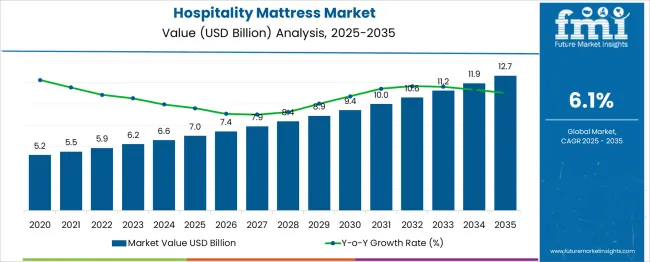

The global hospitality mattress market is estimated to grow from USD 7 billion in 2025 to approximately USD 12.7 billion by 2035, recording an absolute increase of USD 5.7 billion over the forecast period. This translates into a total growth of 81.4%, with the market forecast to expand at a CAGR of 6.1% between 2025 and 2035. The overall market size is expected to grow by nearly 1.81X during the same period, supported by increasing global tourism, rising demand for premium guest experiences, and growing focus on sleep quality and comfort in hospitality establishments.

Between 2025 and 2030, the hospitality mattress market is projected to expand from USD 7 billion to USD 9.4 billion, resulting in a value increase of USD 2.4 billion, which represents 42.1% of the total forecast growth for the decade. This phase of growth will be shaped by a recovering tourism industry, increasing investment in hotel renovations and new property development, and growing demand for enhanced guest comfort solutions. Mattress manufacturers are expanding their hospitality-focused product portfolios to address the growing demand for durable and comfortable sleep solutions in commercial accommodation settings.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 7 billion |

| Forecast Value in (2035F) | USD 12.7 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

From 2030 to 2035, the market is forecast to grow from USD 9.4 billion to USD 12.7 billion, adding another USD 3.3 billion, which constitutes 57.9% of the overall ten-year expansion. This period is expected to be characterized by the expansion of boutique and luxury accommodation segments, the integration of smart mattress technologies in premium properties, and the development of eco-friendly mattress solutions. The growing adoption of wellness-focused hospitality concepts and personalized guest experiences will drive demand for hospitality mattresses with enhanced comfort features and advanced sleep technology.

Between 2020 and 2025, the hospitality mattress market experienced recovery and transformation, driven by the hospitality industry's focus on rebuilding guest confidence and enhancing accommodation standards following global travel disruptions. The market developed as hotel operators recognized the critical importance of sleep quality in guest satisfaction and property differentiation. Investment in property upgrades and guest experience enhancement began emphasizing the role of premium mattresses in delivering superior accommodation standards.

Market expansion is being supported by the recovering global tourism industry and the corresponding demand for enhanced guest comfort and satisfaction in hospitality establishments. Modern travelers are increasingly focused on accommodation quality and comfort standards, with sleep quality being a critical factor in guest experience and property reviews. Hospitality mattresses' proven ability to enhance guest comfort while providing durability and longevity makes them essential investments for hotels, resorts, and other accommodation providers seeking to maintain competitive advantage and guest loyalty.

The growing focus on wellness tourism and premium guest experiences is driving demand for hospitality mattresses that can deliver superior comfort and support characteristics comparable to high-end residential mattresses. Hotel operators' preference for mattresses that combine guest satisfaction with operational efficiency and durability is creating opportunities for innovative hospitality mattress solutions. The rising influence of online reviews and guest feedback platforms is also contributing to increased investment in quality mattresses that can enhance guest satisfaction scores and property reputation.

The market is segmented by type, size, end use, and region. By type, the market is divided into foam, innerspring, hybrid, and others. Based on size, the market is categorized into queen, single, double, and king. In terms of end use, the market is segmented into hotels & resorts, vacation rentals, hostels, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The foam mattress segment is projected to hold 45.3% of the hospitality mattress market in 2025, reaffirming its position as the leading mattress type. Hotel operators increasingly prefer foam mattresses for their consistent comfort delivery, motion isolation properties, and ability to accommodate diverse guest preferences and sleeping positions. Foam mattresses' superior durability and resistance to sagging directly address hospitality industry requirements for long-lasting products that maintain comfort characteristics under frequent use conditions.

This mattress type forms the foundation of most hospitality bedding strategies, as it represents the most versatile and reliable solution for delivering consistent guest comfort across different property types and guest demographics. Manufacturer investments in advanced foam technologies and ongoing development of specialized hospitality-grade formulations continue to strengthen market adoption. With hotel operators prioritizing guest satisfaction and operational efficiency, foam mattresses align with both comfort requirements and durability considerations, making them the central component of hospitality sleep solutions.

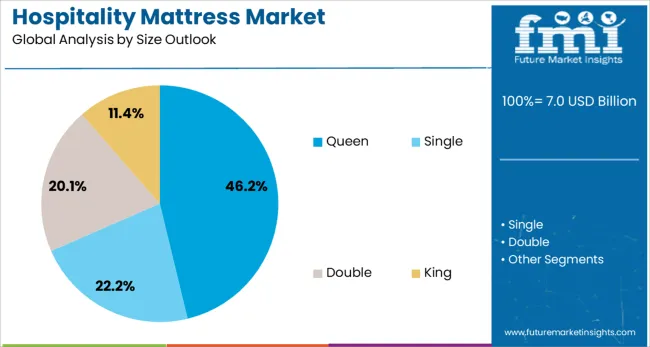

Queen-size mattresses are projected to represent 46.2% of hospitality mattress demand in 2025, underscoring their critical role as the standard accommodation size in most hotel properties. Hotel operators prefer queen-size mattresses for their optimal balance of guest comfort and room space utilization, providing adequate sleeping space for couples while maximizing room layout efficiency. Positioned as the most practical size for standard hotel rooms, queen mattresses offer both guest satisfaction and operational advantages for property management.

The segment is supported by established hospitality industry standards and guest expectations for comfortable sleeping accommodations that can accommodate various travel scenarios, including business and leisure travellers. Queen-size mattresses provide operational benefits, including simplified inventory management and consistent room configuration across hotel properties. As hospitality operators prioritize guest comfort and operational efficiency, queen-size mattresses will continue to dominate the market while supporting standardized accommodation delivery.

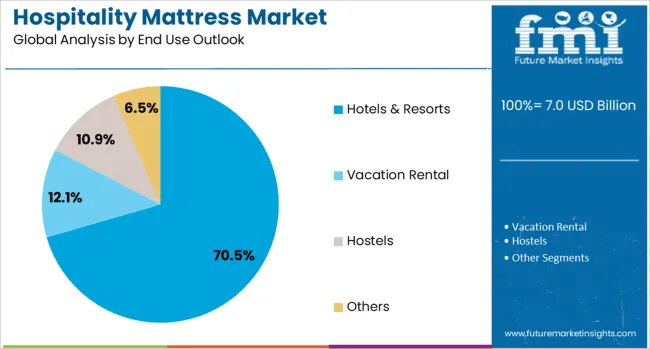

The hotels & resorts end-use segment is forecasted to contribute 70.5% of the hospitality mattress market in 2025, reflecting the dominant role of traditional hospitality establishments in driving market demand. Hotel and resort operators increasingly invest in premium mattresses to enhance guest experiences and maintain competitive positioning in the accommodation market. This aligns with hospitality industry trends that emphasize guest satisfaction and property differentiation through superior comfort amenities.

The segment benefits from continuous property development and renovation activities across the global hospitality sector, with mattress replacement being a regular component of property maintenance and upgrade programs. With established procurement processes and quality standards, hotels & resorts serve as the primary market for hospitality mattresses, making them a critical foundation for market growth and product innovation in commercial accommodation sectors.

The hospitality mattress market is advancing steadily due to recovering global tourism and growing focus on guest experience quality in accommodation establishments. The market faces challenges, including economic uncertainty affecting travel demand, high replacement costs for large-scale mattress procurement, and varying quality standards across different hospitality segments. Innovation in mattress technologies and materials continues to influence product development and market expansion patterns.

The growing adoption of wellness-focused hospitality concepts is enabling hotels and resorts to differentiate their properties through superior sleep quality offerings. Premium mattresses contribute to overall guest wellness experiences while supporting hotel positioning in luxury and health-conscious travel segments. Hospitality operators are increasingly recognizing the competitive advantages of investing in sleep quality as a key amenity and guest satisfaction driver.

Modern hospitality mattress manufacturers are incorporating smart technologies, including sleep monitoring, temperature regulation, and adjustable firmness capabilities, to enhance guest experiences in premium properties. These technologies improve guest comfort while providing properties with data insights for service optimization and guest personalization. Advanced mattress solutions also enable hotels to offer customized sleep experiences that can differentiate their properties in competitive markets.

| Countries | CAGR (2025-2035) |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7% |

| France | 6.4% |

| UK | 5.8% |

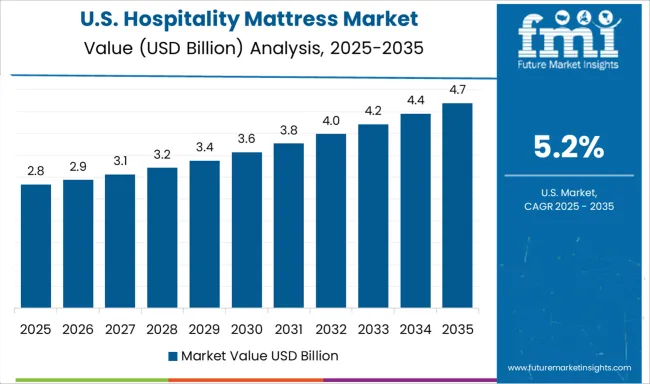

| USA | 5.2% |

| Brazil | 4.6% |

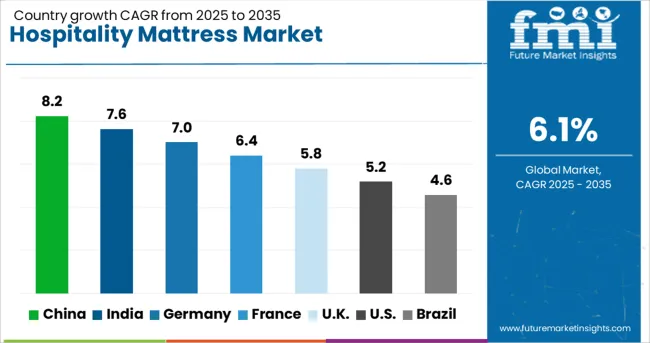

The hospitality mattress market is experiencing solid growth globally, with China leading at an 8.2% CAGR through 2035, driven by rapid tourism industry expansion, increasing hotel development, and growing focus on guest experience quality. India follows closely at 7.6%, supported by expanding hospitality infrastructure, rising domestic and international tourism, and increasing investment in accommodation quality standards. Germany shows strong growth at 7%, emphasizing premium hospitality services and guest comfort standards. France records 6.4%, focusing on luxury hospitality and tourism excellence. The UK shows 5.8% growth, prioritizing diverse accommodation quality and guest satisfaction. The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from hospitality mattresses in China is projected to exhibit strong growth with a CAGR of 8.2% through 2035, driven by massive tourism industry development and rapid expansion of hotel and resort infrastructure. The country's growing domestic tourism market and increasing international visitor arrivals are creating significant demand for quality hospitality mattresses. Major global and domestic hospitality chains are establishing comprehensive procurement programs to serve the expanding accommodation sector across urban and tourist destinations.

Revenue from hospitality mattresses in India is expanding at a CAGR of 7.6%, supported by the rapidly growing hospitality sector, expanding tourism infrastructure, and increasing focus on guest experience quality in accommodation establishments. The country's developing tourism market and rising hospitality investment are driving demand for reliable and comfortable mattress solutions. International hospitality brands and domestic hotel operators are establishing comprehensive mattress procurement strategies to address growing accommodation quality requirements.

Demand for hospitality mattresses in Germany is estimated to grow at a CAGR of 7%, supported by the country's established hospitality industry and strong focus on guest service quality and accommodation standards. German hospitality operators consistently demand high-performance mattresses that meet stringent comfort requirements and provide reliable durability for intensive commercial use.

Revenue from hospitality mattresses in France is projected to grow at a CAGR of 6.4% through 2035, driven by the country's luxury tourism industry and focus on premium guest experience delivery in hospitality establishments. French hospitality operators consistently demand high-quality mattress solutions that deliver superior comfort while supporting the country's reputation for hospitality excellence.

Revenue from hospitality mattresses in the UK is anticipated to grow at a CAGR of 5.8% through 2035, supported by diverse hospitality sector development and a strong focus on guest satisfaction across various accommodation types. British hospitality operators value comfort, quality, durability, and proven performance, positioning quality mattresses as essential components of competitive accommodation delivery.

Revenue from hospitality mattresses in the USA is projected to grow at a CAGR of 5.2% through 2035, supported by the country's leadership in hospitality innovation, established accommodation industry, and preference for advanced guest comfort solutions. American hospitality operators prioritize guest satisfaction, operational efficiency, and brand standards, making quality mattresses a preferred investment in property differentiation and guest experience enhancement.

Revenue from hospitality mattresses in Brazil is projected to grow at a CAGR of 4.6% through 2035, supported by the expanding tourism industry, growing hospitality investment, and increasing focus on accommodation quality standards in hotel and resort properties. The country's developing tourism infrastructure and rising international visitor arrivals are creating significant opportunities for the hospitality mattress market growth. International hospitality brands and domestic hotel operators are establishing comprehensive mattress procurement strategies to serve growing accommodation quality requirements.

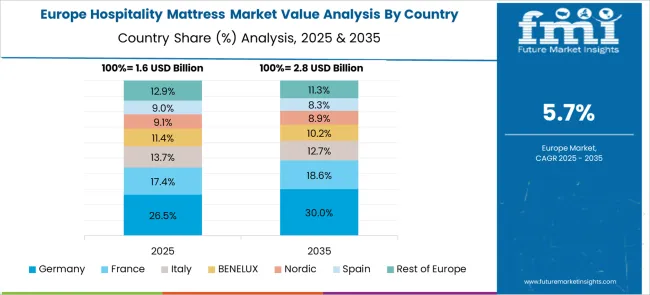

The hospitality mattress market in Europe demonstrates mature development across major economies, with Germany showing a strong presence through its established hospitality industry and focus on quality accommodation standards, supported by hotel operators leveraging hospitality expertise to implement high-quality mattress solutions that emphasize guest comfort and operational durability across business and leisure properties.

France represents a significant market driven by its tourism industry heritage and sophisticated understanding of guest experience quality, with hospitality operators focusing on premium mattress solutions that combine French hospitality excellence with advanced comfort technologies for enhanced guest satisfaction and property differentiation in luxury and boutique accommodation segments.

The UK exhibits considerable growth through its diverse hospitality sector and focus on guest satisfaction standards, with strong adoption of quality mattresses in hotels, bed & breakfasts, and alternative accommodation properties. Germany and France are showing increasing interest in mattress applications, particularly in eco-friendly hotel operations and green hospitality certification programs. BENELUX countries contribute through their focus on hospitality innovation and premium guest services. At the same time, Eastern Europe and the Nordic regions display growing potential driven by expanding tourism infrastructure and increasing investment in accommodation quality standards.

The hospitality mattress market is characterized by competition among established mattress manufacturers, specialized hospitality bedding companies, and emerging sleep technology providers. Companies are investing in product innovation, hospitality-specific solutions, distribution network development, and customer service capabilities to deliver durable, comfortable, and cost-effective mattress solutions for commercial accommodation applications. Product differentiation, durability testing, and hospitality industry expertise are central to strengthening market position and customer relationships.

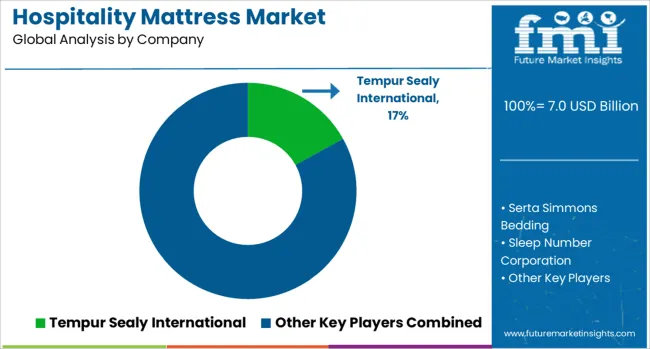

Tempur Sealy International leads the market with significant global market share, offering comprehensive hospitality mattress solutions with a focus on premium comfort and proven durability. Serta Simmons Bedding provides advanced mattress technologies with a focus on hospitality-specific products and brand recognition. Sleep Number Corporation delivers customizable sleep solutions with a focus on personalization and smart technology integration. King Koil focuses on traditional hospitality mattress solutions with a focus on durability and value.

Kingsdown Inc. provides premium mattress solutions with a focus on luxury hospitality applications. Corsicana Mattress Company offers value-oriented hospitality mattresses with a focus on operational efficiency and cost-effectiveness. Pikolin delivers European hospitality mattress solutions with a focus on quality and comfort. Breckle focuses on European market hospitality applications. Hilding Anders provides comprehensive bedding solutions across European hospitality markets. Restonic Mattress Corporation offers specialized hospitality mattress products with a focus on durability and guest satisfaction.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 7 billion |

| Type | Foam, Innerspring, Hybrid, Others |

| Size | Queen, Single, Double, King |

| End Use | Hotels & Resorts, Vacation Rentals, Hostels, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Tempur Sealy International, Serta Simmons Bedding, Sleep Number Corporation, King Koil, Kingsdown Inc., Corsicana Mattress Company, Pikolin, Breckle, Hilding Anders, and Restonic Mattress Corporation |

| Additional Attributes | Dollar sales by mattress type and size category, regional demand trends, competitive landscape, buyer preferences for foam versus spring technologies, integration with hospitality design trends, innovations in sleep technology, materials, and guest experience enhancement solutions |

The global hospitality mattress market is estimated to be valued at USD 7.0 billion in 2025.

The market size for the hospitality mattress market is projected to reach USD 12.7 billion by 2035.

The hospitality mattress market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in hospitality mattress market are foam, innerspring, hybrid and others.

In terms of size outlook, queen segment to command 46.2% share in the hospitality mattress market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hospitality Staffing Market Size and Share Forecast Outlook 2025 to 2035

Smart Hospitality & Coworking Spaces Market Trends - Growth & Forecast 2025 to 2035

Smart Hospitality Management Market

Mattress Topper Market Size and Share Forecast Outlook 2025 to 2035

Mattress and Mattress Component Market Size and Share Forecast Outlook 2025 to 2035

Mattress And Furniture Bags Market Size and Share Forecast Outlook 2025 to 2035

Mattresses & Accessories Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mattress Pads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Mattress and Furniture Bags

Air Mattress Market Insights – Growth & Forecast 2019 to 2029

Smart Mattress Market Size and Share Forecast Outlook 2025 to 2035

Latex Mattress Market Growth & Forecast 2025-2035

Queen Mattress Market

Luxury Mattress Market Size and Share Forecast Outlook 2025 to 2035

Heated Mattress Pads Market

Children Mattress Market Product Type, Ingredient Type, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Innerspring Mattresses Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Smart Medical Mattress Market Size and Share Forecast Outlook 2025 to 2035

Down Alternative Mattresses Market Size and Share Forecast Outlook 2025 to 2035

Emergency Transfer Vacuum Mattress Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA