The prime diesel fueled power rental market is estimated to be valued at USD 5.1 billion in 2025 and is projected to reach USD 7.2 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period. This growth trajectory indicates a sustained demand for diesel-powered rental solutions, driven by their reliability, fuel efficiency, and adaptability across diverse sectors, including construction, industrial, and events.

Several factors contribute to this market expansion. Diesel generators are preferred for backup power and remote operations due to their robust performance and lower operational costs compared to alternative energy sources. Additionally, increasing infrastructure development, particularly in emerging economies, is fueling demand for temporary power solutions where grid connectivity is limited or inconsistent.

The industrial sector’s reliance on uninterrupted power for operations further strengthens market prospects. However, the market faces challenges related to environmental regulations and a global push toward cleaner energy alternatives. The gradual adoption of hybrid and renewable energy solutions may temper the pace of growth, but is unlikely to displace diesel entirely in the near term.

| Metric | Value |

|---|---|

| Prime Diesel Fueled Power Rental Market Estimated Value in (2025 E) | USD 5.1 billion |

| Prime Diesel Fueled Power Rental Market Forecast Value in (2035 F) | USD 7.2 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The current market scenario reflects a growing reliance on diesel-powered rental generators driven by rapid urbanization, infrastructure development, and the need for uninterrupted power during grid outages.

As economies continue to expand, power rental has emerged as a cost-effective and flexible alternative to permanent installations, especially in regions with unreliable power grids or ongoing construction activity. Additionally, the growing frequency of natural disasters and seasonal demand fluctuations has further amplified the requirement for quick-deployment backup systems.

Diesel-fueled generators remain the preferred choice due to their robustness, fuel efficiency, and ability to perform under harsh operating conditions. The market is expected to benefit from ongoing development of smart grid systems and hybrid energy solutions, which will complement diesel rentals while ensuring adaptability to changing power needs.

The prime diesel fueled power rental market is segmented by power rating, end use, and geographic regions. By power rating, the prime diesel fueled power rental market is divided into > 75 kVA - 375 kVA, ≤ 75 kVA, > 375 kVA - 750 kVA, and > 750 kVA. In terms of end use, the prime diesel fueled power rental market is classified into Construction, Telecom, Data Center, Healthcare, Oil & Gas, Electric Utilities, Offshore, Manufacturing, Mining, Marine, and Others. Regionally, the prime diesel fueled power rental industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The > 75 kVA - 375 kVA power rating segment is projected to account for 41.3% of the Prime Diesel Fueled Power Rental market revenue in 2025, positioning it as the leading segment by capacity. This dominance is being supported by the segment’s versatility in meeting medium-scale power demands across sectors such as construction, events, utilities, and industrial operations. These units offer an optimal balance between mobility and performance, making them suitable for both short-term and semi-permanent deployment.

The ability of this power range to support multiple load applications without oversizing has made it cost-effective for operators. Additionally, rental companies prefer this range due to its high utilization rate, standardization, and ease of fleet maintenance.

The segment’s growth has also been reinforced by increasing infrastructure projects in remote areas where grid access is limited. As businesses prioritize reliable and mobile power sources that can scale with project needs, the > 75 kVA - 375 kVA segment is expected to maintain its leading position.

The construction end-use segment is expected to capture 24.6% of the total market revenue in 2025, making it one of the most significant contributors to the Prime Diesel Fueled Power Rental market. This growth is being driven by the consistent global rise in infrastructure development, including road building, commercial real estate, and public works. Construction sites typically require reliable temporary power for equipment, lighting, and on-site facilities, often in areas without grid access or during early phases of development.

Diesel generators have been widely adopted in this sector due to their durability, ease of transport, and immediate readiness for deployment. The frequent need for flexible power across changing site conditions has further supported demand in this segment.

Additionally, the cyclical nature of construction activity has encouraged companies to opt for rental solutions over ownership, optimizing capital expenditure. As large-scale infrastructure investments continue in both developed and emerging markets, the construction segment is expected to remain a key driver of growth.

The prime diesel-powered rental market continues to grow due to flexible power needs, cost-efficiency, and infrastructure development. Regulatory pressures are also influencing innovations in emission controls to ensure continued market expansion.

Prime diesel-powered rental solutions is driven by the need for flexible, reliable power across industries like construction, events, and emergency services. Diesel generators offer a continuous power supply in remote areas, where grid access is limited. The growing construction industry, along with infrastructure projects in emerging markets, has fueled the need for temporary power solutions. Moreover, industries like mining and oil & gas rely on diesel rental units for their operations in off-grid locations, where access to electricity is either unavailable or unreliable. These factors ensure a steady demand for prime diesel-powered rental solutions in diverse sectors.

Prime diesel-powered rental solutions are favored for their cost-effectiveness and operational efficiency, especially in situations requiring temporary power. The ability to quickly mobilize rental units at competitive prices allows businesses to manage power needs without heavy upfront investment. Diesel-powered generators are known for their durability and fuel efficiency, which reduces operational costs. Their ability to handle high power loads also makes them suitable for large-scale industrial projects or emergency situations, ensuring a cost-effective power supply for various durations. This efficiency continues to drive adoption, especially in regions with fluctuating power demands and limited access to grid infrastructure.

Regulatory pressure related to emissions remains a critical dynamic in the prime diesel-powered rental market. Governments around the world are tightening regulations on fuel efficiency and emissions from diesel-powered generators. As a result, manufacturers of prime diesel-powered rental units are required to improve emission controls, ensuring compliance with evolving environmental standards. This has led to a push for more efficient and cleaner diesel technologies, even within the rental market. While diesel remains a key solution, rental companies are increasingly integrating advanced filtration and emission-reducing technologies to meet local regulations and address environmental concerns.

The growing demand for prime diesel-powered rental solutions is closely linked to regional infrastructure development and industrial expansion. Emerging markets, particularly in Africa, Latin America, and parts of Asia, are experiencing significant growth in industrial activities, construction, and energy infrastructure projects. This surge in development has led to an increased demand for flexible and reliable power solutions in areas with underdeveloped grid infrastructure. As new projects and industries emerge, rental companies are expanding their operations to cater to these growing regions. In turn, regional expansion strategies are helping fuel the adoption of prime diesel-powered rental solutions in untapped markets.

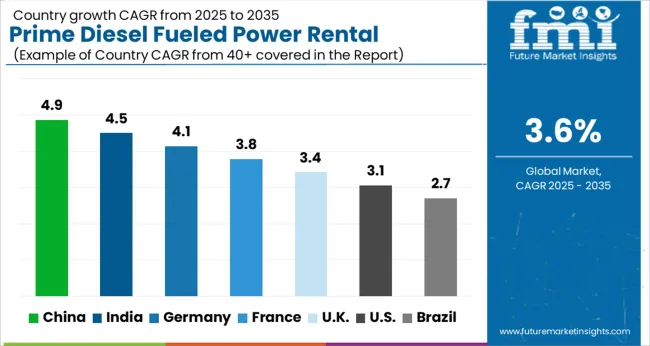

The prime diesel fueled power rental Market is projected to expand globally at a CAGR of 3.6% from 2025 to 2035, driven by increasing industrialization, infrastructure development, and the need for flexible power solutions. China leads with a CAGR of 4.9%, bolstered by rapid industrial growth, infrastructure projects, and a strong demand for temporary power solutions in remote locations. India follows at 4.5%, supported by the expansion of construction activities, mining, and telecom sectors. France posts 3.8%, shaped by the need for reliable power during large-scale events and emergency power situations. The United Kingdom registers 3.4%, with steady demand from the construction and manufacturing sectors, while the United States records 3.1%, reflecting a more mature market but steady growth in emergency power rental for commercial and industrial purposes. The report covers more than 30 countries, with these leading markets setting the pace for temporary power solutions, shaping rental power infrastructure, and influencing competitive strategies in the global prime diesel-powered rental sector.

The CAGR of the China prime diesel fueled power rental market averaged 4.6% during 2020–2024 and is expected to rise to 4.9% in 2025–2035, driven by increasing industrial growth and construction activities. The early phase saw steady demand from industries like mining, construction, and infrastructure projects that required reliable power in remote areas. Between 2025 and 2035, the market is expected to accelerate, supported by ongoing urbanization and major government-backed infrastructure projects. The shift to more efficient diesel generators and expansion into emerging regions will further drive the growth rate.

India’s prime diesel fueled power rental market posted a CAGR of around 4.3% between 2020 and 2024 and is projected to rise to 4.5% from 2025 to 2035. In the earlier phase, growth was driven by the increasing need for power in the construction, telecom, and mining sectors. With expanding infrastructure and rural electrification projects, the demand for reliable temporary power solutions continued to rise. The accelerating growth from 2025 is attributed to the expanding industrial sectors, the government's push for infrastructural development, and the adoption of more fuel-efficient diesel generators.

France’s prime diesel fueled power rental market experienced a CAGR of 3.2% from 2020 to 2024 and is forecast to grow at 3.8% between 2025 and 2035. The earlier phase was marked by steady usage in construction and large-scale events requiring reliable power solutions. France’s energy transition policies and renewable energy adoption led to slower growth. However, as demand for backup and emergency power continues to rise in sectors like construction and event management, the market will see an accelerated growth rate from 2025. The need for flexible power solutions, coupled with increasing regulatory compliance, will push growth in the next decade.

The UK prime diesel fueled power rental market recorded a CAGR of 3.2% from 2020 to 2024 and is projected to rise to 3.4% from 2025 to 2035. Growth during the earlier phase was steady, driven by demand from the construction industry and temporary power needs for events. As the market matures, the demand for backup and emergency power solutions has remained relatively stable. However, with the government’s continued infrastructure focus and the ongoing need for temporary power during large-scale projects and events, growth from 2025 onwards will be supported. Fuel-efficient rental power solutions will become even more crucial in this evolving market.

The USA prime diesel fueled power rental market posted a CAGR of around 2.9% during 2020–2024 and is projected to grow at 3.1% from 2025 to 2035. The market saw slow growth due to the availability of established grid infrastructure, with power rental solutions mainly utilized for emergencies, backup power, and temporary events. As the market matures, demand from the construction sector, energy, and telecom industries remains steady. Moving forward, the adoption of fuel-efficient diesel rental solutions and the increasing need for backup power during natural disasters will drive growth, contributing to a modest but steady expansion in the coming decade.

The competitive landscape of the prime diesel fueled power rental market is defined by a mix of global players and regional suppliers, each focusing on innovation, fleet management, and expanding geographical reach. Aggreko leads the market, with over $1.5 billion invested into expanding its fleet and enhancing service capabilities across key industrial sectors, including construction, mining, and oil & gas.

Ashtead Group strengthens its position through strategic acquisitions and a growing portfolio of rental solutions in North America and Europe, focusing on providing flexible, on-demand power for short-term projects. Atlas Copco is capitalizing on its strong engineering expertise, targeting sustainable power rental solutions with emphasis on fuel-efficient diesel generators for critical industries. Bredenoord maintains a niche presence with high-quality, modular, and adaptable diesel rental units, primarily catering to the European market. Byrne Equipment Rental focuses on expanding its diesel-powered fleet across the Middle East, offering cost-effective and high-performance solutions tailored for the construction and event industries. Caterpillar, a global powerhouse in heavy equipment, leverages its extensive dealer network and innovative technology to offer highly reliable and fuel-efficient diesel rental generators, further expanding into emerging markets.

Cummins provides a wide range of prime diesel-powered rental units, emphasizing performance, fuel efficiency, and low-emission solutions to meet growing demand for temporary power. Generac Power Systems and Herc Rentals continue to gain market share by expanding their rental services and introducing competitive pricing for residential, commercial, and industrial rental needs. HIMOINSA, Modern Hiring Service, and Perennial Technologies focus on growing their market share in niche regional sectors by delivering cost-effective diesel generators. Power Express Gensets and Shenton Group offer high-value power rental solutions in South Asia, with tailored solutions for industries like construction and mining.

Sudhir Power and United Rentals continue to expand their global footprint, with United Rentals further pushing into Europe and Asia, strengthening its international power rental operations. Key strategies include fleet expansion, strategic acquisitions, investment in eco-friendly solutions, and leveraging regional production capabilities to meet growing demand across different sectors. These companies focus on increasing fleet size and enhancing operational efficiency, enabling them to remain competitive in an evolving, highly fragmented market.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.1 Billion |

| Power Rating | > 75 kVA - 375 kVA, ≤ 75 kVA, > 375 kVA - 750 kVA, and > 750 kVA |

| End Use | Construction, Telecom, Data Center, Healthcare, Oil & Gas, Electric Utilities, Offshore, Manufacturing, Mining, Marine, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aggreko, Ashtead Group, Atlas Copco, Bredenoord, Byrne Equipment Rental, Caterpillar, Cummins, Generac Power Systems, Herc Rentals, HIMOINSA, Modern Hiring Service, Perennial Technologies, Power Express Gensets, Shenton Group, Sudhir Power, and United Rentals |

| Additional Attributes | Dollar sales trends across regions, market share by segment, and growth forecasts for temporary power solutions. |

The global prime diesel fueled power rental market is estimated to be valued at USD 5.1 billion in 2025.

The market size for the prime diesel fueled power rental market is projected to reach USD 7.2 billion by 2035.

The prime diesel fueled power rental market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in prime diesel fueled power rental market are > 75 kva - 375 kva, ≤ 75 kva, > 375 kva - 750 kva and > 750 kva.

In terms of end use, construction segment to command 24.6% share in the prime diesel fueled power rental market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Prime Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Prime Power Reciprocating Power Generating Engine Market Size and Share Forecast Outlook 2025 to 2035

Canvas Primer Market Analysis - Growth, Demand & Trends 2025 to 2035

Diesel Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

China Packaging Primers Market Size and Share Forecast Outlook 2025 to 2035

Diesel Particulate Filter Market Size and Share Forecast Outlook 2025 to 2035

Diesel Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fired Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Engine Management System Market

Diesel Common Rail Injection Systems Market

Diesel Power Engine Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Electric Powered Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fueled Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

E-Diesel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA