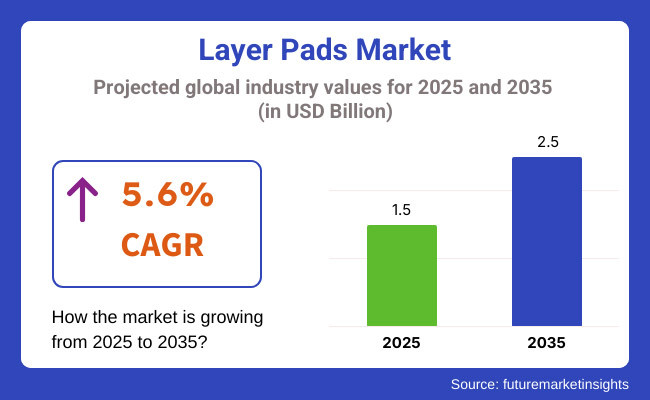

The global layer pads market is projected to reach USD 1.5 billion in 2025 and is anticipated to grow at a CAGR of 5.6% to attain USD 2.5 billion by 2035. This growth is driven by increasing demand for durable, economic, and sustainable packaging solutions across food & beverage, pharmaceuticals, electronics, and logistics sectors.

Layer pads play a crucial role in securing products during transportation and storage, minimizing damage, and enhancing supply chain operations. Advancements in recyclable materials, automation in packaging logistics, and high-barrier protection technologies are further propelling market growth.

Innovations such as moisture-resistant and high-strength layer pads are gaining traction, addressing the need for cost-efficient and sustainable packaging solutions. The integration of green materials, digital tracking, and smart packaging solutions is enhancing market adoption.

Improvements in material durability, advancements in both corrugated and plastic layer pads, and automation of palletizing systems are contributing to growth initiatives. The expansion of e-commerce, demand for protective packaging, and use of reusable and recyclable layer pads are driving market expansion.

The incorporation of RFID tracking on layer pads, integrated with anti-slip coatings and IoT-based monitoring solutions, is strengthening security, traceability, and efficiency in logistics. These technologies enable real-time monitoring of assets, improving operational efficiency and reducing losses.

Regionally, the Asia Pacific layer pads market is expected to witness significant growth, expanding at a CAGR of 7.5%. This growth is attributed to the expanding middle class and increasing demand for sustainable packaging solutions in the region. Overall, the layer pads market is poised for substantial growth, driven by technological advancements, sustainability initiatives, and increasing demand across various industries.

Corrugated layer pads are projected to dominate the global layer pads market, capturing approximately 51.4% market share in 2025. This dominance is driven primarily by their lightweight construction, cost-effectiveness, and strong sustainability profile.

Widely used in industries such as food & beverages, consumer goods, and e-commerce, corrugated pads effectively safeguard products during transportation by absorbing shocks, preventing damage, and stabilizing packaged items.

Manufacturers actively innovate to enhance corrugated pad durability and performance, developing water-resistant, reinforced, and multi-layered variants suitable for challenging logistics environments. For example, advancements like moisture-resistant coatings and multi-wall structures significantly increase strength and longevity, boosting reliability for heavier goods or longer transit distances.

Furthermore, sustainability remains a central growth driver, as corrugated pads are recyclable, biodegradable, and increasingly feature biodegradable coatings and compostable adhesives.

Companies such as International Paper, DS Smith, and Smurfit Kappa invest substantially in eco-friendly manufacturing practices, leveraging these products to meet growing consumer demands for environmentally responsible packaging.

Additionally, printed branding and marketing capabilities of corrugated pads attract companies seeking enhanced consumer engagement through visual branding opportunities. Collectively, the practicality, affordability, innovation, and environmental responsibility of corrugated layer pads underscore their substantial market leadership

Asia-Pacific will lead the layer pads market due to accelerating industrialization, growing needs for effective supply chain solutions, and government encouragement for sustainable packaging. China, India, and Japan are among the countries with rising demand for recyclable layer pads with high barrier applications for food packaging, automotive logistics, and industry usage.

Market growth is bolstered by investment in cost-saving bio-based materials, technological advances in impact-resistant pads, and automation of logistics handling. In addition, regulatory measures for reusable and lightweight packaging are spurring next-generation layer pad development by manufacturers. Increasing involvement of global logistics companies and e-commerce behemoths in the region is also increasing local manufacturing capacity. Further, development of anti-slip coatings and moisture-proof technologies will provide new prospects in the Asia-Pacific region.

The USA and Canada are the leading regions in this technological advancement, in ergonomically crafted layer pads with water resistant, impact-proof, lightweight features. An improvement in automation and investment in AI-controlled defect detection also enhances efficiency with losses due to waste reduced in manufacturing layer pads.

Besides that, the phase of affordability and popularity concerning recycled, reusable, and RFID-enabled layer pads is almost at the peak, with influence from both strict regulatory environments and the industry itself. Companies are innovating with anti-bacterial coursing, thermal insulation layers, and interactive packaging for better functional improvement and alignment with compliance. In addition, there is a surge in demand for protective transit packaging systems, high-load bearing solutions, and high-quality stacking pads driving innovation in the product line. Top it up with advancements in AI-powered tracking, biodegradable coatings, and automation in pallet logistics, and the North American layer pads market will be transformed.

Europe grabs a huge chunk of the layer pads market with stringency on sustainability regulations and a hike in demand for fully recyclable packaging coupled with consumers who prefer an eco-friendly logistics solution. Advanced developments in circular economy packaging, lightweight protective materials, and intelligent logistics technology have brought Germany, France, and the UK to the forefront.

Because of stringent policies enforcing plastic reduction, extended producer responsibility (EPR), and carbon footprint reduction, the future shapes itself in the market. The region is experiencing growing alliances of layer pad manufacturers and logistics providers along with regulators collating possible next-generation sustainable packaging designs. Such momentum is also occurring in innovations of corrugated fiberboard, high-strength polymer pads, and digital supply chain tracking. Research institutions in Europe are venturing toward AI-driven load optimization, real-time tracking, and next-gen lightweight protective solutions, which would also contribute to the industry's growth.

Challenges

Opportunities

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Initial focus on improving supply chain sustainability. |

| Material and Formulation Innovations | Development of lightweight, durable layer pads. |

| Industry Adoption | Widely used in food, beverage, and industrial packaging. |

| Market Competition | Dominated by traditional packaging and logistics firms. |

| Market Growth Drivers | Growth driven by demand for protective and sustainable packaging. |

| Sustainability and Environmental Impact | Early-stage transition to reusable and recyclable layer pads. |

| Integration of AI and Process Optimization | Limited AI use in defect detection and logistics tracking. |

| Advancements in Logistics Technology | Basic improvements in pallet stacking and protection. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global policies promoting recyclable, reusable, and carbon-neutral logistics. |

| Material and Formulation Innovations | Expansion of biodegradable, RFID-integrated, and moisture-resistant layer pad materials. |

| Industry Adoption | Increased adoption in high-value goods, automation-driven logistics, and pharma transit. |

| Market Competition | Rise of automation-focused startups and sustainability-driven material developers. |

| Market Growth Drivers | Expansion fueled by automation, AI integration, and recyclable packaging solutions. |

| Sustainability and Environmental Impact | Large-scale shift to fully compostable, fiber-reinforced, and low-carbon packaging. |

| Integration of AI and Process Optimization | AI-driven predictive analytics, real-time logistics monitoring, and load optimization. |

| Advancements in Logistics Technology | Development of IoT-enabled, RFID-tracked, and AI-powered supply chain optimization. |

The USA market for layer pads is important since demand is growing for various industries for durable, economic, sustainable packaging solutions. Such industries include food & beverage, pharmaceuticals, logistics, and consumer goods. Manufacturers are now making sustainable layer pads from recyclable and light-weight materials in view of the increasing regulations on sustainable packaging and extended producer responsibility (EPR) policies. Advancements in corrugated, plastic, and fiber-based layer pads, offering enhanced moisture resistance, anti-slip coatings, and properties for impact absorption, are further promoting market growth.

Added e-commerce and warehouse automation have also generated an increasing demand for high-strength, reusable, and customized layer pads for palletized bulk shipments. Innovations such as RFID-enabled smart tracking, anti-microbial coatings, and bio-based layer pads increase the level of functionality and efficiency in logistics and supply chain operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.1% |

The UK layer pads market is witnessing growth as companies consider sustainability, compliance with regulations, and logistics efficiencies. Circular economy policies by the government to reduce single-use plastics and enhance recyclability are forcing companies to consider environmentally friendly and biodegradable layer pads. Water-resistant and slip-resistant layer pads to enhance the storage and transportation functions are being adopted more by food and beverage industries (breweries, dairy producers, and bottled water industries).

The development of HDPE, PP, and recycled paperboard-based layer pads is bringing improvements in product strength and reusability. Companies are also integrating digital printing, barcoding, and tamper-evident designs for better inventory management and product authentication.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.7% |

Japan's layer pads market is seeing a progressive growth trend the result of the increase in precision-engineered high-performance packaging solutions for electronics, automotive, and pharmaceutical applications. According to the manufacturers in Japan, ultra-lightweight, shock-absorbent, moisture-resistant layer pads are especially being developed for high-value product transportation.

This has emanated from the strict sustainability regulations and zero-waste initiatives instituted by the country to support the use of biodegradable, fiber-based, and returnable plastic layer pads. Research into nanocoatings, self-repairing polymer surfaces, and RFID-embedded smart layer pads also makes supply chain operations more efficient. In addition, the trend of growing automation has led to rising demand for standardized and reusable layer pads that are highly durable in warehouses and logistics hubs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The burgeoning development of logistics, automotive, and food processing industries is expanding the layer pads market in South Korea. Usage of high-strength moisture-and-impact-absorbing layer pads increases with rapid e-commerce growth, alongside high-volume warehouse operations. Additional government regulations supporting sustainable packaging solutions and reduction in plastic waste have all encouraged manufacturers to produce recyclable, compostable, and lightweight layer pads.

Businesses are also bringing smart technologies running on AI-powered defect detection and advanced polymer formulations integration into their manufacturing procedures to improve durability and reduce packaging waste. Cold chain logistics, transportation of temperature-sensitive products, and stackable storage are all gaining importance and further driving innovation towards high-performance layer pads.

Country

| CAGR (2025 to 2035) | |

|---|---|

| South Korea | 4.9% |

The layer pads market is expanding across key industries such as food & beverage, logistics, pharmaceuticals, and electronics. Companies are focusing on automation, recyclable materials, and high-performance protective solutions to enhance efficiency and sustainability. The increasing emphasis on reusable and returnable packaging solutions is further propelling market growth.

Rising investments in advanced manufacturing techniques and automation are streamlining production and enhancing product quality. Additionally, demand for moisture-resistant and anti-microbial coatings in layer pads is gaining traction across healthcare and food packaging sectors. The push for cost-effective, lightweight materials is encouraging innovation in composite fiberboard and plastic-based layer pads. With the rise of e-commerce and warehouse automation, the adoption of high-strength layer pads for improved load stability continues to grow.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Smurfit Kappa Group | 10-14% |

| DS Smith Plc | 8-12% |

| International Paper | 6-10% |

| WestRock Company | 4-8% |

| Mondi Group | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Smurfit Kappa Group | Develops high-strength, recyclable corrugated layer pads with customizable designs. |

| DS Smith Plc | Specializes in lightweight, eco-friendly fiberboard layer pads for beverage and logistics applications. |

| International Paper | Produces durable and moisture-resistant layer pads for food, electronics, and industrial sectors. |

| WestRock Company | Focuses on sustainable, high-performance fiber-based packaging solutions. |

| Mondi Group | Expands its portfolio with recyclable and biodegradable layer pads for diverse applications. |

Key Company Insights

Smurfit Kappa Group (10-14%) Smurfit Kappa leads in high-strength, recyclable corrugated layer pads with customizable designs.

DS Smith Plc (8-12%) DS Smith specializes in lightweight, eco-friendly fiberboard layer pads for beverage and logistics applications.

International Paper (6-10%) International Paper produces durable and moisture-resistant layer pads for food, electronics, and industrial sectors.

WestRock Company (4-8%) WestRock focuses on sustainable, high-performance fiber-based packaging solutions.

Mondi Group (3-7%) Mondi is expanding its portfolio with recyclable and biodegradable layer pads for diverse applications.

Other Key Players (45-55% Combined) Several specialty packaging manufacturers contribute to the expanding layer pads market. These include:

The overall market size for the Layer Pads Market was USD 1.5 Billion in 2025.

The Layer Pads Market is expected to reach USD 2.5 Billion in 2035.

The market will be driven by increasing demand from food & beverage, logistics, and industrial sectors. The push for sustainable, lightweight, and high-performance protective packaging solutions will further fuel growth.

Key challenges include raw material price volatility, recyclability concerns, and regional regulatory variations. However, innovations in biodegradable materials, AI-driven logistics solutions, and high-strength composite designs are mitigating these issues.

North America and Europe are expected to dominate due to strong demand for sustainable packaging solutions and stringent recycling regulations. Meanwhile, Asia-Pacific is witnessing rapid growth driven by expanding manufacturing and e-commerce sectors.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User Base, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by End User Base, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Shape Type, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Shape Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End User Base, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by End User Base, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Shape Type, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Shape Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End User Base, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by End User Base, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Shape Type, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Shape Type, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 28: Europe Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by End User Base, 2018 to 2033

Table 30: Europe Market Volume (Tons) Forecast by End User Base, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Shape Type, 2018 to 2033

Table 32: Europe Market Volume (Tons) Forecast by Shape Type, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by End User Base, 2018 to 2033

Table 38: Asia Pacific Market Volume (Tons) Forecast by End User Base, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Shape Type, 2018 to 2033

Table 40: Asia Pacific Market Volume (Tons) Forecast by Shape Type, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: MEA Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by End User Base, 2018 to 2033

Table 46: MEA Market Volume (Tons) Forecast by End User Base, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Shape Type, 2018 to 2033

Table 48: MEA Market Volume (Tons) Forecast by Shape Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User Base, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Shape Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End User Base, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by End User Base, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User Base, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User Base, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Shape Type, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by Shape Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Shape Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Shape Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 22: Global Market Attractiveness by End User Base, 2023 to 2033

Figure 23: Global Market Attractiveness by Shape Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End User Base, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Shape Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End User Base, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by End User Base, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End User Base, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End User Base, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Shape Type, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by Shape Type, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Shape Type, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Shape Type, 2023 to 2033

Figure 45: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 46: North America Market Attractiveness by End User Base, 2023 to 2033

Figure 47: North America Market Attractiveness by Shape Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End User Base, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Shape Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End User Base, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by End User Base, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End User Base, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End User Base, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Shape Type, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by Shape Type, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Shape Type, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Shape Type, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End User Base, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Shape Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by End User Base, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Shape Type, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 82: Europe Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by End User Base, 2018 to 2033

Figure 86: Europe Market Volume (Tons) Analysis by End User Base, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by End User Base, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by End User Base, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Shape Type, 2018 to 2033

Figure 90: Europe Market Volume (Tons) Analysis by Shape Type, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Shape Type, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Shape Type, 2023 to 2033

Figure 93: Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by End User Base, 2023 to 2033

Figure 95: Europe Market Attractiveness by Shape Type, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by End User Base, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Shape Type, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by End User Base, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Tons) Analysis by End User Base, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by End User Base, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by End User Base, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Shape Type, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Tons) Analysis by Shape Type, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Shape Type, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Shape Type, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by End User Base, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Shape Type, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by End User Base, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Shape Type, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 130: MEA Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by End User Base, 2018 to 2033

Figure 134: MEA Market Volume (Tons) Analysis by End User Base, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by End User Base, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by End User Base, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Shape Type, 2018 to 2033

Figure 138: MEA Market Volume (Tons) Analysis by Shape Type, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Shape Type, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Shape Type, 2023 to 2033

Figure 141: MEA Market Attractiveness by Material Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by End User Base, 2023 to 2033

Figure 143: MEA Market Attractiveness by Shape Type, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Layer Palletizers Market Size and Share Forecast Outlook 2025 to 2035

3-Layer Seam Tapes Market Size and Share Forecast Outlook 2025 to 2035

Multilayer Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Multilayer Transparent Conductors Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Multilayer Flexible Packaging Manufacturers

Multi-layer Film Recycling Market Size and Share Forecast Outlook 2025 to 2035

Multi-layer Ceramic Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Multi-layer Blow Molded Containers Market

Atomic Layer Deposition (ALD) Equipment Market Growth - Trends & Forecast 2025 to 2035

Single Layer Capacitors Market

Boundary Layer Wind Lidar Market Size and Share Forecast Outlook 2025 to 2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

Functional Multi-Layer Coextruded Film Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Meat Pads Industry

Global Toner Pads Market Size and Share Forecast Outlook 2025 to 2035

Corner Pads Market Insights - Growth & Demand 2025 to 2035

Tipper Pads Market

Sleeper Pads Market Size and Share Forecast Outlook 2025 to 2035

Scouring Pads Market Size and Share Forecast Outlook 2025 to 2035

Mattress Pads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA