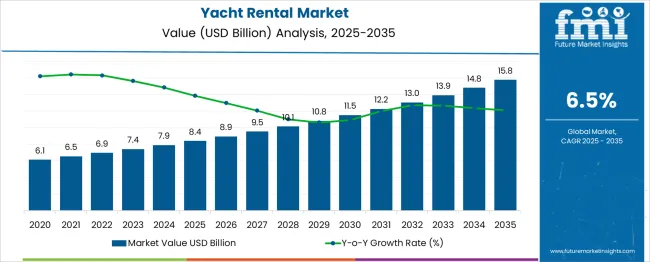

The Yacht Rental Market is estimated to be valued at USD 8.4 billion in 2025 and is projected to reach USD 15.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. From 2025 to 2030, the market is projected to increase from USD 8.4 billion to USD 11.5 billion, indicating consistent expansion fueled by growing demand for leisure and luxury experiences. Year-on-year analysis shows the market rising to USD 8.9 billion in 2026 and USD 9.5 billion in 2027, supported by increasing consumer preference for customized charter services and short-term rentals across popular coastal destinations.

By 2028, the market is forecasted to reach USD 10.1 billion, followed by USD 10.8 billion in 2029 and USD 11.5 billion by 2030. The rise of online booking platforms and the inclusion of personalized itineraries are expected to enhance customer convenience and broaden accessibility. Market players are focusing on sustainability features such as hybrid propulsion systems and eco-certified vessels to cater to evolving traveler expectations. These factors position yacht rentals as an attractive segment within the luxury tourism industry, offering opportunities for operators to capitalize on premium travel trends and experiential vacations worldwide.

| Metric | Value |

|---|---|

| Yacht Rental Market Estimated Value in (2025E) | USD 8.4 billion |

| Yacht Rental Market Forecast Value in (2035F) | USD 15.8 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The yacht rental market holds a distinct and premium position within multiple leisure and travel-related segments. In the leisure and recreational boating market, its share is approximately 10-12%, as boat rentals dominate overall activity while yachts cater to luxury demand. Within the luxury tourism and travel market, the share is about 6-8%, since high-end accommodations and luxury resorts represent larger portions of spending.

The marine and watercraft services market sees a share of 5-6%, given the inclusion of maintenance, marina services, and other vessel-related activities. In the hospitality and experiential tourism market, its share is roughly 2-3%, as this segment covers a broad range of experiences beyond yachting. For the charter services and cruise market, yacht rentals contribute around 8-10%, driven by consumer preference for private and personalized travel experiences over mass cruises.

Market growth is driven by increasing demand for customized itineraries, luxury lifestyle experiences, and short-term charters across global destinations. Technological advancements in online booking platforms, integration of AI-based concierge services, and availability of eco-friendly yachts are further boosting adoption. As affluent travelers prioritize exclusivity and immersive experiences, yacht rentals are expected to strengthen their presence across these parent markets, positioning themselves as a core luxury travel offering worldwide.

The yacht rental market is undergoing significant growth as luxury tourism, experiential travel, and increasing disposable incomes converge to reshape leisure spending patterns. Rising demand for personalized and premium travel experiences has positioned yacht rentals as an aspirational choice among high-net-worth individuals and affluent millennials.

Advancements in marina infrastructure, easing of charter regulations, and the growing appeal of coastal and island tourism destinations have supported this upward trajectory. Future growth is expected to be driven by innovation in onboard amenities, digital booking platforms, and expanding offerings in emerging markets.

Operators are increasingly focusing on sustainability, hybrid propulsion technologies, and curated itineraries to attract environmentally conscious and experience-driven customers, laying the groundwork for sustained expansion in the coming years.

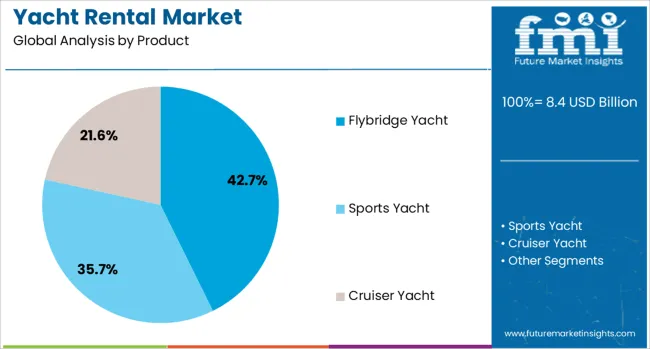

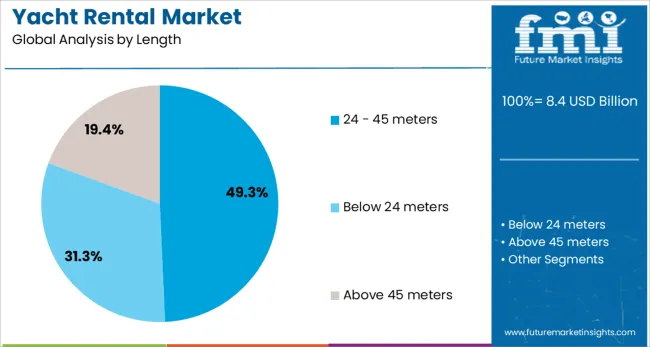

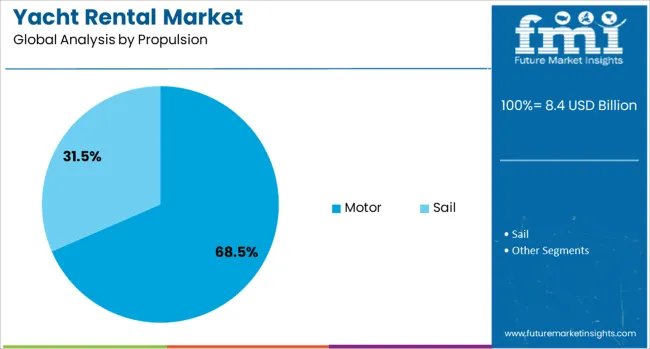

The yacht rental market is segmented by product, length, propulsion, application, and geographic regions. The yacht rental market is divided into Flybridge Yacht, Sports Yacht, and Cruiser Yacht. In terms of length, the yacht rental market is classified into 24 - 45 meters, below 24 meters, and above 45 meters. The propulsion of the yacht rental market is segmented into Motor and Sail.

The yacht rental market is segmented into Leisure, Events, Fishing, and Adventure and Water Sports. Regionally, the yacht rental industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product, the flybridge yacht segment is expected to hold 42.7% of the total market revenue in 2025, making it the leading product segment. This position has been established due to the segment’s ability to offer enhanced onboard space utilization, panoramic views, and dedicated entertainment zones, which have appealed strongly to luxury travelers seeking comfort and exclusivity.

The design of flybridge yachts has been optimized for social gatherings and leisure activities, which has increased their attractiveness among group charters and family bookings. Additionally, improvements in hull designs and fuel efficiency have strengthened their value proposition, enabling charter companies to cater to both aesthetic and operational expectations.

The segment’s dominance has been further reinforced by its suitability for diverse cruising routes and seasonal conditions, making it a versatile and preferred choice across global charter markets.

Segmenting by length shows that yachts in the 24 45 meters category are projected to account for 49.3% of the total market revenue in 2025, securing the top position in this dimension. This leadership has been driven by the balance this size offers between operational efficiency, luxury amenities, and marina accessibility.

Yachts in this length range have been favored for their ability to accommodate larger groups without incurring the significantly higher costs associated with superyachts, making them accessible to a broader segment of high-end clientele. Enhanced design flexibility within this category has allowed charter operators to offer customized layouts, multiple cabins, and premium features while maintaining manageable crew requirements.

The segment’s popularity has also been supported by regulatory advantages and availability of berthing facilities, which have further strengthened its dominance in the yacht rental market.

When segmented by propulsion type, motor yachts are forecast to hold 68.5% of the market revenue in 2025, maintaining their position as the leading propulsion segment. This dominance has been underpinned by the superior speed, maneuverability, and onboard amenities that motor yachts offer compared to their sailing counterparts.

Clients have increasingly favored motor yachts for their ability to cover greater distances in shorter timeframes while providing stability and luxury features that meet contemporary expectations. Continuous advancements in engine technology, noise reduction, and fuel efficiency have enhanced the operational appeal of motor yachts for both operators and clients.

Moreover, the reliability and minimal dependency on wind conditions have allowed for predictable itineraries, making motor yachts the preferred choice for charter operators aiming to deliver seamless and memorable experiences to their clientele.

The yacht rental market is expanding as demand increases for leisure experiences that combine privacy and premium service. In 2024, luxury travel brands and charter operators introduced themed packages and multi-day itineraries to meet rising interest. By 2025, digital booking platforms and concierge services scaled operations, enabling seamless access to yacht charters in both coastal and inland regions. Providers offering diverse vessel design, transparent pricing structures, and curated guest experiences are positioned to gain market leadership.

Emerging consumer interest in exclusive leisure experiences has elevated yacht rentals into mainstream travel offerings. In 2024, luxury tourism firms launched curated sailing vacations, wellness retreats, and corporate charter packages aboard yachts to cater to demand for differentiated hospitality. By 2025, designers of bespoke itineraries combining private cruising with on-shore experiences enabled higher utilization of vessels across seasons. These developments underscore that experiential quality is shaping rental uptake. Operators offering fleet variety, premium amenities, and personalized service models are being prioritized in high-net-worth and adventure travel segments.

Deployment of online charter marketplaces has created notable opportunity for growth and accessibility. In 2024, platforms showcasing live availability, pricing transparency, and guest reviews expanded reach to affluent and aspirational travelers. By 2025, integrated mobile apps enabled instant booking, itinerary customization, and crew matching to elevate user experience. This progression shows that digital visibility and convenience-not just luxury vessel offerings-are redefining consumer engagement. Yacht rental businesses that combine digital marketing, real-time booking capabilities, and curated fleet displays are best positioned to scale across both leisure and corporate charter markets.

In 2024 and 2025, yacht rental services faced limitations due to rising fuel prices, maintenance expenses, and crew charges. Charter operators were compelled to increase rental rates to maintain margins, which reduced accessibility for mid-segment customers. Seasonal demand fluctuations in regions like the Mediterranean and Caribbean further intensified cost recovery pressures. Additionally, unexpected repair requirements on luxury fleets added financial unpredictability for service providers. Unless operational cost efficiencies or shared rental models are implemented, premium pricing will continue to restrict broader adoption of yacht rental offerings across global markets.

In 2024 and 2025, yacht rental companies introduced short-duration charters ranging from a few hours to single-day excursions. This approach appealed to travelers seeking premium experiences without committing to extended rentals. Coastal destinations in Europe and Asia observed increased uptake for event-based bookings such as private parties and corporate gatherings. Online booking platforms enhanced visibility of these short-term options, making them more accessible to younger demographics and experiential travelers. This trend signals a clear opportunity for operators to expand customer reach by emphasizing flexible, affordable packages tailored to personalized leisure activities.

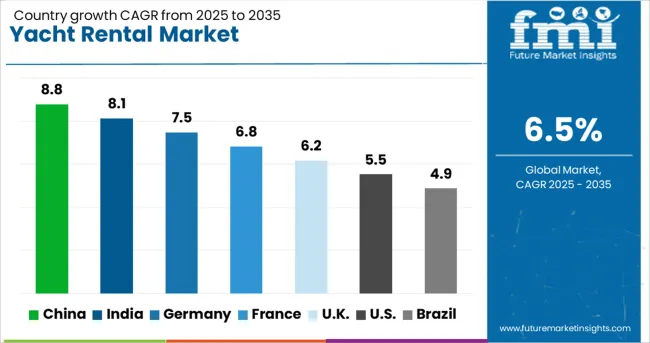

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| Uk | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The global yacht rental market is projected to grow at a CAGR of 6.5% from 2025 to 2035. China leads with 8.8%, followed by India at 8.1% and Germany at 7.5%. France stands at 6.8%, while the United Kingdom posts 6.2%. Growth is driven by rising demand for leisure marine tourism, premium charter services, and luxury lifestyle experiences. China and India dominate due to rapid growth in high-net-worth individuals and coastal tourism infrastructure, while Germany emphasizes personalized yacht experiences. France and the UK focus on integrating digital booking platforms to expand accessibility for premium vacation planning.

The yacht rental market in China is expected to grow at 8.8%, supported by increasing wealth among affluent consumers and coastal tourism development. Luxury motor yachts dominate high-demand charter services in top destinations like Hainan. Companies leverage digital platforms for real-time bookings and exclusive event-based rentals. Expansion of marina facilities and supportive government policies enhance industry growth prospects.

The yacht rental market in India is projected to grow at 8.1%, driven by the growing preference for luxury tourism and event-based charters. Mid-sized yachts dominate bookings for corporate gatherings and private celebrations. Operators introduce flexible pricing models and short-term rentals to attract new customers. Expanding coastal leisure destinations such as Goa and Mumbai supports growth in yacht charter services.

The yacht rental market in Germany is forecast to grow at 7.5%, driven by increasing interest in leisure boating among affluent consumers. Sailing yachts dominate bookings in inland lakes and luxury vacation spots. Operators invest in sustainability-focused charters using hybrid-powered yachts. Growth in yacht-sharing platforms accelerates accessibility for younger demographics interested in premium marine experiences.

The yacht rental market in France is projected to grow at 6.8%, supported by strong demand along the French Riviera and Mediterranean coastlines. Mega-yachts dominate bookings for high-profile events and luxury holidays. Operators enhance services with crewed charters and onboard amenities such as chefs and spas. Partnerships with luxury travel agencies improve reach among elite clientele seeking bespoke yacht experiences.

The yacht rental market in the UK is forecast to grow at 6.2%, driven by increasing interest in coastal tourism and river-based luxury cruising. Small to mid-sized yachts dominate event-based charters and weekend leisure trips. Operators integrate app-based booking solutions to improve convenience for domestic travelers. Growth in themed yacht experiences, such as gourmet dining and corporate parties, supports market expansion.

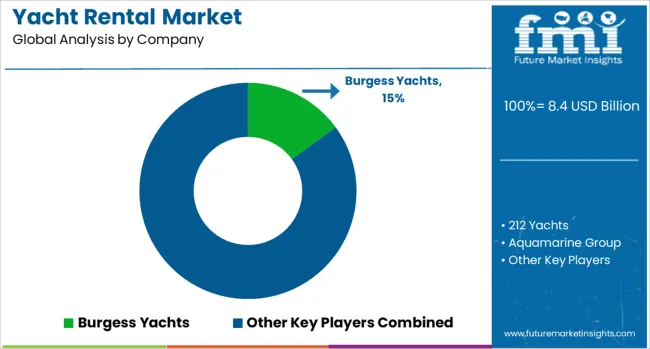

The yacht rental market is moderately consolidated, with Burgess Yachts holding a leading position through its extensive fleet management, premium charter services, and strong presence in luxury destinations such as the Mediterranean and the Caribbean. The company specializes in bespoke itineraries and high-end client experiences, securing its leadership in the global charter market. Key players include 212 Yachts, Aquamarine Group, Bluewater Yachting, Boatbookings, Camper & Nicholsons, Edmiston, Fraser Yachts, Moran Yacht & Ship, Nicholson Yachts, and Princess Yacht Charter.

These companies provide a diverse range of luxury yacht rental services, including motor yachts, sailing yachts, and superyachts, catering to both private and corporate clients. Many also offer value-added services such as crew management, event planning, and concierge solutions to enhance customer experience. Market growth is being driven by the rising popularity of experiential luxury travel, increasing high-net-worth individual (HNWI) spending, and growing demand for private, safe travel alternatives post-pandemic.

Companies are adopting digital platforms for seamless booking experiences, virtual yacht tours, and dynamic pricing models. Emerging trends include sustainable yacht design, hybrid propulsion systems, and personalized vacation packages with curated onboard experiences. The Mediterranean, Caribbean, and Asia-Pacific remain key regions, while North America and the Middle East show significant potential due to expanding ultra-luxury tourism markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.4 Billion |

| Product | Flybridge Yacht, Sports Yacht, and Cruiser Yacht |

| Length | 24 - 45 meters, Below 24 meters, and Above 45 meters |

| Propulsion | Motor and Sail |

| Application | Leisure, Events, Fishing, and Adventure and Water Sports |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Burgess Yachts, 212 Yachts, Aquamarine Group, Bluewater Yachting, Boatbookings, Camper & Nicholsons, Edmiston, Fraser Yachts, Moran Yacht & Ship, Nicholson Yachts, and Princess Yacht Charter |

| Additional Attributes | Dollar sales by yacht type (motor, sailing, catamaran), Dollar sales by service model (bareboat, crewed, luxury), regional demand trends, competitive landscape, consumer preference for personalized and flexible experiences, integration with digital booking platforms and eco-friendly vessels, innovations in hybrid propulsion and smart navigation systems. |

The global yacht rental market is estimated to be valued at USD 8.4 billion in 2025.

The market size for the yacht rental market is projected to reach USD 15.8 billion by 2035.

The yacht rental market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in yacht rental market are flybridge yacht, sports yacht and cruiser yacht.

In terms of length, 24 - 45 meters segment to command 49.3% share in the yacht rental market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yacht Shell Doors Market Size and Share Forecast Outlook 2025 to 2035

Yacht Market Size and Share Forecast Outlook 2025 to 2035

Yacht Maintenance and Refit Market Size and Share Forecast Outlook 2025 to 2035

Yacht Charter Market Analysis – Size, Share & Forecast 2025 to 2035

GCC Yacht Charter Service Market Analysis – Trends & Forecast 2025 to 2035

Competitive Overview of Luxury Yacht Market Share & Providers

Luxury Yacht Industry Analysis by Type, by Size, by Application , by Ownership, and by Region- Forecast for 2025 to 2035

Rental Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Parental Control Software Market Report - Demand & Outlook 2025 to 2035

IBC Rental Business Market Size and Share Forecast Outlook 2025 to 2035

P2P Rental Apps Market Size and Share Forecast Outlook 2025 to 2035

Breakdown for IBC Rental Business Market: Trends, Players, and Innovations

Car Rental Service Market Trends - Growth & Forecast 2024 to 2034

Boat Rental Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Crane Rental Market Analysis by Product Type, End-Use Industry, and Region through 2035

Vacation Rental Website Market Size and Share Forecast Outlook 2025 to 2035

Vacation Rentals Industry Analysis By Platform, By Service Type, By End User, By Region – Forecast for 2025 to 2035

The Furniture Rental Services Market is segmented by material, application and region from 2025 to 2035.

Furniture Rental Market by Product, Material, Application, and Region – Growth, Trends, and Forecast through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA