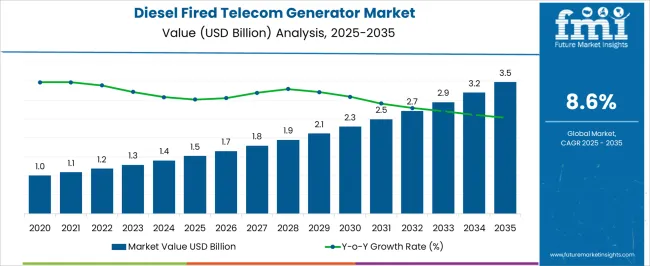

The Diesel Fired Telecom Generator Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 3.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period. In the initial phase from 2024 to 2029, the market rises from USD 1.0 billion to USD 1.8 billion, driven by the increasing need for reliable off-grid and backup power solutions to support expanding telecom infrastructure, particularly in remote and rural regions. Growth during this period is supported by rising network densification, the rollout of 5G services, and increased investment in rural connectivity projects.

Annual progress is reflected in figures such as USD 1.1 billion in 2025, USD 1.2 billion in 2026, USD 1.3 billion in 2027, USD 1.4 billion in 2028, and USD 1.5 billion in 2029. From 2030 to 2034, the market expands from USD 1.9 billion to USD 2.9 billion, driven by technological upgrades in generator efficiency, fuel-efficient designs, and hybrid diesel-solar configurations to reduce operational costs. The final phase sees further growth from USD 3.2 billion to USD 3.5 billion, underpinned by continuous network expansion in developing economies, modernization of existing telecom sites, and greater emphasis on reliability in mission-critical communication networks. The diesel fired telecom generator sector is positioned for consistent growth, fueled by the global push for uninterrupted telecom service delivery.

| Metric | Value |

|---|---|

| Diesel Fired Telecom Generator Market Estimated Value in (2025 E) | USD 1.5 billion |

| Diesel Fired Telecom Generator Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

The diesel fired telecom generator market is expanding steadily due to the increasing need for reliable and uninterrupted power supply in telecom networks. With telecom infrastructure growing rapidly, especially in remote and off-grid areas, the demand for robust backup power solutions has surged.

Diesel generators have been favored for their reliability, ease of maintenance, and ability to deliver consistent power output. The rising investments in telecom infrastructure, driven by expanding mobile networks and data centers, have further stimulated market growth.

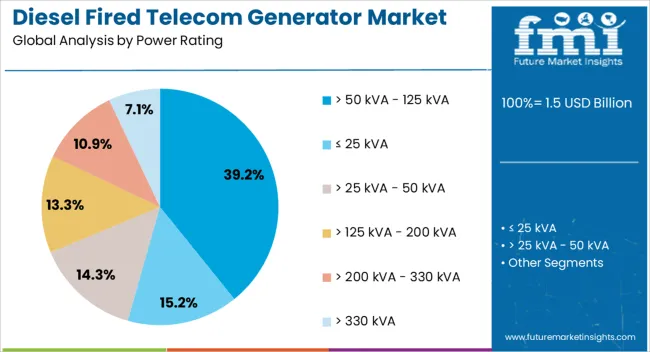

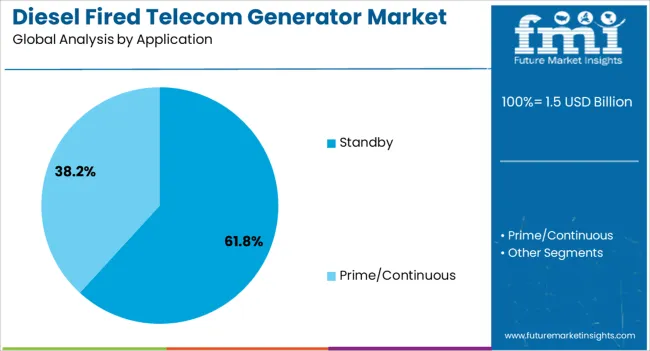

Additionally, the emphasis on network uptime and quality of service has made standby generators a critical component of telecom power backup systems. Future market growth is expected to be propelled by increasing deployments in emerging markets and upgrades to existing telecom facilities. Segment growth is expected to be led by the >50 kVA - 125 kVA power rating category and standby application due to their balanced power capacity and critical backup function.

The diesel fired telecom generator market is segmented by power rating, application, and geographic regions. By power rating, the diesel fired telecom generator market is divided into > 50 kVA - 125 kVA, ≤ 25 kVA, > 25 kVA - 50 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, and > 330 kVA. In terms of application, the diesel-fired telecom generator market is classified into Standby and Prime/Continuous. Regionally, the diesel fired telecom generator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The > 50 kVA - 125 kVA power rating segment is projected to hold 39.2% of the diesel fired telecom generator market revenue in 2025, making it the largest segment by power capacity. This segment has gained prominence as it offers an ideal balance of power output and efficiency suitable for medium-sized telecom sites.

Operators prefer generators in this range because they provide sufficient power for critical loads without excessive fuel consumption or space requirements. This capacity range fits well with the growing number of telecom base stations and data centers that require reliable backup power during outages.

The segment benefits from the ability to scale with network expansions and varying power demands, making it a flexible and widely adopted solution. With telecom operators prioritizing cost-effective and efficient power backup, this segment is expected to remain dominant.

The Standby application segment is projected to contribute 61.8% of the diesel fired telecom generator market revenue in 2025, maintaining its leadership position. The essential role standby generators drive growth in this segment play in providing backup power during grid failures or power interruptions.

Telecom networks depend heavily on uninterrupted power to maintain connectivity and avoid service disruptions, especially in critical communications infrastructure. Standby generators are preferred for their rapid start-up capabilities and ability to maintain continuous operation for extended periods.

The increasing frequency of power outages and the critical nature of telecom services have heightened the importance of standby power solutions. Investments in network reliability and service quality have further boosted the demand for standby diesel generators. This segment is expected to maintain its lead as telecom infrastructure continues to expand globally.

The diesel fired telecom generator market is shaped by demand for reliable off-grid power, advancements in efficiency, and integration with hybrid systems. Regional expansion and regulatory compliance are key factors driving competitive strategies.

Rising mobile subscriber bases and rural network expansion are fueling demand for diesel fired telecom generators. Telecom operators in remote and underserved areas require dependable power sources to maintain uninterrupted connectivity. Diesel units remain a preferred choice due to their ability to operate for long durations in harsh environments where grid access is unreliable or absent. The deployment of 4G and ongoing 5G rollouts in developing markets is increasing the need for resilient power backup. Large-scale rural connectivity programs in Asia-Pacific and Africa are further driving sales. This trend is reinforced by the need to keep base transceiver stations operational during outages, ensuring consistent service delivery.

Ongoing improvements in diesel generator design are enhancing efficiency and reducing operational costs for telecom operators. Fuel-efficient engines, advanced cooling systems, and optimized load management technologies allow operators to reduce consumption and extend maintenance intervals. Remote monitoring capabilities enable predictive maintenance and minimize downtime, improving network reliability. Noise-reduction enclosures make these units suitable for deployment in both urban-fringe and rural settings. Enhanced corrosion resistance and weatherproofing extend operational life, even in challenging climates. These advancements are enabling operators to lower total cost of ownership while maintaining consistent performance across diverse geographies and operational conditions.

Integration of diesel fired telecom generators with renewable sources and battery storage is becoming more prevalent. Hybrid configurations allow telecom operators to reduce fuel usage while maintaining the reliability of diesel backup. Solar-diesel hybrid systems are increasingly deployed in remote areas with high sunlight availability, cutting operational expenses over the long term. Battery storage enables generators to run at optimal load, reducing wear and fuel consumption. Telecom companies are adopting these systems to meet emission compliance requirements and improve cost efficiency. As hybrid solutions mature, they are expected to capture a larger share of the market, especially in regions with strong renewable energy potential.

Emerging markets in Asia-Pacific, Africa, and Latin America are seeing rapid deployment of diesel fired telecom generators as network operators expand coverage. Government-backed telecom infrastructure programs and universal service obligations are driving installations in remote areas. At the same time, stricter emission regulations are prompting manufacturers to develop engines that meet Tier standards while maintaining performance. Local assembly and service centers are being established to cater to regional demand quickly and cost-effectively. These initiatives are improving product availability, reducing delivery times, and enhancing aftersales support, strengthening the position of diesel fired generators in the telecom power supply market.

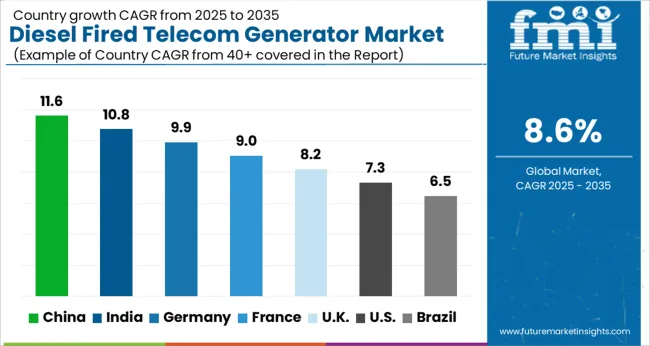

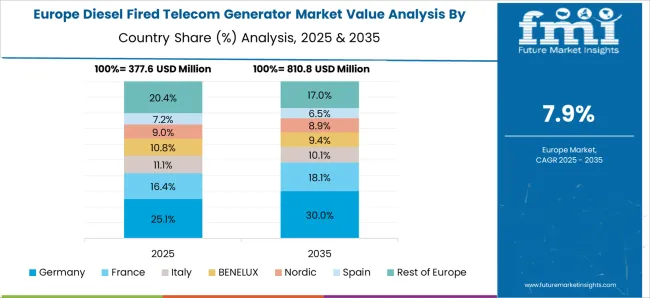

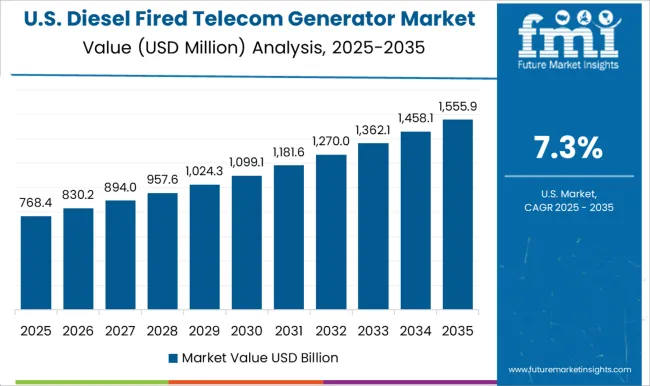

The diesel fired telecom generator market is projected to grow globally at a CAGR of 8.6% between 2025 and 2035, supported by network densification, rural coverage programs, and the need for assured uptime at base stations. China leads with a CAGR of 11.6%, driven by towerco-led rollouts, long-distance backhaul coverage, and hybrid diesel battery deployments in remote zones. India follows at 10.8%, supported by new tower additions, fiberization of sites, and rental power usage for hard-to-serve regions. France posts 9.0%, benefitting from replacement of aging fleets, stricter uptime requirements, and low-noise enclosure adoption. The United Kingdom grows at 8.2%, aided by resilience upgrades, HVO-ready gensets, and rental fleet expansion, while the United States records 7.3%, shaped by hurricane and wildfire risk, public safety networks, and extended runtime needs. The analysis covers over 40 countries, with these five serving as benchmarks for supplier capacity planning, fuel logistics strategy, hybrid project sizing, and service footprint priorities in the global diesel fired telecom power segment.

China is projected to record a CAGR of 11.6% during 2025–2035, well above the global average of 8.6%. Between 2020–2024, the CAGR stood at about 7.9%, supported by steady rural telecom expansion and selective tower upgrades in remote provinces. The increase in growth rate is linked to aggressive 5G densification, hybrid diesel-battery deployments in off-grid sites, and large-scale tower company investment in resilient backup systems. Government-backed programs to connect underserved regions are further amplifying demand. Manufacturers are strengthening local assembly and service capabilities to meet fast-paced deployment schedules while also supplying low-emission, high-efficiency models.

India is forecast to post a CAGR of 10.8% between 2025–2035, up from approximately 7.5% in 2020–2024, signaling a strong upward trend. The earlier growth phase was fueled by rural tower deployments, fiberization projects, and reliance on rental power in unreliable grid regions. The sharper future growth is being driven by telecom operator consolidation, rapid small-cell rollout for 5G, and adoption of fuel-optimized gensets with remote monitoring. Government infrastructure initiatives, combined with universal service obligations, are pushing deeper network penetration into tier-three and rural areas. This momentum is expected to keep demand elevated for reliable, long-duration diesel generator sets.

France is expected to achieve a CAGR of 9.0% for 2025–2035, compared with about 6.4% during 2020–2024, reflecting an acceleration in replacement and upgrade cycles. Early growth was tied to maintaining network uptime in rural areas and select urban fringe sites. The step-up is driven by replacement of older fleets with lower-emission, low-noise models, combined with regulatory pressure for high-reliability backup in public safety networks. Telecom operators are investing in hybrid-ready gensets to reduce fuel use without compromising reliability. Demand is also supported by growing site counts for data-heavy 5G networks.

The United Kingdom is projected to post a CAGR of 8.2% for 2025–2035, compared to roughly 5.8% between 2020–2024, indicating a stronger pace ahead. The earlier period’s growth was influenced by selective deployment in remote rural areas and network hardening in coastal zones. The rise is due to resilience investments in telecom infrastructure, increased adoption of HVO-compatible gensets, and greater demand from rental fleets supporting temporary tower setups during maintenance or emergencies. Regulatory requirements for backup power in critical communications are also shaping the market.

The United States is expected to grow at a CAGR of 7.3% for 2025–2035, up from about 5.2% in 2020–2024, marking a gradual but steady acceleration. Earlier growth came from hurricane-prone regions, wildfire-affected states, and replacement of end-of-life units. The upcoming period’s rise will be supported by investment in public safety networks, hardening of telecom infrastructure in extreme weather zones, and hybrid diesel-solar site deployments. Operators are also focusing on gensets with extended run times and advanced fuel management systems to handle prolonged outages.

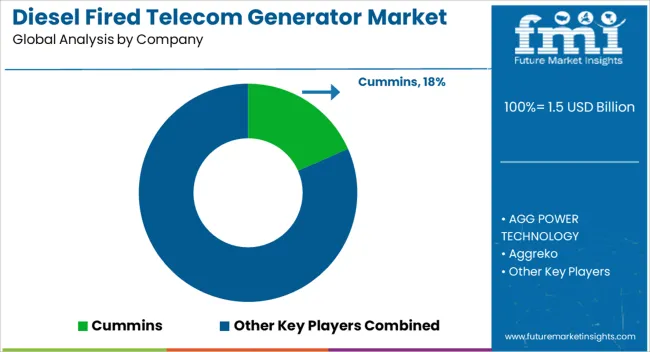

The diesel fired telecom generator market features leading global and regional manufacturers such as Cummins, AGG Power Technology, Aggreko, Atlas Copco, Caterpillar, Deere & Company, FG Wilson, Generac Power Systems, HIMOINSA, Kirloskar Electric, Kohler, Mahindra POWEROL, Perkins Engines Company, Supernova Genset, Tractors and Farm Equipment, and Wärtsilä. Cummins commands a strong position with a diversified range of high-efficiency gensets, supported by advanced fuel management and remote monitoring solutions. AGG Power Technology focuses on cost-effective, durable models for emerging markets. Aggreko leads in rental-based deployments, offering flexible, short-term power solutions for telecom operators. Atlas Copco integrates gensets into mobile and stationary packages optimized for telecom infrastructure. Caterpillar emphasizes premium-grade, low-emission units designed for extreme operating conditions. Deere & Company applies its engine expertise to deliver reliable mid-capacity gensets. FG Wilson provides rugged, long-life generators with extensive dealer support networks. Generac Power Systems targets the market with configurable solutions and strong distribution reach. HIMOINSA delivers weatherized, turnkey telecom power systems. Kirloskar Electric and Mahindra POWEROL cater to value-driven segments with localized manufacturing and quick service turnaround. Kohler offers low-noise, fuel-efficient generators for urban and rural deployments. Perkins Engines Company specializes in supplying robust engines to OEM genset builders. Supernova Genset focuses on customizable configurations for regional needs, while Tractors and Farm Equipment targets multi-application versatility. Wärtsilä provides large-scale, high-reliability power solutions for complex telecom infrastructure. Competitive strategies emphasize hybrid compatibility, compliance with emission norms, enhanced service coverage, and expansion into fast-growing telecom infrastructure markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Power Rating | > 50 kVA - 125 kVA, ≤ 25 kVA, > 25 kVA - 50 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, and > 330 kVA |

| Application | Standby and Prime/Continuous |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cummins, AGG POWER TECHNOLOGY, Aggreko, Atlas Copco, Caterpillar, Deere & Company, FG Wilson, Generac Power Systems, HIMOINSA, Kirloskar Electric, Kohler, MAHINDRA POWEROL, Perkins Engines Company, SUPERNOVA GENSET, Tractors and Farm Equipment, and Wärtsilä |

| Additional Attributes | Dollar sales, share, regional demand trends, competitive landscape, fuel cost impact, regulatory compliance, hybrid adoption rates, service network coverage, and long-term replacement demand. |

The global diesel fired telecom generator market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the diesel fired telecom generator market is projected to reach USD 3.5 billion by 2035.

The diesel fired telecom generator market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in diesel fired telecom generator market are > 50 kva - 125 kva, ≤ 25 kva, > 25 kva - 50 kva, > 125 kva - 200 kva, > 200 kva - 330 kva and > 330 kva.

In terms of application, standby segment to command 61.8% share in the diesel fired telecom generator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diesel-Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Prime Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Standby Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Telecom Site Management Software Market Size and Share Forecast Outlook 2025 to 2035

Generator Bushing Market Size and Share Forecast Outlook 2025 to 2035

Diesel Parking Heater Market Size and Share Forecast Outlook 2025 to 2035

Diesel Power Engine Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Size and Share Forecast Outlook 2025 to 2035

Telecom Mounting Hardware Market Size and Share Forecast Outlook 2025 to 2035

Diesel Particulate Filter Market Size and Share Forecast Outlook 2025 to 2035

Telecom Billing And Revenue Management Market Size and Share Forecast Outlook 2025 to 2035

Telecom Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Telecom Analytics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA