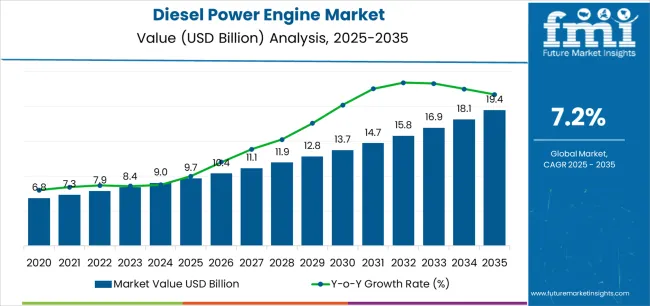

The Diesel Power Engine Market is estimated to be valued at USD 9.7 billion in 2025 and is projected to reach USD 19.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

The diesel power engine market is expanding steadily, supported by consistent demand from industrial, commercial, and utility sectors for reliable power backup and prime generation solutions. Diesel engines’ operational durability, fuel efficiency, and ability to perform under variable load conditions have maintained their relevance despite the transition toward cleaner energy systems.

Increasing investments in manufacturing, data centers, and infrastructure projects have boosted deployment across both stationary and mobile power applications. The market also benefits from strong demand in regions with unreliable grid infrastructure.

Technological advancements, including electronic fuel injection and emission control upgrades, are improving performance and compliance with environmental norms. Looking ahead, hybridization and biofuel-compatible engine designs are expected to sustain growth, balancing efficiency with sustainability objectives..

| Metric | Value |

|---|---|

| Diesel Power Engine Market Estimated Value in (2025 E) | USD 9.7 billion |

| Diesel Power Engine Market Forecast Value in (2035 F) | USD 19.4 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

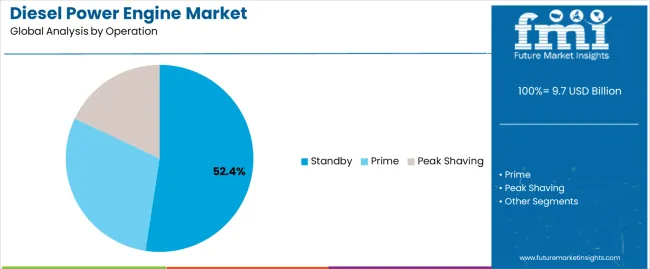

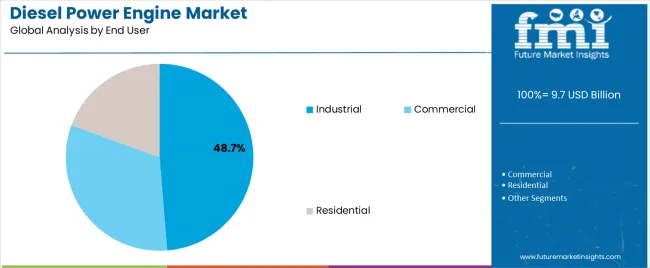

The market is segmented by Operation, Rated Power, and End User and region. By Operation, the market is divided into Standby, Prime, and Peak Shaving. In terms of Rated Power, the market is classified into Up To 0.5 MW, 0.5 To 1 MW, 1 To 2 MW, 2 To 5 MW, and Above 5 MW. Based on End User, the market is segmented into Industrial, Commercial, and Residential. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The standby segment dominates the operation category, holding approximately 52.4% share. This segment’s leadership is driven by rising reliance on emergency backup systems in commercial buildings, healthcare, and industrial operations.

Diesel-powered standby generators offer rapid response and high load-handling capability during power outages, ensuring business continuity. Increasing urbanization and grid instability in developing regions further reinforce demand.

The segment’s prominence is supported by government regulations mandating power redundancy in critical infrastructure. With continuous expansion in data centers and essential service sectors, the standby segment is expected to maintain its dominance over the forecast horizon..

The up to 0.5 MW segment holds approximately 45.6% share in the rated power category, supported by its suitability for small-scale commercial, residential, and light industrial applications. Compact size, cost-effectiveness, and ease of installation make these engines highly preferred in distributed energy systems.

The segment benefits from growing adoption in telecom towers, retail establishments, and emergency service facilities requiring consistent power at moderate loads. Its dominance is further reinforced by rising demand from developing economies, where small-scale backup solutions are vital.

With continued emphasis on energy security and distributed generation, this power range is expected to sustain a significant share through the forecast period..

The industrial segment accounts for approximately 48.7% of the diesel power engine market, driven by widespread deployment across manufacturing, mining, and construction sectors. Industries depend on diesel engines for both standby and prime power due to their robustness and low operational downtime.

The segment benefits from increased capital investment in industrial expansion, particularly in emerging markets with rapid infrastructure development. Enhanced engine performance, fuel efficiency, and compliance with emission standards have strengthened adoption in industrial facilities.

With sustained global demand for reliable on-site power, the industrial segment is projected to maintain its leading position over the forecast timeline..

The global diesel power engine market expanded at a CAGR of about 9.2% in the historical period 2020 to 2025. It will likely rise at a CAGR of 7.6% in the assessment period. The market stood at a valuation of USD 9.7 billion in 2025.

| Historical CAGR (2020 to 2025) | 9.2% |

|---|---|

| Forecast CAGR (2025 to 2035) | 7.6% |

Diesel Engine Market Growth Outlook from 2020 to 2025

Diesel Engine Market Size Analysis from 2025 to 2035

The table provides information about significant variations in growth rates and dynamic trends in the diesel power engine market. Readers can gain insights into changing consumer tastes and evolving market dynamics throughout an array of different periods.

The table offers an explanation of growth potential, scrutinizing the role that actual numbers and predictions have in determining the future path of the market.

| Details | CAGR |

|---|---|

| H1 (2025 to 2035) | 8.1% |

| H2 (2025 to 2035) | 7.0% |

| H1 (2025 to 2035) | 8.2% |

| H2 (2025 to 2035) | 6.9% |

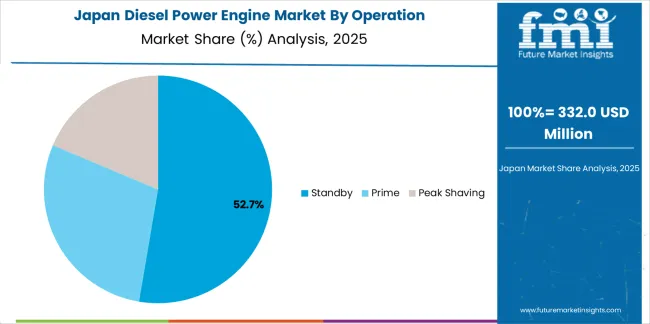

The section below highlights the CAGRs of the leading countries in the diesel power engine market. The three main countries pushing diesel power engine demand include Japan, the United Kingdom, and the United States.

According to the analysis, Japan is set to lead the diesel power engine market by showcasing a CAGR of 9.0% in the forecast period. The country is anticipated to be followed by the United Kingdom and the United States, with CAGRs of 8.5% and 7.9%, respectively.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 7.9% |

| United Kingdom | 8.5% |

| China | 6.8% |

| Japan | 9.0% |

| South Korea | 5.1% |

The table below showcases the size of the top 5 countries present in the global diesel power engine market. Out of all the countries, the United States is expected to reach a valuation of USD 19.4 billion by 2035. Followed by the United States, China and Japan are anticipated to attain valuations of USD 2.6 billion and USD 2.1 billion, respectively.

| Countries | Market Size (2035) |

|---|---|

| United States | USD 19.4 billion |

| United Kingdom | USD 781.7 million |

| China | USD 2.6 billion |

| Japan | USD 2.1 billion |

| South Korea | USD 692.8 million |

The United States diesel power engine market is projected to attain a valuation of USD 19.4 billion by 2035. It will likely rise at a CAGR of 7.9% from 2025 to 2035. Factors pushing the diesel engine industry in the country are:

It is estimated that China will generate a steady diesel power engine market share in the forecast period. The country is anticipated to expand at a CAGR of 6.8% from 2025 to 2035. Key factors augmenting the market include:

Japan’s diesel power engine market is anticipated to witness a CAGR of 9.0% through 2035. The country is likely to expand considerably due to the following factors:

The below section shows the global trends in the diesel power engine industry in terms of operation and rated power. The standby segment is expected to lead the diesel power engine market based on operation.

It is set to showcase a CAGR of around 7.4% from 2025 to 2035. Based on the rated power, the up to 0.5 MW segment is anticipated to exhibit a dominant CAGR of 7.1% through 2035.

| Segment | Value CAGR (2025 to 2035) |

|---|---|

| Standby (Operation) | 7.4% |

| Up to 0.5 MW (Rated Power) | 7.1% |

In terms of operation, the standby segment is projected to witness a CAGR of 7.4% from 2025 to 2035. The segment is likely to surge rapidly owing to the following factors:

Based on rated power, the up to 0.5 MW category is estimated to exhibit a CAGR of around 7.1% through 2035. This growth is attributed to the following factors:

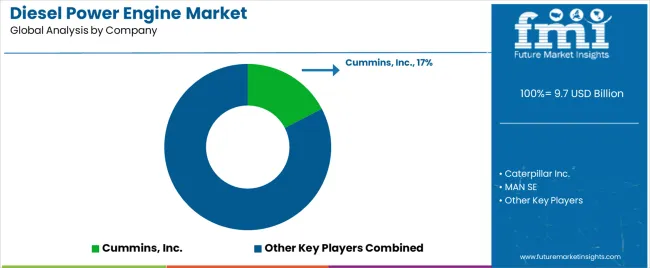

The global diesel power engine market is highly fragmented, with the presence of several key companies. They are mainly focusing on joining hands with renowned automakers to provide their in-house heavy-duty diesel engines.

Several automotive manufacturers worldwide are striving to increase sales of their diesel-powered vehicles to gain a competitive edge. They are constantly updating their old car models to include diesel engines and new features.

For instance:

The global diesel power engine market is estimated to be valued at USD 9.7 billion in 2025.

The market size for the diesel power engine market is projected to reach USD 19.4 billion by 2035.

The diesel power engine market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in diesel power engine market are standby, prime and peak shaving.

In terms of rated power, up to 0.5 mw segment to command 45.6% share in the diesel power engine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diesel Powered Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Engine Management System Market

Diesel Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Diesel Electric Powered Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Marine Diesel Engine Market Size and Share Forecast Outlook 2025 to 2035

Prime Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Reciprocating Power Generating Engine Market Size and Share Forecast Outlook 2025 to 2035

Prime Power Reciprocating Power Generating Engine Market Size and Share Forecast Outlook 2025 to 2035

Backup Reciprocating Power Generating Engine Market Size and Share Forecast Outlook 2025 to 2035

Engineering Machinery Counterweight Iron Market Size and Share Forecast Outlook 2025 to 2035

Engine-Driven Endodontic File Market Size and Share Forecast Outlook 2025 to 2035

Diesel Parking Heater Market Size and Share Forecast Outlook 2025 to 2035

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Engine Fixture Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Engine Piston Ring Set Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA