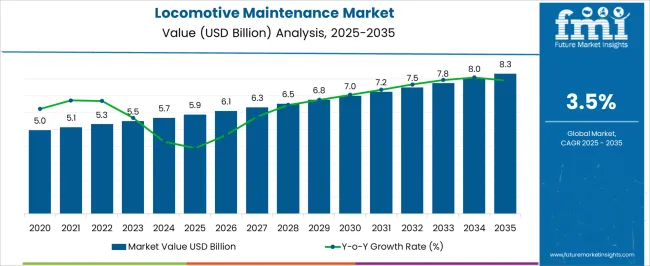

The locomotive maintenance market is estimated to be valued at USD 5.9 billion in 2025 and is projected to reach USD 8.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

The locomotive maintenance market is valued at USD 5.9 billion in 2025 and is expected to grow to USD 8.3 billion by 2035, with a CAGR of 3.5%. From 2021 to 2025, the market experiences steady growth from USD 5.0 billion to USD 5.9 billion, with values progressing through USD 5.1 billion, 5.3 billion, 5.5 billion, and 5.7 billion. This gradual increase is driven by ongoing investments in maintaining and modernizing rail fleets, as well as the need for improved safety, efficiency, and sustainability within the railway industry. The growth during this period is primarily contributed by essential maintenance services for existing locomotives.

Between 2026 and 2030, the market accelerates from USD 5.9 billion to USD 7.2 billion. During this period, values progress through USD 6.1 billion, 6.3 billion, 6.5 billion, 6.8 billion, and 7.0 billion, fueled by increasing demand for locomotive overhauls, advanced diagnostic tools, and digital maintenance technologies. The market also benefits from rising freight and passenger transport demand, especially in emerging economies investing in railway infrastructure.

From 2031 to 2035, the market reaches USD 8.3 billion, with incremental progress through USD 7.5 billion, 7.8 billion, and 8.0 billion. The growth contribution index during this phase is led by technological advancements in predictive maintenance and the expanding use of automation in locomotive servicing.

| Metric | Value |

|---|---|

| Locomotive Maintenance Market Estimated Value in (2025 E) | USD 5.9 billion |

| Locomotive Maintenance Market Forecast Value in (2035 F) | USD 8.3 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The locomotive maintenance market is a major driver, accounting for around 25-30%, as locomotives are critical components of railway systems, requiring regular maintenance to ensure optimal performance, reliability, and safety. The transportation and logistics market plays a significant role, contributing approximately 20-25%, since locomotives are integral to freight and passenger transportation, and maintaining them is crucial for minimizing downtime and ensuring smooth operations across transportation networks. The industrial equipment and machinery market also contributes around 15-20%, as locomotives are used in various industries like mining, manufacturing, and energy production, where they are essential for transporting raw materials and goods across long distances.

The automotive and heavy machinery market adds approximately 10-12%, as locomotive maintenance shares similar requirements with heavy machinery, such as engine repairs, inspections, and parts replacements, to maintain operational efficiency. Lastly, the energy and power market, particularly in regions with large freight transportation networks, contributes around 8-10%, as locomotives used for transporting energy resources, like coal and oil, need regular upkeep to ensure safe and efficient operations. These parent markets highlight the critical role of locomotive maintenance across transportation, logistics, industrial, and energy sectors, emphasizing the need for consistent and thorough servicing.

The locomotive maintenance market is experiencing steady expansion, supported by the increasing need for reliable, safe, and efficient railway operations across global freight and passenger networks. As governments and private operators invest in modernizing rail infrastructure and extending the life of rolling stock, maintenance services are gaining strategic importance. The growing emphasis on operational efficiency, fuel performance, and asset lifecycle management is driving demand for predictive and condition-based maintenance practices.

Technological advancements such as digital diagnostics, real-time performance monitoring, and component-specific health tracking are transforming traditional maintenance into intelligent, data-driven services. Aging locomotive fleets, especially in emerging economies, are further increasing the demand for specialized maintenance services aimed at extending service life while reducing unplanned downtimes.

Additionally, regulatory mandates focusing on emissions control, safety compliance, and equipment reliability are encouraging operators to prioritize regular and comprehensive maintenance As digital transformation reshapes the rail industry and fleet optimization becomes a key operational objective, the locomotive maintenance market is expected to witness continued growth driven by both technological innovation and infrastructure development.

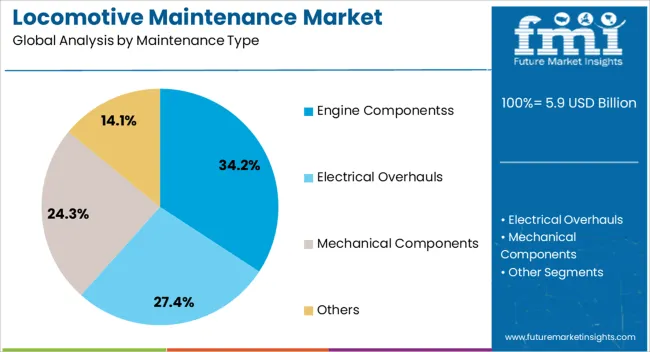

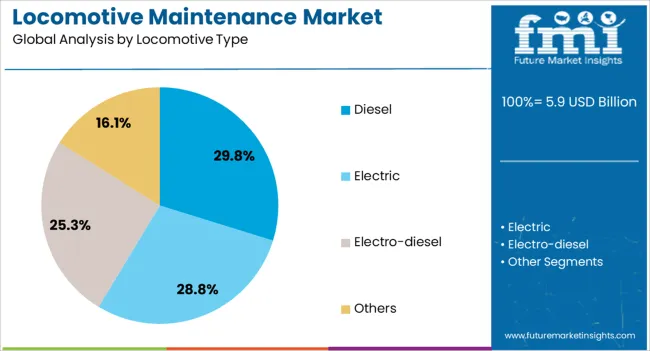

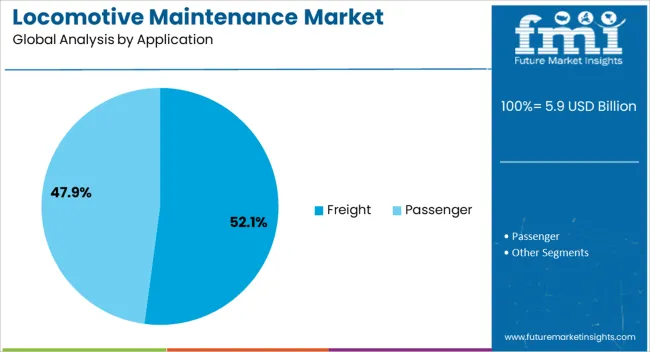

The locomotive maintenance market is segmented by maintenance type, locomotive type, application, service provider, and geographic regions. By maintenance type, locomotive maintenance market is divided into engine componentss, electrical overhauls, mechanical components, and others. In terms of locomotive type, locomotive maintenance market is classified into diesel, electric, electro-diesel, and others. Based on application, locomotive maintenance market is segmented into freight and passenger. By service provider, locomotive maintenance market is segmented into OEM, third party, and operator. Regionally, the locomotive maintenance industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The engine components segment is expected to hold 34.2% of the locomotive maintenance market revenue share in 2025, establishing it as the leading maintenance type. This leadership is being driven by the engine’s critical role in overall locomotive functionality and performance. As the most complex and high-stress component in a locomotive, the engine requires frequent inspection, repair, and part replacement to ensure consistent power output, fuel efficiency, and emissions compliance.

Increased operational hours, especially in freight-heavy regions, are contributing to higher wear and tear on engine components, necessitating more frequent servicing cycles. Technological advancements in engine diagnostics and sensor integration are enabling early detection of component degradation, allowing for timely maintenance interventions.

The demand for cleaner and more fuel-efficient engines is also leading operators to invest in upgrading and maintaining existing systems rather than full replacements Additionally, stringent emission norms and performance standards are pushing fleet operators to maintain engine systems in optimal condition, reinforcing the segment’s dominant share within the overall market.

The diesel locomotive segment is projected to account for 29.8% of the locomotive maintenance market revenue share in 2025, making it the leading locomotive type in maintenance demand. This prominence is being driven by the widespread use of diesel locomotives in non-electrified rail networks, particularly across emerging economies and long-haul freight corridors. Diesel engines require frequent maintenance due to their mechanical complexity and continuous exposure to high thermal and mechanical stresses.

The need to ensure operational reliability, reduce fuel consumption, and meet evolving emission regulations is reinforcing demand for regular servicing of diesel units. As many regions continue to operate hybrid or legacy diesel fleets, maintenance remains a cost-effective solution to prolong asset life without complete fleet overhaul.

Component-level innovations and retrofitting strategies are also allowing operators to modernize diesel locomotives incrementally, further encouraging continued investment in maintenance While electrification projects are underway in several regions, diesel locomotives are expected to retain a significant share in global operations, sustaining demand for their maintenance services well into the forecast period.

The freight application segment is anticipated to command 52.1% of the locomotive maintenance market revenue share in 2025, positioning it as the most dominant application area. This dominance is being driven by the high utilization rates and long operational cycles associated with freight locomotives, which result in accelerated component wear and maintenance needs. Freight locomotives are subjected to heavy loads, long-distance hauls, and often harsh environmental conditions, all of which increase the frequency and complexity of required maintenance.

Rising global trade volumes, expansion of rail freight corridors, and the emphasis on efficient cargo movement are further increasing the workload on freight fleets. As logistics companies prioritize delivery reliability and cost control, preventive and condition-based maintenance strategies are being widely adopted to minimize downtime and optimize fleet performance.

Moreover, the integration of digital monitoring systems in freight locomotives is enabling predictive maintenance, allowing for timely interventions before failures occur The critical role of rail freight in industrial supply chains ensures that freight-focused maintenance services will remain essential for uninterrupted operations and long-term asset value preservation.

The locomotive maintenance market is growing as the demand for efficient, reliable, and safe rail transport continues to rise globally. Regular maintenance and timely repairs are critical to ensuring the longevity of locomotives and minimizing unplanned downtime, which can disrupt service operations. The market is driven by the increasing number of rail passengers and freight transport, along with the modernization of existing locomotive fleets to improve fuel efficiency, safety, and environmental performance. Challenges include the high costs associated with parts replacement, labor, and compliance with stringent safety regulations. Opportunities are emerging in predictive maintenance technologies, which leverage IoT and AI to improve maintenance scheduling and reduce operational disruptions. Trends indicate an increasing focus on the development of eco-friendly locomotives and advanced diagnostic systems to improve the efficiency and reliability of rail networks. Suppliers offering advanced maintenance solutions, smart diagnostics, and sustainable locomotive parts are well-positioned for growth.

The locomotive maintenance market is being driven by the increasing demand for reliable, efficient, and safe rail transport services worldwide. Rail transport continues to grow as an important mode of both passenger and freight transport, especially with the rise of high-speed trains and the need for efficient supply chains. As rail networks expand and evolve, maintaining locomotives in optimal condition becomes critical to ensure smooth and continuous operations. Regular maintenance helps prevent costly delays, improves fuel efficiency, and extends the lifespan of locomotive assets. The rise in demand for cleaner and more efficient locomotives, particularly in freight transport, is further fueling the growth of the market, as companies seek to minimize environmental impact and operational costs.

The locomotive maintenance market faces several challenges, primarily related to the high costs of maintenance, spare parts, and skilled labor. Locomotive repairs often require specialized parts, which can be expensive, and extended downtime due to maintenance can disrupt services and lead to revenue loss. In addition, the complexity of maintaining different types of locomotives—especially those with advanced or hybrid technologies—requires skilled technicians and training, further driving up costs. Regulatory compliance with safety standards, particularly in regions like Europe and North America, can also increase operational expenses. The need for regular inspections and the adoption of new technologies such as predictive maintenance can also add to the market's technical constraints. Manufacturers and service providers must focus on cost-effective solutions and regulatory compliance while maintaining high-quality services.

Opportunities in the locomotive maintenance market are growing with the rise of predictive maintenance technologies and smart diagnostics. These technologies allow operators to monitor the health of locomotives in real time, detect faults early, and schedule maintenance before a failure occurs. By using IoT sensors and AI-driven analytics, predictive maintenance reduces unplanned downtime, optimizes the use of spare parts, and helps extend the lifespan of locomotives. This shift towards data-driven decision-making is expected to reduce overall maintenance costs and improve operational efficiency. Additionally, smart diagnostics systems are enabling better fault detection, reducing the need for manual inspections and enabling maintenance teams to focus on high-priority tasks. As these technologies become more widely adopted, there is significant potential for growth in the market, particularly in regions with advanced rail networks.

The locomotive maintenance market is witnessing several trends, including the growing adoption of eco-friendly locomotives and advanced diagnostic systems. As environmental regulations become stricter and sustainability becomes a key focus in the transportation industry, rail operators are looking for ways to reduce emissions and energy consumption. This is driving the demand for hybrid and electric locomotives, which require specialized maintenance services and parts. In parallel, there is a significant shift toward the integration of advanced diagnostic systems that offer real-time data on locomotive performance, reducing the risk of costly failures and improving overall maintenance efficiency. The use of AI, machine learning, and big data analytics is further enhancing the accuracy of predictive maintenance tools. As these trends continue, locomotive maintenance services will become more technology-driven and focused on operational efficiency, safety, and environmental sustainability.

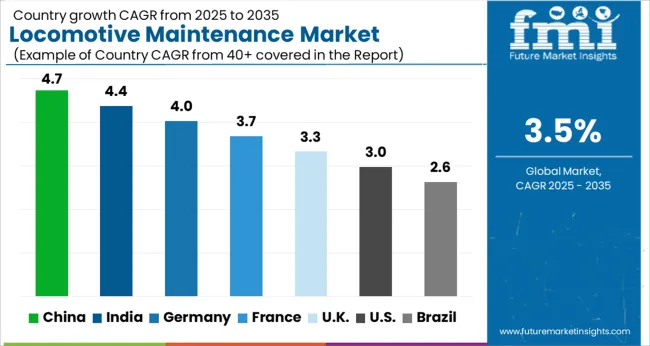

| Country | CAGR |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| France | 3.7% |

| UK | 3.3% |

| USA | 3.0% |

| Brazil | 2.6% |

The global locomotive maintenance market is projected to grow at a CAGR of 3.5% from 2025 to 2035. China leads with a growth rate of 4.7%, followed by India at 4.4% and France at 3.7%. The UK and USA show more moderate growth rates of 3.3% and 3.0%, respectively. The demand for locomotive maintenance services is being driven by infrastructure development, modernization of rail networks, and the need for advanced maintenance solutions in high-speed and freight trains. Additionally, the adoption of technologies like automation and predictive maintenance is further boosting the growth of the market. The analysis spans over 40+ countries, with the leading markets shown below.

The locomotive maintenance market in China is projected to grow at a CAGR of 4.7% from 2025 to 2035. The country’s rapid urbanization and extensive railway network, one of the largest in the world, are driving the demand for locomotive maintenance services. With a significant increase in high-speed rail and freight transportation projects, China’s rail infrastructure is expanding rapidly, creating a growing need for regular maintenance and servicing of locomotives. The government’s heavy investments in railway development, including modernizing tracks and stations, are encouraging the growth of the maintenance sector. As China focuses on sustainable and efficient rail transportation, the demand for advanced locomotive technologies and maintenance solutions, such as predictive analytics and automated diagnostics, is expected to rise.

The locomotive maintenance market in India is set to grow at a CAGR of 4.4% from 2025 to 2035. India’s rail network is one of the largest in the world, and the demand for locomotive maintenance services is closely tied to the country’s plans for infrastructure development. With the Indian government investing heavily in modernizing its railway systems, including the introduction of high-speed trains and upgraded freight services, the demand for regular maintenance is expected to increase. The growing trend towards rail-based transportation to reduce road congestion and carbon emissions will contribute to the rising demand for locomotive maintenance. As India moves toward modernizing its fleet with advanced technologies, including electrification and automation, there is a greater need for specialized maintenance solutions. The government’s commitment to improving railway safety and operational efficiency is also driving the market.

The locomotive maintenance market is projected to expand at a CAGR of 3.7% from 2025 to 2035. France’s rail network plays a vital role in the movement of passengers and freight. The growing trend of high-speed trains and the increasing demand for efficient rail freight services are driving the need for advanced locomotive maintenance solutions. The French government’s focus on expanding and upgrading the rail infrastructure is further boosting the demand for maintenance services. As the country adopts more energy-efficient rail systems, including electrification and automation, the demand for regular and preventive maintenance services for locomotives and rail infrastructure will rise. The increase in international rail connections and the need for cross-border transportation services is further contributing to market growth. France is also adopting predictive maintenance technologies to reduce downtime and improve operational efficiency, making it a crucial market for innovation in locomotive maintenance services.

The UK locomotive maintenance market is expected to grow at a CAGR of 3.3% from 2025 to 2035. The UK is increasingly modernizing its rail network with the introduction of high-speed trains and efforts to improve rail infrastructure, such as the High-Speed 2 (HS2) project. As the demand for rail transportation continues to rise, particularly for freight and intercity travel, the need for locomotive maintenance services is also expanding. The UK government’s focus on enhancing railway safety, reducing carbon emissions, and improving operational efficiency is driving the adoption of new technologies in maintenance, such as automated diagnostic tools and real-time monitoring systems. As the rail industry moves toward electrification and greener alternatives, regular maintenance of locomotives, including upgrading systems and components, will become even more crucial. The UK market is also benefiting from the increasing emphasis on preventative maintenance and the introduction of more flexible and efficient service models.

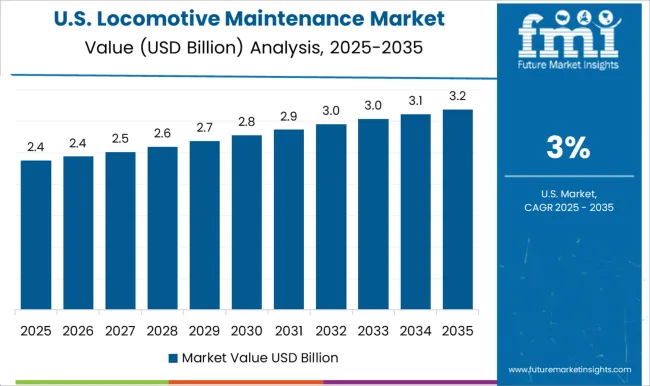

The USA locomotive maintenance market is forecasted to grow at a CAGR of 3.0% from 2025 to 2035. The USA has one of the largest freight rail networks in the world, and the demand for maintenance services is driven by the country’s extensive use of rail for cargo transportation. As the USA invests in infrastructure modernization, including upgrading freight services and introducing high-speed rail projects, there is a growing need for maintenance services for locomotives and related systems. With a focus on reducing emissions and improving fuel efficiency, the adoption of electric and hybrid locomotives is increasing, which will drive the demand for specialized maintenance services. The USA market is also witnessing an increase in the use of advanced technologies, such as predictive maintenance and condition-based monitoring systems, which improve operational efficiency and reduce downtime.

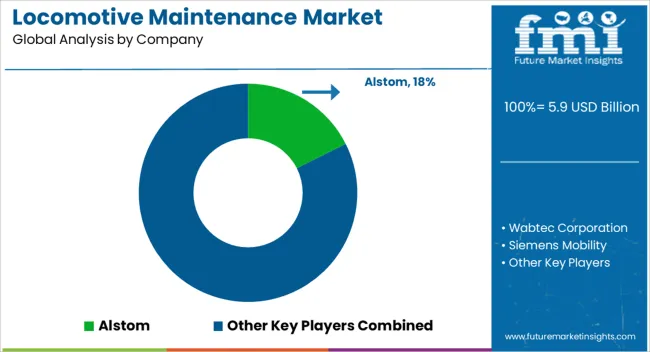

The locomotive maintenance market is driven by the increasing demand for efficient and reliable transportation, particularly in the rail and freight industries. Alstom is a dominant player in the market, offering comprehensive locomotive maintenance solutions, including repair, overhaul, and upgrades for electric and diesel-powered locomotives. The company focuses on ensuring optimal performance and compliance with environmental and safety standards, while providing long-term support services to railway operators. Wabtec Corporation is another major competitor, offering a wide range of locomotive maintenance services, including diagnostics, component replacement, and performance optimization.

Wabtec’s technology-driven solutions, particularly in terms of predictive maintenance, provide significant value to customers looking for operational efficiency. Siemens Mobility competes by offering advanced digital services for locomotive maintenance, leveraging its expertise in automation and control systems to monitor and maintain locomotive performance. The company’s solutions help reduce downtime and improve fleet management through predictive analytics and IoT integration. GE Transportation, now part of Wabtec, focuses on providing integrated maintenance and optimization solutions for locomotives, emphasizing increased reliability, fuel efficiency, and operational cost reduction.

The company’s digital services, such as condition monitoring and predictive analytics, offer significant value to the rail sector. CRRC, a Chinese multinational corporation, provides maintenance services for a wide range of locomotives, including high-speed trains and freight vehicles. The company’s advanced capabilities in electric locomotive technology make it a strong competitor, especially in the Asian market. Hitachi Rail offers tailored maintenance packages, with a strong focus on preventive maintenance and lifecycle management, ensuring that locomotives remain in optimal condition for extended periods. Progress Rail and Stadler Rail focus on providing specialized locomotive maintenance services, ensuring high performance, safety, and operational efficiency.

CAD Railway Industries and Network Rail focus on providing comprehensive repair, maintenance, and overhaul services, specifically for heavy-duty freight locomotives and infrastructure. Competitive strategies across these companies involve providing high-quality, customized maintenance solutions that leverage digital technologies, predictive analytics, and advanced diagnostics to improve operational efficiency and reduce downtime. Product brochures from these companies highlight their ability to offer full-service maintenance packages, including diagnostics, preventive care, spare parts, and fleet management solutions, ensuring the longevity and reliability of locomotives across various regions and sectors.

| Items | Values |

|---|---|

| Quantitative Units | USD 5.9 billion |

| Maintenance Type | Engine Componentss, Electrical Overhauls, Mechanical Components, and Others |

| Locomotive Type | Diesel, Electric, Electro-diesel, and Others |

| Application | Freight and Passenger |

| Service Provider | OEM, Third party, and Operator |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alstom, Wabtec Corporation, Siemens Mobility, GE Transportation, CRRC, Hitachi Rail, Progress Rail, Stadler Rail, CAD Railway Industries, and Network Rail |

| Additional Attributes | Dollar sales by service type (preventive maintenance, corrective maintenance, predictive maintenance), locomotive type (freight, passenger), and service area (engine maintenance, bodywork, component repair). Demand dynamics are driven by the increasing adoption of modern locomotives, the need for extended equipment life, and the growing demand for sustainable rail operations. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with increasing investments in rail infrastructure modernization, fleet upgrades, and the rise of digitized maintenance technologies to ensure efficient and reliable rail operations. |

The global locomotive maintenance market is estimated to be valued at USD 5.9 billion in 2025.

The market size for the locomotive maintenance market is projected to reach USD 8.3 billion by 2035.

The locomotive maintenance market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in locomotive maintenance market are engine componentss, electrical overhauls, mechanical components and others.

In terms of locomotive type, diesel segment to command 29.8% share in the locomotive maintenance market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Locomotive Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Locomotive Lighting Batteries Market Analysis - Size, Share & Forecast 2025 to 2035

Locomotive Wiring Harness Market Growth – Trends & Forecast 2023-2033

Locomotive Traction Transformer Market Growth – Trends & Forecast 2025 to 2035

Locomotive Pantographs Market Growth – Trends & Forecast 2025 to 2035

Locomotive Drive Shaft Market Growth - Trends & Forecast 2024 to 2034

Locomotive Radiator Fans Market Growth - Trends & Forecast 2024 to 2034

Locomotive Doors Market Growth – Trends & Forecast 2024 to 2034

USA Locomotive Pantographs Market Trends – Size, Demand & Forecast 2025-2035

Japan Locomotive Pantographs Market Outlook – Size, Share & Innovations 2025-2035

India Locomotive Pantographs Market Report – Size, Share & Demand Trends 2025-2035

China Locomotive Pantographs Market Analysis – Demand, Growth & Forecast 2025-2035

Mining Locomotive Market

Germany Locomotive Pantographs Market Growth – Innovations, Trends & Forecast 2025-2035

Yacht Maintenance and Refit Market Size and Share Forecast Outlook 2025 to 2035

Highway Maintenance Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Building Maintenance Unit (BMU) Market Size and Share Forecast Outlook 2025 to 2035

Conveyor Maintenance Industry Analysis in Australia - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA