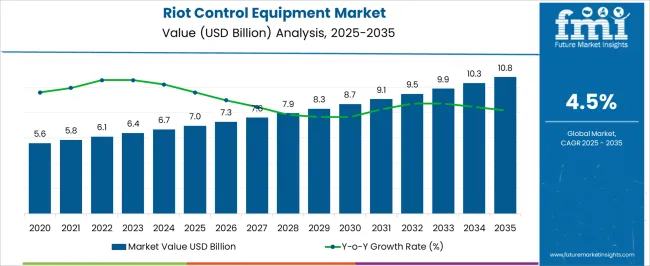

The riot control equipment market is projected to grow from USD 7.0 billion in 2025 to USD 10.8 billion in 2035, reflecting a CAGR of 4.5%. During the early adoption phase (2020–2024), the market expanded gradually from USD 5.6 billion to USD 7.0 billion as equipment was procured and tested by law enforcement agencies and security forces. Pilot deployments were conducted to evaluate effectiveness, safety, and operational handling. By 2025, the market is expected to reach USD 7.0 billion, with broader procurement programs underway. Initial adoption is being supported through policy approvals, budget allocations, and strategic planning by government authorities and security organizations.

From 2025 to 2035, the market is expected to transition through scaling (2025–2030) and consolidation (2030–2035). By 2030, the market is projected to surpass USD 8.3 billion, driven by expanded deployment across urban and high-risk regions, training initiatives, and maintenance services. During the consolidation phase, growth is forecast to moderate toward USD 10.8 billion by 2035 as leading suppliers strengthen their presence and smaller players consolidate or exit. The 4.5% CAGR indicates steady expansion, establishing the market as a standard solution for crowd management, security operations, and tactical preparedness across law enforcement and public safety organizations.

| Metric | Value |

|---|---|

| Riot Control Equipment Market Estimated Value in (2025 E) | USD 7.0 billion |

| Riot Control Equipment Market Forecast Value in (2035 F) | USD 10.8 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The riot control equipment market is influenced by several parent markets, each contributing to overall growth. The law enforcement and policing sector is estimated to drive approximately 35%, as equipment is deployed to manage public safety and civil unrest. Security services and private protection are considered responsible for 20%, as non-government agencies adopt specialized equipment for personnel protection and crowd management. Defense and military procurement is assessed to account for 15%, as tactical and perimeter control tools are utilized in specialized operations. Training and simulation services are estimated to influence 10%, as personnel are instructed in safe and effective equipment use. Personal protective equipment (PPE) contributes around 7%, as helmets, shields, and body armor are integrated into riot control deployments. Surveillance and monitoring solutions are evaluated at 5%, as video and sensor systems are incorporated for operational coordination. Non-lethal weapons manufacturing accounts for 5%, as tear gas, stun devices, and related products are produced and supplied. Finally, research and regulatory services are estimated at 3%, as policies, standards, and evaluations guide market adoption.

The Riot Control Equipment market is experiencing steady growth, driven by increasing emphasis on public safety, crowd management, and law enforcement modernization across both developed and emerging regions. The current market scenario reflects rising investments in protective gear, non-lethal equipment, and technologically advanced surveillance-integrated systems.

Growth is being fueled by the need to enhance operational efficiency and minimize risks during large-scale public gatherings, protests, and civil unrest situations. Rising governmental regulations and safety protocols have contributed to the increased procurement of riot control solutions, while ongoing urbanization and rising population densities are further accelerating demand.

The integration of smart technologies and wearable sensors into riot control equipment is expected to create future growth opportunities by providing actionable intelligence and improving situational awareness for law enforcement personnel With a focus on minimizing injuries and maintaining order in public spaces, the market is anticipated to continue its upward trajectory, offering scalable solutions that combine durability, flexibility, and technological innovation for modern law enforcement operations.

The riot control equipment market is segmented by product type, end user, application, and geographic regions. By product type, riot control equipment market is divided into Personal Protective Equipment and Offensive Equipment. In terms of end user, riot control equipment market is classified into Law Enforcement, Military Forces, and Security Organizations. Based on application, riot control equipment market is segmented into Public Order Management and Security & Protection. Regionally, the riot control equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

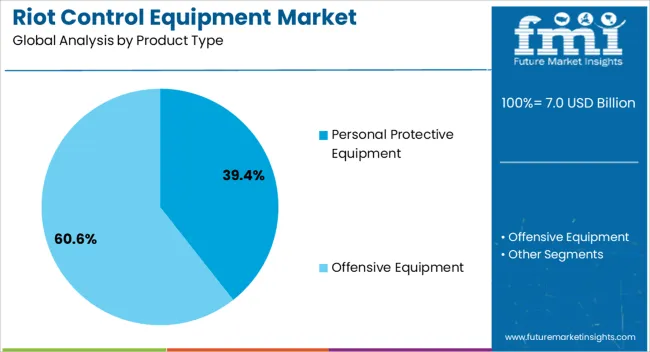

The Personal Protective Equipment segment is projected to hold 39.4% of the Riot Control Equipment market revenue share in 2025, making it the leading product type. This dominance is being attributed to its essential role in safeguarding law enforcement officers and security personnel during high-risk operations. The growth of this segment has been supported by increased investment in helmets, shields, body armor, and protective clothing that can be rapidly deployed in various operational scenarios.

Rising concerns over officer safety, coupled with regulatory mandates emphasizing protective standards, have reinforced adoption. The modularity and versatility of personal protective equipment allow for customization to specific threat levels, operational environments, and tactical requirements.

Additionally, the integration of lightweight materials and ergonomic designs has improved mobility and user comfort, further encouraging widespread deployment The demand for PPE is expected to remain robust as law enforcement agencies continue to prioritize officer protection while managing large-scale public events and maintaining public order.

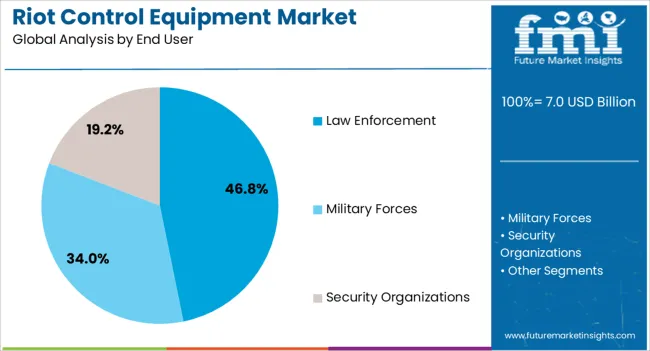

The Law Enforcement end user segment is expected to account for 46.8% of the Riot Control Equipment market revenue share in 2025, highlighting its primary role in driving market growth. This segment has been supported by the increasing professionalization of police forces, the expansion of urban policing strategies, and the rising requirement for non-lethal crowd management solutions.

Investment in training, modernization programs, and standardized operational protocols has enhanced the adoption of riot control equipment by law enforcement agencies. As agencies seek to balance public safety with minimal use of force, demand for equipment that improves situational awareness, ensures officer protection, and enables controlled response has surged.

The integration of smart tools and technology-enabled monitoring into traditional riot control practices has further accelerated deployment The market share is being reinforced by government focus on law and order, rising public safety budgets, and an emphasis on strategic urban security planning, positioning law enforcement as the largest end user segment in the market.

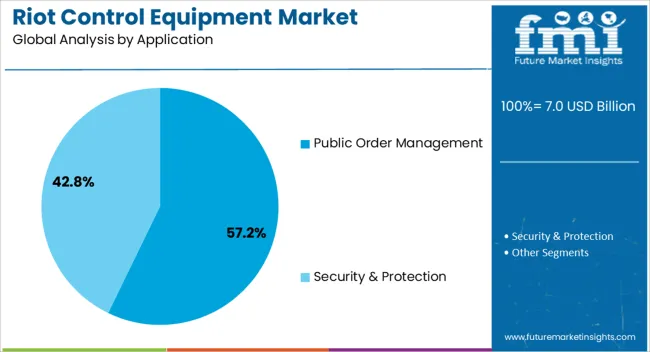

The Public Order Management application segment is projected to hold 57.2% of the Riot Control Equipment market revenue share in 2025, making it the leading application area. This prominence is being driven by the growing need to efficiently manage large crowds, civil disturbances, and organized public events while minimizing injuries and property damage.

Deployment of riot control equipment in public order scenarios has been supported by increasing awareness of crowd dynamics, the adoption of non-lethal intervention strategies, and government mandates on crowd control protocols. The software-enabled monitoring of crowd movements, combined with the strategic deployment of personal protective equipment, shields, and less-lethal projectiles, has enhanced operational effectiveness.

Rising concerns regarding public safety during protests, festivals, and sporting events have further reinforced demand The segment’s leadership is expected to continue as public authorities prioritize preventive measures, invest in modern equipment, and integrate intelligent response systems to maintain order, providing law enforcement personnel with tools that improve both efficiency and safety in managing complex urban environments.

The riot control equipment market is expanding due to increasing civil unrest, crowd management requirements, and heightened focus on law enforcement preparedness. North America and Europe lead with advanced non-lethal systems such as tear gas launchers, water cannons, and protective gear, emphasizing safety, precision, and operational efficiency. Asia-Pacific is witnessing growing demand for affordable, scalable riot control solutions for law enforcement agencies. Manufacturers differentiate through mobility, modularity, protective materials, and multi-use capabilities. Regional variations in law enforcement protocols, regulatory frameworks, and security budgets influence adoption, procurement strategies, and competitive positioning globally.

Adoption of riot control equipment is heavily influenced by the effectiveness of protective gear in ensuring personnel safety. North America and Europe prioritize advanced body armor, helmets, shields, and gas masks designed to withstand high-impact scenarios and chemical irritants, protecting law enforcement officers during large-scale events. Asia-Pacific markets often adopt cost-effective, durable equipment suitable for general crowd control and regional unrest, balancing protection with affordability. Differences in protective capability affect officer safety, operational effectiveness, and public perception. Leading suppliers invest in high-strength polymers, modular armor systems, and ergonomically designed protective gear for premium applications, while regional manufacturers provide functional, low-cost alternatives. Protective gear contrasts shape adoption, operational reliability, and competitiveness in global riot control equipment markets.

Non-lethal systems such as tear gas launchers, water cannons, rubber bullets, and electroshock devices are key drivers of market adoption. North America and Europe emphasize precision-engineered, multi-use systems integrated with safety controls to minimize collateral damage while maintaining crowd management effectiveness. Asia-Pacific markets increasingly adopt simple, robust, and affordable systems suitable for regional law enforcement needs. Differences in non-lethal system sophistication affect operational accuracy, deployment flexibility, and public acceptance. Suppliers offering advanced, modular, and compliant non-lethal systems gain premium adoption, while regional producers focus on cost-efficient, reliable alternatives. Non-lethal weapon contrasts shape adoption, tactical versatility, and competitive positioning across global riot control equipment markets.

Proper training and operational readiness are critical for effective deployment of riot control equipment. North America and Europe invest heavily in simulation-based training, standard operating procedures, and scenario-driven exercises to optimize response efficiency and reduce injury risk. Asia-Pacific adoption focuses on foundational training programs aligned with equipment usage, balancing cost and operational readiness. Differences in training emphasis affect equipment utilization, response time, and incident outcomes. Suppliers providing integrated training solutions, instructional programs, and operational support gain higher adoption, while regional manufacturers offer basic guidelines and user manuals. Training and readiness contrasts influence adoption, operational performance, and market positioning in global riot control equipment markets.

Regulatory guidelines, legal restrictions, and use-of-force policies significantly influence adoption and deployment. North America and Europe enforce strict regulations regarding non-lethal weapon usage, certification standards, and law enforcement liability, driving demand for compliant equipment. Asia-Pacific markets exhibit varied legal frameworks; advanced regions align with global standards, while emerging markets emphasize cost-effective compliance with local policies. Differences in regulatory rigor affect procurement, operational guidelines, and public accountability. Suppliers providing certified, regulation-compliant equipment gain higher adoption and credibility, while regional players focus on affordable, locally approved solutions. Regulatory contrasts shape market accessibility, adoption rates, and competitive positioning across global riot control equipment markets.

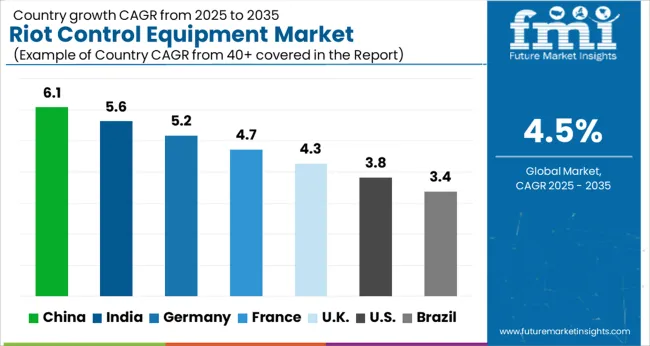

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global plant breeding market was projected to grow at a 12.8% CAGR through 2035, driven by demand in crop improvement, hybrid seed production, and agricultural biotechnology applications. Among BRICS nations, China recorded 17.3% growth as large-scale research and breeding facilities were commissioned and compliance with agricultural and safety standards was enforced, while India at 16.0% growth saw expansion of production and research units to meet rising regional agricultural demand. In the OECD region, Germany at 14.7% maintained substantial output under strict industrial and regulatory guidelines, while the United Kingdom at 12.2% relied on moderate-scale operations for crop breeding and seed development applications. The USA, expanding at 10.9%, remained a mature market with steady demand across commercial and research-driven plant breeding segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The riot control equipment market in China is being driven at a CAGR of 6.1% due to increasing demand from law enforcement agencies and security organizations. Equipment such as shields, batons, protective gear, and crowd control systems is being adopted to enhance officer safety and operational efficiency. Manufacturers are being encouraged to produce durable, reliable, and advanced equipment. Distribution through authorized suppliers, government contracts, and security service providers is being ensured. Training programs and awareness campaigns on proper usage and safety protocols are being conducted. Government regulations on public safety and law enforcement standards are being followed strictly. The growth of urban populations and increased need for crowd management solutions are being considered key factors supporting adoption of riot control equipment in China.

Riot control equipment market in India is being expanded at a CAGR of 5.6% due to rising security requirements and increasing deployment in urban and high-risk areas. Shields, protective gear, batons, and non-lethal control systems are being adopted to ensure safety and crowd management efficiency. Manufacturers are being encouraged to supply reliable, durable, and cost-effective equipment. Distribution through government contracts, security suppliers, and authorized dealers is being maintained. Training programs and workshops are being conducted to educate personnel on proper usage. Increasing urban population, frequent public gatherings, and government emphasis on maintaining public order are being considered primary drivers of market growth in India.

The riot control equipment market in Germany is being driven at a CAGR of 5.2% due to increased demand for law enforcement and crowd management solutions. Equipment such as shields, batons, protective gear, and non-lethal control systems is being adopted to ensure personnel safety and operational effectiveness. Manufacturers are being focused on high quality, reliable, and ergonomic equipment. Distribution through authorized suppliers, government contracts, and security agencies is being maintained. Research and development in advanced materials, lightweight protective gear, and improved control systems is being undertaken to enhance performance. Compliance with safety regulations and operational standards is being ensured. Germany’s law enforcement agencies are increasingly adopting modern riot control solutions to manage public events and maintain safety.

The United Kingdom riot control equipment market is being expanded at a CAGR of 4.3% with growing demand for riot control solutions from law enforcement agencies. Shields, batons, protective gear, and crowd control systems are being adopted to ensure officer safety and effective public management. Manufacturers are being encouraged to provide durable, reliable, and certified equipment. Distribution through government suppliers, authorized dealers, and security agencies is being ensured. Training programs and workshops are being conducted to educate personnel on proper use and safety protocols. Urban population growth and increased public events are being considered key factors supporting market adoption in the United Kingdom.

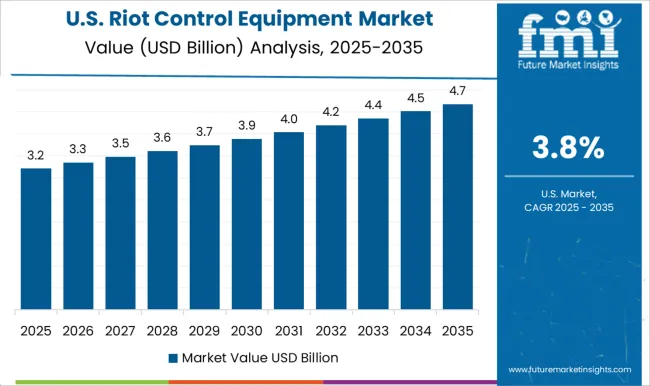

The United States riot control equipment market is being driven at a CAGR of 3.8% due to rising demand from law enforcement agencies, security organizations, and municipal authorities. Equipment such as protective gear, shields, batons, and non-lethal control devices is being adopted to improve safety and operational efficiency. Manufacturers are being focused on supplying durable, reliable, and technologically advanced systems. Distribution through government contracts, authorized dealers, and security suppliers is being maintained. Training programs and workshops are being conducted to ensure proper usage and adherence to safety protocols. Growing public events, demonstrations, and security concerns are being considered key factors supporting market growth in the United States.

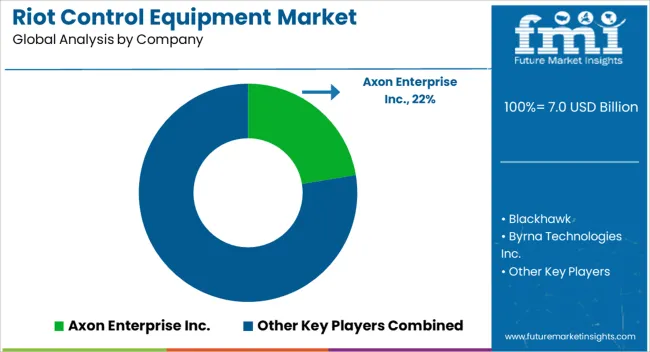

The riot control equipment market is driven by increasing security concerns, urbanization, and the need for law enforcement and crowd management solutions worldwide. Key suppliers in this market include Axon Enterprise Inc., Blackhawk, Byrna Technologies Inc., Combined Systems, Inc., Condor Non-lethal Technologies, Desert Wolf, Etienne Lacroix Group, Genasys, Inc., Rheinmetall AG, and Safariland, LLC. Advanced equipment is designed, developed, and supplied to ensure public safety while minimizing the risk of fatal injuries during civil disturbances. Non-lethal devices such as stun guns, tear gas launchers, rubber bullets, and directed energy solutions are produced and distributed by companies like Axon Enterprise Inc. and Byrna Technologies Inc. to support law enforcement agencies. Protective gear, including helmets, shields, and body armor, is manufactured by Blackhawk, Safariland, and Combined Systems, Inc., where emphasis is placed on durability, ergonomics, and resistance to extreme conditions. These products are engineered and tested to withstand high-intensity scenarios and provide enhanced operational efficiency for first responders and security personnel. Technology-driven systems such as long-range acoustic devices (LRAD), crowd control sensors, and non-lethal chemical agents are developed by Genasys, Inc., Etienne Lacroix Group, and Rheinmetall AG to support advanced monitoring and rapid response capabilities. Research and development are continuously conducted to integrate automation, AI-assisted threat detection, and improved deployment mechanisms. The market expansion is further supported by rising investments in public safety infrastructure, defense modernization programs, and urban security initiatives, where these leading suppliers provide critical tools and solutions to enhance crowd control and emergency response effectiveness.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.0 Billion |

| Product Type | Personal Protective Equipment and Offensive Equipment |

| End User | Law Enforcement, Military Forces, and Security Organizations |

| Application | Public Order Management and Security & Protection |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Axon Enterprise Inc., Blackhawk, Byrna Technologies Inc., Combined Systems, Inc., Condor Non-lethal Technologies, Desert Wolf, Etienne Lacroix Group, Genasys, Inc., Rheinmetall AG, and Safariland, LLC |

| Additional Attributes | Dollar sales vary by equipment type, including shields, batons, tear gas, water cannons, and protective gear; by application, such as crowd management, law enforcement, and military operations; by end-use, spanning police forces, security agencies, and defense organizations; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising civil unrest, law enforcement modernization, and demand for non-lethal crowd control solutions. |

The global riot control equipment market is estimated to be valued at USD 7.0 billion in 2025.

The market size for the riot control equipment market is projected to reach USD 10.8 billion by 2035.

The riot control equipment market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in riot control equipment market are personal protective equipment, _vests, _helmets, _gas masks, _shields, offensive equipment, _area denia, _ammunition, _explosives, _gases & sprays, _directed energy weapons, _electroshock weapons and _others.

In terms of end user, law enforcement segment to command 46.8% share in the riot control equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Riot Control Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Solid Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

Combustion Controls, Equipment & Systems Market – Forecast 2025 to 2035

Air Traffic Control Equipment Market

Air Pollution Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

End-of-Pipe Air Pollution Control Equipment Market- Trends & Forecast 2025 to 2035

Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Control Towers Market Size and Share Forecast Outlook 2025 to 2035

Controlled & Slow Release Fertilizers Market 2025-2035

Controlled Intelligent Packaging Market

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA