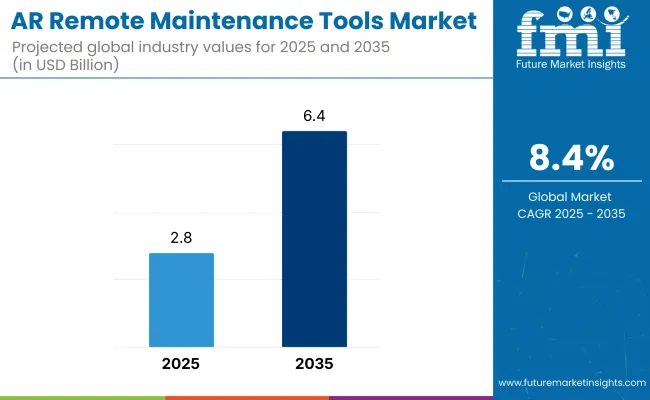

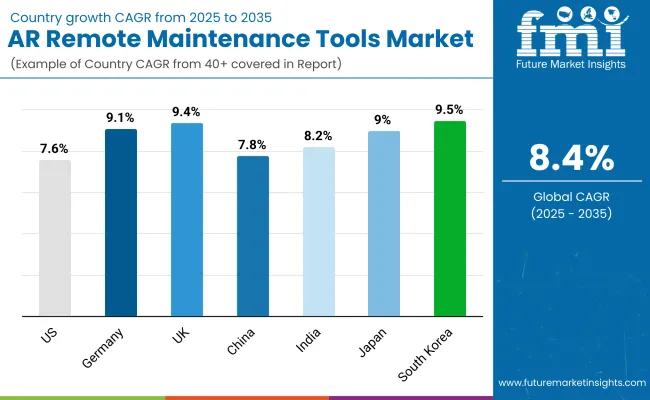

The AR remote maintenance tools market is expected to grow from USD 2.8 billion in 2025 to USD 6.4 billion by 2035, resulting in a total increase of USD 3.6 billion over the forecast decade. This represents a 128.6% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 8.4%. Over ten years, the market grows by a 2.3 multiple.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.8 billion |

| Industry Value (2035F) | USD 6.4 billion |

| CAGR (2025 to 2035) | 8.4% |

In the first five years (2025-2030), the market progresses from USD 2.8 billion to USD 4.2 billion, contributing USD 1.4 billion, or 38.9% of total decade growth. This phase is shaped by manufacturing, energy, and aerospace sectors adopting AR for real-time equipment troubleshooting and training. High demand is driven by reduced downtime, lower travel costs, and improved technician productivity.

In the second half (2030-2035), the market grows from USD 4.2 billion to USD 6.4 billion, adding USD 2.2 billion, or 61.1% of the total growth. This acceleration is supported by integration with AI-driven diagnostics, IoT connectivity, and wearable AR headsets with enhanced field-of-view. Expansion into emerging markets and increased 5G coverage further enable instant, high-quality remote support, solidifying AR tools in industrial maintenance strategies.

From 2020 to 2024, the AR remote maintenance tools market expanded from USD 2.1 billion to USD 2.6 billion, fueled by industrial digitalization, equipment uptime optimization, and skilled labor shortages. Over 70% of revenue came from OEM-led platforms embedded into machinery servicing ecosystems. Market leaders such as PTC, TeamViewer, and Scope AR emphasized real-time 3D visualization, IoT sensor integration, and secure remote access.

Differentiation focused on precision overlay accuracy, latency reduction, and cross-device compatibility, while advanced AI-based diagnostics were secondary add-ons. Service models tied to predictive maintenance contracts accounted for less than 20% of revenue, with most enterprises investing in capital deployments for long-term operational control.

By 2035, the AR remote maintenance tools market will reach USD 6.4 billion, growing at a CAGR of 8.4%, with software-driven capabilities accounting for more than 40% of total value. Competitive momentum will shift toward integrated solution providers offering AI-guided repair workflows, digital twin synchronization, and immersive multi-user collaboration.

Established players are adapting to hybrid models with subscription-based AR servicing, continuous cloud updates, and edge AI for instant failure detection. New entrants such as Librestream, RE’FLEKT, and XMReality are gaining traction through modular deployment options, enhanced cybersecurity features, and industry-specific AR content libraries tailored for sectors like aerospace, energy, and advanced manufacturing.

The increasing need for real-time technical support, reduced downtime, and cost-efficient maintenance is driving growth in the AR remote maintenance tools market. These solutions enable technicians to receive expert guidance through augmented reality interfaces, improving accuracy and speed. Adoption is rising across manufacturing, energy, automotive, and aerospace sectors due to global skilled labour shortages.

Tools integrating hands-free AR headsets, IoT-enabled diagnostics, and cloud-based collaboration are gaining traction for their ability to provide instant problem-solving without travel. Features like remote annotations, 3D overlays, and step-by-step guidance enhance operational efficiency. Compatibility with existing enterprise systems and sustainability benefits from reduced carbon footprints further boost their appeal in industrial and field service applications.

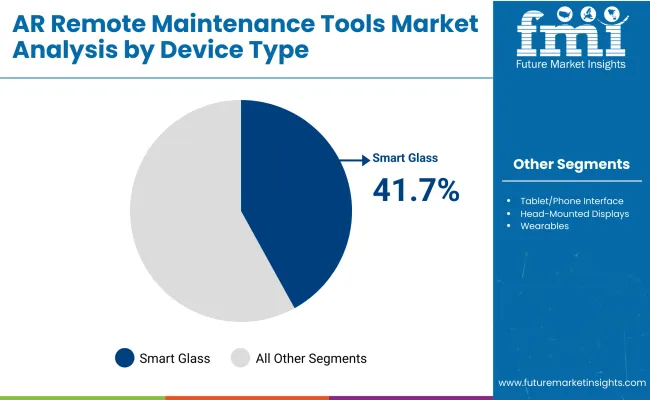

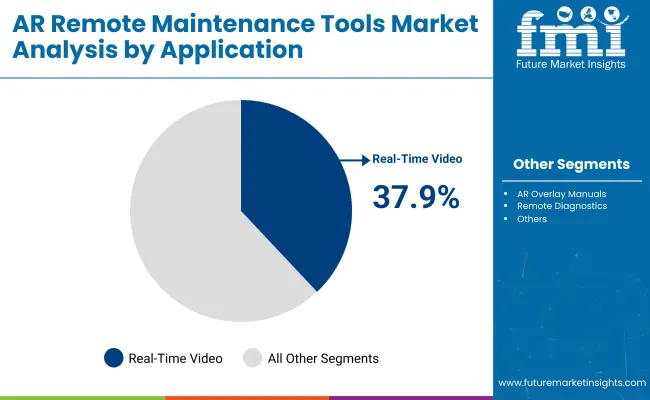

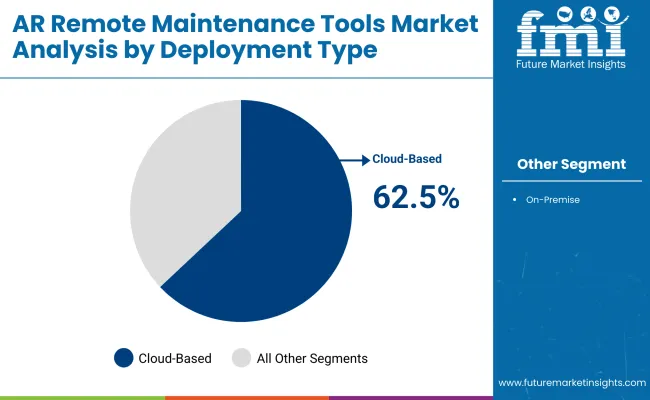

The market is segmented by device type, functionality, deployment type, application, end-use industry, and region. Device type segmentation includes smart glasses, tablet/phone interfaces, head-mounted displays (HMDs), and wearables, each enhancing hands-free access to maintenance instructions. Functionality covers real-time video support, AR overlay manuals, remote diagnostics, and IoT integration, streamlining operational efficiency and minimizing downtime. Deployment type includes cloud-based and on premise models, catering to varied data security and accessibility needs.

Applications include packaging line troubleshooting, machine setup, and remote operator training, enabling rapid skill transfer and reduced service delays. End-use industries include food packaging, pharma lines, industrial equipment, aerospace, and automotive. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Smart glasses are projected to hold a 41.7% share in 2025, driven by their ability to deliver hands-free, real-time visual instructions in industrial settings. These devices overlay digital schematics, work instructions, and 3D annotations directly into the technician’s field of view, reducing downtime and error rates. Integrated sensors and high-resolution displays enable precision work in complex maintenance tasks.

Adoption is fuelled by compatibility with AR software platforms that allow remote experts to guide on-site staff without physical presence. Durable, lightweight designs with safety compliance make them ideal for packaging plants and high-speed production lines. As battery life, processing power, and connectivity improve, smart glasses are becoming essential for modern maintenance operations.

The real-time video support segment is expected to account for 37.9% of the market in 2025, providing live, interactive communication between field technicians and remote specialists. This functionality enables step-by-step troubleshooting, with shared camera views and annotation tools to highlight critical components or procedures. The approach reduces costly service delays and accelerates repair cycles.

Its adoption is increasing in packaging and manufacturing sectors where immediate fault resolution minimizes production loss. Integration with AR platforms allows remote experts to superimpose visual cues onto live feeds, improving technician accuracy. Enhanced bandwidth through 5G and low-latency streaming ensures seamless communication, even in challenging industrial network environments.

Cloud-based solutions are forecast to hold a 62.5% share in 2025, enabling flexible access to AR maintenance tools without extensive on-premise infrastructure. These platforms allow real-time data synchronization, remote diagnostics, and continuous software updates, ensuring optimal tool performance. Lower upfront costs and simplified integration appeal to both small and large enterprises.

The model supports multi-location operations, allowing centralized teams to manage maintenance support globally. Enhanced data security, encryption protocols, and compliance with industry regulations improve trust in cloud deployment. With predictive analytics and AI capabilities, cloud-based AR systems are becoming critical to proactive maintenance strategies across diverse industrial sectors.

Packaging line troubleshooting is projected to hold a 34.9% share in 2025, as AR tools streamline fault detection and resolution in automated packaging environments. These tools enable quick identification of mechanical, electrical, or software-related issues through guided visual workflows. The capability reduces unplanned downtime and preserves production schedules.

Industries such as food, beverage, and consumer goods rely heavily on uninterrupted packaging operations. AR-guided troubleshooting supports faster part replacements, configuration adjustments, and quality checks. With high-speed lines handling diverse SKUs, rapid changeovers are critical, making AR-based guidance a valuable addition to operational efficiency frameworks.

The food packaging industry is expected to account for 28.4% of market demand in 2025, driven by strict hygiene regulations and zero-contamination requirements. AR maintenance tools assist in ensuring equipment is serviced without compromising sterile production environments. They also help document compliance for audits and traceability records.

Adoption is further supported by the need to minimize downtime in high-volume food processing lines. Remote AR guidance enables safe intervention without prolonged exposure to sensitive production zones. As the sector embraces automation, AR maintenance tools are becoming integral to quality assurance, preventive maintenance, and workforce training initiatives.

The AR remote maintenance tools market is expanding as industries adopt immersive technologies to improve equipment servicing, reduce downtime, and minimize travel costs. Growing reliance on real-time, hands-free technical guidance is boosting uptake in manufacturing, energy, and aerospace sectors. However, high deployment costs, infrastructure limitations, and integration complexities slow adoption in smaller operations. Advances in AI-enabled diagnostics, wearable compatibility, and cloud-based collaboration are expected to define future growth.

Efficiency Gains, Cost Savings, and Workforce Training Driving Adoption

AR remote maintenance tools enable technicians to receive visual, step-by-step guidance without being physically on-site, reducing operational delays and minimizing the need for expert travel. Manufacturing plants use these tools to troubleshoot machinery, energy firms deploy them for field inspections, and aerospace operators integrate them for aircraft servicing.

The ability to overlay real-time data, schematics, and sensor readings onto physical equipment enhances repair accuracy and shortens maintenance cycles. These tools also facilitate remote training, enabling less experienced staff to complete complex tasks under virtual supervision, reducing skill gaps and increasing productivity across global operations.

High Implementation Costs, Network Dependence, and Security Concerns

While adoption is rising, high hardware costs for AR headsets, compatible mobile devices, and supporting sensors remain a challenge, especially for smaller firms. The technology’s reliance on stable high-speed internet can limit use in remote or offshore environments where connectivity is inconsistent. Integration with legacy systems requires substantial IT investment and change management efforts.

Furthermore, the transmission of sensitive maintenance data over networks raises cybersecurity and intellectual property protection concerns, leading some industries to hesitate until stronger security protocols are standardized. These barriers are slowing large-scale deployment in cost-sensitive markets.

AI-driven Guidance, 5G Connectivity, and Wearable Integration Emerging

Technological innovation is accelerating, with AI-enabled AR tools capable of auto-detecting faults and recommending corrective actions in real time. The rollout of 5G networks is enhancing data transmission speed and reliability, enabling smoother remote collaboration even in bandwidth-intensive scenarios. Wearable integration, from smart glasses to AR-enabled helmets, is making hands-free operation more practical and comfortable for field workers.

Cloud-based platforms now store maintenance histories, enabling predictive servicing and reducing unplanned downtime. As industries prioritize sustainability, AR tools are also contributing by reducing the environmental impact of travel for maintenance teams, reinforcing their role in future operational strategies.

The global AR remote maintenance tools market is growing steadily, supported by increasing adoption of Industry 4.0, real-time troubleshooting needs, and remote collaboration requirements. Asia-Pacific is emerging as a high-growth region, with India and China expanding due to industrial automation investments and workforce upskilling. Developed markets like the USA, Germany, and Japan are advancing AR-integrated diagnostics, wearable compatibility, and AI-enhanced assistance to meet operational efficiency, safety, and compliance demands.

The USA market is projected to grow at a CAGR of 7.6% from 2025 to 2035, driven by high adoption in manufacturing, aerospace, and energy sectors. Enterprises are deploying AR tools for equipment inspection, guided repair, and real-time expert collaboration. Integration with IoT sensors and cloud-based analytics is enhancing predictive maintenance capabilities.

Germany’s market is expected to grow at a CAGR of 9.1%, powered by strong manufacturing and engineering sectors. Automotive and machinery industries are using AR solutions to streamline complex assembly and maintenance tasks. Collaboration tools integrating CAD overlays and multilingual instructions are gaining traction.

The UK market is forecast to expand at a CAGR of 9.4%, driven by defense, energy, and transport infrastructure modernization. SMEs are adopting subscription-based AR platforms to cut operational costs and improve workforce productivity. Cloud-enabled AR tools with remote supervision features are increasingly preferred.

China’s market is projected to grow at a CAGR of 7.8%, fueled by large-scale smart manufacturing initiatives and government support for industrial digitization. AR solutions are being deployed in electronics, automotive, and heavy machinery sectors to enhance production line uptime.

India’s market is set to grow at a CAGR of 8.2%, supported by rapid industrial growth and digital transformation programs. AR tools are being used in utilities, automotive, and telecom maintenance to optimize performance. Affordable AR headsets and localized software are increasing adoption among mid-sized firms.

Japan is projected to grow at a CAGR of 9.0%, with industries focusing on AR for precision manufacturing, healthcare equipment maintenance, and transport systems. Demand is rising for wearable-integrated AR systems with gesture control.

South Korea’s market is expected to expand at a CAGR of 9.5%, led by semiconductor, shipbuilding, and electronics sectors. High-speed connectivity supports seamless AR streaming for real-time problem-solving.

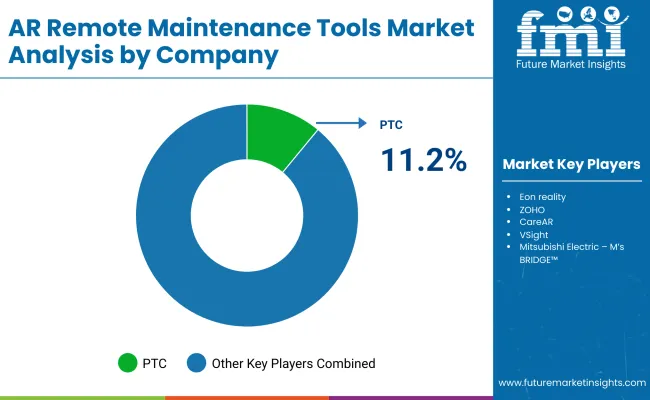

The AR remote maintenance tools market is moderately fragmented, with industrial software leaders, AR platform providers, and enterprise service innovators competing across manufacturing, utilities, and field service sectors. Global leaders such as PTC, Eon Reality, and ZOHO hold notable market share, driven by advanced AR visualization, real-time collaboration, and integration with enterprise asset management systems. Their strategies increasingly emphasize AI-enabled diagnostics, multi-device compatibility, and secure cloud-based deployment to enhance operational uptime.

Established mid-sized players including CareAR, VSight, and Mitsubishi Electric’s M’s BRIDGE™ are supporting adoption of modular AR maintenance solutions featuring live annotation, 3D model overlays, and IoT data integration. These companies are especially active in aerospace, automotive, and energy maintenance operations, offering cross-platform support, customizable workflows, and remote expertise delivery for time-critical interventions.

Specialized technology providers such as LG CNS, ABB, Taqtile, and Acty focus on tailored AR solutions for regional industries and niche use cases. Their strengths lie in developing scalable AR toolkits, integrating wearable hardware with maintenance platforms, and delivering end-to-end solutions combining AR guidance with predictive analytics for proactive asset management and reduced service downtime.

Key Development of AR Remote Maintenance Tools Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| By Device Type | Smart Glasses, Tablet/Phone Interface, Head-Mounted Displays (HMDs), Wearables |

| By Functionality | Real-time Video Support, AR Overlay Manuals, Remote Diagnostics, IoT Integration |

| By Deployment Type | Cloud-based, On-Premise |

| By Application | Packaging Line Troubleshooting, Machine Setup, Remote Operator Training |

| By End-Use Industry | Food Packaging, Pharma Lines, Industrial Equipment, Aerospace, Automotive |

| Key Companies Profiled | PTC, Eon Reality, ZOHO, CareAR, VSight, Mitsubishi Electric - M’s BRIDGE™, LG CNS, ABB, Taqtile, Acty |

| Additional Attributes | Rising demand for AR tools to minimize downtime and enhance operational efficiency, increasing adoption of smart glasses and HMDs for hands-free remote support, integration of IoT data overlays for predictive maintenance, cloud-based deployments enabling scalability and global collaboration, growing focus on training solutions using AR simulations, and industry adoption across packaging, pharma, and heavy equipment sectors driven by efficiency, safety, and cost reduction benefits. |

The global AR remote maintenance tools market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the AR remote maintenance tools market is projected to reach USD 6.4 billion by 2035.

The AR remote maintenance tools market is expected to grow at a CAGR of 8.4% between 2025 and 2035.

The key device types in the AR remote maintenance tools market include smart glasses, tablet/phone interfaces, head-mounted displays (HMDs), and wearables.

The smart glasses segment is expected to account for the highest share of 41.7% in the AR remote maintenance tools market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AR and VR in Training Market Size and Share Forecast Outlook 2025 to 2035

AR Coating Liquid Market Size and Share Forecast Outlook 2025 to 2035

AR Coated Film Glass Market Size and Share Forecast Outlook 2025 to 2035

Artificial Insemination Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Construction Market Size and Share Forecast Outlook 2025 to 2035

Artificial Tears Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Artificial Urinary Sphincter Market Size and Share Forecast Outlook 2025 to 2035

Art and Office Marker Pen Market Size and Share Forecast Outlook 2025 to 2035

Architectural Membranes Market Size and Share Forecast Outlook 2025 to 2035

Areca Nut Market Size and Share Forecast Outlook 2025 to 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Argan Oil Moisturizers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Artificial Lift Systems Market Size and Share Forecast Outlook 2025 to 2035

AR Fitness Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Aromatic Ketone Polymers Market Size and Share Forecast Outlook 2025 to 2035

Aromatic Polyamine Market Size and Share Forecast Outlook 2025 to 2035

Architectural Flat Glass Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Retail Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence (AI) in Automotive Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA