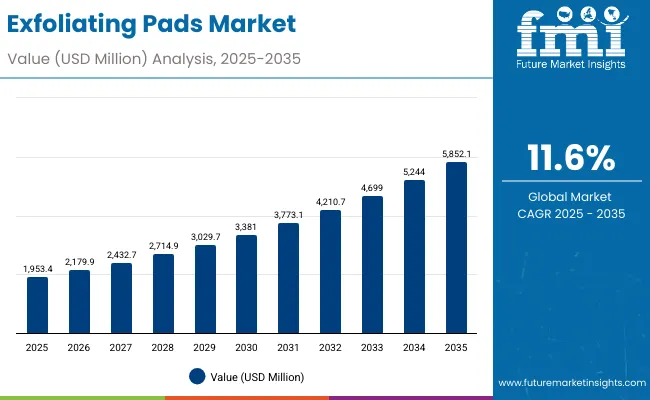

A market valuation of USD 1,953.4 million is projected in 2025 for exfoliating pads, and this value is expected to surge to USD 5,852.1 million by 2035. Over the decade, the market is anticipated to expand by nearly USD 3.9 billion, reflecting an impressive 11.6% CAGR and signaling a threefold increase in size.

Quick Stats for Exfoliating Pads Market

Exfoliating Pads Market Key Takeaways

| Metric | Value |

|---|---|

| EXFOLIATING PADS Market Estimated Value in (2025E) | USD 1,953.4 million |

| EXFOLIATING PADS Market Forecast Value in (2035F) | USD 5,852.1 million |

| Forecast CAGR (2025 to 2035) | 11.60% |

The first half of the forecast period (2025-2030) is projected to add approximately USD 1,428 million, with the market advancing from USD 1,953.4 million in 2025 to USD 3,381.0 million in 2030. This stage is likely to be shaped by strong adoption among urban consumers seeking convenient yet clinically effective skincare solutions. Widespread preference for dermatologically tested and claim-based products such as alcohol-free, hypoallergenic, and vegan pads is expected to reinforce growth momentum.

The second phase (2030-2035) is anticipated to contribute an additional USD 2,471 million, with the market increasing from USD 3,381.0 million in 2030 to USD 5,852.1 million by 2035. This acceleration is projected to be fueled by premiumization, eco-conscious material choices, and deep penetration of e-commerce-driven beauty retail.

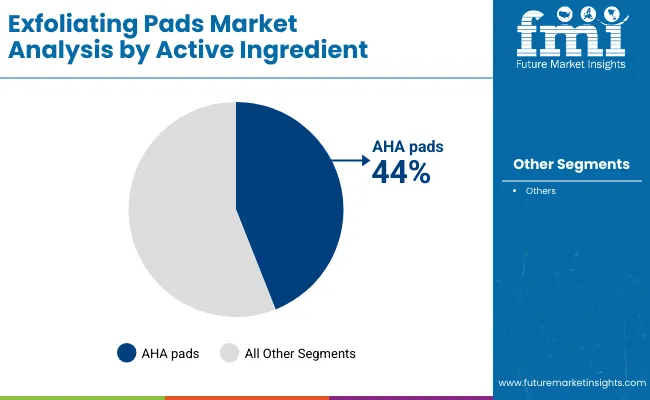

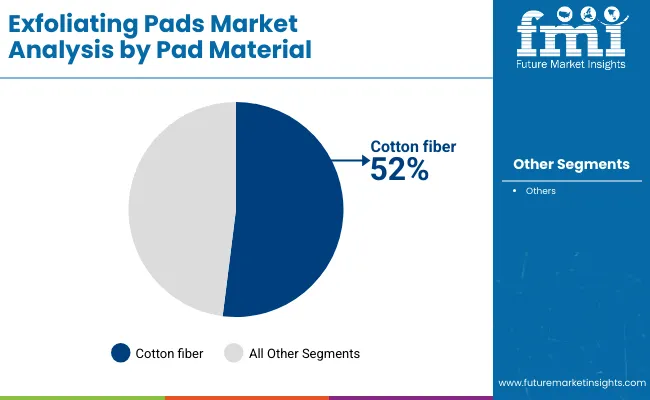

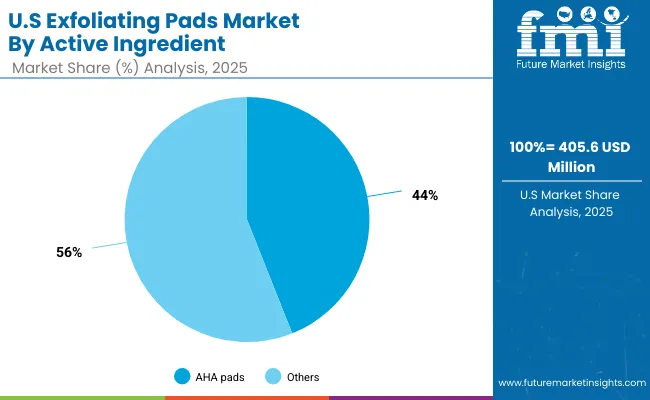

In terms of segmentation, AHA pads are expected to dominate with 44% share in 2025, translating to USD 859.5 million. By pad material, cotton fiber pads are anticipated to lead with 52% share, equivalent to USD 1,015.8 million in 2025. These dynamics highlight how both performance-driven actives and consumer trust in familiar materials will anchor the competitive positioning of this category.

From 2025 to 2035, the market is expected to expand by nearly USD 3.9 billion, reflecting a threefold increase in overall size. Growth will be shaped by consumer inclination toward dermatologist-inspired formulations, eco-conscious pad materials, and strong e-commerce penetration. Leadership is anticipated to be anchored by AHA-based pads and cotton fiber formats, while regional acceleration is likely to be strongest in Asia-Pacific, particularly China and India.

Expansion in the Exfoliating Pads Market is being driven by rising consumer awareness of skin health and the growing preference for convenient at-home exfoliation solutions. Demand is being reinforced by the widespread adoption of AHA-based formulations, which are recognized for their efficacy in improving skin renewal and texture. Increasing focus on acne and blemish care, brightening, and anti-aging benefits is expected to accelerate adoption across diverse age groups, particularly women aged 25+ and young adults.

The shift toward eco-conscious and biodegradable pad materials, such as bamboo fiber, is also influencing purchase decisions as sustainability becomes a priority in beauty and personal care. Simultaneously, e-commerce channels are projected to dominate sales by 2025, driven by digital engagement and direct-to-consumer strategies from leading brands.

Strong growth in Asia-Pacific markets, especially China (15.8% CAGR) and India (17.7% CAGR), is anticipated to reshape global demand dynamics, while established markets such as the USA and Europe continue to provide stable consumption bases.

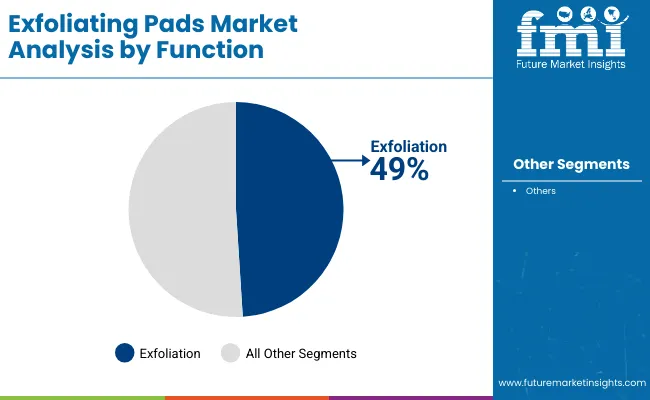

The Exfoliating Pads Market has been structured around key dimensions such as active ingredient, function, and pad material, which highlight the evolving nature of consumer demand and product innovation. Each of these segments reflects distinct growth drivers that are expected to influence market positioning between 2025 and 2035.

By active ingredient, the dominance of AHA-based pads demonstrates how efficacy and clinical credibility are being prioritized in consumer choices, while broader alternatives continue to expand appeal through diverse formulations. By function, exfoliation remains the central benefit driving adoption, though complementary claims such as brightening, acne care, and anti-aging are expected to strengthen the value proposition. By pad material, cotton fibers are set to hold leadership due to consumer familiarity, though biodegradable and innovative formats are increasingly shaping sustainability narratives. Together, these segments capture the balance of performance, trust, and environmental consciousness that will define future market expansion.

| Segment | Market Value Share, 2025 |

|---|---|

| AHA pads | 44% |

| Others | 56.0% |

Segmentation by active ingredient highlights the dominance of AHA pads, which are projected to capture 44% of market share in 2025, equivalent to USD 859.5 million. This leadership is expected to be anchored in the proven efficacy of AHAs for exfoliation and skin renewal, resonating strongly with consumer demand for dermatologist-inspired formulations. Growth of this segment will also be reinforced by its alignment with claims such as brightening and anti-aging, which continue to be prioritized across premium and mass-market categories. Although the "others" category commands a slightly higher share of 56% in 2025 (USD 1,093.9 million), the credibility and clinical positioning of AHA-based products are anticipated to sustain their premium positioning, ensuring strong adoption across both developed and emerging markets.

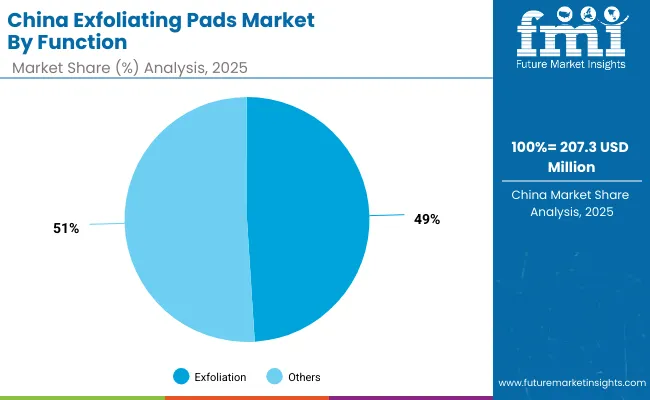

| Segment | Market Value Share, 2025 |

|---|---|

| Exfoliation | 49% |

| Others | 51.0% |

By function, exfoliation remains the largest contributor, projected to account for 49% share in 2025, equivalent to USD 957.2 million. Growth is anticipated to be reinforced by consumer demand for reliable solutions that deliver visible improvements in skin texture and clarity. The segment’s strength lies in its universal appeal across both younger demographics seeking preventive care and older users prioritizing anti-aging benefits. The "others" category, which holds 51% share in 2025 (USD 996.2 million), reflects the diversification of claims such as brightening, acne care, and hydration. However, exfoliation’s fundamental role as the core skincare benefit ensures it will remain the most dominant functional positioning, supported by innovation in multi-acid and enzyme-based formulations that promise safer, more targeted results.

| Segment | Market Value Share, 2025 |

|---|---|

| Cotton fiber | 52% |

| Others | 48.0% |

Segmentation by pad material shows cotton fiber retaining dominance, expected to command 52% of market share in 2025, representing USD 1,015.8 million. Consumer trust in cotton-based materials is reinforced by familiarity, comfort, and perceived safety, making this segment a consistent choice in both premium and mass retail channels. At the same time, the "others" category, which accounts for 48% share in 2025 (USD 937.6 million), is likely to gain traction with the introduction of biodegradable bamboo fiber and dual-textured materials. Sustainability concerns and eco-conscious purchasing behavior are projected to strengthen momentum for alternative fibers in the coming years. Nevertheless, cotton fiber is anticipated to remain the material of choice in the near term due to its affordability, scalability, and wide acceptance across global markets.

Challenges in sustainability compliance and evolving ingredient regulations are being navigated in the Exfoliating Pads Market, even as functional innovation and digital-first retail models create new opportunities for consumer engagement, premium positioning, and accelerated category expansion across key regions.

Dermatologist-Led Positioning and Clinical Validation

The market is being accelerated by dermatologist-led endorsements and scientific validation, which are reshaping consumer trust and purchase intent. Products formulated with clinically backed actives such as AHAs are being prioritized, as consumers increasingly evaluate claims through a lens of safety, efficacy, and transparency. This shift is expected to favor brands investing in clinical trials and evidence-based marketing, ensuring a competitive edge in both developed and emerging markets. Over the next decade, greater alignment with regulatory bodies and dermatological associations is anticipated to cement consumer trust, creating premium pricing opportunities while setting higher entry barriers for unverified offerings.

Integration of Sustainability with Material Innovation

Sustainability is no longer confined to packaging but is now driving innovation in pad materials themselves. Cotton fiber retains dominance, yet a pronounced transition toward biodegradable bamboo and dual-textured gauze pads is being witnessed. This transition is being reinforced by eco-certifications, consumer activism, and retailer mandates that increasingly require proof of environmental responsibility. Such integration of sustainability with product performance is expected to shape competitive differentiation, as brands that deliver both efficacy and eco-credibility are anticipated to secure greater loyalty. By 2035, sustainability-aligned innovations are projected to redefine material choices, repositioning the category as a benchmark for responsible beauty.

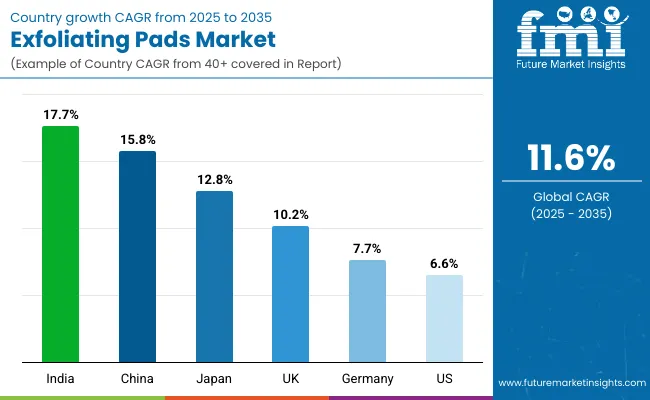

| Countries | CAGR |

|---|---|

| China | 15.8% |

| USA | 6.6% |

| India | 17.7% |

| UK | 10.2% |

| Germany | 7.7% |

| Japan | 12.8% |

The Exfoliating Pads Market is projected to expand unevenly across countries, reflecting differences in consumer maturity, digital adoption, and beauty care spending. The highest pace of growth is expected in India, where a CAGR of 17.7% is forecast from 2025 to 2035. This acceleration is anticipated to be supported by rising disposable incomes, increasing adoption of modern beauty routines, and the rapid expansion of e-commerce-driven distribution. China is projected to grow at a 15.8% CAGR, underpinned by strong demand for dermatologist-led skincare, premium brand penetration, and eco-conscious innovation in pad materials.

Japan is anticipated to record a 12.8% CAGR, driven by the popularity of multi-functional skincare formats and preference for high-quality textures. Meanwhile, the UK (10.2% CAGR) is expected to be fueled by demand for vegan, alcohol-free, and fragrance-free formulations, aligning with broader clean beauty movements.

In comparison, Europe is forecast to expand at 8.2% CAGR, supported by demand for dermatologically tested solutions and sustainability-led product innovations. Growth in Germany (7.7% CAGR) highlights the steady role of clinical positioning, while the USA is expected to advance at a more modest 6.6% CAGR, reflecting its already mature beauty market but continued appetite for premium exfoliating products.

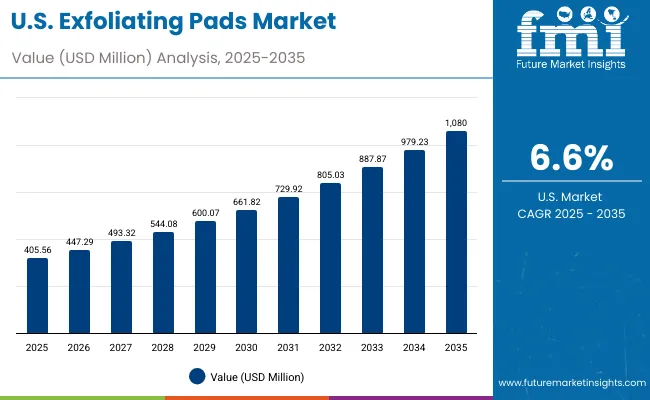

| Year | USA Exfoliating Pads Market (USD Million) |

|---|---|

| 2025 | 405.56 |

| 2026 | 447.29 |

| 2027 | 493.32 |

| 2028 | 544.08 |

| 2029 | 600.07 |

| 2030 | 661.82 |

| 2031 | 729.92 |

| 2032 | 805.03 |

| 2033 | 887.87 |

| 2034 | 979.23 |

| 2035 | 1080.00 |

The Exfoliating Pads Market in the United States is forecast to expand at a CAGR of around 10.1% between 2025 and 2035, increasing from USD 405.6 million to USD 1,080.0 million. Growth is expected to be driven by consumer preference for dermatologist-backed actives, sustainability-linked materials, and omnichannel retail penetration.

Premiumization is projected to strengthen, as USA consumers increasingly align skincare purchases with clinical credibility and eco-conscious choices. The competitive landscape is anticipated to reflect a mix of multinational leaders and emerging indie brands, both leveraging digital-first engagement to capture market share.

The Exfoliating Pads Market in the UK is projected to grow at a CAGR of 10.2% between 2025 and 2035, supported by consumer alignment with clean beauty and ethical skincare. Growth is expected to be reinforced by the rising demand for vegan, alcohol-free, and fragrance-free claims that resonate with ingredient-conscious buyers. The maturing beauty retail landscape is anticipated to further accelerate digital adoption, with specialty retailers and online-first brands shaping competitive dynamics. Premium skincare adoption is likely to sustain the influence of international brands, while local niche players will gain momentum through targeted innovation.

The Exfoliating Pads Market in India is forecast to expand at the fastest CAGR of 17.7% from 2025 to 2035, highlighting its role as a pivotal growth engine globally. Rapid digital adoption and increasing penetration of affordable skincare formats are expected to drive consumption among younger demographics and urban consumers. E-commerce platforms are anticipated to be critical in shaping access, with beauty-focused apps and D2C models playing central roles. Growing experimentation with exfoliating actives, combined with rising skincare literacy, is projected to reshape preferences toward dermatologist-backed offerings.

The Exfoliating Pads Market in China is projected to advance at a CAGR of 15.8% from 2025 to 2035, reflecting strong demand for premium skincare solutions. Growth is anticipated to be driven by high digital adoption, rapid uptake of dermatologist-inspired formats, and preference for premium international brands. E-commerce ecosystems, particularly beauty-specific platforms, are expected to expand their dominance, while social commerce and influencer-driven strategies reshape buying behaviors. The shift toward eco-conscious materials and multi-functional formats is anticipated to further enhance competitive positioning.

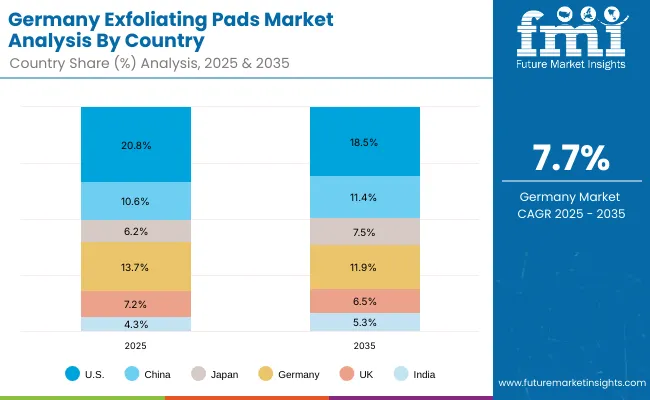

| Countries | 2025 |

|---|---|

| USA | 20.8% |

| China | 10.6% |

| Japan | 6.2% |

| Germany | 13.7% |

| UK | 7.2% |

| India | 4.3% |

| Countries | 2035 |

|---|---|

| USA | 18.5% |

| China | 11.4% |

| Japan | 7.5% |

| Germany | 11.9% |

| UK | 6.5% |

| India | 5.3% |

The Exfoliating Pads Market in Germany is expected to grow at a CAGR of 7.7% between 2025 and 2035, reflecting steady but moderate expansion. Consumer demand is anticipated to be anchored in clinical credibility, safety claims, and dermatologist-tested formulations. German consumers are projected to maintain strong preferences for regulated, high-quality products, making compliance and transparency central to brand positioning. While e-commerce will gain share, established pharmacy and specialty retail channels are expected to retain relevance due to consumer trust. Innovation in biodegradable and eco-certified pads is anticipated to resonate strongly within this sustainability-conscious market.

| Segment | Market Value Share, 2025 |

|---|---|

| AHA pads | 44% |

| Others | 56.0% |

The Exfoliating Pads Market in the USA is projected at USD 405.6 million in 2025. Within this, AHA pads contribute 44% (USD 178.5 million), while the "others" category holds a slightly higher share of 56% (USD 227.1 million). This distribution illustrates a balanced market structure where traditional AHA-led efficacy coexists with alternative formulations targeting broader consumer needs.

The continued preference for AHA pads is expected to stem from their proven effectiveness in exfoliation, anti-aging, and brightening routines, reinforcing their clinical credibility. The stronger share held by the "others" segment reflects rising experimentation with multi-acid blends, enzyme-based pads, and evolving claims such as vegan or fragrance-free solutions. This demonstrates a shift toward personalization and diversified skin concerns being addressed through multiple actives.

As demand for dermatologist-tested products strengthens, future growth will be shaped by brand strategies that integrate efficacy with sustainability and digital-first outreach. The USA market is anticipated to act as a benchmark for premium skincare adoption, with active ingredient innovation driving category competitiveness.

| Segment | Market Value Share, 2025 |

|---|---|

| Exfoliation | 49% |

| Others | 51.0% |

The Exfoliating Pads Market in China is projected at USD 207.3 million in 2025. Within this, exfoliation-focused pads contribute 49% (USD 101.6 million), while the "others" category maintains a slightly larger share of 51% (USD 105.7 million). This near-equal split underscores the dual emphasis on traditional exfoliation benefits and evolving multifunctional claims.

The strength of the exfoliation segment reflects enduring consumer trust in products designed to improve skin clarity, texture, and renewal, aligning with China’s strong demand for visible skincare efficacy. The "others" category demonstrates growing adoption of pads formulated for brightening, acne care, and hydration, driven by younger demographics and premium brand strategies. This segment is expected to expand further as consumers increasingly seek holistic solutions addressing multiple skin concerns simultaneously.

As digital-first platforms amplify beauty education and ingredient awareness, Chinese consumers are anticipated to diversify product usage, blending exfoliation with multifunctional skincare benefits. This shift is projected to redefine competitive positioning, favoring brands that integrate efficacy with tailored innovation.

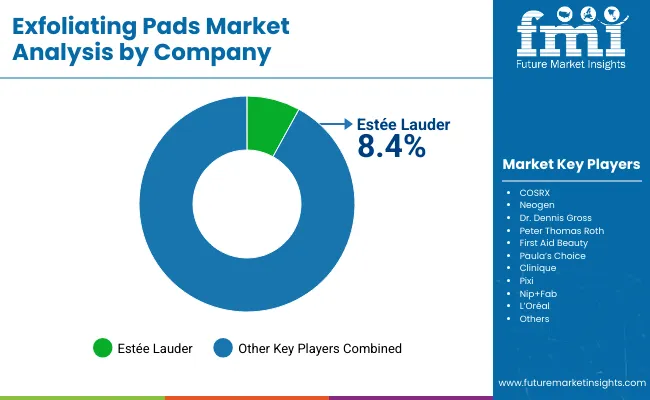

The Exfoliating Pads Market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused skincare specialists competing across diverse segments. Estée Lauder is recognized as the leading global player, holding 8.4% of global value share in 2025, while all other companies collectively account for 91.6%. Based on available data, Estée Lauder also dominated in 2024 with approximately 8.2% share, maintaining leadership through its premium skincare brands and dermatologically tested product lines.

Other relevant players in this market include COSRX, Neogen, Dr. Dennis Gross, Paula’s Choice, Clinique, Pixi, Nip+Fab, L’Oréal, and Peter Thomas Roth. These companies are appropriate for this segment, as they are actively engaged in skincare solutions where exfoliating pads represent an important portfolio extension. Unlike hardware-focused companies such as Faro Technologies or Hexagon AB, which are not relevant for this market, these beauty and personal care brands are positioned correctly.

Competitive strategies are expected to evolve beyond ingredient efficacy toward integrated brand ecosystems. Future differentiation will likely stem from dermatologist endorsements, sustainability-certified pad materials, and omnichannel retail strategies. Digital-first indie brands are anticipated to accelerate competition by leveraging influencer-driven marketing and e-commerce exclusivity, while global giants will consolidate share through innovation pipelines and premium positioning.

Key Developments in Exfoliating Pads Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,953.4 million (2025) → USD 5,852.1 million (2035), CAGR 11.6% |

| Active Ingredient | AHA Pads (44% share; USD 859.5 million, 2025), Others (56% share; USD 1,093.9 million, 2025) |

| Function | Exfoliation (49% share; USD 957.2 million, 2025), Others (51% share; USD 996.2 million, 2025) |

| Pad Material | Cotton Fiber (52% share; USD 1,015.8 million, 2025), Others (48% share; USD 937.6 million, 2025) |

| End-use Consumers | Teen/Young Adults, Women 25+, Men, Sensitive Skin Users |

| Distribution Channels | E-commerce, Pharmacies, Specialty Beauty Retail, Mass Retail |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, China, Japan, India |

| Key Companies Profiled | Estée Lauder, COSRX, Neogen, Dr. Dennis Gross, Peter Thomas Roth, First Aid Beauty, Paula’s Choice, Clinique, Pixi, Nip+Fab, L’Oréal |

| Additional Attributes | Dollar sales by active ingredient, function, and pad material; premiumization trends in dermatologist-tested actives; adoption of biodegradable and eco-friendly materials; expansion of e-commerce-led distribution; growing demand in Asia-Pacific (China, India) with double-digit CAGR; competitive differentiation via sustainability, clinical validation, and digital-first strategies. |

The global Exfoliating Pads Market is estimated to be valued at USD 1,953.4 million in 2025.

The market size for the Exfoliating Pads Market is projected to reach USD 5,852.1 million by 2035.

The Exfoliating Pads Market is expected to grow at an 11.6% CAGR between 2025 and 2035.

The key product types in the Exfoliating Pads Market are AHA pads and other formulations including multi-acid blends, enzyme-based pads, and PHAs.

In terms of function, the exfoliation segment is anticipated to command 49% share in the Exfoliating Pads Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Exfoliating Scrubs and Peels Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Meat Pads Industry

Brake Pads and Shoes Market Size and Share Forecast Outlook 2025 to 2035

Global Toner Pads Market Size and Share Forecast Outlook 2025 to 2035

Layer Pads Market from 2025 to 2035

Corner Pads Market Insights - Growth & Demand 2025 to 2035

Tipper Pads Market

Sleeper Pads Market Size and Share Forecast Outlook 2025 to 2035

Scouring Pads Market Size and Share Forecast Outlook 2025 to 2035

Mattress Pads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Die Cut Support Pads Market Size and Share Forecast Outlook 2025 to 2035

Heated Mattress Pads Market

Reusable Nursing Pads Market Size and Share Forecast Outlook 2025 to 2035

Reusable Sanitary Pads Market Growth - Size, Demand & Forecast 2025 to 2035

Thermal Interface Pads and Materials Market Growth - Trends, Analysis & Forecast by Type, product, Application and Region through 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Pressure Redistribution Pads Market

Automotive Sintered Brake Pads Market Size and Share Forecast Outlook 2025 to 2035

Automotive Energy Absorption (EA) Pads Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA