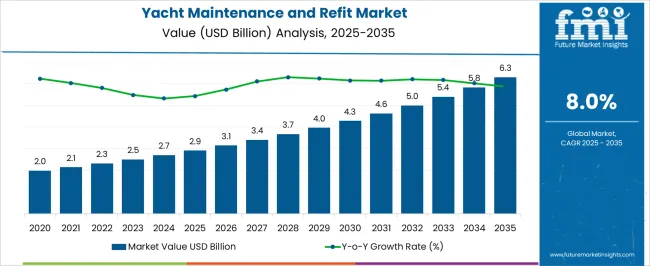

The yacht maintenance and refit market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 6.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

From 2021 to 2025, the market experiences steady growth, moving from USD 2.0 billion to USD 2.9 billion, with annual increments passing through USD 2.1 billion, 2.3 billion, 2.5 billion, and 2.7 billion. This period marks a gradual upward curve as yacht owners and operators increasingly focus on maintenance and upgrading to enhance performance, extend service life, and ensure compliance with environmental regulations. Between 2026 and 2030, the market strengthens, advancing from USD 2.9 billion to USD 4.6 billion. Values progress from USD 3.1 billion, 3.4 billion, 3.7 billion, and 4.0 billion, with the curve becoming steeper as yacht owners invest more in high-quality refits, technology upgrades, and eco-friendly solutions.

The demand for advanced materials, energy-efficient systems, and luxurious interiors fuels growth during this period. From 2031 to 2035, the market further accelerates, reaching USD 6.3 billion by 2035, with intermediate values of USD 4.3 billion, 4.6 billion, 5.0 billion, 5.4 billion, and 5.8 billion. The curve sharpens as market maturity is reached, driven by continuous demand for sophisticated refit services, especially in the high-end yacht sector, alongside increased investment in marine technologies.

| Metric | Value |

|---|---|

| Yacht Maintenance and Refit Market Estimated Value in (2025 E) | USD 2.9 billion |

| Yacht Maintenance and Refit Market Forecast Value in (2035 F) | USD 6.3 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The marine services market is a major contributor, accounting for approximately 30-35%, as yacht maintenance, repair, and refitting services are an integral part of the broader marine industry, ensuring the proper functioning and longevity of yachts. The luxury goods market plays a significant role, contributing around 25-30%, as yachts are considered luxury assets and owners invest in high-quality maintenance to preserve their value, aesthetics, and performance. The shipbuilding and ship repair market contributes about 15-20%, as yacht owners often seek specialized shipyards and repair facilities for comprehensive refitting services, such as hull repairs, engine overhauls, and the installation of advanced technology.

The maritime equipment and parts market is also a key player, contributing roughly 10-12%, as it supplies the essential parts and components, including engines, electrical systems, and luxury finishes, necessary for yacht upkeep. Lastly, the recreational boating market accounts for approximately 8-10%, as yachts fall under the broader category of recreational boats, and the demand for maintenance and refitting services is closely tied to the growth of recreational boating, particularly in regions with large yacht fleets. These parent markets illustrate the interconnected nature of the yacht maintenance and refit industry, which is driven by luxury, marine services, and the growing popularity of recreational boating.

The yacht maintenance and refit market is experiencing significant expansion, supported by the increasing global yacht fleet size and rising ownership among high-net-worth individuals. Regular maintenance and periodic refits are essential to preserve vessel performance, meet safety regulations, and maintain asset value, making them indispensable components of yacht lifecycle management. Market growth is further driven by evolving environmental compliance requirements and the integration of advanced propulsion, navigation, and energy efficiency systems into existing vessels.

As owners seek to modernize interiors, upgrade technology, and enhance sustainability, demand for skilled refit services is rising. Yards and service providers are investing in advanced facilities and workforce development to meet the growing need for specialized yacht servicing.

The market is also benefiting from the increased usage of yachts for charter and private purposes, which elevates the frequency of maintenance and system overhauls As the global yacht market becomes more active, maintenance and refit services are expected to remain the primary recurring expenditure category, ensuring long-term market growth driven by both operational necessity and luxury expectations.

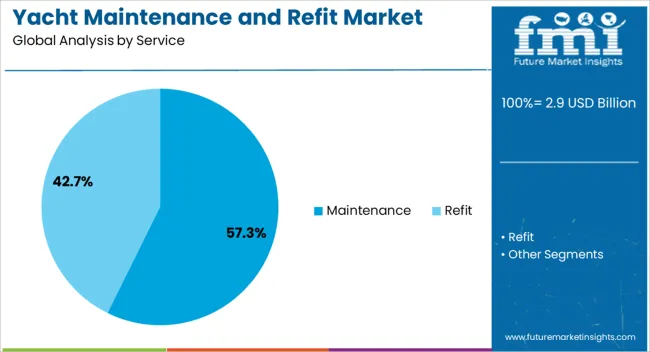

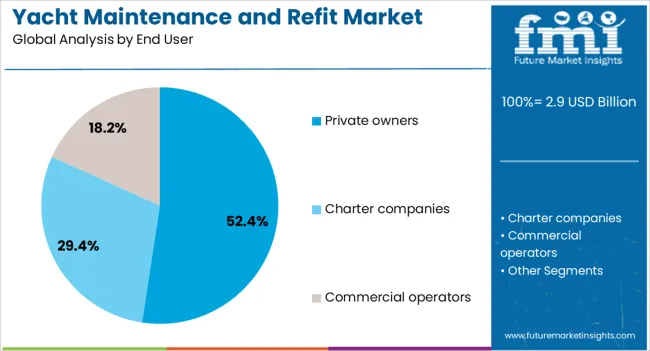

The yacht maintenance and refit market is segmented by service, end user, and geographic regions. By service, yacht maintenance and refit market is divided into maintenance and refit. In terms of end user, yacht maintenance and refit market is classified into private owners, charter companies, and commercial operators. Regionally, the yacht maintenance and refit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The maintenance service segment is projected to hold 57.3% of the yacht maintenance and refit market revenue share in 2025, making it the dominant service category. This leadership is attributed to the ongoing requirement for routine servicing, inspections, cleaning, mechanical tuning, and hull preservation, which are essential for keeping yachts seaworthy and compliant with maritime standards. Maintenance activities are typically scheduled at regular intervals and are mandatory for both safety and insurance coverage, ensuring consistent demand across all vessel sizes.

As the global fleet continues to expand, the cumulative need for periodic engine, electrical, and structural servicing is intensifying. Maintenance work also encompasses seasonal preparation and post-use inspections, especially in regions with defined yachting seasons. With owners prioritizing longevity and resale value, preventive maintenance practices are increasingly being adopted.

Additionally, marina-based service centers and mobile maintenance units are making services more accessible and responsive, further supporting segment growth As more yachts enter active use in both private and charter fleets, maintenance services are expected to maintain their lead as the most critical and recurring revenue stream in the market.

The private owners segment is expected to represent 52.4% of the yacht maintenance and refit market revenue share in 2025, establishing itself as the leading end user category. This dominance is driven by the growing base of individual yacht owners worldwide, particularly in Europe, North America, and the Middle East. Private owners often prioritize vessel customization, performance upgrades, and aesthetic enhancements, all of which contribute to sustained demand for maintenance and refit services.

Unlike charter operators, private owners are more inclined to invest in high-end finishes, bespoke interiors, and advanced onboard systems, making refit projects more comprehensive and frequent. Routine maintenance is also strictly observed by private owners to maintain asset value and ensure reliability during recreational use.

Many owners also employ full-time crew or management companies, which further ensures scheduled servicing is consistently executed As luxury yacht ownership continues to rise and vessels become more technologically complex, private owners are expected to remain the primary clients for service yards, reinforcing this segment’s leading position in the market.

The yacht maintenance and refit market is experiencing steady growth due to the increasing number of luxury yachts, rising demand for boat upgrades, and the need for regular maintenance to ensure operational safety and longevity. Yacht owners are increasingly opting for advanced refit services that enhance both performance and aesthetics. Challenges include the high costs of materials and labor, limited availability of skilled technicians, and regulatory requirements for safety and environmental standards. Opportunities lie in the growing demand for eco-friendly materials, retrofitting for energy efficiency, and smart yacht technologies. Trends indicate increased spending on luxury yacht refits, including interior overhauls, advanced navigation systems, and environmentally friendly propulsion systems. Suppliers who provide high-quality, specialized refit and maintenance services are well-positioned to capture market growth, particularly in regions with high concentrations of luxury yacht owners such as North America and Europe.

The yacht maintenance and refit market is benefiting from the increasing popularity of luxury yachts, particularly in regions like North America, Europe, and the Middle East. As the number of yacht owners grows, so does the demand for maintenance and refit services to ensure yachts perform optimally. Regular maintenance is crucial for extending the lifespan of these high-value assets, as yachts require specific care and upkeep to maintain their performance and appearance. Refitting services, including hull repairs, engine upgrades, interior renovations, and customizations, are becoming more sought after. Furthermore, owners are investing in advanced technologies and luxurious enhancements to ensure their yachts meet the latest standards and trends. As the trend toward luxury yachting continues, the demand for professional refit and maintenance services is expected to grow.

The yacht maintenance and refit market faces challenges related to the high costs of materials, skilled labor, and specialized equipment required for complex refit projects. Luxury yachts are often custom-built, which increases the complexity of repairs and upgrades. The demand for skilled technicians, boatbuilders, and engineers is rising, but supply is limited, which can lead to long lead times and higher service costs. Additionally, yachts are subject to strict regulatory requirements related to safety standards, emissions, and environmental concerns, particularly in certain regions. These regulations necessitate the use of certified materials and compliance with environmental protocols during refits, adding another layer of complexity to the market. Suppliers must navigate these challenges while maintaining high-quality service standards to remain competitive.

Opportunities in the yacht maintenance and refit market are growing in areas such as eco-friendly materials, energy-efficient upgrades, and the integration of smart technologies. As environmental concerns become more prevalent, yacht owners are seeking refit services that incorporate sustainable materials and technologies that reduce the environmental impact of their vessels. This includes retrofitting yachts with energy-efficient propulsion systems, solar panels, and low-emission engines. Additionally, the adoption of smart technologies such as advanced navigation systems, IoT-based monitoring, and automation in yacht systems is on the rise. As demand for these advanced refit services grows, companies offering specialized solutions in eco-friendly upgrades and smart yacht technologies are positioned to gain a competitive advantage.

The yacht maintenance and refit market is trending toward increased customization and interior overhauls. Yacht owners are increasingly seeking personalized refits to reflect their lifestyle and preferences, leading to a surge in demand for high-end interior designs, modern amenities, and innovative layouts. Additionally, advanced navigation systems, including radar, satellite communication, and GPS-based tracking, are becoming a key focus in yacht refits. The growing interest in luxury features such as swimming pools, spas, and expanded deck spaces is also contributing to the demand for refitting services. As these trends gain momentum, suppliers offering cutting-edge design capabilities, advanced technology integration, and superior craftsmanship are positioned to capitalize on the growing market for high-end yacht maintenance and refit services.

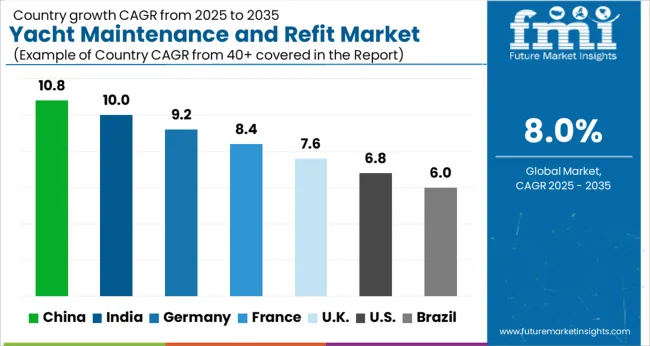

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

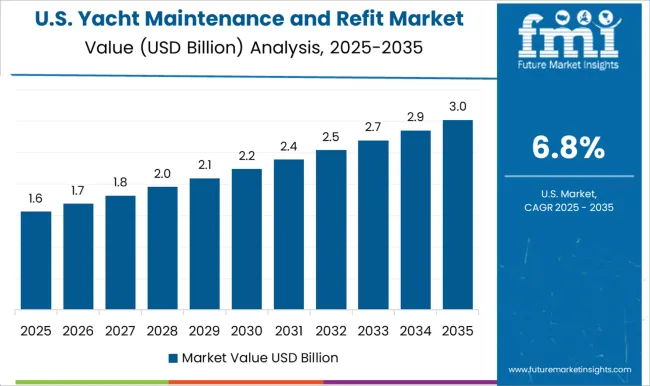

| USA | 6.8% |

| Brazil | 6.0% |

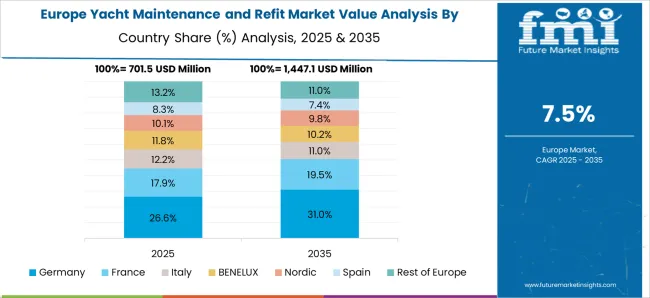

The global yacht maintenance and refit market is projected to grow at a CAGR of 8.0% from 2025 to 2035. China leads with 10.8%, followed by India at 10.0%, and France at 8.4%. The UK and USA show more moderate growth rates of 7.6% and 6.8%, respectively. Growth is primarily driven by the increasing number of luxury yacht owners, the rise in yacht charter services, and expanding coastal tourism. Additionally, advancements in yacht technology, increasing demand for eco-friendly solutions, and a focus on premium yacht services are key factors supporting the market’s expansion globally. The analysis includes over 40+ countries, with the leading markets detailed below.

The yacht maintenance and refit market in China is projected to grow at a robust CAGR of 10.8% from 2025 to 2035. As the world’s second-largest economy, China’s rising interest in luxury leisure activities and yachting is a key driver behind this growth. The increasing number of high-net-worth individuals, particularly in coastal cities like Shanghai, Shenzhen, and Hong Kong, is contributing to the demand for yacht maintenance and refit services. The country’s expanding yacht fleet, both in terms of new builds and second-hand purchases, is also contributing to the market’s growth. With China’s rapid development of marinas, boat clubs, and yachting hubs, the demand for specialized yacht maintenance and repair services is on the rise. Furthermore, China’s growing focus on improving marine infrastructure and regulatory changes surrounding yacht registrations and certifications are fostering the growth of yacht refit businesses.

The yacht maintenance and refit market in India is expected to grow at a CAGR of 10.0% from 2025 to 2035. India’s growing interest in luxury lifestyles, especially among the rising affluent population, is driving the demand for yacht ownership and related services. While the Indian yachting market is still in its nascent stages, the increase in leisure boating activities, especially in coastal cities such as Mumbai, Goa, and Kochi, is expected to create substantial opportunities for yacht maintenance and refit services. The country’s improving tourism sector, along with investments in luxury leisure infrastructure, is contributing to the demand for yacht refits. As more individuals invest in yachts for personal use or charter services, the need for reliable maintenance and refit services is expected to rise significantly.

The yacht maintenance and refit market in Franceis projected to grow at a CAGR of 8.4% from 2025 to 2035. France, with its rich maritime heritage and numerous luxurious coastlines along the Mediterranean, is a hub for yacht ownership and marine leisure activities. The growing number of private yacht owners and charter services, especially in regions like the French Riviera, is creating a consistent demand for yacht maintenance and refit services. France’s expanding superyacht industry, with increasingly luxurious and specialized vessels, is driving the need for high-end maintenance and renovation services. The country’s large network of marinas and its role as a global center for yachting events further contribute to the market's expansion. The French yacht maintenance market benefits from advanced technologies used in refitting, along with a skilled workforce offering specialized services to both domestic and international yacht owners.

The UK yacht maintenance and refit market is expected to grow at a CAGR of 7.6% from 2025 to 2035. The UK has a well-established yachting culture, with a large number of private yacht owners and marinas, particularly in coastal areas such as Southampton and Portsmouth. The demand for yacht maintenance and refit services is increasing as the country’s affluent population continues to invest in luxury yachts and recreational boating. The UK’s boating sector is growing due to the rising popularity of yachting as a leisure activity and the need for consistent upkeep and refurbishing. The UK is also home to some of the world’s leading yacht maintenance and repair companies, further driving demand. As yacht owners invest in maintenance and refits to extend the life and enhance the value of their vessels, the market is expected to grow steadily. The rise of environmentally conscious refit solutions also supports market expansion, as yacht owners seek eco-friendly options for their vessels.

The USA yacht maintenance and refit market is projected to grow at a CAGR of 6.8% from 2025 to 2035. The USA is one of the largest markets for yachting in the world, with significant growth in both private yacht ownership and yacht charter services. The country’s coastal regions, including Florida, California, and the East Coast, are prime areas for yacht ownership, further driving the demand for maintenance and refit services. With a growing number of luxury yacht owners and the expansion of the superyacht sector, the demand for specialized services such as engine maintenance, hull repairs, and interior refurbishing is increasing. Furthermore, the USA market benefits from a well-established network of skilled technicians, high-quality services, and advanced technologies for yacht refurbishing. The growing interest in sustainable, eco-friendly refitting options is also influencing the market, especially among environmentally conscious yacht owners.

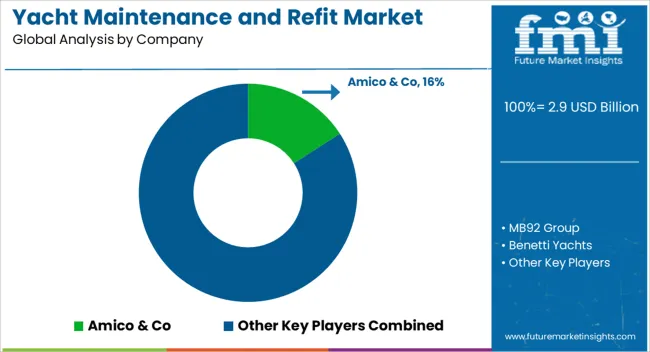

In the yacht maintenance and refit market, competition is driven by craftsmanship, service quality, and the ability to handle complex, custom refit projects. Amico & Co is a leading player, offering comprehensive maintenance and refit services for yachts of all sizes, with a strong reputation for high-quality work and attention to detail. The company’s strategic positioning in the Mediterranean ensures it caters to a wide range of luxury yacht owners seeking premium services. MB92 Group competes by offering full-service refit and repair facilities, specializing in large yachts. MB92’s advanced technical expertise and state-of-the-art facilities make it a go-to choice for high-end superyachts.

Benetti Yachts focuses on providing a full range of refit services, including bespoke refurbishments and customizations. The company’s legacy in luxury yacht construction gives it a competitive edge in the refit market, offering both new builds and comprehensive maintenance. Lürssen Yachts is a major competitor, known for its elite status in the superyacht sector. Lürssen offers high-end refit services, specializing in large, complex yacht projects, including structural changes, system upgrades, and aesthetic enhancements. Monaco Marine provides a full-service portfolio for yacht maintenance and refitting, with a focus on environmental sustainability in its services, offering efficient refit solutions and expert craftsmanship. Derecktor Shipyards and Heesen Yachts are prominent in the USA market, with expertise in both yacht construction and refit services. Heesen specializes in luxury yachts and custom projects, providing tailored solutions to suit individual client needs.

Oceanco is known for its exceptional design and refit capabilities, offering top-tier services for superyachts, ensuring they remain in pristine condition and up to date with the latest innovations. Northrop & Johnson and Pendennis Shipyard focus on high-end, bespoke yacht refits, offering personalized services that cater to every aspect of yacht maintenance, from hull repairs to complete overhauls. Product brochures highlight the expertise, customized services, and state-of-the-art facilities these companies offer, emphasizing their ability to handle complex, large-scale projects with precision and luxury standards. Whether it’s for hull work, interior refurbishments, or technological upgrades, these players provide specialized services tailored to the needs of yacht owners.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 billion |

| Service | Maintenance and Refit |

| End User | Private owners, Charter companies, and Commercial operators |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amico & Co, MB92 Group, Benetti Yachts, Lurssen Yachts, Monaco Marine, Derecktor Shipyards, Heesen Yachts, Oceanco, Northrop & Johnson, and Pendennis Shipyard |

| Additional Attributes | Dollar sales by service type (maintenance, refit, restoration), yacht type (motor yachts, sailing yachts), and service area (interior, exterior, mechanical, electrical). Demand dynamics are driven by the increasing number of luxury yacht owners, growing interest in sustainable and efficient yacht operations, and a desire to enhance yacht performance and aesthetics. Regional trends indicate robust growth in the Mediterranean, North America, and Asia-Pacific, driven by the rise in luxury tourism, yacht ownership, and high-net-worth individuals seeking bespoke services. |

The global yacht maintenance and refit market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the yacht maintenance and refit market is projected to reach USD 6.3 billion by 2035.

The yacht maintenance and refit market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in yacht maintenance and refit market are maintenance, routine maintenance, and others.

In terms of end user, private owners segment to command 52.4% share in the yacht maintenance and refit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yacht Shell Doors Market Size and Share Forecast Outlook 2025 to 2035

Yacht Market Size and Share Forecast Outlook 2025 to 2035

Yacht Rental Market Size and Share Forecast Outlook 2025 to 2035

Yacht Charter Market Analysis – Size, Share & Forecast 2025 to 2035

GCC Yacht Charter Service Market Analysis – Trends & Forecast 2025 to 2035

Competitive Overview of Luxury Yacht Market Share & Providers

Luxury Yacht Industry Analysis by Type, by Size, by Application , by Ownership, and by Region- Forecast for 2025 to 2035

Highway Maintenance Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Building Maintenance Unit (BMU) Market Size and Share Forecast Outlook 2025 to 2035

Conveyor Maintenance Industry Analysis in Australia - Size, Share, and Forecast Outlook 2025 to 2035

Catenary Maintenance Vehicle Market

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

AR Remote Maintenance Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Aerospace Maintenance Chemical Market - Trends & Forecast 2025 to 2035

Locomotive Maintenance Market Size and Share Forecast Outlook 2025 to 2035

Predictive Maintenance Market Analysis – Growth & Industry Trends through 2034

Golf Course Maintenance Robot Market Size and Share Forecast Outlook 2025 to 2035

Computerized Maintenance Management Systems (CMMS) Market Trends – Size, Share & Growth 2025–2035

Ship Repair and Maintenance Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA