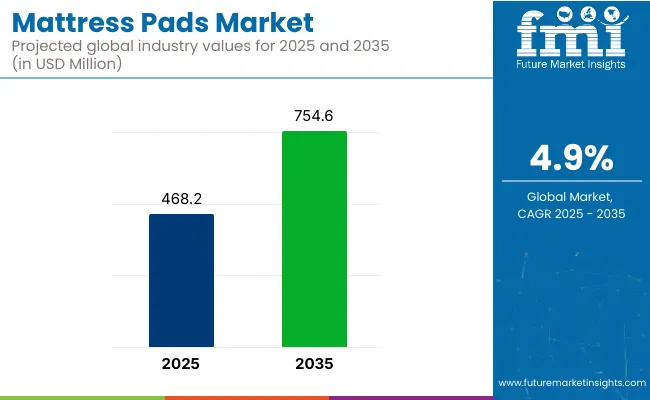

The global mattress pads market is valued at USD 468.2 million in 2025 and is slated to be worth USD 754.6 million by 2035, at 4.9% CAGR. This growth will be propelled by increasing demand for quality sleep products, a rising preference for hypoallergenic and temperature-controlled bedding, and a wider shift toward sustainable home accessories. The post-pandemic wellness trend has intensified demand for orthopedic sleep aids and premium comfort solutions.

| Metric | Value |

|---|---|

| Estimated Market Size (2025) | USD 468.2 million |

| Projected Market Size (2035) | USD 754.6 million |

| CAGR (2025 to 2035) | 4.9% |

Advancements in sleep technology and consumer wellness trends are driving innovation in the mattress pads market. Government regulations promoting fire-retardant and hypoallergenic materials have influenced manufacturing standards globally. The integration of smart features, such as IoT-enabled sleep tracking and climate control, is reshaping consumer expectations.

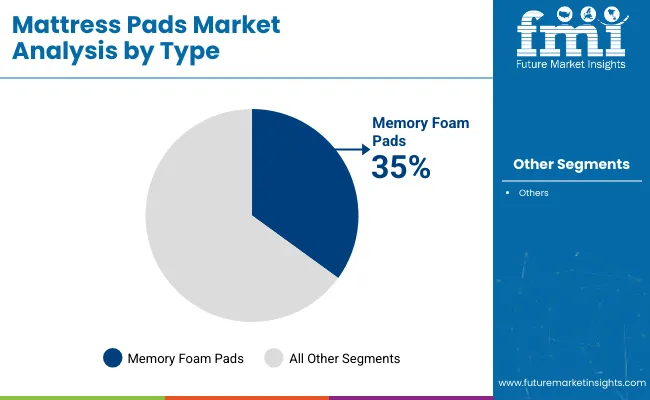

Memory foam and gel-based pads are projected to dominate the product landscape, offering pressure relief and enhanced airflow. The growing focus on sleep health, especially in urban and aging populations, is further propelling demand. Additionally, the rise in sustainable product development using organic and plant-based materials is contributing to the evolution of the premium mattress pad segment.

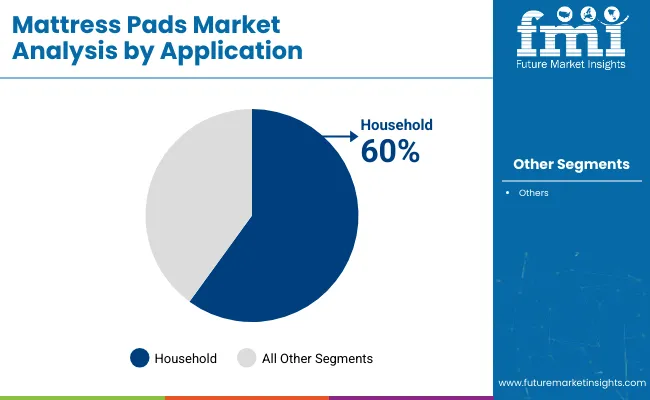

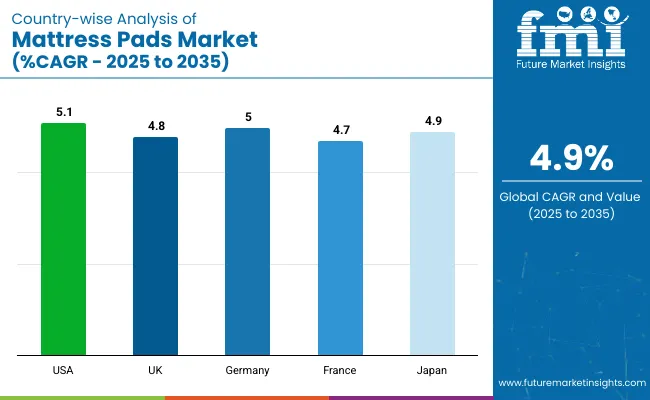

The USA is projected to be the fastest-growing country, with a CAGR of 5.1% from 2025 to 2035. Memory foam pads will lead the type segment with a 35% market share in 2025, driven by demand for orthopedic comfort. Household applications are expected to dominate, accounting for over 60% of total market share.

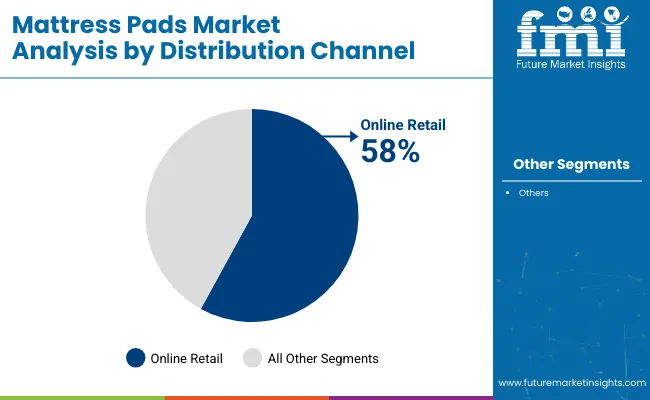

Online retail is gaining traction and is projected to contribute 58% of total sales by 2035. Moreover, rising disposable income enables consumers to spend more on home comfort products like mattress pads. As budgets grow, people prioritize better sleep quality and invest in premium, durable mattress pads with advanced features. This increased purchasing power drives higher sales and market growth in the mattress pads sector.

The mattress pads market is segmented by type, application, distribution channel, and region. By type, the market is segmented into memory foam mattress topper, latex mattress, feather mattress topper, wool mattress topper, and others (cotton pads, down-alternative pads, waterproof pads, and cooling/moisture-wicking pads).

In terms of application, the market is bifurcated into household and commercial. By distribution channel, the market is categorized into online and offline. Regionally, the market is analyzed across North America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Latin America, and the Middle East & Africa.

Memory foam pads are projected to lead the type segment with a 35% market share in 2025.

The household segment is expected to dominate the application category, contributing over 60% of market share in 2025.

Online retail is projected to secure approximately 58% of total mattress pad sales by 2035.

The global mattress pads market is witnessing steady expansion, supported by growing consumer focus on sleep wellness, increased adoption of memory foam and eco-friendly materials, and the emergence of smart temperature-regulating technologies.

Recent Trends in the Mattress Pads Market

Key Challenges in the Mattress Pads Market

The global mattress pads market is expanding due to increased awareness of sleep health, demand for pressure-relieving materials, and rising interest in smart and eco-conscious bedding. Innovations in memory foam, gel-infused pads, and temperature-regulating fabrics are driving production and distribution growth across both residential and commercial end-use segments.

The USA mattress pads market is projected to grow at a CAGR of 5.1% from 2025 to 2035. Growth is supported by rising consumer emphasis on sleep wellness, higher disposable income, and the popularity of premium home comfort products.

The presence of well-established brands and continued innovation in memory foam and cooling technologies drive market penetration. The e-commerce boom, along with the expansion of direct-to-consumer business models, is making sleep products more accessible across urban and suburban households.

The mattress pads market in the UK is expected to register a CAGR of 4.8% between 2025 and 2035. Increased preference for natural, chemical-free bedding products is shaping consumer demand. Regulatory frameworks such as REACH are pushing manufacturers toward eco-labeled materials and sustainable sourcing. Urban buyers are also showing interest in customizable sleep solutions, driving innovation in design and material use.

Germany’s mattress pads market is forecast to grow at a CAGR of 5% from 2025 to 2035. A mature and sustainability-driven consumer base is powering demand for certified organic products. Eco-conscious shopping habits are steering purchases toward OEKO-TEX certified and washable mattress pads.

France’s mattress pads market is projected to register a CAGR of 4.7% from 2025 to 2035. Premium sleep experiences shape demand, particularly in the hospitality and urban home segments. French consumers are gravitating toward hypoallergenic and breathable bedding that aligns with lifestyle and health preferences.

Japan’s mattress pads market is estimated to grow at a CAGR of 4.9% from 2025 to 2035. Demand is driven by urban minimalism, advanced consumer technology, and demographic shifts. Elderly care facilities are investing in pressure-relief pads with advanced features like smart sensors and AI-assisted adjustments.

The mattress pads market is moderately fragmented, with a mix of established global brands and emerging regional players competing on innovation, comfort, and material quality. Key players include Sleep Number Corporation, Sunbeam Products, Perfect Fit Industries, Therapedic International, and Silentnight Group. Sleep Number stands out with its smart, climate-regulating pads featuring AI-enabled sleep tracking.

Sunbeam Products focuses on heated pads with Wi‑Fi connectivity and customizable temperature settings. Perfect Fit Industries offers hypoallergenic, dual-zone designs for health-conscious users. Therapedic International delivers orthopedic and gel-infused options, while Silentnight leads in Europe with certified eco-friendly and breathable bedding solutions.

Recent Mattress Pads Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 468.2 million |

| Projected Market Size (2035) | USD 754.6 million |

| CAGR (2025 to 2035) | 4.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameters | Revenue in USD millions/units |

| By Type | Memory Foam, Latex, Feather, Wool, and Others ( Cotton Pads, Down-Alternative Pads, Waterproof Pads, and Cooling/Moisture-Wicking Pads ) |

| By Application | Household and Commercial |

| By Distribution Channel | Online and Offline |

| Regions Covered | North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, Oceania |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Sunbeam Products, Inc., Perfect Fit Industries, LLC, Sleep Number Corporation, Biddeford Blankets LLC, Therapedic International, ElectroWarmth , SensorPEDIC , Soft Heat, Silentnight Group, Beurer GmbH |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

The market is valued at USD 468.2 million in 2025.

The market is expected to reach USD 754.6 million by 2035.

The market is projected to grow at a CAGR of 4.9% between 2025 and 2035.

Memory foam pads lead the market with a 35% share in 2025.

The USA is the fastest-growing country with a CAGR of 5.1% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heated Mattress Pads Market

Mattress Topper Market Size and Share Forecast Outlook 2025 to 2035

Mattress and Mattress Component Market Size and Share Forecast Outlook 2025 to 2035

Mattress And Furniture Bags Market Size and Share Forecast Outlook 2025 to 2035

Mattresses & Accessories Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Mattress and Furniture Bags

Air Mattress Market Insights – Growth & Forecast 2019 to 2029

Examining Market Share Trends in the Meat Pads Industry

Brake Pads and Shoes Market Size and Share Forecast Outlook 2025 to 2035

Smart Mattress Market Size and Share Forecast Outlook 2025 to 2035

Global Toner Pads Market Size and Share Forecast Outlook 2025 to 2035

Layer Pads Market from 2025 to 2035

Latex Mattress Market Growth & Forecast 2025-2035

Queen Mattress Market

Luxury Mattress Market Size and Share Forecast Outlook 2025 to 2035

Corner Pads Market Insights - Growth & Demand 2025 to 2035

Tipper Pads Market

Sleeper Pads Market Size and Share Forecast Outlook 2025 to 2035

Scouring Pads Market Size and Share Forecast Outlook 2025 to 2035

Children Mattress Market Product Type, Ingredient Type, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA