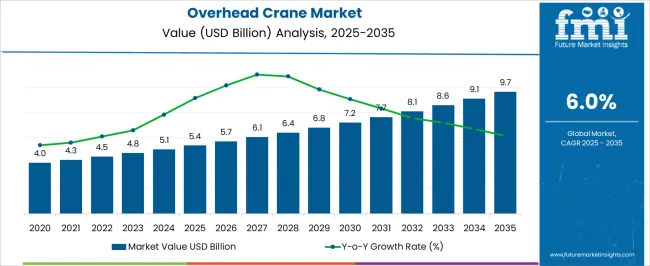

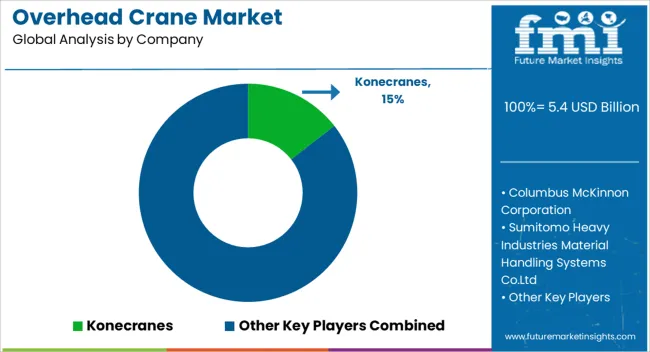

The Overhead Crane Market is estimated to be valued at USD 5.4 billion in 2025 and is projected to reach USD 9.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. From 2020 to 2024, the industry experienced its early adoption phase, with market values rising steadily from USD 4.0 billion in 2020 to USD 5.1 billion in 2024. The modernization of industrial facilities drove this stage, the rising demand for efficiency in material handling, and the adoption of automation in warehouses and manufacturing plants. However, growth was gradual, reflecting the limited penetration of smart cranes and integration with IoT and AI technologies.

The scaling phase (2025–2030) represents the first major growth surge, with values increasing from USD 5.4 billion in 2025 to around USD 7.2 billion by 2030. Here, technological advancements, such as remote monitoring, predictive maintenance, and improved safety systems, accelerate adoption across construction, automotive, and logistics sectors. The second breakpoint occurs in the consolidation phase (2030–2035), where the market matures and growth stabilizes, expanding from USD 7.2 billion to USD 9.7 billion. At this stage, differentiation is shaped by efficiency, lifecycle services, and energy-efficient designs. Competition centers around advanced automation, sustainability, and integration into Industry 4.0 ecosystems.

| Metric | Value |

|---|---|

| Overhead Crane Market Estimated Value in (2025 E) | USD 5.4 billion |

| Overhead Crane Market Forecast Value in (2035 F) | USD 9.7 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

A surge in infrastructure development and construction activities across both developed and emerging economies is influencing the current market scenario. Companies are increasingly focused on enhancing operational safety and efficiency, leading to the adoption of technologically advanced crane systems.

Investor briefings and corporate strategy updates from equipment manufacturers emphasize the integration of remote diagnostics, IoT, and predictive maintenance, which is helping extend product life cycles and reduce downtime. The future outlook remains positive as industries such as automotive, steel, and logistics continue to invest in capacity expansion.

Additionally, rising awareness regarding workplace safety and labor cost optimization is prompting companies to replace conventional systems with intelligent lifting equipment. These combined factors are paving the path for further market expansion in the coming years, reinforcing the relevance and demand for overhead cranes across industrial sectors.

The overhead crane market is segmented by cranes, lifting capacity, business industry, and geographic regions. By cranes, the overhead crane market is divided into Bridge crane, Gantry crane, Jib crane, and Others. In terms of lifting capacity, the overhead crane market is classified into medium-duty (5-10 tons), light-duty (up to 5 tons), and heavy-duty (more than 10 tons). Based on business, the overhead crane market is segmented into Original Equipment Manufacturer (OEM) and Aftermarket. By industry, the overhead crane market is segmented into Metal & mining, Automotive, Manufacturing, Aerospace, Utilities, Shipyards, and Others. Regionally, the overhead crane industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

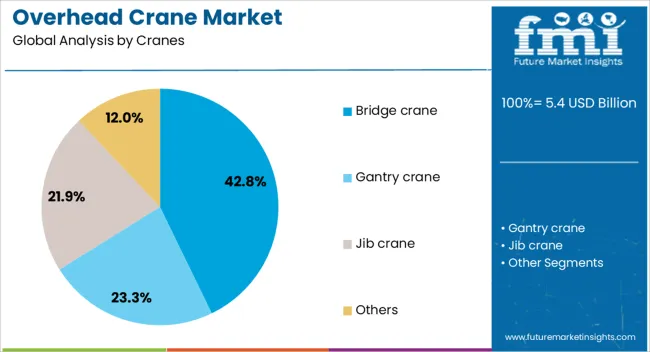

The bridge crane segment is projected to contribute 42.8% of the Overhead Crane Market revenue share in 2025, making it the dominant crane type. This leading position has been supported by the bridge crane’s ability to offer high load stability, efficient material handling, and flexibility in covering large operational areas. Industrial publications and product announcements from crane manufacturers indicate that bridge cranes are widely deployed in manufacturing and assembly lines due to their capacity to manage repetitive lifting tasks with precision.

Their long-span configuration has enabled usage in high-volume production units where uninterrupted workflow is critical. Additionally, companies have favored bridge cranes for their compatibility with modern automation systems and advanced safety features.

The segment’s dominance has also been influenced by its reduced need for manual labor, consistent performance across varying workloads, and adaptability to both light and heavy-duty operations. These operational advantages have strengthened the segment’s adoption and ensured its continued growth through 2025.

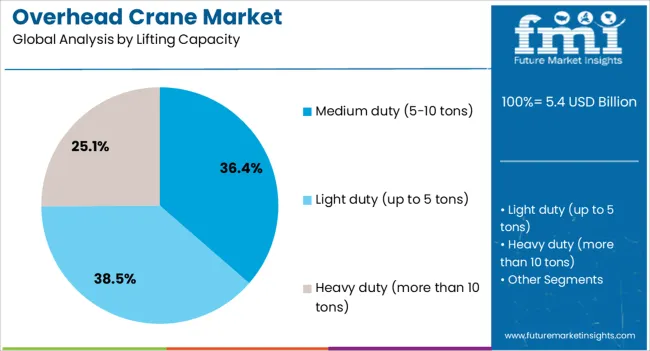

The medium-duty (5–10 tons) segment is estimated to hold 36.4% of the Overhead Crane Market revenue share in 2025, reflecting a strong preference across multiple industries. This growth has been driven by increasing demand for flexible and efficient lifting solutions in medium-scale production environments. Use in manufacturing, metal processing, and warehouse applications has been prominent, as noted in equipment catalogs and technical specifications shared by leading manufacturers.

Medium duty cranes have been favored for balancing cost-efficiency and performance while meeting operational requirements in small to mid-sized facilities. Furthermore, their adaptability to various load types and compatibility with semi-automated and automated systems have made them an optimal choice for businesses seeking scalability.

Reports from industry-focused journals have highlighted a steady rise in orders for this capacity range due to its ability to support moderate lifting without compromising safety standards.

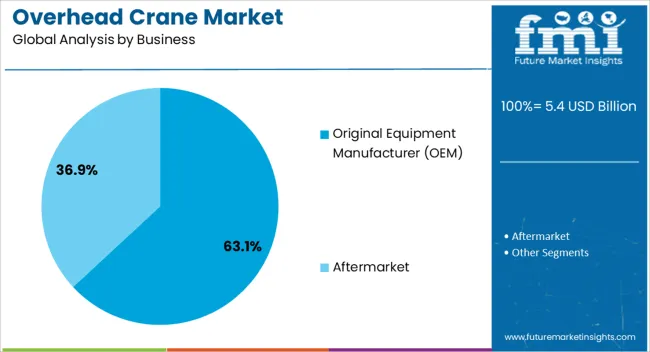

The original equipment manufacturer (OEM) segment is projected to account for 63.1% of the Overhead Crane Market revenue share in 2025, making it the leading business segment. This position has been reinforced by strong demand for new crane installations across greenfield projects and industrial expansions. OEMs have been instrumental in supplying customized crane systems that meet project-specific requirements while ensuring compliance with regional safety and performance standards.

Investor presentations and annual reports from major crane manufacturers have highlighted a growing trend among industries to invest in advanced OEM-built systems rather than retrofitting older models. The OEM segment’s strength has also been supported by its ability to provide integrated digital solutions, including remote monitoring, data analytics, and maintenance planning.

These capabilities have helped businesses minimize unplanned downtime and improve productivity. As industries aim for operational excellence and future-proofing of assets, reliance on OEMs for high-performance and fully compliant crane systems has significantly increased, securing the segment’s top position in 2025.

The overhead crane market is witnessing steady growth as industries such as manufacturing, construction, automotive, and logistics increasingly adopt these systems for material handling and heavy-load operations. Demand is supported by the need for efficient lifting solutions that enhance safety, reduce labor dependence, and improve workflow efficiency. Growth in industrial expansion and warehousing further strengthens adoption across regions. While factors like high initial investment and maintenance costs may limit small-scale adoption, innovation in design, automation, and after-sales services supports long-term opportunities.

The growing industrial base and expanding warehousing networks are key contributors to overhead crane adoption. These cranes streamline the lifting and movement of bulky loads, reducing operational downtime and enhancing throughput. Industries like steel, automotive, and heavy machinery manufacturing rely on overhead cranes for handling raw materials and finished products. Warehousing and logistics operators also employ cranes to manage increasing cargo volumes. With global supply chains becoming more complex, the demand for cranes that improve efficiency and reduce manual handling risks is steadily increasing.

Overhead cranes are increasingly being designed with advanced safety mechanisms and efficiency-enhancing features. Collision detection systems, automated load monitoring, and ergonomic operator controls minimize risks in heavy-duty operations. Such innovations ensure compliance with stringent workplace safety standards while improving productivity. Additionally, cranes with energy-efficient motors and durable components help reduce long-term operational costs. The combination of safety, reliability, and performance makes these systems attractive investments for industries with demanding material handling requirements. This trend is expected to strengthen customer trust and adoption across sectors.

The overhead crane market features a mix of global leaders and regional manufacturers, resulting in intense competition. Large-scale suppliers offer advanced crane systems with integrated service contracts, while regional players attract buyers with cost-effective and customized solutions. Price competition remains high, especially in developing regions, but brand reputation and after-sales service strongly influence purchasing decisions. Companies investing in customer-focused services such as maintenance packages, training programs, and spare parts availability gain a competitive edge. This rivalry ensures a wide variety of crane options for buyers.

Despite clear benefits, overhead crane adoption faces hurdles related to high initial investment, ongoing maintenance, and operator training. Small and medium enterprises often hesitate to invest due to limited capital budgets. Regular inspections and upkeep are necessary to comply with safety regulations, adding to operational expenses. Additionally, a shortage of skilled operators can affect utilization efficiency. Companies offering rental services, financing options, and comprehensive support packages are helping to mitigate these concerns, but cost sensitivity remains a notable barrier for widespread adoption.

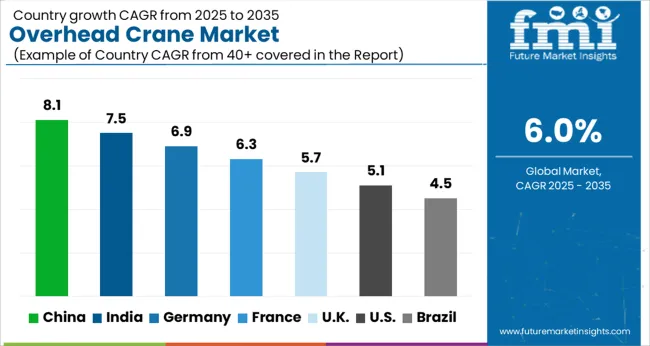

The global overhead crane market is projected to grow at a CAGR of 6.0%, driven by rising demand in manufacturing, construction, logistics, and heavy industries. China dominates the market with an 8.1% growth rate, supported by large-scale infrastructure projects, rapid industrialization, and modernization of manufacturing facilities. India follows at 7.5%, benefiting from growing investments in construction, smart cities, and industrial automation. Germany maintains steady growth at 6.9%, fueled by advanced engineering and high demand in automotive and heavy machinery sectors. The UK records a 5.7% growth rate, supported by warehouse automation and logistics modernization, while the USA grows at 5.1%, driven by infrastructure upgrades and expansion in industrial applications. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the Overhead Crane Market with an impressive growth rate of 8.1%, reflecting the country’s rapid industrialization and strong construction activities. The demand is particularly high in manufacturing, steel production, shipbuilding, and logistics sectors, where cranes play a critical role in material handling and operational efficiency. Government investments in smart factories, infrastructure development, and renewable energy projects also contribute to the sector’s strong performance. With automation and IoT integration becoming key industry trends, Chinese companies are upgrading traditional cranes to modern, sensor-driven systems that improve safety and productivity. Additionally, the presence of leading domestic manufacturers provides competitive pricing and robust local supply chains, further fueling adoption. The country’s ongoing focus on technological advancements and export-oriented manufacturing positions China as a dominant global hub for overhead crane production and utilization.

Overhead crane market in India is expanding at 7.5%, supported by increasing investments in infrastructure, real estate, and manufacturing. As the country accelerates industrial growth under initiatives like “Make in India,” demand for advanced material-handling equipment is on the rise. Overhead cranes are widely used in steel plants, automotive manufacturing, and port operations, where they ensure efficient lifting and transportation of heavy loads. The rapid growth of e-commerce and warehousing sectors also supports adoption, with cranes enhancing productivity and safety in large distribution facilities. Moreover, rising interest in automation and digital monitoring systems is gradually modernizing traditional operations. The presence of both domestic manufacturers and international players ensures a competitive landscape, providing businesses with cost-effective yet advanced solutions. India’s expanding construction activities and industrial output will continue driving strong market growth in the coming years.

Germany records a steady CAGR of 6.9% in the Overhead Crane Market, driven by its highly advanced manufacturing sector and emphasis on precision engineering. The country is a hub for industries such as automotive, aerospace, and heavy machinery, which rely heavily on overhead cranes for safe and efficient operations. German manufacturers are recognized for introducing technologically advanced cranes with features like energy efficiency, remote monitoring, and improved safety mechanisms. The demand is also rising in logistics hubs and renewable energy projects, particularly wind energy, where cranes play a critical role in assembly. Government support for Industry 4.0 further accelerates adoption of smart and automated cranes across factories. With sustainability gaining importance, eco-friendly crane designs and energy-efficient solutions are becoming widely adopted. Germany’s reputation for innovation and engineering excellence ensures steady growth in both domestic and export markets.

The United Kingdom overhead crane market is projected to grow at 5.7%, fueled by rising demand across construction, manufacturing, and logistics industries. Infrastructure projects, particularly in transportation and renewable energy, are creating new opportunities for overhead crane deployment. The market is also supported by a growing need for modernization of existing material-handling equipment to meet higher safety and efficiency standards. British industries are adopting cranes with advanced control systems, automation features, and remote monitoring capabilities, which improve operational performance. Additionally, the growing warehousing sector, driven by e-commerce expansion, requires cranes for effective material handling. The UK also emphasizes sustainability, with an increasing focus on energy-efficient crane models. Although growth is moderate compared to Asia, continuous investments in infrastructure and industrial modernization will ensure steady expansion of the market.

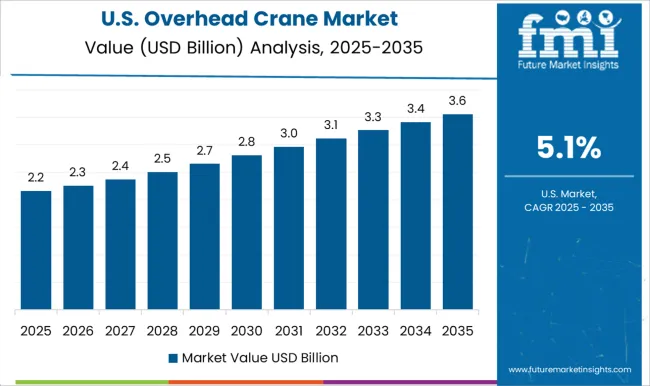

The USA Overhead Crane Market grows at 5.1%, supported by strong industrial activities in sectors like automotive, steel, construction, and aerospace. The country emphasizes safety, productivity, and automation, driving investments in advanced crane technologies with IoT integration and remote operation systems. Warehousing and logistics industries, fueled by the rise of e-commerce, are increasingly adopting overhead cranes to improve efficiency. The USA government’s investments in infrastructure modernization, including bridges, highways, and energy projects, create consistent demand for cranes in large-scale construction. Furthermore, the market benefits from the presence of global and local players offering technologically advanced solutions. Sustainability trends are also influencing crane designs, with growing demand for energy-efficient and low-emission models. While competition is intense, strong technological innovation and a focus on operational efficiency will continue to shape the USA market’s steady growth.

Konecranes and Columbus McKinnon Corporation are among the leading global players, offering a broad portfolio of technologically advanced cranes, hoists, and lifting equipment. Sumitomo Heavy Industries Material Handling Systems Co., Ltd. and Kito Corp strengthen the market with their precision-engineered products and innovations in material handling. Demag Cranes & Components GmbH and STAHL CraneSystems are renowned for their German engineering and reliability, serving industries worldwide. Liebherr Group and Terex Corporation leverage their expertise in heavy machinery to expand crane solutions across multiple applications. Cargotec Corporation and ZPMC (Shanghai Zhenhua Heavy Industries) are major players in port and container handling cranes, dominating global shipping hubs. ABUS Kransysteme GmbH, GH Cranes & Components, and Ralf Teichmann GmbH provide tailored crane solutions for industrial customers. Meanwhile, Weihua Group and EMH, Inc. are expanding their footprint by offering cost-effective and versatile overhead crane systems. With increasing automation, safety compliance requirements, and demand for customized lifting solutions, the overhead crane market is expected to witness significant growth worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.4 Billion |

| Cranes | Bridge crane, Gantry crane, Jib crane, and Others |

| Lifting Capacity | Medium duty (5-10 tons), Light duty (up to 5 tons), and Heavy duty (more than 10 tons) |

| Business | Original Equipment Manufacturer (OEM) and Aftermarket |

| Industry | Metal & mining, Automotive, Manufacturing, Aerospace, Utilities, Shipyards, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Konecranes, Columbus McKinnon Corporation, Sumitomo Heavy Industries Material Handling Systems Co.Ltd, Ralf Teichmann GmbH, Gorbel Cranes, ABUS Kransysteme GmbH, Kito Corp, GH Cranes & Components, Weihua Group, EMH, Inc, Terex Corporation, Cargotec Corporation, Liebherr Group, ZPMC, Demag Cranes & Components GmbH, and STAHL CraneSystems |

| Additional Attributes | Dollar sales by type including bridge cranes, gantry cranes, and jib cranes, application across manufacturing, construction, and shipping yards, and region covering North America, Europe, and Asia-Pacific. Growth is driven by expanding industrial automation, increasing construction activities, and rising demand for efficient material handling solutions. |

The global overhead crane market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the overhead crane market is projected to reach USD 9.7 billion by 2035.

The overhead crane market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in overhead crane market are bridge crane, gantry crane, jib crane and others.

In terms of lifting capacity, medium duty (5-10 tons) segment to command 36.4% share in the overhead crane market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Overhead Conductor Market Size and Share Forecast Outlook 2025 to 2035

Overhead Cables Market Size, Growth, and Forecast 2025 to 2035

Conventional Overhead Conductor Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Overhead Conductor Market Size and Share Forecast Outlook 2025 to 2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Crane Cabin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Crane Rental Market Analysis by Product Type, End-Use Industry, and Region through 2035

Crane Motors Market Growth – Trends & Forecast 2025 to 2035

Crane Aftermarket Growth – Trends & Forecast 2025 to 2035

Crane Market Growth - Trends & Forecast 2025 to 2035

Key Companies & Market Share in Crane Scales Industry

Crane Scales Market Analysis – Growth, Demand & Forecast 2024-2034

Mini Cranes Market Size and Share Forecast Outlook 2025 to 2035

Yard Crane Market Size and Share Forecast Outlook 2025 to 2035

Global Mini Cranes Market Share Analysis – Growth, Trends & Forecast 2025–2035

Fixed Cranes Market Size and Share Forecast Outlook 2025 to 2035

Tower Crane Rental Market Growth – Trends & Forecast 2025 to 2035

Tower Crane Market Growth - Trends & Forecast 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Marine Cranes Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA