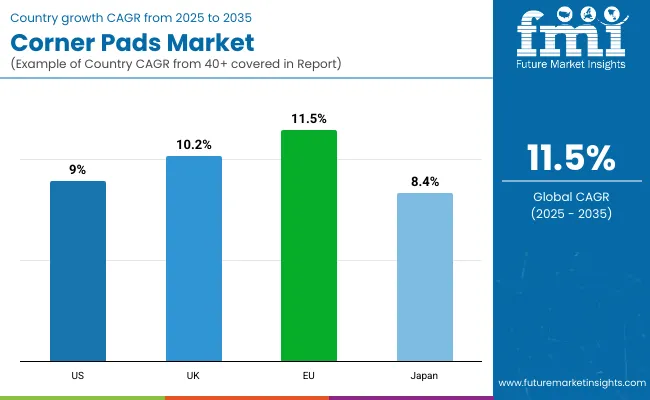

The global corner pads market is valued at USD 495.1 million in 2025 and is projected to reach USD 1,470.4 million by 2035, expanding at a CAGR of 11.5%. A balanced split between paper and alternative materials is observed, indicating strong demand for material diversification and innovation in the corner pads market.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 495.1 Million |

| Projected Market Size in 2035 | USD 1,470.4 million |

| CAGR (2025 to 2035) | 11.5% |

Market expansion is being driven by increasing demand for protective packaging in e-commerce and logistics, where corner pads are required to secure palletized goods and prevent transit damage. Growth is further supported by the adoption of lightweight materials that reduce shipping costs while maintaining structural integrity. Regional uptake has been bolstered by investments in manufacturing and warehousing infrastructure across North America and Europe.

Market development is being restrained by raw material price volatility, which can compress margins for producers. Occasional supply-chain disruptions have led to shortages and delayed fulfilments. Additionally, evolving packaging-waste regulations are imposing compliance costs without mandating material substitution.

Opportunities are being created by the emergence of novel composite materials offering improved impact resistance at lower weight. Customisation trends are being driven by end users seeking designs tailored to specific load profiles and transit conditions. Production automation is being adopted to enhance consistency and scale output in high-growth regions such as the USA and EU.

The corner pads market is segmented by type of material into paper; plastic; and foam; by product type into angular edge; straight edge; and custom edge; by end use into automotive; food & beverages; building and construction; electronics and electricals; and other industrial; and by region into North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia Pacific; and Middle East and Africa.

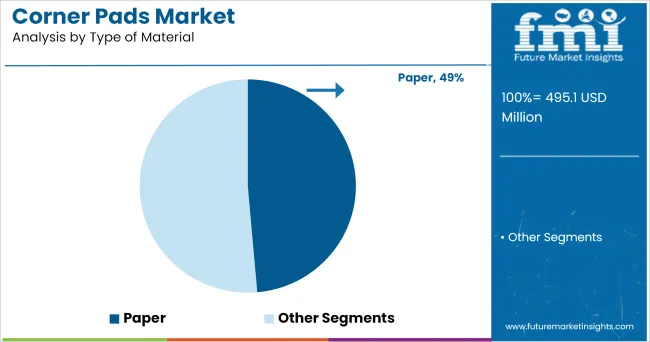

In 2025, paper corner pads hold a 49% share, valued at USD 242.6 million, offering a lightweight and recyclable solution for pallet edge protection. Plastic and foam materials together account for the remaining 51%, driven by demand for higher durability and moisture resistance in industrial and export packaging. While paper maintains its relevance in cost-sensitive and eco-aligned markets, growth in plastic and foam segments reflects shifting preferences in high-impact applications, particularly in electronics and construction logistics.

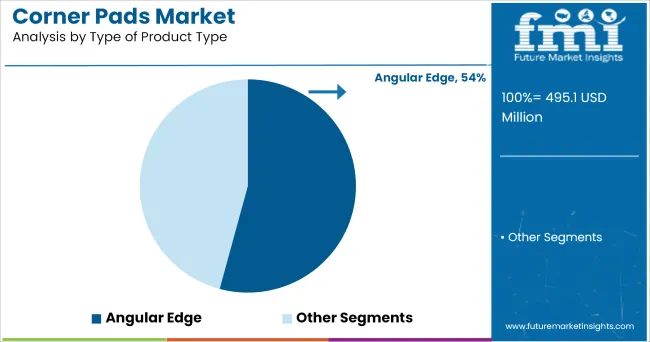

Angular edge corner pads lead with a 54% share in 2025, valued at USD 267.4 million, owing to their standardized fit and wide applicability across sectors like building materials and electronics. Straight edge and custom edge variants collectively represent 46%, used in non-standard load profiles and bespoke packaging solutions. While angular edge designs dominate due to ease of stacking and lower production costs, custom edge formats are gaining traction in niche sectors that demand tailored structural protection.

In 2025, the building and construction sector emerges as the leading end user of corner pads, driven by high-volume transport of panels, tiles, and other fragile materials requiring edge protection. The automotive and electronics sectors follow, leveraging corner pads to prevent damage during assembly-line transfers and global shipping. Meanwhile, food & beverage and other industrial segments adopt corner pads selectively for secondary packaging, particularly for bulk shipments. Regulatory attention to transport safety and damage mitigation continues to expand usage across all verticals.

The corner pads market is witnessing steady uptake across the top 10 global economies, each reflecting a distinct pattern in protective packaging demand, regulatory influence, and material preference.

In the United States, growth is led by e-commerce and industrial shipments, with strong traction for paper-based and custom-edge solutions. China’s scale drives high-volume demand in electronics and construction, favoring foam and plastic variants. Japan emphasizes precision-fit angular edge formats, aligning with its electronics and automotive exports. Germany and France show a shift toward recyclable options, especially in the building sector, while the UK balances between cost-efficiency and compliance-driven packaging solutions.

India’s infrastructure expansion accelerates demand for basic foam and plastic pads, whereas South Korea focuses on export-grade protective materials. In Italy, demand stems from automotive and ceramic tile logistics, prompting hybrid material use. Canada’s moderate-scale adoption emphasizes sustainability, aligning with paper-based variants in food and beverage logistics.

Across these markets, end-user diversity and logistical standards shape corner pad adoption patterns, with material innovation and regional regulation acting as key differentiators.

The United States corner pads market projected to expand at a CAGR of 9%. Growth is driven by the scale of domestic logistics, particularly in e-commerce, food service distribution, and retail warehousing, where demand for durable yet lightweight edge protection remains high.

No federal packaging mandates exist, but ASTM and industry-led standards influence design and testing benchmarks. Recyclable paper variants are increasingly favored by bulk shippers and B2B retailers seeking to align with internal sustainability KPIs. Custom-edge formats have also gained popularity, particularly in sectors such as furniture and industrial equipment, where packaging precision is linked to damage prevention.

The United Kingdom corner pads market is likely to grow at a CAGR of 10.2%. Market expansion is supported by increased demand from the construction, electronics, and food sectors, alongside strict packaging waste compliance driven by UK Plastic Packaging Tax and Extended Producer Responsibility (EPR) frameworks.

While foam and plastic variants are still in use for fragile goods, the shift toward recyclable and compostable materials is accelerating. Paper-based corner pads are gaining preference among UK distributors and construction firms due to their cost-efficiency and ease of disposal. Additionally, demand for custom-edge solutions is rising among furniture exporters and industrial equipment manufacturers targeting EU and US markets.

The European Union corner pads market is projected to grow at a CAGR of 11.5%. Growth is anchored in strong regulatory pressure from the EU Packaging and Packaging Waste Directive, pushing industries toward recyclable and reusable protective materials, especially paper-based options.

Demand is highest in Germany, France, Italy, and Spain, where construction and industrial goods shipping dominate corner pad usage. Angular edge designs are standard due to their structural simplicity, while custom-edge variants are increasingly used in automotive components and electronics. The EU’s single-market logistics ecosystem further drives adoption by large distributors and packaging consolidators seeking standardized yet compliant corner protection solutions.

The Japan corner pads market is expected to grow at a CAGR of 8.4%. Demand is primarily driven by the country’s precision manufacturing sectors-electronics, automotive, and optics-where damage-free handling during domestic and export shipping is critical.

Regulatory emphasis lies in waste minimization and material optimization, with voluntary standards from the Japan Packaging Institute influencing material selection. Paper and hybrid paper-foam variants are preferred for their balance of strength and recyclability. Angular edge pads dominate due to their compatibility with automated packing systems widely used in Japanese manufacturing logistics.

The players in the corner pads market are focusing on material innovation, regional expansion, and end-use customization to address growing demand across construction, industrial, and logistics sectors. Leading firms are strengthening their foothold through recyclable and lightweight material formats, particularly paper-based and hybrid corner pads, to align with regulatory and operational priorities of large-scale shippers. Strategic collaborations with packaging distributors and pallet manufacturers have also been observed to streamline product integration.

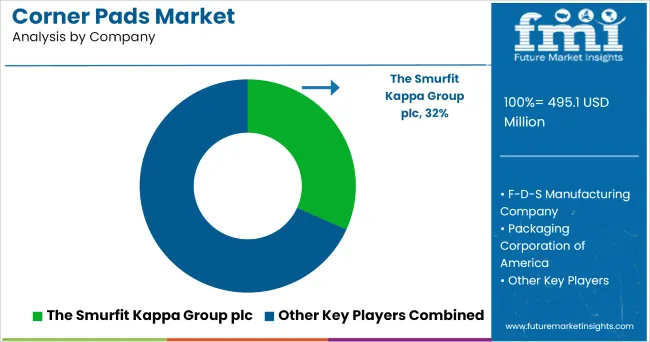

Tier 1 companies like The Smurfit Kappa Group plc, which holds a 32% share, continue to dominate through vertically integrated manufacturing, global distribution networks, and large-volume supply contracts. These players invest heavily in automated production and R&D for custom-fit edge solutions.

Tier 2 firms such as Packaging Corporation of America and F-D-S Manufacturing Company are expanding regionally, targeting mid-size B2B clients with cost-competitive offerings and adaptable SKUs. Meanwhile, smaller players and startups are entering the market by offering niche products, particularly in foam and bio-based formats tailored for fragile or premium goods.

The corner pads market presents viable entry points for startups, though Tier 1 players maintain scale advantages.

This is not a closed market. While large firms like Smurfit Kappa dominate institutional contracts and high-volume B2B supply chains, startups are carving niches through:

The capital barrier is moderate, tooling and basic die-cutting or molding are accessible with minimal investment compared to other packaging categories. However, to grow beyond niche segments, scaling operations and meeting cost efficiency benchmarks becomes critical.

The corner pads market is expected to reach USD 495.1 million in 2025.

The corner pads market is projected to reach USD 1,470.4 million by 2035.

The corner pads market is anticipated to grow at a CAGR of 11.5% between 2025 and 2035.

Other materials lead the corner pads market with a 51% share in 2025, slightly ahead of paper at 49%.

Angular edge corner pads hold the largest share at 54% in 2025.

The Smurfit Kappa Group plc leads the corner pads market with a 32% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examining Market Share Trends in the Meat Pads Industry

Brake Pads and Shoes Market Size and Share Forecast Outlook 2025 to 2035

Cross Corner Industrial Bags Market Size and Share Forecast Outlook 2025 to 2035

Global Toner Pads Market Size and Share Forecast Outlook 2025 to 2035

Layer Pads Market from 2025 to 2035

Pallet Corner Boards Market from 2025 to 2035

Tipper Pads Market

Sleeper Pads Market Size and Share Forecast Outlook 2025 to 2035

Scouring Pads Market Size and Share Forecast Outlook 2025 to 2035

Mattress Pads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Exfoliating Pads Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Print & Apply Corner Wrap Labelling System Market

Die Cut Support Pads Market Size and Share Forecast Outlook 2025 to 2035

Heated Mattress Pads Market

Reusable Nursing Pads Market Size and Share Forecast Outlook 2025 to 2035

Reusable Sanitary Pads Market Growth - Size, Demand & Forecast 2025 to 2035

Thermal Interface Pads and Materials Market Growth - Trends, Analysis & Forecast by Type, product, Application and Region through 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Pressure Redistribution Pads Market

Automotive Sintered Brake Pads Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA