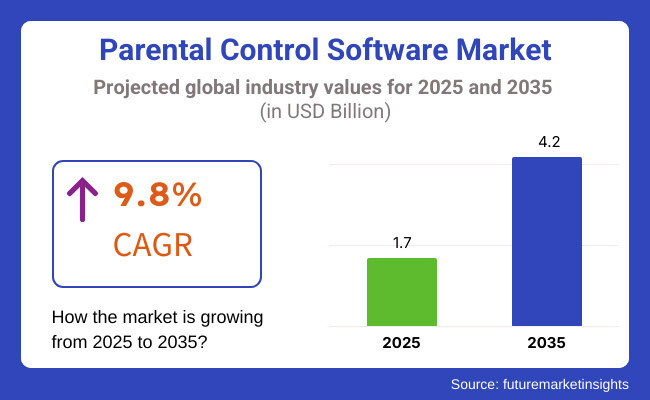

The parental control software market is expected to grow at a moderate CAGR of 9.8% from around USD 1.7 billion in 2025 to USD 4.2 billion by 2035. As the number of children spending their time online goes up, parents and guardians have taken to using sophisticated monitoring systems to protect their families online.

Parents around the world use parental controls software on smartphones, tablets, gaming consoles, and PCs, being driven by growing concern about cyber-attack, screen dependency, and inadvertent exposure to undesirable material.

Parental control software helps parents and guardians monitor, manage, and restrict their online activity, making the digital terrain safe for them. Sure, such features as content filtering, screen time management, app-blocking, and real-time alerts are some of the features that ensure that children are safe from cyber risk in the form of cyberbullying, identity theft, and exposure to obscene content.

In this age of digital media, online education apps, and video games, the introduction of tighter parental control measures could not have come more in the nick of time. Regulatory bodies worldwide (for example, the GDPR in Europe and the USA Children's Online Privacy Protection Act (COPPA)) have strengthened an emerging trend for stricter online protection of minors.

There are a number of factors responsible for the soaring growth of the global parental control software market. The increased dependence on digital devices for everything from studying to recreation to socializing has also spurred heightened anxiety among parents about online safety.

Artificial intelligence (AI) and machine learning have made advanced high-tech monitoring systems possible for tracking suspicious behavior online and sending out real-time alerts. Also, the rise in awareness of cyber threats like online predators, phishing, and data breaches has further increased the demand for IA-based security solutions. In addition, due to the ease and convenience it offers, parental control has been made available in mobile applications (via their operating systems, browsers, etc.).

The growing industry has some challenges. Privacy concerns have inhibited the widespread adoption of parental control software, as sometimes trackers and activity monitors harvest data that could facilitate or enable monitoring of parents' devices. Smart children will bypass certain solutions, such as blocking software.

Another issue is low awareness in some regions, which could be a barrier to this technology, with digital literacy also being developed, which limits the penetration. As premium parental control software is costly, affordability is the most important concern in price-sensitive markets, and this may discourage some users.

As AI-based behavioral tracking and predictive analysis become increasingly what AIGS users experience, the sophistication of monitoring intelligence grows into action that actively targets online safety. Cloud-based parental control software, on the other hand, has boomed and allows long-ranging parents to control and monitor their kids from anywhere and at any time.

As more people sign up for the internet and savvy, safety-sensitive consumers learn more about how to stay secure online, growing economies such as Canada, Mexico, Australia, and India will see greater adoption. That logic, paired with increased demand for safer online spaces for children, puts the parental control software market on track for substantial growth through 2035.

The market is segmented based on platform, device access, and region. By platform, the market is divided into mobile based and system based. In terms of device access, it is segmented into smartphones, desktop/laptop, and tablet. Regionally, the market is classified into North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

The mobile based segment holds 61% share in 2025, driven by the growing need to manage children’s digital behavior on smartphones. As mobile devices become the primary gateway for internet access among younger users, parents increasingly seek real-time control and monitoring tools tailored to mobile environments. Mobile based parental control software allows parents to track screen time, block inappropriate apps, filter content, and monitor device usage on the go. The segment benefits from advancements in AI-driven content filtering, GPS tracking, and cross-platform compatibility with wearable devices and connected home systems. As children’s screen time rises, mobile based parental controls are evolving to deliver proactive insights and enhanced safety.

System based parental control software remains vital for desktops and laptops used in home learning and school environments. These solutions offer comprehensive reporting, web filtering, and time management functionalities for PC-based learning and entertainment. The increasing integration of system based solutions with broader family safety ecosystems also supports continued adoption. With the expansion of hybrid learning, online gaming, and social media use, mobile based parental control solutions are poised to remain the primary choice for modern families.

| Platform | Share (2025) |

|---|---|

| Mobile Based | 61% |

The smartphones segment holds 64% share in 2025, making it the leading device access category for parental control software. Smartphones are central to children’s online activities, with growing usage across messaging apps, social media, streaming platforms, and mobile gaming. Parents prioritize smartphone-based parental controls to manage content exposure, monitor app usage, and ensure location safety.

Key drivers include advancements in app-based controls, increased customization for individual child profiles, and improved visibility into mobile app behavior. Cloud-based parental control ecosystems are enabling seamless synchronization across smartphones and family accounts, enhancing user experience.

Desktop/laptop access continues to play an important role, particularly in managing children’s online behavior during homework and educational activities. Schools and parents value desktop parental controls for their robust filtering and scheduling capabilities. Tablet access is steadily growing as children use tablets for both entertainment and hybrid learning.

Tablets often serve as a child’s first personal device, making tablet-specific controls an important part of parental control strategies. As content consumption shifts further to mobile-first channels, smartphones are expected to sustain their leadership in driving parental control software demand.

| Device Access | Share (2025) |

|---|---|

| Smartphones | 64% |

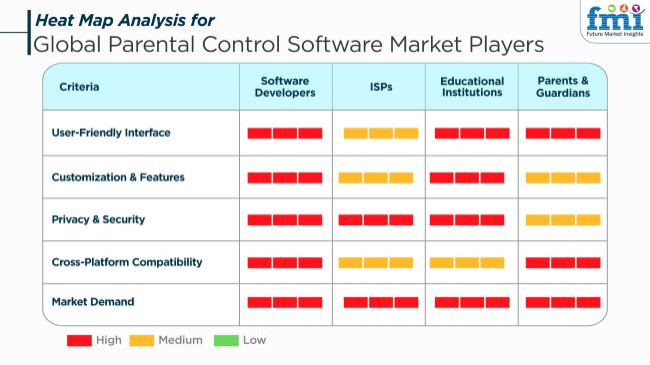

Worldwide sales of parental control software are currently in a state of rapid expansion due to the alarming rate of cyber threats, the necessity of screen time management, and the question of safety for children accessing the internet. Software developers emphasize feature-rich solutions like machine-learning-driven content filtering, monitoring in real-time, and geofencing in the provision of security at the advanced level.

Communication companies include parental controls in their services as a part of the process of making monitoring without installation easier. Academic institutions opt for these solutions to monitor students' use of digital content creators, and students apply knowledge to cybersecurity and safe browsing at the same time. Parents are concerned with user-friendliness, the price of the application, and the multi-device use that comes with it, thus being able to handle the children's screen time and online activities smartly.

The criteria for purchasing are modifications, simple usage, universal compatibility, and good privacy security. As long as cyber threats are present, the demand for parental control based on AI technology, cloud computing, and real-time will be on the rise, making these tools indispensable for the digital age of child safety.

Contracts & Deals Analysis

| Company | Contract Value (USD Million) |

|---|---|

| Qustodio | 5 |

| Net Nanny | 20-50 |

| Kaspersky Safe Kids | 10-25 |

The sector of parental control software is plagued with risks that come from the fact that this software has to cope with ever-evolving security issues, regulatory compliance, and technological adaptability.

Data privacy and security have been the greatest risks as parents have to allow the software to access sensitive information related to their children's online activities, their location, and the devices they use. A data breach or incorrect data usage can have legal consequences, affect one's reputation, and cause a loss of trust from the customers. The suffering employer must provide end-to-end encryption, offer transparent data policies, and comply with GDPR and COPPA regulations.

Moreover, competition for cyber threats contributes to this issue. Data breaches are ever-evolving as more and more cybercriminals and inappropriate content sources use new methods to slack off parental control. The software has to be equipped with these tools: AI-driven content filtering, and deep-learning-based anomaly detection, and real-time monitoring for its efficiency to remain at the top.

Regulatory compliance is quite heterogeneous depending on the region, some with highly stringent laws on child data protection, use of digital surveillance, and app permissions. The adaptation to newer data security laws and cross-border digital laws, which may be contrary to each other, will result in more legal expenses and software updates in a bid to avoid penalties.

The industry is aggressively competitive since it sees various players such as Qustodio, Norton Family, and Kaspersky Safe Kids, which carry a bunch of alternatives. In particular, gaining the consumers' trust and industry share primarily lies in distinguishing oneself through the facility of an AI-powered monitoring function, integrating cross-device functionality seamlessly, and offering friendly interfaces.

Tier 1 vendors are industry leaders with substantial shares, extensive global reach, and comprehensive product portfolios. These companies have established themselves as dominant players through continuous innovation, strategic partnerships, and robust customer bases. They often set industry standards and influence trends. While specific share percentages for individual companies are proprietary and not publicly disclosed, Tier 1 vendors collectively command a significant portion. Their revenues typically range in the hundreds of millions, reflecting their strong positions.

Tier 2 vendors are mid-sized companies with a notable presence in the parental control software market. They offer competitive products and have a substantial customer base, though their share and global reach are less extensive than Tier 1 vendors. These companies often focus on specific regions or niches, providing specialized solutions that cater to particular customer needs. Their revenues are generally in the tens of millions, indicating a solid position but with room for growth.

Tier 3 vendors consist of smaller companies, startups, or niche players with limited share and regional focus. They may offer innovative or specialized solutions but lack the extensive resources and global presence of Tier 1 and Tier 2 vendors. These companies often target specific demographics or address unique challenges within the parental control landscape. Their revenues are typically in the lower millions or below, reflecting their emerging status in the market.

| Countries | CAGR 2025 to 2035 |

|---|---|

| India | 13.7% |

| China | 12.0% |

| Germany | 8.1% |

| Japan | 10.5% |

| The USA | 9.2% |

India witnessed aggressive adoption of smartphones by children with higher low-cost mobile phones and internet coverage. Social networks, educational sites, and apps are growing faster, and thereby, the risk of cybercrime and offensive content. Parents themselves choose in favor of monitoring solutions beforehand, particularly working professionals who require real-time monitoring solutions. FMI anticipates India's market to expand at 13.7% CAGR during the period of research.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Smartphone adoption among children | Affordable mobile devices and widespread internet availability increase online engagement. |

| Digital learning expansion | Educational apps and platforms contribute to extended screen time. |

| Cyber threats and online safety concerns | A 40% rise in child-targeted cyber threats in 2023 highlights the need for monitoring solutions. |

| Government initiatives | Regulations such as the IT (Intermediary Guidelines and Digital Media Ethics Code) Rules promote online safety. |

Growing parental awareness of digital well-being has led to a growing use of monitoring software in the USA. The government has implemented strong child protection policies, including COPPA, with strict data privacy measures. Advanced parental control solutions provide real-time alerts and customized settings to address problems associated with cyberbullying, screen addiction, and online content. FMI&rsquos analysis says that the USA market will grow at a 9.2% CAGR during the research study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Digital well-being awareness | Parents actively monitor children&rsquos screen time and online interactions. |

| Government regulations | Laws like COPPA enforce strict data privacy measures for child-focused platforms. |

| Advanced monitoring tools | Real-time alerts and customizable restrictions increase adoption. |

| Legislative support | A proposed 2024 bill enforces default safety settings on social media for minors. |

China's booming EdTech industry has driven the surge in demand for parental control tools as students increasingly use online learning platforms. Parents look for means to manage digital distractions, over-screening, and app usage themselves to guarantee an undistracted learning experience.

The government also improved security under the "Double Reduction" policy and included parental control capabilities as a requirement in online learning platforms. According to FMI, China is set to expand at 12.0% CAGR during the forecast period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Expanding EdTech industry | Millions of students use online education platforms, increasing demand for monitoring tools. |

| Parental control integration | Educational applications incorporate monitoring features to regulate study schedules. |

| Government regulations | The "Double Reduction" policy reduces students' excessive reliance on digital tutoring. |

| Mandated parental controls | In 2023, authorities required all online education platforms to include monitoring settings. |

German stringent data privacy and its internet penetration level are reasons for rising demand for parental control software. Parents want to provide children with secure online spaces. With more powerful EdTech, schools implement online learning software, and this requires more monitoring solutions demand.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Stringent data protection laws | Germany enforces strict regulations on digital privacy and child safety online. |

| High internet penetration | A large percentage of children have internet access, increasing demand for monitoring software. |

| Parental awareness | Parents emphasize digital well-being and responsible internet use among children. |

| EdTech advancements | Schools integrate digital learning tools, making parental monitoring essential. |

Japan's digital security technological innovation has made parental control products better. With increasing screen time for children through smartphone and game console usage, parents have the pleasure of monitoring features. Digital literacy programs supported by the government aid in increasing safe internet use, further requiring efficient parental control software.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Technological advancements | Japan's innovation in digital security enhances parental control solutions. |

| Rising screen time among children | Increased use of smartphones and gaming consoles requires monitoring tools. |

| Government initiatives | Authorities implement digital literacy programs to promote safe internet usage. |

| Cybersecurity concerns | An uptick in cyber threats targeting children necessitates stricter online safety measures. |

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.7 billion |

| Projected Market Size (2035) | USD 4.2 billion |

| CAGR (2025 to 2035) | 9.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameter | Revenue in USD billion |

| By Platform | Mobile Based, System Based |

| By Device Access | Smartphones, Desktop / Laptop, Tablet |

| Regions Covered | North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Qustodio, Net Nanny, Norton Family, Kaspersky Safe Kids, Mobicip, Bark, FamilyTime, OurPact, MMGuardian, FamiSafe |

| Additional Attributes | Rising demand for cost-effective dairy alternatives, growing infant nutrition sector, expanding bakery industry |

| Customization and Pricing | Available upon request |

By deployment, the market is segmented into on-premises parental control software and cloud parental control software.

By platform, the market is segmented into Android-based parental control software, iOS-based parental control software, and Windows-based parental control software.

By region, the market is segmented into North America, Latin America, Asia Pacific, Europe, and the Middle East and Africa.

The industry is projected to reach USD 1.7 billion in 2025.

The industry is expected to grow significantly, reaching USD 4.2 billion by 2035.

China is poised for the fastest growth, with a CAGR of 12.0% from 2025 to 2035.

Key companies in the market include Norton, Kaspersky Lab, Qustodio LLC, Mobicip, uKnow.com Inc., Salfeld Computer GmbH, FamilyTime, SafeDNS Inc., mSpy, BitDefender, Content Watch Holdings Inc., TeenSafe Inc., and Bark.

The smartphone segment (device access) is widely used, providing parental control solutions across Android, iOS, and Windows-based platforms.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Platform, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 13: Global Market Attractiveness by Deployment, 2023 to 2033

Figure 14: Global Market Attractiveness by Platform, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Platform, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 28: North America Market Attractiveness by Deployment, 2023 to 2033

Figure 29: North America Market Attractiveness by Platform, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Platform, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Deployment, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Platform, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by Platform, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Deployment, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Platform, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by Platform, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Deployment, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Platform, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by Platform, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Deployment, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Platform, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by Platform, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Deployment, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Platform, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by Platform, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Deployment, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Platform, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Control Towers Market Size and Share Forecast Outlook 2025 to 2035

Controlled & Slow Release Fertilizers Market 2025-2035

Controlled Intelligent Packaging Market

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

Sun Control Films Market Size and Share Forecast Outlook 2025 to 2035

CNC Controller Market Size and Share Forecast Outlook 2025 to 2035

PID Controller Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Sun Control Films Manufacturers

PLC Controlled Packing Machine Market Trends – Forecast 2024-2034

Riot Control Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Lane Control Signals Market Size and Share Forecast Outlook 2025 to 2035

Riot Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA