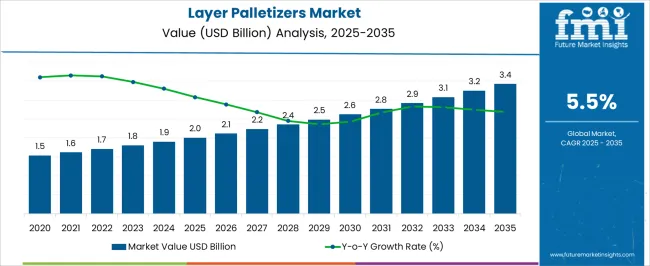

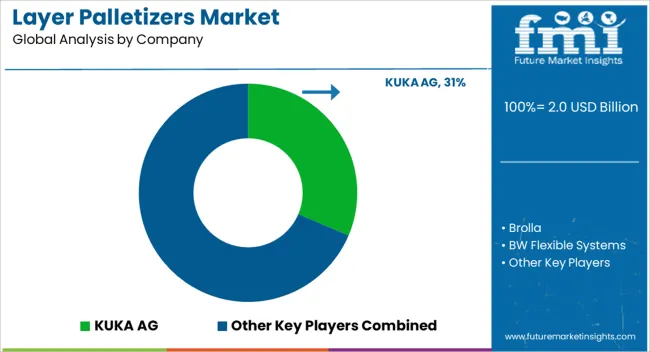

The layer palletizers market, valued at USD 2.0 billion in 2025 and projected to reach USD 3.4 billion by 2035 at a CAGR of 5.5%, demonstrates a cost structure highly influenced by mechanical components, automation systems, and integration services. The value chain spans from raw material procurement to end-user deployment, with each stage shaping cost efficiency and overall competitiveness.

Within the cost structure, hardware components such as conveyors, robotic arms, and pallet handling modules contribute significantly, often accounting for the bulk of production expenses. Software integration for automation and control adds another substantial layer, as demand for flexible, programmable palletizers continues to expand. Labor and assembly costs remain relevant, particularly in markets where semi-automated solutions still coexist with fully automated systems. Maintenance and after-sales services also represent long-term recurring expenditures that reinforce overall lifecycle costs. In terms of the value chain, upstream suppliers of precision motors, sensors, and control electronics provide essential inputs, while system integrators capture value through customization and installation. OEMs dominate the midstream, while downstream distributors and service providers ensure market reach and operational reliability. Efficiency gains are being sought through modular designs and advanced controls, streamlining both cost competitiveness and long-term value capture across the palletizer ecosystem.

| Metric | Value |

|---|---|

| Layer Palletizers Market Estimated Value in (2025 E) | USD 2.0 billion |

| Layer Palletizers Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The layer palletizers market forms a crucial part of global material handling and packaging machinery, valued for its efficiency in stacking products onto pallets with precision and consistency. Within the overall palletizing equipment industry, it secures about 5.1%, reflecting its widespread use in high-volume production lines. In the broader packaging automation market, it holds nearly 3.8%, supported by the need for reduced labor reliance and increased throughput.

Across the warehouse automation sector, its share is estimated at 3.3%, driven by rising demand for streamlined logistics. In the food and beverage packaging machinery segment, the layer palletizers market accounts for approximately 4.2%, highlighting its role in meeting speed and hygiene standards. Its contribution within the industrial robotics-assisted machinery space stands at 2.9%, underscoring integration with automated handling systems.

Recent developments in this market emphasize digitalization, robotics integration, and sustainability. Manufacturers are introducing layer palletizers with advanced human-machine interfaces and intuitive programming to reduce training requirements. Collaborative robots are being deployed alongside traditional palletizers to improve flexibility for mixed-load handling. Energy-efficient designs are gaining traction, reducing power consumption while maintaining high-speed performance. Predictive maintenance supported by IoT-enabled sensors is being adopted to minimize downtime and improve asset utilization.

Modular and space-saving designs are being developed to support smaller facilities with limited floor space. The systems are being tailored for eco-friendly packaging materials, ensuring compatibility with recyclable cartons and lightweight bottles. These advancements highlight the market’s progression toward productivity, adaptability, and environmentally responsible operations.

The market is witnessing notable growth, driven by the increasing automation in packaging and material handling processes across manufacturing, logistics, and warehousing sectors. The current market environment reflects strong adoption of palletizing solutions that enhance efficiency, reduce labor costs, and maintain product handling precision.

Advancements in robotics, vision systems, and control software are enabling more flexible and faster operations, meeting the demands of diverse product types and packaging formats. Growing emphasis on operational safety, workplace ergonomics, and space optimization is influencing companies to adopt modern palletizing solutions over conventional manual methods.

Future growth is expected to be supported by integration with Industry 4.0 technologies, enabling real-time monitoring, predictive maintenance, and improved process optimization. As global trade volumes rise and supply chain efficiency becomes a competitive priority, the market is positioned to experience sustained demand across multiple industries.

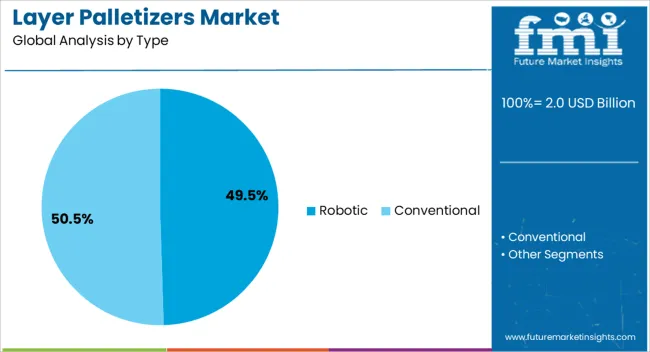

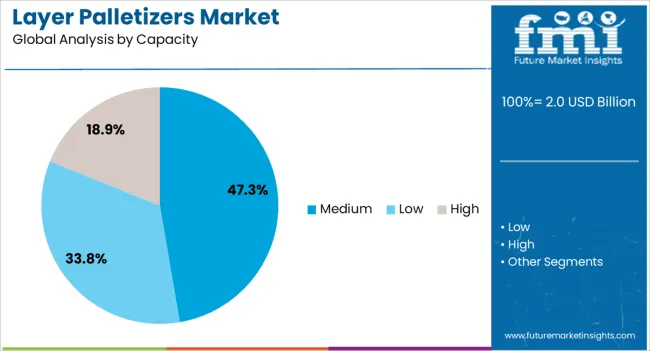

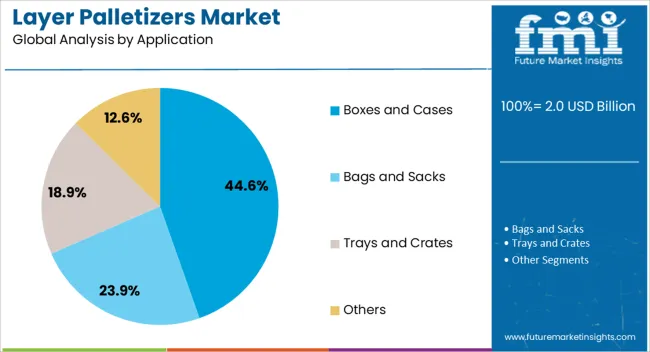

The layer palletizers market is segmented by type, capacity, application, end use industry, and geographic regions. By type, layer palletizers market is divided into robotic and conventional. In terms of capacity, layer palletizers market is classified into medium, low, and high. Based on application, layer palletizers market is segmented into boxes and cases, bags and sacks, trays and crates, and others.

By end use industry, layer palletizers market is segmented into food and beverages, pharmaceuticals, consumer goods, E-commerce and logistics, chemicals and materials, and others. Regionally, the layer palletizers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Robotic type segment is projected to hold 49.5% of the market revenue in 2025, making it the leading segment by type. This leadership is being attributed to the segment’s capability to handle high-speed, multi-line operations with minimal downtime.

Robotic palletizers offer greater flexibility in handling varied product sizes and packaging formats without extensive mechanical adjustments. Their adoption has been driven by the growing need for space-efficient systems that can operate in confined layouts while maintaining accuracy and consistency.

The ability to reprogram and adapt to changing production requirements without significant hardware modifications has further supported growth. Lower long-term operational costs and improved safety standards have encouraged widespread deployment in industries seeking high reliability and throughput efficiency.

The Medium capacity segment is expected to capture 47.3% of the Layer Palletizers market revenue in 2025, emerging as the leading capacity range. Its dominance is being supported by the balance it offers between throughput capability and operational footprint, making it suitable for a wide variety of manufacturing and distribution environments.

Medium capacity palletizers are favored by mid to large-scale operations that require consistent output without the higher investment associated with large-scale systems. The adaptability of this segment to different product categories and line speeds has increased its adoption.

Moreover, advancements in control systems and modular designs are enabling faster installation and easier integration into existing production lines, further driving its market leadership.

The Boxes and Cases application segment is anticipated to account for 44.6% of the Layer Palletizers market revenue in 2025, making it the top application category. Growth in this segment is being driven by the high prevalence of boxed and cased goods in industries such as food and beverages, consumer goods, and pharmaceuticals.

The requirement for uniform stacking, stability during transportation, and protection of goods has reinforced the preference for palletizing solutions tailored to this application. Software-enabled precision placement and pattern flexibility have enhanced handling efficiency for varied box sizes and weights.

In addition, the rising demand for high-speed packaging lines capable of accommodating diverse box dimensions without prolonged changeover times has further contributed to this segment’s dominance.

The market has gained prominence as industries seek automated material handling solutions to improve productivity, efficiency, and workplace safety. These machines are designed to stack goods in layers on pallets with precision, reducing manual labor and increasing throughput in sectors such as food and beverages, pharmaceuticals, chemicals, and logistics. Automation in packaging lines, along with rising demand for consistent palletizing operations, has been a core driver. Investments in advanced robotics and control systems have further transformed palletizing equipment, enabling better adaptability to various product shapes and weights.

Automation has been a major factor shaping the demand for layer palletizers. As industries move toward fully integrated production systems, the role of palletizers in reducing human error and ensuring consistency has become critical. Manufacturers increasingly prefer automated palletizing due to its ability to enhance speed, reduce downtime, and accommodate multiple product formats. The use of robotics and programmable logic controllers has expanded functionality, making machines more flexible in handling diverse loads. With industrial environments emphasizing efficiency and cost reduction, layer palletizers have become essential equipment. The integration of sensors and digital monitoring further enhances operational reliability, reflecting how automation is transforming end of line packaging systems globally.

The food and beverage sector has emerged as a dominant application area for layer palletizers. Growing product diversity, coupled with the need for high volume packaging, has strengthened their importance. Beverage companies, in particular, benefit from palletizers capable of handling bottles, cans, and cartons with accuracy. Consistency in stacking helps reduce transport damages and optimizes warehouse storage efficiency. Increasing consumption of packaged food products and expansion of distribution channels have further supported demand. The requirement for hygienic handling and compliance with safety standards also favors automated palletizing. As companies scale up production capacity, layer palletizers are increasingly adopted as a strategic solution to meet rising throughput expectations without compromising quality.

The expansion of logistics and warehousing operations has significantly contributed to the adoption of layer palletizers. The need for efficient palletizing solutions in distribution centers, third-party logistics providers, and e-commerce supply chains has grown as global trade volumes increase. Automated palletizers reduce labor dependency and enable faster order fulfillment, directly supporting supply chain resilience. Their ability to handle mixed loads, customized pallets, and varying product dimensions has improved their role in modern logistics environments. Growing demand for high-throughput systems that optimize pallet utilization and minimize handling costs has further driven investment. This shift reflects the importance of palletizers in sustaining efficient warehousing and distribution processes worldwide.

Despite their advantages, the adoption of layer palletizers faces barriers such as high capital costs, space constraints, and maintenance requirements. Small and medium sized enterprises often find it challenging to justify investment due to limited budgets and floor space. However, advancements in compact designs and modular solutions have started addressing these challenges.

The development of energy-efficient systems and user-friendly interfaces has improved accessibility for a broader range of industries. As digitalization expands in industrial environments, predictive maintenance and remote monitoring capabilities are increasingly integrated, enhancing reliability and reducing downtime. Continuous innovation in material handling technologies is expected to mitigate adoption barriers and sustain growth momentum.

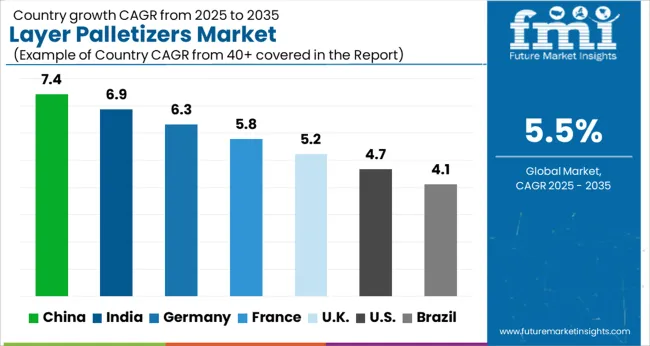

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The market is gaining momentum as industries emphasize automated material handling to improve efficiency and reduce operational costs. Germany grows at 6.3%, with strong adoption in its packaging and manufacturing sectors that require advanced palletizing solutions. India records 6.9%, supported by rising demand in food and beverage processing facilities. China takes the lead with 7.4%, driven by large-scale industrial automation and expanding logistics operations. The United Kingdom follows with 5.2%, where modernization of warehouses and supply chains plays a key role. The United States advances at 4.7%, with integration of palletizing equipment across consumer goods and retail industries. These developments underline the crucial role of palletizing technologies in modern supply chain operations. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is forecast to register a CAGR of 7.4% in the market, reflecting robust manufacturing expansion and automation uptake. Adoption has been propelled by large scale food and beverage packaging, chemical processing, and e commerce warehousing. It is considered that Chinese firms have increasingly turned to layer palletizers to enhance throughput and minimize labor reliance. Domestic equipment suppliers have benefited from competitive pricing, while international players such as KUKA and ABB have expanded joint ventures to capture share. The integration of robotics and AI into palletizing systems has further advanced efficiency and reduced cycle time. With government policies encouraging smart manufacturing, demand for high speed and flexible palletizers is expected to remain strong, making China a global center for palletizing technology deployment.

India is projected to expand at a CAGR of 6.9% in the layer palletizers market, driven by manufacturing diversification and packaging automation. The rapid rise of FMCG and pharmaceuticals has increased the need for efficient palletizing to support distribution. It is assessed that demand for compact, cost effective palletizers has grown among mid-sized manufacturers, while large conglomerates have invested in advanced systems with robotic integration. Indian firms have focused on adapting imported technologies for local conditions, ensuring scalability and affordability. The emphasis on export readiness has also compelled manufacturers to adopt globally compliant palletizing systems. With government initiatives promoting smart factories, India is anticipated to emerge as a strong regional market for palletizer deployment across varied industrial sectors.

Germany is expected to post a CAGR of 6.3% in the market, supported by strong engineering standards and industrial automation. The German manufacturing sector, particularly in automotive, chemicals, and beverages, has increasingly deployed palletizers to optimize logistics. It is considered that emphasis on efficiency, precision, and energy saving has guided investment in advanced palletizer designs. European equipment suppliers such as BEUMER Group and Krones AG remain highly competitive in the market, offering tailored solutions. Germany’s robust export orientation has reinforced the need for consistent and standardized packaging, which relies on palletizer efficiency. Continuous investment in Industry 4.0 systems has created further scope for intelligent palletizers integrated with IoT and data monitoring, sustaining long term growth in the market.

A CAGR of 5.2% has been anticipated for the United Kingdom layer palletizers market, influenced by packaging modernization and supply chain efficiency needs. Adoption has been reinforced by growing emphasis on flexible manufacturing and warehouse automation. U K firms have increasingly adopted hybrid palletizers capable of handling multiple product formats, particularly in beverage and personal care packaging. International suppliers such as Fanuc and ABB have established strong presence, while local integrators provide system customization. The country’s logistics sector, with its reliance on just in time supply chains, has further boosted palletizer installations. It is assessed that long term growth will be supported by the integration of robotics and digital monitoring systems, ensuring improved productivity across U K industries.

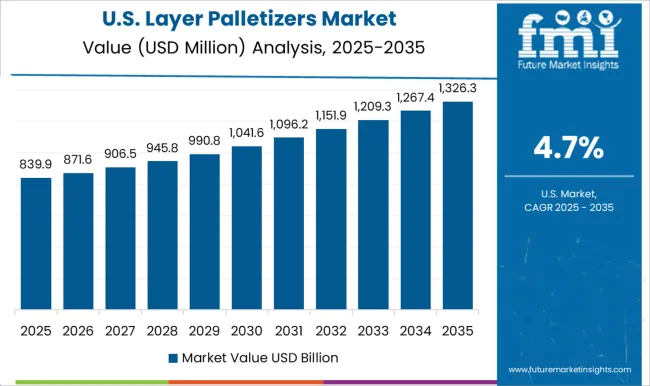

The United States market for layer palletizers is set to grow at a CAGR of 4.7%, reflecting steady automation uptake across manufacturing and logistics. Adoption has been shaped by the food, beverage, and pharmaceutical industries, where palletizing ensures speed and compliance with distribution standards. It is considered that U S manufacturers prioritize flexible palletizing solutions that handle diverse product lines with minimal changeover time. Major players such as Honeywell Intelligrated and Columbia Machine have focused on software integrated palletizers that improve throughput and monitoring. The warehouse and distribution sector has also driven demand, as palletizers support large scale e commerce fulfillment. Growth is expected to continue, albeit at a moderate pace, as firms invest in robotic and semi automatic systems to enhance operational resilience.

The market is gaining traction as industries enhance automation in packaging, warehousing, and logistics to streamline efficiency and reduce manual labor. KUKA AG and Honeywell International Inc lead the sector with advanced robotic palletizing solutions integrated with artificial intelligence and vision systems for high-speed operations. Körber AG and Premier Tech provide modular and flexible palletizing systems suitable for diverse industries such as food, beverage, chemicals, and pharmaceuticals. BW Flexible Systems, Concetti SpA, and Mollers Packaging Technology GmbH are recognized for offering customized palletizing machines tailored for bagged goods, cartons, and bulk materials. TRAPO GmbH, Scott Automation, and SMB drive innovation with fully automated systems designed to meet Industry 4.0 requirements, ensuring connectivity, precision, and adaptability.

COSMAPACK and TMI contribute with cost-efficient systems catering to mid-sized manufacturers, improving their competitiveness in regional markets. Segbert Palletizing and Automation and PHS Innovate focus on turnkey palletizing solutions integrating robotics, conveyors, and software platforms, while Brolla emphasizes specialized equipment for niche packaging needs. The market is evolving with rising demand for sustainability, productivity, and warehouse optimization. These players are strengthening their portfolios through robotics, digital twin technology, and energy-efficient designs, ensuring their presence in the market.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Type | Robotic and Conventional |

| Capacity | Medium, Low, and High |

| Application | Boxes and Cases, Bags and Sacks, Trays and Crates, and Others |

| End Use Industry | Food and Beverages, Pharmaceuticals, Consumer Goods, E-commerce and Logistics, Chemicals and Materials, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | KUKA AG, Brolla, BW Flexible Systems, Concetti SpA, COSMAPACK, Honeywell International Inc, Körber AG, Mollers Packaging Technology GmbH, PHS Innovate, Premier Tech, Scott Automation, Segbert Palletizing and Automation, SMB, TMI, and TRAPO GmbH |

| Additional Attributes | Dollar sales by palletizer type and application, demand dynamics across food, beverage, and industrial packaging sectors, regional trends in automated material handling adoption, innovation in stacking precision, speed, and robotic integration, environmental impact of energy use and equipment lifecycle, and emerging use cases in e-commerce logistics, bulk material handling, and flexible packaging operations. |

The global layer palletizers market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the layer palletizers market is projected to reach USD 3.4 billion by 2035.

The layer palletizers market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in layer palletizers market are robotic, conventional, _low/floor level and _high level.

In terms of capacity, medium segment to command 47.3% share in the layer palletizers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Layer Pads Market from 2025 to 2035

3-Layer Seam Tapes Market Size and Share Forecast Outlook 2025 to 2035

Multilayer Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Multilayer Transparent Conductors Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Multilayer Flexible Packaging Manufacturers

Multi-layer Film Recycling Market Size and Share Forecast Outlook 2025 to 2035

Multi-layer Ceramic Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Multi-layer Blow Molded Containers Market

Atomic Layer Deposition (ALD) Equipment Market Growth - Trends & Forecast 2025 to 2035

Single Layer Capacitors Market

Boundary Layer Wind Lidar Market Size and Share Forecast Outlook 2025 to 2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

Functional Multi-Layer Coextruded Film Market Size and Share Forecast Outlook 2025 to 2035

Depalletizers Market

Robotic Palletizers & De-Palletizers Market Growth - Forecast 2025 to 2035

Conventional Palletizers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA