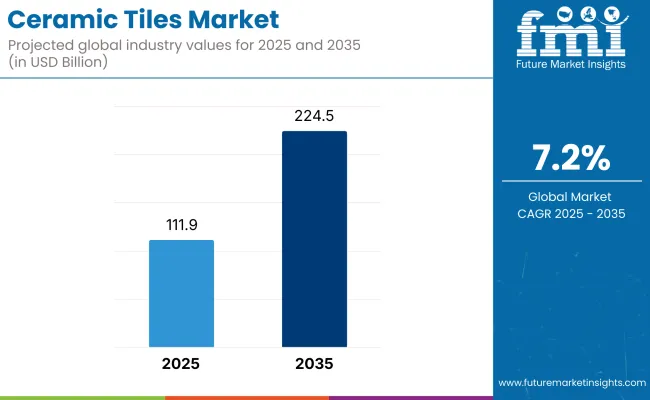

The global ceramic tiles market is estimated to reach USD 111.9 billion in 2025. A projected CAGR of 7.2% is expected to drive the market to USD 224.5 billion by 2035. Demand is being propelled by urban housing schemes, green construction mandates, and renovation activity. Asia Pacific is expected to be the epicenter of the demand, supported by infrastructure megaprojects in India, China, and ASEAN economies.

The adoption of ceramic tiles has been driven by their insulation properties, resistance to moisture, and minimal upkeep. As per the 2025 Sustainability in Construction Report by the International Ceramic Federation, ceramic tiles have emerged as the leading flooring material used in LEED Platinum buildings in Southeast Asia. Energy-saving and anti-skid variants are increasingly mandated in public infrastructure projects under India’s Smart Cities Mission and Indonesia’s National Urban Housing Plan.

In its 2025 Q1 earnings call, RAK Ceramics CEO Abdallah Massaad confirmed that "strong demand for large-format and antibacterial tiles in Europe lifted exports by 18% YoY." This was attributed to strategic partnerships with distributors in Germany and Spain. In another development, Kajaria Ceramics, in its 2025 investor presentation, recorded a 15.3% YoY revenue rise, with an additional 20 million sq. meters in manufacturing capacity established across Gujarat and Andhra Pradesh.

In the recent past, sustainability efforts by key players have gained traction. Grupo Lamosa’s 2025 Environmental Report confirmed that 60% of kiln operations are powered by solar and biogas sources, helping cut CO₂ emissions by 35% over the last two years. Their proprietary low-bake digital glazing process has also reduced energy consumption by 19%.

Rising input costs have added operational stress across the ceramic tiles industry. Volatility in natural gas prices, combined with a sharp rise in feldspar costs-a critical raw material-has compressed manufacturer margins during FY2024 to 2025. In response, Somany Ceramics, as noted in its 2025 press briefing, disclosed the signing of a long-term sourcing agreement with feldspar cooperatives in Rajasthan.

To ensure future supply chain stability and cost efficiency, plans were also outlined to develop backward-integrated mining operations in proximity to its existing tile production hubs. These strategic moves reflect a broader industry trend toward vertical integration to mitigate raw material price exposure and secure consistent quality inputs amid global supply uncertainty.

The market is segmented based on product, application, and region. By product, the market is divided into floor tiles, wall tiles, and other tiles (roof tiles, ceiling tiles, backsplash tiles, and countertop tiles). In terms of application, it is segmented into residential replacement, commercial, new residential, and others, which include facades, countertops, and decorative surfaces. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia Pacific, and Middle East & Africa.

The other tiles category, encompassing roof tiles, ceiling tiles, backsplash tiles, and countertop tiles, is projected to grow at the fastest CAGR of 6.3% between 2025 and 2035. This segment is experiencing significant traction due to shifting architectural trends that emphasize multifunctional and decorative ceramic applications beyond floors and walls.

With demand intensifying across high-end residential, boutique hospitality, and corporate settings, these tiles offer surface flexibility, visual appeal, and durability. Technological advancements in inkjet printing, UV resistance, and non-slip coatings have further broadened their use in facades, wet areas, and modular kitchens. As green building certifications prioritize eco-friendly construction, tile manufacturers are also integrating recycled content and energy-efficient kilns to cater to sustainability goals.

In contrast, floor tiles retain dominance in market volume and revenue, particularly in areas requiring resilient surfaces such as entryways, corridors, and commercial complexes. Their long lifecycle, wide range of textures, and compatibility with underfloor heating systems contribute to sustained demand.

Wall tiles continue to perform well in bathrooms and kitchens due to their water resistance and hygiene benefits. However, their growth is relatively muted due to confined application zones. The evolution of aesthetic design preferences and installation technologies is expected to further differentiate product segments by functionality and innovation.

| Product Segment | CAGR (2025 to 2035) |

|---|---|

| Other Tiles (Roof Tiles, Ceiling Tiles, Backsplash Tiles, and Countertop Tiles) | 6.3% |

The new residential segment is expected to register the fastest CAGR of 6.8% from 2025 to 2035. This rapid growth is being driven by an unprecedented surge in urbanization, public-private housing schemes, and increased disposable incomes in emerging economies.

Countries such as India, Indonesia, Vietnam, and South Africa are seeing a wave of real estate development, including mass housing, where ceramic tiles are preferred due to cost-effectiveness, hygiene, and compatibility with fast-track construction. Furthermore, evolving buyer preferences for premium finishes and customizable surfaces are prompting developers to choose high-quality tiles for flooring, kitchens, and bathrooms in new builds.

Residential replacement remains a mature yet steady segment, contributing significantly in North America and Europe, where renovation cycles drive continuous re-tiling of kitchens, patios, and wet rooms. Consumer spending on interior upgrades, combined with DIY-friendly tile options, supports this trend. The commercial segment benefits from institutional demand in airports, malls, schools, and offices, with tiles chosen for durability and low maintenance.

The others segment, which includes countertops, decorative cladding, and backsplashes, offers niche growth opportunities, especially in high-value interior design projects. Overall, new residential construction remains the cornerstone of market expansion, supported by urban policy shifts, design evolution, and improved tile performance attributes.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| New Residential | 6.8% |

Price Volatility and Raw Material Supply

The ceramic tiles sector is at the forefront of the issues arising out of the changing prices and the limited availability of raw materials like clay and natural minerals. The raw material prices not only depend on the global market but also, the unavailability in supply chains-due to geopolitical situations, natural disasters, or trade restrictions-can convert them into shortages or price hikes.

The companies need to find the right materials at a stable rate, which itself calls for strategic sourcing and strong supply chain management. Besides, procuring ecological raw materials, for instance, recycled content, becomes a challenge as some of the markets still are not equipped with the needed materials.

Environmental Impact and Sustainability

The ceramic tiles industry has to deal with the pressure to adopt more environmental-friendly ways of getting supplies and production. The increasing consumer demand for eco-friendly tiles, which are made from recycle materials and possess energy-saving production processes, represents the manufacturers' opportunity. Though, the complete supply chain sustainability is a tangled web.

Emission of carbon during production, reducing water usage, and embracing green power sources are the three major areas that need to be worked on. The force of environmental legislation and the influence of consumers preferring environmental-friendly products make it a must for manufacturers to keep innovating. Nevertheless, not all producers have the means to implement these changes.

Green and Eco-friendly Tiles

The recent trend towards using construction materials that respect the environment is a real chance to the ceramic tiles market. Meanwhile, the construction field globally is more-oriented towards zero carbon buildings which leads to the increment in the demand for ecological tiles.

Companies producing ceramic tiles made of recycled waste, implementing energy-efficient processes, or low-emission technologies are in the best possible conditions to follow the tendency. Furthermore, the support from public authorities and the environment certifications promotes the use of green materials in construction. With sustainability as a frontline in building design, ceramic tile manufacturers embrace new markets by promoting solutions that consider the environment.

Technological Innovations in Tile Production

Technological advancements, like the introduction of digital printing, a big format of tiles, and implementing 3D designs, have completely changed the ceramic tiles market. These advancements enable manufacturers to offer the high degree of customization, eye-catching designs with enhanced functionality.

The tiles with such properties as being antibacterial, water-resistant, and stain-resistant are more than ever demanded. Manufacturing tiles that have digitized patterns and textures, which are also the output of technology and customer personalization, deal with the ever-growing market demand. As production procedures become more advanced the market will consequently show up with more brilliant and practical new items that will fit modern architecture and refurbishments.

Rising Demand for Luxury and Designer Tiles

With consumers shifting their preferences more towards high luxury and exclusive interior design, the popularity of designer ceramic tiles is growing at a fast pace. Super high-rise hotels and other tourism-related sectors are very demand-intensive to luxury tiles which feature luxurious textures, complex geometrical shapes, and stylish finishes.

Besides their intangibility ceramic tiles can be used in many applications such as luxury flats, high status firms, and exclusive hotels. The increased occurrence of designer tiles entails the utilization of sophisticated materials, novel styles, and custom designs and thus it embraces the opportunity for manufacturers to widen their products and, in turn, also tackle the retail expansion in wall and flooring solutions.

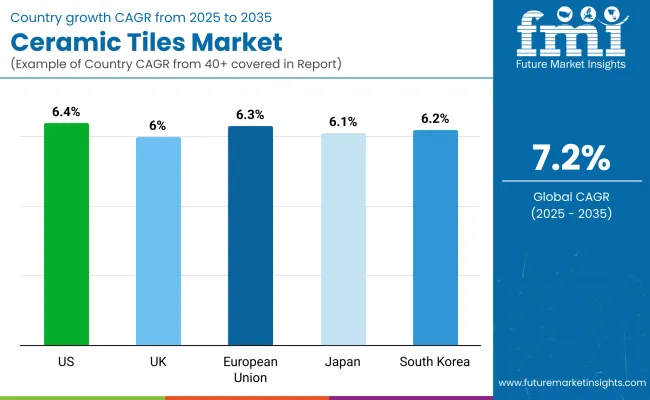

The booming USA ceramic tiles market is associated with consumers' increasing quest for high-quality, decorative, and biodegradable products. The market is positively impacted by the growth in residential and commercial building constructions as well as house renovation works. Additionally, consumers' green energy concerns are causing the rise in the demand for the use of eco-friendly tiles.

The USA tile market is also experiencing the application of new designs, with currently popular modular, customizable pieces of ceramic tiles. The demand for premium and high-class tiles is on the rise, thus manufacturers are focusing on the development of innovative methods for the production of these tiles. Government regulations that endorse the construction of green buildings and energy-efficient buildings are also the factors that consolidate the development of ceramic tile consumption in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.4% |

The ceramic tile trade in the United Kingdom is flourishing on account of the heightened need for high-performance and decorative tiles both in the residential and the commercial sectors. The interest of the consumers in the use of sustainable and eco-friendly tiles is moving up as the United Kingdom is prioritizing energy-efficient building standards.

Likewise, the demand for the ever-popular custom and unique designs, like large-format and digitally printed tiles, is also on the rise. Green is the government’s policy for more environmentally friendly building practices and green building certifications, thus the use of breathable ceramics is being promoted. The recovery in the residential and commercial construction sectors is the cause of increased demand for high-end and versatile tiles.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.0% |

The tiles market in the sovereign-state union has experienced pervasive growth as a result of the regional agency's inclination towards sustainability and green construction materials. Besides offbeat ceramic heritage and the newest innovations in tile design, the main contributors to the economic growth of the market are, of course, Italy and Spain. Sustainable tiles made from reclaimed resources and using low-energy production methods are being embraced more and more.

The EU Green Deal and relevant laws that regulate energy-saving construction are, therefore, the ones that are speeding up the process excessively. In addition to that, consumer satisfaction is on the rise with the advent of high-quality tiles, which include polymers with anti-bacterial and anti-slip characteristics among other things. The latest developments in alternative materials and manufacturing techniques are the other factors that make the market flourish.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.3% |

Japan's ceramic tile market has been propelled to the forefront due to the growing demand for both decorative and utilitarian tiles, which are primarily driven by the construction of new residential and commercial buildings. The market is further boosted by technology developments that enhance tile performance, like moisture-proof and heat-proof properties.

Eco-friendly tiles produced by ceramicists, who are willing to harm the environment the least, are influenced by Japan's emphasis on green building materials. The introduction of new innovative designs, like oversized or 3D tiles, also contribute to the increasing demand for tiles. As the construction and renovation works in Japan progress, the perception of ceramic tiles has also evolved, and they are more and more frequently viewed as both practical and beautiful building materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The ceramic tiles market in South Korea progresses due to the rise in demand for superior tiles in residential and commercial buildings. The country's increasing emphasis on sustainability in building materials is becoming a catalyst for the introduction of eco-friendly and energy-efficient tiles.

Unique designs such as the customizable and large-format option are trending. Apart from that, the growing construction sector coupled with the increase in renovation projects is setting off the demand for advanced ceramic tile designs. The government's incentives and policies that are aimed at proposing sustainable building methods are also helping the market to rise. Due to the change in customer preference from traditional to modern and functional design, the ceramic tile sector is destined to bloom.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

The ceramic tile industry is as competitive as it can get, majorly due to the high number of competitors who are relentless in their quest for a better market share in both the residential and commercial sections. Besides, focusing on sustainability, and distribution expansion, manufacturers also give priority to product innovation to meet the increasing demand for the durable, eco-friendly, and good-looking tiles.

The market is propelled by technological developments in design, among others, such as digital printing and the ever-rising preference of consumers for more sustainable materials. Furthermore, suppliers are majorly concerned about regional market expansion partnerships and low-cost production techniques so as to stay competitive in a quickly changing environment.

The global market is expected to reach USD 224.5 billion by 2035, growing from USD 111.9 billion in 2025, at a CAGR of 7.2% over the forecast period.

The residential segment is projected to dominate the market due to rising home renovation activities, increased urbanization, and growing demand for aesthetically pleasing and durable flooring and wall solutions.

Key drivers include rapid infrastructure development, shifting consumer preference toward low-maintenance surfaces, technological innovations in digital printing, and a growing focus on green building materials.

Residential construction, commercial buildings, and institutional projects are key sectors fueling growth, driven by rising disposable incomes, real estate expansion, and public infrastructure investments.

Top companies include Mohawk Industries, Inc., SCG Ceramics, Grupo Lamosa, S.A.B. de C.V., RAK Ceramics, and Kajaria Ceramics Limited, recognized for broad product portfolios, global presence, and technological advancements.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Sq. Mts.) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Sq. Mts.) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Sq. Mts.) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Sq. Mts.) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 10: North America Market Volume (Sq. Mts.) Forecast by Product, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Sq. Mts.) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Sq. Mts.) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 16: Latin America Market Volume (Sq. Mts.) Forecast by Product, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Sq. Mts.) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Sq. Mts.) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 22: Western Europe Market Volume (Sq. Mts.) Forecast by Product, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Sq. Mts.) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Sq. Mts.) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Eastern Europe Market Volume (Sq. Mts.) Forecast by Product, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Sq. Mts.) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Sq. Mts.) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Sq. Mts.) Forecast by Product, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Sq. Mts.) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Sq. Mts.) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 40: East Asia Market Volume (Sq. Mts.) Forecast by Product, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Sq. Mts.) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Sq. Mts.) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Sq. Mts.) Forecast by Product, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Sq. Mts.) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Sq. Mts.) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Volume (Sq. Mts.) Analysis by Product, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Sq. Mts.) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Sq. Mts.) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 27: North America Market Volume (Sq. Mts.) Analysis by Product, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Sq. Mts.) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Sq. Mts.) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 45: Latin America Market Volume (Sq. Mts.) Analysis by Product, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Sq. Mts.) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Sq. Mts.) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 63: Western Europe Market Volume (Sq. Mts.) Analysis by Product, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Sq. Mts.) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Sq. Mts.) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Sq. Mts.) Analysis by Product, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Sq. Mts.) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Sq. Mts.) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Sq. Mts.) Analysis by Product, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Sq. Mts.) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Sq. Mts.) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 117: East Asia Market Volume (Sq. Mts.) Analysis by Product, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Sq. Mts.) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Sq. Mts.) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Sq. Mts.) Analysis by Product, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Sq. Mts.) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ceramic to Metal Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Textile Market Size and Share Forecast Outlook 2025 to 2035

Ceramic and Porcelain Tableware Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Matrix Composites Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Frit Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Substrates Market Size and Share Forecast Outlook 2025 to 2035

Ceramic 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Injection Molding Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Tableware Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Paper Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Balls Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Tester Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Membranes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Ceramic Barbeque Grill Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ceramic Sanitary Ware Market Trends & Forecast 2025 to 2035

Ceramic Transducers Market Growth - Trends & Forecast 2025 to 2035

Leading Providers & Market Share in Ceramic Barbeque Grill Industry

Ceramic Ink Market

Ceramic Coating Market Growth – Trends & Forecast 2024-2034

Ceramic Additives Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA