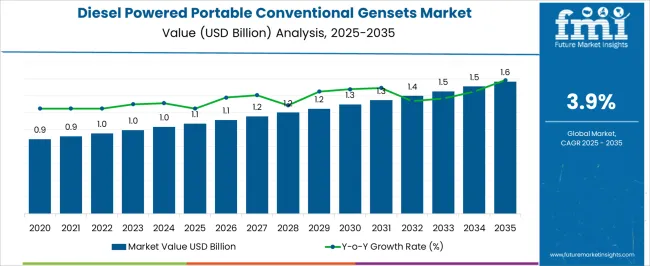

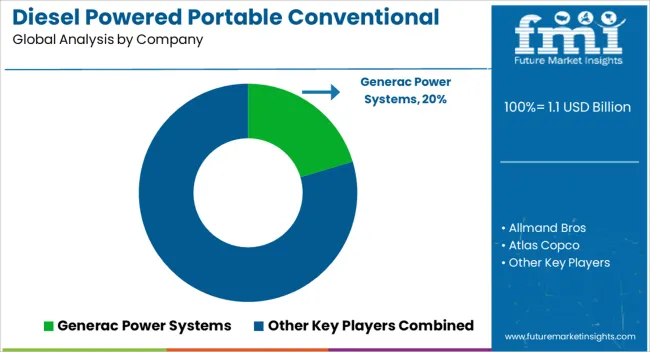

The diesel powered portable conventional gensets market is projected to grow from USD 1.1 billion in 2025 to USD 1.6 billion by 2035, representing a CAGR of 3.9%. This indicates an absolute dollar opportunity of USD 0.5 billion over the decade. Growth is supported by steady demand for reliable and portable power solutions across construction, industrial, and emergency applications. Companies can leverage this predictable expansion to optimize production and distribution strategies.

The incremental market value allows stakeholders to strategically plan investments in manufacturing capacity and logistics to ensure they capture a significant portion of the expanding market. Over the next ten years, the USD 0.5 billion opportunity highlights a moderate yet consistent growth trajectory in the diesel powered portable conventional gensets market. By 2035, rising replacement cycles of older gensets and stable demand in critical sectors will drive revenue. The CAGR of 3.9% indicates a steady expansion, allowing businesses to align pricing, sales, and regional strategies to maximize returns. Firms can focus on enhancing service networks and availability to strengthen market presence, ensuring they benefit from the absolute growth potential while maintaining operational efficiency across the projected period.

| Metric | Value |

|---|---|

| Diesel Powered Portable Conventional Gensets Market Estimated Value in (2025 E) | USD 1.1 billion |

| Diesel Powered Portable Conventional Gensets Market Forecast Value in (2035 F) | USD 1.6 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

In the early growth phase of the diesel powered portable conventional gensets market, revenue expansion is relatively gradual. Starting at USD 1.1 billion in 2025 with a CAGR of 3.9%, this stage focuses on building market presence and establishing supply and distribution channels. Growth is primarily driven by initial adoption in construction, industrial, and emergency power applications. Companies prioritize reliability, availability, and service support to gain customer trust. The absolute dollar opportunity during this phase is modest, allowing businesses to test strategies, refine operations, and respond to market feedback.

In the late growth phase, approaching 2035 and a market size of USD 1.6 billion, the diesel powered portable conventional gensets market experiences more pronounced revenue capture. Demand broadens due to replacement cycles and sustained needs across multiple sectors. Market strategies shift toward expanding production, strengthening regional distribution, and leveraging established customer relationships. The absolute dollar opportunity in this stage is significant, representing most of the USD 0.5 billion growth over the decade.

The diesel powered portable conventional gensets market is witnessing robust demand owing to growing energy reliability concerns, frequent power outages, and the rising need for decentralized backup power across industries. Rapid urban expansion, coupled with increasing commercial and industrial setups in power-deficient regions, is accelerating genset adoption.

Diesel-powered portable gensets remain the preferred choice for temporary or mobile power due to their ruggedness, long run-time, and operational flexibility. Stringent emission regulations and fuel-efficiency improvements are encouraging manufacturers to enhance technology without compromising reliability.

As construction, events, mining, and commercial facilities seek mobile solutions, the demand for conventional gensets continues to expand across varied operational scales.

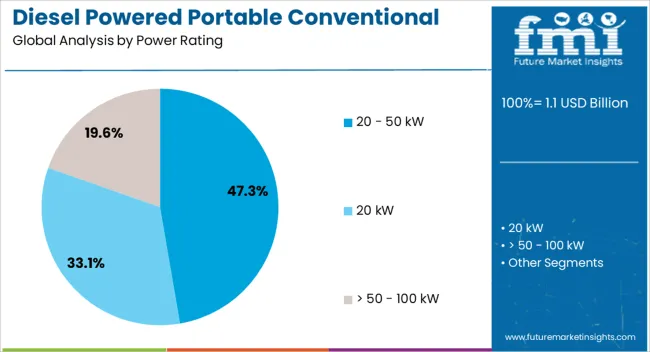

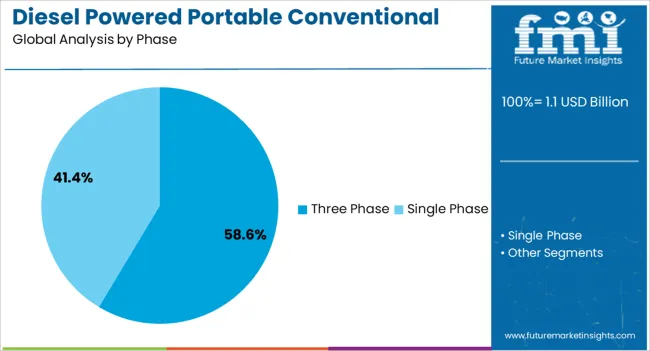

The diesel powered portable conventional gensets market is segmented by power rating, phase, end use, and geographic regions. By power rating, diesel powered portable conventional gensets market is divided into 20 - 50 kW, 20 kW, and > 50 - 100 kW. In terms of phase, diesel powered portable conventional gensets market is classified into Three Phase and Single Phase.

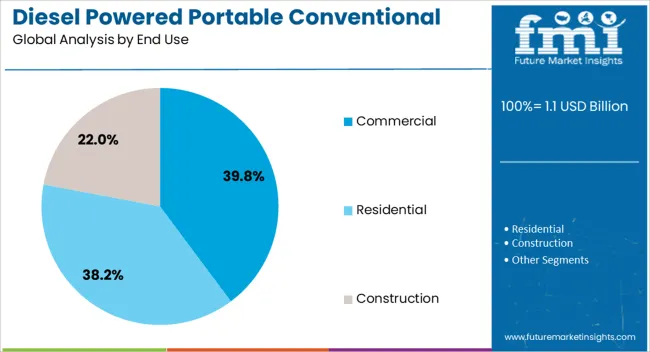

Based on end use, diesel powered portable conventional gensets market is segmented into Commercial, Residential, and Construction. Regionally, the diesel powered portable conventional gensets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 20 - 50 kW category is anticipated to dominate with a 47.3% share of the diesel powered portable conventional gensets market in 2025. This range offers the ideal balance between output and portability, making it highly suitable for medium-scale applications.

Businesses in construction, telecom, and retail use these gensets for temporary sites or remote operations where grid connectivity is unreliable. The segment also benefits from strong aftermarket demand due to frequent deployment across disaster-relief zones and emergency scenarios.

Compact design, efficient fuel consumption, and ease of transport are key attributes driving preference for this power band among commercial operators and contractors.

Three phase gensets are expected to lead the market with a 58.6% share by 2025, owing to their compatibility with high-load industrial and commercial equipment. Their ability to distribute power more efficiently over long distances with minimal losses is particularly beneficial in construction and remote operations.

The segment’s dominance stems from increasing usage across critical infrastructure, event setups, and backup power systems in medium to large enterprises.

With rising investments in public infrastructure, telecom expansion, and healthcare facilities, demand for three-phase gensets with improved power stability and fuel economy continues to rise across both developed and developing markets.

The commercial segment is projected to command 39.8% of the market share by 2025, emerging as the leading end-use application for diesel powered portable conventional gensets. Hotels, hospitals, retail stores, and educational institutions are increasingly adopting gensets for backup power to ensure uninterrupted operations.

In emerging economies, a lack of consistent grid access has amplified the reliance on portable diesel gensets in commercial setups. The rapid growth of the service sector, expanding hospitality establishments in remote areas, and infrastructure upgrades are contributing to heightened product adoption.

Customizable runtime, low initial cost, and dependable performance in demanding environments are further propelling the segment's growth.

The diesel powered portable conventional gensets market is growing as demand rises for reliable, flexible, and cost-effective power solutions in construction, industrial, commercial, and emergency applications. These gensets provide portable electricity during grid outages, remote operations, and temporary setups. Growth is fueled by industrialization, infrastructure development, and the need for backup power in regions with unstable electricity supply.

Manufacturers offering fuel-efficient, durable, and easy-to-transport gensets with low maintenance requirements are well-positioned to capture opportunities in both urban and remote markets. Increasing awareness of operational efficiency and regulatory compliance further supports adoption in safety-critical and industrial operations.

Growth is constrained by high fuel consumption, operational costs, and maintenance requirements. Diesel gensets require regular refueling, which raises total cost of ownership, especially during continuous or long-term operations. Noise levels and exhaust emissions can restrict use in urban or residential areas due to environmental regulations. Maintenance tasks, including oil changes, filter replacement, and engine servicing, further increase operational expenses. Small and medium-scale users may hesitate to adopt diesel gensets due to these costs. To overcome this challenge, manufacturers are focusing on fuel-efficient engines, quieter operation, and simplified maintenance solutions. By improving operational efficiency and reducing lifecycle costs, companies can enhance adoption across industrial, commercial, and emergency applications.

The market is being shaped by trends such as fuel-efficient engines, IoT-enabled monitoring, and modular designs. Advanced diesel engines with optimized combustion, cooling systems, and emission controls are being introduced to improve fuel efficiency and reduce environmental impact. Integration with digital monitoring platforms enables operators to track performance, schedule preventive maintenance, and optimize operations. Modular and compact designs allow easier transport, deployment, and scaling of power output according to needs. These trends highlight the move toward intelligent, sustainable, and user-friendly portable diesel gensets. Operators benefit from reduced downtime, enhanced operational visibility, and improved energy management, which is increasing adoption across industrial, commercial, and emergency-use scenarios.

Opportunities arise from rapid infrastructure development, industrial expansion, and increased need for emergency power supply. Construction sites, mining operations, industrial plants, and temporary event venues require portable, reliable electricity solutions. Regions with unstable power grids are increasingly adopting diesel gensets for backup energy. Additionally, the frequency of natural disasters and emergencies has highlighted the importance of a reliable power supply for critical operations. Emerging markets with industrial growth and urbanization offer further potential. Manufacturers providing durable, fuel-efficient, and service-ready gensets with strong after-sales support can leverage these opportunities. The market growth is supported by the need for reliable, high-performance, and cost-effective power solutions in both developed and developing regions worldwide.

Stringent environmental regulations, diesel price fluctuations, and competition from alternative solutions restrain market growth. Diesel gensets produce greenhouse gas emissions and particulate matter, and compliance with emission standards increases production costs. Volatile diesel prices impact operating expenses and can deter customers from investing in diesel-based generators.

Additionally, alternative solutions, including solar-powered systems, hybrid generators, and lithium-ion battery-based backup units, are becoming more attractive due to lower emissions and reduced maintenance. Supply chain disruptions in engine components and fuel systems can further delay production and delivery. Until manufacturers reduce emissions, improve fuel efficiency, and stabilize supply chains, market adoption may remain focused on industrial, construction, and emergency applications rather than broader commercial or residential sectors.

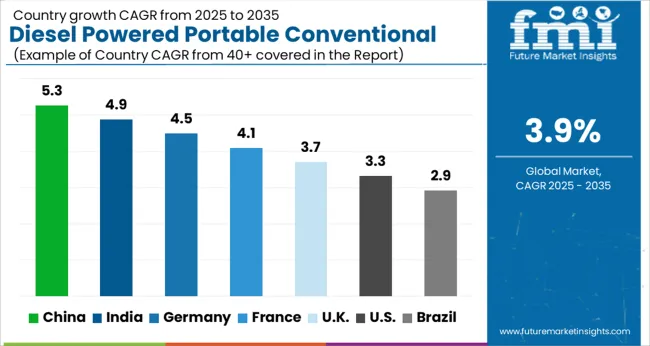

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

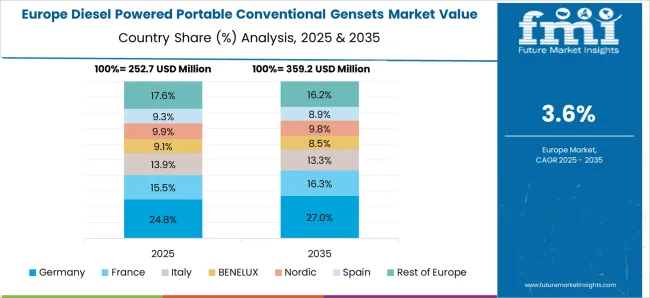

The global diesel powered portable conventional gensets market is projected to grow at a CAGR of 3.9% through 2035, supported by increasing demand across construction sites, remote industrial operations, and emergency power applications. Among BRICS nations, China has been recorded with 5.3% growth, driven by large-scale production and deployment in construction, mining, and temporary power projects, while India has been observed at 4.9%, supported by rising utilization in rural electrification, industrial backup, and small-scale construction operations. In the OECD region, Germany has been measured at 4.5%, where production and adoption in industrial maintenance, construction, and outdoor events have been steadily maintained. The United Kingdom has been noted at 3.7%, reflecting consistent use in temporary power and industrial applications, while the USA has been recorded at 3.3%, with production and utilization across commercial, construction, and emergency backup sectors being steadily increased. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market for diesel powered portable conventional gensets in China is expanding at a CAGR of 5.3%, driven by growing industrial demand, construction activities, and off-grid power requirements. Manufacturers are providing compact and efficient gensets suitable for construction sites, industrial facilities, and emergency backup power. Government initiatives promoting rural electrification, industrial modernization, and energy infrastructure are supporting adoption. Pilot deployments in construction projects and industrial sites demonstrate operational benefits including reliable power supply, fuel efficiency, and reduced downtime. Collaborations between local manufacturers, distributors, and research institutes are enhancing durability, noise reduction, and emission compliance. Expanding industrial and construction sectors continue to drive growth for diesel powered portable conventional gensets in China.

The market for diesel powered portable conventional gensets in India is growing at a CAGR of 4.9%, fueled by demand from construction, industrial, and commercial sectors. Manufacturers are supplying compact gensets for off-grid power, emergency backup, and temporary power supply needs. Government initiatives promoting rural electrification, infrastructure development, and industrial growth encourage adoption. Pilot projects in construction sites and industrial facilities highlight benefits including reliable operation, fuel efficiency, and reduced maintenance. Collaborations between manufacturers, distributors, and engineering firms are improving generator performance, emission control, and operational reliability.

The market for diesel powered portable conventional gensets in Germany is growing at a CAGR of 4.5%, supported by construction, manufacturing, and industrial operations requiring reliable backup power. Manufacturers are supplying gensets designed for low emissions, fuel efficiency, and noise reduction to meet strict environmental regulations. Government programs promoting green energy compliance and industrial efficiency support adoption. Pilot deployments in industrial facilities and construction projects demonstrate operational benefits including energy reliability, reduced downtime, and cost-effective operation. Collaborations with technology providers and research institutions are enhancing durability, operational efficiency, and environmental compliance. Germany’s focus on sustainable and efficient industrial operations continues to support genset market growth.

The market for diesel powered portable conventional gensets in the United Kingdom is expanding at a CAGR of 3.7%, driven by industrial, commercial, and construction sectors requiring temporary and emergency power. Manufacturers provide compact gensets for industrial sites, construction projects, and backup power applications. Government programs supporting energy efficiency, workplace safety, and industrial modernization foster adoption. Pilot deployments in industrial and construction facilities demonstrate operational benefits such as reliable power supply, lower maintenance, and improved operational efficiency. Collaborations between manufacturers, distributors, and research institutes enhance fuel efficiency, durability, and compliance with emission standards. Continued demand from industrial and infrastructure projects is supporting market growth in the United Kingdom.

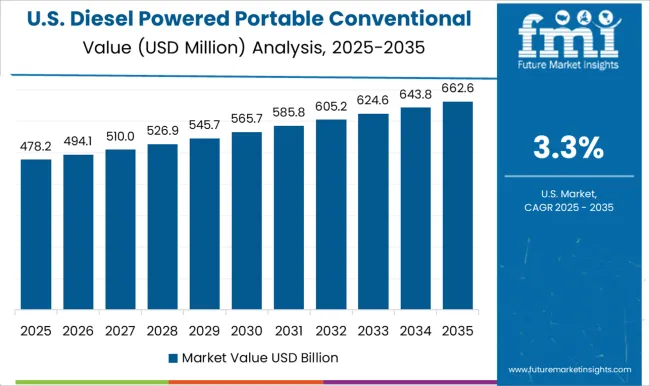

The market for diesel powered portable conventional gensets in the United States is growing at a CAGR of 3.3%, supported by construction, industrial, and emergency backup power requirements. Manufacturers supply gensets designed for reliable performance, fuel efficiency, and low maintenance for industrial facilities, commercial sites, and emergency applications. Government initiatives supporting energy efficiency, infrastructure development, and industrial safety encourage adoption. Pilot projects in construction and industrial sites show operational benefits such as continuous power supply, reduced downtime, and cost-effectiveness. Collaborations between manufacturers, distributors, and research organizations are improving genset durability, operational efficiency, and emissions compliance. The expanding construction and industrial infrastructure sectors are sustaining market growth in the United States.

Demand for portable diesel gensets is driven by construction, industrial, and emergency backup applications, with suppliers competing on power output, fuel efficiency, and portability. Generac Power Systems is positioned as a leading provider, with brochures emphasizing compact diesel engines, noise reduction features, and operational endurance. Allmand Bros and Atlas Copco provide high-performance portable gensets, with technical literature detailing fuel consumption, voltage regulation, and ambient operating conditions. Bobcat Company and Champion Power Equipment focus on ruggedized units for construction and industrial use, with brochures presenting power ratings, start-up reliability, and maintenance schedules.

Changzhou ITC Power Equipment Manufacturing, Chicago Pneumatic, and Himalayan Power Machine deliver mid-range gensets, with literature highlighting engine durability, load capacity, and noise levels. HIMOINSA and Kirloskar emphasize industrial-grade reliability, with brochures presenting thermal performance, voltage stability, and service intervals. Powerhouse Diesel Generators, Pramac, and Rishabh Engineering offer customizable portable solutions, with technical literature detailing emission ratings, control panels, and fuel tank capacities. Whisper Power and YANMAR provide small to medium portable units for marine and remote applications, with brochures highlighting compact design, vibration isolation, and corrosion resistance. Other regional players compete with cost-effective models, rapid delivery, and tailored solutions for niche sectors. Strategic approaches focus on reliability, fuel efficiency, and ease of deployment. Investments are directed toward engine performance optimization, sound insulation, and control system integration. Partnerships with distributors, contractors, and rental companies are leveraged to ensure availability and service coverage.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Power Rating | 20 - 50 kW, 20 kW, and > 50 - 100 kW |

| Phase | Three Phase and Single Phase |

| End Use | Commercial, Residential, and Construction |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Generac Power Systems, Allmand Bros, Atlas Copco, Bobcat Company, Champion Power Equipment, Changzhou ITC Power Equipment Manufacturing, Chicago Pneumatic, Himalayan Power Machine, HIMOINSA, Kirloskar, Powerhouse Diesel Generators, Pramac, Rishabh Engineering, Whisper Power, and YANMAR |

| Additional Attributes | Dollar sales by type including open, enclosed, and silent gensets, application across construction, events, residential backup, and industrial sites, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for reliable power supply, increasing construction activities, and need for portable energy solutions in remote areas. |

The global diesel powered portable conventional gensets market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the diesel powered portable conventional gensets market is projected to reach USD 1.6 billion by 2035.

The diesel powered portable conventional gensets market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in diesel powered portable conventional gensets market are 20 - 50 kw, 20 kw and > 50 - 100 kw.

In terms of phase, three phase segment to command 58.6% share in the diesel powered portable conventional gensets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diesel Power Engine Market Size and Share Forecast Outlook 2025 to 2035

Diesel Particulate Filter Market Size and Share Forecast Outlook 2025 to 2035

Diesel Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fired Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Diesel Engine Management System Market

Diesel Common Rail Injection Systems Market

Diesel Fueled Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Electric Powered Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

E-Diesel Market Size and Share Forecast Outlook 2025 to 2035

No.2 Diesel Fuel Market

Prime Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Marine Diesel Engine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Diesel Gensets Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Diesel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA