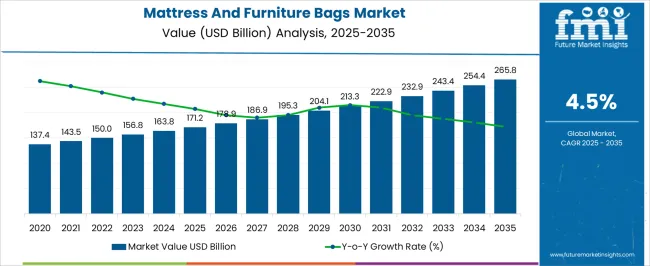

The Mattress And Furniture Bags Market is estimated to be valued at USD 171.2 billion in 2025 and is projected to reach USD 265.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Mattress And Furniture Bags Market Estimated Value in (2025 E) | USD 171.2 billion |

| Mattress And Furniture Bags Market Forecast Value in (2035 F) | USD 265.8 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The mattress and furniture bags market is currently experiencing solid growth, supported by rising urbanization, increasing household mobility, and the growing emphasis on product protection during storage and transport. Consumers and manufacturers are increasingly prioritizing durable packaging solutions that prevent moisture, dust, and physical damage, particularly for high-value home products. Retailers and logistics providers are opting for reusable and protective bags as part of enhanced delivery experiences, especially with the surge in e-commerce furniture sales.

As real estate turnover and home renovations grow globally, so does the need for protective materials that enable hassle-free shifting and long-term storage. Additionally, evolving sustainability concerns have encouraged innovations in recyclable plastics and multi-use packaging designs.

Manufacturers are focused on offering bags that blend practicality with aesthetics, facilitating both consumer convenience and branding potential. The market outlook remains positive, driven by demand from residential, commercial, and institutional sectors seeking to maintain hygiene and protection during transport and warehousing.

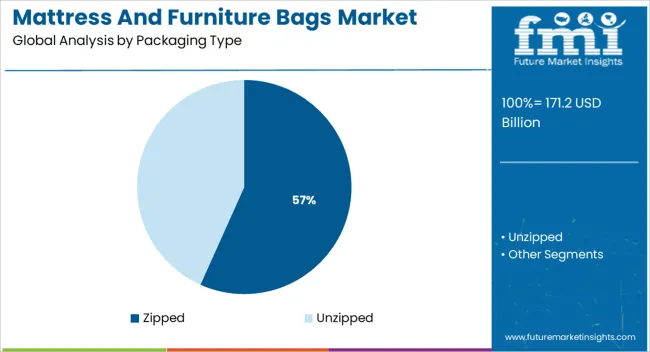

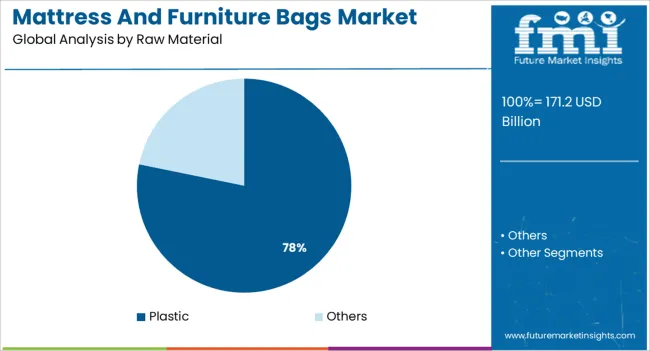

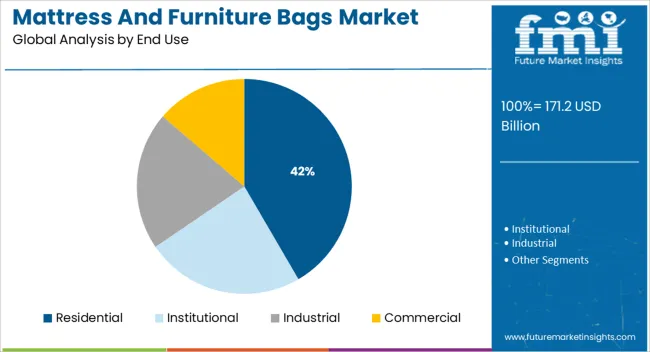

The market is segmented by Packaging Type, Raw Material, End Use, Size, and Mattress and region. By Packaging Type, the market is divided into Zipped and Unzipped. In terms of Raw Material, the market is classified into Plastic and Others. Based on End Use, the market is segmented into Residential, Institutional, Industrial, and Commercial. By Size, the market is divided into Single/Twin size (75” x 39”), Full size (74” x 44”), Queen size (60” x 80”), King size (76” x 80”), California King size (72” x 84”), and Customized. By Mattress, the market is segmented into Standard (1 - 2 mil) and Tough ( > 3 mil). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The zipped packaging type segment is projected to lead the market with a 56.7% revenue share in 2025. This dominance has been driven by the ease of sealing, resealing, and the added protection zipped closures offer against external contaminants.

Zipped bags have become increasingly favored in both residential and commercial moving scenarios due to their user-friendly design and enhanced durability. Their ability to enclose mattresses and furniture without the need for adhesives or tapes improves efficiency during packing and unpacking.

Manufacturers have responded to demand by introducing zip mechanisms that support airtight and watertight properties, further reinforcing product longevity during storage. The growth of this segment is also supported by reusability trends and the premium positioning of zipped solutions in protective packaging portfolios.

Plastic is anticipated to dominate the raw material category with a 78.2% revenue share in 2025. The dominance of plastic stems from its cost-effectiveness, lightweight structure, and strong barrier properties against moisture, dust, and mechanical damage.

High-density polyethylene and low-density polyethylene variants are widely used due to their flexibility, strength, and compatibility with different closure types such as zippers and adhesive flaps. Moreover, plastic’s ability to be manufactured at scale while meeting diverse size and thickness requirements makes it the preferred choice for mattress and furniture protection.

As recyclability initiatives advance, plastic manufacturers are focusing on circular economy practices and bio-based alternatives to address environmental concerns. Despite scrutiny around single-use plastics, the reusability and recyclability of furniture bags have helped maintain plastic’s leading position.

The residential end use segment is forecast to account for 41.6% of total market revenue in 2025, placing it as the leading consumer category. Growth in this segment is being fueled by increasing urban migration, homeownership, and rental turnover rates, all of which create strong demand for protective packaging during relocation and renovation.

Homeowners are seeking solutions that ensure cleanliness and safety for mattresses and furniture, especially during storage in garages, basements, or during moves. The rise of DIY moving services and e-commerce furniture deliveries has further contributed to the demand for easy-to-handle, protective bags suited for residential applications.

Residential consumers are also more inclined toward reusable options, encouraging manufacturers to produce bags with extended life cycles and enhanced aesthetics. With the continued growth of the housing sector and consumer awareness of preservation practices, this segment is expected to remain at the forefront of market expansion.

Mattress and furniture bags are used to store and wrap around mattresses and furniture, especially for transit or storage. They are used to protect the products from exposure to dust, soil, light, water and moisture. Rapid urbanization and improvement in standard of living has led to an increase in the number of people moving homes on a given day.

Across the world, millions of people are known to move to a new home, on any given day, thereby increasing the demand for solutions to keep heavy products like furniture and mattresses safe from physical and chemical harm. The preference for these bags is attributed to their flexibility and shapes.

They come in various sizes and shapes, designed to match the shape of their contents, thereby reducing the extra space that other forms of packaging take, such as large cardboard boxes. Attributed to the protection that they provide to the contents, and the ease of unpacking them, the global mattress and furniture bags market is expected to rise over the forecast period.

Urbanization has been known to have emerged as a rapid process with the fast changing technology and increasing disposable income. According to a UN report, the world is projected to have around 40 megacities, by 2035, with more than 10 million inhabitants each.

2.5 billion people are expected to be added to the global urban population by 2050. In addition to that, globalization has led to an increase in job opportunities, leading to many people deciding to move homes. Also, holidaying has emerged as a trend over the past couple of decades, resulting in families staying away from homes for long durations, during which, there are chances of bug and termite infestations in mattresses and furniture. They can be prevented by using mattress and furniture bags.

The continuous evolution of the standard of living leads people to incline more towards materialistic comfort and convenience goods. Mattress and furniture bags occupy relatively less space and are easier to handle and move. All these are expected to fuel the global mattress and furniture bags market.

Despite these factors, there are other potential restraints for the global mattress and furniture bags market, such as, the usage of other forms of packaging, which may be cardboard boxes and thermocole.

North America is expected to lead the global mattress and furniture bags market over the forecast period, owing to a higher consumer base, followed by Western and Eastern Europe. APEJ region is expected to register the highest CAGR, owing to a significant amount of domestic migration, fueled by an increasing inclination towards urban centers.

Especially in emerging economies such as India, as much 1/5th of its population is expected to be added to the middle class by 2035, leading to an increase in the number of domestic migrants to metropolitan and urban places.

Some of the players in the global mattress and furniture bags market are Britwrap protective packaging store, U-Haul International, Inc., FOUR STAR PLASTICS, Duo Plastics Limited, International Plastics Inc. etc.

The report offers an accurate evaluation of the market through detailed qualitative insights and verifiable projections about market size. The projections presented in the report have been derived using proven research methodologies and assumptions.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

For furniture:

The global mattress and furniture bags market is estimated to be valued at USD 171.2 billion in 2025.

The market size for the mattress and furniture bags market is projected to reach USD 265.8 billion by 2035.

The mattress and furniture bags market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in mattress and furniture bags market are zipped and unzipped.

In terms of raw material, plastic segment to command 78.2% share in the mattress and furniture bags market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Mattress and Furniture Bags

Mattress Topper Market Size and Share Forecast Outlook 2025 to 2035

Mattresses & Accessories Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mattress Pads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mattress and Mattress Component Market Size and Share Forecast Outlook 2025 to 2035

Air Mattress Market Insights – Growth & Forecast 2019 to 2029

Smart Mattress Market Size and Share Forecast Outlook 2025 to 2035

Latex Mattress Market Growth & Forecast 2025-2035

Queen Mattress Market

Luxury Mattress Market Size and Share Forecast Outlook 2025 to 2035

Heated Mattress Pads Market

Children Mattress Market Product Type, Ingredient Type, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Hospitality Mattress Market Size and Share Forecast Outlook 2025 to 2035

Innerspring Mattresses Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Smart Medical Mattress Market Size and Share Forecast Outlook 2025 to 2035

Down Alternative Mattresses Market Size and Share Forecast Outlook 2025 to 2035

Medical Anti-Decubitus Air Mattress Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA