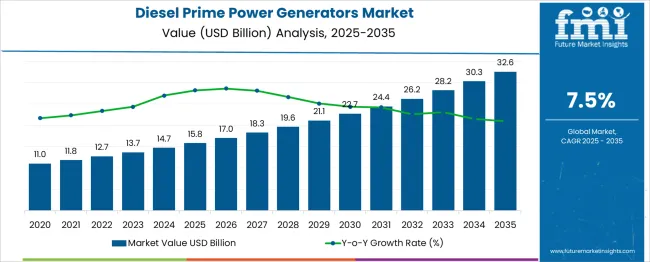

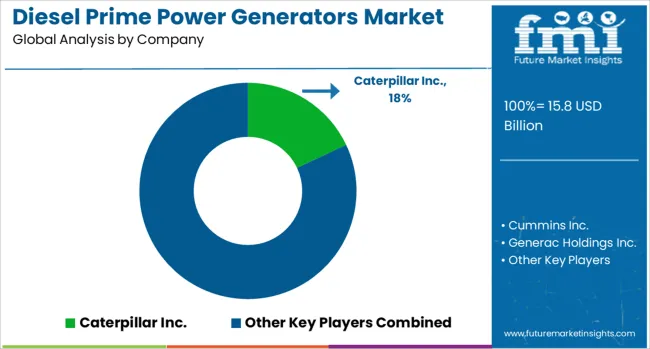

The Diesel Prime Power Generators Market is estimated to be valued at USD 15.8 billion in 2025 and is projected to reach USD 32.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. This reflects a multiplying factor of 2.06x across the forecast period, indicating that the market size is expected to more than double. A CAGR of 7.5% is expected to be driven by persistent demand from sectors requiring uninterrupted power, such as mining, construction, and oil extraction.

Off-grid regions in Africa and Southeast Asia are likely to contribute to first-time installations, while project-based deployments in Central Asia and Latin America are expected to generate recurring bulk orders, especially in the 375 -750 kVA segment. The multiplying factor will be reinforced by growth in high-capacity systems above 1,000 kVA, which are expected to see wider adoption in infrastructure zones with grid shortfalls.

In North America and Europe, aging generator fleets are projected to support value recovery through replacement demand. As emission compliance requirements evolve, advanced filtration, fuel optimization, and noise reduction features are likely to push average selling prices upward. These variables together are expected to shape the USD 16.8 billion absolute dollar opportunity through both volume and value expansion.

| Metric | Value |

|---|---|

| Diesel Prime Power Generators Market Estimated Value in (2025 E) | USD 15.8 billion |

| Diesel Prime Power Generators Market Forecast Value in (2035 F) | USD 32.6 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The diesel prime power generators market comprises approximately 78 % of the total diesel generator segment, reflecting its dominant use in continuous power applications. It holds an estimated 10-12 % share of the power generation equipment market due to consistent deployment across industrial, construction, and infrastructure sites. Within the industrial engines category, its contribution ranges from 7-9 % where long-duration operation is required.

It accounts for around 5-6 % of the distributed energy systems market in remote and decentralised settings. In off-grid energy infrastructure, it represents about 3-4 %, while contributing less than 1 % in the heavy-duty machinery market, mainly as an auxiliary component. Hybrid configurations that combine diesel generators with solar and battery systems are reducing operational fuel loads and increasing efficiency across variable runtime applications.

Integrated digital controls now offer remote diagnostics, automated load balancing, and real-time performance monitoring. Modular containerised units are increasingly deployed in short-cycle, mobile, and field-based operations. Engine design strategies now prioritise multi-fuel compatibility, firmware-based optimisation, and load-specific runtime calibration.

Hydrogen-ready platforms are also being explored to support emissions compliance and future adaptability. These developments reflect a transition toward more intelligent, resilient, and low-maintenance generator systems suited to the operational needs of energy-intensive environments.

The Diesel Prime Power Generators market is experiencing sustained growth as industries and infrastructure sectors seek reliable off-grid and backup power solutions. This growth is being influenced by increasing power outages in emerging economies, rapid urbanization, and the expansion of sectors requiring continuous power supply, such as telecommunications, healthcare, and construction.

The demand for diesel-based generators has remained strong due to their robustness, fuel efficiency, and quick response capabilities under varying load conditions. As global energy infrastructures struggle to keep pace with demand, especially in remote or underdeveloped areas, diesel prime generators are being adopted as essential assets for uninterrupted operations.

Additionally, advancements in emission control technologies and remote monitoring systems are enhancing their operational efficiency and environmental compliance. The market outlook remains positive, with continued investments in infrastructure development, emergency preparedness strategies, and telecom expansion further reinforcing the relevance of diesel generators in both developed and developing regions..

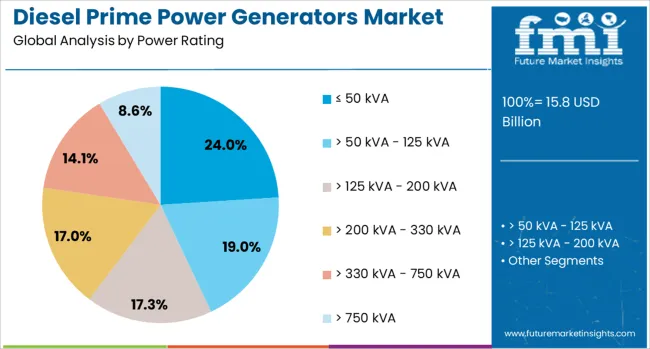

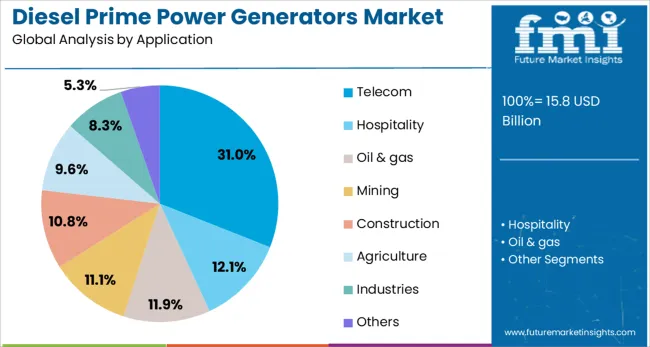

The diesel prime power generators market is segmented by power rating, application, and geographic regions. The power rating of the diesel prime power generators market is divided into ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA. The diesel prime power generators market is classified into Telecom, Hospitality, Oil & gas, Mining, Construction, Agriculture, Industries, and Others. Regionally, the diesel prime power generators industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≤ 50 kVA power rating segment is projected to account for 24% of the Diesel Prime Power Generators market revenue share in 2025. The growth of this segment has been primarily influenced by rising demand from small-scale commercial units, remote construction sites, and rural electrification programs. These generators have been preferred for their compact design, ease of transportation, and lower fuel consumption, which make them ideal for decentralized operations.

In regions with frequent grid instability, the ≤ 50 kVA category has provided reliable primary power for applications with modest energy requirements. Additionally, advancements in automation, digital controls, and noise reduction features have made these generators more suitable for telecom towers and mobile units.

Their affordability and adaptability have supported widespread deployment across developing economies, particularly in off-grid or semi-urban areas. The ability to meet essential power needs without incurring high capital or operational costs has further strengthened the segment’s position as a dependable choice for primary energy supply in light-duty scenarios..

The telecom segment is anticipated to hold 31% of the Diesel Prime Power Generators market revenue share in 2025, establishing it as the leading application segment. The expansion of mobile networks and internet connectivity infrastructure, particularly in remote and rural regions, has significantly contributed to this dominance. Telecom operators have increasingly relied on diesel prime generators to ensure consistent power supply for base transceiver stations and data hubs, where grid reliability remains a concern.

As network uptime is critical to service continuity, diesel generators have been deployed extensively to mitigate risks associated with outages and voltage fluctuations. Their ability to operate in diverse environmental conditions with minimal maintenance has made them a preferred solution for tower installations.

Moreover, the rise in mobile data consumption and the rollout of next-generation networks have necessitated dependable power support, further driving the uptake of diesel generators in the telecom sector. This sustained reliance on uninterrupted power delivery has reinforced the segment’s leading position in the market..

The diesel prime power generators market is expanding due to persistent grid unreliability, growing industrial operations in off-grid zones, and rising demand across construction, mining, and telecom infrastructure. Diesel gensets are deployed as continuous power solutions in locations with frequent outages or no grid access. The demand for high-capacity units over 750 kVA is rising, particularly in data-heavy sectors and energy-intensive environments.

Diesel prime power generators are increasingly installed as primary energy sources in areas where grid access is limited or unreliable. Mining operations, remote manufacturing facilities, and critical infrastructure in off-grid zones rely on diesel gensets for uninterrupted power. Telecom towers, utility repair depots, and medical centers across semi-urban and rural zones continue to demand medium to high-capacity units to support uninterrupted operation. Energy security concerns in regions with fragile grids are accelerating new installations. Industrial operators are opting for gensets that provide high thermal efficiency and can operate seamlessly in high-load, long-hour usage environments without performance degradation.

Rising fuel costs and compliance burdens tied to emissions standards are constraining the diesel prime power generator market. Governments are tightening rules on diesel particulate and NOx emissions, pushing manufacturers to integrate cost-intensive filtration and aftertreatment systems. Smaller businesses and low-margin operations find it increasingly difficult to justify upfront investment and maintenance. Urban restrictions on diesel usage, aimed at controlling air quality, have reduced demand in cities. Simultaneously, public and private institutions are being incentivized to shift toward hybrid or alternative fuel solutions, diverting budget allocations away from diesel-based systems and slowing replacement cycles for existing units.

The integration of diesel generators with solar PV, battery storage, and digital controls is opening untapped growth avenues. Smart gensets capable of predictive diagnostics, automatic load management, and remote monitoring are being adopted in industries seeking greater fuel efficiency and uptime. Hybrid configurations are emerging across logistics zones, construction clusters, and isolated industrial estates. Modular gensets with twin-engine systems are being positioned as scalable, relocatable power assets. Demand is increasing for biodiesel-compatible models and emissions-compliant systems, especially in transition economies. These advancements are not only improving operational economics but also helping retain diesel systems within evolving energy transition strategies.

A transition toward smart, modular diesel gensets is reshaping how businesses deploy off-grid energy assets. Integrated IoT features are enabling operators to monitor performance in real-time, schedule predictive maintenance, and reduce fuel waste through load-matching algorithms. Twin-power units and containerized gensets are replacing fixed setups, especially in fast-moving construction or event-based deployments. New genset models are being designed for hybrid microgrid compatibility, with features supporting fast ramp-up and fuel switching. This shift reflects a broader market movement toward digitalized, adaptive power platforms that fit within temporary, mobile, and high-resilience energy planning—without fully phasing out diesel-based solutions.

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

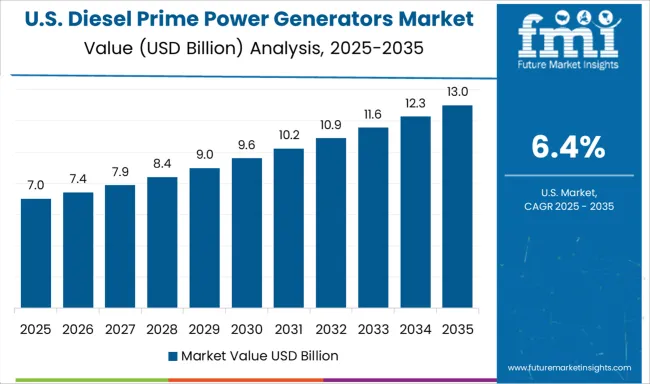

| USA | 6.4% |

| Brazil | 5.6% |

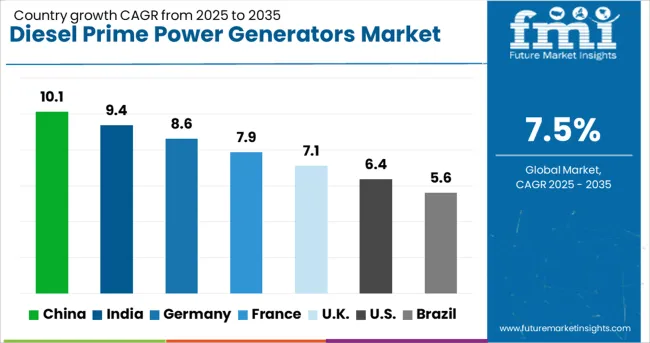

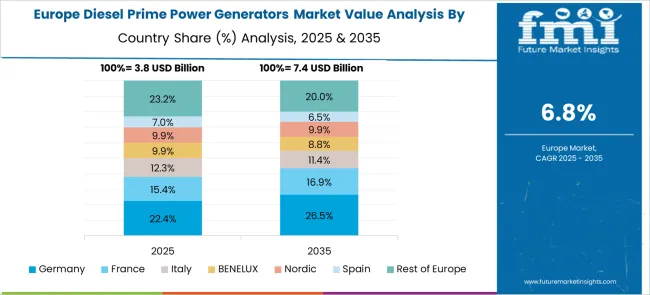

Global demand for diesel prime power generators is projected to grow at a CAGR of 7.5% from 2025 to 2035. Among the five benchmark markets profiled out of 40+ analyzed, China leads with a CAGR of 10.1%, followed by India at 9.4%, Germany at 8.6%, the United Kingdom at 7.1%, and the United States at 6.4%.

These figures reflect a +35% premium for China, while India and Germany register above-baseline growth at +25% and +15% respectively. The UK remains close to the global average, trailing by -5%, whereas the USA falls -15% below the baseline. Growth in China and India is attributed to increasing industrial dependency on off-grid solutions. In contrast, slower growth in the US and UK stems from greater grid reliability and regulatory constraints.

Growth in China is being driven by the persistent demand for prime backup power in industrial manufacturing hubs and logistical zones. Rising outages in northern and central provinces have pushed reliance on diesel-based generators as grid instability has continued despite investments in transmission infrastructure. Industrial estates in Guangdong, Hebei, and Jiangsu have recorded increasing procurement rates, where production downtime costs are exceptionally high.

Major players such as Weichai Power and Yuchai have invested in high-capacity engine series that cater to energy-intensive sectors. While renewable integration has increased, dependency on diesel generators remains prominent for uninterrupted operations in energy-volatile zones. Data centers under construction across tier-2 cities are adopting dual-backup systems, with diesel units forming the primary node for critical loads.

India is projected to maintain high market velocity due to power inconsistency across rural and semi-urban zones, leading to elevated reliance on diesel prime power systems. Construction-intensive states like Maharashtra, Tamil Nadu, and Gujarat have sustained equipment demand, particularly for portable and trailer-mounted variants.

The agriculture sector has also been identified as a significant demand node, with irrigation operations increasingly dependent on diesel generators in regions without steady grid access. Kirloskar Oil Engines and Mahindra Powerol have increased outreach through dealer networks in Tier 2 towns. Mining operations in Jharkhand and Chhattisgarh have reported steady replacement cycles, further reinforcing equipment turnover rates. These conditions have positioned India’s diesel generator market for compound growth well above the global baseline.

In Germany, expansion in the diesel generator market has been tied to grid-secure redundancy planning across manufacturing clusters and automation-intensive zones. With pressure mounting from carbon targets, diesel prime generators are still considered necessary for emergency backup in critical verticals such as pharmaceuticals, automotive, and industrial automation.

The diesel segment remains defensible due to its immediate deployment ability and high load endurance. MAN Engines and Hatz Diesel continue to dominate the OEM space by adapting product lines to emission-compliant configurations under Stage V norms. The market is further stabilized by increasing installation of gensets in food cold storage and data handling centers where temporary shutdowns cause costly inventory losses.

The United Kingdom is witnessing a measured expansion of diesel prime power generator usage, mostly in commercial real estate, hospital infrastructure, and older energy systems requiring refurbishment. Market dynamics are shaped by regulatory scrutiny concerning NOx emissions, resulting in increased demand for retrofitted units with filtration and SCR systems.

Standby diesel generators continue to dominate in data security installations and logistics depots, particularly near key ports such as Southampton and Felixstowe. Perkins and FG Wilson have retained supply leadership through leasing-based models. Although grid reliability is relatively strong, generator usage has increased in fast-deployment applications such as remote healthcare setups and temporary critical infrastructure support.

The United States market for diesel prime power generators is forecasted to expand steadily, driven by demand across oil and gas, emergency preparedness, and telecommunications infrastructure. The southern and central states, particularly Texas, Oklahoma, and Louisiana, have sustained elevated adoption levels due to frequent weather disruptions and grid strain.

Tier 4 Final compliance remains a pivotal determinant in procurement decisions, favoring vendors like Caterpillar and Cummins. New installations in large-scale logistics parks and telecom tower installations have also increased. However, market share is gradually fragmenting due to competition from gas and hybrid alternatives, especially in non-industrial use cases. Diesel continues to dominate for prime applications where refueling logistics and long-load cycles are prioritized.

Caterpillar Inc. retains a strong position in the diesel prime power generator market through a combination of dealer-backed service networks and equipment suited for continuous operation. Expansion of its XQ series has catered to high-demand environments, particularly for infrastructure development in off-grid regions.

Cummins Inc. has advanced its QSK product line while scaling regional production in Asia and the Middle East to reduce lead times. Generac Holdings Inc. has focused on supplying large-output gensets for commercial properties and data hubs, supported by distributor alliances in Eastern Europe and Latin America. Kohler Co. continues to extend its KD Series range and offers extended service agreements, especially for institutions requiring steady supply. Kirloskar Oil Engines Ltd. has introduced models in the 15–625 kVA range, with strong acceptance in semi-urban and industrial zones.

Its emphasis on engine optimization for varying load profiles has improved fuel efficiency. Atlas Copco’s QAS VSG range has enabled variable speed control for applications like quarrying and mining. Mahindra Powerol targets telecom tower installations and SME facilities with compact gensets tailored for space-restricted sites.

Mitsubishi Heavy Industries expanded the MGS Series to meet critical power needs in emerging Asian markets. Honda Power Equipment and Doosan Portable Power supply mobile units suited for temporary setups and contractor-based rentals.

Mass production of 2nm semiconductor process technology has been officially achieved, marking a verified advancement in chip fabrication. This new node delivers approximately 25% better performance and 30% lower power consumption compared to the 3nm process.

The shift introduces nanosheet transistors, replacing the older FinFET design, and enables greater transistor density within the same chip area. This breakthrough supports more efficient processing across AI workloads, edge computing, and high-performance systems. The technology is no longer in the prototype phase and is currently being implemented in operational fabs, ensuring a confirmed and practical step forward in semiconductor performance and energy efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.8 Billion |

| Power Rating | ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA |

| Application | Telecom, Hospitality, Oil & gas, Mining, Construction, Agriculture, Industries, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Kohler Co., Kirloskar Oil Engines Ltd., Atlas Copco, Mahindra Powerol, Mitsubishi Heavy Industries, Honda Power Equipment, and Doosan Portable Power |

The global diesel prime power generators market is estimated to be valued at USD 15.8 billion in 2025.

The market size for the diesel prime power generators market is projected to reach USD 32.6 billion by 2035.

The diesel prime power generators market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in diesel prime power generators market are ≤ 50 kva, > 50 kva - 125 kva, > 125 kva - 200 kva, > 200 kva - 330 kva, > 330 kva - 750 kva and > 750 kva.

In terms of application, telecom segment to command 31.0% share in the diesel prime power generators market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diesel Parking Heater Market Size and Share Forecast Outlook 2025 to 2035

Diesel Particulate Filter Market Size and Share Forecast Outlook 2025 to 2035

Diesel Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fired Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fueled Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Engine Management System Market

Diesel Common Rail Injection Systems Market

Diesel Power Engine Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Electric Powered Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

E-Diesel Market Size and Share Forecast Outlook 2025 to 2035

No.2 Diesel Fuel Market

Prime Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Marine Diesel Engine Market Size and Share Forecast Outlook 2025 to 2035

Demand for Diesel Parking Heater in USA Size and Share Forecast Outlook 2025 to 2035

Commercial Diesel Gensets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA