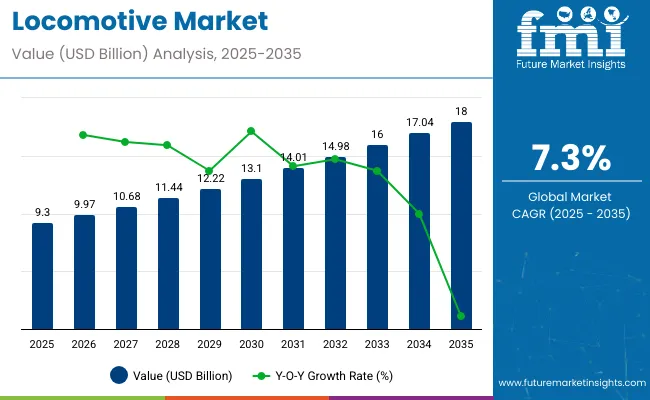

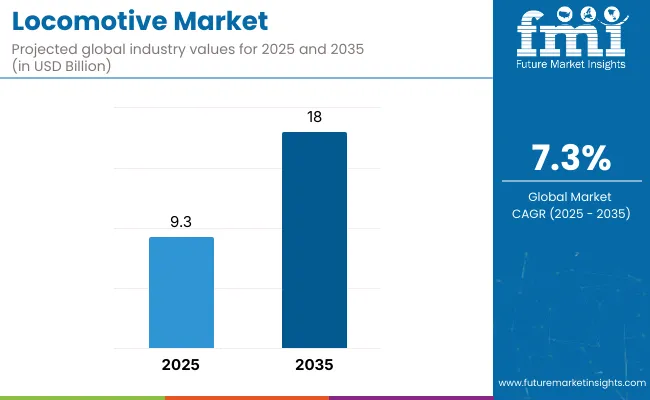

The global locomotive market is anticipated to reach USD 9.3 billion in 2025 and USD 18 billion by 2035, growing at a CAGR of 7.3%, representing a multiplying factor of approximately 1.94 over the decade. Growth is driven by rising rail freight demand, expansion of rail infrastructure, and modernization of passenger rail networks.

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 9.3 billion |

| Market Forecast Value in (2035F) | USD 18 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

Investment in advanced locomotive technologies, including fuel-efficient engines, hybrid systems, and digital controls, supports long-term value accumulation. Market expansion is shaped by government initiatives, regional rail development, and a shift toward rail transport for both cargo and passengers.

The long-term value accumulation curve shows steady growth with phases of accelerated gains linked to technology adoption and network upgrades. Early stages reflect investments in fleet expansion and modernization, while mid-cycle periods benefit from efficiency improvements and regulatory incentives. By 2035, with a market value of 18 billion and nearly double the 2025 value, the curve is expected to steepen as advanced locomotives see broader adoption and rail networks integrate further. Strategic deployment of energy-efficient locomotives, digital monitoring systems, and optimized fleet management enables operators to navigate cyclical fluctuations while maximizing long-term returns, underlining the sector’s resilience and growth potential over the next decade.

The locomotive market is influenced by several core parent industries. Rail transport and operations account for about 45%, reflecting demand from freight and passenger operators. Engine and propulsion manufacturing contributes roughly 25%, covering diesel, electric, and hybrid engine systems. Rail infrastructure and signaling holds close to 15%, encompassing tracks, control systems, and electrification. Maintenance and repair services represent around 10%, supporting fleet reliability and lifecycle extension. Metal fabrication and component suppliers add approximately 5%, providing structural parts, bogies, and other critical assemblies.

The sector is advancing through electrification, hybrid propulsion, and automation. Manufacturers are increasingly introducing hybrid and battery-powered models to reduce emissions and energy costs. Digital solutions, including predictive maintenance, AI-driven performance monitoring, and remote diagnostics, are improving operational efficiency. Global operators are standardizing fleets to streamline maintenance and training while reducing costs. Lightweight materials, aerodynamic designs, and energy-efficient propulsion systems are gaining traction. Strategic alliances between rail operators, component suppliers, and technology providers are accelerating adoption of next-generation locomotives and integrating smart systems for safety, performance, and sustainability in long-haul freight and passenger services.

The global locomotive market is projected to reach USD 9.3 billion in 2025 and USD 18 billion by 2035, growing at a CAGR of 7.3%. Diesel-electric locomotives continue to dominate, while electric and hybrid units are gaining traction in high-density freight and passenger corridors. Asia Pacific accounts for over 40% of new orders due to expanding rail networks and urban metro projects. Europe and North America focus on modernizing fleets with energy-efficient units. Increased freight demand, passenger mobility growth, and infrastructure upgrades support market expansion across major regions.

Driving Force Expansion of Freight and Passenger Networks

Rising industrial production and urbanization are driving locomotive demand for both freight and passenger applications. High-density freight routes are increasingly adopting electric traction to reduce fuel costs and emissions. Investment in high-speed rail projects in Asia and Europe is boosting the deployment of advanced passenger locomotives. Predictive maintenance and energy-efficient engines lower operational costs and reduce downtime, while government investments of USD 12-15 billion annually for rail modernization are fueling fleet replacement cycles.

Growth Avenue Technological Integration and Electrification

The shift toward electric and hybrid locomotives is accelerating, with electric units expected to account for nearly 38% of new orders by 2030. Battery-electric and hydrogen fuel cell technologies are being trialed for regional passenger services. Digital fleet management and driver-assist systems optimize routing, predictive maintenance, and energy efficiency. Modular designs allow retrofitting older fleets, extending service life and reducing lifecycle costs.

Emerging Trend Sustainable and High-Efficiency Operations

Locomotive manufacturers are focusing on energy-efficient designs, regenerative braking, and lightweight materials, reducing energy consumption by nearly 10%. Smart track integration and signaling systems improve operational efficiency on congested routes. Emerging markets are upgrading infrastructure to allow higher axle loads, increasing cargo capacity. Environmental compliance and efficiency improvements are driving adoption of modern locomotives while lowering operating costs.

Market Challenge High Capital Costs and Regulatory Compliance

New locomotives cost between USD 2.5 million for regional diesel units and over USD 12 million for high-speed electric trains. Maintenance, infrastructure adaptation, and emission compliance further raise total expenditure. Supply chain limitations for steel, electronics, and traction motors can delay production by 6-9 months. Fluctuating raw material and labor costs challenge operators aiming to modernize fleets while maintaining profitability.

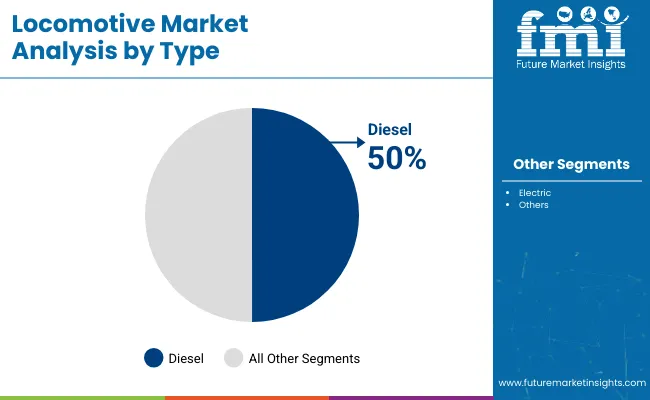

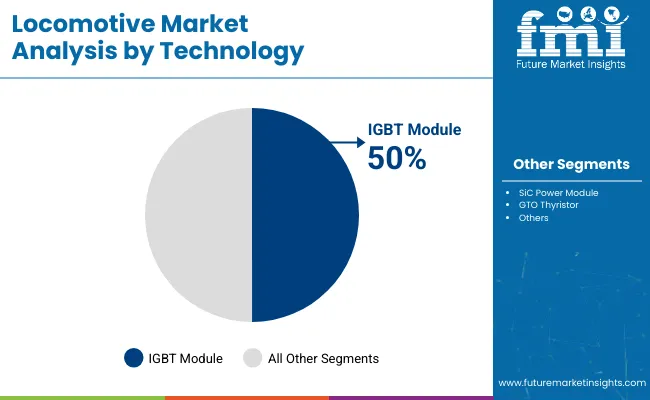

The global locomotive market is primarily segmented by type, technology, component, and end-use. Diesel locomotives dominate regions with limited electrification, while electric locomotives are preferred on high-speed corridors. Traction motor efficiency and IGBT module adoption are central to fleet modernization, enhancing reliability and energy management. Freight operations are the largest end-use segment, driving locomotive production volumes. Manufacturers such as Siemens, CRRC, Alstom, Bombardier, and General Electric focus on high-horsepower engines, energy-efficient power electronics, and regenerative braking solutions.

Diesel locomotives command 50% of the market, deployed mainly for freight and regional passenger transport. Electric locomotives hold 40% and are increasingly integrated into urban rail networks. Other types account for 10% and serve industrial or niche switching roles. Companies such as CRRC and General Electric operate diesel fleets capable of hauling 4,000-6,000 tons over 1,500 km per trip. Diesel engines continue to be cost-effective in regions without electrification, providing reliability and ease of maintenance. Fleet expansion is driven by increasing freight volumes and logistics requirements. Diesel locomotives are also being retrofitted with hybrid systems to reduce fuel consumption and emissions over long-haul routes.

IGBT modules capture 50% share due to high voltage tolerance and efficiency in traction inverters, supporting both electric and hybrid diesel-electric locomotives. SiC modules are used in high-speed corridors, representing 30%, while GTO thyristors continue at 20%. IGBT modules improve acceleration, regenerative braking, and energy recovery efficiency. Siemens, Alstom, CRRC, and Hitachi are deploying IGBT-based systems in locomotives with traction outputs up to 6,000 kW. Market adoption is strongest in freight operations requiring precise control over power-intensive loads. Research indicates IGBT-equipped locomotives can cut energy loss by 18% compared with GTO-based systems.

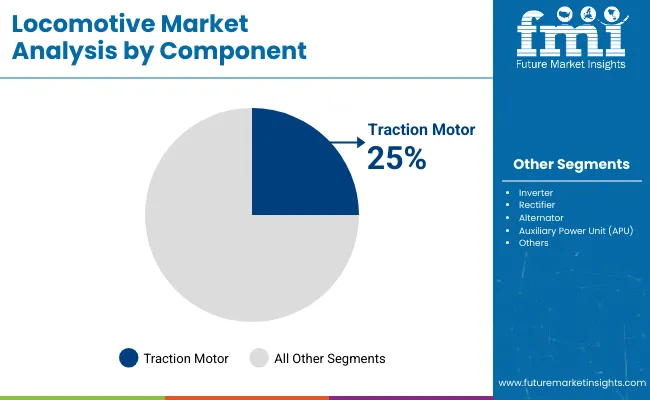

Traction motors hold 25% of component market share, converting electrical energy into mechanical motion for diesel, electric, and hybrid locomotives. Inverters follow at 20%, while rectifiers, alternators, and APUs each account for 15%. High-performance traction motors deliver torque ratings between 3,000-7,000 Nm, suitable for long-haul freight or passenger services at speeds of 80-200 km/h. Siemens, Bombardier, CRRC, and Alstom produce traction motors with enhanced thermal management and reduced weight for efficiency. Fleet operators report up to 10% reduction in maintenance cycles with upgraded motor designs. Manufacturing capacity is concentrated in Asia, Europe, and North America, reflecting regional rail investment patterns.

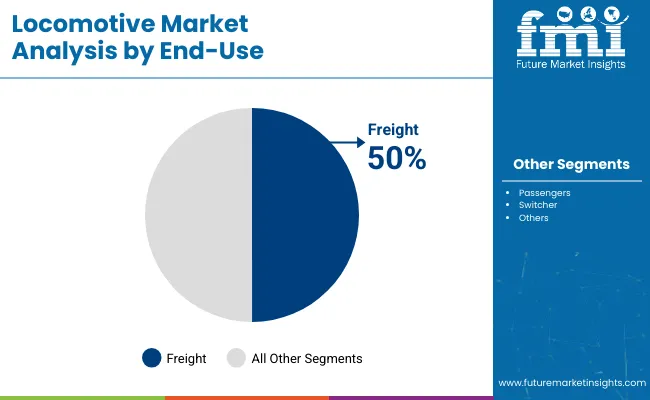

Freight locomotives account for 50% of demand, transporting bulk, intermodal, and industrial cargo. Passenger locomotives follow at 40%, while switcher locomotives represent 10%. High-powered locomotives of 3,500-4,500 horsepower are common on freight routes spanning 1,000-3,000 km. General Electric, CRRC, and Alstom maintain large fleets dedicated to freight, especially in North America and Asia. Fleet expansion focuses on high-capacity traction motors, IGBT modules, and regenerative braking for energy efficiency. Infrastructure development, such as upgraded freight corridors and intermodal terminals, further supports locomotive demand in industrially active regions.

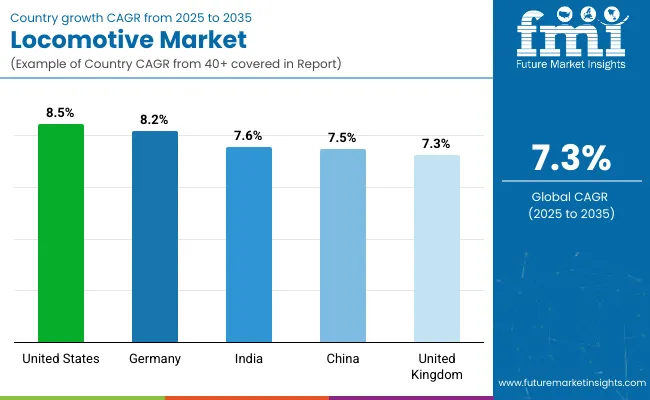

The global market is growing at a CAGR of 7.3% from 2025 to 2035. The United States leads at 8.5%, +16% above the global average, driven by OECD-supported fleet modernization and technological upgrades. Germany follows at 8.2%, +12% higher than the global rate, reflecting OECD investment in high-speed and freight locomotive improvements. India records 7.6%, +4% above the global CAGR, supported by BRICS-linked expansion in passenger and freight rail networks. China stands at 7.5%, +3% above the global rate, with BRICS-driven industrial rail and infrastructure projects accelerating demand. The United Kingdom matches the global rate at 7.3%, showing steady growth through OECD-backed network upgrades. The OECD markets are leading technology-focused expansion, while BRICS countries like India and China drive volume growth through infrastructure and industrial development.

The United States locomotive industry is projected to grow at a CAGR of 8.5%, exceeding the global 7.3%. Expansion is driven by freight demand, modernization of rail infrastructure, and government investments in electric and hybrid locomotives. High-volume cargo transport and regional logistics optimization contribute to increased fleet utilization. By 2030, the US is expected to account for around 20% of global locomotive demand. Technological adoption, including energy-efficient engines and predictive maintenance systems, supports accelerated growth. Despite rising competition from Asia and Europe, domestic investment in rail networks maintains a higher than average CAGR.

The Demand of locomotives in Germany is expected to expand at a CAGR of 8.2%, above the global 7.3%. Growth is supported by strong freight and passenger rail demand, technological upgrades, and electrification programs. Germany is projected to account for nearly 12% of European locomotive demand by 2030. Investments focus on energy-efficient engines, digital train control, and network optimization. Regulatory frameworks promoting low-emission transport further accelerate modernization efforts. Fleet replacement programs and infrastructure upgrades support consistent growth, maintaining a CAGR above the global average.

India is projected to grow at a CAGR of 7.6%, slightly above the global 7.3%. Expansion is driven by freight corridor development, electrification projects, and increased passenger rail demand. By 2030, India is expected to account for roughly 10% of global locomotive demand. Government initiatives to modernize rail yards and introduce high-capacity locomotives support steady growth. Adoption of energy-efficient engines and predictive maintenance technologies enhances operational reliability. Despite infrastructure challenges and fleet limitations, market modernization programs keep growth slightly above global levels.

The Demand of locomotive in China is projected to grow at a CAGR of 7.5%, slightly above the global 7.3%. Growth is fueled by high freight transport volumes, expansion of high-speed rail networks, and modernization of locomotive fleets. By 2030, China is expected to represent around 25% of global demand. Investments in energy-efficient engines, hybrid systems, and predictive maintenance contribute to operational efficiency. Government-led infrastructure projects and increased domestic freight volumes maintain steady growth. Despite being marginally higher than global CAGR, market maturity and regulatory oversight moderate acceleration.

The United Kingdom locomotive market is expected to expand at a CAGR of 7.3%, matching the global growth rate. Growth is driven by freight modernization, electrification programs, and maintenance upgrades. By 2030, the UK is expected to contribute approximately 5% of global locomotive demand. Investment in energy-efficient engines, digital signaling systems, and network optimization supports steady expansion. Regulatory compliance and emissions reduction initiatives influence operational strategies. Moderate fleet expansion combined with infrastructure improvements keeps growth aligned with global levels.

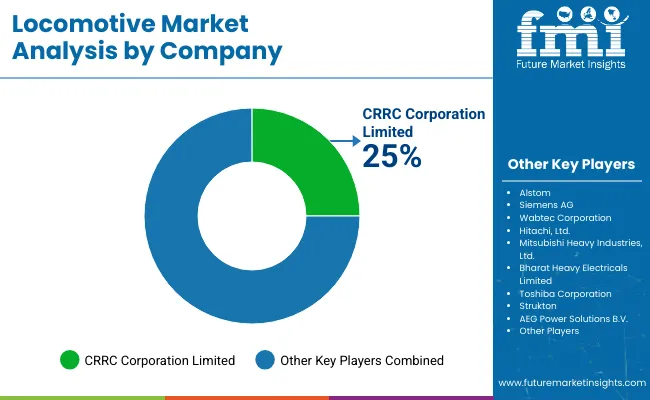

Top Player - CRRC Corporation Limited - 25%

The industry is shaped by a mix of established manufacturers and emerging players that focus on product diversification, fleet expansion, and strategic partnerships. CRRC Corporation Limited has strengthened its position through large-scale contracts with multiple railway operators and continuous development of high-capacity locomotives. Alstom and Siemens AG concentrate on advanced electric and diesel-electric locomotive offerings, while Wabtec Corporation emphasizes retrofit solutions and modernization services for older fleets. Hitachi, Ltd. and Mitsubishi Heavy Industries, Ltd. focus on regional projects and turnkey solutions, whereas Bharat Heavy Electricals Limited leverages its domestic manufacturing base to supply locomotives for national rail networks. Emerging players such as Strukton and Toshiba Corporation are exploring niche segments, including lightweight locomotives and modular designs, to gain a foothold in competitive markets.

Key strategies in this sector include research and development to improve efficiency, customized solutions for freight and passenger operations, and alliances with regional operators to expand global presence. AEG Power Solutions B.V. is investing in power management systems for locomotives, while Alstom recently launched new electric locomotive models for long-distance routes. These efforts illustrate how both established and emerging players are shaping the locomotive industry through innovation, targeted product launches, and strategic collaborations, ensuring they remain competitive in a rapidly evolving market.

Recent Industry News

| Report Attributes | Details |

| Market Size (2025) | USD 9.3 billion |

| Projected Market Size (2035) | USD 18 billion |

| CAGR (2025 to 2035) | 7.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Type Segments Analyzed | Diesel, Electric, Other |

| Technology Segments Analyzed | IGBT Module, GTO Thyristor, SiC Power Module |

| Component Segments Analyzed | Rectifier, Traction Motor, Alternator, Inverter, Auxiliary Power Unit (APU), Others |

| End-Use Segments Analyzed | Freight, Passengers, Switcher |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Middle East and Africa |

| Key Players | AEG Power Solutions B.V., Alstom, Bharat Heavy Electricals Limited, Siemens AG, Strukton, Toshiba Corporation, Wabtec Corporation, CRRC Corporation Limited, Hitachi Ltd., Mitsubishi Heavy Industries Ltd. |

| Additional Attributes | Dollar sales by locomotive type and application, demand dynamics across freight, passenger, and high-speed rail, regional trends across North America, Europe, and Asia-Pacific, innovation in electric and hybrid propulsion, digital control systems, environmental impact of emissions reduction, emerging use in automated and smart rail networks |

The locomotive market is valued at USD 9.3 billion in 2025.

The market is expected to reach USD 18 billion by 2035.

The market is growing at a CAGR of 7.3% between 2025 and 2035.

Diesel locomotives account for the largest share at 50% in 2025.

CRRC Corporation Limited holds the leading position with a 25% market share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Locomotive Maintenance Market Size and Share Forecast Outlook 2025 to 2035

Locomotive Lighting Batteries Market Analysis - Size, Share & Forecast 2025 to 2035

Locomotive Wiring Harness Market Growth – Trends & Forecast 2023-2033

Locomotive Traction Transformer Market Growth – Trends & Forecast 2025 to 2035

Locomotive Pantographs Market Growth – Trends & Forecast 2025 to 2035

Locomotive Radiator Fans Market Growth - Trends & Forecast 2024 to 2034

Locomotive Drive Shaft Market Growth - Trends & Forecast 2024 to 2034

Locomotive Doors Market Growth – Trends & Forecast 2024 to 2034

USA Locomotive Pantographs Market Trends – Size, Demand & Forecast 2025-2035

Japan Locomotive Pantographs Market Outlook – Size, Share & Innovations 2025-2035

China Locomotive Pantographs Market Analysis – Demand, Growth & Forecast 2025-2035

India Locomotive Pantographs Market Report – Size, Share & Demand Trends 2025-2035

Mining Locomotive Market

Germany Locomotive Pantographs Market Growth – Innovations, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA