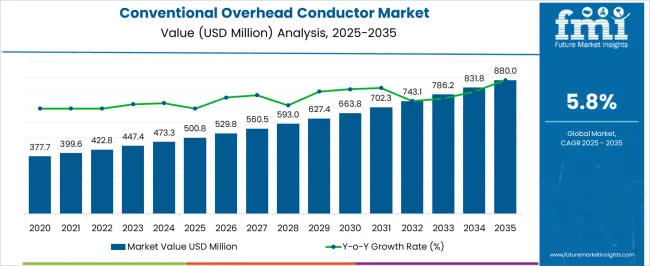

The conventional overhead conductor market is estimated to be valued at USD 500.8 million in 2025 and is projected to reach USD 880.0 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

The conventional overhead conductor market is anticipated to grow from USD 500.8 million in 2025 to nearly USD 880 million by 2035, reflecting a CAGR of 5.8% across the forecast horizon. Yearly progressions show a steady climb in demand, moving from USD 529.8 million in 2026 to USD 831.8 million in 2034, before reaching the projected peak in 2035. The volatility index suggests that while growth remains consistent, occasional fluctuations in raw material prices, installation costs, and regulatory approvals could create variations in market pace. Still, the sector demonstrates resilience, as the need for reliable grid infrastructure and expansion of transmission networks continues to be reinforced by regional energy requirements and cross-border power trade initiatives.

The conventional overhead conductor market’s long-term growth pattern portrays it as a sector of necessity rather than choice, with its role central to power transmission and grid stability. Investors and industry participants can view the 5.8% CAGR as a sign of sustained demand, particularly where grid expansion and modernization projects remain critical. The volatility index also indicates that while temporary demand shifts may occur due to economic cycles, the reliance on conventional conductors for cost-effective and tested solutions provides a stable foundation. In my view, the industry’s ability to balance efficiency, affordability, and dependable performance will keep conventional conductors relevant even as alternatives emerge, positioning this segment as a steady yet vital contributor to the global transmission infrastructure landscape.

| Metric | Value |

|---|---|

| Conventional Overhead Conductor Market Estimated Value in (2025 E) | USD 500.8 million |

| Conventional Overhead Conductor Market Forecast Value in (2035 F) | USD 880.0 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The conventional overhead conductor market has been integrated into multiple parent segments, holding nearly 18-20% of the power transmission market, close to 12-14% of the electrical equipment market, around 15-17% of the utility infrastructure market, nearly 10-12% of the grid modernization market, and about 14-16% of the energy distribution market. Taken together, the overall contribution accounts for approximately 69-79%, which highlights the entrenched reliance of energy systems on conventional overhead conductors for reliable electricity delivery.

The use of such conductors has been sustained due to their proven cost-effectiveness, mechanical strength, and broad deployment across emerging and developed economies, even as alternative advanced conductors and underground cabling have gained some presence. In opinion, the dominance of conventional overhead conductors persists because utility providers often prioritize tried-and-tested solutions that minimize both initial investment and long-term operational risk.

Their role in grid expansion projects, rural electrification programs, and interregional connectivity has been pronounced, as utilities continue to depend on established materials and designs rather than shifting prematurely toward costly alternatives. Despite pressures from newer technologies, conventional overhead conductors have been viewed as the backbone of transmission and distribution networks due to their operational familiarity and scalability. The market, therefore, remains strongly interlinked with broader electrical and infrastructure investments, underscoring its relevance within the parent domains.

The conventional overhead conductor market is advancing steadily, supported by ongoing infrastructure upgrades, grid expansion projects, and rising electricity demand across emerging and developed economies. As governments and utilities prioritize the modernization of transmission and distribution networks, conventional conductors continue to play a vital role in ensuring efficient and reliable power delivery.

Their established cost-effectiveness, ease of installation, and compatibility with existing infrastructure have sustained demand, particularly in high-load applications. The push for rural electrification, industrial development, and inter-regional grid connectivity is further boosting market relevance.

Looking forward, the market is expected to maintain resilience as energy security and reliability remain critical national objectives. Investments in renewable integration and cross-border electricity trade will further reinforce the deployment of proven conductor technologies

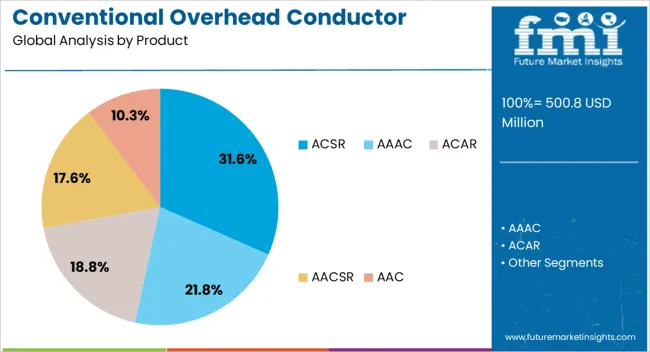

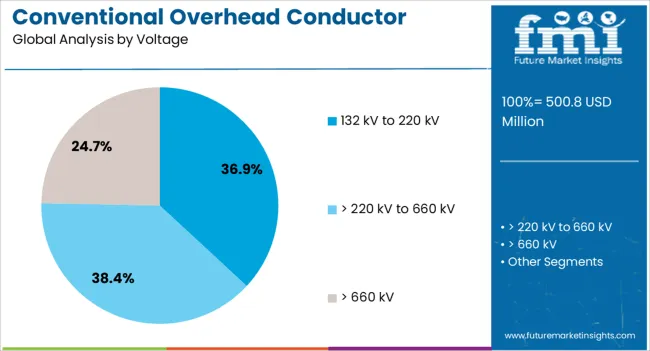

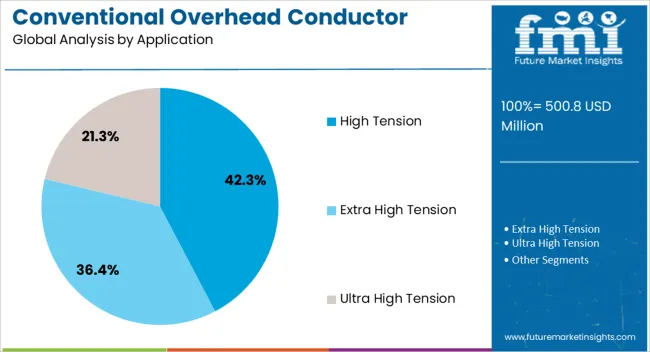

The conventional overhead conductor market is segmented by product, voltage, application, and geographic regions. By product, conventional overhead conductor market is divided into ACSR, AAAC, ACAR, AACSR, and AAC. In terms of voltage, conventional overhead conductor market is classified into 132 kV to 220 kV, > 220 kV to 660 kV, and > 660 kV. Based on application, conventional overhead conductor market is segmented into high tension, extra high tension, and ultra high tension. Regionally, the conventional overhead conductor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ACSR (Aluminum Conductor Steel Reinforced) product segment leads the conventional overhead conductor market with a 31.6% share, favored for its superior strength-to-weight ratio and high tensile capacity. Widely adopted in high-voltage transmission lines, ACSR conductors are valued for their ability to span long distances with minimal sag, making them ideal for varied terrain and extreme weather conditions.

Their durability and corrosion resistance, especially with galvanized steel cores, have ensured widespread usage across power utilities and state transmission agencies. As grid operators continue to replace aging infrastructure and expand capacity, ACSR remains a preferred solution due to its proven reliability and economic efficiency.

This segment is expected to remain dominant, supported by standardization in utility procurement practices and consistent performance in demanding operational environments

The 220 kV to 660 kV segment holds a significant 38.4% share of the market by voltage, reflecting its role as a backbone range for high-capacity power transmission and inter-regional grid connectivity. These voltages are widely utilized for long-distance electricity transport, bulk power transfer, and integration of large-scale generation assets such as hydropower and renewables.

Utilities favor this range for its ability to minimize transmission losses while handling substantial power loads, making it essential for national grid stability and cross-border interconnections. The segment’s prominence is driven by large-scale infrastructure projects, interregional transmission upgrades, and growing renewable integration into centralized grids.

As countries expand high-voltage transmission corridors and modernize aging networks, the 220 kV to 660 kV range is expected to maintain strategic importance in ensuring grid reliability, reduced congestion, and efficient delivery of electricity across vast distances.

The high tension application segment accounts for a dominant 42.3% market share, underlining its essential function in medium and long-distance electricity transmission across densely populated and industrialized regions. High tension conductors are deployed to efficiently transport large volumes of electricity from generation hubs to load centers, often traversing challenging environmental conditions.

The reliability and mechanical strength of conventional overhead conductors in this category make them suitable for demanding infrastructure projects where uninterrupted power supply is critical. Governments and utilities continue to focus on high tension networks to reduce transmission losses and enhance grid efficiency, especially in the face of growing electricity consumption.

The segment’s sustained leadership is supported by its compatibility with legacy systems and critical role in high-capacity power corridors, reinforcing its relevance in both ongoing expansions and replacement programs.

The conventional overhead conductor market is being driven by demand from grid expansion and infrastructure modernization projects. Opportunities are being created by refurbishment of aging networks, rural electrification programs, and interconnection projects across regions. Trends such as grid upgrades, cross-border power trade, and customized procurement standards are reshaping market behavior. However, challenges related to competition from advanced alternatives, raw material volatility, and regulatory delays continue to test suppliers. Overall, the market remains significant due to its practical role in balancing affordability with reliability in transmission infrastructure.

The conventional overhead conductor market is witnessing robust demand as grid expansion projects and electricity reliability requirements continue to intensify worldwide. Power utilities are placing higher emphasis on transmission and distribution infrastructure upgrades to accommodate rising electricity consumption from residential, commercial, and industrial sectors. Conventional conductors are being chosen for their durability, cost-effectiveness, and established performance across varied climatic conditions, making them the most preferred option in large-scale power projects. Expanding rural electrification programs and integration of renewable energy into existing transmission grids are also playing a key role in shaping this demand. Developing regions in Asia-Pacific and Africa are emerging as high-demand zones due to government-backed initiatives to strengthen electricity networks. The demand surge is further reinforced by the replacement cycle of aging infrastructure in developed economies, highlighting the relevance of conventional overhead conductors in both expansion and modernization efforts.

The market for conventional overhead conductors is being presented with expansive opportunities as modernization of outdated power networks has become a pressing requirement for utilities. Many transmission and distribution systems, especially in Europe and North America, are facing efficiency concerns due to age, making refurbishment projects critical. Conventional conductors are offering opportunities in such projects where cost-sensitive upgrades are prioritized without compromising operational reliability. Countries with rising electricity demand are seeking efficient and scalable solutions, creating new contracts for suppliers. Emerging economies are extending opportunities as national programs prioritize rural grid electrification and cross-border interconnections to stabilize supply-demand imbalances. Vendors are positioned to benefit from these opportunities by aligning with government tenders, large-scale EPC contractors, and private grid operators. Opportunities also exist in upgrading sub-transmission lines and secondary distribution circuits, where conventional solutions are considered the most practical choice compared to newer but costlier alternatives.

Notable trends are shaping the conventional overhead conductor market as regional interconnections and cross-border electricity trade are being pursued aggressively. Power utilities are emphasizing the creation of stronger grids capable of carrying electricity across longer distances, prompting renewed investments in transmission lines. Upgrades of outdated networks to reduce line losses and improve energy efficiency are also trending, with conventional conductors being widely applied in secondary and mid-level networks. Another emerging trend is the preference for conductors with improved thermal capacity and reduced sag, as utilities balance cost and efficiency considerations. Suppliers are tailoring product lines to meet specific regional standards, reflecting a growing trend of customization in procurement strategies. Increasing collaborations between governments and private utilities to strengthen interregional power corridors are further reinforcing the deployment of conventional conductors. These trends indicate a steady market evolution where practicality and affordability continue to outweigh experimental alternatives.

The conventional overhead conductor market faces persistent challenges caused by stiff competition, rising raw material costs, and regulatory pressures. The entry of advanced conductor technologies, such as high-temperature low-sag conductors, poses competition by offering performance advantages that may attract certain utilities despite higher costs. Volatility in aluminum and steel prices creates uncertainty in procurement contracts, reducing margins for manufacturers and suppliers. Regulatory frameworks surrounding land acquisition, environmental clearances, and right-of-way approvals for transmission projects continue to delay implementation timelines, impacting market growth. Geopolitical risks and trade restrictions on raw material exports further complicate supply chains, forcing vendors to adapt quickly. Utilities are also demanding higher efficiency standards, pressuring suppliers to innovate within the conventional product category. These challenges underline the competitive tension in the market, requiring players to strike a balance between cost, compliance, and consistent delivery timelines.

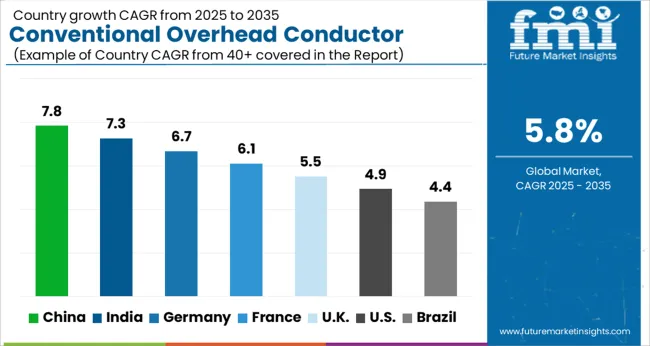

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The global conventional overhead conductor market is projected to grow at a CAGR of 5.8% from 2025 to 2035. China leads the expansion with a growth rate of 7.8%, followed by India at 7.3% and Germany at 6.7%. The United Kingdom is forecast to grow at 5.5%, while the United States is expected to expand at 4.9%. Market growth is being supported by investments in power transmission infrastructure, increasing electricity demand, and modernization of aging grids. Emerging economies such as China and India are prioritizing transmission network expansion to meet rising power needs, while developed nations like Germany, the UK, and the USA are focusing on upgrading grid reliability and integrating renewable energy. This report includes insights on 40+ countries; the top markets are shown here for reference.

The conventional overhead conductor market in China is expanding at a CAGR of 7.8%, the highest among leading regions, driven by large-scale grid expansion and power distribution projects. China’s rapid industrial growth and rising electricity consumption are pushing authorities to strengthen transmission lines across provinces. The government’s strong focus on renewable energy integration, particularly wind and solar, requires robust overhead conductors to transport power over long distances from generation hubs to consumption centers. Domestic manufacturers are increasing production capacity and improving conductor efficiency to meet demand. With urban clusters and industrial parks requiring reliable supply, the market is also supported by grid modernization programs. Challenges exist in balancing cost efficiency with advanced conductor technologies, but China remains the largest contributor to global demand.

The conventional overhead conductor market in India is growing at a CAGR of 7.3%, reflecting strong demand for power transmission infrastructure. Rising electricity consumption from residential, commercial, and industrial users is pressuring utilities to expand and modernize networks. India’s government-backed electrification initiatives, combined with policies promoting renewable integration, are strengthening the need for high-capacity overhead conductors. Increasing private sector investments in power projects further enhance demand. Rural electrification and inter-state transmission corridors are particularly driving large-scale installations. While challenges remain in cost management and timely project execution, India continues to emerge as one of the most attractive markets for conductor suppliers, with opportunities across both urban and rural expansion projects.

The conventional overhead conductor market in Germany is advancing at a CAGR of 6.7%, driven by the country’s strong commitment to grid modernization and renewable energy integration. Germany’s transition toward renewable energy under the Energiewende program requires efficient long-distance transmission of wind and solar power. Investments in upgrading old infrastructure and creating new high-voltage transmission lines are fueling conductor demand. The automotive and manufacturing industries’ electricity requirements also strengthen the case for robust power delivery networks. Regulatory support for green energy integration ensures steady project execution, while rising demand for energy efficiency encourages the adoption of higher-performance conductor types. Germany stands as one of the leading European contributors to market growth due to its large-scale infrastructure development and focus on decarbonization.

The conventional overhead conductor market in the United Kingdom is forecast to grow at a CAGR of 5.5%, with demand being shaped by grid modernization and renewable integration. The UK’s energy strategy emphasizes shifting toward renewable generation sources such as offshore wind, which requires enhanced transmission infrastructure. Aging power grids across the country necessitate upgrades, creating consistent demand for overhead conductors. Utilities and transmission operators are investing in strengthening networks to handle fluctuating renewable inputs while maintaining reliability. Challenges include regulatory constraints and project delays, but the need to support long-term decarbonization targets continues to drive investments. The UK market outlook is stable, supported by its balanced focus on modernizing infrastructure and enabling renewable growth.

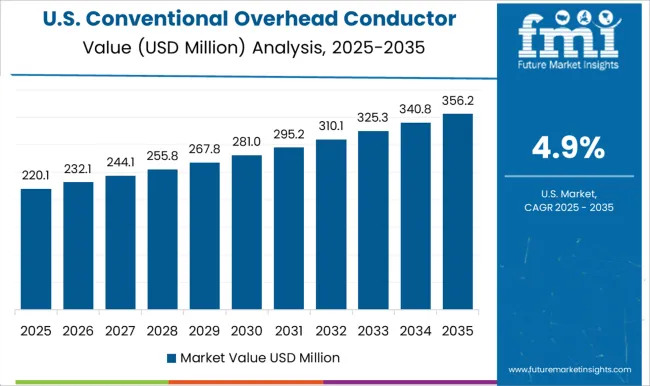

The conventional overhead conductor market in the United States is expanding at a CAGR of 4.9%, reflecting steady but slower growth compared to emerging markets. The country’s electricity grid is one of the largest in the world, yet much of its infrastructure is aging, prompting the need for upgrades. Growth is being supported by investments in strengthening resilience against extreme weather events, as well as efforts to integrate renewable energy sources such as solar and wind. Demand from utilities for high-capacity conductors is increasing in regions with growing industrial and residential load requirements. While regulatory complexities and high project costs remain barriers, the USA market is sustained by modernization programs and government initiatives aimed at energy reliability and renewable expansion.

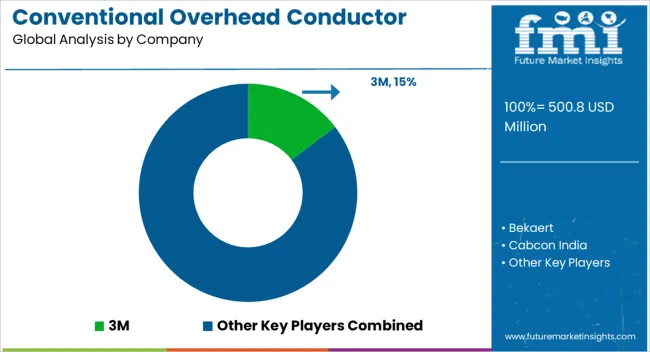

The conventional overhead conductor market plays an essential role in electricity transmission and distribution networks, supporting global demand for reliable power infrastructure. Companies such as 3M, Bekaert, Prysmian Group, Nexans, and Southwire Company, LLC are recognized as leading players with extensive expertise in manufacturing conductors that ensure efficiency, durability, and long-distance transmission capacity. These firms are complemented by regional manufacturers like Sterlite Power, KEI Industries, Elsewedy Electric, and Gupta Power, which supply to fast-developing electricity grids in Asia, the Middle East, and Africa.

Specialized suppliers such as CTC Global, Cabcon India, and Galaxy Transmissions contribute with customized conductor solutions tailored to local requirements. Additionally, companies including Sumitomo Electric, LS Cable & System, and ZTT are expanding their influence in global projects by offering diverse conductor portfolios that cater to transmission operators’ needs. The wide representation of multinational giants and domestic producers ensures that this market is competitive, price-sensitive, and highly project-driven. Market growth is shaped by the rising demand for electricity transmission to support industrialization, renewable energy integration, and grid modernization initiatives.

Increasing investments in upgrading existing power grids and constructing new high-voltage lines are driving greater demand for conventional conductors. Companies like Sterlite Power and Elsewedy Electric are actively engaging in large-scale projects in developing regions, while global manufacturers such as Prysmian Group, Nexans, and Southwire continue to dominate technologically advanced markets with proven conductor quality and capacity.

Emerging players such as ZMS Cable and Tropical Cable & Conductor are gaining traction by catering to niche regional demands, ensuring broader participation in infrastructure growth. The presence of firms like 3M and Bekaert, with a focus on material innovation, is also helping improve conductor performance in terms of strength-to-weight ratio and resistance to environmental stress. Overall, the conventional overhead conductor market is expanding steadily, supported by the dual drivers of energy transition and infrastructure expansion, with established and regional companies competing to secure long-term grid development contracts.

| Items | Values |

|---|---|

| Quantitative Units | USD 500.8 million |

| Product | ACSR, AAAC, ACAR, AACSR, and AAC |

| Voltage | 132 kV to 220 kV, > 220 kV to 660 kV, and > 660 kV |

| Application | High Tension, Extra High Tension, and Ultra High Tension |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Bekaert, Cabcon India, CMI, CTC Global, Eland Cables, Elsewedy Electric, Galaxy Transmissions, Gupta Power, Hindustan Urban Infrastructure, KEI Industries, LS Cable & System, Nexans, Prysmian Group, Priority Wire & Cable, Inc., Special Cables, Sterlite Power, Sumitomo Electric, Southwire Company, LLC, Tropical Cable & Conductor, ZMS Cable, and ZTT |

| Additional Attributes | Dollar sales by conductor type (AAC, AAAC, ACSR, ACAR) and application (transmission lines, distribution lines, utilities, railways) are key metrics. Trends include rising demand for reliable electricity transmission, growth in grid expansion projects, and increasing replacement of aging infrastructure. Regional deployment, regulatory compliance, and material advancements are driving market growth. |

The global conventional overhead conductor market is estimated to be valued at USD 500.8 million in 2025.

The market size for the conventional overhead conductor market is projected to reach USD 880.0 million by 2035.

The conventional overhead conductor market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in conventional overhead conductor market are ACSR, AAAC, ACAR, AACSR, and AAC.

In terms of voltage, 220 kv to 660 kv segment to command 38.4% share in the conventional overhead conductor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Conventional Palletizers Market Size and Share Forecast Outlook 2025 to 2035

Conventional Motorcycles & Scooters Market Growth - Trends & Forecast 2025 to 2035

Portable Conventional Generator Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Overhead Crane Market Size and Share Forecast Outlook 2025 to 2035

Overhead Cables Market Size, Growth, and Forecast 2025 to 2035

Overhead Conductor Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Overhead Conductor Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Vacuum Feedthroughs Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Assembly and Testing Service Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Lift-off Resists Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Inspection System Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Grade Carbon Fiber Rigid Felts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Semiconductor Intellectual Property Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Grade Carbon Fiber Soft Felts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Semiconductor Fingerprint Collector Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Semiconductor Metrology and Inspection Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Defect Inspection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Bonding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA