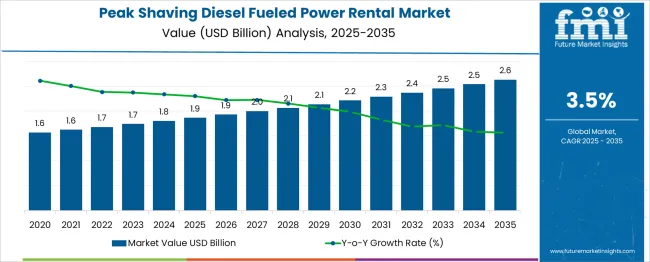

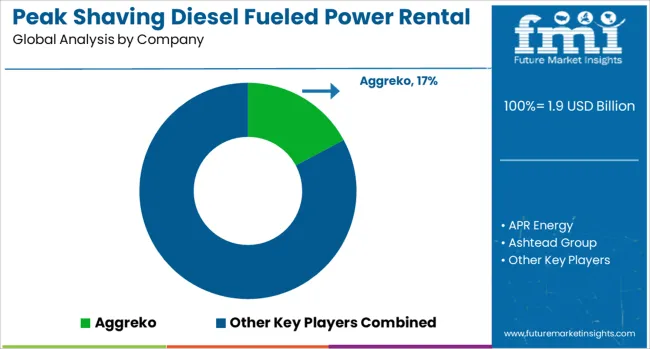

The Peak Shaving Diesel Fueled Power Rental Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

| Metric | Value |

|---|---|

| Peak Shaving Diesel Fueled Power Rental Market Estimated Value in (2025 E) | USD 1.9 billion |

| Peak Shaving Diesel Fueled Power Rental Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The peak shaving diesel fueled power rental market is expanding steadily as industries seek flexible and reliable power solutions to manage peak electricity demand. The growing complexity of power grids and increasing energy consumption have driven businesses to adopt rental power systems that help avoid costly infrastructure upgrades and reduce operational downtime.

Industries such as oil and gas have specific power needs that require dependable and scalable solutions to support continuous operations in remote or off-grid locations. Advances in diesel engine technology and rental service models have improved fuel efficiency and operational flexibility, making diesel power rentals an attractive choice.

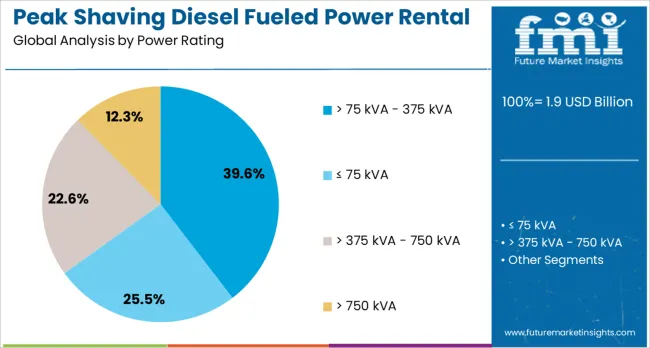

The market is expected to grow further due to increasing energy demand, aging grid infrastructure, and the need for backup power during peak load periods. Segmental growth is anticipated to be driven by power ratings between 75 kVA and 375 kVA, which offer an optimal balance between capacity and mobility, and the oil and gas sector as a primary end-use industry.

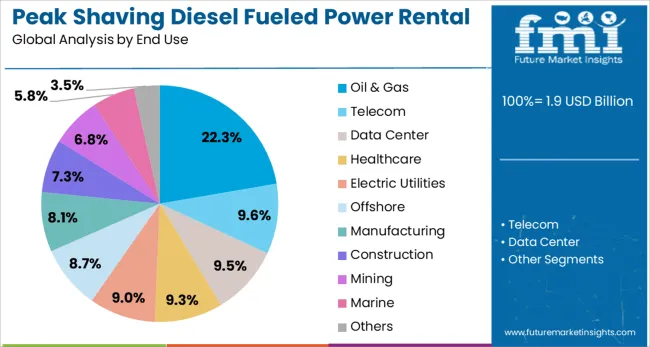

The peak shaving diesel fueled power rental market is segmented by power rating and end use and geographic regions. By power rating of the peak shaving diesel fueled power rental market is divided into > 75 kVA - 375 kVA, ≤ 75 kVA, > 375 kVA - 750 kVA, and > 750 kVA. In terms of end use of the peak shaving diesel fueled power rental market is classified into Oil & Gas, Telecom, Data Center, Healthcare, Electric Utilities, Offshore, Manufacturing, Construction, Mining, Marine, and Others. Regionally, the peak shaving diesel fueled power rental industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The power rating segment between 75 kVA and 375 kVA is expected to hold 39.6% of the peak shaving diesel fueled power rental market revenue in 2025. This segment’s prominence is due to its suitability for a wide range of industrial and commercial applications that require medium-scale power capacity. The flexibility of these power units allows operators to efficiently manage peak demand without committing to permanent infrastructure investments.

Rental providers have focused on optimizing these units for fuel efficiency and ease of deployment. This power range is also favored in temporary setups and emergency backup scenarios where rapid mobilization is critical.

Given its adaptability and cost-effectiveness, this segment is projected to maintain strong demand as industries continue to manage energy costs and reliability concerns.

The oil and gas sector is projected to account for 22.3% of the market revenue in 2025, positioning it as a key end-use segment. The industry's power requirements are driven by the need for uninterrupted operations in exploration, production, and processing activities often located in remote areas with limited grid access.

Peak shaving power rental solutions provide a reliable alternative to meet fluctuating power demands while minimizing downtime and supporting regulatory compliance. The sector's emphasis on operational continuity and safety has led to increased adoption of diesel-fueled rental units that can deliver consistent power in challenging environments.

As oil and gas projects expand globally and production activities intensify, the reliance on flexible power rental solutions is expected to grow, reinforcing this segment’s significance in the market.

Peak shaving diesel power rentals are increasingly used to manage grid instability, seasonal demand spikes, and emergency outages, ensuring cost-effective continuity for industries. Growing adoption in construction, oil and gas, and event sectors is supported by modular fleets and flexible rental solutions.

The demand for peak-shaving diesel-fueled power rental solutions has been growing due to fluctuating grid reliability and surges in seasonal energy consumption. Businesses have increasingly relied on rental generators to avoid production downtime during peak load conditions. Short-term deployments have become a preferred option for industries facing grid constraints, enabling cost control without investing in permanent infrastructure. Backup diesel systems have been integrated into operations to manage unpredictable weather events and regional blackouts. Rental providers have been offering flexible contracts, advanced load-sharing modules, and remote monitoring capabilities, supporting operational continuity and energy cost optimization in sectors such as mining, construction, and heavy manufacturing.

The expansion of industrial projects and large-scale events has driven consistent use of diesel power rental services. Construction firms have deployed these units to maintain equipment operations in off-grid or partially electrified regions, reducing project delays. Event organizers have adopted portable diesel generators to power lighting, sound systems, and essential amenities without relying on fixed connections. Oil and gas operations have embraced peak shaving strategies to ensure uninterrupted processes during drilling and refining activities. Service providers have responded with modular generator fleets and rapid deployment services, ensuring a reliable energy supply across diverse use cases. Demand has further intensified, where stringent timelines and mobility requirements dominate operational strategies.

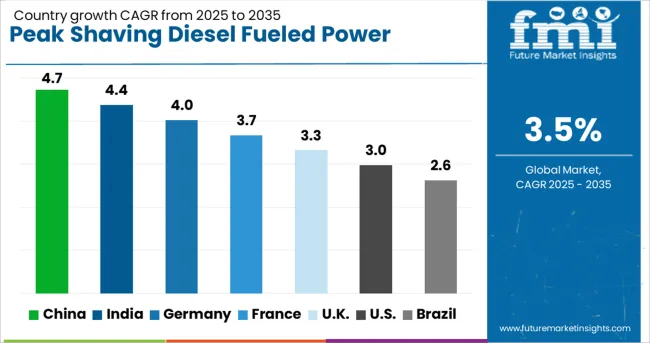

| Country | CAGR |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| France | 3.7% |

| UK | 3.3% |

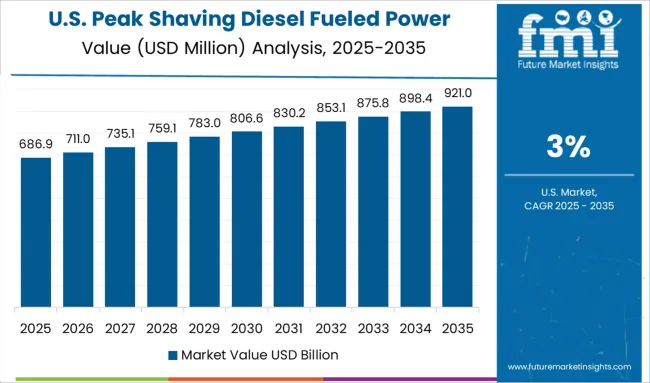

| USA | 3.0% |

| Brazil | 2.6% |

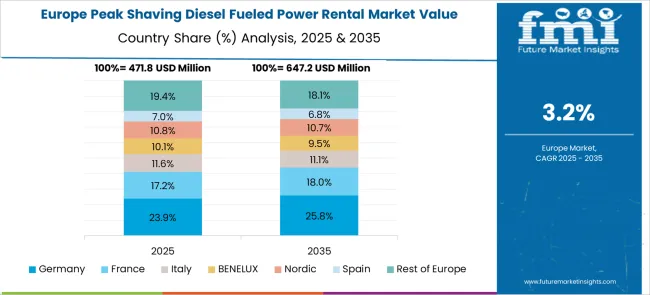

The peak shaving diesel fueled power rental market, anticipated to expand at a global CAGR of 3.5% from 2025 to 2035, is exhibiting modest yet steady growth across major economies. China leads with a CAGR of 4.7%, supported by expanding industrial infrastructure, high seasonal demand in manufacturing hubs, and government-driven power reliability programs. India follows at 4.4%, driven by grid instability in regional zones, adoption in construction projects, and demand for backup solutions during peak electricity consumption. Germany records 4.0%, with strong expansion in temporary power solutions for critical manufacturing sectors and compliance with EU emission norms for diesel generators. The UK posts 3.3%, influenced by rental demand from event management and utility maintenance segments, though stringent emission regulations limit growth. The USA shows a 3.0% CAGR, shaped by temporary energy demand during extreme weather events and industrial shutdowns, yet moderated by rising renewable integration. BRICS economies are fueling growth through affordability and flexible rental models, while OECD countries prioritize regulatory compliance, low-emission engines, and hybrid diesel solutions to align with energy transition goals. The report provides analysis of 40+ countries, with the top five highlighted as a reference

The CAGR in the United States was approximately 2.2% during 2020–2024 and is projected to reach 3.0% between 2025 and 2035, marking an upward shift aligned with energy resilience priorities. The increase is driven by industries mitigating risks associated with grid disruptions during seasonal demand surges and severe weather events. Data center operators and critical healthcare facilities have relied heavily on peak shaving rentals to avoid service interruptions. Construction and oilfield operators also utilized modular diesel generator fleets to maintain operational continuity in remote and off-grid projects. Growth was further strengthened by regulatory flexibility in fuel compliance standards and rapid deployment capabilities offered by leading rental providers. Broader adoption across emergency response and disaster recovery projects reinforced the segment’s performance outlook.

The CAGR in Germany advanced from 3.2% in 2020–2024 to 4.0% for 2025–2035, expanding energy security measures and strict reliability requirements for industrial clusters. Manufacturing facilities in automotive and machinery sectors adopted temporary power units to ensure uninterrupted production during grid fluctuations. Growth was supported by construction activities in infrastructure renewal and renewable energy installations, where backup power was essential for continuity. Stringent compliance norms around emissions influenced a preference for fuel-efficient, low-emission diesel units in rental fleets. Market momentum was amplified by municipal projects requiring power redundancy during the modernization of public utilities. The availability of advanced control systems in rental offerings further boosted demand for high-performance solutions across industrial applications.

The CAGR in China rose from 3.8% in 2020–2024 to 4.7% for 2025–2035, surpassing the global benchmark due to widespread deployment in manufacturing zones and energy-intensive projects. Industrial parks in Jiangsu, Zhejiang, and Guangdong increasingly relied on rental generators during load shedding and seasonal demand peaks. Infrastructure megaprojects such as rail expansion and smart city developments also require temporary power solutions to maintain work timelines. Rising e-commerce logistics and cold chain warehousing reinforced reliance on backup systems to avoid operational bottlenecks. The shift toward mobile and modular generator fleets facilitated rapid deployment in multi-site projects, while advanced load management tools improved energy efficiency. This strengthened the strategic position of rental companies in the Chinese market.

India’s CAGR improved from 3.5% during 2020–2024 to 4.4% across 2025–2035, signaling strong market acceleration driven by infrastructure development and grid reliability issues. High reliance on decentralized power for rural electrification projects and large-scale construction activity bolstered demand for rental solutions. Mining operations, especially in eastern states, adopted diesel fleets to maintain energy supply in remote terrains. Rapid industrialization of Tier 2 cities increased the adoption of temporary power solutions for factories and warehouses. Rental providers introduced competitive pricing models and fuel-efficient gensets to cater to cost-sensitive sectors. Evolving preference for integrated remote monitoring features also encouraged adoption among corporate clients seeking better energy management. These developments positioned India as a high-growth rental market in the Asia-Pacific region.

The CAGR for the United Kingdom moved from about 2.6% during 2020–2024 to 3.3% for 2025–2035, aligning closely with the global trajectory of 3.5%. The rise is attributed to stronger reliance on backup energy systems by industrial facilities amid grid stress and periodic outages. Public event organizers and temporary construction projects increasingly demanded portable generators for power assurance. Expansion of onshore energy projects and regional manufacturing clusters also elevated the need for scalable rental solutions. The UK market benefited from contractual flexibility introduced by major rental firms, enabling short-term deals with advanced remote monitoring features. Strategic deployment in large-scale festivals and critical infrastructure projects reinforced the market’s performance outlook through 2035.

In the peak shaving diesel power rental market, dominant players are strengthening their fleets with fuel-efficient gensets, remote monitoring capabilities, and modular deployment solutions. Companies such as Aggreko, APR Energy, and Ashtead Group are focusing on high-capacity diesel units and rapid mobilization strategies to serve energy-intensive sectors, including construction, oil and gas, and manufacturing. Atlas Copco and Caterpillar are emphasizing advanced control systems and hybrid-ready diesel solutions to meet evolving client expectations for reliability and operational continuity. Key players like Cummins, Generac Power Systems, and HIMOINSA are driving rental accessibility through distributed service networks, offering 24/7 support and maintenance packages. Regional firms such as Byrne Equipment Rental, Sudhir Power, and Modern Hiring Service are strengthening localized presence through competitive pricing and customized rental terms for short- and long-term applications. United Rentals and Herc Rentals continue to dominate the North American segment with flexible power-as-a-service models.

Atlas Copco finalized its 2024 acquisition of Generator Rental Services Limited (GRS), a specialized power rental firm in New Zealand.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Power Rating | > 75 kVA - 375 kVA, ≤ 75 kVA, > 375 kVA - 750 kVA, and > 750 kVA |

| End Use | Oil & Gas, Telecom, Data Center, Healthcare, Electric Utilities, Offshore, Manufacturing, Construction, Mining, Marine, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aggreko, APR Energy, Ashtead Group, Atlas Copco, Byrne Equipment Rental, Caterpillar, Cummins, Generac Power Systems, Herc Rentals, HIMOINSA, Modern Hiring Service, Perennial Technologies, Power Express Gensets, Shenton Group, Sudhir Power, and United Rentals |

| Additional Attributes | Dollar sales, share by application and power rating, rental fleet utilization trends, regional demand hotspots, regulatory impact on diesel gensets, competitive positioning of key players, pricing benchmarks, and growth projections for hybrid-ready rental solutions. |

The global peak shaving diesel fueled power rental market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the peak shaving diesel fueled power rental market is projected to reach USD 2.6 billion by 2035.

The peak shaving diesel fueled power rental market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in peak shaving diesel fueled power rental market are > 75 kva - 375 kva, ≤ 75 kva, > 375 kva - 750 kva and > 750 kva.

In terms of end use, oil & gas segment to command 22.3% share in the peak shaving diesel fueled power rental market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Peak Shaving Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Loudspeaker Market Insights - Size, Share & Industry Growth 2025-2035

Loudspeaker Subwoofer Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Speaker Market Analysis - Trends, Growth & Forecast 2025 to 2035

Shaving Pen Market Analysis – Trends, Growth & Forecast 2025-2035

Shaving Care Market Insights – Growth & Forecast 2024-2034

Rental Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Parental Control Software Market Report - Demand & Outlook 2025 to 2035

IBC Rental Business Market Size and Share Forecast Outlook 2025 to 2035

P2P Rental Apps Market Size and Share Forecast Outlook 2025 to 2035

Breakdown for IBC Rental Business Market: Trends, Players, and Innovations

Car Rental Service Market Trends - Growth & Forecast 2024 to 2034

Boat Rental Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Yacht Rental Market Size and Share Forecast Outlook 2025 to 2035

Crane Rental Market Analysis by Product Type, End-Use Industry, and Region through 2035

Vacation Rental Website Market Size and Share Forecast Outlook 2025 to 2035

Vacation Rentals Industry Analysis By Platform, By Service Type, By End User, By Region – Forecast for 2025 to 2035

The Furniture Rental Services Market is segmented by material, application and region from 2025 to 2035.

Furniture Rental Market by Product, Material, Application, and Region – Growth, Trends, and Forecast through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA