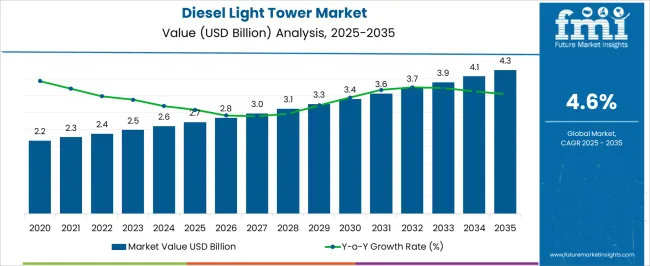

The diesel light tower market is projected to grow at a CAGR of 4.6% from 2025 to 2035, with estimated market sizes of 2.7 USD billion in 2025 and 4.3 USD billion in 2035. Market growth is characterized by moderate fluctuations due to seasonal construction cycles, infrastructure investment trends, and variations in energy and fuel costs. Demand peaks often align with large-scale construction, mining, and outdoor event projects where reliable, mobile lighting is critical.

Off-peak periods, fuel price volatility, and stricter emission regulations may temporarily slow adoption. Manufacturers are responding by introducing hybrid and fuel-efficient towers, portable LED integration, and enhanced automation for energy optimization. Regional deployment differences also contribute to growth variability, as North America and Europe favor technologically advanced, low-emission models, while Asia-Pacific and Latin America rely on cost-effective diesel units for large-scale industrial and infrastructure projects. Fleet modernization, rental market expansion, and government-backed infrastructure initiatives influence short-term demand shifts. End-user preferences for ease of transport, fast setup, and durability further modulate sales trends. The market exhibits steady long-term expansion with short-term volatility driven by regulatory, economic, and sector-specific factors, highlighting both risk and opportunity for stakeholders in manufacturing, distribution, and rental services.

| Metric | Value |

|---|---|

| Diesel Light Tower Market Estimated Value in (2025 E) | USD 2.7 billion |

| Diesel Light Tower Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The construction and infrastructure market holds the largest share at 40%, as ongoing urban development, roadwork, and large-scale projects require reliable temporary lighting solutions for safety and operational continuity. The mining and quarrying sector contributes 25%, where underground and open-pit mining operations rely on diesel light towers to illuminate expansive work areas, ensuring productivity during night shifts and in low-light conditions.

The oil and gas market accounts for 15%, driven by exploration, drilling, and maintenance activities in remote locations where portable, robust lighting solutions are essential. The events, entertainment, and emergency services market holds a 12% share, with outdoor concerts, sports events, disaster response, and military operations adopting mobile lighting towers for rapid deployment and coverage. Finally, the equipment rental and fleet management segment represents 8%, supporting temporary lighting needs, maintenance services, and flexible deployment options for industrial and commercial clients. Construction, mining, and oil & gas sectors account for 80% of overall demand, highlighting that large-scale industrial operations, safety compliance, and operational efficiency remain the primary growth drivers. Events and rental services contribute to incremental market expansion globally.

The Diesel Light Tower market is experiencing strong growth supported by the rising demand for reliable, portable lighting solutions across construction, mining, oil and gas, and emergency response operations. The current market landscape reflects a steady shift towards fuel-efficient and low-maintenance designs that ensure extended operational hours and reduced downtime.

Increasing infrastructure development activities, particularly in emerging economies, are boosting the requirement for continuous illumination in remote or off-grid areas. Technological enhancements in engine performance, noise reduction, and integration of advanced control systems are further adding value for end-users.

The future outlook is shaped by the growing preference for environmentally compliant diesel engines and hybrid-ready designs, enabling reduced emissions while maintaining performance As industries continue to focus on operational efficiency, safety compliance, and mobility, the market is poised to expand through innovations that blend durability with energy efficiency, ensuring sustained adoption across diverse applications.

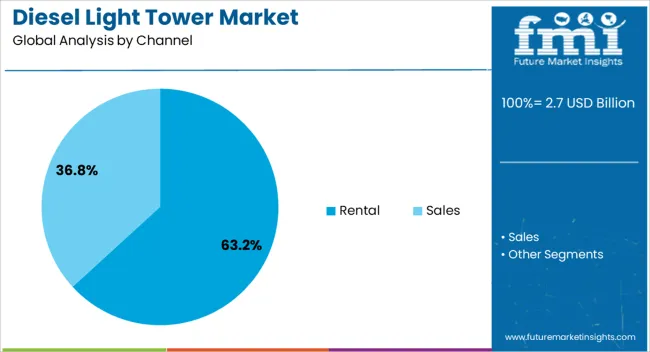

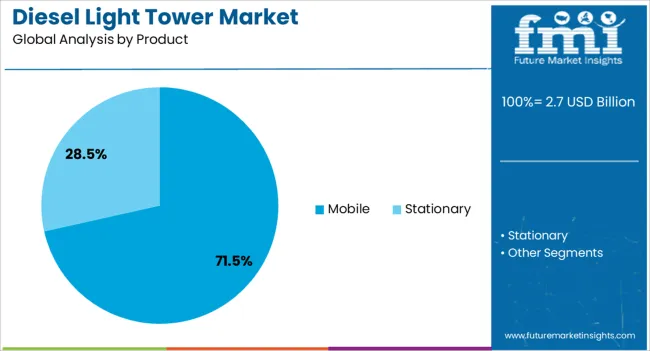

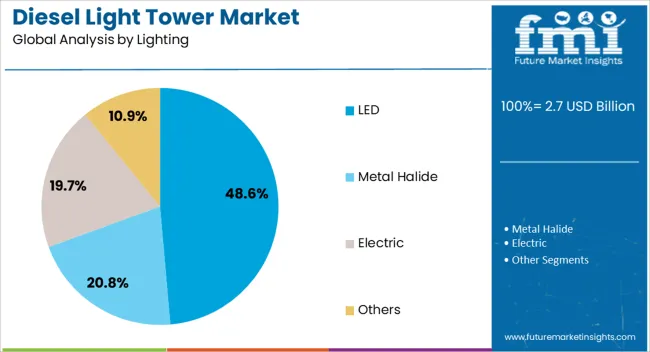

The diesel light tower market is segmented by channel, product, lighting, technology, application, and geographic regions. By channel, diesel light tower market is divided into Rental and Sales. In terms of product, diesel light tower market is classified into Mobile and Stationary. Based on lighting, diesel light tower market is segmented into LED, Metal Halide, Electric, and Others.

By technology, diesel light tower market is segmented into Hydraulic lifting system and Manual lifting system. By application, diesel light tower market is segmented into Construction, Infrastructure development, Oil & Gas, Mining, Military & defense, Emergency & disaster relief, and Others. Regionally, the diesel light tower industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Rental channel is projected to account for 63.2% of the Diesel Light Tower market revenue in 2025, making it the leading distribution channel. This dominance is being driven by the high cost efficiency and flexibility offered to end-users who require temporary lighting solutions for short-term projects or seasonal operations.

Renting allows businesses to avoid large capital expenditures while gaining access to the latest models equipped with advanced features. The segment’s growth has been supported by the increasing number of infrastructure and construction projects where project timelines are limited, and mobility is essential.

Maintenance, servicing, and equipment replacement responsibilities are handled by rental providers, reducing operational burdens for users. Additionally, the availability of customized rental packages and rapid delivery services is reinforcing the adoption of rental solutions, ensuring that this segment continues to lead the market.

The Mobile product category is expected to hold 71.5% of the Diesel Light Tower market revenue in 2025, representing the dominant product type. This leadership position is being attributed to the ease of transportation, rapid deployment, and adaptability of mobile units in varied terrains and operational conditions. Mobile light towers can be quickly relocated to different project sites, making them ideal for industries where operational requirements change frequently.

Their compact design, combined with powerful lighting capabilities, ensures efficient performance without compromising mobility. The increasing focus on operational efficiency in construction, mining, and event management sectors is further driving preference for mobile units.

Advances in trailer-mounted configurations and improved towing capabilities have enhanced their practicality, while robust build quality ensures durability in demanding environments These factors are collectively strengthening the mobile segment’s position in the market.

The LED lighting category is forecast to capture 48.6% of the market revenue in 2025, making it the leading lighting technology. This growth is being supported by the superior energy efficiency, longer operational life, and reduced maintenance requirements of LED lighting compared to conventional alternatives.

The high lumen output of LED lights, combined with lower power consumption, enables extended runtime for diesel-powered towers, reducing fuel usage and operating costs. Enhanced durability and resistance to harsh environmental conditions make LED-equipped towers well-suited for remote and outdoor applications.

Additionally, the increasing focus on sustainable operations and compliance with energy efficiency standards is encouraging the shift towards LED-based solutions. The ability to deliver consistent illumination with minimal heat generation further enhances their appeal, ensuring that LED lighting maintains its stronghold in the market.

Diesel light tower demand is primarily driven by construction, mining, and industrial operations, supported by rental and emergency applications. Operational efficiency, durability, and portability remain critical growth factors globally.

The diesel light tower market is witnessing growth driven by large-scale construction activities, including roadwork, bridges, and commercial buildings. Contractors prioritize reliable, high-intensity lighting to ensure safety during night shifts and adverse weather conditions. Portable light towers reduce downtime, facilitate extended work hours, and maintain productivity across multiple project sites.

Small- and medium-sized construction firms increasingly adopt rental and leasing models to minimize capital expenditure while ensuring access to high-performance equipment. The demand for rugged, easily transportable, and low-maintenance units is accelerating, especially in regions experiencing high infrastructure development. High illumination coverage, fuel efficiency, and operational reliability remain key factors influencing procurement decisions and fleet expansion.

Mining, quarrying, and other heavy industrial operations are significant contributors to diesel light tower adoption. Large open-pit mines and underground facilities require extensive illumination for safety, equipment operation, and compliance with occupational regulations. Portable lighting units enhance productivity during nighttime operations and in remote locations where grid power is unavailable. Industrial firms value durability, corrosion resistance, and continuous performance under harsh conditions, including dust, vibration, and extreme temperatures. Rental services and fleet management solutions are increasingly leveraged to maintain flexible deployment across multiple sites. Integration of LED lamps and advanced reflector designs improves light distribution, reduces fuel consumption, and ensures uniform visibility, enhancing operational efficiency and worker safety across mining and industrial sectors.

The events, sports, entertainment, and emergency services sectors contribute meaningfully to diesel light tower demand. Temporary outdoor venues, concerts, sports arenas, and disaster response operations require rapid deployment of portable lighting solutions. Diesel towers provide high-intensity illumination with minimal setup time, ensuring event safety, security, and operational efficiency. Emergency response teams, including fire, military, and humanitarian units, rely on mobile units in remote or disaster-affected areas to provide reliable lighting. Service providers are expanding rental options for short-term projects, reducing upfront investment for clients. Product features like adjustable height, rotating lamps, and automated tilt control enhance adaptability, meeting the diverse needs of temporary outdoor illumination across public events and emergency scenarios.

The diesel light tower rental and fleet management segment is gaining traction as organizations seek cost-effective access to high-quality lighting solutions. Contractors, industrial operators, and event managers prefer leasing or rental models to reduce upfront costs, avoid maintenance responsibilities, and scale operations as needed. Fleet management solutions provide real-time tracking, maintenance scheduling, and fuel optimization, increasing operational efficiency.

Regional service providers are expanding rental networks to support short-term projects and emergency deployments. The combination of durable construction, high lumen output, and long fuel life drives rental adoption. Businesses are increasingly investing in multi-unit fleets with standardized features to ensure flexibility, consistent lighting performance, and rapid deployment for diverse industrial, commercial, and recreational applications.

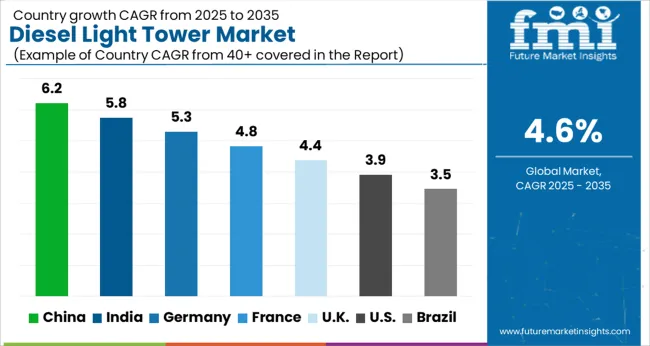

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

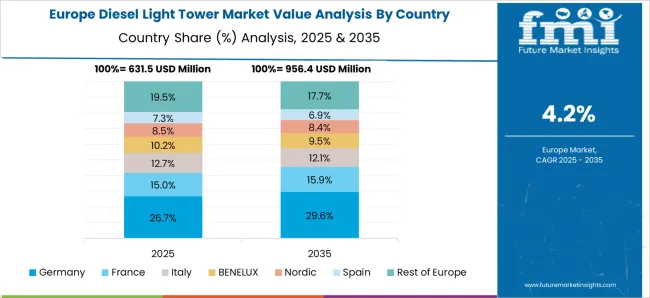

The global diesel light tower market is projected to grow at a CAGR of 4.6% from 2025 to 2035. China leads at 6.2%, followed by India at 5.8%, Germany at 5.3%, the UK at 4.4%, and the USA at 3.9%. Growth is driven by increasing construction, mining, and industrial activities requiring portable, high-intensity lighting solutions. Asia, particularly China and India, shows accelerated adoption due to large-scale infrastructure projects, expanding industrial operations, and rising investment in temporary lighting for events and emergency services. Europe and North America focus on advanced, durable, and fuel-efficient towers with enhanced operational performance, reliability, and low maintenance requirements. Rental and fleet management models further support market penetration and flexible deployment. The analysis spans over 40+ countries, with the leading markets highlighted below.

The diesel light tower market in China is projected to grow at a CAGR of 6.2% from 2025 to 2035, fueled by large-scale construction, mining, and infrastructure projects requiring high-intensity, portable lighting solutions. Urban and industrial development, alongside government-supported infrastructure initiatives, drives demand for reliable and fuel-efficient light towers capable of operating in remote and temporary sites. Domestic manufacturers are investing in advanced lighting technology, long-lasting LED lamps, and improved fuel economy, while rental and fleet service providers expand market penetration. Partnerships with international technology providers enhance product quality, compliance with safety standards, and operational efficiency. Event management, emergency response, and mining sectors further contribute to adoption, creating opportunities for both rental and direct sales channels.

The diesel light tower market in India is expected to expand at a CAGR of 5.8% from 2025 to 2035, driven by growing industrialization, renewable energy construction sites, and large-scale infrastructure developments. Portable lighting solutions are increasingly deployed in remote mining operations, road construction projects, and outdoor event setups. Domestic manufacturers focus on energy-efficient engines, long-life lighting systems, and ease of mobility to meet operational requirements. Rental services are expanding rapidly, offering cost-effective solutions to small and mid-sized contractors. Collaborations with global players support design optimization, emission compliance, and reliability under harsh environmental conditions. Government and private projects emphasizing nighttime work schedules further enhance light tower adoption.

Germany’s diesel light tower market is projected to grow at a CAGR of 5.3% from 2025 to 2035, driven by stringent safety and environmental regulations, alongside high-quality construction and industrial projects. The market emphasizes emission-compliant, low-noise, and energy-efficient light towers for construction, events, and emergency applications. Manufacturers focus on advanced LED lighting, automated control systems, and durable chassis to enhance performance and operational reliability. Rental and leasing models gain traction to reduce upfront capital expenditure for contractors and event managers. Integration of telematics and remote monitoring is increasingly adopted to optimize fuel consumption, maintenance, and operational efficiency. Partnerships with engineering and construction firms facilitate adoption across industrial and municipal projects.

The diesel light tower market in the UK is expected to grow at a CAGR of 4.4% from 2025 to 2035, supported by construction, mining, and infrastructure projects requiring temporary and portable lighting. Contractors are increasingly adopting LED-based towers with extended operating hours, low fuel consumption, and weather-resistant designs. Rental services are driving affordability, while municipal and public works projects boost demand for reliable lighting in urban and rural settings. Manufacturers focus on robust chassis, ease of transportation, and compliance with UK emission standards. Partnerships with contractors and event organizers improve market reach, while technical support services enhance operational reliability and maintenance efficiency.

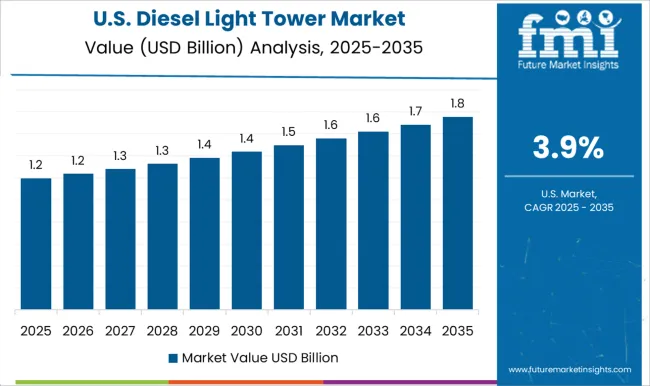

The diesel light tower market in the USA is projected to expand at a CAGR of 3.9% from 2025 to 2035, driven by construction, oil & gas, mining, and disaster management sectors. Portable, high-intensity lighting is critical for nighttime operations and emergency response. Emphasis is placed on low-maintenance, fuel-efficient, and durable LED systems capable of enduring harsh outdoor conditions. Rental and leasing solutions support small contractors and seasonal projects, while large construction and mining companies invest in fleet ownership. Technological features, such as remote monitoring and automatic light control, enhance operational efficiency and cost-effectiveness. Safety regulations and environmental standards further influence product design and adoption across industries.

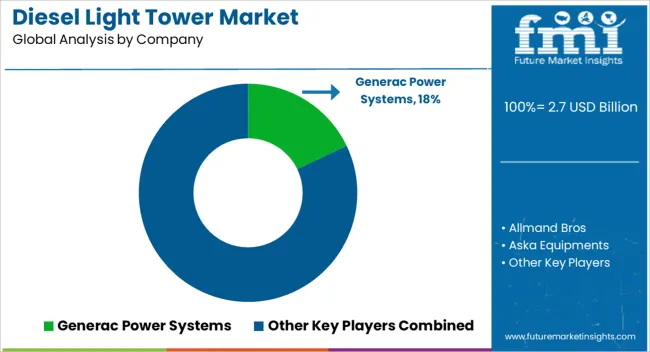

Competition in the diesel light tower market is defined by durability, portability, and fuel efficiency under diverse operating conditions. Generac Power Systems leads with robust, high-performance towers suitable for construction, mining, and emergency operations, emphasizing long operational hours, low fuel consumption, and ease of maintenance. Allmand Bros and Atlas Copco compete through modular, transportable units with advanced LED lighting systems, optimized mast height, and safety features tailored for industrial and outdoor events. Caterpillar and Chicago Pneumatic differentiate by offering heavy-duty, ruggedized towers designed for continuous operation in harsh environments, with a focus on energy-efficient engines and compliance with emission standards. Doosan Portable Power, Inmesol Gensets, and Multiquip target versatility, providing solutions for rental fleets, temporary site lighting, and rapid deployment in remote areas.

Regional and mid-tier players such as J C Bamford Excavators, Larson Electronics, Trime, United Rentals, Wacker Neuson, and Aska Equipment provide niche solutions emphasizing compact design, ease of transportation, and low operating costs. Strategies focus on fleet rental services, quick setup, modular lighting systems, and customer support. Partnerships with contractors, municipal authorities, and industrial project operators help expand market reach. Product brochures highlight mast height, light intensity, fuel capacity, runtime, and engine type. Optional accessories, maintenance schedules, and warranty programs are detailed. Rental and fleet solutions are emphasized for small- and medium-sized operators, while large-scale construction and mining projects prioritize performance, durability, and operational efficiency. The market is centered on reliable, high-intensity lighting, versatile deployment, and energy-efficient solutions for industrial, municipal, and emergency applications globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| Channel | Rental and Sales |

| Product | Mobile and Stationary |

| Lighting | LED, Metal Halide, Electric, and Others |

| Technology | Hydraulic lifting system and Manual lifting system |

| Application | Construction, Infrastructure development, Oil & Gas, Mining, Military & defense, Emergency & disaster relief, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Generac Power Systems, Allmand Bros, Aska Equipments, Atlas Copco, Caterpillar, Chicago Pneumatic, Colorado Standby, Doosan Portable Power, Inmesol Gensets, J C Bamford Excavators, Larson Electronics, Multiquip, Trime, United Rentals, and Wacker Neuson |

| Additional Attributes | Dollar sales, share, key end-use sectors like construction, mining, and events, competitive landscape, emerging rental and fleet demand, emission regulations, technology preferences, product durability, mast height, lighting type, fuel efficiency, maintenance requirements, and aftermarket opportunities, highlighting high-demand geographies and customer buying behavior. |

The global diesel light tower market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the diesel light tower market is projected to reach USD 4.3 billion by 2035.

The diesel light tower market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in diesel light tower market are rental and sales.

In terms of product, mobile segment to command 71.5% share in the diesel light tower market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diesel Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Power Engine Market Size and Share Forecast Outlook 2025 to 2035

Diesel Particulate Filter Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Electric Powered Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fired Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fueled Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Diesel Engine Management System Market

Diesel Common Rail Injection Systems Market

E-Diesel Market Size and Share Forecast Outlook 2025 to 2035

No.2 Diesel Fuel Market

Prime Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Marine Diesel Engine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Diesel Gensets Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Diesel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA