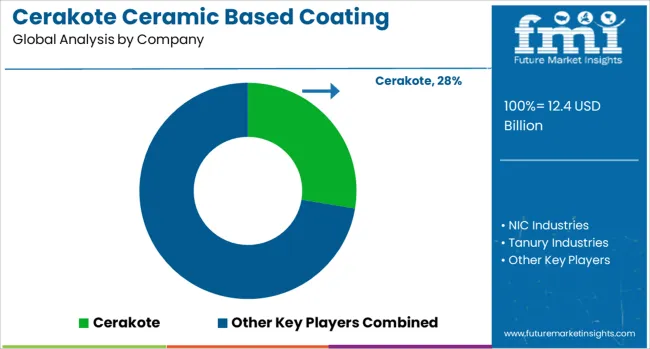

The Cerakote Ceramic Based Coating Market is estimated to be valued at USD 12.4 billion in 2025 and is projected to reach USD 26.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

| Metric | Value |

|---|---|

| Cerakote Ceramic Based Coating Market Estimated Value in (2025 E) | USD 12.4 billion |

| Cerakote Ceramic Based Coating Market Forecast Value in (2035 F) | USD 26.3 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The Cerakote ceramic based coating market is experiencing steady growth driven by the demand for durable protective finishes in various industries. The superior properties of ceramic coatings such as resistance to abrasion corrosion and chemicals have made them essential in enhancing the lifespan of coated surfaces.

Growing industrial activities and the need for reliable surface protection in harsh environments have fueled the adoption of ceramic coatings. Technological advances have improved coating application processes enabling more precise and efficient surface coverage.

The defense and firearms sectors have notably increased usage due to the need for coatings that can withstand extreme conditions and wear. Rising investments in manufacturing and infrastructure along with heightened focus on maintenance cost reduction are also supporting market expansion. Segmental growth is expected to be led by H-series product types, metals as the primary compatible substrate, and the defense and firearms industry as a major application area.

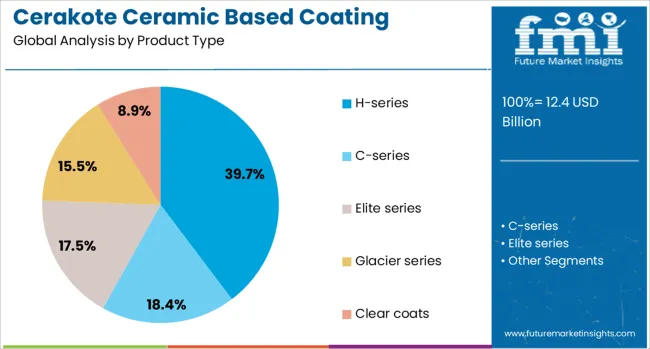

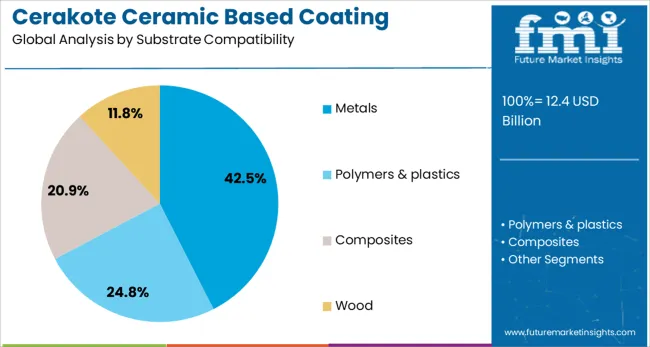

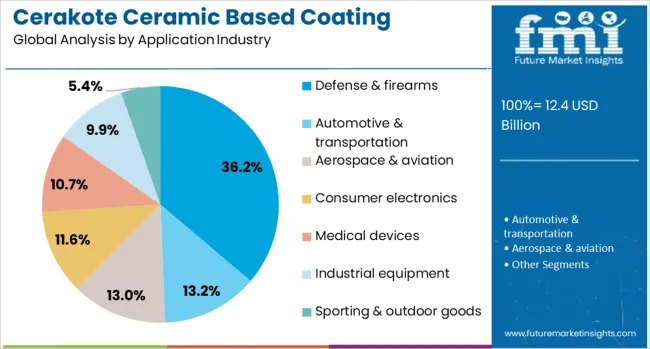

The cerakote ceramic based coating market is segmented by product type, substrate compatibility, application industry, and application method and geographic regions. By product type of the cerakote ceramic based coating market is divided into H-series, C-series, Elite series, Glacier series, and Clear coats. In terms of substrate compatibility of the cerakote ceramic based coating market is classified into Metals, Polymers & plastics, Composites, and Wood. Based on application industry of the cerakote ceramic based coating market is segmented into Defense & firearms, Automotive & transportation, Aerospace & aviation, Consumer electronics, Medical devices, Industrial equipment, and Sporting & outdoor goods. By application method of the cerakote ceramic based coating market is segmented into Spray coating, Heat curing, and Air drying. Regionally, the cerakote ceramic based coating industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The H-series product type segment is projected to hold 39.7% of the Cerakote ceramic based coating market revenue in 2025 maintaining its leadership position. Growth in this segment has been driven by the H-series coatings’ balance of durability and flexibility suitable for a wide range of applications. Its formulation provides excellent chemical resistance and surface hardness while allowing for application on complex geometries.

This versatility has made H-series popular in industries requiring robust performance under demanding conditions. The segment benefits from continuous formulation improvements that enhance adhesion and color retention.

As industries seek coatings that deliver reliable protection without compromising aesthetics the H-series segment is expected to sustain its market prominence.

The metals substrate segment is anticipated to account for 42.5% of the market revenue in 2025 positioning it as the leading substrate compatibility category. This dominance results from the extensive use of metals in manufacturing defense firearms automotive and industrial equipment where corrosion resistance and wear protection are critical.

Ceramic coatings have been preferred for metals due to their ability to create tough protective barriers against environmental and mechanical stressors. The segment has seen growth supported by the rising demand for coated metal parts in harsh operational environments.

As the importance of extending component life and reducing maintenance costs intensifies the metals substrate segment is expected to maintain its leading position.

The defense and firearms application segment is projected to contribute 36.2% of the Cerakote ceramic based coating market revenue in 2025 retaining its position as the primary industry application. The segment’s growth is driven by the critical need for coatings that can endure high abrasion corrosion and impact typical of firearms and defense equipment.

Cerakote coatings have been adopted extensively for their ability to protect weapon surfaces from wear and harsh operational environments. The sector has focused on coatings that ensure reliability functionality and longevity in demanding conditions.

Increasing defense budgets and modernization programs have further accelerated the demand for advanced ceramic coatings in this industry. As durability and performance remain key priorities the defense and firearms segment is expected to sustain its market leadership.

Cerakote ceramic based coatings are being used widely for protective and aesthetic enhancement of firearms, automotive components, and industrial tools. The coatings are selected for their high resistance to abrasion, temperature, and corrosion, offering durable finishes with customizable color options. Market expansion has been observed in sectors requiring long-term surface protection and visual differentiation. Application methods such as spray, dip, and robot-enabled systems have been implemented across small workshops and OEM production lines. Formulators are offering tailored formulations to meet specific wear and heat resistance requirements.

Cerakote coatings have been embraced to increase longevity and performance of metal, polymer, and composite components in harsh environments. High-temperature ceramic blends are being applied to exhaust systems, engine parts, and shooter's gear to resist heat and wear. Firearm manufacturers and restorers have favored Cerakote for its hard finish and corrosion resistance benefits. In automotive and motorcycle customization, coatings have been applied to frames, wheels, and brake parts to provide both aesthetic appeal and protection against road salts and debris. Industrial tool producers have integrated Cerakote to reduce abrasive wear and extend maintenance intervals. Facility efficiency has been improved through faster cure cycles and consistent thickness results delivered by oven or UV-curing techniques. As parts replacement costs have risen, the value of protective ceramic coatings has become more convincing for both aftermarket and OEM applications.

Cerakote adoption has been limited by initial investment in baking ovens, spray systems, and curing equipment. Small-scale applicators have hesitated due to capital requirements and classification of coated parts under industrial finish regulations. Surface preparation demands such as media blasting and solvent degreasing have introduced time and tooling expense into the process. Color matching consistency across batches has been affected by differences in application parameters and ambient curing conditions. VOC regulations and hazardous material handling procedures for solvents and prep chemicals have increased operational complexity. Certification standards related to food contact surfaces, medical devices, or aerospace allowances have created additional testing and documentation burdens. As alternative powder or Teflon-like coatings exist, decision-makers have balanced performance advantages against processing and compliance overhead.

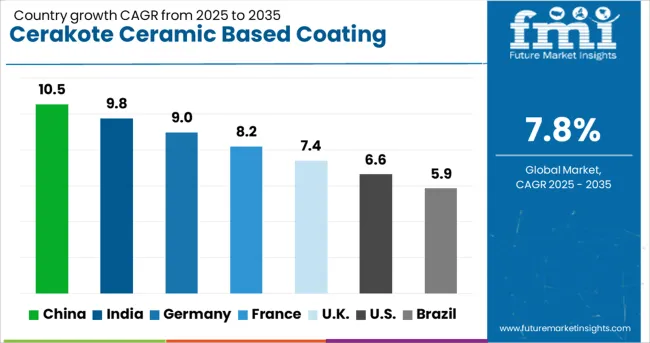

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

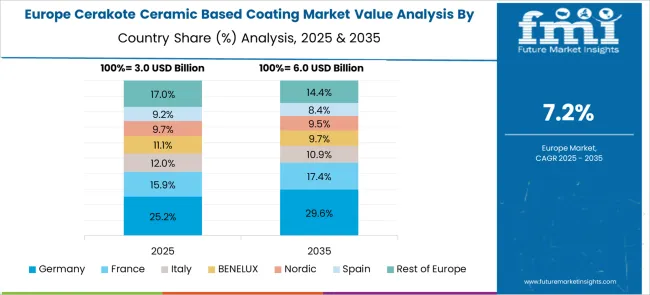

| Brazil | 5.9% |

The global cerakote ceramic-based coating market is projected to grow at a 7.8% CAGR from 2025 to 2035, supported by demand for advanced protective coatings in automotive, aerospace, and defense sectors. BRICS economies lead growth, with China at 10.5% and India at 9.8%, driven by increased automotive production and industrial applications requiring high thermal resistance. In OECD regions, Germany grows at 9.0%, emphasizing Cerakote adoption for performance components, while France records 8.2% due to rising demand from aerospace manufacturing hubs. The United Kingdom, at 7.4%, focuses on Cerakote coatings for firearms, sports equipment, and specialty automotive customization. The report includes analysis of over 40 countries, with five profiled below for reference.

India is expected to grow at a 9.8% CAGR, fueled by demand from automotive, defense, and energy sectors. Cerakote coatings are gaining adoption for their durability, wear resistance, and ability to withstand high temperatures. Automotive applications include protective coatings for exhaust headers, alloy wheels, and turbocharger housings. Defense manufacturers favor Cerakote for weapon components to enhance corrosion resistance in humid environments. Industrial equipment suppliers are leveraging these coatings for critical parts used in high-heat processing. Indian coating service providers are forming partnerships with global technology firms to introduce advanced spray systems and ensure compliance with performance standards.

Germany is projected to grow at a 9.0% CAGR, driven by stringent performance standards across automotive and aerospace sectors. Manufacturers increasingly use cerakote coatings for heat shielding, corrosion resistance, and lightweight protection in advanced vehicles. Aerospace applications include structural parts requiring extreme durability under thermal stress. Demand for decorative coatings in premium automotive customization is also rising, with cerakote finishes applied to alloy wheels, calipers, and interior trims. Local applicators are investing in automated coating booths for precision and consistency in industrial-scale projects. Partnerships with aerospace and automotive OEMs are reinforcing cerakote’s role as a high-performance coating solution.

France is forecast to grow at an 8.2% CAGR, with strong adoption in aerospace and defense manufacturing. Cerakote coatings are widely used for components exposed to extreme heat and corrosive conditions in aircraft and military equipment. Premium automotive brands operating in France are integrating these coatings for performance parts and custom finishes. Coating applicators are introducing eco-compliant processes to align with EU environmental directives. Expanding demand from luxury goods and sporting equipment segments adds new opportunities for decorative cerakote applications. Local service providers are upgrading to automated systems to meet quality standards and reduce application time.

The United Kingdom is expected to grow at a 7.4% CAGR, with increased demand from automotive customization and defense equipment manufacturing. Cerakote coatings are being used for protective finishes on firearms, performance car parts, and motorsport components. Coating applicators focus on high-precision spraying techniques to achieve durable and uniform layers for corrosion and heat resistance. Growth in the motorsport industry and niche customization services fuels demand for specialized cerakote finishes. Strategic investments are directed toward energy-efficient coating technologies to reduce operational costs. UK-based defense contractors are also adopting cerakote for lightweight military equipment exposed to harsh field environments.

China is projected to grow at a 10.5% CAGR, driven by the rapid expansion of automotive and industrial sectors. Demand for cerakote coatings is rising due to their superior corrosion resistance, thermal stability, and aesthetic flexibility for metal components. Automotive manufacturers increasingly use these coatings for exhaust systems and engine parts to withstand extreme conditions. The aerospace industry is also integrating cerakote for lightweight durability and heat resistance in structural components. Domestic coating applicators are investing in advanced spray technologies to ensure uniform coating across complex geometries. Growth in custom firearm finishes and premium consumer products further supports demand.

Cerakote, the flagship brand under NIC Industries, dominates the ceramic-based coating market with a singificant share, supported by a global network of over 2,000 certified applicators and thin-film ceramic coatings for defense, automotive, aerospace, medical, and industrial applications. NIC Industries drives innovation through PFAS-free F-Series coatings and advanced training programs distributed globally via partners like PBN Coatings. Mueller Coatings leverages Cerakote for OEM-grade finishing in high-performance sectors such as aerospace and medical devices. MSP Manufacturing and Tanury Industries specialize in custom Cerakote-based coatings tailored for aftermarket and regional markets. Competition emphasizes substrate versatility across metal, polymer, and wood, low-VOC chemistries, thermal resistance, and integrated services covering OEM partnerships, private labeling, and niche applications across multiple end-use industries.

On July 9, 2025, NIC Industries (Cerakote) unveiled LR 200, a breakthrough ultra-low reflective ceramic coating designed for aerospace, defense, and high-performance applications, significantly reducing surface reflectivity for tactical and optical uses.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.4 Billion |

| Product Type | H-series, C-series, Elite series, Glacier series, and Clear coats |

| Substrate Compatibility | Metals, Polymers & plastics, Composites, and Wood |

| Application Industry | Defense & firearms, Automotive & transportation, Aerospace & aviation, Consumer electronics, Medical devices, Industrial equipment, and Sporting & outdoor goods |

| Application Method | Spray coating, Heat curing, and Air drying |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cerakote, NIC Industries, Tanury Industries, Mueller Coatings, and MSP Manufacturing |

| Additional Attributes | Dollar sales in the Cerakote ceramic based coating market are driven by demand for durable, heat-resistant, and corrosion-protective coatings. Applications span defense, automotive, and industrial sectors. Spray coating dominates due to precision. Adoption grows in North America and Asia-Pacific, supported by environmental regulations and focus on functional, aesthetic surface solutions. |

The global cerakote ceramic based coating market is estimated to be valued at USD 12.4 billion in 2025.

The market size for the cerakote ceramic based coating market is projected to reach USD 26.3 billion by 2035.

The cerakote ceramic based coating market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in cerakote ceramic based coating market are h-series, c-series, elite series, glacier series and clear coats.

In terms of substrate compatibility, metals segment to command 42.5% share in the cerakote ceramic based coating market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ceramic Textile Market Size and Share Forecast Outlook 2025 to 2035

Ceramic and Porcelain Tableware Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Matrix Composites Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Frit Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Substrates Market Size and Share Forecast Outlook 2025 to 2035

Ceramic 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Injection Molding Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Tableware Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Paper Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Balls Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Tester Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Membranes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Ceramic Barbeque Grill Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ceramic Tiles Market Growth & Trends 2025 to 2035

Ceramic Sanitary Ware Market Trends & Forecast 2025 to 2035

Ceramic Transducers Market Growth - Trends & Forecast 2025 to 2035

Leading Providers & Market Share in Ceramic Barbeque Grill Industry

Ceramic Ink Market

Ceramic Additives Market

Ceramic Insulator Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA