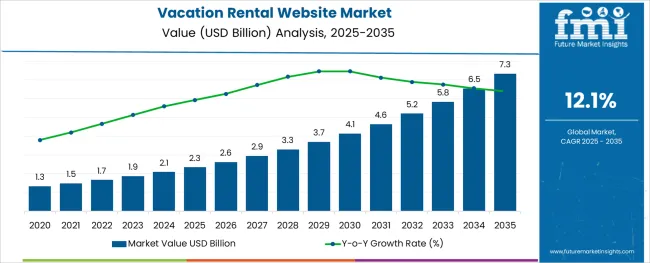

The Vacation Rental Website Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 7.3 billion by 2035, registering a compound annual growth rate (CAGR) of 12.1% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

The market is segmented by Property Type and End User and region. By Property Type, the market is divided into House/Apartment, Hotel/Hostel, and Other. In terms of End User, the market is classified into Vacation Rental Agency, Vacation Rental Owners, and Property Managers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5 % of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0 % of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

By 2035, the vacation rental website market is predicted by FMI to reach over USD 4,640.2 Million. It is estimated that the global vacation rental website market share increased by 12.7% in the first half of 2025, which is a market share valued at USD 1335.7 Million. Though not equally distributed throughout all regions, this growth is stronger in developing markets. It is predicted to reach the end of 2025 valued at USD 1,482.6 Million registering at a CAGR of 12.1%.

The Growing Tourism Industry

The Rise in Online Booking Mode

Online booking mode is predicted to grow due to consumers’ preference to have detailed access to the offerings of accommodation, amenities, and other benefits. Travelers are increasingly turning to online bookings for a variety of reasons, including value for money, convenience, and the search for authentic travel experiences. As a result, there is a growing number of start-ups and third-party companies offering travel booking services exclusively through their applications and websites.

Instant booking is a major factor supporting vacation rental website market share growth. As the trend towards instant bookings continues to grow, the global market is likely to benefit as the process of making instant bookings is accompanied by minimal or zero waiting times.

Vacation rental sites that offer online bookings facilitate the ability to book vacation rentals in real time, and this value-added feature will make it easier for customers to book vacation rentals, which in turn will increase customer satisfaction.

Among the major challenges facing the vacation rental website market in the near future are the risks associated with fraudulent vacation rental houses, apartments, and homestays. Several scams, fraudulent reviews, and unethical dealings are impacting the operations of key vendors in the market.

Although these activities are being undertaken by counterfeit players, they have an impact on the business operations of key vendors in the market as well. As a result, market revenue declines and market expansion is constrained. In recent years, the market's overall revenue has decreased as a result of false advertising, the bait-and-switch strategy, and the prevalence of double bookings.

The hotel/hostel property types segment dominated the revenue table in 2024. This is because it had a share of over 73.1% and the highest CAGR of 13.6%. This represents a share of almost 73% of the global market. This is attributed to the high popularity of hotels among travelers owing to space availability, safety, and access to amenities.

Millennials are majorly responsible for driving this segment because they are more inclined to spend money on things such as barbecue pits, games, swimming pools, clubhouses, and tennis courts, among other amenities. As per a study by iProperty Management published in 2024, 12% of millennials plan to move into a villa/estate, while only 6% of Boomers and 9% of Gen Xers plan to move into one. Furthermore, the low cost of accommodation in rural areas and travel destinations is acting as a major driver for the segment.

In the vacation rental market, vacation rental agencies hold the largest market share for the end-user segment and they have a market share of 43.3% with a CAGR of 10.7%. The market players are engaged in providing leisure and relaxing experiences to the end-users through better facilities in the properties.

To gain a larger share of the market, agencies are engaging in strategic acquisition processes, such as product launches, Research and Development, agreements, and collaborations with other agencies. It appears that Airbnb Inc. is looking forward to expanding its domain of short-term rentals to long-term rentals in order to capitalize on the growing online rental market.

Accordingly, the company is expected to raise funds amounting to USD 1 billion in both equity and debt. The company noted higher levels of acceptance of lengthier rental alternatives from residents of the same city as the standard brokerage system for leasing and decided to take this step to accommodate those looking for rental options that run longer than a month.

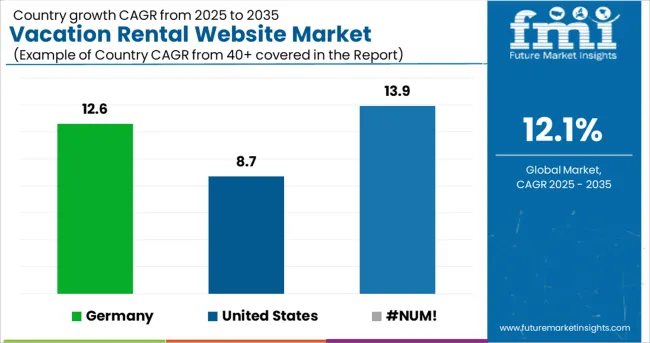

As a result of the improved tourist infrastructure, favorable government conditions, and increasing customer awareness in North America, the North American vacation rental websites had the largest share of 34.3% in the forecast period and recorded a CAGR of 8.5% over this period.

According to Airbnb, there are more than 1.6 billion people around the world who are over the age of 50 on the planet. There is also a significant number of Baby Boomers in North America who are looking forward to traveling as one of their top goals.

Vacation rental websites are growing rapidly due to developments in resorts and condominiums such as spas, boats, private beaches, and yoga centers, and the development of luxurious amenities in North America.

| Country | Statistics |

|---|---|

| United States | The USA is one of the most influential markets for vacation rental websites and contributes greatly to the growth of the North American market share. Over time, vacation rental websites have evolved in the USA during various stages, and today it is one of the largest markets in the hospitality industry. The vacation rental website in the USA currently holds the maximum number of shares and the market was projected to reach a CAGR of 8.7% by the end of 2024. Market Share in 2024: 23.1% |

| Germany | Germany is the leading country in the European region and is accountable for advancing at a fast-paced CAGR of 12.6% by the end of 2024. The rise in the number of glamping resorts and condominiums is attributed to the big tour operators and online tour operators catching up with the growing trend of glamping. This is because of the rising expenditures for booking accommodation in resorts and condominiums. Market Share in 2024: 15.2% |

| India | India is projected to advance at a rapid pace, registering a CAGR of 10.9% through the forecast period. In India, exploring untapped locations, soul-searching trips, yoga retreats, and promoting health and wellness have taken off. Also due to the rapid expansion of middle-class households and the rapid development of road and rail networks in the country, there has been rapid growth in the number of mid-range accommodations in the country. Market Share in 2024: 11.2% |

| China | China is projected to advance at a moderate pace, registering a CAGR of 6.3% through the forecast period. China has become more and more evident across the globe due to the amazing sites such as Yunnan's Himalayan foothills and Mission Hills Volcanic Mineral Springs & Spa, which possess an immense amount of potential. Market Share in 2024: 7.9% |

| Japan | The Japanese vacation rental website is anticipated to advance at a fast-paced CAGR of 11.1% during the forecast period. Market Share in 2024: 9.7% |

Different Vendors Add an Edge to the Vacation Rental Website Dynamics

Vacation rental websites are a highly fragmented market, and different vendors are deploying a variety of organic and inorganic growth strategies to compete for a share of the market There has been an increase in the level of competition in the market.

This is forcing vendors to adopt various growth strategies, such as promotional activities and advertisements. This is to improve the visibility of their products to attract potential customers. It has also been observed that some vendors are adopting inorganic growth strategies such as mergers and acquisitions to remain competitive in the market.

It is estimated that more than 60 percent of start-ups aim to increase profitability by improving the hospitality business, building traveler confidence, attracting new clients, and making data-driven decisions. Competitive Landscape

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | million for Value and MT for Volume |

| Key Regions Covered | North America; Latin America; Europe; The Middle East and Africa; East Asia |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Chile, Peru, Germany, United Kingdom, Spain, Italy, France, Russia, Poland, China, India, Japan, Australia, New Zealand, GCC Countries, North Africa, South Africa, and Turkey |

| Key Segments Covered | Property Type, End User, Region |

| Key Companies Profiled | BookingSync; CiiRUS; Kigo Inc.; Virtual Resort Manager; LiveRez; OwnerRez; 365Villas; Convoyant; 9flats Pvt Limited; Airbnb Inc; Booking Holdings Inc; Expedia Group; Hotelplan Holding AG; MakeMyTrip Limited; NOVASOL; Oravel Stays Private Limited; TripAdvisor Inc; Rentalo Inc.; Wyndham Destinations Inc; World Travel Holdings Inc |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global vacation rental website market is estimated to be valued at USD 2.3 billion in 2025.

It is projected to reach USD 7.3 billion by 2035.

The market is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types are house/apartment, hotel/hostel and other.

vacation rental agency segment is expected to dominate with a 47.6% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vacation Ownership Market Trends - Growth & Forecast 2025 to 2035

Vacation Rentals Industry Analysis By Platform, By Service Type, By End User, By Region – Forecast for 2025 to 2035

Ski Vacation Market Size and Share Forecast Outlook 2025 to 2035

Lake Vacations Market Size and Share Forecast Outlook 2025 to 2035

Custom Vacation Planning Market Size and Share Forecast Outlook 2025 to 2035

Himalaya Vacations Tourism Market Size and Share Forecast Outlook 2025 to 2035

Short-Term Vacation Rental Market Trends – Growth & Forecast 2025 to 2035

Rental Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Parental Control Software Market Report - Demand & Outlook 2025 to 2035

IBC Rental Business Market Size and Share Forecast Outlook 2025 to 2035

P2P Rental Apps Market Size and Share Forecast Outlook 2025 to 2035

Breakdown for IBC Rental Business Market: Trends, Players, and Innovations

Car Rental Service Market Trends - Growth & Forecast 2024 to 2034

Boat Rental Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Yacht Rental Market Size and Share Forecast Outlook 2025 to 2035

Crane Rental Market Analysis by Product Type, End-Use Industry, and Region through 2035

The Furniture Rental Services Market is segmented by material, application and region from 2025 to 2035.

Furniture Rental Market by Product, Material, Application, and Region – Growth, Trends, and Forecast through 2025 to 2035

Short-Term Rental Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA