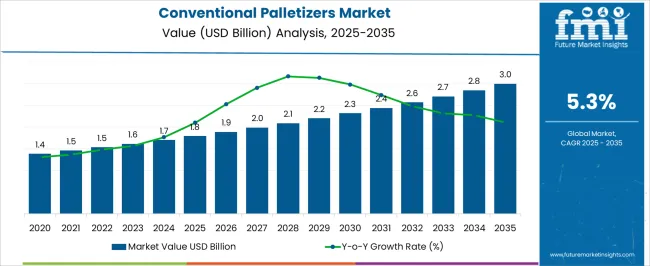

The Conventional Palletizers Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. A 5-year growth block analysis highlights the phased expansion and evolving adoption patterns across the industry. In the first block, from 2025 to 2029, the market is expected to grow from USD 1.7 billion to roughly USD 1.8 billion, indicating gradual uptake driven by small and medium-scale manufacturing facilities seeking basic automation solutions. The second block, covering the period from 2030 to 2034, shows an increase from USD 1.9 billion to approximately USD 2.7 billion, reflecting a stronger emphasis on operational efficiency, labor reduction, and the broader deployment of conventional palletizers in the food, beverage, and consumer goods industries.

Annual gains in this period remain moderate yet consistent, demonstrating steady market consolidation and standardization of technology. The final block, culminating in 2035 at USD 3.0 billion, represents a mature stage where adoption saturates in high-volume production lines while expanding selectively in emerging regions. Over the entire period, this 5-year block analysis underscores how gradual investment cycles, industrial automation trends, and efficiency-driven upgrades shape market growth, offering manufacturers and suppliers insights to optimize production strategies, target strategic geographies, and align capacity with evolving demand across the global palletizing sector.

| Metric | Value |

|---|---|

| Conventional Palletizers Market Estimated Value in (2025 E) | USD 1.8 billion |

| Conventional Palletizers Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The conventional palletizers market is closely influenced by five interconnected parent markets that collectively drive its adoption and long-term growth. The largest contributor is the food and beverage packaging market, which accounts for about 35% share, as conventional palletizers are extensively used to automate the stacking of cartons, cases, and bottles, ensuring efficiency in high-volume production lines. The consumer goods and household products sector contributes around 25%, as packaged goods such as detergents, personal care items, and packaged snacks rely on palletization for storage, handling, and distribution. The logistics and warehousing solutions market holds close to 15% influence, supported by the demand for efficient pallet handling, storage optimization, and material movement across supply chains. The industrial manufacturing and machinery sector adds nearly 12%, as manufacturers of packaging lines, conveyors, and robotic integration systems depend on palletizers to streamline operations and reduce manual labor costs.

The e-commerce and retail fulfillment market contributes close to 8%, as the rise in online order fulfillment drives the need for automated pallet stacking for faster dispatch and order consolidation. The distribution of market influence shows that food and beverage, along with consumer packaged goods, form the backbone of the conventional palletizers market, while logistics and industrial integration continue to enhance operational efficiency and commercial adoption.

The conventional palletizers market is gaining traction due to growing industrial automation and the need for reliable, high-speed material handling solutions in manufacturing and logistics operations. As industries scale up production volumes, conventional palletizers offer an efficient means to stack, transport, and organize products such as boxes, cases, and bags with minimal manual intervention.

These systems are known for their durability, ease of maintenance, and suitability for high-throughput environments. Compared to robotic alternatives, conventional palletizers present a cost-effective and proven solution, especially in applications where speed and consistency are prioritized over flexibility.

The market is expected to witness further growth as sectors like food and beverage, chemicals, and consumer goods invest in streamlined packaging and warehousing operations. Rising labor costs and workplace safety regulations also contribute to the adoption of palletizing systems, positioning the market for continued expansion in both established and emerging economies.

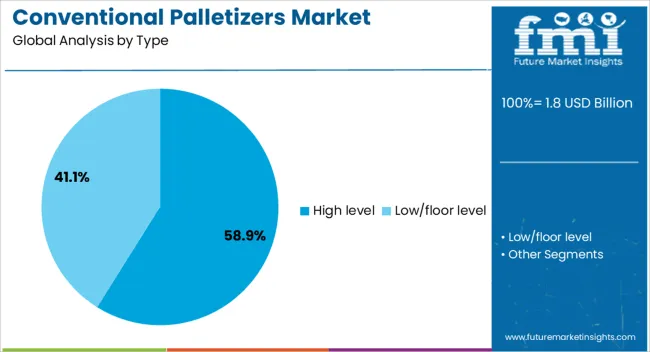

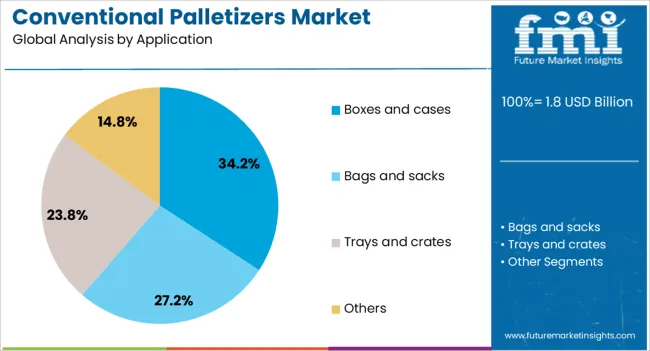

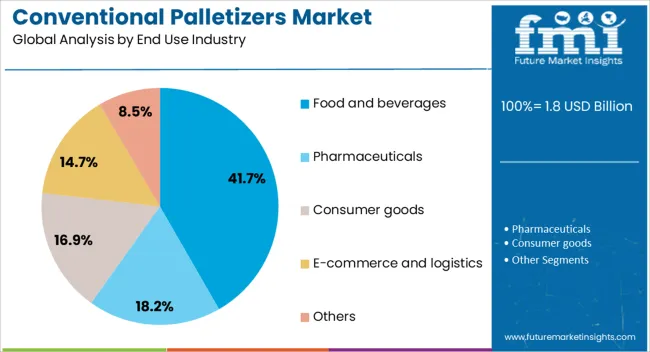

The conventional palletizers market is segmented by type, application, end use industry, distribution channel, and geographic regions. By type, conventional palletizers market is divided into High level and Low/floor level. In terms of application, conventional palletizers market is classified into Boxes and cases, Bags and sacks, Trays and crates, and Others. Based on end use industry, conventional palletizers market is segmented into Food and beverages, Pharmaceuticals, Consumer goods, E-commerce and logistics, and Others. By distribution channel, conventional palletizers market is segmented into Direct sales and Indirect sales. Regionally, the conventional palletizers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The high level palletizer segment leads the market with a 59% share in the type category, owing to its ability to handle high-speed and high-volume palletizing operations efficiently. These systems operate with product infeed positioned at an elevated level, allowing for seamless stacking of items from conveyor belts onto pallets with minimal downtime.

High level palletizers are widely favored in industries that require fast and continuous operation, such as beverages, chemicals, and packaged goods. Their robust design, combined with advanced layer-forming mechanisms, ensures consistent output and reduced operational disruptions.

Manufacturers are continuously enhancing machine flexibility and integrating programmable logic controls to meet varying production needs. As production facilities focus on maximizing throughput and reducing labor dependency, the high level segment is anticipated to maintain its stronghold in the palletizing equipment market.

The boxes and cases application segment commands 34% of the conventional palletizers market, reflecting its essential role in packaging, storage, and distribution processes. Conventional palletizers are extensively used to handle standard corrugated boxes and rigid cases, which form the bulk of secondary packaging in various industries.

Their ability to process uniform, stackable loads with precision and speed makes them ideal for large-scale operations with repetitive packaging formats. With rising e-commerce activities and bulk product shipments, the need for secure and efficient handling of boxed goods has increased significantly.

The segment benefits from advancements in system customization and compatibility with different pallet sizes, enabling seamless integration into existing production lines. As manufacturers strive for operational efficiency and reduced manual handling, the demand for palletizing solutions tailored to box and case applications is expected to remain robust.

The food and beverages sector holds a leading 42% share in the end use industry category, driven by its high production volumes and stringent packaging requirements. Conventional palletizers are widely used in this sector to manage diverse packaging formats, including boxes, trays, and shrink-wrapped bundles, ensuring stability during transportation and storage.

The growing emphasis on hygiene, speed, and precision in food processing facilities supports the widespread adoption of automated palletizing systems. With expanding product portfolios and increased SKU diversity, food and beverage manufacturers require palletizers capable of accommodating various sizes and load configurations.

Additionally, the shift toward sustainable packaging and recyclable materials calls for palletizers that can handle lightweight and delicate products without compromising efficiency. The segment is expected to maintain strong demand for conventional palletizers as industry players invest in automation to meet evolving consumer and regulatory expectations.

The conventional palletizer market is shaped by rising demand for automated material handling, integration with packaging and supply chain systems, emphasis on reliability and safety, and regional industrial growth. Adoption is being fueled by industries seeking efficiency, reduced labor dependency, and streamlined operations. Cost-effective and durable solutions are attracting both small and large-scale manufacturers. Regional expansion, supported by e-commerce and industrial modernization, is enhancing market penetration and enabling global supply chain optimization. These combined dynamics are fostering sustained growth, encouraging equipment innovation, and reinforcing the strategic importance of conventional palletizers across diverse manufacturing and logistics sectors.

The market is being driven by increasing automation in material handling and warehousing operations. Industries such as food and beverage, pharmaceuticals, and consumer goods are adopting palletizers to improve operational efficiency, reduce labor costs, and enhance workplace safety. Conventional palletizers offer reliable stacking and organization of products for shipment and storage, making them essential in high-volume production environments. Growing industrialization and expansion of manufacturing facilities in emerging economies are further increasing demand. Companies are investing in these systems to streamline logistics, reduce turnaround times, and optimize warehouse space, contributing to sustained market growth.

Conventional palletizers are being increasingly integrated with upstream packaging and downstream distribution systems. Automation in packaging lines, conveyor systems, and labeling operations enhances the overall efficiency of palletizing processes. This integration ensures seamless handling from production to dispatch, minimizing product damage and reducing operational delays. Companies offering turnkey solutions are gaining a competitive edge by providing comprehensive systems that meet specific industrial needs. The ability to adapt palletizers to various packaging sizes, shapes, and weights is strengthening their adoption across industries. Efficient supply chain operations supported by conventional palletizers are becoming a key driver of market expansion.

Manufacturers are emphasizing the reliability, durability, and cost-effectiveness of conventional palletizers. These systems are preferred in environments where consistent performance and low maintenance are critical. Safety features such as emergency stops, protective enclosures, and ergonomic designs are enhancing workplace compliance and reducing injury risks. Cost efficiency is achieved through energy-saving mechanisms, minimal downtime, and scalable operation capabilities. Industries with moderate automation needs often favor conventional palletizers over fully robotic alternatives due to lower capital expenditure. By balancing performance, safety, and cost, these systems continue to attract investment from small and medium-sized manufacturing units as well as large-scale industrial players.

The conventional palletizer market is benefiting from industrial growth and modernization of warehouses across North America, Europe, and Asia-Pacific. Expansion of e-commerce, retail distribution, and FMCG sectors has increased the need for efficient pallet handling solutions. Local manufacturing and assembly operations in emerging regions are boosting market penetration. Collaborations between equipment manufacturers and logistics providers are improving supply chain efficiency and service support. Regional regulatory standards and safety compliance also influence product design and adoption. These factors are driving broader deployment of conventional palletizers, ensuring consistent market growth and positioning manufacturers to capture new industrial opportunities globally.

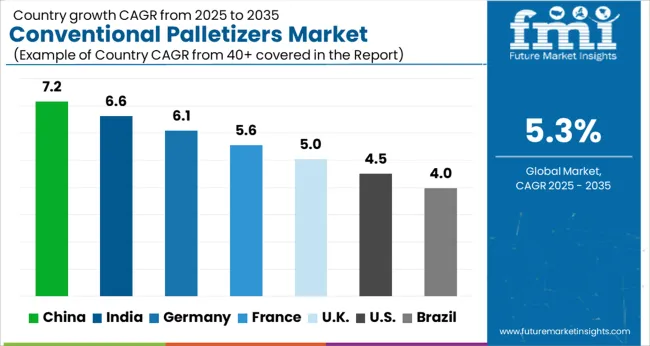

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The global conventional palletizers market is projected to grow at a CAGR of 5.3% between 2025 and 2035. China and India, as leading BRICS economies, drive adoption through expanding manufacturing bases, e-commerce logistics, and increasing automation in packaging lines. Germany, the UK, and the USA, representing mature OECD markets, focus on high-precision palletizing systems, integration with robotics, and efficiency improvements in warehousing and supply chains. Growth is further supported by rising demand for industrial automation, standardization of pallet handling, and optimization of labor costs. Asia dominates in volume deployment, while Europe and North America lead in technologically advanced solutions, system reliability, and service integration. The analysis spans over 40+ countries, with the leading markets detailed below.

The conventional palletizer market in China is projected to grow at a CAGR of 7.2% from 2025 to 2035, supported by rapid industrialization and increasing automation adoption in manufacturing and logistics sectors. Rising labor costs and the need for efficient material handling are driving investments in conventional palletizers across food and beverage, automotive, and pharmaceutical industries. Advanced logistics infrastructure and e-commerce growth facilitate wider deployment of automated systems. Domestic and international suppliers are investing in production and distribution networks to meet growing demand, while government regulations focusing on workplace safety and industrial efficiency further support adoption. China’s leadership in industrial manufacturing ensures it remains a key market for palletizer expansion.

The conventional palletizer market in India is expected to grow at a CAGR of 6.6% from 2025 to 2035, driven by expanding industrial activity and the rise of the e-commerce sector. Increasing demand for faster and more efficient material handling solutions in warehouses and production units encourages adoption of automated palletizing systems. Government initiatives promoting industrial automation and modernization of logistics infrastructure are supporting market growth. Local manufacturers and international suppliers are collaborating to establish scalable production and distribution networks. Growing awareness about productivity improvements, labor cost reduction, and operational efficiency further strengthens the market outlook across multiple sectors, including food processing, pharmaceuticals, and consumer goods.

The conventional palletizer market in Germany is projected to grow at a CAGR of 6.1% from 2025 to 2035, driven by high automation levels in manufacturing and logistics. Germany’s strong industrial base, particularly in automotive, chemicals, and pharmaceuticals, demands efficient palletizing solutions. Focus on operational efficiency, supply chain optimization, and quality standards encourages adoption of conventional palletizers. Subscription and service-based models for maintenance and support further enhance market attractiveness. Manufacturers leverage advanced robotics, standardized palletizing protocols, and integration with warehouse management systems to meet market requirements. Germany’s emphasis on Industry 4.0 and technological advancement strengthens growth prospects and sustains long-term demand.

The conventional palletizer market in the UK is expected to grow at a CAGR of 5.0% from 2025 to 2035, supported by expanding logistics, retail, and industrial sectors. Businesses are adopting automated palletizing systems to improve efficiency, reduce labor costs, and ensure consistent material handling. Growth is further encouraged by investments in smart warehouse technologies, including integration with conveyors and automated storage systems. Market players are focusing on tailored solutions and after-sales services to increase adoption in key sectors such as food and beverage, pharmaceuticals, and consumer goods. The strategic location of the UK as a logistics hub enhances demand for efficient palletizing solutions across domestic and export operations.

The conventional palletizer market in the USA is projected to grow at a CAGR of 4.5% from 2025 to 2035, driven by increasing automation in manufacturing and warehousing. Companies are investing in palletizing solutions to improve operational efficiency, reduce errors, and optimize labor utilization. The food and beverage, pharmaceuticals, and consumer goods industries are major adopters, seeking scalable and reliable material handling systems. Advanced robotics, integration with warehouse management systems, and predictive maintenance services enhance the appeal of conventional palletizers. Rising e-commerce demand and warehouse automation initiatives are further propelling the market, enabling USA manufacturers to maintain global competitiveness.

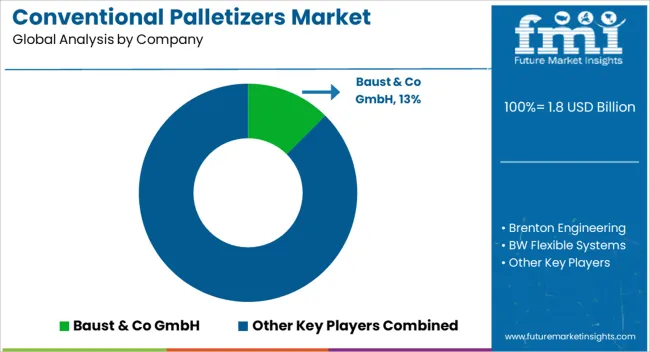

Competition in the conventional palletizers market is driven by automation efficiency, system flexibility, and throughput performance. Baust & Co GmbH differentiates through durable conventional palletizing systems designed for industrial reliability. Brenton Engineering offers a full line of palletizers, combining conventional and hybrid systems with high adaptability for varied packaging lines. BW Flexible Systems competes with high-speed push-type palletizers optimized for bags, bales, and crates. Columbia Machine Inc. provides floor-level, high-level, and hybrid palletizers, alongside complete integration solutions for end-of-line automation. Concetti SpA focuses on turnkey palletizing systems emphasizing efficiency and space optimization. KUKA AG leverages robotics and automation expertise to enhance conventional palletizer performance. MSK Covertech delivers customized solutions targeting industrial flexibility. OCME Srl provides end-of-line automation, including customer-specific palletizing solutions. Okura Yusoki offers precision-oriented conventional and robotic palletizers. PAYPER SA develops automated bagging and palletizing systems. Premier Tech emphasizes operational efficiency and sustainability in its palletizing solutions. ROBOPAC integrates stretch-wrapping and palletizing capabilities. Signode Industrial Group LLC delivers durable and reliable systems for industrial stacking. SIPA SpA focuses on innovative, application-specific palletizing machinery. Wuxi Taiyang Packaging Technology Co. Ltd. supplies versatile palletizing solutions for diverse industries. Strategies across the industry focus on automation, scalability, and seamless integration with packaging lines. Differentiation is achieved through throughput efficiency, payload capacity, stacking precision, and system customization. Partnerships with industrial integrators and adoption of AI-enabled control systems enhance operational performance and reduce downtime. Product catalogs highlight specifications such as stacking speed, load capacity, pallet patterns, and packaging compatibility. Layer-forming, floor-level, and hybrid palletizers are detailed with technical datasheets, installation guidance, and application notes, reflecting a market where reliability, adaptability, and automation capabilities are key competitive levers.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Type | High level and Low/floor level |

| Application | Boxes and cases, Bags and sacks, Trays and crates, and Others |

| End Use Industry | Food and beverages, Pharmaceuticals, Consumer goods, E-commerce and logistics, and Others |

| Distribution channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Baust & Co GmbH, Brenton Engineering, BW Flexible Systems, Columbia Machine Inc, Concetti SpA, KUKA AG, MSK Covertech, OCME Srl, Okura Yusoki, PAYPER SA, Premier Tech, ROBOPAC, Signode Industrial Group LLC, SIPA SpA, and Wuxi Taiyang Packaging Technology Co Ltd |

| Additional Attributes | Dollar sales, share, automation adoption, production capacity, end-use industry demand, regional deployment, competitor landscape, pricing trends, system efficiency, service and maintenance programs, technology differentiation. |

The global conventional palletizers market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the conventional palletizers market is projected to reach USD 3.0 billion by 2035.

The conventional palletizers market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in conventional palletizers market are high level and low/floor level.

In terms of application, boxes and cases segment to command 34.2% share in the conventional palletizers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Conventional Overhead Conductor Market Size and Share Forecast Outlook 2025 to 2035

Conventional Motorcycles & Scooters Market Growth - Trends & Forecast 2025 to 2035

Depalletizers Market

Layer Palletizers Market Size and Share Forecast Outlook 2025 to 2035

Robotic Palletizers & De-Palletizers Market Growth - Forecast 2025 to 2035

Portable Conventional Generator Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA