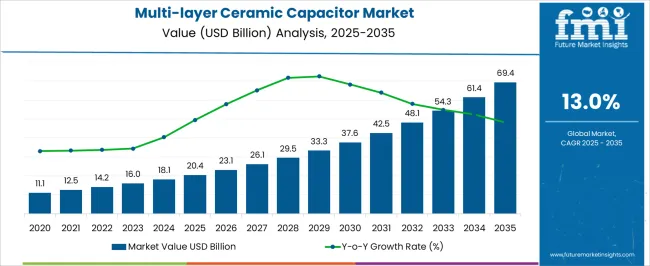

The Multi-layer Ceramic Capacitor Market is estimated to be valued at USD 20.4 billion in 2025 and is projected to reach USD 69.4 billion by 2035, registering a compound annual growth rate (CAGR) of 13.0% over the forecast period. Early growth from USD 20.4 billion to USD 33.3 billion over the first five years signals the expansion phase, characterized by increasing adoption across consumer electronics, automotive, and industrial applications. This period reflects early and majority adopter segments engaging with the technology as awareness and integration capabilities improve, establishing the foundation for broader market penetration.

The mid-phase growth from USD 37.6 billion to USD 54.3 billion indicates the market entering the maturity stage, with adoption accelerating among conservative buyers and across emerging applications such as 5G devices, electric vehicles, and renewable energy systems. Technological refinements, standardization of production processes, and improvements in dielectric materials contribute to increased reliability, performance, and adoption rates. The final stage, approaching USD 69.4 billion, demonstrates the late majority and laggards entering the market, driven by strong demand in high-performance sectors and increasing replacement cycles.

The adoption lifecycle is shaped by innovation diffusion, where the rate of uptake corresponds with decreasing barriers to integration and increasing awareness of MLCC advantages. The market’s trajectory from USD 20.4 billion to USD 69.4 billion reflects a sustained expansion through successive adoption phases, highlighting both technology acceptance and lifecycle-driven revenue growth.

| Metric | Value |

|---|---|

| Multi-layer Ceramic Capacitor Market Estimated Value in (2025 E) | USD 20.4 billion |

| Multi-layer Ceramic Capacitor Market Forecast Value in (2035 F) | USD 69.4 billion |

| Forecast CAGR (2025 to 2035) | 13.0% |

The multi layer ceramic capacitor market is witnessing robust growth due to increasing adoption of compact high performance electronic components in consumer electronics, automotive electronics, and telecommunications infrastructure. Miniaturization trends and rising demand for energy efficient circuits are accelerating the deployment of these capacitors across multilayer board designs.

Their high capacitance in a small footprint, excellent temperature stability, and long operational life have positioned them as a preferred choice over other capacitor types. Technological improvements in ceramic material processing and electrode layering have enhanced product reliability and manufacturing yields.

Additionally, global expansion in electric vehicles and 5G base stations is creating significant demand for capacitors with stable dielectric performance. The market outlook remains strong as industries prioritize high reliability components for increasingly dense and multifunctional electronic devices.

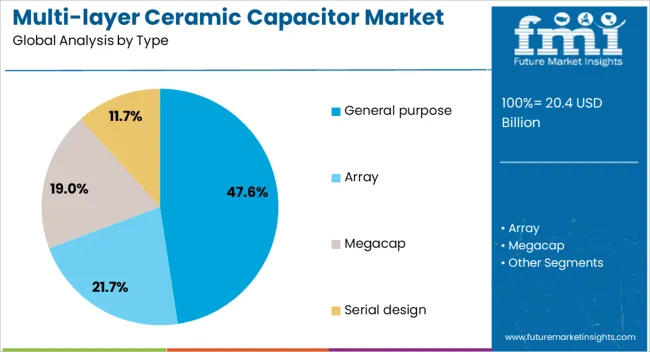

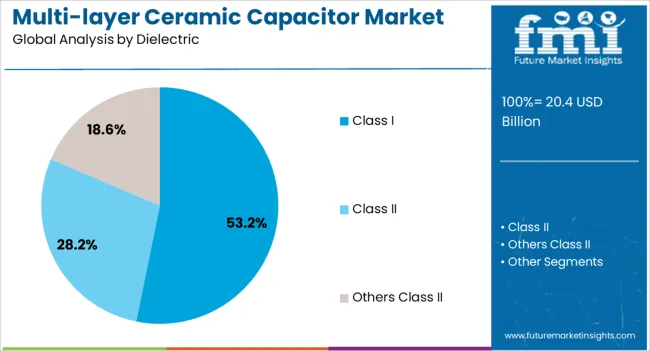

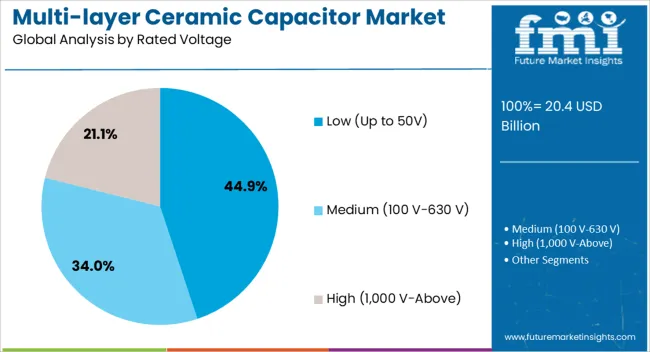

The multi-layer ceramic capacitor market is segmented by type, dielectric material, rated voltage, end-use, and geographic region. By type, the multi-layer ceramic capacitor market is divided into general-purpose, Array, Megacap, and Serial design. In terms of dielectric, the multi-layer ceramic capacitor market is classified into Class I, Class II, and Other Class II. Based on rated voltage, the multi-layer ceramic capacitor market is segmented into Low (up to 50V), Medium (100V-630V), and High (1,000V and above).

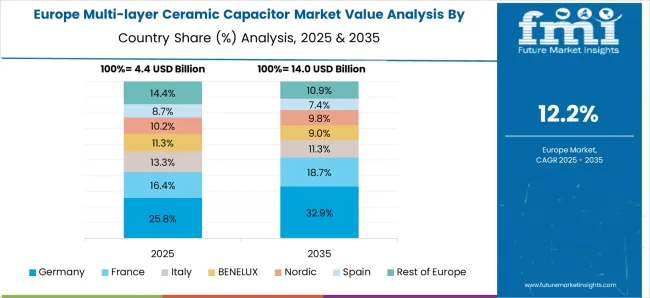

By end use, the multi-layer ceramic capacitor market is segmented into Automotive, Electronics, Telecommunication, Industrial equipment, and Others. Regionally, the multi-layer ceramic capacitor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The general purpose type segment is projected to account for 47.60% of total market revenue by 2025, positioning it as the leading segment. This dominance is supported by broad applicability in diverse end uses, including smartphones, tablets, televisions, and industrial control systems.

These capacitors offer balanced performance across capacitance, size, and cost, making them ideal for standard electronic functions such as filtering, bypassing, and decoupling. Their availability in a wide range of sizes and specifications supports scalable integration into various circuit designs.

Additionally, their compatibility with automated surface mounting processes enhances manufacturing efficiency, reinforcing their adoption across high-volume production lines. The general purpose segment continues to lead due to its functional versatility and strong demand across core electronics markets.

The class I dielectric segment is expected to represent 53.20% of market revenue by 2025, establishing it as the most dominant dielectric classification. This is attributed to its superior temperature stability, low-loss characteristics, and high-frequency response, which are critical in timing, tuning, and precision filtering applications.

Class I ceramic materials maintain consistent performance across variable thermal and electrical conditions, making them ideal for mission-critical systems in aerospace, defense, and communication sectors. Continued innovation in low-drift formulations and miniaturized formats has further expanded their utility in next-generation electronics.

As precision and frequency stability become increasingly important across end-use applications, class I dielectrics remain the material of choice for engineers seeking high-reliability performance.

The low rated voltage segment, defined as up to 50V, is projected to hold 44.90% of total market share by 2025, reflecting its leadership in the rated voltage category. This growth is primarily driven by widespread use in consumer electronics, where devices require compact components operating within low voltage ranges.

Applications such as mobile phones, laptops, and wearables rely heavily on low voltage multilayer ceramic capacitors for power management, signal filtering, and noise suppression. Their small size, affordability, and compatibility with portable device circuits make them essential in miniaturized electronic assemblies.

The segment’s continued expansion is reinforced by high volume demand and strong alignment with the voltage requirements of most handheld and embedded systems.

The market has been expanding due to increasing demand for compact, high-performance electronic components in consumer electronics, automotive, telecommunications, and industrial sectors. These capacitors have been valued for their reliability, high capacitance density, and ability to operate under varying temperatures and voltages. Market growth has been reinforced by technological innovations in dielectric materials, miniaturization, and surface-mount packaging. Rising adoption of IoT devices, electric vehicles, and 5G infrastructure has further strengthened demand. Multi-layer ceramic capacitors have become essential for ensuring stable performance, energy efficiency, and integration in modern electronic circuits globally.

The market has been primarily driven by rapid growth in consumer electronics, including smartphones, tablets, laptops, and wearable devices. Compact device designs and high functionality have necessitated capacitors capable of high capacitance in small packages. Surface-mount multi-layer ceramic capacitors (MLCCs) have been extensively adopted due to their reliability, low equivalent series resistance, and temperature stability. Rising demand for high-speed data processing, advanced display technologies, and power management solutions has further increased adoption. Manufacturers have invested in miniaturization techniques, multilayer stacking, and enhanced dielectric materials to improve performance while maintaining form factor compatibility. Continuous upgrades in consumer electronics and increasing integration of MLCCs into IoT-enabled devices have reinforced market growth across Asia-Pacific, North America, and Europe.

Technological advancements have strengthened the market by improving capacitance, temperature stability, and voltage handling. High-permittivity dielectric materials such as Class II and Class III ceramics have enabled compact designs with increased energy storage. Innovations in surface-mount technology, automated assembly, and quality testing have enhanced production efficiency and component reliability. Low-loss designs, high-frequency operation, and improved thermal performance have made capacitors suitable for automotive electronics, industrial automation, and 5G communication systems. Furthermore, advancements in multilayer stacking and electrode patterning have increased capacitance without enlarging the device footprint. These innovations have allowed manufacturers to meet the growing requirements of miniaturized and high-performance electronic systems, reinforcing the essential role of MLCCs in modern circuit design globally.

The market has been significantly influenced by adoption in automotive electronics and industrial automation applications. Capacitors have been employed in electric vehicles, infotainment systems, advanced driver-assistance systems (ADAS), and motor control units due to their reliability under high temperature and vibration conditions. In industrial environments, MLCCs have been utilized in power inverters, robotics, and sensor systems, supporting automation and energy efficiency objectives. Regulatory mandates for vehicle safety, emissions control, and energy efficiency have further encouraged integration. High demand in electric and hybrid vehicles, coupled with investments in smart factories and Industry 4.0 initiatives, has reinforced the market. The ability of MLCCs to operate consistently in harsh conditions and support high-speed, high-power electronics has positioned them as critical components in automotive and industrial applications worldwide.

Despite strong growth, the market has faced challenges related to material costs, supply chain disruptions, and manufacturing complexity. High-quality ceramic powders and precious metals for electrodes have been subject to price volatility, influencing production costs. Manufacturing processes require precision in layer stacking, sintering, and electrode alignment to ensure performance and reliability. Yield losses during fabrication and defect detection have further impacted efficiency. Competition from alternative capacitor technologies, such as tantalum and polymer capacitors, has influenced adoption in specific applications. Manufacturers have responded with advanced process control, automated quality inspection, and research in cost-effective materials to overcome these challenges. Continuous innovation in miniaturization, dielectric performance, and production efficiency has remained critical to sustaining multi-layer ceramic capacitor market growth globally.

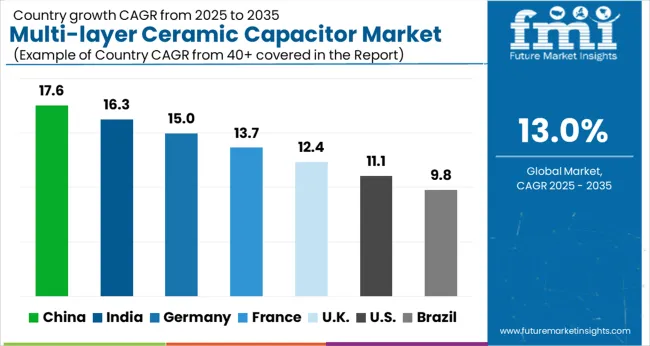

| Countries | CAGR |

|---|---|

| China | 17.6% |

| India | 16.3% |

| Germany | 15.0% |

| France | 13.7% |

| UK | 12.4% |

| USA | 11.1% |

| Brazil | 9.8% |

The market is projected to grow at a CAGR of 13.0% from 2025 to 2035, driven by rising demand in consumer electronics, automotive electronics, and industrial applications. China leads with a 17.6% CAGR, propelled by large-scale electronics manufacturing and adoption of advanced capacitor technologies. India follows at 16.3%, supported by growing electronics assembly and automotive component production. Germany, at 15.0%, benefits from advanced automotive and industrial electronics engineering. The UK, growing at 12.4%, focuses on high-performance electronic applications, while the USA, at 11.1%, witnesses steady demand from consumer electronics and EV sectors. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to witness a robust CAGR of 17.6% due to its dominant role in global electronics manufacturing, automotive production, and consumer electronics sectors. Increasing demand for miniaturized, high-capacitance, and high-reliability capacitors is driving growth. Expansion in 5G infrastructure, electric vehicle production, and renewable energy projects further strengthens market potential. Technological innovations in high-voltage and high-frequency multilayer capacitors support diverse applications in both industrial and consumer electronics.

India is projected to grow at a CAGR of 16.3%, propelled by the rapid adoption of automotive electronics, industrial automation, and consumer electronics production. Increasing investments in smart devices, renewable energy, and automation technologies drive market expansion. The demand for durable, compact, and high-performance multilayer ceramic capacitors remains high, and the country’s focus on enhancing manufacturing infrastructure supports sustained growth.

Germany is anticipated to grow at a CAGR of 15.0%, led by increasing applications in automotive electronics, industrial automation, and smart energy systems. German manufacturers prioritize reliability, miniaturization, and high-capacitance performance, driving adoption in critical applications. Government incentives for advanced electronics manufacturing and research in high-performance capacitor technologies reinforce the country’s market position.

The United Kingdom is expected to witness a CAGR of 12.4%, supported by growth in consumer electronics, renewable energy installations, and medical and aerospace devices. High-performance multilayer ceramic capacitors are increasingly deployed to meet stringent reliability and miniaturization requirements. Investments in smart infrastructure and research in high-frequency applications also drive market expansion.

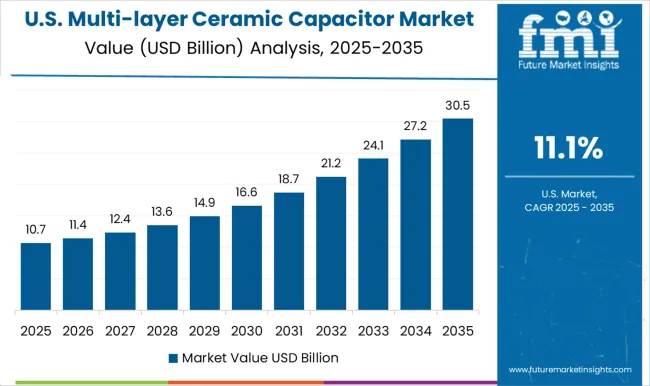

The United States is projected to grow at a CAGR of 11.1%, fueled by consumer electronics, automotive electronics, industrial automation, and renewable energy sectors. Technological advancements in multilayer ceramic structures enhance efficiency, durability, and high-frequency performance. The market benefits from strong R&D investment and increasing demand for compact, high-capacitance components across aerospace, medical, and smart device applications.

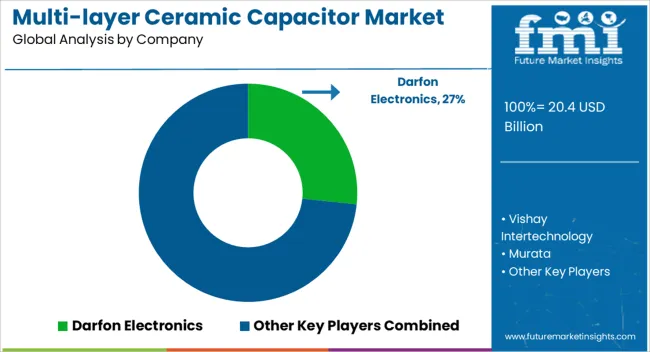

The MLCC market is witnessing significant growth, driven by the increasing adoption of compact and high-performance electronic devices across automotive, consumer electronics, industrial, and telecommunications sectors. Companies such as Murata, Samsung Electro-Mechanics, and Taiyo Yuden are leading the market by offering high-capacitance, miniaturized, and highly reliable ceramic capacitors. These providers focus on innovations that improve energy efficiency, enhance thermal stability, and support high-frequency applications in complex electronic circuits.

Vishay Intertechnology, Yageo, and TDK are recognized for their extensive product portfolios that cater to diverse applications ranging from smartphones, laptops, and automotive electronics to industrial machinery. These companies emphasize precision manufacturing, stringent quality control, and advanced dielectric materials to ensure high performance and durability. Darfon Electronics also contributes by delivering customizable MLCC solutions designed to meet specific client requirements, strengthening its position in both consumer and industrial segments.

Market growth is further reinforced by rising global demand for miniaturized electronic components and the transition toward electric vehicles, 5G-enabled devices, and IoT applications. By combining technological expertise, strategic partnerships, and continuous research and development, these leading providers are shaping the MLCC market to deliver reliable, high-capacity, and space-efficient solutions for modern electronic systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.4 Billion |

| Type | General purpose, Array, Megacap, and Serial design |

| Dielectric | Class I, Class II, and Others Class II |

| Rated Voltage | Low (Up to 50V), Medium (100 V-630 V), and High (1,000 V-Above) |

| End Use | Automotive, Electronics, Telecommunication, Industrial equipment, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Darfon Electronics, Vishay Intertechnology, Murata, Samsung Electro-Mechanics, Taiyo Yuden, Yageo, and TDK |

| Additional Attributes | Dollar sales by capacitor type and application, demand dynamics across consumer electronics, automotive, and industrial sectors, regional trends in electronic component adoption, innovation in capacitance density and reliability, environmental impact of manufacturing and disposal, and emerging use cases in electric vehicles, IoT devices, and high-frequency circuits. |

The global multi-layer ceramic capacitor market is estimated to be valued at USD 20.4 billion in 2025.

The market size for the multi-layer ceramic capacitor market is projected to reach USD 69.4 billion by 2035.

The multi-layer ceramic capacitor market is expected to grow at a 13.0% CAGR between 2025 and 2035.

The key product types in multi-layer ceramic capacitor market are general purpose, array, megacap and serial design.

In terms of dielectric, class i segment to command 53.2% share in the multi-layer ceramic capacitor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ceramic Matrix Composites Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Frit Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Substrates Market Size and Share Forecast Outlook 2025 to 2035

Ceramic 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Injection Molding Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Tableware Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Paper Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Balls Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Tester Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Membranes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Ceramic Barbeque Grill Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ceramic Tiles Market Growth & Trends 2025 to 2035

Ceramic Sanitary Ware Market Trends & Forecast 2025 to 2035

Ceramic Transducers Market Growth - Trends & Forecast 2025 to 2035

Leading Providers & Market Share in Ceramic Barbeque Grill Industry

Ceramic Ink Market

Ceramic Coating Market Growth – Trends & Forecast 2024-2034

Ceramic Textile Market Growth – Trends & Forecast 2024-2034

Ceramic & Porcelain Tableware Market Growth – Trends & Forecast 2024-2034

Ceramic Additives Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA