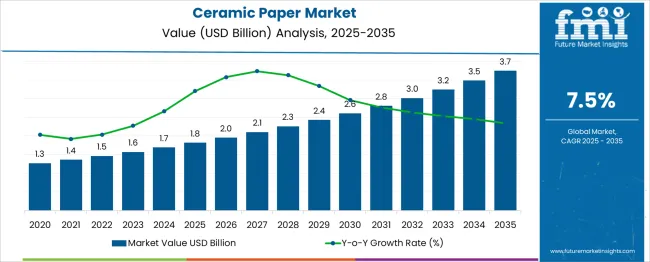

The Ceramic Paper Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 3.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

From 2025 to 2030, the market expands from USD 1.3 billion to USD 2.0 billion, with YoY growth between USD 0.1–0.2 billion annually. This 5-year growth of USD 0.7 billion reflects increasing demand from thermal insulation, filtration, and fire protection applications across heavy industry, aerospace, and high-temperature processing sectors. As confirmed in Ceramics International, ceramic fiber papers are gaining traction due to their lightweight, flexibility, and resistance to thermal shock and chemical degradation. Between 2030 and 2035, the market accelerates further, rising from USD 2.0 billion to USD 3.7 billion an increase of USD 1.7 billion in just five years. This sharp growth is attributed to material replacement trends and stricter global fire safety codes in industrial infrastructure. The demand for low-density refractory solutions, particularly in Asia-Pacific and the EU, is expanding rapidly. Advanced ceramic paper grades are increasingly integrated into battery insulation for EVs and thermal shielding for electronics. As energy efficiency and weight reduction become design priorities, ceramic paper emerges as a vital engineered material.

| Metric | Value |

|---|---|

| Ceramic Paper Market Estimated Value in (2025 E) | USD 1.8 billion |

| Ceramic Paper Market Forecast Value in (2035 F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

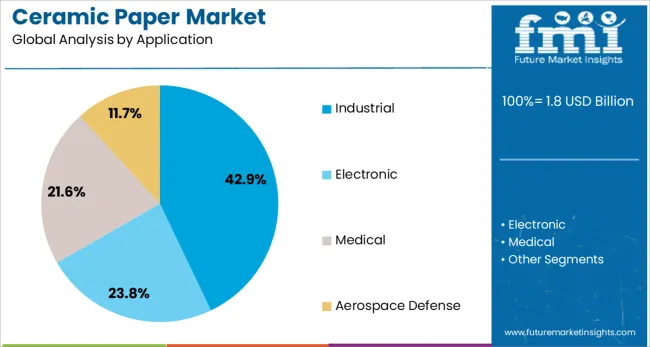

The Ceramic Paper Market is predominantly driven by the industrial insulation sector, which holds the largest market share at approximately 42%. This segment utilizes ceramic paper for lining high-temperature equipment such as kilns, furnaces, boilers, and reactors due to its excellent thermal resistance, flexibility, and low thermal conductivity. The aerospace and automotive sectors together account for about 20–25% of the market, where ceramic paper is applied in engine insulation, exhaust system linings, and heat shields to manage extreme heat while reducing overall system weight. Fire protection and safety applications contribute around 10–15%, as ceramic paper is a preferred material for fire barriers, wraps, and expansion joints thanks to its non-combustible and high-temperature stability. High-temperature filtration systems in metallurgy, cement, and petrochemical industries make up around 10–12% of market demand, leveraging ceramic paper’s durability and chemical resistance. The electronics industry adds another 5–8%, using it for insulation in circuit boards and power devices. Additionally, gasket and seal applications account for approximately 5–7%, where the paper’s structural integrity under high heat is critical. Niche applications across chemical processing, glass production, and medical equipment represent the remaining 3–5%. This market segmentation highlights ceramic paper’s versatility and its strong presence in temperature-intensive industrial operations.

Ceramic paper is being recognized for its versatility in high-heat environments, supported by its excellent thermal shock resistance, low thermal conductivity, and flexibility in fabrication.

The growing need for energy-efficient furnaces, kilns, and processing units has driven demand across metal processing, petrochemicals, and automotive manufacturing industries. Technological innovations in fiber engineering and binder-free manufacturing methods have expanded the performance range of ceramic paper, enabling broader applications without compromising structural integrity.

Furthermore, regulatory emphasis on workplace safety and emission reduction is encouraging the integration of non-toxic, asbestos-free insulation materials, further boosting market growth. As manufacturing sectors in emerging economies continue to scale, and global infrastructure projects demand high-performance thermal solutions, ceramic paper is expected to experience sustained demand across both established and developing industrial ecosystems.

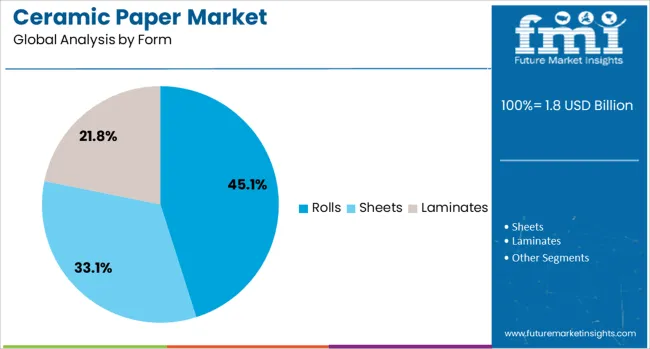

The ceramic paper market is segmented by technology, application, form, composition, substrate, and geographic regions. The ceramic paper market is divided into Advanced Ceramic Paper and Conventional Ceramic Paper. The ceramic paper market is classified into Industrial, Electronic, Medical, and Aerospace Defense. Based on the form, the ceramic paper market is segmented into Rolls, Sheets, and Laminates. The ceramic paper market is segmented by composition into Alumina, Zirconia, Mullite, and Silica. The substrate of the ceramic paper market is segmented into Ceramic, Glass, Metal, and Polyimide. Regionally, the ceramic paper industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The advanced ceramic paper segment is expected to account for 53.6% of the total ceramic paper market revenue in 2025, reflecting its dominant position due to enhanced material performance under extreme operational conditions. The segment's growth is being driven by improvements in thermal stability, flexibility, and fiber composition that allow usage in temperatures exceeding 1200°C.

Advanced ceramic papers have been increasingly utilized in critical insulation areas such as expansion joints, gaskets, and pipe wrapping due to their superior chemical resistance and dimensional integrity. The absence of organic binders in these products enhances purity and thermal efficiency, making them suitable for vacuum environments and cleanroom operations.

Their compatibility with high-tech industrial standards and capability for customized thickness and density support their application in specialized sectors such as aerospace and semiconductor manufacturing. The preference for low-mass insulation materials in energy-intensive operations has further reinforced the market position of advanced ceramic paper as the material of choice for high-performance thermal management.

The industrial application segment is projected to contribute 42.9% of the overall revenue share in the ceramic paper market by 2025, driven by rising adoption across metallurgical, petrochemical, and power generation industries. Ceramic paper's function has propelled the demand as a reliable barrier for thermal insulation, flame protection, and equipment safeguarding under rigorous operating conditions.

Industrial facilities are increasingly integrating ceramic paper for furnace linings, duct insulation, and heat shields to optimize energy usage and ensure personnel safety. The growing focus on reducing thermal loss in process industries has encouraged a shift toward durable, reusable, and non-reactive insulation solutions.

With sustainability and emission norms tightening globally, ceramic paper’s low outgassing and chemical inertness have aligned with industry goals for greener production practices. The operational longevity and reduced maintenance cycles associated with industrial-grade ceramic paper have further contributed to its broad acceptance in manufacturing and heavy engineering sectors.

The rolls segment is anticipated to hold 45.1% of the total revenue share in the ceramic paper market by 2025, reflecting its prominence due to convenience in handling, storage, and application across varied industrial settings. The roll form allows seamless installation over large surfaces, reducing joint gaps and thermal leakage in high-temperature insulation applications. Rolls are widely favored in production environments where quick deployment and customizable lengths are critical to operational efficiency.

The uniform thickness and consistent fiber distribution achieved in rolled ceramic paper enhance thermal performance and structural adherence on irregular surfaces. This form is particularly advantageous in sectors like metal treatment, ceramics, and chemical processing, where equipment requires continuous insulation linings.

In addition, roll-based formats support automated processing and lamination in downstream manufacturing, contributing to cost efficiency and installation speed. The ease of integration into multi-layer insulation systems and superior handling during shipping and storage have established rolls as the preferred delivery format in commercial and industrial use cases.

Ceramic paper is gaining traction across industrial sectors due to its heat resistance, low thermal conductivity, and lightweight insulation properties. Expanding demand from automotive, aerospace, and manufacturing sectors continues to create new opportunities.

Ceramic paper is increasingly selected for use in high-temperature environments such as kilns, furnaces, and exhaust systems. Its ability to withstand temperatures beyond 1000°C while providing thermal insulation makes it suitable for applications in metallurgy, petrochemicals, and glass manufacturing. Regulatory guidelines promoting fire resistance and energy efficiency are pushing industries to replace traditional materials with ceramic-based solutions. Additionally, it's non-combustible and low-shrinkage characteristics support safe operations in sectors where fire hazards and heat loss must be minimized. Manufacturers are integrating ceramic paper into gaskets, seals, and protective linings to improve operational stability and comply with performance benchmarks.

Manufacturers are establishing production units near ceramic fiber sources to reduce costs and ensure timely availability. The market is benefiting from the ability to customize product thickness, density, and reinforcement to suit diverse industry needs. New use cases in electric vehicle battery insulation, aerospace panels, and industrial filter support layers are being explored through pilot collaborations. Smaller players are entering the space with modular offerings designed for niche applications such as laboratory furnaces or HVAC duct barriers. The ability to convert ceramic paper into preformed or die-cut shapes also enables adoption in space-constrained or performance-critical installations. Rising demand for lightweight and high-temperature resistant insulation is supporting the adoption of ceramic paper. New applications and regional production capabilities are further strengthening its industrial market position.

Manufacturers of ceramic paper face challenges in maintaining consistent thickness, density, and fiber orientation across production batches. Variations in raw ceramic fiber slurry, binder concentration, and drying conditions lead to differing thermal conductivity, tensile strength, and porosity. These inconsistencies reduce reliability in applications such as furnace wall liners, high-voltage insulation, and gasket seals in engine compartments. End users demand tight tolerances for insulation effectiveness and press-fit performance under thermal cycling. Without industrial automation, inline density measurement, and improved slurry homogenization, scrap rates and customer complaints increase. In high-volume supply contracts, such as OEM insulation kits, inconsistent paper quality creates installation errors and warranty issues. Stability across batches is necessary to support large-scale adoption in aerospace and energy equipment manufacturing, where performance failures can carry high liability. Until production quality stabilizes, ceramic paper may remain confined to niche or small-scale applications.

Ceramic paper is increasingly specified in applications that require resistance to high temperatures and tight thermal control. These include furnace linings, gas turbine insulation, expansion joint wraps, and catalytic converter heat shields. Compared to conventional insulation materials, ceramic paper offers low thermal conductivity, high infrared reflectivity, and a lighter weight profile. Equipment manufacturers in heavy industry and aerospace sectors benefit from reduced turnaround during thermal expansion or maintenance. The demand for compact insulation systems in battery thermal management and electric motor housings also grows. Suppliers that develop high-density paper grades with controlled porosity and flame-resistant binders gain preference among thermal management engineers. Advancements in binder chemistry and fiber composition improve tear resistance and reduce dust emissions during handling. These enhancements position ceramic paper as a key enabler in compact thermal systems across emerging electrified equipment and combustible machinery.

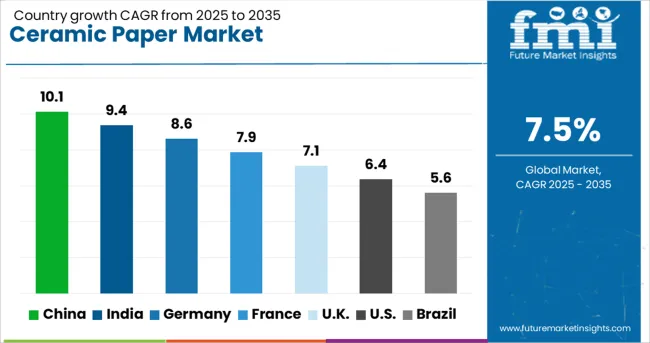

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

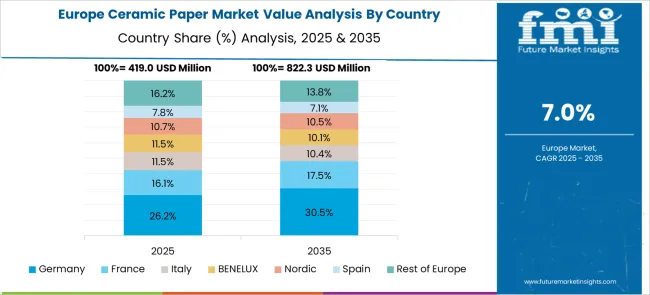

Within the BRICS group, China leads with a projected CAGR of 10.1% from 2025 to 2035, driven by large-scale industrial insulation projects, growing demand from the metallurgy sector, and increased domestic manufacturing of high-temperature materials. India follows at 9.4%, supported by the expansion of steel and cement industries, rapid growth in thermal power plants, and government incentives for indigenous refractory material production. Among OECD countries, Germany is growing at 8.6%, fueled by its advanced automotive and aerospace sectors, which use ceramic paper in heat shielding and emission control applications. France, with a CAGR of 7.9%, sees steady demand in nuclear energy and chemical processing, where thermal stability is critical. The United Kingdom, growing at 7.1%, benefits from infrastructure refurbishment projects and increasing use in lightweight fire-resistant building materials. The report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The ceramic paper market in China is being driven at a strong CAGR of 10.1%, supported by extensive usage in high-temperature insulation across steel, aluminum, and power generation sectors. Thermal stability and flexibility are being improved by manufacturers through advanced processing technologies. Government initiatives focused on energy efficiency and industrial safety are leading to increased adoption of non-combustible insulation materials. Applications in electric vehicle battery compartments and furnace manufacturing for export are contributing to accelerated market expansion. Research collaborations between industry and academic institutions are resulting in innovative solutions that meet stringent international safety and performance standards. Investment in automated production systems is being pursued to boost scale and efficiency.

The ceramic paper market in India is witnessing a CAGR of 9.4%, fueled by rapid growth in steel, cement, and foundry sectors. Expanding infrastructure and renewable energy projects are driving the use of ceramic insulation materials. Domestic manufacturers are scaling operations with support from international technology collaborations. The fire-resistant, lightweight, and flexible properties of ceramic paper are being used in industrial boilers, furnaces, and electric mobility applications. Growing use in lithium-ion battery packs and sustainable construction practices is contributing to market growth. Government-backed programs promoting energy-efficient buildings and self-reliant energy systems are strengthening demand.

In Germany, the ceramic paper market is growing at a CAGR of 8.6%, supported by demand in high-temperature processing, electric mobility, and clean energy sectors. Adoption is being influenced by EU regulations focused on fire safety and emissions reduction. Manufacturers are engineering high-purity ceramic fiber blends for use in kilns, reactors, and electronic systems. Ceramic paper is being used in electric vehicles for battery safety and thermal barriers. Innovation is being driven by collaborations between research institutions and industrial partners, with a focus on performance and environmental compliance. Circular economy practices are encouraging recyclable and sustainable insulation materials.

The ceramic paper market in France is expanding at a CAGR of 7.9%, driven by increased application in aerospace, defense, and energy-related systems. Ceramic paper is being used for its thermal stability and fire resistance in turbines, protective linings, and heat shielding solutions. R and D initiatives are creating lightweight insulation for renewable energy storage and space systems. Domestic producers are broadening product offerings to align with EU environmental standards while delivering high-performance results. Ceramic paper is also being integrated into heat recovery systems and energy-efficient buildings. Public and industrial fire safety regulations are further supporting market adoption.

The ceramic paper market in the United Kingdom is growing at a CAGR of 7.1%, propelled by rising interest in fire-safe insulation for buildings, transportation, and electronic systems. Integration into electric vehicle batteries is being fueled by the need for thermal control and safety. Retrofit initiatives in aging marine and rail infrastructure are maintaining strong demand for reliable insulation. Local manufacturers are enhancing production efficiency through improved fiber-forming technologies and sustainable sourcing. Use cases are expanding across aerospace, marine, and electrical enclosures due to the material's heat resistance and low combustibility. Regulatory support for decarbonization and fireproofing continues to influence growth.

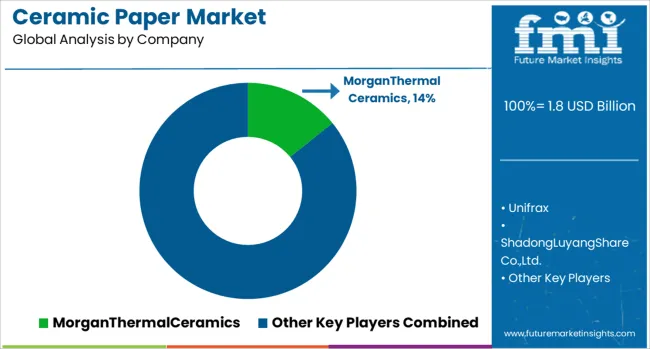

The ceramic paper market features a tiered structure comprising global leaders, mid-sized manufacturers, and regionally focused suppliers, each addressing specific industrial thermal insulation needs. Tier 1 suppliers are prominent multinational companies with advanced manufacturing capabilities and extensive product portfolios. These firms offer high-performance ceramic paper products designed for use in extreme temperature environments such as metallurgy, petrochemical processing, power generation, and aerospace.

Their ceramic papers are engineered for low thermal conductivity, excellent flexibility, and resistance to thermal shock, making them ideal for applications like furnace linings, pipe insulation, and gasketing. These companies often emphasize research and development, producing specialized variants including soluble fiber papers for improved health and environmental compliance. Tier 1 players also benefit from robust global distribution networks and strong relationships with OEMs and EPC contractors, enabling them to serve both standard and high-specification industrial requirements.

Tier 2 suppliers focus on providing reliable, thermally stable ceramic fiber papers for mid-sized applications in industries such as refractory construction, glass processing, and fire protection. These manufacturers typically emphasize cost-performance balance, offering papers with moderate density and insulation efficiency that suit general-purpose high-temperature applications. Tier 2 firms often operate regionally or through dedicated partners to meet localized industrial demand while maintaining quality consistency.

Tier 3 suppliers, often regional manufacturers, concentrate on providing affordable, customizable ceramic paper solutions for smaller-scale or maintenance-focused applications. They serve sectors such as ceramics, foundries, and local kiln operations, offering flexible production runs and competitive pricing.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Technology | Advanced Ceramic Paper and Conventional Ceramic Paper |

| Application | Industrial, Electronic, Medical, and Aerospace Defense |

| Form | Rolls, Sheets, and Laminates |

| Composition | Alumina, Zirconia, Mullite, and Silica |

| Substrate | Ceramic, Glass, Metal, and Polyimide |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | MorganThermalCeramics, Unifrax, ShadongLuyangShareCo.,Ltd., RathInc., VitcasLtd., NutecInc., ShreeCeramicFibersPvt.Ltd., YesoInsulatingProducts,Ltd., MillenniumMultiTradePvt.Ltd., IsoliteInsulatingProductsCo.,Ltd., ImperialWorldTrade, and GalaxyEnterprise |

| Additional Attributes | Dollar sales by product form including sheet, roll, and laminate, by industry application such as thermal insulation, fire protection, high‑temperature filtration, aerospace and automotive, and by region including Asia Pacific, North America and Europe; demand driven by energy-efficient insulation needs in industrial and aerospace sectors; innovation in advanced alumina‑silicate and zirconia papers; cost shaped by raw fiber sourcing and manufacturing complexity; and emerging use cases in EV battery thermal shielding and electronics thermal interface materials. |

The global ceramic paper market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the ceramic paper market is projected to reach USD 3.7 billion by 2035.

The ceramic paper market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in ceramic paper market are advanced ceramic paper and conventional ceramic paper.

In terms of application, industrial segment to command 42.9% share in the ceramic paper market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ceramic to Metal Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Textile Market Size and Share Forecast Outlook 2025 to 2035

Ceramic and Porcelain Tableware Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Matrix Composites Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Frit Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Substrates Market Size and Share Forecast Outlook 2025 to 2035

Ceramic 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Injection Molding Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Tableware Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Balls Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Tester Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Membranes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Ceramic Barbeque Grill Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ceramic Tiles Market Growth & Trends 2025 to 2035

Ceramic Sanitary Ware Market Trends & Forecast 2025 to 2035

Ceramic Transducers Market Growth - Trends & Forecast 2025 to 2035

Leading Providers & Market Share in Ceramic Barbeque Grill Industry

Ceramic Ink Market

Ceramic Coating Market Growth – Trends & Forecast 2024-2034

Ceramic Additives Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA