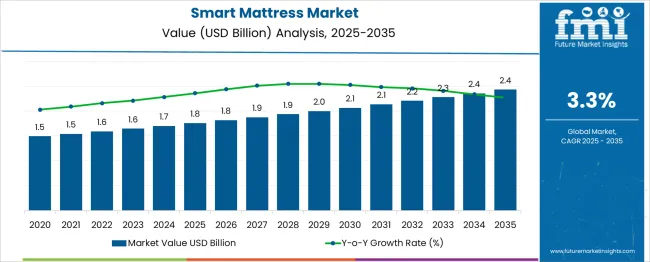

The Smart Mattress Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period. An observable plateau in early-stage growth was recorded between 2025 and 2027, where the market held at USD 1.8 billion, suggesting demand saturation in early adopters or deferred upgrades in the B2C segment. Between 2028 and 2030, a slower acceleration phase unfolded, moving from USD 1.9 billion to USD 2.1 billion, with revenue rising only marginally across these three years. After 2030, the market displayed a steadier pace, increasing from USD 2.1 billion to USD 2.4 billion by 2035.The rise remained linear rather than exponential, indicating weak demand elasticity and a longer replacement cycle. Segment growth appeared to be guided by gradual penetration into healthcare and hospitality sectors, yet lacking any sudden upturns. No sharp deceleration was observed, though momentum stayed muted across the decade. These figures point to a low-volatility market wherein acceleration has been constrained by high product price points, limited value differentiation, and slower consumer adoption curves, particularly in price-sensitive economies with low smart home conversion rates.

| Metric | Value |

|---|---|

| Smart Mattress Market Estimated Value in (2025 E) | USD 1.8 billion |

| Smart Mattress Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The smart mattress market is witnessing accelerated traction due to increasing consumer preference for personalized sleep solutions and the integration of IoT-enabled health monitoring systems. Growth is being propelled by rising awareness regarding sleep disorders, lifestyle-induced stress, and the importance of sleep quality in overall well-being. Technological advancements in embedded sensors, AI-powered sleep tracking, and mobile app synchronization have enhanced user experience, driving adoption across premium residential and hospitality segments.

Additionally, smart home integration and the rising geriatric population seeking health-responsive bedding have contributed to market expansion. Manufacturers are focusing on delivering features such as temperature control, automatic firmness adjustment, and anti-snore detection to meet diverse consumer needs.

As sustainability becomes a major purchase factor, smart mattresses featuring eco-friendly materials and modular designs are gaining preference. With growing urbanization and disposable income levels, especially in emerging economies, demand is expected to rise further through both online and offline retail channels.

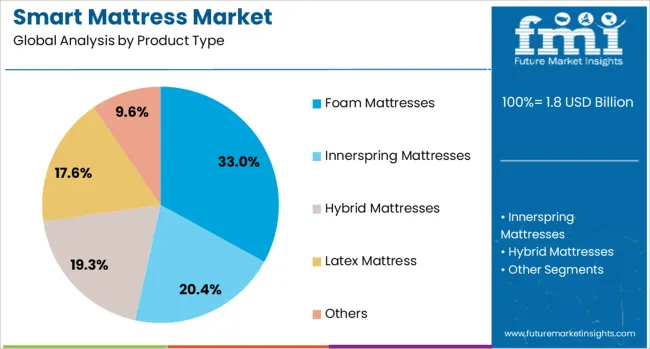

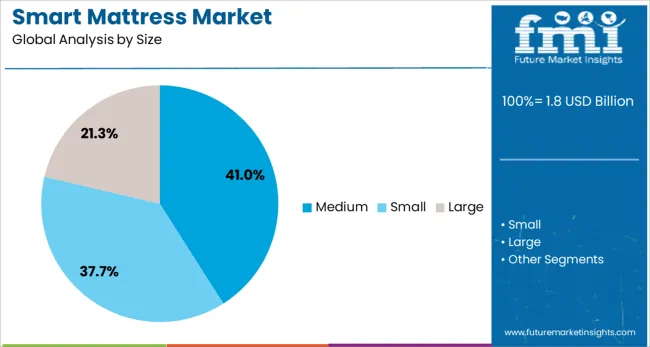

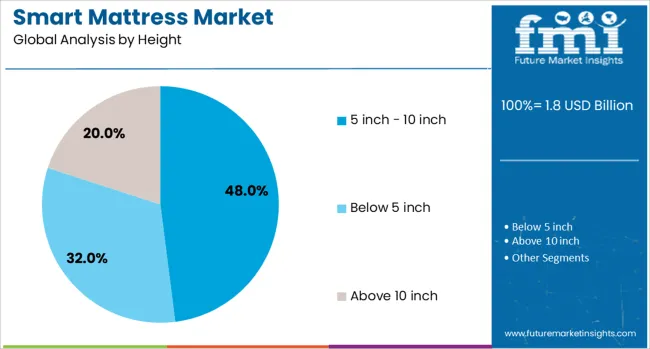

The smart mattress market is segmented by product type, size, height, firmness level, price range, application, and geographic regions. By product type, the smart mattress market is divided into Foam Mattresses, Innerspring Mattresses, Hybrid Mattresses, Latex Mattresses, and others. In terms of size, the smart mattress market is classified into Medium, Small, and Large. Based on height, the smart mattress market is segmented into 5-inch to 10-inch, below 5-inch, and above 10-inch. The firmness level of the smart mattress market is segmented into Medium, Soft, and Firm. The price range of the smart mattress market is segmented into Medium, Low, and High. The smart mattress market is segmented into residential and commercial. Regionally, the smart mattress industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Foam mattresses are expected to lead the smart mattress market with a 33.00% revenue share in 2025. This leadership is being driven by the material's adaptability to pressure points, durability, and compatibility with sensor-based technologies. Foam offers a stable base for integrating motion sensors, temperature regulators, and biometric monitoring systems, making it suitable for smart applications.

The material’s ability to contour to body shape enhances sleep quality, particularly for users with orthopedic concerns or chronic pain. Additionally, foam's lightweight and layered design supports efficient manufacturing of modular and adjustable smart mattresses.

Cost-effectiveness and ease of customization have further strengthened foam’s position in both mid-range and premium product offerings. As wellness-driven consumers prioritize sleep optimization, foam mattresses continue to gain traction in the connected sleep tech ecosystem.

The medium-sized smart mattress segment is projected to account for 41.00% of market revenue in 2025, marking it as the preferred size category. This dominance is being attributed to its balanced suitability for single and couple use across residential settings.

Medium-sized formats offer an optimal combination of spatial comfort and portability, aligning with the needs of urban dwellers and nuclear families. Their compatibility with standard bed frames and modular furniture systems makes them a flexible choice for buyers with space constraints.

Manufacturers also prioritize this size range when launching new models due to its broader market appeal and reduced logistic complexities. As lifestyle trends shift toward compact living environments, demand for medium-sized smart mattresses with advanced functionalities is expected to remain robust.

Smart mattresses with a height range of 5 inch - 10 inch are expected to capture a 48.00% share of the market in 2025, making it the leading height category. This preference is driven by ergonomic comfort, ease of accessibility, and optimal support for embedded hardware components such as pressure sensors and thermal elements.

Mattresses in this height range offer a balanced profile that supports posture alignment while accommodating additional smart features without compromising structure. They are also favored in both household and hospitality applications where ease of bed entry and exit is a priority.

Moreover, this height range supports sustainable shipping and packaging configurations, benefiting supply chain efficiency. As brands strive to offer user-friendly, health-conscious sleep solutions, mattresses in the 5–10 inch range continue to align with functional and aesthetic preferences in the smart bedding segment.

The smart mattress market has expanded steadily thanks to rising awareness of sleep quality, smart home integration, and technological affordability. Sensor-embedded mattresses now deliver sleep analytics, climate control, and app-based adjustments. Market value stood at approximately $1.7 billion in 2023 and is expected to grow at a mid- to high-single-digit CAGR, depending on region and forecast source. Demand is being led by residential consumers seeking personalized comfort and supported by luxury hospitality and healthcare adoption. Growth is most pronounced in North America and Asia Pacific where smart home ecosystems are maturing fast.

Innovations in smart mattresses include temperature zones, biometric sensors, AI-based sleep coaching, and integration with smart thermostats and lighting. These features respond to demand from health-conscious consumers seeking better rest, stress reduction, and performance monitoring. Hybrid innerspring and memory foam models dominate, combining conventional support with electronic capabilities. Applications in smart homes facilitate immersive sleep-focused environments, while hospitals and eldercare facilities are adopting these mattresses to support patient monitoring. As awareness of sleep’s impact on wellness grows, smart mattresses are being perceived less as novelty and more as functional health solutions for both homes and institutions.

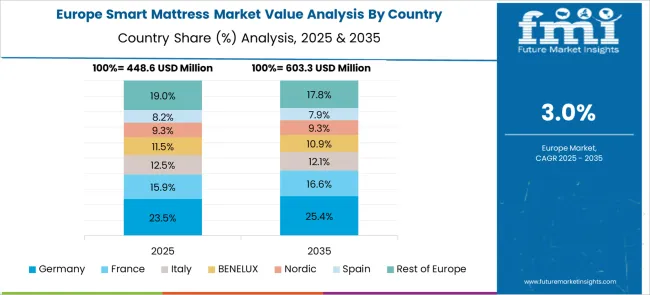

North America remains the largest regional market, supported by high consumer spending and smart home adoption. Asia Pacific is the fastest growing—with double-digit CAGR forecast—driven by urbanization, rising middle class, and e commerce growth. Europe follows, supported by health regulation and lifestyle trends. Market penetration in Latin America, Middle East, and Africa is emerging, often tied to hospitality upgrades and luxury retail adoption. Apartment and hotel integrations provide early access points for consumers in regions where full home installations remain costly. Strategic growth is being enabled by augmenting distribution networks and showcasing smart mattresses at retail and expo venues.

Despite the benefits, broader adoption is limited by premium pricing, which averages above $1,000 for sensor-rich models. Clinical validation of sleep improvement remains scarce, and skepticism about efficacy persists. Integration with existing smart home platforms can be complex due to fragmented protocols. Privacy concerns regarding biometric data and lack of industry standards may deter adoption, especially in medical or shared environments. Durability of embedded electronics in mattresses and warranty coverage can raise post-purchase concerns. Overcoming these barriers requires transparent performance evidence, cost reductions through scale, and improved interoperability and data security.

The smart mattress market is stratified across budget, mid-range, premium, and luxury tiers with differing feature sets. Affordable models offer basic sleep tracking and app integration, while premium and luxury units include temperature control, adjustable firmness, biometric analytics, and voice assistant connectivity. Major brands are differentiating via partnerships with wellness apps, sleep coaching, or subscription services. Customizable comfort profiles and sustainability credentials are becoming attractive features. Direct-to-consumer channels, demand trials, and flexible returns policies are helping adoption. Startups and tech-first brands continue to disrupt, while traditional bedding companies are expanding their portfolios via strategic alliances and technology licensing agreements.

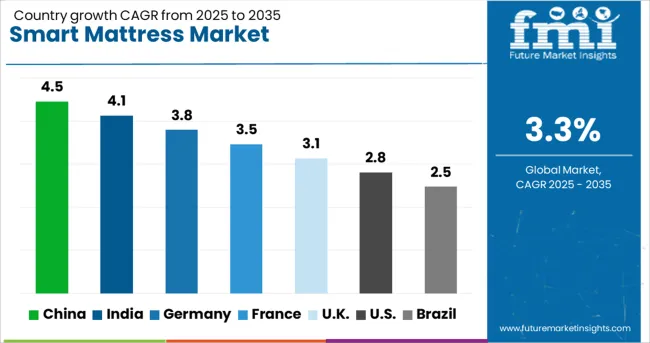

| Country | CAGR |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| France | 3.5% |

| UK | 3.1% |

| USA | 2.8% |

| Brazil | 2.5% |

Global demand for smart mattresses is forecast to grow at a CAGR of 3.3% from 2025 to 2035. China, India, and Germany are positioned above this baseline at 4.5%, 4.1%, and 3.8%, yielding premiums of +36%, +24%, and +15%. The United Kingdom and United States fall below the baseline at 3.1% and 2.8%, showing declines of –6% and –15%. Higher CAGR countries have experienced commercial traction due to increasing emphasis on digital sleep diagnostics, wellness-linked infrastructure, and flexible ownership models. Growth within the OECD has been mixed, whereas ASEAN markets have prioritised localisation strategies and ecommerce bundling. Market expansion remains concentrated around mid-tier pricing bands, embedded sensor features, and B2B procurement aligned with wellness architecture and AI-driven comfort systems.

Chinas smart mattress market is projected to expand at a CAGR of 4.5% from 2025 to 2035, outperforming the global average by 36%. Growth has been supported by urban households integrating biometric sleep technologies and wellness monitoring. Digital health clusters in Shenzhen and Suzhou have adopted AI-assisted firmness controls and app-linked ecosystem integration. Procurement by smart hospital networks has driven bulk unit orders, while ecommerce platforms have enabled scale within second-tier cities. Locally developed variants now dominate shipments below USD 800. Usage remains highest among age groups between 30 and 55. Interoperability with home automation systems has added value perception across premium households and institutional buyers.

Indias smart mattress market is expected to grow at a CAGR of 4.1% through 2035, which is 24% higher than the global average. Demand has expanded across mid-income housing developments near IT zones and Tier I health clusters. Deployment in Ayurveda-integrated wellness programs has stimulated demand for AI-adjusted support mattresses. Bulk procurement remains rare, but EMI-based models have enabled ecommerce growth in Bengaluru and Pune. Region-specific manufacturing has reduced import reliance for standard models. In-built sensor features, including temperature and movement detection, are gaining visibility. Market development has been supported by mid-tier pricing strategies, festival-linked bundles, and co-living trials in metro regions.

Germanys smart mattress market is forecast to expand at a CAGR of 3.8% from 2025 to 2035, exceeding the global average by 15%. Growth has been concentrated in elder care housing, where real-time motion sensing and bed-exit alerts support safety compliance. Procurement volumes from B2B insurance-linked platforms have increased, particularly in Munich, Hamburg, and Leipzig. Sleep analytics have been customised to German DIN standards, supporting integration in residential medical facilities. Market activity has been reinforced by EU-funded projects promoting sensor calibration. Co-living spaces and wellness hospitality zones are becoming secondary growth segments. Technical compatibility with domestic smart home systems remains a key selection factor.

The United Kingdom smart mattress market is projected to grow at a CAGR of 3.1% through 2035, which is 6% lower than the global average. Growth remains slow across institutional buyers, with minimal NHS-linked adoption. Demand has remained concentrated in high-income urban zones such as London and Manchester, where home automation compatibility influences purchases. Privacy concerns around sleep data tracking have limited uptake of full-featured models. Import-heavy supply chains have resulted in lower responsiveness to retail pricing changes. Co-living operators and private landlords remain occasional buyers. Bluetooth-enabled models with temperature control are available but rarely included in rental furnishing schemes.

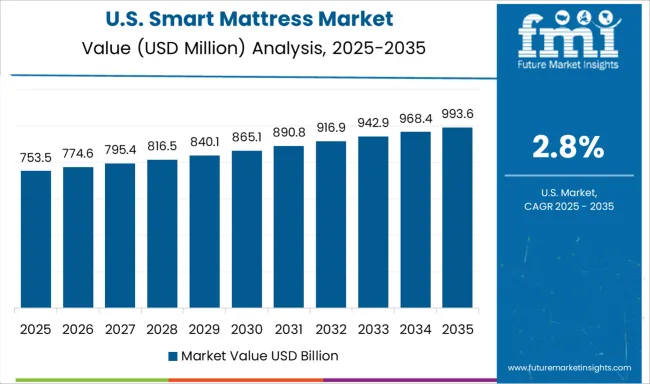

The United States smart mattress market is expected to grow at a CAGR of 2.8% between 2025 and 2035, trailing the global benchmark by 15%. Market saturation in metro regions and a lack of insurance incentives have slowed household replacement rates. Most demand remains within high-income states including California and New York, where smart home integration is advanced. Commercial uptake has been minimal outside of boutique hospitals. Replacement cycles have extended beyond 8 years, with consumers opting for firmware upgrades rather than full replacement. Smart voice features and partner-specific comfort zones retain limited traction. B2B procurement from hospitality chains remains weak across mid-tier operators.

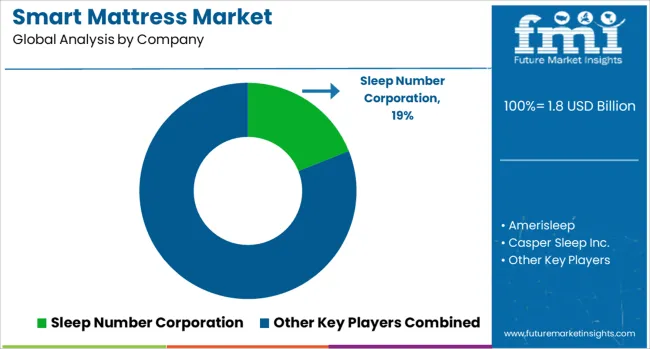

Sleep Number Corporation remains a dominant force in the smart mattress market due to its patented adjustable firmness and biometric monitoring systems. Tempur Sealy International and Serta Simmons Bedding, LLC have also maintained strong market positions by integrating pressure-relief technology with IoT-enabled sleep tracking, particularly across premium and orthopedic segments. Eight Sleep and ReST have led in thermal regulation and sensor-based pressure response features, appealing to performance-conscious users and clinical applications. Xiaomi and Zeeq by REM-Fit are active in cost-sensitive and tech-savvy segments, especially in Asia, offering app-connected sleep analytics and embedded audio features. iOBED and Nolah Sleep have focused on modular support zones and eco-conscious foam materials, gaining appeal among mid-income consumers in the OECD region. Casper Sleep Inc., Amerisleep, and Purple Innovation continue to differentiate through layered memory foams and integration with wellness platforms.

Hilding Anders and Kingsdown, Inc. have diversified their smart sleep systems into European and Southeast Asian hotel chains. Leesa Sleep’s emphasis on sustainability and social impact has also boosted brand equity, particularly in Western markets. Competitive advantage across brands is increasingly defined by AI-driven sleep optimization algorithms and adaptive firmness personalization for individual and dual-sleeper use cases.

Temperature-regulating models with dual-zone cooling and heating features gained traction in the USA, EU, Japan, and South Korea. Smart beds integrated biometric monitoring, sleep apnea detection, and IoT-enabled controls. A major retail acquisition improved global distribution reach. These mattresses now support personalized climate control, sleep tracking, and automated adjustments, aligning with growing consumer demand for connected wellness solutions across premium and mid-range segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Product Type | Foam Mattresses, Innerspring Mattresses, Hybrid Mattresses, Latex Mattress, and Others |

| Size | Medium, Small, and Large |

| Height | 5 inch - 10 inch, Below 5 inch, and Above 10 inch |

| Firmness Level | Medium, Soft, and Firm |

| Price Range | Medium, Low, and High |

| Application | Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sleep Number Corporation, Amerisleep, Casper Sleep Inc., Eight Sleep, Hilding Anders, iOBED, Kingsdown, Inc., Leesa Sleep, Nolah Sleep, Purple Innovation, LLC, ReST (Responsive Surface Technology), Serta Simmons Bedding, LLC, Tempur Sealy International, Inc., Xiaomi, and Zeeq by REM-Fit |

| Additional Attributes | Dollar sales by product type (foam, innerspring, hybrid), application (residential, commercial), demand driven by smart home integration and health awareness, regional leadership in North America and rapid growth in Asia Pacific, innovation in IoT sensors and AI sleep analytics, environmental edge via eco friendly materials, and emerging use cases in healthcare settings and smart bedroom ecosystems. |

The global smart mattress market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the smart mattress market is projected to reach USD 2.4 billion by 2035.

The smart mattress market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in smart mattress market are foam mattresses, innerspring mattresses, hybrid mattresses, latex mattress and others.

In terms of size, medium segment to command 41.0% share in the smart mattress market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Medical Mattress Market Size and Share Forecast Outlook 2025 to 2035

Smart Meeting Pod Market Size and Share Forecast Outlook 2025 to 2035

Smart Electrogastrogram Recorder Market Size and Share Forecast Outlook 2025 to 2035

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA